Question: Over the past two years, Jonas Cone

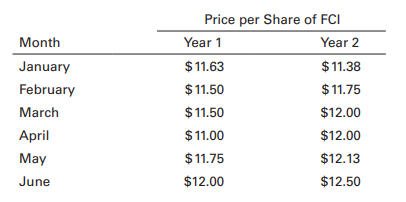

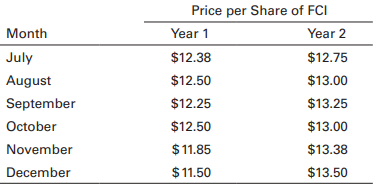

Over the past two years, Jonas Cone has used a dollar-cost averaging formula to purchase $300 worth of FCI common stock each month. The price per share paid each month over the two years is given in the following table. Assume that Jonas paid no brokerage commissions on these transactions.

a. How much was Jonas’s total investment over the two-year period?

b. How many shares did Jonas purchase over the two-year period?

c. Use your findings in parts a and b to calculate Jonas’s average cost per share of FCI.

d. What was the value of Jonas’s holdings in FCI at the end of the second year?

> You were just notified that you will receive $100,000 in two months from the estate of a deceased relative. You want to invest this money in safe, interest-bearing instruments, so you decide to purchase five-year Treasury notes. You believe, however, tha

> Taryn Arsenault is a regular commodities speculator. She is currently considering a short position in July oats, which are now trading at 248. Her analysis suggests that July oats should be trading at about 240 in a couple of months. Assuming that her ex

> As it turns out, you were correct when you purchased four contracts for feeder cattle at $1.494, as the spot price on cattle rose to 1.658 on the delivery date given in your contracts. How much money did you make? What was your return on invested capital

> Because of an outbreak of mad cow disease in Britain, you think that U.S. cattle futures will rise as cattle buyers switch to U.S. suppliers. You act on your belief by purchasing four contracts (50,000 pounds per contract) for April delivery at $1.494. Y

> You think bitcoin is a fad, and an overvalued one at that. You short three bitcoin futures contracts, each of which has five bitcoins as the underlying asset, at a price of $6,410. A month later the same contract sells for $5,985. What is your dollar pro

> One of the unique features of futures contracts is that they have only one source of return—the capital gains that can accrue when price movements have an upward bias. Remember that there are no current cash flows associated with this financial asset. Th

> With regard to futures options, how much profit would an investor make if he or she bought a call option on gold at 7.20 when gold was trading at $482 an ounce, given that the price of gold went up to $525 an ounce by the expiration date on the call?

> An American currency speculator feels strongly that the value of the Canadian dollar is going to fall relative to the U.S. dollar over the short run. If he wants to profit from these expectations, what kind of position (long or short) should he take in C

> In late December you decide, for tax purposes, to sell a losing position that you hold in Twitter, which is listed on the NYSE, so that you can capture the loss and use it to offset some capital gains, thus minimizing your tax liability for the current y

> You have purchased a futures contract for euros. The contract is for €125,000, and the quote was $1.1636/€. On the delivery date, the exchange quote is $1.1050/€. Assuming you took delivery of the euros, how many dollars would you have after converting b

> A quote for a futures contract for British pounds is $1.6683/£. The contract size for British pounds is £62,500. What is the dollar equivalent of this contract?

> Not long ago, Vanessa Woods sold her company for several million dollars. She took some of that money and put it into the stock market. Today Vanessa’s portfolio of blue-chip stocks is worth $3.8 million. Vanessa wants to keep her portfolio intact, but s

> Hillary considers herself a shrewd commodities investor. She bought a May cotton contract (50,000 pounds) at $0.7744 a pound and later sold it at $0.8104 a pound. What were her profit and her return on invested capital if her initial margin was $1,260 an

> For each of the 100-share options shown in the following table, use the underlying stock price at expiration and other information to determine the amount of profit or loss an investor would have had, ignoring brokerage fees.

> Repeat the analysis of Problem 14.7, but this time focus on the Facebook call and put options that have a strike price of $87.50. If you use put-call parity to find the price of Facebook stock at the time those call prices were quoted, would you expect t

> Look at the Facebook option quotes, and focus on the call and put options with a strike price of $80. Can you use put-call parity to infer what the market price of Facebook stock must have been when these option prices were quoted? To keep things simple,

> Suppose that a call option with a strike price of $45 expires in one year and has a current market price of $5.16. The market price of the underlying stock is $46.21, and the risk-free rate is 1%. Use put-call parity to calculate the price of a put optio

> A six-month call option contract on 100 shares of Home Depot common stock with a strike price of $50 can be purchased for $500. Assuming that the market price of Home Depot stock rises to $65 per share by the expiration date of the option, what is the ca

> Abercrombie & Fitch is trading at $21.50. Put options with a strike price of $20.50 are priced at $0.85. What is the intrinsic value of the option, and what is the time value?

> You would like to purchase one Class A share of Berkshire Hathaway through your Scottrade brokerage account. Scottrade charges a $7 commission for online trades. You log into your account, check the real-time quotes for Berkshire Hathaway (you see a bid

> Using the individual tax rate schedule shown in Table 1.2, perform the following: a. Calculate the tax liability, after-tax earnings, and average tax rates for the following levels of partnership earnings before taxes: $10,000; $80,000; $300,000; $500,00

> Verizon is trading at $50. Put options with a strike price of $55 are priced at $5.79. What is the intrinsic value of the option, and what is the time value?

> John has been following the stock market very closely over the past 18 months and has a strong belief that future stock prices will be significantly higher. He has two alternatives that he can follow. The first is to use a long-term strategyâ€

> Twitter is trading at $34.50. Call options with a strike price of $35 are priced at $2.30. What is the intrinsic value of the option, and what is the time value?

> Repeat the analysis of Problem 14.18, assuming that the volatility of the stock’s return is 40%. Intuitively, would you expect this to cause the call price to rise or fall? By how much does the call price change? Data from Problem 14.18: A stock trades

> A stock trades for $45 per share. A call option on that stock has a strike price of $50 and an expiration date one year in the future. The volatility of the stock’s return is 30%, and the risk-free rate is 2%. What is the Black and Scholes value of this

> Suppose the DJIA stands at 25,500. You want to set up a long straddle by purchasing 100 calls and an equal number of puts on the index, both of which expire in three months and have a strike of 255. The put price is listed at $4.25, and the call sells fo

> Luke owns stock in a retailer that he believes is highly undervalued. Luke expects that the stock will increase in value nicely over the long term. He is concerned, however, that the entire retail industry may fall out of favor with investors as some lar

> Adam Smith just purchased 300 shares of AT&E at $54.00, and he has decided to write covered calls against these stocks. Accordingly, he sells five AT&E calls at their current market price of $4.75. The calls have three months to expiration and carry a st

> Nick Fitzgerald holds a well-diversified portfolio of high-quality large-cap stocks. The current value of Fitzgerald’s portfolio is $825,000, but he is concerned that the market is heading for a big fall (perhaps as much as 20%) over the next three to si

> Max Houck holds 600 shares of Boulder Gas and Light. He bought the stock several years ago at $52.75, and the shares are now trading at $78. Max is concerned that the market is beginning to soften. He doesn’t want to sell the stock, but he would like to

> MuleSoft, Inc. conducted its IPO on March 17, 2017, for the principal purposes of increasing its capitalization and financial flexibility, creating a public market for its Class A common stock, and enabling access to the public equity markets for it and

> Dorothy Santosuosso does a lot of investing in the stock market and is a frequent user of stock-index options. She is convinced that the market is about to undergo a broad retreat and has decided to buy a put option on the S&P 100 Index. The put option h

> Refer to Problem 14.10. What happens if you are wrong and the price of QLT increases to $25 on the expiration date? Data from Problem 14.10: You believe that oil prices will be rising more than expected and that rising prices will result in lower earnin

> You believe that oil prices will be rising more than expected and that rising prices will result in lower earnings for industrial companies that use a lot of petroleum-related products in their operations. You also believe that the effects on this sector

> Apple stock is selling for $120 per share. Call options with a $117 exercise price are priced at $12. What is the intrinsic value of the option, and what is the time value?

> On January 1, 2020, Simon Love’s portfolio of 15 common stocks had a market value of $264,000. At the end of May 2020, Simon sold one of the stocks, which had a beginning-of-year value of $26,300, for $31,500. He did not reinvest those or any other funds

> Mom and Pop had a portfolio of long-term bonds that they purchased many years ago. The bonds pay 12% interest annually, and the face value is $100,000. If Mom and Pop are in the 25% tax bracket, what is their annual after-tax HPR on this investment? (Ass

> Linda Babeu, who is in a 33% ordinary tax bracket (federal and state combined) and pays a 15% capital gains rate on dividends and capital gains for holding periods longer than 12 months, purchased 10 options contracts for a total cost of $4,000 just over

> Charlotte Smidt bought 2,000 shares of the balanced no-load LaJolla Fund exactly one year and two days ago for an NAV of $8.60 per share. During the year, the fund distributed investment income dividends of $0.32 per share and capital gains dividends of

> Jill Clark invested $25,000 in the bonds of Industrial Aromatics, Inc. She held them for 13 months, at the end of which she sold them for $26,746. During the period of ownership she received $2,000 interest. Calculate the pretax and after-tax HPR on Jill

> Jeff Krause purchased 1,000 shares of a speculative stock on January 2 for $2.00 per share. Six months later on July 1, he sold them for $9.50 per share. He uses an online broker that charges him $10 per trade. What was Jeff’s annualized HPR on this inve

> A Brazilian company called Netshoes completed its IPO on April 12, 2017, and listed on the NYSE. Netshoes sold 8,250,000 shares of stock to primary market investors at an IPO offer price of $18. Secondary market investors, however, were paying only $16.1

> John Reardon purchased 100 shares of Tomco Corporation in December 2019 at a total cost of $1,762. He held the shares for 15 months and then sold them, netting $2,500. During the period he held the stock, the company paid him $3 per share in cash dividen

> While most people believe that it is not possible to consistently time the market, there are several plans that allow investors to time purchases and sales of securities. These are referred to as formula plans—mechanical methods of mana

> Using the data in the following table, assume you are using a variable-ratio plan. You have decided that when the speculative portfolio reaches 60% of the total, you will reduce its proportion to 45%. What action, if any, should you take in time period 2

> Portfolio A and Portfolio B had the same holding period return last year. Most of the returns from Portfolio A came from dividends, while most of the returns from Portfolio B came from capital gains. Which portfolio was likely owned by a single working p

> Referring to Problem 13.18, assume you are using a constant-ratio plan with a rebalance trigger of speculative-to-conservative of 1.25. What action, if any, should you take in time period 2? Be specific. Data from Problem 13.18: Using the data in the fo

> Using the data in the following table, assume you are using a constant-dollar plan with a rebalancing trigger of $1,500. The stock price represents your speculative portfolio, and the MM mutual fund represents your conservative portfolio. What action, if

> The risk-free rate is currently 8.1%. Use the data in the accompanying table for the Fio family’s portfolio and the market portfolio during the year just ended to answer the questions that follow. a. Calculate Sharpe’s

> Chee Chew’s portfolio has a beta of 1.3 and earned a return of 12.9% during the year just ended. The risk-free rate is currently 4.2%. The return on the market portfolio during the year just ended was 11.0%. a. Calculate Jensen’s measure (Jensen’s alpha)

> Your portfolio returned 13% last year, with a beta equal to 1.5. The market return was 10%, and the risk-free rate was 4%. Did you earn more or less than the required rate of return on your portfolio?

> On April 13, 2017, Yext Inc. completed its IPO on the NYSE. Yext sold 10,500,000 shares of stock at an offer price of $11 per share. Yext’s closing stock price on the first day of trading on the secondary market was $13.41. a. Calculate the gross proceed

> During the year just ended, Anna Schultz’s portfolio, which has a beta of 0.90, earned a return of 8.6%. The risk-free rate is currently 3.3%, and the return on the market portfolio during the year just ended was 9.2%. a. Calculate Treynor’s measure for

> Your portfolio has a beta equal to 1.3. It returned 12% last year. The market returned 10%; the risk-free rate is 2%. Calculate Treynor’s measure for your portfolio and the market. Did you earn a better return than the market given the risk you took?

> Niki Malone’s portfolio earned a return of 11.8% during the year just ended. The portfolio’s standard deviation of return was 14.1%. The risk-free rate is currently 6.2%. During the year, the return on the market portfolio was 9.0% and its standard devia

> Congratulations! Your portfolio returned 11% last year, 2% better than the market return of 9%. Your portfolio’s return had a standard deviation equal to 18%, and the risk-free rate is 3%. Calculate Sharpe’s measure for your portfolio. If the market’s Sh

> Refer to the following table: Between Investor A and Investor B, which is more likely to represent a retired couple? Why?

> Five years ago, you invested in the Future Investco Mutual Fund by purchasing 1,500 shares of the fund at a net asset value of $18.75 per share. Because you did not need the income, you elected to reinvest all dividends and capital gains distributions. T

> The Good Pick Closed-End Fund turned in the following performance for the year 2019. a. Based on this information, what was the NAV-based HPR for the GPCEF in 2019? b. Find the percentage (%) premium or discount at which the fund was trading at the begin

> One year ago, Big Deal Closed-End Fund had a NAV of $10.20 and was selling at an 16% discount. Today, its NAV is $11.59, and it is priced at a 3% premium. During the year, Big Deal paid dividends of $0.35 and had a capital gains distribution of $0.90. On

> Using the resources at your campus or public library (or on the Internet), select five mutual funds—a growth fund, an equity-income fund, an international (stock) fund, an index fund, and a high-yield corporate bond fund—that you think would make good in

> Listed below is the 10-year, per-share performance record of the Blue Chip Growth Fund as obtained from the fund’s May 30, 2019, prospectus. Use this information to find the holding period return in 2019 and 2016. Also find the fund&aci

> On April 27, 2018, DocuSign, a California company that provides technology to enable digital signatures on important documents, conducted its initial public offering (IPO) of common stock. In the primary market the company’s shares were priced at $29 per

> You’ve uncovered the following per-share information about a certain mutual fund: Find the fund’s holding period return for 2017, 2018, and 2019. (In all three cases, assume you buy the fund at the beginning of the yea

> The All-State Mutual Fund has the following five-year record of performance: Find this no-load fund’s five-year (2015–2019) average annual compound rate of return. Also find its three-year (2017–2019)

> A year ago, the Very Large Growth Fund was quoted at a NAV of $21.25 and an offer price of $23.25. Today, it’s being quoted at $22.94 (NAV) and $24.94 (offer). What is the holding period return on this load fund, given that it was purchased a year ago an

> Create a spreadsheet model similar to the spreadsheet for Table 12.2, which you can view at www.pearson.com/mylab/finance, to analyze the following three years of data relating to the MoMoney Mutual Fund. It should report the amount of dividend income an

> On January 1, 2018, you purchased 1,000 shares of a fund for $20.00 per share. During the year, you received $2.00 in dividends, half of which was from dividends on stock the fund held and half of which was from interest earned on bonds in the fund portf

> You are considering the purchase of shares in a closed-end mutual fund. The NAV is equal to $23.75, and the latest close is $25.50. Is this fund trading at a premium or a discount? How big is the premium or discount?

> Refer to Problem 12.11. If Best was a load fund with a 2.5% front-end load, what would be the HPR? Data from Problem 12.11: You invested in the no-load Best Mutual Fund one year ago by purchasing 1,000 shares of the fund at the net asset value of $20.00

> You invested in the no-load Best Mutual Fund one year ago by purchasing 1,000 shares of the fund at the net asset value of $20.00 per share. The fund distributed dividends of $1.00 and capital gains of $1.50. Today, the NAV is $21.00. What was your holdi

> Refer to Problem 12.9. If there were a 2.5% load on this fund, assuming you purchased the same number of shares, what would you rate of return be? Data from Problem 12.9: Five years ago, you invested in the Future Investco Mutual Fund by purchasing 1,50

> A year ago, an investor bought 100 shares of a mutual fund at $7.50 per share. This year, the fund paid dividends of $0.75 per share capital gains of $0.50 per share. a. Find the investor’s holding period return, given that this no-load fund now has a ne

> You have decided to open a margin account with your broker and to secure a margin loan. The initial margin requirement is 70%, and the maintenance margin is 30%. You have been following the price movements of a stock over the past year and believe that i

> Calculate the value of each of the bonds shown in the following table, all of which pay interest semiannually.

> Calculate the value of each of the bonds shown in the following table, all of which pay interest annually.

> A 15-year bond has a coupon of 8% and is priced to yield 6%. Calculate the price per $1,000 par value using semiannual compounding. If an investor purchases this bond two months before a scheduled coupon payment, how much accrued interest must be paid to

> A $1,000 par value bond has a current price of $800 and a maturity value of $1,000 and matures in five years. If interest is paid semiannually and the bond is priced to yield 8%, what is the bond’s annual coupon rate?

> You have the opportunity to purchase a 25-year, $1,000 par value bond that has an annual coupon rate of 9%. If you require a YTM of 7.6%, how much is the bond worth to you?

> Using semiannual compounding, find the prices of the following bonds. a. A 10%, 15-year bond priced to yield 7% b. A 6%, 10-year bond priced to yield 10% c. An 11%, 20-year bond priced at 9% Repeat the problem using annual compounding. Then comment on th

> A bond issued by H&W Corporation has an annual-pay coupon of 5.625% plus a par value of $1,000 at maturity. This bond has a remaining maturity of 23 years. The required rate of return on securities of similar-risk grade is 6.76%. a. What is the value of

> Elliot Karlin is a 35-year-old bank executive who has just inherited a large sum of money. Having spent several years in the bank’s investments department, he’s well aware of the concept of duration and decides to apply it to his bond portfolio. In part

> Stacy Picone is an aggressive bond trader who likes to speculate on interest rate swings. Market interest rates are currently at 9%, but she expects them to fall to 7% within a year. As a result, Stacy is thinking about buying either a 25-year, zero-coup

> Which one of the following bonds would you select if you thought market interest rates were going to fall by 50 basis points over the next six months? a. A bond with a Macaulay duration of 8.36 years that’s currently being priced to yield 7.25% b. A bond

> Sharnel Bitker expected the price of PharmaScripts shares to drop in the near future in response to the expected failure of its new drug to pass FDA tests. As a result, she sold short 1,000 shares of PharmaScripts at $9.75 per share. How much would Sharn

> Find the Macaulay duration and the modified duration of a 15-year, 9% corporate bond priced to yield 7%. According to the modified duration of this bond, how much of a price change would this bond incur if market yields rose to 8%? Using annual compoundi

> An investor wants to find the duration of a 25-year, 6% semiannual-pay, noncallable bond that’s currently priced in the market at $882.72 to yield 7%. Using a 50 basis point change in yield, find the effective duration of this bond.

> A bond has a Macaulay duration of 8.24 and is priced to yield 7%. If interest rates go up so that the yield goes to 7.5%, what will be the percentage change in the price of the bond? Now, if the yield on this bond goes down to 6.5%, what will be the bond

> Two bonds have par values of $1,000. One is a 6%, 20-year bond priced to yield 7%. The other is an 8%, 25-year bond priced to yield 5%. Which of these has the lower price? (Assume annual compounding in both cases.)

> A bond has a Macaulay duration equal to 9.8 and a yield to maturity of 8%. What is the modified duration of this bond?

> Using annual compounding, find the yield to maturity for each of the following bonds. a. A 9.75%, 18-year bond priced at $962.41 b. A 14%, 20-year bond priced at $1,612.98 c. A 6.25%, 15-year bond priced at $592.45 Now assume that each of the previous bo

> Assume that an investor pays $850 for a long-term bond that carries a 10% coupon. In three years, he hopes to sell the issue for $975. If his expectations come true, what yield will this investor realize? (Use annual compounding.) What would the holding

> Each of the bonds shown in the following table pays interest annually. a. Calculate the yield to maturity (YTM) for each bond. b. What relationship exists between the coupon interest rate and yield to maturity and the par value and market value of a bond

> A 20-year, zero-coupon bond was recently being quoted at 10.625% of par. Find the current yield and the promised yield of this issue, given that the bond has a par value of $1,000. Using semiannual compounding, determine how much an investor would have t

> What is the price of a zero-coupon ($1,000 par value) bond that matures in 20 years and has a promised yield of 9.5%?

> Calculate the profit or loss per share realized on each of the following short-sale Transactions.

> A zero-coupon bond that matures in 20 years is currently selling for $156 per $1,000 par value. What is the promised yield on this bond?

> Assume that an investor is looking at two bonds: Bond A is a 25-year, 9.5% (semiannual pay) bond that is priced to yield 10%. Bond B is a 25-year, 9% (annual pay) bond that is priced to yield 8%. Both bonds carry five-year call deferments and call prices

> An 8.5%, 20-year bond has a par value of $1,000 and a call price of $1,050. (The bond’s first call date is in five years.) Coupon payments are made semiannually (so use semiannual compounding where appropriate). a. Find the current yield, YTM, and YTC on