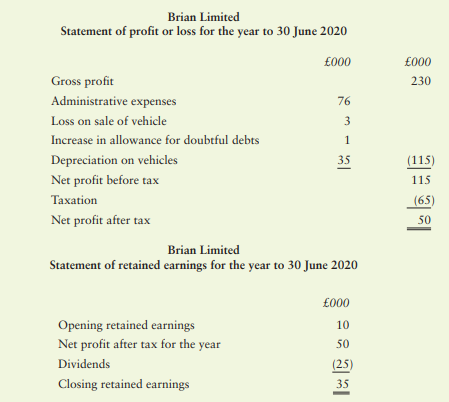

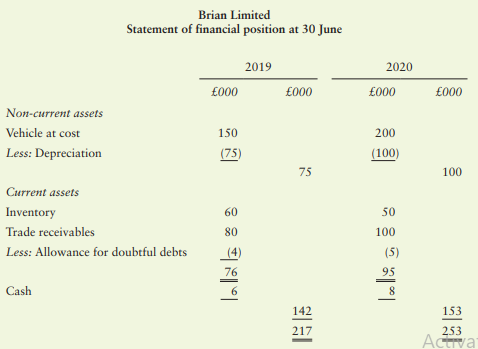

Question: The following information relates to Brian Limited

The following information relates to Brian Limited for the year ended 30 June 2020.

Additional information:

1 The company purchased some new vehicles during 2020 for £75,000.

2 During 2020 the company also sold a vehicle for £12,000 in cash. The vehicle had originally cost £25,000, and £10,000 had been set aside for depreciation.

Required:

(a) Prepare a statement of cash flows for Brian Limited for the year ended 30 June 2020.

(b) Outline what it tells the managers of Brian Limited.

> Nelson Ltd was incorporated in 2003 with an authorized share capital of 500,000 £1 ordinary shares, and 200,000 5 per cent cumulative preference shares of £1 each. The following trial balance was extracted as at 31 May 2020: Add

> The following trial balance has been extracted from Carol Ltd as at 30 April 2020: Additional information: 1 Inventory at 30 April 2020 was valued at £140,000. 2 Depreciation for the year of £28,000 is to be provided on building

> Beech is a retailer. Most of his sales are made on credit terms. The following information relates to the first four years that he has been in business: The trade is one that experiences a high level of bad debts. Accordingly, Beech decides to set aside

> Design a possible fraud scheme. Consider what its impact would be on the financial statements and how auditors may uncover a similar fraud.

> Examine the usefulness of management accounting in a service-based economy.

> Critically evaluate the purpose audit serves in the corporate world and its value to society. Answer: 1. Arguably audit allows companies to get easier access to the capital markets. 2. It improves trust in the actions of directors (who act as ‘agents

> Standard costing is all about number crunching and for someone on the shop floor it has absolutely no relevance.’ Do you agree with this statement?

> Is it likely that a standard-costing system is of any relevance in a service industry?

> Chimes Limited has prepared a flexible budget for one of its factories for the year to 30 June 2021. The details are as follows: Additional information: 1 The company only expects to operate at a capacity of 45 per cent. At that capacity, the sales reven

> The following budget information relates to Flossy Limited for the three months to 31 March 2021: 3 Capital expenditure to be incurred on 20 February 2021 is expected to amount to £470,000. 4 Sales of plant and equipment on 15 March 2021 is

> Avsar Limited has extracted the following budgeting details for the year to 30 September 2020: 1 Sales: 4000 units of V at £500 per unit7000 units of R at £300 per unit 2 Materials usage (units): 8 Fixed overhead: £

> Gorse Limited manufactures one product. The budgeted sales for period 6 are for 10,000 units at a selling price of £100 per unit. Other details are as follows: Two components are used in the manufacture of each unit: Inventory at the beginni

> It is impossible to introduce a budgetary control system into a hospital because if someone’s life needs saving it has to be saved irrespective of the cost.’ How far do you agree with this statement?

> Does a fixed budget serve any useful purpose?

> Suppose that when all the individual budgets at Sparks plc are put together there is a shortfall of resources needed to support them. The Board suggests that all departmental budgets should be reduced by 15 per cent. As the company’s Chief Accountant, ho

> Assume that you are a personnel officer in a manufacturing company and that one of your employees is a young engineering manager called Joseph Sykes. Joseph has been chosen to attend the local university’s business school to study for a diploma in manage

> How far do you think that the information presented in a limited liability company’s financial statements is useful to the owners of a small business? Answer: 1. The information provided is little different from that relating to sole trader or partn

> The Head of Department of Business and Management at Birch College has been told by the Vice Principal (Resources) that his departmental budget for the next academic year is £150,000. What comment would you make about the system of budgeting used at Birc

> What do you expect is the required experience and background of a CEO (Chief Executive Officer) and CFO (Chief Financial Officer) of a big business?

> Outlane Limited’s overhead budget for 2019 is as follows: The company has four production departments: L, M, N and O. The following information relates to each department. Previously, the company has absorbed overhead on the basis of 10

> Assess the usefulness of activity-based costing in managerial decision making.

> How should reciprocal service costs be dealt with when calculating product costs?

> Some non-accountants believe that the technique of overhead absorption was devised simply to provide jobs for accountants. How far do you agree?

> Has total absorption costing any relevance in a service industry?

> Arithmetical precision for precision’s sake’. How far is this statement true of the traditional methods used in absorbing overheads into product costs?

> Iron Limited is a small manufacturing company. During the year to 31 December 2020 it has taken into inventory and issued to production the following items of raw material, known as XY1: Notes: 1 There were no opening inventory of raw material XY1. 2 The

> Find out more details about a high profile fraud or accounting scandal case of your choice. Present to the class. Answer: Leave students to present their findings.

> The following information relates to Steed Limited for the year to 31 May 2021: Required: Calculate Steed Limited’s gross profit for the year to 31 May 2021 using each of the above closing inventory values.

> Appleton used to operate her business as a sole trader entity. She has recently converted it into a limited liability company. Appleton owns 80 per cent of the ordinary (voting) shares, the remaining 20 per cent being held by various relatives and friend

> You are presented with the following information for Trusty Limited: Required: Calculate the value of closing inventory at 31 March 2020 using each of the following methods of pricing the issue of materials to production: (a) FIFO (first-in, first-out) (

> Examine the argument that an arbitrary pricing system used to charge direct materials to production leads to erroneous product costing.

> Clare Wong spends a lot of her time working for a large local charity. The charity has grown enormously in recent years and the trustees have been advised to overhaul their accounting procedures. This would involve its workers (most of whom are volunteer

> ‘Management accountants hold an extremely powerful position in an entity and this enables them to influence most of the decisions.’ How far do you think that this assertion is likely to be true in practice?

> What is the difference between ‘planning’ and ‘control’?

> Outline the main steps involved in preparing a strategic plan.

> Assess the importance of taking into account behavioural considerations when operating a management accounting system from the point of view of (a) the management accountant and (b) a senior departmental manager.

> The first step in preparing a strategic plan is to specify the entity’s goals. Formulate three possible objectives for (a) a manufacturing entity and (b) a national charity involved in animal welfare.

> Imagine that you have £10,000 that you are willing to invest in shares. What follows are the 2014 financial statement of Sainsbury’s plc – a supermarket. You can find the 2014 financial statements of its c

> Is ratio analysis useful in understanding how an entity has performed? Answer: 1. Yes, provided the underlying information has been accurately and consistently prepared, that the basic deficiencies of such underlying information are understood, that

> How far do you accept the argument that the return on capital employed ratio can give a misleading impression of an entity’s profitability? Answer: 1. ROCE is a complex ratio because there are many different definitions of both ‘profit’ and ‘capital

> Accounting ratios are only as good as the data on which they are based.’ Discuss. Answer: 1. Accounting ratios attempt to express in simple terms the relationship between factors that may contain some highly complex information. Their calculation is

> State briefly the main reasons why a company may employ a team of accountants.

> Suggest 10 items that should be disclosed in a listed company’s periodic summary statement. Answer: 1. This question calls for some originality on the part of the student. 2. An explanation of what is a periodic summary statement should be given. 3

> Describe what is meant by a ‘qualified audit report’ illustrating your answer with appropriate examples. Answer: 1. There are two main types of audit report: unqualified and qualified. 2. An unqualified report is one where the auditors state that th

> What items do you think could be taken out of a listed company’s published statement or profit or loss and other comprehensive income and its statement of financial position without affecting the usefulness of such statements? Answer: 1. It is assum

> Should companies be banned from including non-financial data in their annual reports? Answer: 1. This would appear to be an extreme reaction. Assuming that companies operate within the law, it would be a questionable step in a democratic society to

> What is the difference between tax avoidance and tax evasion? From a personal finance perspective, do you think either of these activities is justified?

> Examine the argument that annual reports are a costly irrelevance because hardly anyone refers to them. Answer: 1. It is not clear whether annual reports are largely ignored. It is possibly the case that a high proportion of small shareholders do n

> A limited liability company’s annual report should be made easier to understand for the average shareholder.’ Discuss. Answer: 1. This is an argument between two schools of thought: those who argue that the simplification of accounting information is

> The following summarized accounts have been prepared for Pill Limited: Additional information: (a) There were no sales of non-current assets during the year ended 31 May 2020. (b) The loans were paid back at the beginning of the year. Required: (a) Compi

> The following is a summary of Gregory Limited’s accounts for the year ended 30 April 2021. Additional information: There were no sales of non-current assets during the year ended 30 April 2021. Required: (a) Prepare Gregory Limited&acir

> Lime’s business has had liquidity problems for some months. The following trial balance was extracted from his books of account as at 30 September 2020: Additional information: 1 Inventory at 30 September 2020: £68 000. 2

> You are presented with the following information: Required: (a) Compile Starter’s statement of cash flows for the year ended 31 March 2021. (b) What does it tell the owners of Starter?

> Does a statement of cash flows serve any useful purpose? Answer: 1. The short answer is ‘yes’ given the importance of monitoring net cash flow. No matter how profitable an entity is in accounting terms, if it has not got the cash to operate on a day

> Unlike traditional financial accounting, cash flow accounting does not require the accountant to make a series of arbitrary assumptions, apportionments and estimates. How far, therefore, do you think that there is a case for abandoning traditional financ

> Proprietors are more interested in cash than profit.’ Discuss. Answer: 1. In the short term, without an adequate cash flow, an entity will find it difficult to survive; in the longer term the accounting profit has to be available to be paid out in c

> The following balances have been extracted from the books of the David and Peter Manufacturing Company as at 30 April 2021: Additional information Inventory at 30 April 2021 £000 Raw material 14 Work-in-progress 16 The factory equipment

> Do you think a small limited liability company will benefit from engaging a firm of external auditors?

> The following balances have been extracted from the books of Stuart for the year to 31 March 2021: Required Prepare Stuart’s manufacturing account for the year to 31 March 2021.

> It has been asserted that the main objective of a profit-making entity is to make a profit, while that of a not-for-profit entity is to provide a service. Discuss this assertion in the context of the accounting requirements of different types of entities

> Although a manufacturing account may contain a great deal of information, how far do you think that it helps managers who are in charge of production cost centres?

> A direct cost has been defined as ‘a cost that can be easily and economically identified with a particular department, section product or unit’. Critically examine this definition from a non accounting manager’s perspective. Answer: 1. The distinctio

> The following is Ash’s trial balance as at 31 March 2021: Additional information: 1 Inventory at 31 March 2021: £15 000. 2 At 31 March 2021 there was a specific bad debt of £6000. This was to be written off.

> Duxbury started in business on 1 January 2021. The following is his trial balance as at 31 December 2021: Additional information: 1 Inventory at 31 December 2021 was valued at £10 000. 2 At 31 December 2021 an amount of £400 w

> The following information relates to Astley for the year to 30 November 2020: Required: (a) Calculate the charge to the statement of profit or loss for the year to 30 November 2020 for each of the above items. (b) Demonstrate what amounts for accruals an

> Dale has been in business for some years. The following is his trial balance at 31 October 2020: Additional information (not taken into account when compiling the above trial balance): 1 Inventory at 31 October 2020: £26 000. 2 Amount owin

> The following is an extract from Barrow’s statement of financial position at 31 August2020: / Barrow’s depreciation policy is as follows: (a) A full year’s depreciation is charged in the year of acquisition, but none in the year of disposal. (b) No depre

> Wotton commenced business on 1 July 2019. The following trial balance was extracted fromhis books of account as at 30 June 2020: Additional information: Inventory at 30 June 2020: £2000. The motor car is to be depreciated at a rate of 20 per

> Radford presents you with the following information for the year to 31 March 2021 He is not sure how to value the inventory as at 31 March 2021. Three methods have been suggested. They all result in different closing inventory values, namely: Required: (

> Pete has extracted the following trial balance from his books of account as at 31 May 2020: Required: Prepare Pete’s statement of profit or loss and statement of retained earnings for the year to 31 May 2020 and a statement of financia

> The following statement was made by a student: ‘I cannot understand why accountants have such a high status and why they have so much influence.’ How would you respond to such assertions?

> The following trial balance has been extracted from the books of Garswood as at 31 March 2021: Required: Prepare Garwood’s statement of profit or loss and statement of retained earnings for the year to 31 March 2021 and a statement of f

> The following trial balance has been extracted from Jody’s books of account as at 30 April 2020: Required: Prepare Jody’s statement of profit or loss and statement of retained earnings for the year to 30 April 2020 and

> How far is it possible for an entity to build up hidden amounts of profit (known as secret reserves) by making some adjustments in the statement of profit or loss for doubtful debts? Answer: 1. Quite easy. By taking a pessimistic view of whether par

> Explain why it is quite easy to manipulate the level of gross profit when preparing a trading account. Answer: 1. Primarily because of difficulties in the timing of recognising transactions involving inventory. This involved difficulties in recognisi

> Depreciation methods and rates should be prescribed by law.’ Discuss.

> How far does a statement of financial position tell users how much an entity is worth? Answer: 1. Very little. The statement of financial position total is a combination of transactions entered at historic cost, written-down values, estimated curren

> The differentiation between the so-called capital and revenue expenditure is quite arbitrary and unnecessary.’ Discuss. Answer: 1. It is true that the classification of transactions into capital and revenue can sometimes be arbitrary, e.g. for expen

> Explain why an increase in cash during a particular accounting period does not necessarily mean that an entity has made a profit. Answer: Accounting profit is not normally the difference between cash received and cash paid during a particular period

> Donald’s transactions for the month of March 2021 are as follows: Required (a) Enter the above transactions in appropriate ledger accounts. (b) Balance each account as at 31 March 2021. (c) Extract a trial balance as at that date.

> Harry started a new business on 1 January 2020. The following transactions cover his first three months in business: (a) Harry contributed an amount in cash to start the business. (b) He transferred some of the cash to a business bank account. (c) He pai

> Do you think that auditors should be responsible for detecting fraud?

> Double-entry bookkeeping is a waste of time and money because everything has to be recorded twice.’ Discuss.

> Is Freda right? ‘My accountant has got it all wrong’, argued Freda. ‘She’s totally mixed up all her debits and credits. ’‘But what makes you say that?’ queried Dora. ‘Oh! I’ve only to look at my bank statement to see that she’s wrong,’ responded Freda. ‘

> Do you think that non-accounting managers need to know anything about double-entry bookkeeping?

> Consider the Principles of Good Regulation – for both the regulator and business as explained by the Financial Conduct Authority (the regulator of financial institutions in the United Kingdom). Discuss: (a) to what extent do you think t

> The adoption of the realization and matching rules in preparing financial accounts requires a great deal of subjective judgment. Write an essay examining whether it would be fairer, Easier and more meaningful to prepare financial accounts on a cash recei

> The following is a list of problems which an accountant may well meet in practice. Which accounting rule would the accountant most probably adopt in dealing with each of the problems? State the reasons for your choice. (a) The transfer fee of a footballe

> Compare and contrast each of these management accounting techniques and then, giving your reasons, select the one that in your opinion is most likely to be useful to a non-accounting manager: product life cycle costing; throughput accounting and value ch

> Do you think that target costing serves any useful purpose in a service entity? Answer: 1. Target costing involves: (a) determining the likely price that a product can be sold at; (b) deducting the entity’s desired profit; and (c) ensuring that the

> Do you think that environmental management accounting is of any benefit to a company? Answer: 1. Environmental accounting and reporting is at an early stage of development. So there is no consensus on what and how it should be accounted for and repo

> How far do you think that short budget forecasts would be more useful than budgets tied in with the traditional annual financial reporting system? Answer: 1. This question requires a discussion of traditional budgeting techniques and the alterations

> Activity-based management is fine in theory but impossible in practice.’ Discuss. Answer: 1. An outline of ABM should be given including a summary of its benefits and an outline of the difficulties in implementing it. 2. ABM involves the following p

> Ugh!’ snorted the chair when confronting the chief accountant. ‘Strategic management accounting is another of those techniques dreamed up by you and your mates to keep you all in a job.’ Could the chair have a point? Answer: 1. A brief explanation

> Marsh Limited has investigated the possibility of investing in a new machine. The following data have been extracted from the report relating to the project: Cost of machine on 1 January Year 6: £500,000. Life: four years to 31 December Year

> How independent do you think is the independent regulator (the Financial Reporting Council)? How will its proposed successor (the Audit, Reporting and Governance Authority (ARGA)) be more independent?

> Hewie Limited has some capital available for investment and is considering two projects, only one of which can be financed. The details are as follows: Required: Advise management on which project to accept.

> Nicole Limited is considering investing in a new machine. The machine would cost £500,000. It would have a life of five years and a nil residual value. The company uses the straight-line method of depreciation. It is expected that the machin

> Prospect Limited is considering investing in some new plant. The plant would cost £1,000,000 to implement. It would last five years and it would then be sold for £50,000. The relevant profit and loss accounts for each year durin

> Moffat District Council has calculated the following net cash flows for a proposed project costing £1,450,000: Required: Calculate the internal rate of return generated by the project. Answer: Internal rate of return: Year Net cash Disc