Question: NuLife Limited is an investment holding company

NuLife Limited is an investment holding company which operates through a number of subsidiaries and employs over 20,000 people. NuLife operates private hospital, primary healthcare, emergency medical services and renal care networks in South Africa. In addition to its hospital services, the company offers primary healthcare, sub-acute care, day surgery, occupational health and employee wellness services. The company’s ordinary shares have been listed on the Johannesburg Stock Exchange South Africa for a number of years and the company has grown substantially since it listed.

General Information: NuLife Ltd Market & competitors

Net lifecare Ltd has in the recent years developed as a serious competitor in the private healthcare sector. The directors of NuLife Ltd are concerned with this development and the managing director, Dr Bonakela Matewane, stated the following in the recent annual report: 'The role of management in marketing services is critical to the success and the shape of real-world life cycles. Also, of central importance is the high relative market share as the key to competitive success.'

Economic outlook

The recent coronavirus (COVID-19) pandemic has not reduced earnings significantly yet, but it is expected that the decrease in the 2020 earnings will result in cash flow constraints in the next year and this may temporarily hamper expansion projects. Major expansion projects which were considered before the pandemic have been reconsidered and will only be evaluated again in a year or two. However, the medium-term view of the economy and the industry is very positive and the present cash flow may allow for some smaller capital projects to take place.

Corporate & social responsibility

NuLife Ltd is strongly committed to the development of South Africa and its people. Considerable emphasis is placed on giving back to the nation by committing substantial resources to community and nation-building initiatives. Being a healthcare company, the bulk of its CSR activities are in the healthcare arena. Preference is given to initiatives that provide health services to local patients, health science education, at undergraduate as well as postgraduate level, support to faculties of health sciences, community projects, wellness programmes and sport development.

Expanding and Upgrading: NuLife Ltd Hospital Port Elizabeth

The directors of NuLife Ltd are considering upgrading and expanding the existing healthcare facility in Port Elizabeth, Eastern Cape, namely NuLife Ltd Hospital Port Elizabeth, by the addition of a new wing with a state of the art maternity unit and a new ICU facility. The cost of upgrading the healthcare facility is estimated to be R320 million at the start of 2021. Capital expenditure will qualify for a capital allowance for tax purposes of 20 per cent per annum on a straight line basis. It should be assumed that there is no resale value at the end of the project. An additional investment of R40 million to finance working capital will be required at the start of the project and is expected to flow back at the end of the project.

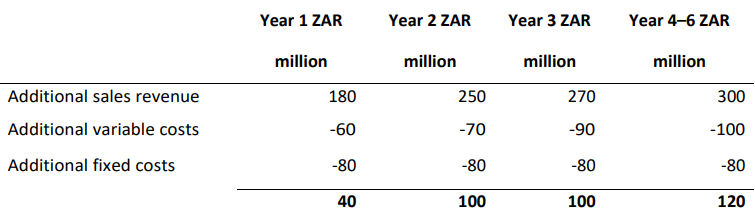

This amount will have to be increased on an annual basis to account for the effects of inflation. The project is evaluated over a period of six years, starting in January 2021. Project net operating profits in real terms (January 2021 values) in South African Rands (ZAR) are estimated as follows:

Additional fixed costs exclude depreciation. All cash flows should be assumed to arise on 31 December of each year. It should also be assumed that taxation is paid on the last day of the year in which the tax liability arises. The cost of upgrading the healthcare facility has not been determined yet, as the board was still awaiting the report from an external consultant.

Possible Expansion of Operations into Botswana

Atthe last board meeting, the operations director added a new point to the agenda –Expansion of private healthcare facilities to Botswana by building a private hospital in Gaborone. The operations director, Dr Sipokazi Potgieter, then asked the board permission to investigate the possibility of expanding private healthcare facilitiesto Botswana, a neighboring country which is also located in Southern Africa, instead of upgrading the existing healthcare facilities in Port Elizabeth. In her discussion of the issue, the operations director concluded that the company needed to expand their operations to new potential markets in other countries in order to maintain growth in operations. She mentioned that the market for private healthcare was virtually unexplored in Botswana and that there was a substantial growing upper middle class in this country, which, according to market research, would utilize private healthcare facilities if they were available.

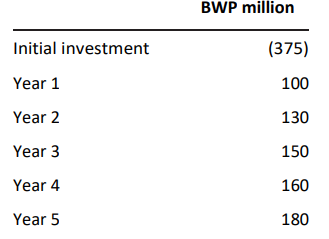

The marketing director added that this is an opportunity to expand into Africa where lack of sufficient government healthcare facilities, together with growing economies, have created the need for private healthcare. The board briefly discussed the matter and then asked the marketing and operating directors to investigate the matter further and to report back at the next board meeting. The two directors have identified a site in Gaborone that could be suitable for a building meeting NuLife Ltd’s operational requirements at a relatively low cost. The project’s net operating cash flows after tax in Botswana Pula, BWP, the local currency of Botswana, were estimated to be as follows (in nominal terms):

The financial director mentioned that it was difficult to compare the expansion of the existing healthcare facility in Port Elizabeth to the building of the new private healthcare facility in Gaborone, Botswana, as cash flows were not in the same currency. He also mentioned that the inflation rate in Botswana, 14 per cent, was considerably higher than the 10 per cent inflation rate in South Africa.

The tax rate for companies in South Africa as well as Botswana is 28 per cent. Due to the double tax agreement with Botswana, profits will not be taxed in both countries. The current exchange rate between the Botswana Pula (BWP) and the rand are expected to be as follows (1 January 2021): 1 Rand: 0,70 BWP The inflation rate in South Africa is approximately 10 per cent per annum and is expected to remain at this level for the foreseeable future. The cost of capital for NuLife Ltd is 12 per cent pa.

Financing

In order to remain within their target capital structure, either of the projects would be funded by a combination of debt and equity financing. Regardless of which project is decided upon, the decision has been made that the project should be financed by means of available cash resources as well as by a long-term loan. Should the project in Botswana be accepted by the directors, the possibility of a loan from the Bank of Botswana will be investigated.

Press Statement

In September 2020, the directors issued a press statement announcing that their intention to temporarily freeze dividend pay-out levels at the current level during the development stage of the proposed capital investment period, due to cash flow constraints.

Required

1. Calculate the NPV of the two alternative investment projects. All cash flows should be shown in ZAR (R).

2. Briefly describe the two methods commonly used for evaluating international investments and discuss why they would render more or less the same net present value in the local currency.

3. Calculate the profitability index of the two projects based on your answer in (1) above and make a recommendation to the directors in respect of which project should be accepted.

4. Discuss the major risk issues that should be considered by NuLife Ltd when evaluating the project in Botswana.

5. Discuss the merit of obtaining a loan from the bank of Botswana if the directors decide to build the hospital in Botswana.

6. Advise on how the press announcement may influence the share price and how investors may perceive the temporary proposed reduction in dividends.

> Kellogg Company and Kraft Heinz Company, Inc. are two companies operating in the packaged food industry. You have noticed their products in numerous grocery and convenience stores and are interested in their production process. Your first step is to anal

> PROBLEM: Selected disclosures related to Foot Locker Company’s inventory follow. Use these disclosures to answer the following questions: a. What percentage of inventory at the end of 2016 is accounted for under each cost-flow assumpti

> Kimberly-Clark Corporation and Procter & Gamble Company reported the following information about inventory in their financial statements and footnotes. Use this information to answer the following questions: a. What cost-flow assumption(s) does Kimbe

> Companies sometimes use accounts receivable as collateral in a secured borrowing or sell them to a factor. The accounting method for these types of transactions is governed by ASC 860—Transfers and Servicing, the majority of which derives from SFAS No. 1

> According to ASC 606, an entity should recognize revenue when goods or services are transferred to a customer. Goods and services are transferred to a customer when the customer obtains control. Refer to the Basis for Conclusions section of ASU 2014-09 t

> What are the general rules related to the amortization of intangible assets? Read the basis for conclusions in SFAS No. 142, particularly paragraphs B49 through B53. What were the amortization rules for intangibles prior to the passage of SFAS No. 142? I

> Consider the Basis for Conclusions in IAS 16, Property, Plant, and Equipment (particularly paragraphs BC26 and BC27). What is the principle underlying component depreciation under IFRS? Although U.S. GAAP does not contain a basis for conclusions for the

> Both IFRS and U.S. GAAP require that firms report inventory at the lower of cost or market. What is the basic principle/characteristic behind this standard that results in this “lower” reporting approach (asset write-down)? Scene 2 Read the objectives

> Martin Software Developers, Inc. recently signed a contract for $1,600,000 to create a registration, grade report, and transcript system for MacFarlane State University. Each part of the system will be delivered separately and must be fully functional up

> Complete the blanks in the five criteria to identify a contract with a customer. 1. All parties agree to the _ and commit to . 2. Each party’s rights with respect to the goods or service being transferred are . 3.

> FIFA World Cup 2010 – A Worthwhile Proposition For South Africa? The hosting of the FIFA World Cup 2010 in South Africa was presented as an opportunity to redefine perceptions of South Africa by demonstrating that an African country could successfully

> One of the major tasks of the workshop on Crystal Palace Gold Mine is to repair winch motors, and about 1,000 motors are repaired annually. Approximately half of the repairs require the burnt out armature to be rewound. At present all armatures requiring

> Douglas Taylor, Lecturer in Management Accounting and Finance, Corporate Governance and Ethics and Head of the Finops Section at Wits Business School, Parktown, South Africa Topics covered include: decision-making under conditions of risk and uncertainty

> Springbok Limited’s budget committee, which had members drawn from all the major functions of the business was meeting to consider the projected income statement 2020/2021, which was composed of the 10 months actuals to the end of Janua

> Founded in 1923, Eskom built 78 large coal-fired plants over 60 years to become the fourth largest power utility in the world. The company generates over 90 per cent of all electricity generated in South Africa. This electricity is distributed to industr

> Kinkead has been a leading UK firm since World War II in specialty instruments for measuring electric current characteristics (voltmeters, ohmmeters, ammeters, etc.). Kinkead’s products are grouped into two main lines of business for internal reporting p

> In November 2020, a consultant was employed to review and document the planning and control systems of Integrated Technology Services (UK) Ltd (ITS-UK), to ensure that these were effectively meeting the needs of the business and to provide a basis for st

> Dave Barry, an engineer, is the general manager of the Beta Company, which manufactures a general range of animal food products. Since joining the company, the sales have been static in both volume and value terms. Now, at the start of the New Year, a po

> Alan Chadwick is the Chairman and Managing Director of Chadwick’s Department Store Ltd. This is the company that operates Chadwick’s, a large independent department store that has been family owned and run for over 100 years. It was started in 1906 by Si

> Amica Foods Ltd. produces a very wide range of food products in a highly competitive industry, almost all under the Primus brand name, which is widely recognized as representing high-quality food products with a loyal customer following. Almost all of t

> Anjo Ltd was established in 1986 by two brothers, Andrew and Jonathan Bright. They saw a market for providing accessories in the home to accommodate the new era of home entertainment, and more recently expanded their range to account for a resurgence i

> Airport Complex was founded in Northern Europe in the early 1960s, and at the time it primarily served as a domestic airport. During the 1980s, flights to foreign destinations became an ever more vital activity for the airport. Today, the airport funct

> Southern Paper Inc. is a global packaging company headquartered in the US. The company was founded in the 1880s and has three principal business sectors – forest products, packaging and papers. The forest products division supplies lumber to the constr

> Professor John Shank, The Amos Tuck School of Business Administration Dartmouth College This case was originally set in Western Europe in 1974, just after the Arab oil shocks of 1972 and 1973. National borders were still very important business barriers.

> Merrion Products Limited is a company owned by the Carroll family. The company manufactures hand-made chocolate biscuits from imported South American cocoa, which are sold to a small number of large retail outlets in the local area. When the company was

> The Managing Director of the Kiddy Toy Company (KTC) needs to decide whether a special export order should be accepted or rejected, with reasons provided, for the manufacture of Panda bears. The background Official statistics indicate that China manufact

> Hardhat Ltd.’s budget committee, which has members drawn from all the major functions in the business, is meeting to consider the projected income statement for 2020/2021, which is composed of the ten months’ actuals t

> Fosters Construction Ltd (FCL) is a privately owned company with revenue of £20 million per annum, and 200 employees. The company has been operating for 24 years and is well established in the marketplace. However, despite a national rate of 4 per cent p

> Mestral is a highly successful company manufacturing a range of quality bathroom fittings. For the past fifteen years production has been carried out at three locations: Northern town in the North East of England; at Western town on the Severn estuary;

> Fleet operates a chain of high street retail outlets selling clothing and household items. In 2019 this company was heading for a financial loss and was deemed to have lost strategic direction. The business formula that had proved successful in the 1980s

> The Board of Dumbellow Ltd are meeting on the 23rd January to discuss the draft budget for 2022/23, some two months before the start of that year. The company produces three industrial valves which are incorporated into equipment used in the Oil and Gas

> The case was prepared as the basis for discussion rather than to illustrate either effective or ineffective handling of an administrative situation. Danfoss Drives A/S is a Danish producer of frequency converters located in Graasten in the southern part

> Company B is a manufacturer of large, complex electrical motors. It has been making them 'to order', in order quantities of, typically, one-four in a jobbing/batch production system for many years. A typical selling price may range from £3,000-£20,000

> Company A is in the chemical industry and a manufacturer of industrial paints. At one of its manufacturing sites (site 1) a new system of costing and management information is being considered to replace a traditional system, which was not meeting fully

> This is a general case relating to joint costs allocation. Although it may be difficult to determine a proper allocation basis for a common cost, the broad objectives for allocating common costs are the same as those for separate costs – cost control and

> At the beginning of September, Paul Owen, the new manager of a division of Bohemia Industries, received the August income statement. He was surprised that the profit had declined from that reported for the previous month. He was expecting an increase in

> Introduction Jack Watson, an electrical engineer, established Electronic Boards plc as a ‘one-man’ company in the late 1970s. From small beginnings, the company earned a reputation for the quality and reliability of i

> John Ford, updated by Denny Emslie, Senior Lecturer in Accounting, University of Fort Hare, 2020 Topics covered include: break-even analysis, marginal/contribution costing, gross margin, sunk costs and cost/overhead recovery Founded in 2000, the Gordon

> A Self-supporting Legacy or a Burdensome White Elephant? In the run-up to the 2010 World Cup, South Africa built new stadia according to a blueprint devised by world football’s organizing body, FIFA. The country was keen to present the event in iconic, p

> The word Kai translates to change, and the word Zen translates to better. Together they are taken as change for the better or continuous improvement. Kaizen is part of a methodology known as lean manufacturing which aims to remove waste through continu

> Freedom Products has just organized a new department in their organization to manufacture and sell specially designed tables made from indigenous South African wood. The division has imported new equipment and machinery. Due to the high level of automati

> Melanie-Jane Brown started manufacturing her own face creams some years ago, having worked for some time for one of the large international cosmetic companies. Initially, she made face creams for herself and a few friends and, in response to their encou

> Grass Cutter Mechanic (GCM) manufactures and sells four types of grass cutters, used mainly by farmers. The details of the four different products are given below and relate to June 2020. In the manufacturing of the four products, similar technology is a

> One of the fastest growing sectors in the South African economy is telecommunications and the current expansion is focused on the growth of the mobile telephone market. South Africa is the fourth fastest growing mobile communications market in the world.

> The International Ecotourism Society (TIES) defines Ecotourism as ‘responsible travel to natural areas that conserves the environment, sustains the well-being of the local people, and involves interpretation and educationâ€&#

> First National Bank is a wholly owned division of FirstRand Bank Limited and is one of South Africa’s largest banks. The bank provides a broad range of financial services to individuals and businesses. FNB’s mission is ‘To move from good to Great by buil

> The SC Company manufactures and markets specialized products for use in the air purifying industry. The company is divisionalized and their operations are structured as follows. Department AC The main focus of Department AC is Research and Development. I

> The following information relates to Socks 'n' Stockings (Pty) Ltd, a wholly owned subsidiary of a major listed group. As investment bankers to the group you have been approached by the financial director who makes the following requests: • The company i

> Potty Plants produces large clay pots at their production plant on the Rose path Acre Woods. Peter, the newly appointed general manager of Potty Plants, has just received the income statement for February 2021, presented below: Peter was shocked to see t

> There are a number of large supermarket chains in South Africa which account for the majority of national retail food sales. They sell large quantities of groceries and other consumer goods, mostly on a self-service basis and increasingly via the online

> Air Gascogne operates daily round-trip flights on the Toulouse–Stockholm route using a fleet of three 747s, the Eclair des Cévennes, the Eclair des Vosges and the Eclair des Alpilles. The budgeted quantity of fuel for each

> Anna-Greta Lantto, the assistant controller of Kiruna AB had recently prepared the following quality report comparing 2018 and 2017 quality performances. Just two days after preparing the report, Lars Törnman, the controller, had called Lant

> Carmody Ltd sells 300 000 V262 valves to the car and truck industry. Carmody has a capacity of 110 000 machine-hours and can produce three valves per machine-hour. V262’s contribution margin per unit is €8. Carmody sel

> Braganza manufactures and sells 20 000 copiers each year. The variable and fixed costs of reworking and repairing copiers are as follows: Braganza’s engineers are currently working to solve the problem of copies being too light or too d

> MikkeliOy has three operating divisions. The managers of these divisions are evaluated on their divisional operating profit, a figure that includes an allocation of corporate overhead proportional to the revenues of each division. The operating profit st

> The Portimão Division of AmicaLda sells car batteries. Amica’s corporate management gives Portimão management considerable operating and investment autonomy in running the division. Amica is considering how it should compensate Manuel Belem, the general

> Thor-Equip AS specialises in the manufacture of medical equipment, a field that has become increasingly competitive. Approximately two years ago, Knut Solbær, president of Thor-Equip, decided to revise the bonus plan (based, at the time, e

> Serra-Mica Srl is a maker of ceramic coffee cups. It imprints company logos and other sayings on the cups for both commercial and wholesale markets. The firm has the capacity to produce 3 000 000 cups per year, but the recession has cut production and sa

> Salvador SA assembles motorcycles and uses long-run (defined as 3–5 years) average demand to set the budgeted production level and costs for pricing. Prices are then adjusted only for large changes in assembly wage rates or direct mater

> Faulkenheim GmbH is a manufacturer of tool and die machinery. Faulkenheim is a vertically integrated company that is organized into two divisions. The Frankfurt Steel Division manufactures alloy steel plates. The Tool and Die Machinery Division uses the

> 1. Discuss the conditions under which the introduction of ABC is likely to be most eective, paying particular attention to: product mix; the significance of overheads and the ABC method of charging costs; the availability of information collection proced

> Récré-Gaules SARL produces and distributes a wide variety of recreational products. One of its divisions, the Idefix Division, manufactures and sells ‘menhirs’, which are very popular with cro

> Refer to the information in Exercise 18.17. Suppose that the Mining Division is not required to transfer its yearly output of 400 000 units of toldine to the Metals Division. Required 1. From the standpoint of Escuelas, SA, as a whole, what quantity of

> Escuelas SA has two divisions. The Mining Division makes toldine, which is then transferred to the Metals Division. The toldine is further processed by the Metals Division and is sold to customers at a price of €150 per unit. The Mining

> Ilmajoki-Lumber Oy has a Raw Lumber Division and Finished Lumber Division. The variable costs are: ● Raw Lumber Division: €100 per 100 board-meters of raw lumber. ● Finished Lumber Division: €125 per 100 board-meters of finished lumber. Assume that there

> Refer to Exercise 18.13. Assume that Division A can sell the 1000 units to other customers at €155 per unit with variable marketing costs of €5 per unit. Required Determine whether Gustavsson will benefit if Division C purchases the 1000 components fr

> Gustavsson AB, manufacturer of tractors and other heavy farm equipment, is organized along decentralized lines, with each manufacturing division operating as a separate profit centre. Each divisional manager has been delegated full authority on all decis

> Montaigne-Chimie SA consists of seven operating divisions, each of which operates independently. The operating divisions are supported by a number of support divisions such as R&D, labor relations and environmental management. The environmental managemen

> SBA is a company that produces televisions and components for televisions. The company has two divisions, Division S and Division B.Division S manufactures components for televisions. Division S sells components to division B and to external customers. D

> AA and BB are two divisions of the ZZ Group. The AA division manufactures electrical components, which it sells to other divisions and external customers.The BB division has designed a new product, Product B, and has asked AA to supply the electrical com

> A company, which operates from a number of different locations, uses a system of centralized purchasing. The directors of the company are considering whether to change to a system of decentralized purchasing. Required Explain the benefits that may res

> Assume all the information in Exercise 12.15. Marcel has just received some bad news. A foreign competitor has introduced products very similar to P-41 and P-63. Given their announced selling prices, he estimates the P-41 clone to have a manufacturing co

> P Ltd has two divisions, Q and R that operate as profit centers. Division Q has recently been set up to provide a component (Comp1) which division R uses to produce its product (ProdX). Prior to division Q being established, division R purchased the comp

> The ZZ Group has two divisions, X and Y. Each division produces only one type of product: X produces a component, C and Y produces a finished product, FP. Each FP needs one C. It is the current policy of the group for C to be transferred to Division Y at

> ZP Plc operates two subsidiaries, X and Y. X is a component manufacturing subsidiary and Y is an assembly and final product subsidiary. Both subsidiaries produce one type of output only. Subsidiary Y needs one component from Subsidiary X for every unit o

> All personnel, including partners, of public accounting firms must usually turn in biweekly time reports, showing how many hours were devoted to their various duties. These firms have traditionally looked unfavorably on idle or unassigned staff time. The

> Calypso SA manufactures and sells fertilizers. Calypso uses the following standard direct materials costs to produce 1 tons of fertilizer Note that 1.2 tons of input quantities are required to produce 1 ton of fertilizer. No stocks of direct materials ar

> Tropical AB processes tropical fruit into fruit salad mix, which it sells to a food-service company. Tropical has in its budget the following standards for the direct materials inputs to produce 80 kg of tropical fruit salad: Note that 100 kg of input q

> Marko Antero Oy produces perfume. To make this perfume, Marko Antero uses three different types of fluid. Tartars, Erebus and Uranus are used in standard proportions of 4/10, 3/10 and 3/ 10, and their standard costs are €6.00, â

> X Ltd uses an automated manufacturing process to produce an industrial chemical, Product P. X Ltd operates a standard marginal costing system. The standard cost data for Product P is as follows: In order to arrive at the budgeted selling price for Produ

> Deadeye Ltd operates a standard costing system in which all stocks are valued at standard cost. The standard direct material cost of one unit of product MS is £36, made up of 4.8 kg of material Hat £7.50 per kg. Material H is u

> The Antwerp Lions play in the Flemish Football League. The Lions play in the Antwerp Stadium (owned and managed by the City of Antwerp), which has a capacity of 30 000 seats (10 000 lower- tier seats and 20 000 upper-tier seats). The Antwerp Stadium char

> Baden-Möbel GmbH manufactures a variety of prestige boardroom chairs. Its job-costing system was designed using an activity-based approach. There are two direct-cost categories (direct materials and direct manufacturing labour) and three ind

> Les Cliniques du Parc reports the following information for July 2018 regarding its nursing staff consisting of nurses, nursing assistants and orderlies. Required 1. Calculate the total direct nursing labor efficiency variance for July 2018. 2. Calculat

> A company sells three products: D, E and F. The market for the products dictates that the numbers of products sold are always in the ratio of 3D:4E:5F. Budgeted sales volumes and prices, and cost details for the previous period were as follows: The budge

> The Safe Soap Co. makes environmentally-friendly soap using three basic ingredients. The standard cost card for one batch of soap for the month of September was as follows: The budget for production and sales in September was 120 000 batches. Actual prod

> O’Connell & Associates, a firm of architects, has three levels of professional staff: principals (managers), who manage all aspects of the architectural job; senior architects, who are responsible for the main designs; and junior ar

> Mondragon SA assembles its CardioX product at its Toledo plant. Manufacturing overhead (both variable and fixed) is allocated to each CardioX unit using budgeted assembly-time hours. Budgeted assembly time per CardioX product is 2 hours. The budgeted var

> PP Ltd operates a standard absorption costing system. The following information has been extracted from the standard cost card for one of its products: Actual results for the period were as follows: It has subsequently been noted that due to a change in

> Braithwaite Ltd manufactures and sells a single product. The following data have been extracted from the current year’s budget: The company’s production capacity is not being fully utilised in the current year and thre

> Coaldale Ltd manufactures and sells product CC. The company operates a standard marginal costing system. The standard cost card for CC includes the following: The budgeted and actual activity levels for the last quarter were as follows: The actual costs

> Migratory Ltd, which manufactures a single product, uses standard absorption costing. A summary of the standard product cost is as follows: Budgeted and actual production for last month were 10 000 units and 9000 units respectively. The actual costs incu

> Willem Nijmegen manages the warehouse of Stinted NV, a mail-order firm. Nijmegen is concerned about controlling the fixed costs of the 20 workers who collect merchandise in the warehouse and bring it to the area where orders are assembled for shipment. E

> Henriksen AS manufactures and sells packaging machines. It recently used an activity-based approach to refine the job-costing system at its Vejle plant. The resulting job-costing system has one direct-cost category (direct materials) and four indirect ma

> L’Evénement du Demarche budgets to produce 300 000 copies of its monthly newspaper for August 2018. It is budgeted to run 15 000 000 print pages in August with 50 print pages per newspaper. Actual production in August 2018

> Lavertezzo allocates fixed manufacturing overhead to each suit using budgeted direct manufacturing labor-hours per suit. Data pertaining to fixed manufacturing overhead costs for June 2018 are budgeted, SFr 62 400, and actual, SFr 63 916. Required 1. C

> MadetojaOy’s job-costing system has two direct-cost categories: direct materials and direct manufacturing labor. Manufacturing overhead (both variable and fixed) is allocated to products on the basis of standard direct manufacturing lab

> Nolton-Ragnvald AS uses a standard costing system. It allocates manufacturing overhead (both variable and fixed) to products on the basis of standard direct manufacturing labor-hours (DLH). Nolton develops its manufacturing overhead rate from the current

> 1. Prepare a comprehensive set of variances for each of the four categories of cost of L’Evénement du Dimanche. 2. Comment on the results in requirement 1. What extra insights are available with a flexible budget analysis over that of a static-budget ana

> The Olsson-Langkilde Air Force Base has an extensive repair facility for jet engines. It developed standard costing and flexible budgets to account for this activity. Budgeted variable overhead at a level of 8000 standard monthly direct labor-hours was S