Question: On December 31, Year 4, RAV Company

On December 31, Year 4, RAV Company purchased 60% of the outstanding common shares of ENS Company for $1,260,000. On that date, ENS had common shares of $500,000 and retained earnings of $130,000. In negotiating the purchase price, it was agreed that recorded assets and liabilities were fairly valued except for equipment, which had a $24,000 excess of carrying amount over fair value, and land, which had a $150,000 excess of fair value over carrying amount. The equipment had a remaining useful life of six years at the acquisition date and no salvage value. ENS did not record the fair value deficiency on the equipment because ENS felt that it would recover the carrying amount of this equipment through future cash flows. In addition, ENS registered and owns a number of Internet domain names, which are estimated to be worth $100,000. The right to the names expires in 12 years but the registration can be renewed for 20 years every 20 years, for a nominal fee.

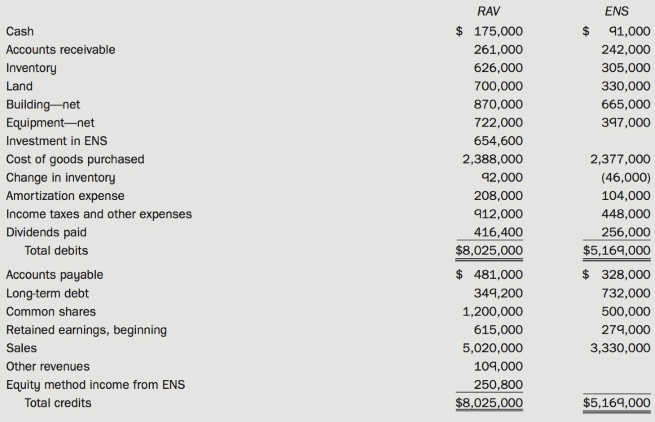

The adjusted trial balances for RAV and ENS for the year ended December 31, Year 8, were as follows:

Additional Information

• Every year, goodwill is evaluated to determine if there has been a loss. The recoverable amount for ENS's goodwill was valued at $100,000 at the end of Year 7 and $75,000 at the end of Year 8.

• RAY's inventories contained $450,000 of merchandise purchased from ENS at December 31, Year 8, and $350,000 at December 31, Year 7. During Year 8, sales from ENS to RAY were $650,000. Merchandise was priced at the same profit margin as applicable to other customers. RAY owed $182,000 to ENS at December 31, Year 8, and $190,000 at December 31, Year 7.

• On July 1, Year 5, ENS purchased a building from RAY for $782,000. The building had an original cost of $832,000 and a carrying amount of $632,000 on RAY's books on July 1, Year 5. ENS estimated the remaining life of the building was 15 years at the time of the purchase from RAY.

• ENS rented another building from RAY throughout the year for $6,000 per month.

• RAY uses the equity method of accounting for its long-term investments.

• Both companies pay tax at the rate of 40%. Ignore deferred income taxes when allocating and amortizing the acquisition differential.

Required:

(a) Prepare a consolidated income statement for the year ended December 31, Year 8.

(b) Prepare the current assets, property, plant, and equipment, and intangible assets sections of the consolidated balance sheet at December 31, Year 8.

(c) Calculate non-controlling interest on the consolidated balance sheet at December 31, Year 7.

(d) If RAY had used the cost method instead of the equity method of accounting for its investment in ENS, would RAY's net income for Year 8 increase, decrease, or remain the same on

(i) its separate-entity income statement?

(ii) the consolidated income statement?

Briefly explain.

(e) Prepare the consolidated financial statements using the worksheet approach.

Transcribed Image Text:

RAV ENS Cash $ 175,000 91,000 Accounts receivable 261,000 242,000 Inventory 626,000 305,000 Land 700,000 330,000 Building-net 870,000 665,000 Equipment-net 722,000 397,000 Investment in ENS 654,600 Cost of goods purchased 2,388,000 2,377,000 (46,000) Change in inventory Amortization expense Income taxes and other expenses Dividends paid 92,000 208,000 104,000 912,000 448,000 256,000 416,400 $8,025,000 Total debits $5,169,000 Accounts payable $ 481,000 $ 328,000 Long-term debt 349,200 732,000 Common shares 1,200,000 500,000 Retained earnings, beginning 615,000 279,000 Sales 5,020,000 3,330,000 Other revenues 109,000 Equity method income from ENS Total credits 250,800 $8,025,000 $5,169,000

> On May 1, Year 1, JDH orders equipment from a supplier in Germany for €100,000 with delivery scheduled for October 1, Year 1. Payment is due on December 31, Year 1. On May 2, Year 1 JDH enters into an 8-month forward contract with its ba

> What criteria would be used to determine whether the equity method should be used to account for a particular investment?

> Gemella Ltd. manufactures construction equipment for sale throughout eastern Canada and northeastern United States. Its year-end is June 30. The following foreign currency transactions occurred during the Year 11 calendar year: 1. On January 10, Gemella

> Manitoba Exporters Inc. (MEl) sells Inuit carvings to countries throughout the world. On December 1, Year 5, MEl sold 10,000 carvings to a wholesaler in a foreign country at a total cost of 600,000 foreign currency units (FCs) when the spot rate was FC1

> The following are the December 31, Year 9, balance sheets of three related companies: Additional Information • On January 1, Year 5, Pro purchased 40% of Forma for $116,000. On that date, Forma's shareholders' equity was as follows:

> Access the 2014 consolidated financial statements for Rogers Communications Inc. by going to the investor relations section of the company's website. Answer the questions below. For each question, indicate where in the financial statements you found the

> The following information has been assembled about Casbar Corp. as at December 31, Year 5 (amounts are in thousands): Required: Determine which operating segments require separate disclosures. Operating Segment Revenues Profit Assets $12,000 9,600

> On January 1, Year 6, HD Ltd., a building supply company, JC Ltd., a construction company, and Mr. Saeid, a private investor, signed an agreement to carry out a joint operation under the following terms and conditions: • JC would buy an

> The statements of financial position of Hui Inc. and Kozikowski Ltd. on December 31, Year 11, were as follows: Kozikowski's manufacturing facility is old and very costly to operate. For the year ended December 31, Year 11, the company lost money for th

> Assume that all of the facts in Problem 3 remain unchanged except that Green paid $211,800 for 60% of the voting shares of Mansford. Required: (a) Prepare a consolidated balance sheet at January 1, Year 5. (b) Calculate goodwill and non-controlling int

> On January 1, Year 5, Green Inc. purchased 100% of the common shares of Mansford Corp. for $353,000. Green's balance sheet data on this date just prior to this acquisition were as follows: The balance sheet and other related data for Mansford are as fo

> On January 1, Year 5, AB Company (AB) purchased 80% of the outstanding common shares of Dandy Limited (Dandy) for $8,000. On that date, Dandy's shareholders' equity consisted of common shares of $1,000 and retained earnings of $6,000. In negotiating the

> Distinguish between the financial reporting for FVTPL investments and that for investments in associates.

> On January 1, Year 5, Wellington Inc. owned 90% of the outstanding common shares of Sussex Corp. Wellington accounts for its investment using the equity method. The balance in the investment account on January 1, Year 5, amounted to $244,800. The unamort

> Jager Ltd., a joint venture, was formed on January 1, Year 3. Clifford Corp., one of the three founding venturers, invested equipment for a 40% interest in the joint venture. The other two venturers invested land and cash for their 60% equity. All of the

> The following are the Year 9 income statements of Poker Inc. and Joker Company: Additional Information • Poker acquired a 60% interest in the common shares of Joker on January 1, Year 4, at a cost of $420,000 and uses the cost method

> On January 1, Year 1, Amco Ltd. and New star Inc. formed Bearcat Resources, a joint venture. New star contributed miscellaneous assets with a fair value of $844,000 for a 65% interest in the venture. Amco contributed plant and equipment with a carrying a

> Albert Company has an investment in the voting shares of Prince Ltd. On December 31, Year 5, Prince reported a net income of $860,000 and declared dividends of $200,000. During Year 5, Albert had sales to Prince of $915,000, and Prince had sales to Alber

> The following are the Year 9 income statements of Kent Corp. and Laurier Enterprises. Additional Information $1,380,000 88,000 118,000 1,586,000 605,000 318,000 13q,ooo 168,000 1,230,000 $ 356,000 • Kent acquired its 40% interest in

> Pharma Company (Pharma) is a pharmaceutical company operating in Winnipeg. It is developing a new drug for treating multiple sclerosis (MS). On January 1, Year 3, Benefit Ltd. (Benefit) signed an agreement to guarantee the debt of Pharma and guarantee a

> Parent Co. owns 9,500 shares of Sub Co. and accounts for its investment by the equity method. On December 31, Year 5, the shareholders' equity of Sub was as follows: On January 1, Year 6, Parent sold 1,900 shares from its holdings in Sub for $66,500. O

> At December 31, Year 4, Hein Company owned 90,000 ordinary shares of Jensen Company when the shareholders' equity of Jensen was as follows: The unamortized acquisition differential at December 31, Year 4, was as follows: On January 1, Year 5, Hein so

> On January 1, Year 8, Summer Company's shareholders' equity was as follows: Plumber Company held 90% of the 4,000 outstanding shares of Summer on January 1, Year 8, and its investment in Summer Company account had a balance of $126,000 on that date. Pl

> Explain whether the needs of external users or management should take precedence in GAAP-based financial statements.

> On January 1, Year 5, PET Company acquired 900 ordinary shares of SET Company for $63,000. On this date, the shareholders' equity accounts of SET Company were as follows: Note 1: The preferred shares are $1, cumulative, nonparticipating with a liquidat

> On April1, Year 7, Princeton Corp. purchased 70% of the ordinary shares of Simon Ltd. for $910,000. On this same date, Simon purchased 60% of the ordinary shares of Fraser Inc. for $600,000. On April1, Year 7, the acquisition differentials from the two i

> The comparative consolidated statement of financial position at December 31, Year 2, and the consolidated income statement for Year 2, of Parent Ltd. and its 70% owned subsidiary are shown below. Additional Information • On December

> On January 1, Year 4, Hidden Company acquired 25,000 ordinary shares of Jovano Company for $142,400 when the shareholders' equity of Jovano was as follows: In addition, Hidden purchased 20,000 shares in Jovano for $121,600 on January 1, Year 5, and 10,

> Financial statements of Par Corp. and its subsidiary Star Inc. on December 31, Year 12, are shown below: Other Information • On January 1, Year 5, the balance sheet of Star showed the following shareholders' equity: On this date, P

> Parento Inc. owns 80% of Santana Corp. The consolidated financial statements of Parento follow: Parento Inc. purchased its 80% interest in Santana Corp. on January 1, Year 2, for $114,000 when Santana had net assets of $90,000. The acquisition differe

> A Company owns 75% of B Company and 40% of C Company. B Company owns 40% of C Company. The following information was assembled at December 31, Year 7. Additional Information • A Company purchased its 40% interest in C Company on Janua

> Craft Ltd. held 80% of the outstanding ordinary shares of Delta Corp. as at December 31, Year 12. In order to establish a closer relationship with Nonaffiliated Corporation, a major supplier to both Craft and Delta, all three companies agreed that Nonaff

> Intercompany shareholdings of an affiliated group during the year ended December 31, Year 2, were as follows: The equity method is being used for intercompany investments, but no entries have been made in Year 2. The profits before equity method earnin

> On January 1, Year 5, Pic Company acquired 7,500 ordinary shares of Sic Company for $600,000. On January 1, Year 6, Pic Company acquired an additional 2,000 ordinary shares of Sic Company for $166,000. On January 1, Year 5, the shareholders' equity of Si

> Identify three main areas where judgment needs to be applied when preparing financial statements.

> The following Year 5 consolidated cash flow statement was prepared for Standard Manufacturing Corp. and its 60%-owned subsidiary, Pritchard Windows Inc.: Required: (a) Did the loss on the sale of equipment shown above result from a sale to an affiliate

> Pure Company purchased 70% of the ordinary shares of Gold Company on January 1, Year 6, for $483,000 when the latter company's accumulated depreciation, ordinary shares and retained earnings were $75,000, $500,000 and $40,000, respectively. Non-controlli

> Income statements of M Cop. and K Co. for the year ended December 31, Year 9, are presented below: Additional Information • M Co. uses the equity method to account for its investment in K Co. • M Co. acquired its 80%

> On January 1, Year 4, Goodkey Co. acquired all of the common shares of Jingya. The condensed income statements for the two companies for January Year 5, were as follows: The following transactions occurred in January, Year 5, and are properly reflected

> The balance sheets of Forest Company and Garden Company are presented below as at December 31, Year 8. Additional Information: • Forest acquired 90% of Garden for $207,900 on July 1, Year 1, and accounts for its investment under the c

> On December 31, Year 2, HABS Inc. sold equipment to NORD at its fair value of $2,000,000 and recorded a gain of $500,000. This was HABS's only income (other than any investment income from NORD) during the year. NORD reported income (other than any inves

> Hanna Corporation owns 80% of the outstanding voting stock of Fellow Inc. At the date of acquisition, Fellow's retained earnings were $2,100,000. On December 31, Year 2, Hanna Inc. sold equipment to Fellow at its fair value of $2,000,000 and recorded a g

> The comparative consolidated income statements of a parent and its 75%-owned subsidiary were prepared incorrectly as at December 31 and are shown in the following table. The following items were overlooked when the statements were prepared: â€

> Peggy Company owns 75% of Sally Inc. and uses the cost method to account for its investment. The following data were taken from the Year 4 income statements of the two companies: On January 1, Year 2, Sally sold equipment to Peggy at a gain of $15,000.

> SENS Ltd. acquired equipment on January 1, Year 1, for $500,000. The equipment was depreciated on a straight-line basis over an estimated useful life of 10 years. On January 1, Year 3, SENS sold this equipment to MEL Corp., its parent company, for $420,0

> Identify the main factors to be used when ranking the importance of issues to be resolved.

> On January 1, Year 4, Handy Company (Handy) purchased 70% of the outstanding common shares of Dandy Limited (Dandy) for $13,300. On that date, Dandy's shareholders' equity consisted of common shares of $1,250 and retained earnings of $6,500. The financia

> Financial statements of Champlain Ltd. and its 80%. owned subsidiary Samuel Ltd. as at December 31, Year 8, are presented below. Additional Information • Champlain acquired 8,000 ordinary shares of Samuel on January 1, Year 4, for $1

> Shown below are selected ledger accounts from the trial balance of a parent and its subsidiary as of December 31, Year 10. Additional Information • P Company purchased its 90% interest in S Company in Year 2, on the date that S Compan

> Palmer Corporation owns 70% of the ordinary shares of Scott Corporation and uses the equity method to account for its investment. Scott purchased $80,000 par of Palmer's 10% bonds from outsiders on October 1, Year 5, for $72,000. Palmer's bond liability

> Parent Co. owns 75% of Sub Co. and uses the cost method to account for its investment. The following are summarized income statements for the year ended December 31, Year 7. Additional Information: • On July 1, Year 7, Parent purchase

> Alpha Corporation owns 90% of the ordinary shares of Beta Corporation and uses the equity method to account for its investment. On January 1, Year 4, Alpha purchased $160,000 of Beta's 10% bonds for $150,064. Beta's bond liability on this date consisted

> X Company owns 80% of Y Company and uses the equity method to account for its investment. On January 1, Year 2, the investment in Y Company account had a balance of $86,900, and Y Company's common shares and retained earnings totaled $100,000. The unamor

> Yosef Corporation acquired 90% of the outstanding voting stock of Randeep Inc. on January 1, Year 6. During Year 6, intercompany sales of inventory of $45,000 (original cost of $27,000) were made. Only 20% of this inventory was still held within the cons

> Explain the difference between report recipient and primary users as they are described in the framework for analyzing a case and which users should be given priority in financial reporting.

> On January 1, Year 8, Fazli Co. acquired all of the common shares of Gervais. The following transactions occurred in January and February, Year 8: • On January 10, Gervais purchased $10,000 of inventory from outsiders. • On January 20, Gervais sold $6,00

> On January 1, Year 3, the Most Company purchased 80% of the outstanding voting shares of the Least Company for $1.6 million in cash. On that date, Least's balance sheet and the fair values of its identifiable assets and liabilities were as follows: On

> L Co. owns a controlling interest in M Co. and Q Co. L Co. purchased an 80% interest in M Co. at a time when M Co. reported retained earnings of $500,000. L Co. purchased a 70% interest in Q Co. at a time when Q Co. reported retained earnings of $50,000.

> X Co. acquired 75% of Y Co. on January 1, Year 3, when Y Co. had common shares of $100,000 and retained earnings of $70,000. The acquisition differential was allocated as follows on this date: Since this date the following events have occurred: Year 3

> The income statements for Paste Company and its subsidiaries, Waste Company, and Baste Company were prepared for the year ended December 31, Year 9, and are shown below: Additional Information • Paste purchased its 80% interest in Was

> On January 1, Year 1, Spike Ltd. purchased land from outsiders for $200,000. On December 31, Year 1, Pike Co. acquired all of the common shares of Spike. The fair value of Spike's land on this date was $230,000. On December 31, Year 2, Spike sold its lan

> The consolidated income statement of a parent and its 90%-owned subsidiary appears below. It was prepared by an accounting student before reading this chapter. The following items were overlooked when the statement was prepared: • The

> Fast Ltd. is a public company that prepares its consolidated financial statements in accordance with IFRS. Its net income in Year 2 was $200,000, and shareholders' equity at December 31, Year 2, was $1,800,000. Mr. Lombardi, the major shareholder, has ma

> IAS 16 Property, Plant, and Equipment requires assets to be initially measured at cost. Subsequently, assets may be carried at cost less accumulated depreciation, or they can be periodically revalued upward to current value and carried at the revalued am

> Part A On January 1, Year 5, Anderson Corporation paid $650,000 for 20,000 (20%) of the outstanding shares of Carter Inc. The investment was considered to be one of significant influence. In Year 5, Carter reported profit of $95,000; in Year 6, its prof

> List the six steps of the case framework.

> On January 1, Year 7, the Vine Company purchased 60,000 of the 80,000 ordinary shares of the Devine Company for $80 per share. On that date, Devine had ordinary shares of $3,440,000, and retained earnings of $2,170,000. When acquired, Devine had inventor

> On January 2, Year 5, Road Ltd. acquired 70% of the outstanding voting shares of Runner Ltd. The acquisition differential of $520,000 on that date was allocated in the following manner: The Year 9 income statements for the two companies were as follows

> The partial trial balances of P Co. and S Co. at December 31, Year 10, were as follows: Additional Information • The investment in the shares of S Co. (a 90% interest) was acquired January 2, Year 6, for $90,000. At that time, the sha

> The income statements of Evans Company and Falcon Company for the current year are shown below: The following amounts were taken from the statement of changes in eq_uity for the two companies: Evans owns 80% of the outstanding common shares of Falcon

> On January 1, Year 2, PAT Ltd. acquired 90% of SAT Inc. when SAT's retained earnings were $1,000,000. There was no acquisition differential. PAT accounts for its investment under the cost method. SAT sells inventory to PAT on a regular basis at a markup

> On July 1, Year 5, Big purchased 80% of the outstanding common shares of Little for $122,080. On that date, Little's equipment had a fair value that was $21,600 less than carrying amount. The equipment had accumulated depreciation of $20,000 and an estim

> On January 1, Year 4, Cyrus Inc. paid $914,000 in cash to acquire all of the ordinary shares of Fazli Company. On that date, Fazli's retained earnings were $200,000. All of Fazli's assets and liabilities had fair values equal to carrying amounts except f

> On January 1, Year 4, Grant Corporation bought 8,000 (80%) of the outstanding common shares of Lee Company for $70,000 cash. Lee's shares were trading for $7 per share on the date of acquisition. On that date, Lee had $25,000 of common shares outstanding

> Explain if and when it may be appropriate for an accountant to prepare financial statements for external users that are not in accordance with GAAP.

> Briefly explain the concept of fund accounting.

> Peach Ltd. acquired 80% of the common shares of Cherry Company on January 1, Year 4. On that date, Cherry had common shares of $710,000 and retained earnings of $410,000. The following is a summary of the changes in Peach's investment account from Januar

> Pen Ltd. acquired an 85% interest in Silk Corp. on December 31, Year 1, for $646,000. On that date, Silk had common shares of $500,000 and retained earnings of $100,000. The imputed acquisition differential was allocated $70,000 to inventory, with the ba

> Summarized balance sheets of Comer Company and its subsidiary Brook Corporation on December 31, Year 4, were as follows: On the date that Comer acquired its interest in Brook, there was no acquisition differential and the carrying amounts of Brook's ne

> On January 1, Year 2, Gros Corporation acquired 70% of the outstanding common shares of Petite Company for a total cost of $84,000. On that date, Petite had $35,000 of common shares and $25,000 of retained earnings. The carrying amounts of each of Petite

> Large Ltd. purchased 70% of Small Company on January 1, Year 6, for $770,000, when the statement of financial position for Small showed common shares of $560,000 and retained earnings of $260,000. On that date, the inventory of Small was undervalued by $

> On January 2, Year 4, Brady Ltd. purchased 80% of the outstanding shares of Partridge Ltd. for $4,320,000. Partridge's statement of financial position and the fair values of its identifiable assets and liabilities for that date were as follows: The pat

> Balance sheet and income statement data for two affiliated companies for the current year appear on the next page. Additional Information • Albeniz acquired an 80% interest in Bach on January 1, Year 3, for $272,000. On that date, the f

> The following financial statements were prepared on December 31, Year 6. Additional Information Pearl purchased 80% of the outstanding voting shares of Silver for $3,300,000 on July 1, Year 2, at which time Silver's retained earnings were $445,000, an

> Foxx Corp. purchased 75% of the outstanding shares of Rabb Ltd. on January 1, Year 3, at a cost of $117,000. Non-controlling interest was valued at $35,000 by an independent business valuator at the date of acquisition. On that date, Rabb had common shar

> On July 1, Year 4, Aaron Co. purchased 80% of the voting shares of Bondi Ltd. for $543,840. The statement of financial position of Bondi on that date follows. The accounts receivable of Bondi were collected in October Year 4, and the inventory was comple

> When writing the final case report, how much attention, if any, should be given to discussing alternatives?

> On December 31, Year 2, Palm Inc. purchased 80% of the outstanding ordinary shares of Storm Company for $350,000. At that date, Storm had ordinary shares of $240,000 and retained earnings of $64,000. In negotiating the purchase price, it was agreed that

> The following information is available for the assets of Saman Ltd. at December 31, Year 5: Required: (The following 3 parts are independent situations.) Part A. Assume that the total fair value for all of Saman's assets as a group is $1,860. (a) Cal

> The balance sheets of Percy Corp. and Saltz Ltd. on December 31, Year 10, are shown below: The fair values of the identifiable net assets of Saltz Ltd. on December 31, Year 10, were as follows: In addition to the assets identified above, Saltz owned

> On January 1, Year 5, Black Corp. purchased 90% of the common shares of Whyte Inc. On this date, the following differences were observed with regard to specific net assets of Whyte: The non-consolidated and consolidated balance sheets of Black Corp. on

> On December 31, Year 1, P Company purchased 80% of the outstanding shares of S Company for $7,900 cash. The statements of financial position of the two companies immediately after the acq,uisition transaction appear below. Required: (a) Calculate conso

> The balance sheets of E Ltd. and J Ltd. on December 30, Year 6, were as follows: The carrying amounts of J Ltd.'s net assets were equal to fair values on this date except for the following: E Ltd. was identified as the acquirer in the combination.

> On December 31, Year 2, Blue purchased a percentage of the outstanding ordinary shares of Joy. On this date all but two categories of Joy's identifiable assets and liabilities had fair values equal to carrying amounts. Following are the statements of fin

> The balance sheets of Hill Corp. and McGraw Ltd. on December 31, Year 4, were as follows: On December 31, Year 4, Hill purchased 80% of the common shares of McGraw for $288,000 plus a commitment to pay an additional $100,000 in two years if sales grow

> The balance sheets of Petron Co. and See view Co. on June 29, Year 2, were as follows: On June 30, Year 2, Petron Co. purchased 90% of the outstanding shares of See view Co. for $52,200 cash. Legal fees involved with the acquisition were an additional

> The balance sheets of Par Ltd. and Sub Ltd. on December 31, Year 1, are as follows: The fair values of the identifiable net assets of Sub on December 31, Year 1, are as follows: Assume that the following took place on January 1, Year 2. (Par acquired

> How will the investment in a private company be reported under IFRS 9, and how does this differ from lAS 39?

> Calof Inc. acquires 100% of the common shares of Xiyu Company on January 1, Year 4, for the following consideration: • $275,000 market value of 5,000 shares of its common shares. • A contingent payment of $40,000 cash on January 1, Year 5 if Xiyu gener

> The balance sheets of Bates Co. and Casey Co. on June 30, Year 2 just before the transaction described below, were as follows: On June 30, Year 2, Bates Co. purchased 2,400 (80%) of Casey Co.'s common shares for $48,000 in cash. On that date, Casey's