Question: It is January 20, Year 13. Mr.

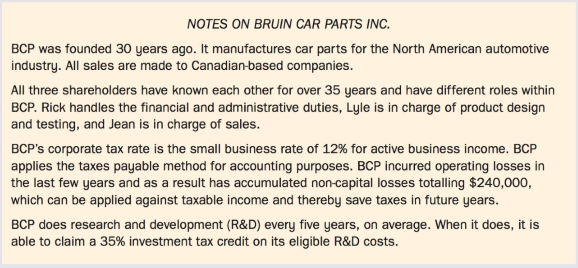

It is January 20, Year 13. Mr. Neely, a partner in your office, wants to see you, CPA, about Bruin Car Parts Inc. (BCP), a client requiring assistance. BCP prepares its financial statements in accordance with ASPE. Richard (Rick) Bergeron, Lyle Chara, and Jean Perron each own 100 common shares of BCP. Jean wants BCP to buy him out. You made some notes on BCP during your discussion with Mr. Neely (Exhibit 1).

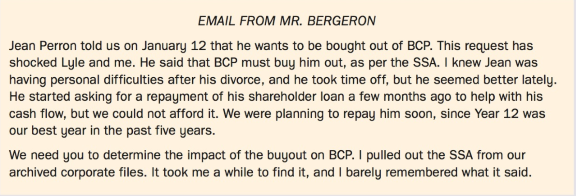

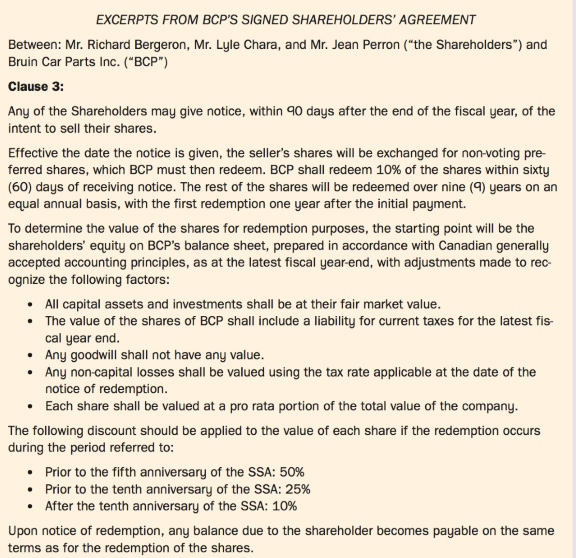

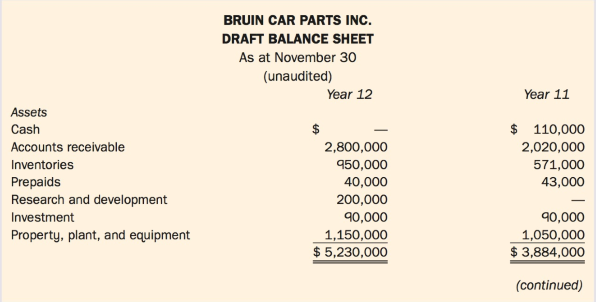

Mr. Neely forwarded an email from Rick (Exhibit II) to you, along with excerpts from the Signed Shareholders' Agreement (SSA) (Exhibit III), the draft financial statements for BCP for the year ended November 30, Year 12 (Exhibit IV), and some additional information regarding the draft financial statements (Exhibit V).

Mr. Neely tells you, "CPA, we need to establish a buyout value. Our valuation must take into account any accounting adjustments required to comply with the SSA requirements. Please also consider any other issues that may be relevant to the other shareholders."

Exhibit 1:

Exhibit II:

Exhibit III:

Exhibit IV:

Exhibit V:

Transcribed Image Text:

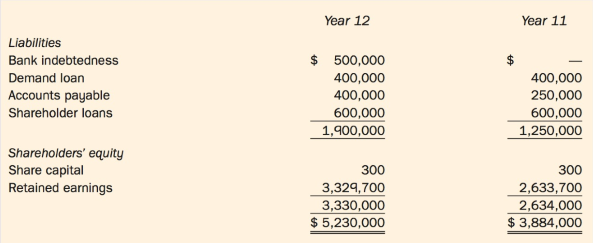

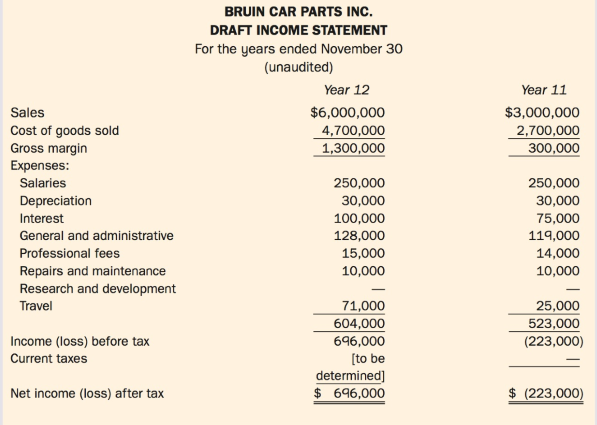

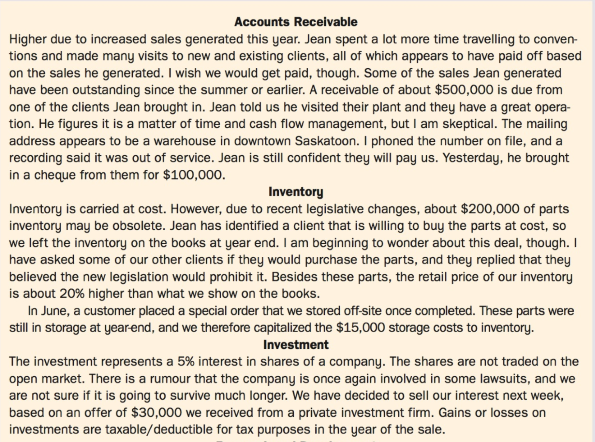

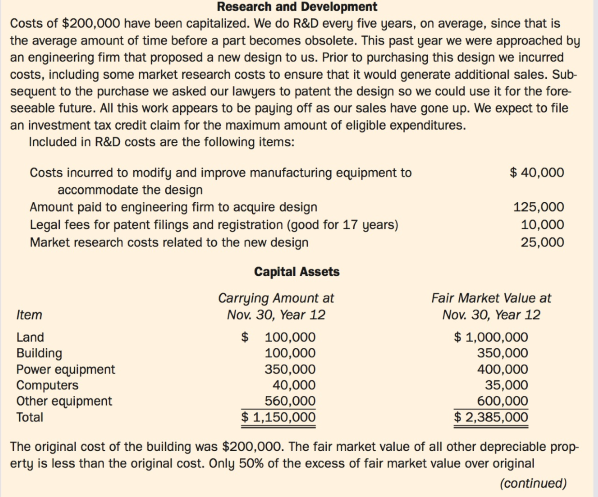

NOTES ON BRUIN CAR PARTS INC. BCP was founded 30 years ago. It manufactures car parts for the North American automotive industry. All sales are made to Canadian-based companies. All three shareholders have known each other for over 35 years and have different roles within BCP. Rick handles the financial and administrative duties, Lyle is in charge of product design and testing, and Jean is in charge of sales. BCP's corporate tax rate is the small business rate of 12% for active business income. BCP applies the taxes payable method for accounting purposes. BCP incurred operating losses in the last few years and as a result has accumulated non-capital losses totalling $240,000, which can be applied against taxable income and thereby save taxes in future years. BCP does research and development (R&D) every five years, on average. When it does, it is able to claim a 35% investment tax credit on its eligible R&D costs. EMAIL FROM MR. BERGERON Jean Perron told us on January 12 that he wants to be bought out of BCP. This request has shocked Lyle and me. He said that BCP must buy him out, as per the SSA. I knew Jean was having personal difficulties after his divorce, and he took time off, but he seemed better lately. He started asking for a repayment of his shareholder loan a few months ago to help with his cash flow, but we could not afford it. We were planning to repay him soon, since Year 12 was our best year in the past five years. We need you to determine the impact of the buyout on BCP. I pulled out the SSA from our archived corporate files. It took me a while to find it, and I barely remembered what it said. EXCERPTS FROM BCP'S SIGNED SHAREHOLDERS' AGREEMENT Between: Mr. Richard Bergeron, Mr. Lyle Chara, and Mr. Jean Perron ("the Shareholders") and Bruin Car Parts Inc. ("BCP") Clause 3: Any of the Shareholders may give notice, within 90 days after the end of the fiscal year, of the intent to sell their shares. Effective the date the notice is given, the seller's shares will be exchanged for non-voting pre- ferred shares, which BCP must then redeem. BCP shall redeem 10% of the shares within sixty (60) days of receiving notice. The rest of the shares will be redeemed over nine (9) years on an equal annual basis, with the first redemption one year after the initial payment. To determine the value of the shares for redemption purposes, the starting point will be the shareholders' equity on BCP's balance sheet, prepared in accordance with Canadian generally accepted accounting principles, as at the latest fiscal year-end, with adjustments made to rec- ognize the following factors: • All capital assets and investments shall be at their fair market value. • The value of the shares of BCP shall include a liability for current taxes for the latest fis- cal year end. • Any goodwill shall not have any value. • Any non-capital losses shall be valued using the tax rate applicable at the date of the notice of redemption. Each share shall be valued at a pro rata portion of the total value of the company. The following discount should be applied to the value of each share if the redemption occurs during the period referred to: • Prior to the fifth anniversary of the SSA: 50% • Prior to the tenth anniversary of the SSA: 25% • After the tenth anniversary of the SSA: 10% Upon notice of redemption, any balance due to the shareholder becomes payable on the same terms as for the redemption of the shares. BRUIN CAR PARTS INC. DRAFT BALANCE SHEET As at November 30 (unaudited) Year 12 Year 11 Assets Cash $ $ 110,000 Accounts receivable 2,800,000 2,020,000 Inventories 950,000 571,000 Prepaids Research and development 40,000 43,000 200,000 - 90,000 1,050,000 $ 3,884,000 Investment 90,000 Property, plant, and equipment 1,150,000 $ 5,230,000 (continued) Year 12 Year 11 Liabilities $ 500,000 400,000 Bank indebtedness 400,000 250,000 600,000 1,250,000 Demand loan Accounts payable 400,000 600,000 1,900,000 Shareholder loans Shareholders' equity Share capital Retained earnings 300 300 3,329,700 3,330,000 2,633,700 2,634,000 $ 3,884,000 $ 5,230,000 BRUIN CAR PARTS INC. DRAFT INCOME STATEMENT For the years ended November 30 (unaudited) Year 12 Year 11 Sales $6,000,000 $3,000,000 Cost of goods sold Gross margin Expenses: 4,700,000 1,300,000 2,700,000 300,000 Salaries 250,000 250,000 Depreciation Interest 30,000 30,000 100,000 75,000 General and administrative 128,000 119,000 Professional fees 15,000 14,000 Repairs and maintenance 10,000 10,000 Research and development 71,000 604,000 696,000 [to be determined] $ 696,000 Travel 25,000 523,000 (223,000) Income (loss) before tax Current taxes Net income (loss) after tax $ (223,000) ADDITIONAL INFORMATION FROM RICK REGARDING BCP'S DRAFT FINANCIAL STATEMENTS This year was much better due to advances in our product design and increased sales efforts. We gained efficiencies in our production processes, so our gross margins were also much better. The notes below explain some of the variances in the draft financials. Accounts receivable Higher due to increased sales generated this year. Jean spent a lot more time travelling to conven- tions and made many visits to new and existing clients, all of which appears to have paid off based on the sales he generated. I wish we would get paid, though. Some of the sales Jean generated have been outstanding since the summer or earlier. A receivable of about $500,000 is due from one of the clients Jean brought in. Jean told us he visited their plant and they have a great opera- tion. He figures it is a matter of time and cash flow management, but I am skeptical. The mailing address appears to be a warehouse in downtown Saskatoon. I phoned the number on file, and a recording said it was out of service. Jean is still confident they will pay us. Yesterday, he brought in a cheque from them for $100,000. Inventory Inventory is carried at cost. However, due to recent legislative changes, about $200,000 of parts inventory may be obsolete. Jean has identified a client that is willing to buy the parts at cost, so we left the inventory on the books at year end. I am beginning to wonder about this deal, though. I have asked some of our other clients if they would purchase the parts, and they replied that they believed the new legislation would prohibit it. Besides these parts, the retail price of our inventory is about 20% higher than what we show on the books. In June, a customer placed a special order that we stored off-site once completed. These parts were still in storage at yearend, and we therefore capitalized the $15,000 storage costs to inventory. Investment The investment represents a 5% interest in shares of a company. The shares are not traded on the open market. There is a rumour that the company is once again involved in some lawsuits, and we are not sure if it is going to survive much longer. We have decided to sell our interest next week, based on an offer of $30,000 we received from a private investment firm. Gains or losses on investments are taxable/deductible for tax purposes in the year of the sale. Research and Development Costs of $200,000 have been capitalized. We do R&D every five years, on average, since that is the average amount of time before a part becomes obsolete. This past year we were approached by an engineering firm that proposed a new design to us. Prior to purchasing this design we incurred costs, including some market research costs to ensure that it would generate additional sales. Sub- sequent to the purchase we asked our lawyers to patent the design so we could use it for the fore- seeable future. All this work appears to be paying off as our sales have gone up. We expect to file an investment tax credit claim for the maximum amount of eligible expenditures. Included in R&D costs are the following items: $ 40,000 Costs incurred to modify and improve manufacturing equipment to accommodate the design Amount paid to engineering firm to acquire design Legal fees for patent filings and registration (good for 17 years) Market research costs related to the new design 125,000 10,000 25,000 Capital Assets Carrying Amount at Nov. 30, Year 12 $ 100,000 100,000 350,000 40,000 Fair Market Value at Nov. 30, Year 12 $ 1,000,000 Item Land Building Power equipment Computers Other equipment Total 350,000 400,000 35,000 600,000 $ 2,385,000 560,000 $ 1,150,000 The original cost of the building was $200,000. The fair market value of all other depreciable prop- erty is less than the original cost. Only 50% of the excess of fair market value over original (continued) cost is taxable for tax purposes in the year of the sale. The maximum capital cost allowance (CCA) that could be claimed for tax purposes in Year 12 is $201,268. Other Short-term liabilities increased to help finance production of inventories while waiting for payment from customers on account. Shareholder loans are split equally between the three of us. Interest expense includes late filing HST/GST interest and penalties of $1,500, which is not deductible for tax purposes.

> What reporting options related to business combinations are available to private companies?

> Explain how changes in the fair value of contingent consideration should be reported, assuming that the contingent consideration will be paid in the form of cash.

> What is contingent consideration, and how is it measured at the date of acquisition?

> What accounts on the consolidated balance sheet differ in value between entity theory and parent company extension theory? Briefly explain why they differ.

> What is non-controlling interest, and where is it reported in the consolidated balance sheet under the parent company extension and entity theories?

> What guidelines does the Handbook provide for pledges received by an NFPO?

> Under the entity theory and when using the implied value approach, consolidated goodwill is determined by inference. Describe how this is achieved, and comment on its shortcomings.

> How is the goodwill appearing on the statement of financial position of a subsidiary prior to a business combination treated in the subsequent preparation of consolidated statements? Explain.

> With respect to the valuation of non-controlling interest, what are the major differences among proprietary, parent company extension, and entity theories?

> In the preparation of a consolidated balance sheet, the differences between the fair value and the carrying amount of the subsidiary's net assets are used. Would these differences be used if the subsidiary applied push-down accounting? Explain.

> How would the consolidation of a parent-founded subsidiary differ from the consolidation of a purchased subsidiary?

> Don Ltd. purchased 80% of the outstanding shares of Gunn Ltd. Before the purchase, Gunn had a deferred charge of $10.5 million on its balance sheet. This item consisted of organization costs that were being amortized over a 20-year period. What amount sh

> In whose accounting records are the consolidation elimination entries recorded? Explain.

> How is the net income earned by a subsidiary in the year of acquisition incorporated in the consolidated income statement?

> Explain whether the historical cost principle is applied when accounting for negative goodwill.

> What is negative goodwill, and how is it accounted for?

> Outline the Handbook's requirements for NFPOs with regard to accounting for the capital assets of NFPOs.

> Is a negative acquisition differential the same as negative goodwill? Explain.

> What is an acquisition differential, and where does it appear on the consolidated balance sheet?

> What part do irrevocable agreements, convertible securities, and warrants play in determining whether control exists? Explain.

> What criteria must be met for a subsidiary to be consolidated? Explain.

> If one company issued shares as payment for the net assets of another company, it would probably insist that the other company be wound up after the sale. Explain why this condition would be part of the purchase agreement.

> Briefly describe the accounting involved with the new-entity method.

> Outline the accounting involved with the acquisition method for a 100%-owned subsidiary.

> Explain how an acquirer is determined in a business combination for a 100%-owned subsidiary.

> Can a statutory amalgamation be considered a form of business combination? Explain.

> What are protective rights, and how do they affect the decision of whether one entity has control over another entity?

> It is common for an NFPO to receive donated supplies, equipment, and services. Do current accounting standards require the recording of donations of this kind? Explain.

> What are separate financial statements, and when can they be presented to external users in accordance with IFRS?

> Does the historical cost principle or fair value reporting take precedence when preparing consolidated financial statements at the date of acquisition under the acquisition method? Explain.

> When must an intangible asset be shown separately from goodwill? What are the criteria for reporting these intangible assets separately from goodwill?

> How is goodwill determined at the date of acquisition? Describe the nature of goodwill.

> What are some reasons for the acquisition cost being in excess of the carrying amount of the acquiree's assets and liabilities? What does this say about the accuracy of the values used in the financial statements of the acquiree?

> What key element must be present in a business combination?

> Able Company holds a 40% interest in Baker Corp. During the year, Able sold a portion of this investment. How should this investment be reported after the sale?

> Ashton Inc. acquired a 40% interest in Villa Corp. for $200,000. In the first year after acquisition, Villa reported a loss of $700,000. Using the equity method, how should Ashton account for this loss assuming (a) Ashton has guaranteed the liabilities o

> Briefly outline how NFPOs differ from profit-oriented organizations.

> The following balance sheets have been prepared as at December 31, Year 6, for Kay Corp. and Adams Ventures: Additional Information • Kay acquired its 40% interest in Adams for $374,000 in Year 2, when Adams's retained earnings amount

> Fairchild Centre is an NFPO funded by government grants and private donations. It was established on January 1, Year 5, to provide counselling services and a drop-in center for single parents. On January 1, Year 5, the center leased an old warehouse in t

> Regina Communications Ltd. develops and manufactures equipment for technology and communications enterprises. Since its incorporation, it has grown steadily through internal expansion. In the middle of Year 14, Arthur Lajord, the sole owner of Regina, me

> When Conoco Inc. of Houston, Texas announced the CAD$7 billion acquisition of Gulf Canada Resources Limited of Calgary, Alberta, a large segment of the press release was devoted to outlining all of the expected benefits to be received from the assets acq

> Manitoba Peat Moss (MPM) was the first Canadian company to provide a reliable supply of high-quality peat moss to be used for greenhouse operations. Owned by Paul Parker, the company's founder and president, MPM began operations approximately 30 years ag

> The directors of Atlas Inc. and Beta Corp. have reached an agreement in principle to merge the two companies and create a new company called AB Ltd. The basics of the agreement confirmed so far are outlined below: • The new company will purchase all of

> On December 30, Year 7, Pepper Company agreed to form a business combination with Salt Limited. Pepper issued 4,640 of its common shares for all (5,800) of the outstanding common shares of Salt. This transaction increased the number of the outstanding Pe

> You are examining the consolidated financial statements of a European company, which have been prepared in accordance with IFRS. You determine that property, plant, and equipment is revalued each year to its current fair value, income and equity are adju

> In this era of rapidly changing technology, research and development (R&D) expenditures represent one of the most important factors in the future success of many companies. Organizations that spend too little on R&D risk being left behind by the competit

> An investor uses the equity method to report its investment in an investee. During the current year, the investee reports other comprehensive income on its statement of comprehensive income. How should this item be reflected in the investor's financial s

> Michael Metals Limited (MML) has been a private company since it was incorporated under federal legislation over 40 years ago. At the present time (September, Year 45), ownership is divided among four cousins, each of whom holds 25% of the 100 outstandin

> Canadian Computer Systems Limited (CCS) is a public company engaged in the development of computer software and the manufacturing of computer hardware. CCS is listed on a Canadian stock exchange and has a 40% non-controlling interest in Sandra Investment

> Floyd's Specialty Foods Inc. (FSFI) operates over 60 shops throughout Ontario. The company was founded by George Floyd when he opened a single shop in the city of Cornwall. This store sold prepared dinners and directed its products at customers who were

> Hil Company purchased 10,000 common shares (10%) of Ton Inc. on January 1, Year 4, for $345,000, when Ton's shareholders' equity was $2,600,000, and it classified the investment as a FVTPL security. On January 1, Year 5, Hil acquired an additional30,000

> Goal Products Limited (GPL) is the official manufacturer and distributor of soccer balls for the North American League Soccer (NALS), a professional soccer association. GPL is a private company. It has always prepared its financial statements in accordan

> Roman Systems Inc. (RSI) is a Canadian private company. It was incorporated in Year 1 by its sole common shareholder, Marge Roman. RSI manufactures, installs, and provides product support for its line of surveillance cameras. Marge started the company wi

> John McCurdy has recently joined a consultant group that provides investment advice to the managers of a special investment fund. This investment fund was created by a group of NFPOs, all of which have endowment funds, and rather than investing their res

> The provincial government (50%) and three private companies (16.67% each) own Access Records Limited (ARL), which commenced operations on April 1, Year 1. The provincial government currently maintains, on a manual basis, all descriptive information on la

> The Sassawinni. First Nation is located adjacent to a town in northern Saskatchewan. The Nation is under the jurisdiction of the federal government’s Aboriginal Affairs and Northern Development Canada, and for years has received substantial funding from

> Because of the acquisition of additional investee shares, an investor may need to change from the fair value method for a FVTPL investment to the equity method for a significant influence investment. What procedures are applied to effect this accounting

> When and why would an NFPO use replacement cost rather than net realizable value to determine whether inventory should be written down?

> Today is September 16, Year 2. You, CPA, work for Garcia & Garcia LLP, a medium-sized firm located in Montreal. Jules Garcia calls you into his office. "CPA, I have a very special engagement for you. A friend of mine, Louise Martin, is starting a not

> In the fall of Year 5, eight wealthy business people from the same ethnic background formed a committee (CKER committee) to obtain a radio license from the Canadian Radio-television and Telecommunications Commission (CRTC). Their goal is to start a non-p

> Confidence Private is a high school in the historic city of Jeanville. It engages students in a dynamic learning environment and inspires them to become intellectually vibrant, compassionate, and responsible citizens. The private school has been run as a

> You have just completed an interview with the newly formed audit committee of the Andrews Street Youth Centre (ASYC). This organization was created to keep neighborhood youth off the streets by providing recreational facilities where they can meet, exerc

> Beaucoup Hospital is located near Montreal. A religious organization created the not-for-profit hospital more than 70 years ago to meet the needs of area residents who could not otherwise afford adequate health care. Although the hospital is open to the

> Maple Limited (Maple) was incorporated on January 2, Year 1, and commenced active operations immediately in Greece. Common shares were issued on the date of incorporation for 100,000 euros (€), and no more common shares have been issued

> Athena Ltd. is a subsidiary located in Greece. It uses the euro for internal reporting purposes. At December 31, Year 11, the company's inventory on hand had a cost of €20,000 and a net realizable value of €21,000. The i

> On January 1, Year 4, P Company (a Canadian company) purchased 90% of S Company (located in a foreign country) at a cost of 15,580 foreign currency units (FC). The carrying amounts of S Company's net assets were equal to fair values on this date except f

> EVA Company was incorporated on January 2, Year 5, and commenced active operations immediately. Ordinary shares were issued on the date of incorporation and no new ordinary shares have been issued since then. On December 31, Year 9, PAL Company purchased

> Refer to Problem 11-3. All of the facts and data given in the problem are the same. Your answer to Problem 11-3 will be incorporated in the answer to this problem. Kelly Corporation's comparative balance sheets and Year 2 income statement are as follows:

> The Ralston Company owns 35% of the outstanding voting shares of Purina Inc. Under what circumstances would Ralston determine that it is inappropriate to report this investment using the equity method?

> On December 31, Year 1, Kelly Corporation of Toronto paid 13.7 million Libyan dinars (LD) for 100% of the outstanding common shares of Arkenu Company of Libya. On this date, the fair values of Arkenu's identifiable assets and liabilities were equal to th

> Refer to Problem 11-1. All of the facts and data given in the problem are the same except that PMI only purchased 40% of the outstanding ordinary shares of Sandora for US$6,400,000. Additional Information • PMI's 40% in Sandora gave it

> On January 1, Year 4, Par Company purchased all the outstanding common shares of Bayshore Company, located in California, for US$260,000. The carrying amount of Bayshore's shareholders' equity on January 1, Year 4, was US$202,000. The fair value of Baysh

> White Company was incorporated on January 2, Year 1, and commenced active operations immediately. Common shares were issued on the date of incorporation and no new common shares have been issued since then. On December 31, Year 5, Black Company purchased

> SPEC Co. is a Canadian investment company. It acquires real estate properties in foreign countries for speculative purposes. On January 1, Year 5, SPEC incorporated a wholly owned subsidiary, CHIN Limited. CIDN immediately purchased a property in Shangha

> The financial statements of Malkin Inc., of Russia, as at December 31, Year 11, follow: Additional Information • On January 1, Year 11, Crichton Corporation of Toronto acquired 40% of Malkin's common shares for RR800,000. â

> In Year 1, Victoria Textiles Limited decided that its Asian operations had expanded such that an Asian office should be established. The office would be involved in selling Victoria's current product lines; it was also expected to establish supplier cont

> On December 31, Year 1, Precision Manufacturing Inc. (PMI) of Edmonton purchased 100% of the outstanding ordinary shares of Sandora Corp. of Flint, Michigan. Sandora's comparative statement of financial position and Year 2 income statement are as follows

> EnDur Corp (EDC) is a Canadian company that exports computer software. On February l, Year 2, EDC contracted to sell software to a customer in Denmark at a selling price of 600,000 Danish krona (DK) with payment due 60 days after installation was complet

> On August 1, Year 3, Carleton Ltd. ordered machinery from a supplier in Hong Kong for HK$500,000. The machinery was delivered on October 1, Year 3, with terms requiring payment in full by December 31, Year 3. On August 2, Year 3, Carleton entered a forwa

> The equity method records dividends as a reduction in the investment account. Explain why.

> Hamilton Importing Corp. (HIC) imports goods from countries around the world for sale in Canada. On December 1, Year 3, HIC purchased 11,300 watches from a foreign wholesaler for DM613,000 when the spot rate was DM1 = $0.754. The invoice called for payme

> On October 1, Year 6, Versatile Company contracted to sell merchandise to a customer in Switzerland at a selling price of SF400,000. The contract called for the merchandise to be delivered to the customer on January 31, Year 7, with payment due on delive

> On January 1, Year 5, Ornate Company Ltd. purchased US$2,200,000 of the bonds of the Gem Corporation. The bonds were trading at par on this date, pay interest at 12% each December 31, and mature on December 31, Year 7. The following Canadian exchange rat

> Lamont Company is a Canadian company that produces electronic switches for the telecommunications industry. Lamont regularly imports component parts from Sousa Ltd., a supplier located in Mexico, and makes payments in Mexican pesos (MP). Based on past ex

> Moose Utilities Ltd. (MUL) borrowed $40,000,000 in U.S. funds on January 1, Year 1, at an annual interest rate of 12%. The loan is due on December 31, Year 4, and interest is paid annually on December 31. The Canadian exchange rates for U.S. dollars over

> Assume that all of the facts in Problem 1 remain unchanged except that MEl uses hedge accounting. Also, assume that the forward element and spot elements on the forward contract are accounted for separately. Required: (a) Prepare the journal entries fo

> As a result of its export sales to customers in Switzerland, the Lenox Company has had Swiss-franc-denominated revenues over the past number of years. In order to gain protection from future exchange rate fluctuations, the company decides to borrow its c

> Hull Manufacturing Corp. (HMC), a Canadian company, manufactures instruments used to measure the moisture content of barley and wheat. The company sells primarily to the domestic market, but in Year 3, it developed a small market in Argentina. In Year 4,

> On June 1, Year 3, Forever Young Corp. (FYC) ordered merchandise from a supplier in Turkey for Turkish lira (TL) 217,000. The goods were delivered on September 30, with terms requiring cash on delivery. On June 2, Year 3, FYC entered a forward contract a

> On May 1, Year 1, JDH orders equipment from a supplier in Germany for €100,000 with delivery scheduled for October 1, Year 1. Payment is due on December 31, Year 1. On May 2, Year 1 JDH enters into an 8-month forward contract with its ba

> What criteria would be used to determine whether the equity method should be used to account for a particular investment?

> Gemella Ltd. manufactures construction equipment for sale throughout eastern Canada and northeastern United States. Its year-end is June 30. The following foreign currency transactions occurred during the Year 11 calendar year: 1. On January 10, Gemella

> Manitoba Exporters Inc. (MEl) sells Inuit carvings to countries throughout the world. On December 1, Year 5, MEl sold 10,000 carvings to a wholesaler in a foreign country at a total cost of 600,000 foreign currency units (FCs) when the spot rate was FC1

> The following are the December 31, Year 9, balance sheets of three related companies: Additional Information • On January 1, Year 5, Pro purchased 40% of Forma for $116,000. On that date, Forma's shareholders' equity was as follows:

> Access the 2014 consolidated financial statements for Rogers Communications Inc. by going to the investor relations section of the company's website. Answer the questions below. For each question, indicate where in the financial statements you found the

> The following information has been assembled about Casbar Corp. as at December 31, Year 5 (amounts are in thousands): Required: Determine which operating segments require separate disclosures. Operating Segment Revenues Profit Assets $12,000 9,600

> On January 1, Year 6, HD Ltd., a building supply company, JC Ltd., a construction company, and Mr. Saeid, a private investor, signed an agreement to carry out a joint operation under the following terms and conditions: • JC would buy an

> The statements of financial position of Hui Inc. and Kozikowski Ltd. on December 31, Year 11, were as follows: Kozikowski's manufacturing facility is old and very costly to operate. For the year ended December 31, Year 11, the company lost money for th

> Assume that all of the facts in Problem 3 remain unchanged except that Green paid $211,800 for 60% of the voting shares of Mansford. Required: (a) Prepare a consolidated balance sheet at January 1, Year 5. (b) Calculate goodwill and non-controlling int

> On January 1, Year 5, Green Inc. purchased 100% of the common shares of Mansford Corp. for $353,000. Green's balance sheet data on this date just prior to this acquisition were as follows: The balance sheet and other related data for Mansford are as fo