Question: Information about Delmott is presented in E6-

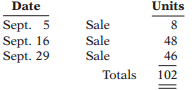

Information about Delmott is presented in E6-4. Additional data regarding the company’s sales of Xpert snowboards are provided below. Assume that Delmott uses a perpetual inventory system.

Instructions:

Compute ending inventory at September 30 using FIFO, LIFO, and moving-average. (Note: For moving-average, round unit cost to three decimal places.)

Transcribed Image Text:

Date Units Sept. 5 Sept. 16 Sept. 29 Sale 8 Sale 48 Sale 46 Totals 102

> Sadowski Video Center accumulates the following cost and market data at December 31. Compute the lower-of-cost-or-market valuation for Sadowski inventory. Market Inventory Categories Cost Data Data Cameras $12,500 9,000 13,000 $13,400 9,500 12,200 C

> Assume the same information as in BE5-8 and also that Tracy Company has beginning inventory of $60,000, ending inventory of $90,000, and net sales of $612,000. Determine the amounts to be reported for cost of goods sold and gross profit.

> Assume that Tracy Company uses a periodic inventory system and has these account balances: Purchases $404,000; Purchase Returns and Allowances $13,000; Purchase Discounts $9,000; and Freight-In $16,000. Determine net purchases and cost of goods purchased

> Sands Company sold goods with a total selling price of $800,000 during the year. It purchased goods for $380,000 and had beginning inventory of $67,000. A count of its ending inventory determined that goods on hand was $50,000. What was its cost of goods

> In 2014, Grossfeld Company has net credit sales of $1,600,000 for the year. It had a beginning accounts receivable (net) balance of $108,000 and an ending accounts receivable (net) balance of $120,000. Compute Grossfeld Company’s (a) accounts receivable

> Alvarado Company provides this information for the month ended October 31, 2014: sales on credit $300,000; cash sales $150,000; sales discounts $5,000; and sales returns and allowances $19,000. Prepare the sales section of the income statement based on t

> From the information in BE5-3, prepare the journal entries to record these transactions on Bernadina Company’s books under a perpetual inventory system. BE5-3: (a) On March 2, Horst Company sold $800,000 of merchandise to Bernadina Company, terms 2/10,

> Assume the same information as BE8-3 and that on March 4, 2014, Morley Co. receives payment of $4,300 in full from Spears Inc. Prepare the journal entries to record this transaction.

> Gerish Company buys merchandise on account from Mangus Company. The selling price of the goods is $900 and the cost of the goods sold is $590. Both companies use perpetual inventory systems. Journalize the transactions on the books of both companies.

> On January 1, 2014, the Ferman Company ledger shows Equipment $36,000 and Accumulated Depreciation $13,600. The depreciation resulted from using the straight line method with a useful life of 10 years and a salvage value of $2,000. On this date, the comp

> Speedy Taxi Service uses the units-of-activity method in computing depreciation on its taxicabs. Each cab is expected to be driven 150,000 miles. Taxi 10 cost $27,500 and is expected to have a salvage value of $500. Taxi 10 was driven 32,000 miles in 201

> Consider these transactions: (a) Draber Restaurant accepted a Visa card in payment of a $200 lunch bill. The bank charges a 3% fee. What entry should Draber make? (b) Marin Company sold its accounts receivable of $65,000. What entry should Marin make, gi

> At the end of 2013, Morley Co. has accounts receivable of $700,000 and an allowance for doubtful accounts of $25,000. On January 24, 2014, it is learned that the company’s receivable from Spears Inc. is not collectible and therefore management authorizes

> Record the following transactions on the books of Cohen Co. (Omit cost of goods sold entries.) (a) On July 1, Cohen Co. sold merchandise on account to Tracy Inc. for $23,000, terms 2/10, n/30. (b) On July 8, Tracy Inc. returned merchandise worth $2,400 t

> Suppose in 2014, Campbell Soup Company reported average total assets of $6,265 million, net sales of $7,586 million, and net income of $736 million. What was Campbell Soup’s return on assets?

> On January 1, 2014, Wolf Creek Country Club purchased a new riding mower for $15,000. The mower is expected to have a 10-year life with a $1,000 salvage value. What journal entry would Wolf Creek make on December 31, 2014, if it uses straight-line deprec

> Suppose during 2014 that Federal Express reported the following information (in millions): net sales of $35,497 and net income of $98. Its balance sheet also showed total assets at the beginning of the year of $25,633 and total assets at the end of the y

> These are selected 2014 transactions for Amarista Corporation: Jan. 1 Purchased a copyright for $120,000. The copyright has a useful life of 6 years and a remaining legal life of 30 years. Mar. 1 Purchased a patent with an estimated useful life of

> On July 4, Susie’s Restaurant accepts a Visa card for a $250 dinner bill. Visa charges a 4% service fee. Instructions: Prepare the entry on Susie’s books related to the transaction.

> On May 10, Renn Company sold merchandise for $4,000 and accepted the customer’s First Business Bank MasterCard. At the end of the day, the First Business Bank MasterCard receipts were deposited in the company’s bank account. First Business Bank charges a

> On March 3, Beachy Appliances sells $710,000 of its receivables to National Factors Inc. National Factors Inc. assesses a service charge of 4% of the amount of receivables sold. Instructions: Prepare the entry on Beachy Appliances’ books to record the s

> Hirdt Co. uses the percentage-of-receivables basis to record bad debt expense and concludes that 2% of accounts receivable will become uncollectible. Accounts receivable are $400,000 at the end of the year, and the allowance for doubtful accounts has a c

> The financial statements of Zetar plc are presented in Appendix C. Appendix C: Instructions: Use the company’s annual report, available in the Investors section at www.zetarplc.com, to answer the following questions. (a) According to

> Parman Industries spent $300,000 on research and $600,000 on development of a new product. Of the $600,000 in development costs, $400,000 was incurred prior to technological feasibility and $200,000 after technological feasibility had been demonstrated.

> Suppose the amounts presented here are basic financial information (in millions) from the 2014 annual reports of Nike and adidas. Instructions: Calculate the accounts receivable turnover and average collection period for both companies. Comment on the

> Holland Company constructed a warehouse for $280,000. Holland estimates that the warehouse has a useful life of 20 years and no residual value. Construction records indicate that $40,000 of the cost of the warehouse relates to its heating, ventilation, a

> On October 5, Narveson Company buys merchandise on account from Rossi Company. The selling price of the goods is $5,000, and the cost to Rossi Company is $3,000. On October 8, Narveson returns defective goods with a selling price of $640 and a scrap valu

> The following information pertains to Joyce Company. 1. Cash balance per bank, July 31, $7,328. 2. July bank service charge not recorded by the depositor $38. 3. Cash balance per books, July 31, $7,364. 4. Deposits in transit, July 31, $2,700. 5. Note fo

> Sally Rice is unable to reconcile the bank balance at January 31. Sally’s reconciliation is shown here. Cash balance per bank …………………………..$3,677.20 Add: NSF check ………………………………………..450.00 Less: Bank service charge …………………………..28.00 Adjusted balance per b

> At Nunez Company, checks are not prenumbered because both the purchasing agent and the treasurer are authorized to issue checks. Each signer has access to unissued checks kept in an unlocked file cabinet. The purchasing agent pays all bills pertaining to

> The following control procedures are used in Penny’s Boutique Shoppe for cash disbursements. 1. Each week, 100 company checks are left in an unmarked envelope on a shelf behind the cash register. 2. The store manager personally approves all payments befo

> The following control procedures are used in Kelton Company for over-the-counter cash receipts. 1. Each store manager is responsible for interviewing applicants for cashier jobs. They are hired if they seem honest and trustworthy. 2. All over-the-counter

> Lyle Company maintains a petty cash fund for small expenditures. These transactions occurred during the month of August. Aug. 1 Established the petty cash fund by writing a check on Westown Bank for $200. 15 Replenished the petty cash fund by writing

> Enright Company expects to have a cash balance of $46,000 on January 1, 2014. These are the relevant monthly budget data for the first two months of 2014. 1. Collections from customers: January $71,000, February $146,000. 2. Payments to suppliers: Januar

> A new accountant at Leftwich Inc. is trying to identify which of the amounts shown below should be reported as the current asset “Cash and cash equivalents” in the year-end balance sheet, as of April 30, 2014. 1. $60 of currency and coin in a locked box

> Werth Inc.’s bank statement from Hometown Bank at August 31, 2014, gives the following information. A summary of the Cash account in the ledger for August shows the following: balance, August 1, $18,700; receipts $74,000; disbursement

> Rosa’s Pizza operates strictly on a carryout basis. Customers pick up their orders at a counter where a clerk exchanges the pizza for cash. While at the counter, the customer can see other employees making the pizzas and the large ovens in which the pizz

> Recently, it was announced that two giant French retailers, Carrefour SA and Promodes SA, would merge. A headline in the Wall Street Journal blared, “French Retailers Create New Wal-Mart Rival.” While Wal-Martâ&#

> Birk Camera Shop Inc. uses the lower-of-cost-or-market basis for its inventory. The following data are available at December 31. Instructions: What amount should be reported on Birk Camera Shop’s financial statements, assuming the low

> The following comparative information is available for Keysor Company for 2014. Instructions: (a) Determine net income under each approach. Assume a 30% tax rate. (b) Determine net cash provided by operating activities under each approach. Assume that

> Eggers Company reports the following for the month of June. Instructions: (a) Compute the cost of the ending inventory and the cost of goods sold under (1) FIFO, (2) LIFO, and (3) average-cost. (Round average unit cost to three decimal places). (b) Wh

> On December 1, Quality Electronics has three DVD players left in stock. All are identical, all are priced to sell at $85. One of the three DVD players left in stock, with serial #1012, was purchased on June 1 at a cost of $52. Another, with serial #1045,

> Mateo Inc. had the following inventory situations to consider at January 31, its year-end. (a) Goods held on consignment for Schrader Corp. since December 12. (b) Goods shipped on consignment to Lyman Holdings Inc. on January 5. (c) Goods shipped to a cu

> Kevin Farley, an auditor with Koews CPAs, is performing a review of Knight Company’s Inventory account. Knight did not have a good year, and top management is under pressure to boost reported income. According to its records, the inventory balance at yea

> Deere & Company is a global manufacturer and distributor of agricultural, construction, and forestry equipment. Suppose it reported the following information in its 2014 annual report. Instructions: (a) Compute Deere’s inventory t

> Columbia Bank and Trust is considering giving Gallup Company a loan. Before doing so, it decides that further discussions with Gallup’s accountant may be desirable. One area of particular concern is the Inventory account, which has a year-end balance of

> Holcomb Company reported these income statement data for a 2-year period Holcomb Company uses a periodic inventory system. The inventories at January 1, 2013, and December 31, 2014, are correct. However, the ending inventory at December 31, 2013, is ov

> Foyle Hardware reported cost of goods sold as follows Foyle made two errors: 1. 2013 ending inventory was overstated by $2,000. 2. 2014 ending inventory was understated by $5,000. Instructions: Compute the correct cost of goods sold for each year.

> Prepare the journal entries to record the following transactions on Horst Company’s books using a perpetual inventory system. (a) On March 2, Horst Company sold $800,000 of merchandise to Bernadina Company, terms 2/10, n/30. The cost of the merchandise s

> Inventory data for Eggers Company are presented in E6-7. Data from E6-7: Eggers Company reports the following for the month of June. Instructions: (a) Calculate the cost of the ending inventory and the cost of goods sold for each cost flow assumption,

> This information relates to Woodward Co. 1. On April 5, purchased merchandise from Cozart Company for $27,000, terms 2/10, n/30. 2. On April 6, paid freight costs of $1,200 on merchandise purchased from Cozart Company. 3. On April 7, purchased equipment

> Dorcas Corporation reported sales revenue of $257,000, net income of $45,300, cash of $9,300, and net cash provided by operating activities of $23,200. Accounts receivable have increased at three times the rate of sales during the last 3 years. Instruc

> Below is a series of cost of goods sold sections for companies A, L, N, and R. Instructions: Fill in the lettered blanks to complete the cost of goods sold sections. A L N R $ 120 $ 250 1,500 80 $ 700 (g) 290 $ (j) 43,590 (k) 42,290 2,240 (1) 49,53

> The trial balance of Sanchez Company at the end of its fiscal year, August 31, 2014, includes these accounts: Beginning Inventory $18,700; Purchases $154,000; Sales Revenue $190,000; Freight-In $8,000; Sales Returns and Allowances $3,000; Freight-Out$1,0

> Suppose in its income statement for the year ended June 30, 2014, The Clorox Company reported the following condensed data (dollars in millions). Instructions: (a) Prepare a multiple-step income statement. (b) Calculate the gross profit rate and the p

> In its income statement for the year ended December 31, 2014, Gavin Company reported the following condensed data. Instructions: (a) Prepare a multiple-step income statement. (b) Calculate the profit margin and gross profit rate. (c) In 2013, Gavin had

> Horne Inc. uses a periodic inventory system. Its records show the following for the month of May, in which 74 units were sold. Instructions: Calculate the ending inventory at May 31 using the (a) FIFO, (b) LIFO, and (c) average cost methods. (For av

> Delmott sells a snowboard, Xpert, that is popular with snowboard enthusiasts. Below is information relating to Delmott’s purchases of Xpert snowboards during September. During the same month, 102 Xpert snowboards were sold. Delmott uses

> Beth Pitchford is the new owner of Brigham Co. She has heard about internal control but is not clear about its importance for her business. Explain to Beth the four purposes of internal control, and give her one application of each purpose for Brigham Co

> On June 10, Purcey Company purchased $9,000 of merchandise from Guyer Company, terms 3/10, n/30. Purcey pays the freight costs of $400 on June 11. Goods totaling $600 are returned to Guyer for credit on June 12. On June 19, Purcey Company pays Guyer Comp

> The following transactions are for Solarte Company. 1. On December 3, Solarte Company sold $500,000 of merchandise to Rooney Co., terms 1/10, n/30. The cost of the merchandise sold was $330,000. 2. On December 8, Rooney Co. was granted an allowance of $2

> This information relates to Crisp Co. 1. On April 5, purchased merchandise from Frost Company for $28,000, terms 2/10, n/30. 2. On April 6, paid freight costs of $700 on merchandise purchased from Frost. 3. On April 7, purchased equipment on account for

> Here are selected 2014 transactions of Cleland Corporation. Jan. 1 Retired a piece of machinery that was purchased on January 1, 2004. The machine cost $62,000 and had a useful life of 10 years with no salvage value. June 30 Sold a computer that wa

> Wang Co. has delivery equipment that cost $50,000 and has been depreciated $24,000. Instructions: Record entries for the disposal under the following assumptions. (a) It was scrapped as having no value. (b) It was sold for $37,000. (c) It was sold for $

> Danny Venable, the new controller of Seratelli Company, has reviewed the expected useful lives and salvage values of selected depreciable assets at the beginning of 2014. Here are his findings: All assets are depreciated by the straight-line method. Se

> Melissa Adduci has prepared the following list of statements about depreciation. 1. Depreciation is a process of asset valuation, not cost allocation. 2. Depreciation provides for the proper matching of expenses with revenues. 3. The book value of a plan

> Thornton Company has an old factory machine that cost $50,000. The machine has accumulated depreciation of $28,000. Thornton has decided to sell the machine. (a) What entry would Thornton make to record the sale of the machine for $25,000 cash? (b) What

> Relaford Corporation purchased a piece of equipment for $50,000. It estimated an 8-year life and $2,000 salvage value. At the end of year four (before the depreciation adjustment), it estimated the new total life to be 10 years and the new salvage value

> Shellhammer Company purchased a delivery truck. The total cash payment was $30,020, including the following items. Negotiated purchase price ………………$24,000 Installation of special shelving ……………. 1,100 Painting and lettering …………………………..900 Motor vehicle

> At December 31, 2013, Weiss Imports reported this information on its balance sheet. Accounts receivable ………………………………………………..$600,000 Less: Allowance for doubtful accounts …………………………. 37,000 During 2014, the company had the following transactions relate

> Lounow Distributors is a growing company whose ability to raise capital has not been growing as quickly as its expanding assets and sales. Lounow’s local banker has indicated that the company cannot increase its borrowing for the foreseeable future. Loun

> Berkman Wholesalers accepts from Almonte Stores a $6,200, 4-month, 9% note dated May 31 in settlement of Almonte’s overdue account. The maturity date of the note is September 30. What entry does Berkman make at the maturity date, assuming Almonte pays th

> Hull Corporation’s management wants to maintain a minimum monthly cash balance of $8,000. At the beginning of September, the cash balance is $12,270; expected cash receipts for September are $97,200; cash disbursements are expected to be $115,000. How mu

> Doug Nicklas owns Doug Blankets. Doug asks you to explain how he should treat the following reconciling items when reconciling the company’s bank account. 1. Outstanding checks 2. A deposit in transit 3. The bank charged to our account a check written by

> Jack Woodling is concerned with control over mail receipts at Yount Sporting Goods. All mail receipts are opened by Bill Morten. Bill sends the checks to the accounting department, where they are stamped “For Deposit Only.” The accounting department reco

> The accounting records of Tuel Electronics show the following data. Beginning inventory 3,000 units at …………………………..$5 Purchases 8,000 units at …………………………………………$7 Sales 9,400 units at ………………………………………………$10 Determine cost of goods sold during the period

> Early in 2014, Defoor Company switched to a just-in-time inventory system. Its sales and inventory amounts for 2013 and 2014 are shown below. Determine the inventory turnover and days in inventory for 2013 and 2014. Discuss the changes in the amount of

> The following information is available for Vogt Corp. for the year ended December 31, 2014: Prepare a multiple-step income statement for Vogt Corp. The company has a tax rate of 30%. Other revenues and gains Other expenses and losses Cost of goods

> Assume information similar to that in 5-1. That is: On October 5, Narveson Company buys merchandise on account from Rossi Company. The selling price of the goods is $5,000, and the cost to Rossi Company is $3,000. On October 8, Narveson returns defective

> Identify which control activity is violated in each of the following situations, and explain how the situation creates an opportunity for fraud or inappropriate accounting practices. 1. Once a month, the sales department sends sales invoices to the accou

> At December 31, 2013, Dustin Company reported this information on its balance sheet. Accounts receivable ………………………………………………$960,000 Less: Allowance for doubtful accounts ………………………...78,000 During 2014, the company had the following transactions related

> If your school has a subscription to the FASB Codification, go to http://aaahq.org/ ascLogin.cfm to log in and prepare responses to the following. (a) What does it mean to capitalize an item? (b) What is the definition provided for an intangible asset? (

> A company’s trade name is a very important asset to the company, as it creates immediate product identification. Companies invest substantial sums to ensure that their product is well known to the consumer. Test your knowledge of who owns some famous bra

> Fresh Air Anti-Pollution Company is suffering declining sales of its principal product, Non biodegradable plastic cartons. The president, Tyler Weber, instructs his controller, Robin Cain, to lengthen asset lives to reduce depreciation expense. A process

> The chapter presented some concerns regarding the current accounting standards for research and development expenditures. Instructions: Assume that you are either (a) the president of a company that is very dependent on ongoing research and development,

> Payton Furniture Corp. is nationally recognized for making high-quality products. Management is concerned that it is not fully exploiting its brand power. Payton’s production managers are also concerned because their plants are not oper

> If your school has a subscription to the FASB Codification, go to http://aaahq.org/ ascLogin.cfm to log in and prepare responses to the following. (a) What does it mean to capitalize an item? (b) What is the definition provided for an intangible asset? (

> Fresh Air Anti-Pollution Company is suffering declining sales of its principal product, non-biodegradable plastic cartons. The president, Tyler Weber, instructs his controller, Robin Cain, to lengthen asset lives to reduce depreciation expense. A process

> The chapter presented some concerns regarding the current accounting standards for research and development expenditures. Instructions: Assume that you are either (a) the president of a company that is very dependent on ongoing research and development

> Payton Furniture Corp. is nationally recognized for making high-quality products. Management is concerned that it is not fully exploiting its brand power. Payton’s production managers are also concerned because their plants are not oper

> If your school has a subscription to the FASB Codification, go to http://aaahq.org/ ascLogin.cfm to log in and prepare responses to the following. Instructions: Access the glossary (“Master Glossary”) to answer the following. (a) What is the definition

> Tiffee Company identifies the following items for possible inclusion in the physical inventory. Indicate whether each item should be included or excluded from the inventory taking. (a) 900 units of inventory shipped on consignment by Tiffee to another co

> Eaton Company is a pesticide manufacturer. Its sales declined greatly this year due to the passage of legislation outlawing the sale of several of Eaton’s chemical pesticides. During the coming year, Eaton will have environmentally safe and competitive

> Lincoln Park was organized on April 1, 2013, by Judy Tercek. Judy is a good manager but a poor accountant. From the trial balance prepared by a part-time bookkeeper, Judy prepared the following income statement for the quarter that ended March 31, 2014.

> Reagen Wholesale Corp. uses the LIFO cost flow method. In the current year, profit at Reagen is running unusually high. The corporate tax rate is also high this year, but it is scheduled to decline significantly next year. In an effort to lower the curre

> You are the controller of Fagan Inc. K. L. Howard, the president, recently mentioned to you that she found an error in the 2013 financial statements which she believes has corrected itself. She determined, in discussions with the purchasing department, t

> If your school has a subscription to the FASB Codification, go to http://aaahq.org/ ascLogin.cfm to log in and prepare responses to the following. (a) The primary basis for accounting for inventories is cost. How is cost defined in the Codification? (b)

> If your school has a subscription to the FASB Codification, go to http://aaahq.org/ ascLogin.cfm to log in and prepare responses to the following. Instructions: Access the glossary (“Master Glossary”) to answer the following. (a) What is the definition

> Eaton Company is a pesticide manufacturer. Its sales declined greatly this year due to the passage of legislation outlawing the sale of several of Eaton’s chemical pesticides. During the coming year, Eaton will have environmentally safe and competitive r

> Lincoln Park was organized on April 1, 2013, by Judy Tercek. Judy is a good manager but a poor accountant. From the trial balance prepared by a part-time bookkeeper, Judy prepared the following income statement for the quarter that ended March 31, 2014.