Question: O’Leary Corporation manufactures special-purpose

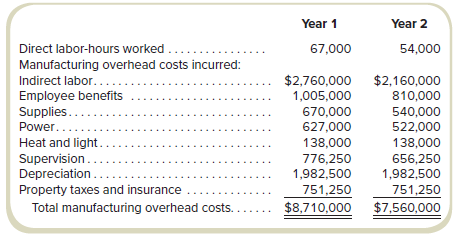

O’Leary Corporation manufactures special-purpose portable structures (huts, mobile offices, and so on) for use at construction sites. It only builds to order (each unit is built to customer specifications). O’Leary uses a normal job costing system. Direct labor at O’Leary is paid $17 per hour, but the employees are not paid if they are not working on jobs. Manufacturing overhead is assigned to jobs by a predetermined rate on the basis of direct labor-hours. The company incurred manufacturing overhead costs during two recent years (adjusted for price-level changes using current prices and wage rates) as follows:

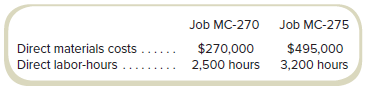

At the beginning of Year 3, O’Leary has two jobs, which have not yet been delivered to customers. Job MC-270 was completed on December 27, Year 2. It is scheduled to ship on January 7, Year 3. Job MC-275 is still in progress. For the purpose of computing the predetermined overhead rate, O’Leary uses the previous year’s actual overhead rate. Data on direct materials costs and direct labor-hours for these jobs in Year 2 follow:

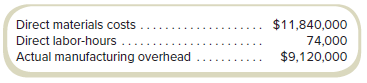

During Year 3, O’Leary incurred the following direct materials costs and direct labor-hours for all jobs worked in Year 3, including the completion of Job MC-275:

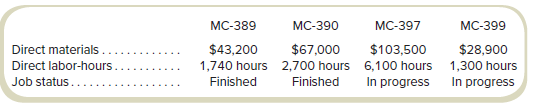

At the end of Year 3, there were four jobs that had not yet shipped. Data on these jobs follow:

Required

a. What were the amounts in the beginning Finished Goods and beginning Work-in-Process accounts for year 3?

b. O’Leary incurred direct materials costs of $57,000 and used an additional 300 hours in Year 3 to complete job MC-275. What was the final (total) cost charged to job MC-275?

c. What was over- or underapplied overhead for Year 3?

d. O’Leary prorates any over- or underapplied overhead to Cost of Goods Sold, Finished Goods Inventory, and Work-in-Process Inventory. Prepare the journal entry to prorate the over- or underapplied overhead computed in requirement (c).

e. A customer has asked O’Leary to bid on a job to be completed in Year 4. O’Leary estimates that the job will require about $92,500 in direct materials and 5,000 direct labor-hours. Because of the economy, O’Leary expects demand for its services to be low in Year 4, and the CEO wants to bid aggressively but does not want to lose any money on the project. O’Leary estimates that there would be virtually no sales or administrative costs associated with this job. What is the minimum amount O’Leary can bid on the job and still not incur a loss?

> Refer to the facts in Problem 8-59. Required a. Prepare a production cost report using FIFO. b. Answer requirement (b) in Problem 8-59. Problem 8-59: Required a. Prepare a production cost report for September using the weighted-average method. b. Manage

> Refer to the data in Exercise 8-56 and Problem 8-74 (Hedwig Optical). The marketing manager cannot believe that the controller wants to treat all binocular models the same. The marketing manager says that in order to understand where to target marketing

> Spokane, Inc. is a manufacturing company that produces parts both for inventory and to custom specifications. Parts produced for inventory are sold at prices determined in the market. Custom parts are sold at a price equal to production cost plus a profi

> Antoine Machining estimated its manufacturing overhead to be $279,000 and its direct materials costs to be $450,000 in Year 1. Three of the jobs that Antoine Machining worked on in Year 1 had actual direct materials costs of $15,000 for Job AM002, $55,00

> Buelow, LLP, is a consulting firm that helps organizations become more efficient. A supervisor on two consulting jobs discusses an issue that arose recently. One of the consulting jobs is for a large technology firm, and the other is for a major automobi

> Jerome Shipyards does work for both the U.S. Navy and private shipping companies. Jerome’s major business is renovating ships, which it does at one of two company dry docks referred to by the names of the local towns: Casgrain and Lyndo

> Plainview Paving Contractors (PPC) is a rapidly growing, recently established company that has not been profitable despite increases in sales. It has hired you as a consultant to find ways to improve profitability. You believe that the problem results fr

> Accounting records for Antoinette Designs (AD) for November show the following (each entry is the total of the actual entries for the account for the month): The Work-in-Process Inventory ending account balance on November 30 was 125 percent of the begin

> Mechanic Implements manufactures miscellaneous parts for building construction and maintenance. The company uses a normal job costing system and overhead is applied on the basis of direct labor cost. Any over- or underapplied overhead is written off to C

> The following financial information about the manufacturing plant of Continental Company for the year-to-date and the month of July appears on the company’s records: A count of the inventories on hand July 31 shows the following: Interv

> Manor Painting is a commercial interior and exterior painting contractor specializing in commercial buildings. An inventory of materials and equipment is on hand at all times, so work can start as quickly as possible. Special equipment is ordered as requ

> Hyde Restorations rebuilds factory facilities. It employs 130 full-time workers at $25 per hour. Despite operating at capacity, last year’s performance was a great disappointment to the managers. In total, nine jobs were accepted and co

> Refer to the facts in Problem 8-64. Required The financial managers at Ambassador Lubricants are trying to decide between whether to continue using the weighted-average method or switch to FIFO. They tell you that the June results are fairly typical. Wha

> On April 1, two jobs were in process at Hartwell Contracting. Details of the jobs follow: The Materials Inventory account on April 1 totaled $7,900. Materials purchased during the month totaled $17,100. Indirect materials of $1,540 were issued from mater

> Cranshaw Business Services (CBS) operates an information technology (IT) consulting firm out of two offices: Detroit and Los Angeles. Corporate services, such as legal, finance, and personnel, are centralized at the main office, and the costs of these se

> The records of Tillman Corporation’s initial and unaudited accounts show the following ending inventory balances, which must be adjusted to actual costs: As the auditor, you have learned the following information. Ending work-in-process

> Rogell Academic Services (RAS) provides tutoring and test preparation services for children and young adults. Employees include a director and six facilitators. The director manages all marketing and administrative activities, sometimes with the help of

> Select the best answer for each of the following independent multiple-choice questions. a. Hillger Paints’s production cycle starts in Department A. The following information is available for April: Materials are added at the beginning

> Garvin, Inc. produces a specialized machine tool to order. Garvin uses a job costing system and applies overhead on the basis of direct labor-hours. Each unit varies according to customer specification, but for planning purposes, Garvin uses the followin

> Mercier Manufacturing produces a plastic part in three sequential departments: Extruding, Fabricating, and Packaging. Mercier uses the weighted-average process costing method to account for costs of production in all three departments. The following info

> Highway 1 Manufacturing (H1M) produces several, related products in multiple factories. At one facility, which produces only a single product, managers are debating whether to use a predetermined rate calculated on a monthly or annual basis. Overhead is

> A series of computer and backup system failures caused the loss of most of the company records at Stotter, Inc. Information technology consultants for the company could recover only a few fragments of the company’s factory ledger for Ju

> Sorrento Products uses a job costing accounting system for its manufacturing costs. A predetermined overhead rate based on machine-hours is used to apply overhead to individual jobs. An estimate of overhead costs at different volumes was prepared for the

> Whitlock Manufacturing uses a job costing accounting system for its production costs. The company uses a predetermined overhead rate based on direct materials costs to apply overhead to individual jobs. The company prepared an estimate of overhead costs

> The following T-accounts represent September activity for Kelly Tools: Additional Data ∙ Sales are billed at 175 percent of Cost of Goods Sold before the over- or underapplied overhead is prorated. ∙ Materials of $75,7

> Refer to the facts in Exercise 11-25. Assume that both Fabricating and Finishing work on just two jobs during the month of March: MP-47 and MP-48. Costs are allocated to jobs based on laborhours in Fabricating and machine-hours in Finishing. The number o

> The following T-accounts for the Fitzpatrick Company represent April activity: Required Compute the missing amounts indicated by the letters (a) through (i).

> Bromley Custom Cabinetry (BCC) uses a job costing system and applies overhead based on direct materials cost. Last year, manufacturing overhead was expected to be $693,000 and direct materials cost was estimated to be $630,000. Actual manufacturing overh

> Hendricks Mining & Manufacturing is a global mineral resource company. At its Taylor site, the company mines and processes three grades of metal—IA, IB, and II—in fixed proportions. The joint costs of mining total $2,550,000. In a typical month, the comp

> Elsa Products processes Chem-Z into two products: Chem-A and Chem-B. Chem-Z costs $42,000 per batch. The joint process produces 11,250 units of Chem-A with a market value of $135,000, and 20,000 units of Chem-B with a market value of $33,750. The convers

> Longwood Corporation processes a liquid into three outputs: K-2, K-4, and K-5. The sales value of each of these products for a single batch follows: The joint costs total $850,000. There are no separable production costs. If K-5 is accounted for as a by-

> Goldsmith Processors produces two joint products from a special type of ore. Product X-1 sells for $8 per unit at the split-off point. After an additional $90,000 of processing costs are incurred, product X-2 sells for $25 per unit. In a typical period,

> Terry Chemicals processes a single raw material, Clean-Z, in Department 1 of its main production facility. Out of the joint process in Department 1, two products emerge: Azyne and Bethanol. Azyne is further processed in Department 2, which also is a join

> Wadsworth Processes manufactures three produces—ABC, DEF, and GHI—from a joint production process. Data on the operations at Wadsworth for the most recent period are as follow: Required Determine the value for each let

> Troester Manufacturing produces products X, Y, and Z from a joint process. Each product can be processed further and sold as X-Prime, Y-Prime, and Z-Prime. Information on the operations for the most recent period follows: Required Determine the value for

> Lipton Liquids produces three products by a joint production process. Raw materials are put into production in Department 1, and at the end of processing in this department, three products appear. Alpha is sold at the split-off point with no further proc

> Mack Precision Tool and Die has two production departments, Fabricating and Finishing, and two service departments, Repair and Quality Control. Direct costs for each department and the proportion of service costs used by the various departments for the m

> Douglass Minerals mines ore and then processes it into other products. At the end of the mining process, the ore splits off into three products: Metal-A, Metal-B, and Metal-C. Douglass sells Metal-C at the split-off point, with no further processing. Met

> Morrell Financial Services (MFS) has three service departments: Accounting, Information Technology (IT), and Personnel. MFS also has two operating departments (Advice and Brokerage). Data on service department usage and service direct costs follow: Requi

> Filer Fabrication has three service departments (S1, S2, and S3) and two production departments (P1 and P2). Data on service department usage and service direct costs follow. Required Assume that Filer Fabrication uses the reciprocal method of service de

> Refer to the information in Problem 11-58 for Rohns Manufacturing. Required Assume that Rohns uses the reciprocal method of service department cost allocation. What is the total service department cost allocated to Fabrication? To Assembly? (Hint: Use th

> Refer to the facts in Problem 11-65. Required a. If Dunedin Bank outsources both the Transactions Department and the IT Department, the total savings (before considering the fee paid to the outside vendor) will be 1. More than the sum of the savings calc

> Refer to the facts in Problem 11-60. The cost accountant at Dunedin Bank estimates that the cost structures in its departments are as follows: Required a. If Dunedin Bank outsources the Transactions Department, what is the maximum it can pay an outside v

> Refer to the facts in Problem 11-57. Baldwin Enterprises estimates that the cost structure in its operations is as follows: Required a. If Baldwin outsources the Legal Department, what is the maximum it can pay an outside vendor without increasing total

> Lothrop Security Group (LSG) provides consulting and security services to various clients, including government agencies and commercial firms. It has two operating departments, Government and Commercial. The Government Department handles contracts with f

> Hessel Corporation has two operating departments (Domestic and Global) and three service departments: Human Resources (HR), Legal, and Testing. In the most recent period, the following costs and service department usage ratios were recorded: Required All

> Dunedin Bank has two operating departments (Retail and Commercial) and three service departments: Operations, Information Technology (IT), and Transactions. For the last period, the following costs and service department usage ratios were recorded: Requi

> The following data are taken from the production records at the Bay Plant of Charlevoix Chemicals for May. Work-in-process beginning inventory consisted of 43,000 units fully complete with respect to materials and 22 percent complete with respect to conv

> A&R Quality Advisors is a small consulting firm offering quality audits and advising services to small and mid-sized manufacturing firms. Quality audits entail reviewing, checking, and documenting quality practices within a firm. Quality advising ent

> Refer to Integrative Case 9-75 in Chapter 9. Assume that all of the facts in Case 9-75 still hold except that the practical capacity of the machinery is 20,000 hours instead of 10,000 hours. Required a. Recompute the unit costs for each of the cola produ

> WSM Corporation is considering offering an air shuttle service between Sao Paulo and Rio de Janeiro. It plans to offer four flights every day (excluding certain holidays) for a total of 1,400 flights per year (= 350 days × 4 flights per day)

> Ag-Coop is a large farm cooperative with a number of agriculture-related manufacturing and service divisions. As a cooperative, it pays no federal income taxes. The company owns a fertilizer plant that processes and mixes petrochemical compounds into thr

> Vermont Company uses continuous processing to produce stuffed bears and FIFO process costing to account for its production costs. It uses FIFO because costs are quite unstable due to the volatile price of fine materials it uses in production. The bears a

> Refer to the data in Exercise 8-24. Required a. Compute the equivalent units for materials using FIFO. b. Compute the equivalent units for conversion costs using FIFO. Exercise 8-24: Kronk, Inc. provides the following information concerning the work in

> Consider the following actions of a retail store trying to manage the costs of its returns service. Required Match each of the process improvements listed with how they deliver cost reductions.

> Refer to the data in Exercise 8-22. Assume that beginning inventory is 20 percent complete with respect to materials and 40 percent complete with respect to conversion costs. Required a. Compute the equivalent units for materials using FIFO. b. Compute t

> By mistake, the production supervisor at East Manufacturing transposed the digits on the production report and reported a higher percentage of completion for each inventory component. Assume that there was no beginning inventory. Required What is the eff

> Kronk, Inc. provides the following information concerning the work in process at its plant: ∙ Beginning inventory was partially complete (materials are 100 percent complete; conversion costs are 10 percent complete). ∙ Started this month, 65,000 units. ∙

> Hoyt, Inc. has a process costing system at its Forest Street Plant. All materials are introduced when conversion costs reach 40 percent. The following information is available for physical units during August: Required a. Compute the equivalent units for

> Refer to the data in Exercise 8-28 for Charlevoix Chemicals. Required Charlevoix Chemicals uses FIFO process costing at the Bay Plant for product costing. The following equivalent units (materials; conversion) used to compute production costs for May wou

> When using the FIFO method of process costing, total equivalent units produced for a given period equal a. The number of units started and completed during the period plus the number of units in beginning work in process plus the number of units in endin

> Sturgis Manufacturing produces one model of precision tool and accounts for costs using a job cost system. Information from the most recent fiscal year indicates the following. ∙ Total manufacturing cost during the year was $2,578,125 based on actual dir

> The partially completed T-accounts and selected additional information for Hancock Parts for the month of February follow: Additional information for February follows: ∙ Sales revenue in February was $179,200. ∙ The op

> Partially completed T-accounts and additional information for Dumfries Designs for the month of August follow: Additional information for August follows: ∙ The labor wage rate was $28 per hour. ∙ During the month, sale

> Selected information from the Iowa Instruments accounting records for April follows: Additional information for April follows: ∙ The labor wage rate was $30 per hour. ∙ During the month, sales revenue was $320,000, and

> The following partially complete T-accounts for the month of June along with additional information are from Renfrew & Co.: Additional information for June follows: ∙ Manufacturing overhead is applied at 90 percent of direct labor c

> Radford Products adds materials at the beginning of the process in Department A. The following information on physical units for Department A for the month of January is available. Required a. Compute the equivalent units for materials costs and for conv

> Lawn Products produces two products (X and Y) and a by-product (Z) from a joint process using a raw material (Alpha). The company chooses to allocate the costs on the basis of the physical quantities method. Last month, it processed 22,000 pounds of Alph

> Elmira Tool and Die makes machine tools to order. The following transactions occurred in October: 1. Issued $2,800 of supplies from the materials inventory. 2. Purchased $42,000 of materials. 3. Issued $37,600 in direct materials to the production depart

> Refer to the facts in Exercise 11-50. The sale of FP-40 has been banned by a recent law. If FP-40 is produced, disposal in an approved manner costs $120,000 for every 55,000 units produced. Required a. Assume that Forest Products continues to use the phy

> Refer to the facts in Exercises 11-47 and 11-48. Required Which, if any, of the four products would you recommend Barrett Chemicals sell at split-off (and not process further)? Explain. Does your answer depend on the method used to allocate the joint cos

> Denver Fabricators manufactures products DF1 and DF2 from a joint process, which also yields a by-product, BP. The company accounts for the revenues from its by-product sales as other income. Additional information follows: Required Assuming that joint p

> Milo Manufacturing produces products Kappa and Lambda from a joint process. Total joint costs are $150,000. The sales value at split-off was $162,000 for 1,200 units of Kappa and $63,000 for 1,800 units of Lambda. Required a. What joint costs are allocat

> Gunston Processing produces two products, ALT-1 and ALT-2, from a batch using a single raw material, ALT-0. Both products require further processing before they be can be sold. A batch of ALT-1 can be sold for $150,000 after processing costs of $30,000.

> Refer to the data in Exercise 11-39. Suppose that Sanford Agricultural Chemicals uses the physical quantities method to allocate joint costs and the revenues from by-products are credited to joint costs. Required Under these assumptions, the following pr

> Sanford Agricultural Chemicals (SAC) produces two main products, M-4 and M-5, and one byproduct, BYP, from a single input, Gen-10. Products M-4 and M-5 can either be sold at split off or processed further and sold. A given batch begins with 2,500 pounds

> Refer to the facts in Exercise 11-27. Woodstock Binding estimates that the variable costs in the IT Department total $110,000, and in the HR Department variable costs total $140,000. Avoidable fixed costs in the IT Department are $18,000. Required If Woo

> Refer to the facts in Exercise 11-25. Mack Precision Tool and Die estimates that the variable costs in the Repair Department total $15,225, and in Quality Control variable costs total $39,200. Avoidable fixed costs in the Repair Department are $12,400. R

> Refer to Exercises 11-27, 11-29, and 11-32 (Woodstock Binding). Required a. Which method do you think is best? Why? b. How much would it be worth to the company to use the best method compared to the worst of the three methods? (Numbers are not required

> Ervin Equipment, a manufacturer of exercise and workout equipment for sale to institutions, uses job costing. The following transactions occurred in January: 1. Purchased $76,000 of materials. 2. Paid $81,000 cash for utilities, power, equipment maintena

> Refer to the data for Memorial Services, Inc. in Exercise 11-33. Required Use the reciprocal method to allocate the service department costs to the production departments. (Matrix algebra is not required.) Exercise 11-33:

> Refer to the data for Memorial Services, Inc. in Exercise 11-33. Required Use the step method to allocate the service department costs to the two production departments. Allocate HR costs first, followed by IT, and then Accounting. Exercise 11-33:

> Refer to the data for Woodstock Binding in Exercise 11-27. Required Allocate the service department costs using the reciprocal method. (Matrix algebra is not required because there are only two service departments.) Exercise 11-27:

> Activity and selected costs for three production departments (Training, Independent, and Commercial) and two service departments (Accounting and Facilities) at DuBay Films for the past month follow: Required Allocate service department costs to Training,

> Refer to the data for Mack Precision Tool and Die in Exercise 11-25. Required Use the reciprocal method to allocate the service costs. (Matrix algebra is not required.) Exercise 11-25:

> Refer to the data for Woodstock Binding in Exercise 11-27. Required Use the step method to allocate the service costs, using the following: a. The order of allocation starts with IT. b. The order of allocation starts with HR. Exercise 11-27:

> You are the division president of Wood Division of Underwood Enterprises. The only other division at Underwood Enterprises is Plastics Division. Each division has 12,000 employees. Last year, Wood Division had a turnover of 2,500 employees (2,500 employe

> Consider adapting the cost of quality framework to financial reporting issues. Assign costs to one of four categories: prevention (P), appraisal (A), internal failure (IF), and external failure (EF), where the categories refer to financial reporting acti

> Many companies have adapted the cost of quality framework to environmental issues. They assign costs to one of four categories: prevention (P), appraisal (A), internal failure (IF), and external failure (EF), where the categories refer to environmental a

> Cairney, Inc. manufactures a specialized part used in internal combustion engines. The annual demand for the part is 225,000 units. The facility has a practical capacity of 240,000 units annually. The company leased the current facility because facilitie

> Barker Products is a job shop. The following events occurred in September: 1. Purchased $13,000 of materials. 2. Issued $14,500 in direct materials to the production department. 3. Purchased $11,000 of materials. 4. Issued $900 of supplies from the mater

> Which method, weighted-average or FIFO, better reflects the current cost of production when using process costing?

> Basil’s Framing manufactures picture frames in one workshop, which has a practical capacity of 40,000 frames. The variable cost of a frame is $24 per unit, and the fixed costs of the workshop are $392,000 annually. Current annual demand is 28,000 frames.

> Middle Industries produces a sensor for use in manufacturing. It produces the sensor in a plant with an annual practical capacity of 75,000 units. The variable cost of the sensor is $185.00 per unit, and the fixed costs of the plant are $12,375,000 annua

> Hosmer Industries provides the following information about resources and usage: Required a. Compute the cost driver rate for each resource. b. Describe what the term unused resource capacity means.

> Wykes Metal Working uses a special lathe to shape components. Data on the lathe and its usage follow: Required Compute the cost of unused resource capacity in energy and repairs for Wykes Metal Working.

> Ellery Products manufactures various components for the fashion industry. Ellery buys fabric from two vendors: Ewers Textiles and Bramford Materials. Ellery chooses the vendor based on price. Once the fabric is received, it is inspected to ensure that it

> Central State College (CSC) is a state-supported college with a large business school. The business school offers an undergraduate degree and training programs for a local manufacturer. The state does not support the training programs, which are paid for

> Lygon Food Distributors (LFD), introduced in the chapter, hired a consultant to update its system for reporting the cost of customers. The consultant showed Anjana Malik, the owner of LFD, an analysis that indicates that customer support costs are signif

> Refer to the data in Exercise 10-32. Required a. How can Northwestern Bank use the information from the activity-based costing analysis to manage its costs? b. What does Northwestern Bank need to consider before implementing your suggestions from require