Question: Joe Bell, president and chief executive officer

Joe Bell, president and chief executive officer of Dyna Golf, has called a meeting of the executive

committee of his board of directors. He is concerned about the price competition and declining sales of his golf wedge line of business. Bell summarizes the current situation by saying,

As you know, we set target prices to maintain a gross margin on sales of 35 percent. On some products, such as our drivers, we have been able to achieve the target price. We have been able to achieve higher prices on our putters than a target 35 percent gross margin would dictate. But our wedges are a totally different story.

Our factory is among the most efficient in the world. I think that some foreign companies are dumping wedges in the U.S. market, driving down prices and unit sales. We’ve been reluctant to further cut our prices for fear of what this will do to our gross margins. Fortunately, we’ve been able to offset the decline in sales of wedges by significantly raising the price of our putters. We were pleasantly surprised when our customers readily accepted the price increases of our putters, and we haven’t experienced much reaction from our competitors on the putter price increases.

Steve Barber, an outside director on the board, asks:

Joe, I don’t pretend to know a lot about the golf club business, but how confident are you in your cost data? If your costs are off, won’t your prices be off as well?

Joe Bell responds:

That’s a good point, Steve, and one I’ve been worried about. We’ve been modernizing our production facilities and I’ve asked our controller, Phil Meyers, to look into it and report back after he has undertaken a thorough analysis. My purpose for calling this meeting was to update you on our current situation and let you know what we are doing.

Background

Dyna Golf has been in business for 15 years. Its one plant manufactures three different types of golf clubs: drivers, wedges, and putters. Dyna does not produce a complete club with a shaft and grip. It makes the metal head that is sold to other companies that assemble and market the complete club. Dyna holds four patents on a unique golf club head design that forges together into one club head three different metals: steel, titanium, and brass. It also has a very distinctive appearance. These three metals weigh different amounts, and by designing a club head with the three metals, Dyna produces a club with unique swing and feel properties. While the Dyna club is unique and covered by patents, other manufacturers have recently introduced similar technology using comparable manufacturing methods.

The Dyna driver is sold to a single distributor that adds the shaft and grip and sells the driver to retail golf shops. Dyna first made its reputation with its driver. It became an “instant hit†with amateurs after a professional golfer won a tournament using the Dyna driver. Based on the name recognition from its driver, Dyna introduced a line of putters and then wedges. The wedges are sold to three different distributors and the putters to six different distributors. Specialty, high-end putters like Dyna’s have a retail price of $120 to $180 and drivers a retail price of $350 to $500. Golfers like to experiment with new equipment, especially when they are playing badly. Therefore, it is not uncommon for golfers to own several putters and switch among them during the year. Putter

manufacturers seek to capitalize on this psychology with aggressive advertising campaigns. It is less common for players to switch among wedges as they do with putters. Since it takes several rounds of golf playing with a new wedge to get its feel and distance control, most players don’t experiment as much with wedges as with putters, or even drivers.

Production process All three clubs (drivers, wedges, and putters) use the same manufacturing process. Each of the three clubs consists of between 5 and 10 components. A component is a precisely machined piece of steel, brass, or titanium that Dyna buys from outside suppliers. The components are positioned in a jig, which is placed in a specially designed computer-controlled machine. This machine first heats the components to a very high temperature that fuses them together, then cools them, and polishes the finished club.

The factory is organized into five departments: Receiving, Engineering, Setup, Machining, and Packing. Before a production run begins, Receiving issues a separate order for each component comprising the club head and inspects each order when it arrives. Engineering ensures that the completed club heads meet the product’s specifications and maintains the operating efficiency of the machines. Because of the preciseness of the production process, Engineering is constantly having to issue Engineering change orders in response to small differences in purchased components. Setup first cleans out the machine and jigs, adjusts the machine to the correct settings to produce the desired club head, and then makes a few pieces to ensure the settings are correct. Machining contains several machines, any of which can be used to manufacture drivers, wedges, or putters once it is equipped with the proper jigs and tools. Packing is responsible for packaging and shipping completed units.

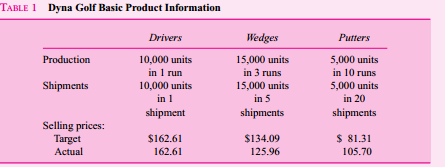

Table 1 summarizes the basic product information for the three products: production, shipments,\ target prices, and actual prices. For example, Dyna manufactured all 10,000 drivers in a single production run and shipped them all out in a single shipment. The 5,000 putters were manufactured in 10 separate runs and shipped in 20 shipments. Dyna set a target price for drivers to be $162.61 (wholesale price) and achieved it. However, it was not able to achieve its target price for wedges ($134.09 versus $125.96), but it exceeded its target price for putters ($105.70 versus $81.31).

Accounting system

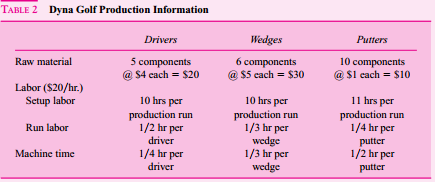

Table 2 summarizes raw material, setup and run labor, and machine time for each of the three products. Each product is produced in the machining department by assembling the metal components. Drivers require 5 components, whereas wedges and putters require 6 and 10 components, respectively. Before the production begins, the machine must be set up, requiring setup labor. Then to produce clubs, operating the machines requires both machine time and run labor time. Both setup and run labor cost $20 per hour. Machining has a total budget of $700,000 consisting of the depreciation on the machine, electricity, and maintenance. Drivers take more run labor time than machine time because several operators are required to operate the machinery when drivers are produced. During putter machining, the operator can be operating two machines at once. Table 3 summarizes the overhead accounts.

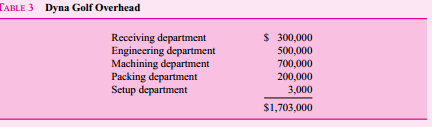

Phil Meyers, Dyna’s controller, and Joe Bell meet a week after the executive committee meeting of the board of directors. Joe Bell asks Phil to report on what he has found. Phil begins, Joe, as you know, our current accounting system assigns the direct material costs of the components and the direct labor for run time to the three products. Then it allocates all overhead costs, including setup time and machine costs, to the three products based on direct run labor dollars. Setup labor is considered an indirect cost and is included in overhead. Based on these procedures we calculate our product costs for drivers, wedges, and putters to be $105.70, $87.16, and $52.85, respectively.

I’ve been looking at our system and have become worried that our overhead rate is getting out of line. It’s now over 750 percent of direct labor cost. Since we’ve introduced more automated machines, we’re substituting capital or overhead dollars for labor dollars. The Engineering department schedules its people based on change orders it receives. Drivers are pretty standard and only generate 25 percent of the change orders and wedges about 35 percent. Putters are our most complex production process and require the remainder of the change orders.

I’m thinking we should refine our accounting system along the following lines. First, we should break out setup labor from the general overhead account and assign that directly to each product. We know how much time we are spending setting up each machine for each club-head run. Second, we should stop allocating receiving costs based on direct labor dollars but rather on raw material dollars. And third, the remaining overhead (excluding setup and receiving) should be allocated based on machine hours. If we make these three changes, I think we’ll get a more accurate estimate of our products’ costs. Joe Bell responded,

These seem to be some pretty major changes in our accounting system. I’ll need some time to mull these over. Let me think about it and I’ll let you know in a few days how to proceed.

Required:

What advice would you offer Joe Bell?

Transcribed Image Text:

TABLE 1 Dyna Golf Basic Product Information Drivers Wedges Putters 5,000 units in 10 runs 5,000 units in 20 shipments Production 10,000 units 15,000 units in 3 runs 15,000 units in 5 shipments in 1 run Shipments 10,000 units in 1 shipment Selling prices: Target Actual $162.61 162.61 $134.09 $ 81.31 125.96 105.70 TABLE 2 Dyna Golf Production Information Drivers Wedges Putters 5 components @ $4 cach = $20 Raw material 6 components @ $5 cach = $30 10 components @ $1 each = $10 Labor ($20/hr.) Setup labor 10 hrs per production run 1/2 hr per 10 hrs per production run 1/3 hr per wedge 1/3 hr per wedge 11 hrs per production run 1/4 hr per Run labor driver putter 1/2 hr per Machine time 1/4 hr per driver putter TABLE 3 Dyna Golf Overhead $ 300,000 Receiving department Engineering department Machining department Packing department Setup department 500,000 700,000 200,000 3,000 $1,703,000

> Madden International is a large ($7 billion sales), successful international pharmaceuticals firm operating in 23 countries with 15 autonomous subsidiaries. The corporate office consists of five vice presidents who oversee the operations of the subsidiar

> The Transfer Price Company has two divisions (Intermediate and Final) that report to the corporate office (Corporate). The two divisions are profit centers. Intermediate produces a proprietary product (called “intermed”

> ICB has four manufacturing divisions, each producing a particular type of cosmetic or beauty aid. These products are then transferred to five marketing divisions, each covering a particular geographic region. Manufacturing and marketing divisions are fre

> Logical Solutions reports the following overhead variances for 2010: Spending variance …………………………………$100,000 F Efficiency variance …………………………………$100,000 F Volume variance …………………………………..$300,000 F In addition, actual overhead incurred in 2010 was $1 mill

> Repro Corporation is the leading manufacturer and seller of office equipment. Its most profitable business segment is the production and sale of large copiers. The company is currently organized into two divisions: manufacturing and sales. Manufacturing

> The Ogden plant makes Beanie Babies, small stuffed toys in a variety of animal shapes. The toys are so popular that they have become collectors’ items. The plant uses a flexible budget and predetermined overhead rates to assign overhead costs to the diff

> Geico is considering expanding an existing plant on a piece of land it already owns. The land was purchased 15 years ago for $325,000 and its current market appraisal is $820,000. A capital budgeting analysis shows that the plant expansion has a net pres

> You work for the strategy group of Adapt Inc., a firm that designs and manufactures memory cards for digital cameras. Your task is to gather intelligence about Adapt’s key competitor, DigiMem, a privately held company. Your boss has asked you to estimate

> Rothwell Inc. is the leader in computer-integrated manufacturing and factory automation products and services. The Rothwell product offering is segmented into 15 product categories, based on product function and primary manufacturing location. Rothwell’s

> Sunder manufactures hard rubber pet toys. The purple dog chewy has a variable cost of $3.00 per unit. It is produced on a machine that is leased. The three models of this machine have three different capacities. Maximum Daily Daily Lease Capacity (Units)

> Eastern Educational Services is considering the following proposal to sell its teaching machine and purchase a new, improved machine. The following data are presented by the department head: Additional information: 1. The company expects to produce 10,00

> JLE Electronics is an independent contract manufacturer of complex printed circuit board assemblies. Computer companies and other electronics firms engage JLE to assemble their boards. Utilizing computer-controlled manufacturing and test machinery and eq

> Salespeople at a particular firm forecast what they expect to sell next period. Their supervisors then review the forecasts and make revisions. These forecasts are used to set production and purchasing plans. In addition, salespeople receive a fixed bonu

> The Mopart Division produces a single product. Its standard cost system uses a flexible budget to assign indirect costs on the basis of standard direct labor hours. At the budgeted volume of 4,000 direct labor hours, the standard cost per unit is as foll

> The standard cost sheet calls for 80 pounds of zinc per batch of 70 faucets. Zinc has a standard price of $5.10 per pound. One thousand pounds of zinc are purchased for $5,530. Ten batches of the faucets are produced, and 840 pounds of zinc are used. The

> Kitchen Rite is considering outsourcing the production of a steel chassis that is used in a kitchen appliance. Two thousand chassis are produced per month. An outside vendor will supply an identical chassis for $9.90. The chassis is manufactured in two s

> A firm has four service centers, S1, S2, S3, and S4, which provide services to each other, as well as to three operating divisions, A, B, and C. The distribution of each service center’s output as well as its cost (in millions) is given

> Employees at White’s Department Store are observed engaging in the following behavior: (1) They hide items that are on sale from the customers and (2) they fail to expend appropriate effort in designing merchandise displays. They are also uncooperative w

> The Mowerson Division of Brown Instruments manufactures testing equipment for the automobile industry. Mowerson’s equipment is installed in several places along an automobile assembly line for component testing and is also used for reco

> Assuming the firm sells everything it produces and assuming that variable cost per unit does not change with volume, total profits are higher as volume increases because fixed costs are spread over more units. Required: a. True or false? b. Explain your

> Fast Photo operates four film developing labs in upstate New York. The four labs are identical: They employ the same production technology, process the same mix of films, and buy raw materials from the same companies at the same prices. Wage rates are al

> Equity Corp. paid a consultant to study the desirability of installing some new equipment. The consultant recently submitted the following analysis: Cost of new machine………………………………………………………. $100,000 Present value of after-tax revenues from operation ………

> Employee satisfaction is a major performance measure used at American Inter Connect (AI), a large communications firm. All employees receive some bonus compensation. The lower-level employees receive a bonus that averages 20 percent of their base pay whe

> The Chicago Omni Hotel is a 750-room luxury hotel offering guests the finest facilities in downtown Chicago. The hotel is organized into four departments: lodging, dining, catering, and retail stores. Each of these departments is treated as a profit cent

> One MBA student was overheard saying to another, “Accounting is baloney. I worked for a genetic engineering company and we never looked at the accounting numbers and our stock price was always growing.” “I agree,” said the other. “I worked in a rust buck

> City Hospital is a city government-owned and -operated hospital providing basic health care to low income people. Most of the hospital’s revenues are from federal, state, county, and city governments. Some patients covered by private insurance are also a

> Savannah Products, a small integrated wood and lumber products company with substantial timber holdings, has two divisions: Forest and Lumber. Forest Division manages the timber holdings, maintains the land, and plants and harvests trees. It acquired its

> Background Woodhaven Service is a small, independent filling station located in the Woodhaven section of Queens. The station has three gasoline pumps and two service bays. The repair facility specializes in automotive maintenance (oil changes, tune-ups,

> Secure Servers Inc. (SSI) is one of the largest software and service providers directed at providing high levels of backup and security for computer servers to the financial community, military, and other clients requiring off-site backup and security sy

> Sanchez Gadgets purchases innovative home kitchen gadgets from around the world (such as kitchen torch, a pasta maker, and an automatic salad spinner) and sells them to specialty cooking retail stores. Sanchez has a marketing department that locates and

> Phonetex is a medium-size manufacturer of telephone sets and switching equipment. Its primary business is government contracts, especially defense contracts, which are very profitable. The company has two plants: Southern and Westbury. The larger plant,

> Jason Rocks is small rock quarry that produces five different sizes of stones, from small crushed stones (#1 stones) to large (3-inch) rocks (#5 stones). The stones are first mined and sorted into the five grades. Once the stones are mined and sorted, th

> It is often argued that private country clubs tend to have low-quality food operations because the members do not join or frequent their clubs for the food but rather for the golf and fellowship. (Note: A private country club charges an initiation fee an

> DVDS manufactures and sells DVD players in two countries. It manufactures two models—Basic and Custom—in the same plant. The Basic DVD has fewer options and provides lower-quality output than the Custom DVD. The basic

> Farmers in a valley are subject to occasional flooding when heavy rains cause the river to overflow. They have asked the federal government to build a dam upstream to prevent flooding. The construction cost of this project is to be repaid by the farm own

> Measer Enterprises produces standardized telephone keypads and operates in a highly competitive market in which the keypads are sold for $4.50 each. Because of the nature of the production technology, the firm can produce only between 10,000 and 13,000 u

> UOP is a manufacturing firm that has depreciation as its only overhead expense (i.e., there are no indirect labor, indirect materials, property taxes, factory insurance, etc.). UOP uses a flexible budget at the beginning of the year to forecast overhead

> Videx is the premier firm in the security systems industry. Martha Rameriz is an account manager at Videx responsible for selling residential systems. She is compensated based on beating a predetermined sales budget. The last seven yearsâ€

> Karsten Mills is one of the premier carpet manufacturers in the world. It manufactures carpeting for both residential and commercial applications. Home sales and commercial sales each account for about 50 percent of total revenue. The firm is organized i

> Golf ball manufacturer Trevino is generally regarded as the industry leader. It commands a 40 percent market share in its targeted channels of distribution and reported net profits of $31.5 million on sales of $171 million in the last fiscal year. A rece

> Warren City, with sales of $2 billion, produces and sells farm equipment. The manufacturing division produces some parts internally and purchases other parts from external suppliers and assembles farm equipment including tractors, combines, and plows. Wi

> The purchasing department at Feder buys all of its raw materials, supplies, and parts. This department is a cost center. It uses a flexible budget based on the number of different items purchased each month to forecast spending and as a control mechanism

> Cibo Leathers manufactures a line of designer purses and handbags, some selling for as much as $1,000 per bag. One particular style requires a hand-stitched shoulder strap of cow leather that has been predyed. Cibo purchases large sheets of predyed leath

> The admissions office of a large hospital has an annual operating budget of $700,000. These costs are distributed to inpatient departments (surgery, medicine, pediatrics, psychiatry) and to outpatient departments (drug treatment, prenatal care, and dialy

> You are working as a loan officer at TransPacific Bank and are analyzing a loan request for a client when you come across the following footnote in the client’s annual report: Inventories are priced at the lower of cost or market of materials plus other

> Massey Electronics manufactures heat sinks. Heat sinks are small devices attached to solid-state circuit boards that dissipate the heat from the circuit board components. Made of aluminum, the devices consist of many small fins cut in the metal to increa

> Navisky designs, manufactures, and sells specialized GPS (Global Positioning System) devices for commercial applications. For example, Navisky currently sells a system for environmental studies and is planning systems for private aviation and fleet manag

> Increased global competition has spurred most firms to take a hard look at their costs and become “lean and mean.” Rochco, a large industrial complex, has seen offshore competition erode its market share. This industrial site of over 100 functional depar

> Mat Machinery has received an order from Dewey Sales Corp. for special machinery. Dewey pays Mat Machinery a deposit of 10 percent of the sales price for the order. Just before the order is completed, Dewey Sales Corp. declares bankruptcy. Details of the

> British Airways (BA) has implemented the balanced scorecard. Match the following performance indicators: Return on invested capital …….………..……On-time arrivals Earnings growth ……………………….…………Percent empty seats Lost baggage ……………………………………….Employee turnove

> Royal Holland is a cruise ship company. It currently has six ships and plans to add two more. It offers luxury passenger cruises in the Caribbean, Alaska, and the Far East. Management is currently addressing what to do with an existing ship, the S.S. Ams

> Magnetic resonance imaging (MRI) is a noninvasive medical diagnostic device that uses magnets and radio waves to produce a picture of an area under investigation inside the body. A patient is positioned in the MRI and a series of images of the area (say,

> Advanced Micro Processors (AMP) has designed a new dual-core microprocessor, dubbed DUALxl. DUALxl microprocessors are produced on silicon wafers with 100 chips per wafer. Once fabricated,the wafer is cut into individual microprocessors (also called &aci

> Vorma manufactures two proprietary all-natural fruit antioxidant food additives that are approved by the U.S. Food and Drug Administration. One is for liquid vitamins (LiqVita) and the other is used by dry cereal producers (Dry). Both of these products a

> Cogen’s Turbine Division manufactures gas-powered turbines for generating electric power and hot water for heating systems. Turbine’s variable cost per unit is $150,000 and its fixed cost is $1.8 million per month. It

> Adrian Power manufactures small power supplies for car stereos. The company uses flexible budgeting techniques to deal with the seasonal and cyclical nature of the business. The accounting department provided the accompanying data on budgeted manufacturi

> The city of Toledo has received a proposal to build a new multipurpose outdoor sports stadium. The expected life of the stadium is 20 years. It will be financed by a 20-year bond paying 8 percent interest annually. The stadium’s primary tenant will be th

> CJ Equity Partners is a privately held firm that buys small family-owned firms, installs professional managers to run the firms, and then sells them 3–5 years later, often for a substantial profit. CJ Equity is owned by four partners wh

> Wine Distributors is a wholesaler of wine, buying from wineries and selling to wine stores. Three different white wines are sold: Chablis, Chardonnay, and Riesling. Here are budgeted and actual sales data for the month of April. Required: Write a short m

> a. What is the difference between budget lapsing and line-item budgets? b. What types of organizations would you expect to use budget lapsing? c. What types of organizations would you expect to use line-item budgets?

> Winter Games manufactures a competitive line of skis and sells its skis to retailers at a price of $225 per pair. Based on an annual volume of 5,000 pairs, the cost per pair is $185: Sports Palace, a discount sporting goods store, currently purchases 500

> Employee bonuses at American InterConnect (AI), a large communications firm, depend on meeting a number of targets, one of which is a revenue target. Some bonus is awarded to the group if it meets or exceeds its target revenue for the year. The bonus is

> Using your knowledge of the relationship between inflation and nominal interest rates, and assuming that the savings were invested in government bills, comment briefly on the analysis presented in the following letter from the National Taxpayers Union: D

> Allied Adhesives (AA) manufactures specialty bonding agents for very specialized applications (electronic circuit boards, aerospace, health care, etc.). AA operates a number of small plants around the world, each one specializing in particular products f

> Home Auto Parts is a large retail auto parts store selling the full range of auto parts and supplies for do-it-yourself auto repair enthusiasts. The store is arranged with three prime displays in the store: front door, checkout counters, and ends of aisl

> a. Scottie Corporation has been offered a contract to produce 100 castings a year for five years at a price of $200 per casting. Producing the castings will require an investment in the plant of $35,000 and operating costs of $50 per casting produced. Fo

> Thermalloy makes extruded aluminum heat sinks that are small devices that help cool semiconductors and printed circuit boards. Thermalloy uses an absorption costing system whereby all fixed and variable manufacturing overhead is absorbed to manufactured

> Jan Vanderschmidt was the founder of a successful chain of restaurants located throughout Europe. He died unexpectedly last week at the age of 55. Jan was sole owner of the company’s common stock and was known for being very authoritarian. He made most o

> Tagway 4000 is a computer manufacturer based in Montana. One component of the computer is an internal battery that keeps track of the time and date while the computer is turned off. Tagway produces the batteries in-house. The division that produces the b

> Betterton Corporation manufactures automobile headlight lenses and uses a standard cost system. At the beginning of the year, the following standards were established per 100 lenses (a single batch). Expected volume per month is 5,000 direct labor hours

> Ed Koehler started Great Southern Furniture five years ago to assemble prefabricated bedroom furniture for large hotel chains. Hotels purchase furniture (beds, night stands, and chests of drawers) from manufacturers who ship the furniture to the hotels u

> You work in the Strategy Analysis department of On-Call, a worldwide paging firm offering satellite based digital communications through sophisticated pagers. On-Call is analyzing the possibility of acquiring AtlantiCom, an East Coast paging firm in Main

> Amy Laura is opening a snowboard rental store. She rents snowboards for skiing on a weekly basis for $75 per week including the boots. The skiing season is 20 weeks long. Laura can buy a snowboard and boots for $550, rent them for a season, and sell them

> PortCo Products is a divisionalized furniture manufacturer. The divisions are autonomous segments, each responsible for its own sales, costs of operations, working capital management, and equipment acquisition. Each division serves a different market in

> A company makes DVD players and incurs a variety of different costs. Place a check in the appropriate column if the cost is a product cost or a period cost. Further, classify each product cost as direct materials, direct labor, or manufacturing overhead.

> Coase Farm grows soybeans near property owned by Taggart Railroad. Taggart can build zero, one, or two railroad tracks adjacent to Coase Farm, yielding a net present value of $0, $9 million, or $12 million. Value of Taggart Railroad

> Picture Maker is a freestanding photo kiosk consumers use to download their digital photos and make prints. Shashi Sharma has a small business that leases several Picture Makers from the manufacturer for $120 per month per kiosk, and she places them in h

> Goodstone Tires designs, manufactures, and sells automotive tires through three profit centers (divisions): Passenger Vehicles, Industrial Vehicles, and Racing. The Racing Division develops state-of the-art high-performance racing tires for NASCAR, grand

> Taylor designs and manufactures high-performance bicycle chains for professional racers and serious amateurs. Two new titanium chain sets, the Challenger and the Tour, sell for €110 and €155, respectively. The following

> Howard Binding manufactures two types of notebooks: large and small. The large and small notebooks are made of the same cloth cover (direct materials) but in different quantities. The standard cost sheet for each follows. At the beginning of the month, t

> The following figures were taken from the records of Wellington Co. for the year 2008. At the end of the year, two jobs were still in process. Details about the two jobs include: Wellington Co. applies overhead at a budgeted rate, calculated at the begin

> An investment under consideration has a payback of five years and a cost of $1,200. If the required return is 20 percent, what is the worst-case NPV? Explain fully.

> Brickley Chains produces five different styles of silver chains, A, B, C, D, and E, in a highly automated batch machining process. The following table summarizes the production and cost data for the five products. Annual overhead is $80,000. Required: a.

> UniCom produces a wide range of consumer electronics. UniCom’s Newark, New York, plant produces two types of cordless phones: 2.4 GHz and 6.0 GHz. The following table summarizes operations at the Newark UniCom plant for the years 2009 a

> Vigdor processes cut trees into various wood products, veneers, lumber, wood chips, and so forth. Each of the products can be sold immediately upon processing the trees, or processed further and sold as a finished product. The following table lists the f

> Fuentes Systems provides security software to law enforcement agencies. It has a sales force of 70 and has plans to add another 10–15 salespeople. Fuentes allocates corporate administrative costs based on the number of salespeople. The current total admi

> You are working in the office of the vice president of administration at International Telecon (IT) as a senior financial planner. IT is a Fortune 500 firm with sales approaching $1 billion. IT provides long-distance satellite communications around the w

> Joint Products, Inc., produces two joint products, X and V, using a common input. These are produced in batches. The common input costs $8,000 per batch. To produce the final products (X and V), additional processing costs beyond the split-off point must

> Mail delivery during the Christmas holidays of 1990 to U.S. troops stationed in Saudi Arabia for Operation Desert Storm was haphazard. So many letters and packages were mailed during the holidays, that warehouse space in Germany, which was the intermedia

> U.S. Pump is a multidivisional firm that manufactures and installs chemical piping and pump systems. The valve division makes a single standardized valve. The valve division and the installation division are currently involved in a transfer pricing dispu

> A large consulting firm is looking to expand the services currently offered its clients. The firm has developed a new performance metric called “Economic Earnings,” or EE for short. The performance metric is argued to be a better measure of both division

> A textbook on organization theory says: Drawing upon the writings of Maslow, McGregor presented his Theory X–Theory Y dichotomy to describe two differing conceptions of human behavior. Theory X assumptions held that people are inherently lazy, they disli

> The following data are available for the Megan Corp. finishing department for the current year. The department makes a single product that requires three hours of labor per unit of finished product. Budgeted volume for the year was 30,000 direct labor ho

> You are considering buying a $50,000 car. The dealer has offered you a 13.6 percent loan with 30 equal monthly payments. On questioning him, you find that the interest charge of $17,000 (or 0.136 x $50,000 x 2.5 years) is added to the $50,000 for a total

> Medical Instruments produces a variety of electronic medical devices. Medical Instruments uses a standard cost system and computes price variances at the time of purchase. One product, a thermometer, measures patient temperatures orally. It requires a si

> Flower City Cartridges (FCC) manufactures replacement cartridges for desktop printers. FCC uses standard costs within a job order cost system. In June, FCC purchased 18 gallons of blue ink for $385.20 and produced the following four different cartridge j

> American Cinema shows first-run movies. It pays the company distributing the movies a fixed fee of $1,000 per week plus a percentage of the gross box office receipts. In the first two weeks a movie is released, the theater pays the fixed fee of $1,000 pe

> Marti Meyers, vice president of marketing for LaserFlo, was concerned as she reviewed the costs for the AP2000 laser printer she was planning to launch next month. The AP2000 is a new commercial printer that LaserFlo designed for medium-size direct mail

> Candice Company has decided to introduce a new product that can be manufactured by either of two methods. The manufacturing method will not affect the quality of the product. The estimated manufacturing costs of the two methods are as follows: Candice&ac

> Wedig Diagnostics manufactures two laser photometers that are used in preparing DNA tests. The U.S. model is designed for use in the United States and the EU model is designed to meet the specifications in most of the European Union. Both models are manu