Question: Merrion Products Limited is a company owned

Merrion Products Limited is a company owned by the Carroll family. The company manufactures hand-made chocolate biscuits from imported South American cocoa, which are sold to a small number of large retail outlets in the local area. When the company was founded some years ago, a single plain chocolate biscuit (Type A) was manufactured and resulting profits were adequate to satisfy the family shareholders. A few years later, it was decided to introduce new chocolate biscuits, using the same cocoa, but refined in different ways to suit different consumer tastes. These additional products are referred to (hereunder) as Type B, C and D respectively and each are sold in the same size biscuit tin. The company is now the brand leader in the segment for home-made, quality biscuits made from real cocoa and the company has always been able to meet demand for its four products.

Not surprisingly, the audited financial statements of Merrion Products Limited indicated that the company generated satisfactory operating profits with strong cash flow. The various family members concentrated mainly on the administrative and selling side of the business. Each family member was paid a basic salary, and in addition, they all shared a sales commission of 10 per cent of total sales revenue for the year. Members of the Carroll family agree that the company's profitability was mainly attributable to two factors. The first factor was the high quality of its products with a guaranteed delivery date to various retail outlets. Michael Carroll, the managing director of the firm, often boasted that the number of customer complaints in any one year could

be counted on the fingers of one hand. The second reason for its success was due to subtle marketing and presentation so that each product type was perceived by potential customers as different. While the ingredients and production methods were similar, they were not considered complementary products, and each had their own brand loyalty. Thus, the sales of one product could fluctuate without affecting the sales of the other products, or the refusal of orders for one product would not lead to cancellation of orders for other product types.

The current problem

An important feature of each biscuit type was that the chocolate coating was made from the best South American cocoa available. Until recently this raw material was available in unlimited quantities and was purchased by Merrion Products quarterly in advance as required. However, recent political instability in the exporting country resulted in a restricted availability of cocoa. Michael Carroll, the managing director, called a meeting to discuss the problem and its impact on the budget for the forthcoming quarter.

At the start of the meeting Michael Carroll explained, ‘Unfortunately our worst suspicions have been confirmed. I saw things first-hand and also had discussions with our Embassy officials. I made direct contact with our usual supplier of cocoa and he indicated that, at current prices, he will be unable to deliver more than €72,000 of raw materials per quarter until conditions improve. Simply, the supply of cocoa is restricted due to the current political situation in the host country and a bad harvest. Since my return home I have made extensive enquiries regarding possible alternative supplies, but they are not available in the short-term. We've just got to accept it for now!’

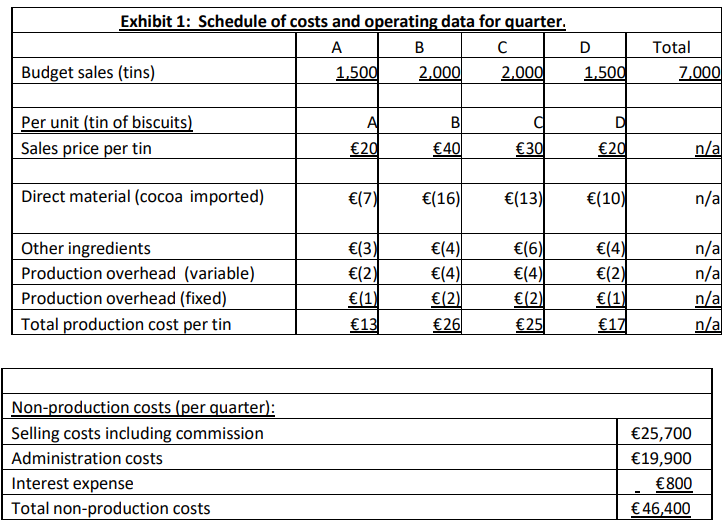

Una Carroll, the only daughter in the family, filled the role of company accountant. After obtaining a business studies degree she joined the family firm. Her role was to monitor progress against budget targets. Generally, the actual financial performance met the budget targets pretty well. Una knew from experience that as long as budgeted profit was higher than last year then everyone was happy. However, the budget setting process for each quarter was unsophisticated in that output levels were determined by amiable consensus among family members. Preference was usually given to the highest priced product type since this procedure maximized sales commission for the family members. After discussion she argued that ‘our budgets for the next quarter shall have to be carefully prepared’. She circulated basic cost and operating data for the forthcoming quarter, based on previous estimates (Exhibit 1).

Una continued ‘In my opinion there is little scope for any reduction in costs. We can't change, at least in the short term, our direct material costs. All our other production costs are already down to an absolute minimum. Sales commission is the only thing that we could effectively cut.’

Michael Carroll interjected, ‘No, I recommend that the sales commission be left alone. We're all in this venture together and I reckon we're going to have to sell our way out of our problem. We should keep our selling prices intact and we need to retain the incentive to sell as much as we can.’

Everyone agreed. Patrick Carroll, the eldest member of the family, who acted as the marketing manager, raised the possibility of maximum sales levels of each product, given that current selling prices were to be maintained, due to contracts already signed and said: ‘We must take into consideration that there is a limit on the amount of goods that we can sell at existing prices next quarter.’ Michael Carroll accepted that the point was valid. After much discussion, all family members agreed that the maximum sales value of each product at current prices for the forthcoming quarter would be as follows:

Subsequently, everyone at the meeting realized that the shortage of cocoa would restrict production so that the above (maximum) sales could not be achieved. Michael Carroll added, ‘I think we shall have to be more selective in what we produce in future. However, I recommend that we produce a minimum of 1,000 tins of each product during the forthcoming quarter. This would comply with legal agreements which we have already signed for the next quarter and also keep the company's products in the minds of the public. Una, now is the ideal time to put some of that theory of yours into practice. If you feel that there is a single, best way to utilize our production facilities in these circumstances now is the ideal time to let us know.’ Everyone agreed and the meeting adjourned. Una sighed and reached for her pencil and calculator.

Required:

1. Prepare a statement showing the most profitable production plan for Merrion Products Limited for the forthcoming quarter. Prepare an income statement to accompany your recommendation. Explain your workings.

2. Calculate the firm's break-even point for the forthcoming quarter, based on your calculations in 1. above. What fundamental assumptions have you made?

3. What is the ‘opportunity cost’, if any, associated with the minimum production of 1,000 tins of each product type?

4. Assuming it was possible to increase all selling prices by €7 per tin without influencing demand, would this price increase impact on your analysis? Explain. (It is not necessary to rework your optimal production plan)

> Sycamore enters into a contract with a customer to sell three products for a total transaction price of $15,000. Each product is appropriately classified as a separate performance obligation. Sycamore only sells products A and B on an individual basis, s

> Smart Cookie Learning Centers enters into a contract to customize and sell its LaLa tutoring software to the Westbro United School District. The contract price is $6,000,000 and must be paid to Smart Cookie immediately. Under the terms of the contract, S

> Tarheel Farm, Inc. (TFI) is a North Carolina corporation involved in agricultural production and has an October 31 fiscal year-end. It is not publicly traded, but it is required to prepare annual financial statements complying with U.S. GAAP for its bank

> More Toys, Inc., a toy retailer that has a calendar year-end and prepares interim financial statements quarterly. As of March 31, 20X4, More Toys has 10,000 Gabriella dolls in stock. The Gabriella dolls are from a recent movie that was showing in the the

> Companies sometimes use accounts receivable as collateral in a secured borrowing or sell them to a factor. The accounting method for these types of transactions is governed by ASC 860—Transfers and Servicing. Review all of ASC 860-10 to answer the follow

> ABC Lending signed a loan agreement with AMRO, Inc. on January 2, 2017. AMRO is borrowing $500,000 for 10 years with a stated interest rate of 7%. AMRO will make a payment of $71,188.75 at the end of each year. AMRO paid $10,000 in points to ABC Lending

> On January 2, 2018, JCR Jets, a calendar-year company, accepts a contract with a major airline to build four jets. JCR accepts a fixed fee of $300 million and must complete the project within three years. JCR Jets uses the percentage-of-completion method

> Assume the same information for Case 4. IFRS does not provide specific rules for software; the accounting for software development costs falls under the general guidance for intangible assets. Does IFRS require that software development costs be expensed

> Companies sometimes develop software for either external use (for example, to sell to customers) or for internal use. Should a company expense or capitalize software for internal use? U.S. GAAP provides specific guidance regarding software and, furthermo

> Ed’s Market Company (EMC) grows and sells fresh fruits and vegetables. EMC is an IFRS reporter. EMC experienced three different unfortunate events in the current year. 1. In February, the government acquired 20 acres from EMC in an eminent domain case.

> Ed’s Market Company (EMC) grows and sells fresh fruits and vegetables. EMC experienced three different unfortunate events in the current year. 1. In February, the government acquired 20 acres from EMC in an eminent domain case. EMC was carrying the land

> Sycamore Sidewalk Company enters into a contract with a customer to sell three products for a total transaction price of $15,000. Information related to these three products is provided in the following table. How should Sycamore Sidewalk Company alloc

> On rare occasions, a company will acquire property, plant, or equipment in a nonmonetary exchange in which two entities exchange one nonmonetary asset for another nonmonetary asset. Read sections 5, 20, and 30 of ASC 845-10. Describe the accounting treat

> Treasure Island Corporation (TIC) sells time shares in luxury oceanfront cottages. During the year ended December 31, 2017, TIC completed a project consisting of 100 cottages in a particularly scenic portion of Hawaii. The project cost TIC $110.24 millio

> Tarheel Farm, Inc. (TFI) is a North Carolina corporation involved in agricultural production and has an October 31 fiscal year-end. It is not publicly traded, but it is required to prepare annual IFRS-complying financial statements for its bank. TFI typi

> The Kroger Co. reported cash income taxes paid of $557 million for the year ended January 28, 2017 (fiscal year 2016). In addition, it reported the following: a. What is the LIFO reserve for Kroger as of January 28, 2017? January 30, 2016? b. What is th

> KR Automotives is a calendar-year car dealer that sells cars made by Hoyta. KR uses LIFO and calculates the lower of cost or market using an individual-item basis. The CFO of KR believes that KR will need to write-down its inventory of one particular car

> Wildcat Sporting Goods (WSG) sells athletic shoes and trendy sports apparel to a variety of sporting goods stores in the Northeast and, in 2011, WSG also began direct Internet sales to consumers. WSG’s common shares are publicly traded

> Absco, Inc. is a calendar-year-end clothing manufacturer that sells exclusively to retailers. It engages in a large number of contracts with its customers. Following are some specific contract issues that have arisen this year. 1. Absco signed a contrac

> Tolls R Us is a company whose primary business activity is operating toll roads. Tolls R Us receives licenses from the government to operate the toll roads that are typically expensed for a specified period of time. The company routinely projects the ant

> Bookstores International, a bookstore chain, has been quite successful over the past few decades and is now in expansion mode. It typically approaches opening a new bookstore by first determining the general geographic location for a new store and then i

> BBS is a calendar-year corporation that manufactures baseballs. BBS produced 9.5 million baseballs in 20x7 and incurred fixed production overhead costs of $2 million. In the past 5 years, it has produced the following number of baseballs: The decline i

> TGW Construction Company enters into a contract to build an office building and detached parking garage for $24 million. TGW determines that the building and parking garage represent separate performance obligations. The standalone price of similar struc

> The following information is from the 2016 financial statements of Revlon, the beauty products company. Required: Use Revlon’s financial information to answer the following questions: a. What is Revlon’s operating cyc

> Use the information related to Bigelow Contractors from P8-7 and P8-8 to answer the following questions. Assume that Bigelow’s total assets were $5,000,000 and its liabilities were $2,000,000 at the beginning of the year. a. Compute net

> Kellogg Company and Kraft Heinz Company, Inc. are two companies operating in the packaged food industry. You have noticed their products in numerous grocery and convenience stores and are interested in their production process. Your first step is to anal

> PROBLEM: Selected disclosures related to Foot Locker Company’s inventory follow. Use these disclosures to answer the following questions: a. What percentage of inventory at the end of 2016 is accounted for under each cost-flow assumpti

> Kimberly-Clark Corporation and Procter & Gamble Company reported the following information about inventory in their financial statements and footnotes. Use this information to answer the following questions: a. What cost-flow assumption(s) does Kimbe

> Companies sometimes use accounts receivable as collateral in a secured borrowing or sell them to a factor. The accounting method for these types of transactions is governed by ASC 860—Transfers and Servicing, the majority of which derives from SFAS No. 1

> According to ASC 606, an entity should recognize revenue when goods or services are transferred to a customer. Goods and services are transferred to a customer when the customer obtains control. Refer to the Basis for Conclusions section of ASU 2014-09 t

> What are the general rules related to the amortization of intangible assets? Read the basis for conclusions in SFAS No. 142, particularly paragraphs B49 through B53. What were the amortization rules for intangibles prior to the passage of SFAS No. 142? I

> Consider the Basis for Conclusions in IAS 16, Property, Plant, and Equipment (particularly paragraphs BC26 and BC27). What is the principle underlying component depreciation under IFRS? Although U.S. GAAP does not contain a basis for conclusions for the

> Both IFRS and U.S. GAAP require that firms report inventory at the lower of cost or market. What is the basic principle/characteristic behind this standard that results in this “lower” reporting approach (asset write-down)? Scene 2 Read the objectives

> Martin Software Developers, Inc. recently signed a contract for $1,600,000 to create a registration, grade report, and transcript system for MacFarlane State University. Each part of the system will be delivered separately and must be fully functional up

> Complete the blanks in the five criteria to identify a contract with a customer. 1. All parties agree to the _ and commit to . 2. Each party’s rights with respect to the goods or service being transferred are . 3.

> FIFA World Cup 2010 – A Worthwhile Proposition For South Africa? The hosting of the FIFA World Cup 2010 in South Africa was presented as an opportunity to redefine perceptions of South Africa by demonstrating that an African country could successfully

> One of the major tasks of the workshop on Crystal Palace Gold Mine is to repair winch motors, and about 1,000 motors are repaired annually. Approximately half of the repairs require the burnt out armature to be rewound. At present all armatures requiring

> Douglas Taylor, Lecturer in Management Accounting and Finance, Corporate Governance and Ethics and Head of the Finops Section at Wits Business School, Parktown, South Africa Topics covered include: decision-making under conditions of risk and uncertainty

> Springbok Limited’s budget committee, which had members drawn from all the major functions of the business was meeting to consider the projected income statement 2020/2021, which was composed of the 10 months actuals to the end of Janua

> Founded in 1923, Eskom built 78 large coal-fired plants over 60 years to become the fourth largest power utility in the world. The company generates over 90 per cent of all electricity generated in South Africa. This electricity is distributed to industr

> Kinkead has been a leading UK firm since World War II in specialty instruments for measuring electric current characteristics (voltmeters, ohmmeters, ammeters, etc.). Kinkead’s products are grouped into two main lines of business for internal reporting p

> In November 2020, a consultant was employed to review and document the planning and control systems of Integrated Technology Services (UK) Ltd (ITS-UK), to ensure that these were effectively meeting the needs of the business and to provide a basis for st

> Dave Barry, an engineer, is the general manager of the Beta Company, which manufactures a general range of animal food products. Since joining the company, the sales have been static in both volume and value terms. Now, at the start of the New Year, a po

> Alan Chadwick is the Chairman and Managing Director of Chadwick’s Department Store Ltd. This is the company that operates Chadwick’s, a large independent department store that has been family owned and run for over 100 years. It was started in 1906 by Si

> Amica Foods Ltd. produces a very wide range of food products in a highly competitive industry, almost all under the Primus brand name, which is widely recognized as representing high-quality food products with a loyal customer following. Almost all of t

> Anjo Ltd was established in 1986 by two brothers, Andrew and Jonathan Bright. They saw a market for providing accessories in the home to accommodate the new era of home entertainment, and more recently expanded their range to account for a resurgence i

> Airport Complex was founded in Northern Europe in the early 1960s, and at the time it primarily served as a domestic airport. During the 1980s, flights to foreign destinations became an ever more vital activity for the airport. Today, the airport funct

> Southern Paper Inc. is a global packaging company headquartered in the US. The company was founded in the 1880s and has three principal business sectors – forest products, packaging and papers. The forest products division supplies lumber to the constr

> Professor John Shank, The Amos Tuck School of Business Administration Dartmouth College This case was originally set in Western Europe in 1974, just after the Arab oil shocks of 1972 and 1973. National borders were still very important business barriers.

> The Managing Director of the Kiddy Toy Company (KTC) needs to decide whether a special export order should be accepted or rejected, with reasons provided, for the manufacture of Panda bears. The background Official statistics indicate that China manufact

> Hardhat Ltd.’s budget committee, which has members drawn from all the major functions in the business, is meeting to consider the projected income statement for 2020/2021, which is composed of the ten months’ actuals t

> Fosters Construction Ltd (FCL) is a privately owned company with revenue of £20 million per annum, and 200 employees. The company has been operating for 24 years and is well established in the marketplace. However, despite a national rate of 4 per cent p

> Mestral is a highly successful company manufacturing a range of quality bathroom fittings. For the past fifteen years production has been carried out at three locations: Northern town in the North East of England; at Western town on the Severn estuary;

> Fleet operates a chain of high street retail outlets selling clothing and household items. In 2019 this company was heading for a financial loss and was deemed to have lost strategic direction. The business formula that had proved successful in the 1980s

> The Board of Dumbellow Ltd are meeting on the 23rd January to discuss the draft budget for 2022/23, some two months before the start of that year. The company produces three industrial valves which are incorporated into equipment used in the Oil and Gas

> The case was prepared as the basis for discussion rather than to illustrate either effective or ineffective handling of an administrative situation. Danfoss Drives A/S is a Danish producer of frequency converters located in Graasten in the southern part

> Company B is a manufacturer of large, complex electrical motors. It has been making them 'to order', in order quantities of, typically, one-four in a jobbing/batch production system for many years. A typical selling price may range from £3,000-£20,000

> Company A is in the chemical industry and a manufacturer of industrial paints. At one of its manufacturing sites (site 1) a new system of costing and management information is being considered to replace a traditional system, which was not meeting fully

> This is a general case relating to joint costs allocation. Although it may be difficult to determine a proper allocation basis for a common cost, the broad objectives for allocating common costs are the same as those for separate costs – cost control and

> At the beginning of September, Paul Owen, the new manager of a division of Bohemia Industries, received the August income statement. He was surprised that the profit had declined from that reported for the previous month. He was expecting an increase in

> Introduction Jack Watson, an electrical engineer, established Electronic Boards plc as a ‘one-man’ company in the late 1970s. From small beginnings, the company earned a reputation for the quality and reliability of i

> John Ford, updated by Denny Emslie, Senior Lecturer in Accounting, University of Fort Hare, 2020 Topics covered include: break-even analysis, marginal/contribution costing, gross margin, sunk costs and cost/overhead recovery Founded in 2000, the Gordon

> A Self-supporting Legacy or a Burdensome White Elephant? In the run-up to the 2010 World Cup, South Africa built new stadia according to a blueprint devised by world football’s organizing body, FIFA. The country was keen to present the event in iconic, p

> The word Kai translates to change, and the word Zen translates to better. Together they are taken as change for the better or continuous improvement. Kaizen is part of a methodology known as lean manufacturing which aims to remove waste through continu

> Freedom Products has just organized a new department in their organization to manufacture and sell specially designed tables made from indigenous South African wood. The division has imported new equipment and machinery. Due to the high level of automati

> Melanie-Jane Brown started manufacturing her own face creams some years ago, having worked for some time for one of the large international cosmetic companies. Initially, she made face creams for herself and a few friends and, in response to their encou

> Grass Cutter Mechanic (GCM) manufactures and sells four types of grass cutters, used mainly by farmers. The details of the four different products are given below and relate to June 2020. In the manufacturing of the four products, similar technology is a

> One of the fastest growing sectors in the South African economy is telecommunications and the current expansion is focused on the growth of the mobile telephone market. South Africa is the fourth fastest growing mobile communications market in the world.

> The International Ecotourism Society (TIES) defines Ecotourism as ‘responsible travel to natural areas that conserves the environment, sustains the well-being of the local people, and involves interpretation and educationâ€&#

> First National Bank is a wholly owned division of FirstRand Bank Limited and is one of South Africa’s largest banks. The bank provides a broad range of financial services to individuals and businesses. FNB’s mission is ‘To move from good to Great by buil

> The SC Company manufactures and markets specialized products for use in the air purifying industry. The company is divisionalized and their operations are structured as follows. Department AC The main focus of Department AC is Research and Development. I

> The following information relates to Socks 'n' Stockings (Pty) Ltd, a wholly owned subsidiary of a major listed group. As investment bankers to the group you have been approached by the financial director who makes the following requests: • The company i

> Potty Plants produces large clay pots at their production plant on the Rose path Acre Woods. Peter, the newly appointed general manager of Potty Plants, has just received the income statement for February 2021, presented below: Peter was shocked to see t

> NuLife Limited is an investment holding company which operates through a number of subsidiaries and employs over 20,000 people. NuLife operates private hospital, primary healthcare, emergency medical services and renal care networks in South Africa. In a

> There are a number of large supermarket chains in South Africa which account for the majority of national retail food sales. They sell large quantities of groceries and other consumer goods, mostly on a self-service basis and increasingly via the online

> Air Gascogne operates daily round-trip flights on the Toulouse–Stockholm route using a fleet of three 747s, the Eclair des Cévennes, the Eclair des Vosges and the Eclair des Alpilles. The budgeted quantity of fuel for each

> Anna-Greta Lantto, the assistant controller of Kiruna AB had recently prepared the following quality report comparing 2018 and 2017 quality performances. Just two days after preparing the report, Lars Törnman, the controller, had called Lant

> Carmody Ltd sells 300 000 V262 valves to the car and truck industry. Carmody has a capacity of 110 000 machine-hours and can produce three valves per machine-hour. V262’s contribution margin per unit is €8. Carmody sel

> Braganza manufactures and sells 20 000 copiers each year. The variable and fixed costs of reworking and repairing copiers are as follows: Braganza’s engineers are currently working to solve the problem of copies being too light or too d

> MikkeliOy has three operating divisions. The managers of these divisions are evaluated on their divisional operating profit, a figure that includes an allocation of corporate overhead proportional to the revenues of each division. The operating profit st

> The Portimão Division of AmicaLda sells car batteries. Amica’s corporate management gives Portimão management considerable operating and investment autonomy in running the division. Amica is considering how it should compensate Manuel Belem, the general

> Thor-Equip AS specialises in the manufacture of medical equipment, a field that has become increasingly competitive. Approximately two years ago, Knut Solbær, president of Thor-Equip, decided to revise the bonus plan (based, at the time, e

> Serra-Mica Srl is a maker of ceramic coffee cups. It imprints company logos and other sayings on the cups for both commercial and wholesale markets. The firm has the capacity to produce 3 000 000 cups per year, but the recession has cut production and sa

> Salvador SA assembles motorcycles and uses long-run (defined as 3–5 years) average demand to set the budgeted production level and costs for pricing. Prices are then adjusted only for large changes in assembly wage rates or direct mater

> Faulkenheim GmbH is a manufacturer of tool and die machinery. Faulkenheim is a vertically integrated company that is organized into two divisions. The Frankfurt Steel Division manufactures alloy steel plates. The Tool and Die Machinery Division uses the

> 1. Discuss the conditions under which the introduction of ABC is likely to be most eective, paying particular attention to: product mix; the significance of overheads and the ABC method of charging costs; the availability of information collection proced

> Récré-Gaules SARL produces and distributes a wide variety of recreational products. One of its divisions, the Idefix Division, manufactures and sells ‘menhirs’, which are very popular with cro

> Refer to the information in Exercise 18.17. Suppose that the Mining Division is not required to transfer its yearly output of 400 000 units of toldine to the Metals Division. Required 1. From the standpoint of Escuelas, SA, as a whole, what quantity of

> Escuelas SA has two divisions. The Mining Division makes toldine, which is then transferred to the Metals Division. The toldine is further processed by the Metals Division and is sold to customers at a price of €150 per unit. The Mining

> Ilmajoki-Lumber Oy has a Raw Lumber Division and Finished Lumber Division. The variable costs are: ● Raw Lumber Division: €100 per 100 board-meters of raw lumber. ● Finished Lumber Division: €125 per 100 board-meters of finished lumber. Assume that there

> Refer to Exercise 18.13. Assume that Division A can sell the 1000 units to other customers at €155 per unit with variable marketing costs of €5 per unit. Required Determine whether Gustavsson will benefit if Division C purchases the 1000 components fr

> Gustavsson AB, manufacturer of tractors and other heavy farm equipment, is organized along decentralized lines, with each manufacturing division operating as a separate profit centre. Each divisional manager has been delegated full authority on all decis

> Montaigne-Chimie SA consists of seven operating divisions, each of which operates independently. The operating divisions are supported by a number of support divisions such as R&D, labor relations and environmental management. The environmental managemen

> SBA is a company that produces televisions and components for televisions. The company has two divisions, Division S and Division B.Division S manufactures components for televisions. Division S sells components to division B and to external customers. D

> AA and BB are two divisions of the ZZ Group. The AA division manufactures electrical components, which it sells to other divisions and external customers.The BB division has designed a new product, Product B, and has asked AA to supply the electrical com

> A company, which operates from a number of different locations, uses a system of centralized purchasing. The directors of the company are considering whether to change to a system of decentralized purchasing. Required Explain the benefits that may res

> Assume all the information in Exercise 12.15. Marcel has just received some bad news. A foreign competitor has introduced products very similar to P-41 and P-63. Given their announced selling prices, he estimates the P-41 clone to have a manufacturing co

> P Ltd has two divisions, Q and R that operate as profit centers. Division Q has recently been set up to provide a component (Comp1) which division R uses to produce its product (ProdX). Prior to division Q being established, division R purchased the comp

> The ZZ Group has two divisions, X and Y. Each division produces only one type of product: X produces a component, C and Y produces a finished product, FP. Each FP needs one C. It is the current policy of the group for C to be transferred to Division Y at

> ZP Plc operates two subsidiaries, X and Y. X is a component manufacturing subsidiary and Y is an assembly and final product subsidiary. Both subsidiaries produce one type of output only. Subsidiary Y needs one component from Subsidiary X for every unit o