Question: Financial statements of Par Corp. and its

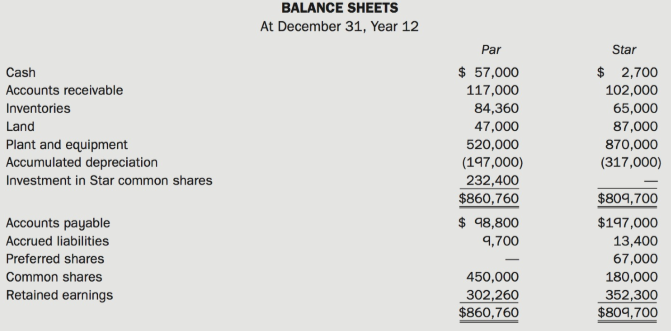

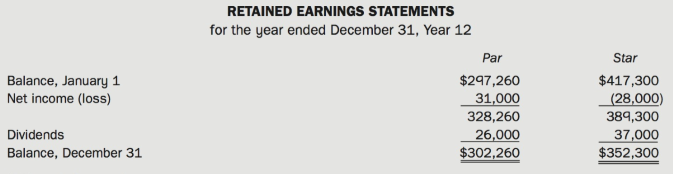

Financial Statements of Par Corp. and its subsidiary Star Inc. on December 31, Year 12, are shown below:

Other Information

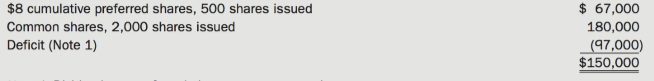

• On January 1, Year 5, the balance sheet of Star showed the following shareholders' equity:

On this date, Par acquired 1,400 common shares of Star for a cash payment of $232,400.

The fair values of Star's identifiable net assets differed from carrying amounts only with respect to the following:

The plant had an estimated remaining useful life of five years on this date, and the long-term liabilities had a maturity date of December 30, Year 12. Any goodwill is to be tested annually for impairment.

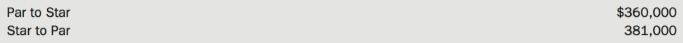

• Both Par and Star make substantial sales to each other at an intercompany selling price that yields the same gross profit as the sales they make to unrelated customers. Intercompany sales in Year 12 were as follows:

• During Year 12, Par billed Star $2,000 per month in management fees. At year-end, Star had paid for all months except for December.

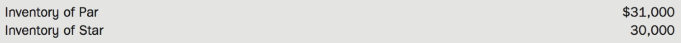

• The January 1, Year 12, inventories of the two companies contained unrealized intercompany profits as follows:

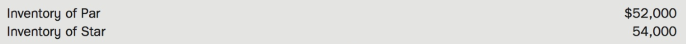

• The December 31, Year 12, inventories of the two companies contained unrealized intercompany profits as follows:

• On July 1, Year 7, Star sold equipment to Par for $76,000. The equipment had a carrying amount in the records of Star of $56,000 on this date and an estimated remaining useful life of five years.

• Goodwill impairment losses were recorded as follows: Year 7, $83,000; Year 9, $51,570; and Year 12, $20,560.

• Assume a 40% corporate tax rate.

• Par has accounted for its investment in Star by the cost method.

• All dividends in arrears were paid by December 31, Year 11.

Required:

(a) Prepare, with all necessary calculations, the following:

(i) Year 12 consolidated retained earnings statement

(ii) Consolidated balance sheet as at December 31, Year 12

(b) How would the return on equity attributable to Par's shareholders for Year 12 change if Star's preferred shares were non-cumulative instead of cumulative?

(c) On January 1, Year 13, Star issued common shares for $100,000 in cash. Because Par did not purchase any of these shares, Par's ownership percentage declined from 70 to 56%. Calculate the gain or loss that would be charged or credited to consolidated shareholders' equity as a result of this transaction.

Transcribed Image Text:

BALANCE SHEETS At December 31, Year 12 Par Star Cash $ 57,000 $ 2,700 Accounts receivable 117,000 102,000 84,360 47,000 520,000 (197,000) Inventories 65,000 87,000 870,000 (317,000) Land Plant and equipment Accumulated depreciation Investment in Star common shares 232,400 $860,760 $809,700 $ 98,800 9,700 Accounts payable $197,000 Accrued liabilities 13,400 67,000 Preferred shares Common shares 450,000 180,000 Retained earnings 302,260 $860,760 352,300 $809,700 RETAINED EARNINGS STATEMENTS for the year ended December 31, Year 12 Par Star Balance, January 1 Net income (loss) $297,260 31,000 328,260 $417,300 (28,000) 389,300 37,000 $352,300 Dividends 26,000 Balance, December 31 $302,260 $8 cumulative preferred shares, 500 shares issued $ 67,000 Common shares, 2,000 shares issued 180,000 Deficit (Note 1) (97,000) $150,000 Par to Star $360,000 Star to Par 381,000 $31,000 Inventory of Par Inventory of Star 30,000 Inventory of Par Inventory of Star $52,000 54,000

> The Ralston Company owns 35% of the outstanding voting shares of Purina Inc. Under what circumstances would Ralston determine that it is inappropriate to report this investment using the equity method?

> On December 31, Year 1, Kelly Corporation of Toronto paid 13.7 million Libyan dinars (LD) for 100% of the outstanding common shares of Arkenu Company of Libya. On this date, the fair values of Arkenu's identifiable assets and liabilities were equal to th

> Refer to Problem 11-1. All of the facts and data given in the problem are the same except that PMI only purchased 40% of the outstanding ordinary shares of Sandora for US$6,400,000. Additional Information • PMI's 40% in Sandora gave it

> On January 1, Year 4, Par Company purchased all the outstanding common shares of Bayshore Company, located in California, for US$260,000. The carrying amount of Bayshore's shareholders' equity on January 1, Year 4, was US$202,000. The fair value of Baysh

> White Company was incorporated on January 2, Year 1, and commenced active operations immediately. Common shares were issued on the date of incorporation and no new common shares have been issued since then. On December 31, Year 5, Black Company purchased

> SPEC Co. is a Canadian investment company. It acquires real estate properties in foreign countries for speculative purposes. On January 1, Year 5, SPEC incorporated a wholly owned subsidiary, CHIN Limited. CIDN immediately purchased a property in Shangha

> The financial statements of Malkin Inc., of Russia, as at December 31, Year 11, follow: Additional Information • On January 1, Year 11, Crichton Corporation of Toronto acquired 40% of Malkin's common shares for RR800,000. â

> In Year 1, Victoria Textiles Limited decided that its Asian operations had expanded such that an Asian office should be established. The office would be involved in selling Victoria's current product lines; it was also expected to establish supplier cont

> On December 31, Year 1, Precision Manufacturing Inc. (PMI) of Edmonton purchased 100% of the outstanding ordinary shares of Sandora Corp. of Flint, Michigan. Sandora's comparative statement of financial position and Year 2 income statement are as follows

> EnDur Corp (EDC) is a Canadian company that exports computer software. On February l, Year 2, EDC contracted to sell software to a customer in Denmark at a selling price of 600,000 Danish krona (DK) with payment due 60 days after installation was complet

> On August 1, Year 3, Carleton Ltd. ordered machinery from a supplier in Hong Kong for HK$500,000. The machinery was delivered on October 1, Year 3, with terms requiring payment in full by December 31, Year 3. On August 2, Year 3, Carleton entered a forwa

> The equity method records dividends as a reduction in the investment account. Explain why.

> Hamilton Importing Corp. (HIC) imports goods from countries around the world for sale in Canada. On December 1, Year 3, HIC purchased 11,300 watches from a foreign wholesaler for DM613,000 when the spot rate was DM1 = $0.754. The invoice called for payme

> On October 1, Year 6, Versatile Company contracted to sell merchandise to a customer in Switzerland at a selling price of SF400,000. The contract called for the merchandise to be delivered to the customer on January 31, Year 7, with payment due on delive

> On January 1, Year 5, Ornate Company Ltd. purchased US$2,200,000 of the bonds of the Gem Corporation. The bonds were trading at par on this date, pay interest at 12% each December 31, and mature on December 31, Year 7. The following Canadian exchange rat

> Lamont Company is a Canadian company that produces electronic switches for the telecommunications industry. Lamont regularly imports component parts from Sousa Ltd., a supplier located in Mexico, and makes payments in Mexican pesos (MP). Based on past ex

> Moose Utilities Ltd. (MUL) borrowed $40,000,000 in U.S. funds on January 1, Year 1, at an annual interest rate of 12%. The loan is due on December 31, Year 4, and interest is paid annually on December 31. The Canadian exchange rates for U.S. dollars over

> Assume that all of the facts in Problem 1 remain unchanged except that MEl uses hedge accounting. Also, assume that the forward element and spot elements on the forward contract are accounted for separately. Required: (a) Prepare the journal entries fo

> As a result of its export sales to customers in Switzerland, the Lenox Company has had Swiss-franc-denominated revenues over the past number of years. In order to gain protection from future exchange rate fluctuations, the company decides to borrow its c

> Hull Manufacturing Corp. (HMC), a Canadian company, manufactures instruments used to measure the moisture content of barley and wheat. The company sells primarily to the domestic market, but in Year 3, it developed a small market in Argentina. In Year 4,

> On June 1, Year 3, Forever Young Corp. (FYC) ordered merchandise from a supplier in Turkey for Turkish lira (TL) 217,000. The goods were delivered on September 30, with terms requiring cash on delivery. On June 2, Year 3, FYC entered a forward contract a

> On May 1, Year 1, JDH orders equipment from a supplier in Germany for €100,000 with delivery scheduled for October 1, Year 1. Payment is due on December 31, Year 1. On May 2, Year 1 JDH enters into an 8-month forward contract with its ba

> What criteria would be used to determine whether the equity method should be used to account for a particular investment?

> Gemella Ltd. manufactures construction equipment for sale throughout eastern Canada and northeastern United States. Its year-end is June 30. The following foreign currency transactions occurred during the Year 11 calendar year: 1. On January 10, Gemella

> Manitoba Exporters Inc. (MEl) sells Inuit carvings to countries throughout the world. On December 1, Year 5, MEl sold 10,000 carvings to a wholesaler in a foreign country at a total cost of 600,000 foreign currency units (FCs) when the spot rate was FC1

> The following are the December 31, Year 9, balance sheets of three related companies: Additional Information • On January 1, Year 5, Pro purchased 40% of Forma for $116,000. On that date, Forma's shareholders' equity was as follows:

> Access the 2014 consolidated financial statements for Rogers Communications Inc. by going to the investor relations section of the company's website. Answer the questions below. For each question, indicate where in the financial statements you found the

> The following information has been assembled about Casbar Corp. as at December 31, Year 5 (amounts are in thousands): Required: Determine which operating segments require separate disclosures. Operating Segment Revenues Profit Assets $12,000 9,600

> On January 1, Year 6, HD Ltd., a building supply company, JC Ltd., a construction company, and Mr. Saeid, a private investor, signed an agreement to carry out a joint operation under the following terms and conditions: • JC would buy an

> The statements of financial position of Hui Inc. and Kozikowski Ltd. on December 31, Year 11, were as follows: Kozikowski's manufacturing facility is old and very costly to operate. For the year ended December 31, Year 11, the company lost money for th

> Assume that all of the facts in Problem 3 remain unchanged except that Green paid $211,800 for 60% of the voting shares of Mansford. Required: (a) Prepare a consolidated balance sheet at January 1, Year 5. (b) Calculate goodwill and non-controlling int

> On January 1, Year 5, Green Inc. purchased 100% of the common shares of Mansford Corp. for $353,000. Green's balance sheet data on this date just prior to this acquisition were as follows: The balance sheet and other related data for Mansford are as fo

> On January 1, Year 5, AB Company (AB) purchased 80% of the outstanding common shares of Dandy Limited (Dandy) for $8,000. On that date, Dandy's shareholders' equity consisted of common shares of $1,000 and retained earnings of $6,000. In negotiating the

> Distinguish between the financial reporting for FVTPL investments and that for investments in associates.

> On January 1, Year 5, Wellington Inc. owned 90% of the outstanding common shares of Sussex Corp. Wellington accounts for its investment using the equity method. The balance in the investment account on January 1, Year 5, amounted to $244,800. The unamort

> Jager Ltd., a joint venture, was formed on January 1, Year 3. Clifford Corp., one of the three founding venturers, invested equipment for a 40% interest in the joint venture. The other two venturers invested land and cash for their 60% equity. All of the

> The following are the Year 9 income statements of Poker Inc. and Joker Company: Additional Information • Poker acquired a 60% interest in the common shares of Joker on January 1, Year 4, at a cost of $420,000 and uses the cost method

> On January 1, Year 1, Amco Ltd. and New star Inc. formed Bearcat Resources, a joint venture. New star contributed miscellaneous assets with a fair value of $844,000 for a 65% interest in the venture. Amco contributed plant and equipment with a carrying a

> Albert Company has an investment in the voting shares of Prince Ltd. On December 31, Year 5, Prince reported a net income of $860,000 and declared dividends of $200,000. During Year 5, Albert had sales to Prince of $915,000, and Prince had sales to Alber

> The following are the Year 9 income statements of Kent Corp. and Laurier Enterprises. Additional Information $1,380,000 88,000 118,000 1,586,000 605,000 318,000 13q,ooo 168,000 1,230,000 $ 356,000 • Kent acquired its 40% interest in

> Pharma Company (Pharma) is a pharmaceutical company operating in Winnipeg. It is developing a new drug for treating multiple sclerosis (MS). On January 1, Year 3, Benefit Ltd. (Benefit) signed an agreement to guarantee the debt of Pharma and guarantee a

> Parent Co. owns 9,500 shares of Sub Co. and accounts for its investment by the equity method. On December 31, Year 5, the shareholders' equity of Sub was as follows: On January 1, Year 6, Parent sold 1,900 shares from its holdings in Sub for $66,500. O

> At December 31, Year 4, Hein Company owned 90,000 ordinary shares of Jensen Company when the shareholders' equity of Jensen was as follows: The unamortized acquisition differential at December 31, Year 4, was as follows: On January 1, Year 5, Hein so

> On January 1, Year 8, Summer Company's shareholders' equity was as follows: Plumber Company held 90% of the 4,000 outstanding shares of Summer on January 1, Year 8, and its investment in Summer Company account had a balance of $126,000 on that date. Pl

> Explain whether the needs of external users or management should take precedence in GAAP-based financial statements.

> On January 1, Year 5, PET Company acquired 900 ordinary shares of SET Company for $63,000. On this date, the shareholders' equity accounts of SET Company were as follows: Note 1: The preferred shares are $1, cumulative, nonparticipating with a liquidat

> On April1, Year 7, Princeton Corp. purchased 70% of the ordinary shares of Simon Ltd. for $910,000. On this same date, Simon purchased 60% of the ordinary shares of Fraser Inc. for $600,000. On April1, Year 7, the acquisition differentials from the two i

> The comparative consolidated statement of financial position at December 31, Year 2, and the consolidated income statement for Year 2, of Parent Ltd. and its 70% owned subsidiary are shown below. Additional Information • On December

> On January 1, Year 4, Hidden Company acquired 25,000 ordinary shares of Jovano Company for $142,400 when the shareholders' equity of Jovano was as follows: In addition, Hidden purchased 20,000 shares in Jovano for $121,600 on January 1, Year 5, and 10,

> Parento Inc. owns 80% of Santana Corp. The consolidated financial statements of Parento follow: Parento Inc. purchased its 80% interest in Santana Corp. on January 1, Year 2, for $114,000 when Santana had net assets of $90,000. The acquisition differe

> A Company owns 75% of B Company and 40% of C Company. B Company owns 40% of C Company. The following information was assembled at December 31, Year 7. Additional Information • A Company purchased its 40% interest in C Company on Janua

> Craft Ltd. held 80% of the outstanding ordinary shares of Delta Corp. as at December 31, Year 12. In order to establish a closer relationship with Nonaffiliated Corporation, a major supplier to both Craft and Delta, all three companies agreed that Nonaff

> Intercompany shareholdings of an affiliated group during the year ended December 31, Year 2, were as follows: The equity method is being used for intercompany investments, but no entries have been made in Year 2. The profits before equity method earnin

> On January 1, Year 5, Pic Company acquired 7,500 ordinary shares of Sic Company for $600,000. On January 1, Year 6, Pic Company acquired an additional 2,000 ordinary shares of Sic Company for $166,000. On January 1, Year 5, the shareholders' equity of Si

> Identify three main areas where judgment needs to be applied when preparing financial statements.

> The following Year 5 consolidated cash flow statement was prepared for Standard Manufacturing Corp. and its 60%-owned subsidiary, Pritchard Windows Inc.: Required: (a) Did the loss on the sale of equipment shown above result from a sale to an affiliate

> Pure Company purchased 70% of the ordinary shares of Gold Company on January 1, Year 6, for $483,000 when the latter company's accumulated depreciation, ordinary shares and retained earnings were $75,000, $500,000 and $40,000, respectively. Non-controlli

> Income statements of M Cop. and K Co. for the year ended December 31, Year 9, are presented below: Additional Information • M Co. uses the equity method to account for its investment in K Co. • M Co. acquired its 80%

> On January 1, Year 4, Goodkey Co. acquired all of the common shares of Jingya. The condensed income statements for the two companies for January Year 5, were as follows: The following transactions occurred in January, Year 5, and are properly reflected

> The balance sheets of Forest Company and Garden Company are presented below as at December 31, Year 8. Additional Information: • Forest acquired 90% of Garden for $207,900 on July 1, Year 1, and accounts for its investment under the c

> On December 31, Year 2, HABS Inc. sold equipment to NORD at its fair value of $2,000,000 and recorded a gain of $500,000. This was HABS's only income (other than any investment income from NORD) during the year. NORD reported income (other than any inves

> Hanna Corporation owns 80% of the outstanding voting stock of Fellow Inc. At the date of acquisition, Fellow's retained earnings were $2,100,000. On December 31, Year 2, Hanna Inc. sold equipment to Fellow at its fair value of $2,000,000 and recorded a g

> The comparative consolidated income statements of a parent and its 75%-owned subsidiary were prepared incorrectly as at December 31 and are shown in the following table. The following items were overlooked when the statements were prepared: â€

> Peggy Company owns 75% of Sally Inc. and uses the cost method to account for its investment. The following data were taken from the Year 4 income statements of the two companies: On January 1, Year 2, Sally sold equipment to Peggy at a gain of $15,000.

> SENS Ltd. acquired equipment on January 1, Year 1, for $500,000. The equipment was depreciated on a straight-line basis over an estimated useful life of 10 years. On January 1, Year 3, SENS sold this equipment to MEL Corp., its parent company, for $420,0

> Identify the main factors to be used when ranking the importance of issues to be resolved.

> On January 1, Year 4, Handy Company (Handy) purchased 70% of the outstanding common shares of Dandy Limited (Dandy) for $13,300. On that date, Dandy's shareholders' equity consisted of common shares of $1,250 and retained earnings of $6,500. The financia

> Financial statements of Champlain Ltd. and its 80%. owned subsidiary Samuel Ltd. as at December 31, Year 8, are presented below. Additional Information • Champlain acquired 8,000 ordinary shares of Samuel on January 1, Year 4, for $1

> Shown below are selected ledger accounts from the trial balance of a parent and its subsidiary as of December 31, Year 10. Additional Information • P Company purchased its 90% interest in S Company in Year 2, on the date that S Compan

> On December 31, Year 4, RAV Company purchased 60% of the outstanding common shares of ENS Company for $1,260,000. On that date, ENS had common shares of $500,000 and retained earnings of $130,000. In negotiating the purchase price, it was agreed that rec

> Palmer Corporation owns 70% of the ordinary shares of Scott Corporation and uses the equity method to account for its investment. Scott purchased $80,000 par of Palmer's 10% bonds from outsiders on October 1, Year 5, for $72,000. Palmer's bond liability

> Parent Co. owns 75% of Sub Co. and uses the cost method to account for its investment. The following are summarized income statements for the year ended December 31, Year 7. Additional Information: • On July 1, Year 7, Parent purchase

> Alpha Corporation owns 90% of the ordinary shares of Beta Corporation and uses the equity method to account for its investment. On January 1, Year 4, Alpha purchased $160,000 of Beta's 10% bonds for $150,064. Beta's bond liability on this date consisted

> X Company owns 80% of Y Company and uses the equity method to account for its investment. On January 1, Year 2, the investment in Y Company account had a balance of $86,900, and Y Company's common shares and retained earnings totaled $100,000. The unamor

> Yosef Corporation acquired 90% of the outstanding voting stock of Randeep Inc. on January 1, Year 6. During Year 6, intercompany sales of inventory of $45,000 (original cost of $27,000) were made. Only 20% of this inventory was still held within the cons

> Explain the difference between report recipient and primary users as they are described in the framework for analyzing a case and which users should be given priority in financial reporting.

> On January 1, Year 8, Fazli Co. acquired all of the common shares of Gervais. The following transactions occurred in January and February, Year 8: • On January 10, Gervais purchased $10,000 of inventory from outsiders. • On January 20, Gervais sold $6,00

> On January 1, Year 3, the Most Company purchased 80% of the outstanding voting shares of the Least Company for $1.6 million in cash. On that date, Least's balance sheet and the fair values of its identifiable assets and liabilities were as follows: On

> L Co. owns a controlling interest in M Co. and Q Co. L Co. purchased an 80% interest in M Co. at a time when M Co. reported retained earnings of $500,000. L Co. purchased a 70% interest in Q Co. at a time when Q Co. reported retained earnings of $50,000.

> X Co. acquired 75% of Y Co. on January 1, Year 3, when Y Co. had common shares of $100,000 and retained earnings of $70,000. The acquisition differential was allocated as follows on this date: Since this date the following events have occurred: Year 3

> The income statements for Paste Company and its subsidiaries, Waste Company, and Baste Company were prepared for the year ended December 31, Year 9, and are shown below: Additional Information • Paste purchased its 80% interest in Was

> On January 1, Year 1, Spike Ltd. purchased land from outsiders for $200,000. On December 31, Year 1, Pike Co. acquired all of the common shares of Spike. The fair value of Spike's land on this date was $230,000. On December 31, Year 2, Spike sold its lan

> The consolidated income statement of a parent and its 90%-owned subsidiary appears below. It was prepared by an accounting student before reading this chapter. The following items were overlooked when the statement was prepared: • The

> Fast Ltd. is a public company that prepares its consolidated financial statements in accordance with IFRS. Its net income in Year 2 was $200,000, and shareholders' equity at December 31, Year 2, was $1,800,000. Mr. Lombardi, the major shareholder, has ma

> IAS 16 Property, Plant, and Equipment requires assets to be initially measured at cost. Subsequently, assets may be carried at cost less accumulated depreciation, or they can be periodically revalued upward to current value and carried at the revalued am

> Part A On January 1, Year 5, Anderson Corporation paid $650,000 for 20,000 (20%) of the outstanding shares of Carter Inc. The investment was considered to be one of significant influence. In Year 5, Carter reported profit of $95,000; in Year 6, its prof

> List the six steps of the case framework.

> On January 1, Year 7, the Vine Company purchased 60,000 of the 80,000 ordinary shares of the Devine Company for $80 per share. On that date, Devine had ordinary shares of $3,440,000, and retained earnings of $2,170,000. When acquired, Devine had inventor

> On January 2, Year 5, Road Ltd. acquired 70% of the outstanding voting shares of Runner Ltd. The acquisition differential of $520,000 on that date was allocated in the following manner: The Year 9 income statements for the two companies were as follows

> The partial trial balances of P Co. and S Co. at December 31, Year 10, were as follows: Additional Information • The investment in the shares of S Co. (a 90% interest) was acquired January 2, Year 6, for $90,000. At that time, the sha

> The income statements of Evans Company and Falcon Company for the current year are shown below: The following amounts were taken from the statement of changes in eq_uity for the two companies: Evans owns 80% of the outstanding common shares of Falcon

> On January 1, Year 2, PAT Ltd. acquired 90% of SAT Inc. when SAT's retained earnings were $1,000,000. There was no acquisition differential. PAT accounts for its investment under the cost method. SAT sells inventory to PAT on a regular basis at a markup

> On July 1, Year 5, Big purchased 80% of the outstanding common shares of Little for $122,080. On that date, Little's equipment had a fair value that was $21,600 less than carrying amount. The equipment had accumulated depreciation of $20,000 and an estim

> On January 1, Year 4, Cyrus Inc. paid $914,000 in cash to acquire all of the ordinary shares of Fazli Company. On that date, Fazli's retained earnings were $200,000. All of Fazli's assets and liabilities had fair values equal to carrying amounts except f

> On January 1, Year 4, Grant Corporation bought 8,000 (80%) of the outstanding common shares of Lee Company for $70,000 cash. Lee's shares were trading for $7 per share on the date of acquisition. On that date, Lee had $25,000 of common shares outstanding

> Explain if and when it may be appropriate for an accountant to prepare financial statements for external users that are not in accordance with GAAP.

> Briefly explain the concept of fund accounting.

> Peach Ltd. acquired 80% of the common shares of Cherry Company on January 1, Year 4. On that date, Cherry had common shares of $710,000 and retained earnings of $410,000. The following is a summary of the changes in Peach's investment account from Januar

> Pen Ltd. acquired an 85% interest in Silk Corp. on December 31, Year 1, for $646,000. On that date, Silk had common shares of $500,000 and retained earnings of $100,000. The imputed acquisition differential was allocated $70,000 to inventory, with the ba

> Summarized balance sheets of Comer Company and its subsidiary Brook Corporation on December 31, Year 4, were as follows: On the date that Comer acquired its interest in Brook, there was no acquisition differential and the carrying amounts of Brook's ne