Question: Pete has extracted the following trial balance

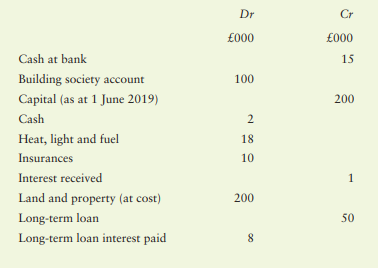

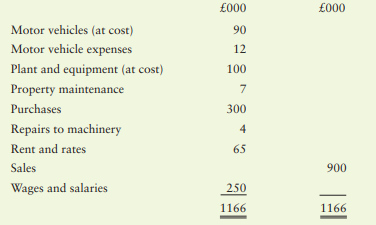

Pete has extracted the following trial balance from his books of account as at 31 May 2020:

Required:

Prepare Pete’s statement of profit or loss and statement of retained earnings for the year to 31 May 2020 and a statement of financial position as at that date.

> How should reciprocal service costs be dealt with when calculating product costs?

> Some non-accountants believe that the technique of overhead absorption was devised simply to provide jobs for accountants. How far do you agree?

> Has total absorption costing any relevance in a service industry?

> Arithmetical precision for precision’s sake’. How far is this statement true of the traditional methods used in absorbing overheads into product costs?

> Iron Limited is a small manufacturing company. During the year to 31 December 2020 it has taken into inventory and issued to production the following items of raw material, known as XY1: Notes: 1 There were no opening inventory of raw material XY1. 2 The

> Find out more details about a high profile fraud or accounting scandal case of your choice. Present to the class. Answer: Leave students to present their findings.

> The following information relates to Steed Limited for the year to 31 May 2021: Required: Calculate Steed Limited’s gross profit for the year to 31 May 2021 using each of the above closing inventory values.

> Appleton used to operate her business as a sole trader entity. She has recently converted it into a limited liability company. Appleton owns 80 per cent of the ordinary (voting) shares, the remaining 20 per cent being held by various relatives and friend

> You are presented with the following information for Trusty Limited: Required: Calculate the value of closing inventory at 31 March 2020 using each of the following methods of pricing the issue of materials to production: (a) FIFO (first-in, first-out) (

> Examine the argument that an arbitrary pricing system used to charge direct materials to production leads to erroneous product costing.

> Clare Wong spends a lot of her time working for a large local charity. The charity has grown enormously in recent years and the trustees have been advised to overhaul their accounting procedures. This would involve its workers (most of whom are volunteer

> ‘Management accountants hold an extremely powerful position in an entity and this enables them to influence most of the decisions.’ How far do you think that this assertion is likely to be true in practice?

> What is the difference between ‘planning’ and ‘control’?

> Outline the main steps involved in preparing a strategic plan.

> Assess the importance of taking into account behavioural considerations when operating a management accounting system from the point of view of (a) the management accountant and (b) a senior departmental manager.

> The first step in preparing a strategic plan is to specify the entity’s goals. Formulate three possible objectives for (a) a manufacturing entity and (b) a national charity involved in animal welfare.

> Imagine that you have £10,000 that you are willing to invest in shares. What follows are the 2014 financial statement of Sainsbury’s plc – a supermarket. You can find the 2014 financial statements of its c

> Is ratio analysis useful in understanding how an entity has performed? Answer: 1. Yes, provided the underlying information has been accurately and consistently prepared, that the basic deficiencies of such underlying information are understood, that

> How far do you accept the argument that the return on capital employed ratio can give a misleading impression of an entity’s profitability? Answer: 1. ROCE is a complex ratio because there are many different definitions of both ‘profit’ and ‘capital

> Accounting ratios are only as good as the data on which they are based.’ Discuss. Answer: 1. Accounting ratios attempt to express in simple terms the relationship between factors that may contain some highly complex information. Their calculation is

> State briefly the main reasons why a company may employ a team of accountants.

> Suggest 10 items that should be disclosed in a listed company’s periodic summary statement. Answer: 1. This question calls for some originality on the part of the student. 2. An explanation of what is a periodic summary statement should be given. 3

> Describe what is meant by a ‘qualified audit report’ illustrating your answer with appropriate examples. Answer: 1. There are two main types of audit report: unqualified and qualified. 2. An unqualified report is one where the auditors state that th

> What items do you think could be taken out of a listed company’s published statement or profit or loss and other comprehensive income and its statement of financial position without affecting the usefulness of such statements? Answer: 1. It is assum

> Should companies be banned from including non-financial data in their annual reports? Answer: 1. This would appear to be an extreme reaction. Assuming that companies operate within the law, it would be a questionable step in a democratic society to

> What is the difference between tax avoidance and tax evasion? From a personal finance perspective, do you think either of these activities is justified?

> Examine the argument that annual reports are a costly irrelevance because hardly anyone refers to them. Answer: 1. It is not clear whether annual reports are largely ignored. It is possibly the case that a high proportion of small shareholders do n

> A limited liability company’s annual report should be made easier to understand for the average shareholder.’ Discuss. Answer: 1. This is an argument between two schools of thought: those who argue that the simplification of accounting information is

> The following information relates to Brian Limited for the year ended 30 June 2020. Additional information: 1 The company purchased some new vehicles during 2020 for £75,000. 2 During 2020 the company also sold a vehicle for £1

> The following summarized accounts have been prepared for Pill Limited: Additional information: (a) There were no sales of non-current assets during the year ended 31 May 2020. (b) The loans were paid back at the beginning of the year. Required: (a) Compi

> The following is a summary of Gregory Limited’s accounts for the year ended 30 April 2021. Additional information: There were no sales of non-current assets during the year ended 30 April 2021. Required: (a) Prepare Gregory Limited&acir

> Lime’s business has had liquidity problems for some months. The following trial balance was extracted from his books of account as at 30 September 2020: Additional information: 1 Inventory at 30 September 2020: £68 000. 2

> You are presented with the following information: Required: (a) Compile Starter’s statement of cash flows for the year ended 31 March 2021. (b) What does it tell the owners of Starter?

> Does a statement of cash flows serve any useful purpose? Answer: 1. The short answer is ‘yes’ given the importance of monitoring net cash flow. No matter how profitable an entity is in accounting terms, if it has not got the cash to operate on a day

> Unlike traditional financial accounting, cash flow accounting does not require the accountant to make a series of arbitrary assumptions, apportionments and estimates. How far, therefore, do you think that there is a case for abandoning traditional financ

> Proprietors are more interested in cash than profit.’ Discuss. Answer: 1. In the short term, without an adequate cash flow, an entity will find it difficult to survive; in the longer term the accounting profit has to be available to be paid out in c

> The following balances have been extracted from the books of the David and Peter Manufacturing Company as at 30 April 2021: Additional information Inventory at 30 April 2021 £000 Raw material 14 Work-in-progress 16 The factory equipment

> Do you think a small limited liability company will benefit from engaging a firm of external auditors?

> The following balances have been extracted from the books of Stuart for the year to 31 March 2021: Required Prepare Stuart’s manufacturing account for the year to 31 March 2021.

> It has been asserted that the main objective of a profit-making entity is to make a profit, while that of a not-for-profit entity is to provide a service. Discuss this assertion in the context of the accounting requirements of different types of entities

> Although a manufacturing account may contain a great deal of information, how far do you think that it helps managers who are in charge of production cost centres?

> A direct cost has been defined as ‘a cost that can be easily and economically identified with a particular department, section product or unit’. Critically examine this definition from a non accounting manager’s perspective. Answer: 1. The distinctio

> The following is Ash’s trial balance as at 31 March 2021: Additional information: 1 Inventory at 31 March 2021: £15 000. 2 At 31 March 2021 there was a specific bad debt of £6000. This was to be written off.

> Duxbury started in business on 1 January 2021. The following is his trial balance as at 31 December 2021: Additional information: 1 Inventory at 31 December 2021 was valued at £10 000. 2 At 31 December 2021 an amount of £400 w

> The following information relates to Astley for the year to 30 November 2020: Required: (a) Calculate the charge to the statement of profit or loss for the year to 30 November 2020 for each of the above items. (b) Demonstrate what amounts for accruals an

> Dale has been in business for some years. The following is his trial balance at 31 October 2020: Additional information (not taken into account when compiling the above trial balance): 1 Inventory at 31 October 2020: £26 000. 2 Amount owin

> The following is an extract from Barrow’s statement of financial position at 31 August2020: / Barrow’s depreciation policy is as follows: (a) A full year’s depreciation is charged in the year of acquisition, but none in the year of disposal. (b) No depre

> Wotton commenced business on 1 July 2019. The following trial balance was extracted fromhis books of account as at 30 June 2020: Additional information: Inventory at 30 June 2020: £2000. The motor car is to be depreciated at a rate of 20 per

> Radford presents you with the following information for the year to 31 March 2021 He is not sure how to value the inventory as at 31 March 2021. Three methods have been suggested. They all result in different closing inventory values, namely: Required: (

> The following statement was made by a student: ‘I cannot understand why accountants have such a high status and why they have so much influence.’ How would you respond to such assertions?

> The following trial balance has been extracted from the books of Garswood as at 31 March 2021: Required: Prepare Garwood’s statement of profit or loss and statement of retained earnings for the year to 31 March 2021 and a statement of f

> The following trial balance has been extracted from Jody’s books of account as at 30 April 2020: Required: Prepare Jody’s statement of profit or loss and statement of retained earnings for the year to 30 April 2020 and

> How far is it possible for an entity to build up hidden amounts of profit (known as secret reserves) by making some adjustments in the statement of profit or loss for doubtful debts? Answer: 1. Quite easy. By taking a pessimistic view of whether par

> Explain why it is quite easy to manipulate the level of gross profit when preparing a trading account. Answer: 1. Primarily because of difficulties in the timing of recognising transactions involving inventory. This involved difficulties in recognisi

> Depreciation methods and rates should be prescribed by law.’ Discuss.

> How far does a statement of financial position tell users how much an entity is worth? Answer: 1. Very little. The statement of financial position total is a combination of transactions entered at historic cost, written-down values, estimated curren

> The differentiation between the so-called capital and revenue expenditure is quite arbitrary and unnecessary.’ Discuss. Answer: 1. It is true that the classification of transactions into capital and revenue can sometimes be arbitrary, e.g. for expen

> Explain why an increase in cash during a particular accounting period does not necessarily mean that an entity has made a profit. Answer: Accounting profit is not normally the difference between cash received and cash paid during a particular period

> Donald’s transactions for the month of March 2021 are as follows: Required (a) Enter the above transactions in appropriate ledger accounts. (b) Balance each account as at 31 March 2021. (c) Extract a trial balance as at that date.

> Harry started a new business on 1 January 2020. The following transactions cover his first three months in business: (a) Harry contributed an amount in cash to start the business. (b) He transferred some of the cash to a business bank account. (c) He pai

> Do you think that auditors should be responsible for detecting fraud?

> Double-entry bookkeeping is a waste of time and money because everything has to be recorded twice.’ Discuss.

> Is Freda right? ‘My accountant has got it all wrong’, argued Freda. ‘She’s totally mixed up all her debits and credits. ’‘But what makes you say that?’ queried Dora. ‘Oh! I’ve only to look at my bank statement to see that she’s wrong,’ responded Freda. ‘

> Do you think that non-accounting managers need to know anything about double-entry bookkeeping?

> Consider the Principles of Good Regulation – for both the regulator and business as explained by the Financial Conduct Authority (the regulator of financial institutions in the United Kingdom). Discuss: (a) to what extent do you think t

> The adoption of the realization and matching rules in preparing financial accounts requires a great deal of subjective judgment. Write an essay examining whether it would be fairer, Easier and more meaningful to prepare financial accounts on a cash recei

> The following is a list of problems which an accountant may well meet in practice. Which accounting rule would the accountant most probably adopt in dealing with each of the problems? State the reasons for your choice. (a) The transfer fee of a footballe

> Compare and contrast each of these management accounting techniques and then, giving your reasons, select the one that in your opinion is most likely to be useful to a non-accounting manager: product life cycle costing; throughput accounting and value ch

> Do you think that target costing serves any useful purpose in a service entity? Answer: 1. Target costing involves: (a) determining the likely price that a product can be sold at; (b) deducting the entity’s desired profit; and (c) ensuring that the

> Do you think that environmental management accounting is of any benefit to a company? Answer: 1. Environmental accounting and reporting is at an early stage of development. So there is no consensus on what and how it should be accounted for and repo

> How far do you think that short budget forecasts would be more useful than budgets tied in with the traditional annual financial reporting system? Answer: 1. This question requires a discussion of traditional budgeting techniques and the alterations

> Activity-based management is fine in theory but impossible in practice.’ Discuss. Answer: 1. An outline of ABM should be given including a summary of its benefits and an outline of the difficulties in implementing it. 2. ABM involves the following p

> Ugh!’ snorted the chair when confronting the chief accountant. ‘Strategic management accounting is another of those techniques dreamed up by you and your mates to keep you all in a job.’ Could the chair have a point? Answer: 1. A brief explanation

> Marsh Limited has investigated the possibility of investing in a new machine. The following data have been extracted from the report relating to the project: Cost of machine on 1 January Year 6: £500,000. Life: four years to 31 December Year

> How independent do you think is the independent regulator (the Financial Reporting Council)? How will its proposed successor (the Audit, Reporting and Governance Authority (ARGA)) be more independent?

> Hewie Limited has some capital available for investment and is considering two projects, only one of which can be financed. The details are as follows: Required: Advise management on which project to accept.

> Nicole Limited is considering investing in a new machine. The machine would cost £500,000. It would have a life of five years and a nil residual value. The company uses the straight-line method of depreciation. It is expected that the machin

> Prospect Limited is considering investing in some new plant. The plant would cost £1,000,000 to implement. It would last five years and it would then be sold for £50,000. The relevant profit and loss accounts for each year durin

> Moffat District Council has calculated the following net cash flows for a proposed project costing £1,450,000: Required: Calculate the internal rate of return generated by the project. Answer: Internal rate of return: Year Net cash Disc

> We can all dream up new capital expenditure proposals’, asserted the Managing Director, ‘but where is the money coming from?’ How might the proposals be financed?

> Do any of the traditional capital investment appraisal techniques help in determining social and welfare capital expenditure proposals? Answer: 1. Most of the traditional techniques do depend on estimating future net cash flows. NCF is, however, lar

> All capital expenditure techniques are irrelevant because: (a) They cannot estimate accurately future cash flows; (b) It is difficult to select an appropriate discount rate.’ Discuss. Answer: 1. These assertions are true: it is difficult to estima

> In capital expenditure appraisal, management cannot cope with any technique that is more advanced than payback.’ How far do you think that this assertion is likely to be true? Answer: 1. The techniques that accountants may use for appraising capital

> Dynasty Limited has been involved in a research project (code named DNY) for a number of months. There is some doubt as to whether the project should be completed. If it is, then it is expected that DNY will require another 12 months’ work. The following

> Bamboo Limited is a highly specialist firm of central heating suppliers operating exclusively in the textiles industry. It has recently been asked to tender for a contract for a prospective customer. The following details relate to the proposed contract.

> The law should lay down precise formats, contents and methods for the preparation of limited liability company accounts.’ Discuss.

> Foo Limited has been asked to quote for a special order. The details are as follows: 1 Prices are to be quoted at order levels of 50,000, 100,000 and 150,000 units respectively. Foo has some surplus capacity and it could deal with up to 160,000 units. 2

> Agra Limited has been asked to quote a price for a special contract. The details are as follows: 1 The specification required a quotation for 100,000 units. 2 The direct costs per unit for the order would be: materials £3, labour £15, distribution £12. 3

> Assume that you were an IT manager in a large entity and that the services that you provide are made available to both internal and external parties. Specify how you would go about negotiating an appropriate fee for services sought by other departments w

> Many of the solutions to the problems posed in this chapter depend on being able to isolate the variable cost associated with a particular decision. In practice, is it realistic to expect that such costs can be readily identified and measured? Answer:

> This chapter has emphasized that it is managers that make decisions and not management accountants. How far do you agree with this assertion? Answer: 1. Management accountants are employed to provide a service: they advise senior management and comm

> The following information relates to Mere’s budget for the year to 31 December 2021: Note: Fixed overheads are apportioned on the basis of direct labour hours. The directors are worried about the loss that product M is budgeted to make

> Puzzled Limited would like to increase its sales during the year to 3l May 2021. To do so, it has several mutually exclusive options open to it: ● reduce the selling price per unit by 15 per cent; ● improve the product

> The following information relates to Carter Limited for the year to 30 April 2021: During 2022 the company would like to increase its sales substantially, but to do so it would have to reduce the selling price per unit by 20 per cent. The variable cost p

> The following information applies to Ayre Limited for the two years to 31 March 2021 and 2022 respectively: Required: Assuming that the cost relationships had remained as given in the question, calculate the company’s profit if the sal

> Do break-even charts and profit graphs help management to make more meaningful decisions?

> What are the limitations of regulation?

> Contribution analysis described in textbooks is too simplistic and is of little relevance to management.’ How far do you agree with this statement?

> It has been suggested that although contribution analysis is fine in theory, fixed costs cannot be ignored in practice.’ Discuss this statement.

> Mean Limited manufactures a single product, and the following information relates to the actual selling price and actual cost of the product for the four weeks to 31 March 2020: The budgeted selling price and standard cost of each unit was as follows: To