Question: Listed here are product costs for the

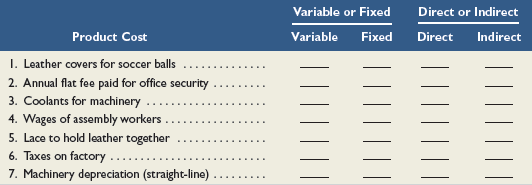

Listed here are product costs for the production of soccer balls. Classify each cost

(a) as either variable or fixed and

(b) as either direct or indirect.

What patterns do you see regarding the relation between costs classified in these two ways?

Transcribed Image Text:

Variable or Fixed Direct or Indirect Product Cost Variable Fixed Direct Indirect I. Leather covers for soccor balls 2. Annual flat fee paid for office security 3. Coolants for machinery ... 4. Wages of assembly workers 5. Lace to hold leather together 6. Taxes on factory 7. Machinery depreciation (straight-line).

> Felix & Co. reports the following information about its sales and cost of sales. Draw an estimated line of cost behavior using a scatter diagram, and compute fixed costs and variable costs per unit sold. Then use the high-low method to estimate the f

> A company reports the following information about its sales and its cost of sales. Each unit of its product sells for $500. Use these data to prepare a scatter diagram. Draw an estimated line of cost behavior and determine whether the cost appears to be

> Refer to the information in Exercise 21-16. 1. Compute the company’s degree of operating leverage for 2015. 2. If sales decrease by 5% in 2016, what will be the company’s pretax income? 3. Assume sales for 2016 decreas

> Company A is a manufacturer with current sales of $6,000,000 and a 60% contribution margin. Its fixed costs equal $2,600,000. Company B is a consulting firm with current service revenues of $4,500,000 and a 25% contribution margin. Its fixed costs equal

> R&R Tax Service offers tax and consulting services to individuals and small businesses. Data for fees and costs of three types of tax returns follow. R&R provides services in the ratio of 5:3:2 (easy, moderate, business). Fixed costs total $18,00

> Handy Home sells windows and doors in the ratio of 8:2 (windows:doors). The selling price of each window is $200 and of each door is $500. The variable cost of a window is $125 and of a door is $350. Fixed costs are $900,000. Use this information to dete

> Nombre Company management predicts $390,000 of variable costs, $430,000 of fixed costs, and a pretax income of $155,000 in the next period. Management also predicts that the contribution margin per unit will be $9. Use this information to compute the (1)

> Refer to the information in Exercise 21-16. The marketing manager believes that increasing advertising costs by $81,000 in 2016 will increase the company’s sales volume to 11,000 units. Prepare a forecasted contribution margin income st

> Refer to the information in Exercise 21-16. If the company raises its selling price to $240 per unit, compute its (1) contribution margin per unit, (2) contribution margin ratio, (3) break-even point in units, and (4) break-even point in sales dollars.

> Refer to the information in Exercise 21-16. Assume the company is considering investing in a new machine that will increase its fixed costs by $40,500 per year and decrease its variable costs by $9 per unit. Prepare a forecasted contribution margin incom

> Refer to Simon Company’s balance sheets in Exercise 17-6. Analyze its year-end short-term liquidity position at the end of 2015, 2014, and 2013 by computing (1) the current ratio and (2) the acid-test ratio. Comment on the ratio results

> Cooper Company expects to sell 200,000 units of its product next year, which would generate total sales of $17 million. Management predicts that pretax net income for next year will be $1,250,000 and that the contribution margin per unit will be $25. Use

> Bloom Company management predicts that it will incur fixed costs of $160,000 and earn pretax income of $164,000 in the next period. Its expected contribution margin ratio is 25%. Use this information to compute the amounts of (1) total dollar sales and (

> Blanchard Company manufactures a single product that sells for $180 per unit and whose total variable costs are $135 per unit. The company’s annual fixed costs are $562,500. Management targets an annual pretax income of $1,012,500. Assume that fixed cost

> The production department described in Exercise 20-8 had $850,368 of direct materials and $649,296 of conversion costs charged to it during April. Also, its beginning inventory of $167,066 consists of $118,472 of direct materials cost and $48,594 of conv

> During April, the production department of a process manufacturing system completed a number of units of a product and transferred them to finished goods. Of these transferred units, 60,000 were in process in the production department at the beginning of

> Refer to the information in Exercise 20-6. Assume that Fields uses the FIFO method of process costing. 1. Calculate the equivalent units of production for the forming department. 2. Calculate the costs per equivalent unit of production for the forming de

> The Fields Company has two manufacturing departments, forming and painting. The company uses the weighted-average method of process costing. At the beginning of the month, the forming department has 25,000 units in inventory, 60% complete as to materials

> Refer to the information in Exercise 20-4 and complete the requirements for each of the three separate assumptions using the FIFO method for process costing. Information from Exercise 20-4: The production department in a process manufacturing system com

> The production department in a process manufacturing system completed 80,000 units of product and transferred them to finished goods during a recent period. Of these units, 24,000 were in process at the beginning of the period. The other 56,000 units wer

> Salud Company reports the following information. Use the indirect method to prepare only the operating activities section of its statement of cash flows for the year ended December 31, 2015. Selected 2015 Income Statement Data Selected Year-End 2015

> Explain a hybrid costing system. Identify a product or service operation that might well fit a hybrid costing system.

> The following journal entries are recorded in Kiesha Co.’s process costing system. Kiesha produces apparel and accessories. Overhead is applied to production based on direct labor cost for the period. Prepare a brief explanation (includ

> Laffer Lumber produces bagged bark for use in landscaping. Production involves packaging bark chips in plastic bags in a bagging department. The following information describes production operations for October. The company’s revenue

> Hi-Test Company uses the weighted-average method of process costing to assign production costs to its products. Information for September follows. Assume that all materials are added at the beginning of its production process, and that conversion costs a

> The flowchart below shows the August production activity of the punching and bending departments of Wire Box Company. Use the amounts shown on the flowchart to compute the missing numbers identified by question marks. Punching Beginning work in pr

> Oslo Company produces large quantities of a standardized product. The following information is available for its production activities for May. Prepare a process cost summary report for this company, showing costs charged to production, unit cost infor

> Elliott Company produces large quantities of a standardized product. The following information is available for its production activities for March. Prepare a process cost summary report for this company, showing costs charged to production, unit cost

> Refer to the information in Exercise 20-14. Prepare journal entries dated June 30 to record: (a) raw materials purchase, (b) direct materials usage, (c) indirect materials usage, (d) direct labor usage, (e) indirect labor usage, (f) other overhead costs,

> Pro-Weave manufactures stadium blankets by passing the products through a weaving department and a sewing department. The following information is available regarding its June inventories: The following additional information describes the company&acir

> Refer to the information in Exercise 20-12. Prepare a process cost summary using the FIFO method. (Round cost per equivalent unit calculations to two decimal places.) Information from Exercise 20-12: The following partially completed process cost summar

> Fitz Company reports the following information. Use the indirect method to prepare only the operating activities section of its statement of cash flows for the year ended December 31, 2015. Selected 2015 Income Statement Data Selected Year-End 2015

> Refer to the information in Exercise 20-9 and complete its parts 1 and 2 using the FIFO method. Information from Exercise 20-9: The production department described in Exercise 20-8 had $850,368 of direct materials and $649,296 of conversion costs charge

> Refer to the information in Exercise 20-8 to compute the number of equivalent units with respect to both materials used and conversion costs in the production department for April using the FIFO method. Information from Exercise 20-8: During April, the

> The following information is available for Lock-Tite Company, which produces special-order security products and uses a job order costing system. Compute the following amounts for the month of May. 1. Cost of direct materials used. 2. Cost of direct la

> Starr Company reports the following information for August. Prepare journal entries to record the following events. 1. Raw materials purchased. 2. Direct materials used in production. 3. Direct labor used in production. 4. Applied overhead. Raw mat

> As of the end of June, the job cost sheets at Racing Wheels, Inc., show the following total costs accumulated on three custom jobs. Job 102 was started in production in May and the following costs were assigned to it in May: direct materials, $6,000; d

> A recent balance sheet for Porsche AG shows beginning raw materials inventory of €83 million and ending raw materials inventory of €85 million. Assume the company purchased raw materials (on account) for €3,108 million during the year. (1) Prepare journa

> Hansel Corporation has requested bids from several architects to design its new corporate headquarters. Frey Architects is one of the firms bidding on the job. Frey estimates that the job will require the following direct labor. Frey applies overhead t

> Custom Cabinetry has one job in process (Job 120) as of June 30; at that time, its job cost sheet reports direct materials of $6,000, direct labor of $2,800, and applied overhead of $2,240. Custom Cabinetry applies overhead at the rate of 80% of direct l

> Moonrise Bakery applies factory overhead based on direct labor costs. The company incurred the following costs during 2015: direct materials costs, $650,000; direct labor costs, $3,000,000; and factory overhead costs applied, $1,800,000. 1. Determine the

> In December 2014, Infodeo established its predetermined overhead rate for movies produced during 2015 by using the following cost predictions: overhead costs, $1,680,000, and direct labor costs, $480,000. At year-end 2015, the company’s

> The following income statement and information about changes in noncash current assets and current liabilities are reported. Changes in current asset and current liability accounts for the year that relate to operations follow. Required Prepare only

> In December 2014, Custom Mfg. established its predetermined overhead rate for jobs produced during 2015 by using the following cost predictions: overhead costs, $750,000, and direct labor costs, $625,000. At year-end 2015, the company’s

> Using Exhibit 19.17 as a guide, prepare summary journal entries to record the following transactions and events a through g for a company in its first month of operations. a. Raw materials purchased on account, $90,000. b. Direct materials used in produc

> Use the data in Exercise 18-8 to prepare an income statement and the current assets section of the balance sheet for each company. Ignore income taxes. Data from Exercise 18-8: Pepper Company Company Garcon Beginning finished goods inventory. Begin

> Using the following data, compute (1) the cost of goods manufactured and (2) the cost of goods sold for both Garcon Company and Pepper Company for the year ended December 31, 2015. Pepper Company Company Garcon Beginning finished goods inventory. Be

> Current assets for two different companies at fiscal year-end 2015 are listed here. One is a manufacturer, Rayzer Skis Mfg., and the other, Sunrise Foods, is a grocery distribution company. (1) Identify which set of numbers relates to the manufacturer an

> Listed below are costs of providing an airline service. Classify each cost as (a) either variable or fixed, and (b) either direct or indirect. Consider the cost object to be a flight. Variable or Fixed Direct or Indirect Cost Variable Fixed Direct I

> Beck Manufacturing reports the information below for 2015. Using this information: 1. Prepare the schedule of cost of goods manufactured for the year. 2. Compute cost of goods sold for the year. Raw Materials Inventory Work in Process Inventory Fini

> Use the information in Exercise 18-13 to prepare an income statement for Delray Mfg. (a manufacturer). Assume that its cost of goods manufactured is $534,390. Information from Exercise 18-13: Following are the selected account balances of Delray Mfg.

> Given the following selected account balances of Delray Mfg. prepare its schedule of cost of goods manufactured for the year ended December 31, 2015. Include a listing of the individual overhead account balances in this schedule. Sales $1,250,000 Re

> Compute trend percents for the following accounts, using 2011 as the base year (round the percents to whole numbers). State whether the situation as revealed by the trends appears to be favorable or unfavorable for each account. 2015 2014 2013 2012

> For each of the following accounts for a manufacturing company, place a ✓ in the appropriate column indicating that it appears on the balance sheet, the income statement, the schedule of cost of goods manufactured, and/or a detailed lis

> Compute cost of goods sold for each of these two companies for the year ended December 31, 2015. A B 1 Precision 2 Unimart Manufacturing 3 Beginning inventory 4 Merchandise $275,000 Finished goods 6 Cost of purchases Cost of goods manufactured 8 End

> Refer to the data in Exercise 18-8. Compute the total (1) prime costs and (2) conversion costs for each company. Data from Exercise 18-8: Pepper Company Company Garcon Beginning finished goods inventory. Beginning work in process inventory Beginnin

> Refer to the Simon Company information in Exercises 17-6 and 17-8. Compare the company’s long-term risk and capital structure positions at the end of 2015 and 2014 by computing these ratios: (1) debt and equity ratios—

> Simon Company’s year-end balance sheets follow. Express the balance sheets in common-size percents. Round amounts to the nearest one-tenth of a percent. Analyze and comment on the results. At December 31 2015 2014 2013 Assets Cash

> Common-size and trend percents for Rustynail Company’s sales, cost of goods sold, and expenses follow. Determine whether net income increased, decreased, or remained unchanged in this three-year period. Common-Size Percents Trend P

> Express the following comparative income statements in common-size percents and assess whether or not this company’s situation has improved in the most recent year (round the percents to one decimal). GOMEZ CORPORATION Comparative

> Nintendo Company, Ltd., reports the following financial information as of, or for the year ended, March 31, 2013. Nintendo reports its financial statements in both Japanese yen and U.S. dollars as shown (amounts in millions). 1. Compute Nintendoâ

> Use the financial data for Randa Merchandising, Inc., in Exercise 17-13 to prepare its income statement for calendar year 2015. (Ignore the earnings per share section.) Data from Exercise 17-13: In 2015, Randa Merchandising, Inc., sold its interest in a

> Roak Company and Clay Company are similar firms that operate in the same industry. Clay began operations in 2013 and Roak in 2010. In 2015, both companies pay 7% interest on their debt to creditors. The following additional information is available. Wr

> Hampton Company reports the following information for its recent calendar year. Prepare the operating activities section of the statement of cash flows for Hampton Company using the indirect method. Income Statement Data Selected Year-End Balance Sh

> Refer to Simon Company’s financial information in Exercises 17-6 and 17-8. Additional information about the company follows. To help evaluate the company’s profitability, compute and interpret the following ratios for

> The following summarized Cash T-account reflects the total debits and total credits to the Cash account of Thomas Corporation for calendar-year 2015. 1. Use this information to prepare a complete statement of cash flows for year 2015. The cash provided o

> Many fast-food restaurants compete on lean business concepts. Match each of the following activities at a fast-food restaurant with the lean business concept it strives to achieve. Some activities might relate to more than one lean business concept. ____

> Refer to the information from Exercise 21-6. Use spreadsheet software to use ordinary least-squares regression to estimate the cost equation, including fixed and variable cost amounts. Information from Exercise 21-6: Felix & Co. reports the followin

> Following are five series of costs A through E measured at various volume levels. Examine each series and identify which is fixed, variable, mixed, step-wise, or curvilinear. A B D E Volume (Units) Series E $5,000 5,000 5,000 5,000 5,000 5,000 5,000

> The left column lists several cost classifications. The right column presents short definitions of those costs. In the blank space beside each of the numbers in the right column, write the letter of the cost best described by the definition. A. Total cos

> Following are five graphs representing various cost behaviors. (1) Identify whether the cost behavior in each graph is mixed, step-wise, fixed, variable, or curvilinear. (2) Identify the graph (by number) that best illustrates each cost behavior: (a) Fac

> Match each of the following items A through G with the best numbered description of its purpose. A. Factory Overhead account B. Process cost summary C. Equivalent units of production D. Work in Process Inventory account E. Raw Materials Inventory account

> Use the following information about the cash flows of Ferron Company to prepare a complete statement of cash flows (direct method) for the year ended December 31, 2015. Use a note disclosure for any noncash investing and financing activities. $ 40,0

> Label each item a through h below as a feature of either a job order or process operation. ______ a. Heterogeneous products and services ______ b. Custom orders ______ c. Low production volume ______ d. Routine, repetitive procedures ______ e. Focus on i

> For each of the following products and services, indicate whether it is more likely produced in a process operation or in a job order operation. ______ 1. Beach towels ______ 2. Bolts and nuts ______ 3. Lawn chairs ______ 4. Headphones ______ 5. Designed

> Some costs related to Apple’s iPad are listed below. Classify each cost as either direct materials, direct labor, factory overhead, selling expenses, or general and administrative expenses. ______ 1. Display screen ______ 2. Assembly-line supervisor sala

> Match each of the terms/phrases numbered 1 through 5 with the best definition on the right. ______ 1. Cost accounting system ______ 2. Target cost ______ 3. Job lot ______ 4. Job ______ 5. Job order production a. Production of products in response to cus

> TechPro offers instructional courses in e-commerce website design. The company holds classes in a building that it owns. Classify each of TechPro’s costs below as (a) variable or fixed and (b) direct or indirect. Assume the cost object is an individual c

> Identify which of the following six metrics a through f best completes questions 1 through 3 below. a. Days’ sales uncollected b. Accounts receivable turnover c. Working capital d. Return on total assets e. Total asset turnover f. Profit margin 1. Which

> Match the ratio to the building block of financial statement analysis to which it best relates. A. Liquidity and efficiency B. Solvency C. Profitability D. Market prospects ______ 1. Equity ratio ______ 2. Return on total assets ______ 3. Dividend yield

> Business Solutions sells upscale modular desk units and office chairs in the ratio of 3:2 (desk unit:chair). The selling prices are $1,250 per desk unit and $500 per chair. The variable costs are $750 per desk unit and $250 per chair. Fixed costs are $12

> The computer workstation furniture manufacturing that Santana Rey started is progressing well. At this point, Santana is using a job order costing system to account for the production costs of this product line. Santana has heard about process costing an

> The computer workstation furniture manufacturing that Santana Rey started in January is progressing well. As of the end of June, Business Solutions’s job cost sheets show the following total costs accumulated on three furniture jobs.

> Refer to Simon Company’s financial information in Exercises 17-6 and 17-8. Evaluate the company’s efficiency and profitability by computing the following for 2015 and 2014: (1) profit margin ratio—per

> Santana Rey, owner of Business Solutions, decides to diversify her business by also manufacturing computer workstation furniture. Required 1. Classify the following manufacturing costs of Business Solutions as either (a) variable or fixed and (b) direct

> Use the following selected data from Business Solutions’s income statement for the three months ended March 31, 2016, and from its March 31, 2016, balance sheet to complete the requirements below: computer services revenue, $25,307; net sales (of goods)

> Santana Rey, owner of Business Solutions, decides to prepare a statement of cash flows for her business. (Although the serial problem allowed for various ownership changes in earlier chapters, we will prepare the statement of cash flows using the followi

> Milano Co. manufactures and sells three products: product 1, product 2, and product 3. Their unit selling prices are product 1, $40; product 2, $30; and product 3, $20. The per unit variable costs to manufacture and sell these products are product 1, $30

> This year Best Company earned a disappointing 5.6% after-tax return on sales (net income/sales) from marketing 100,000 units of its only product. The company buys its product in bulk and repackages it for resale at the price of $20 per unit. Best incurre

> Stam Co. produces and sells two products, BB and TT. It manufactures these products in separate factories and markets them through different channels. They have no shared costs. This year, the company sold 50,000 units of each product. Sales and costs fo

> Rivera Co. sold 20,000 units of its only product and incurred a $50,000 loss (ignoring taxes) for the current year as shown here. During a planning session for year 2016’s activities, the production manager notes that variable costs can

> Hip-Hop Co. manufactures and markets several products. Management is considering the future of one product, electronic keyboards, that has not been as profitable as planned. Since this product is manufactured and marketed independently of the other produ

> Sun Co.’s monthly sales and cost data for its operating activities of the past year follow. Management wants to use these data to predict future fixed and variable costs. (Dollar amounts are in thousands.) Required 1. Prepare a scatte

> The following costs result from the production and sale of 12,000 CD sets manufactured by Gilmore Company for the year ended December 31, 2015. The CD sets sell for $18 each. The company has a 25% income tax rate. Required 1. Prepare a contribution mar

> For each of the following three separate cases, use the information provided about the calendar-year 2016 operations of Sahim Company to compute the required cash flow information. Case X: Compute cash received from customers: Sales .... $515,000 Ac

> Belda Co. makes organic juice in two departments: cutting and blending. Direct materials are added at the beginning of each process, and conversion costs are added evenly throughout each process. The company uses the FIFO method of process costing. Durin

> During May, the production department of a process manufacturing system completed a number of units of a product and transferred them to finished goods. Of these transferred units, 62,500 were in process in the production department at the beginning of M

> Refer to the information in Problem 20-4B. Assume that Switch uses the FIFO method to account for its process costing system. The following additional information is available. * Beginning work in process consists of 10,000 units that were 75% complete w

> Switch Co. manufactures a single product in one department. Direct labor and overhead are added evenly throughout the process. Direct materials are added as needed. The company uses monthly reporting periods for its weighted-average process costing. Duri

> Braun Company produces its product through a single processing department. Direct materials are added at the beginning of the process. Conversion costs are added to the product evenly throughout the process. The company uses monthly reporting periods for