Question: Refer to Samsung’s financial statements in

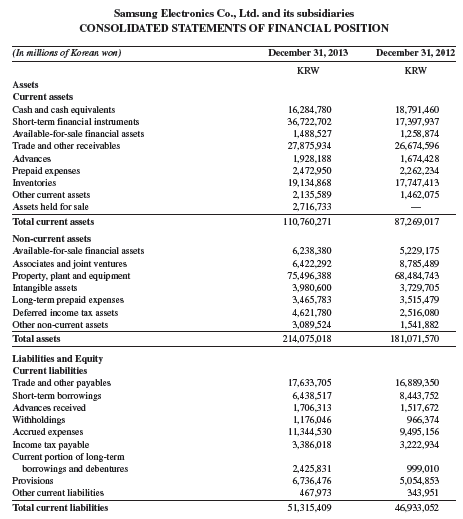

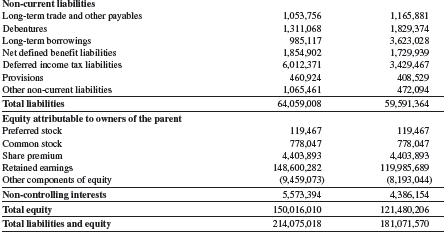

Refer to Samsung’s financial statements in Appendix A. Compute its cost of goods available for sale for the year ended December 31, 2013.

Samsung’s financial statements from Appendix A:

Transcribed Image Text:

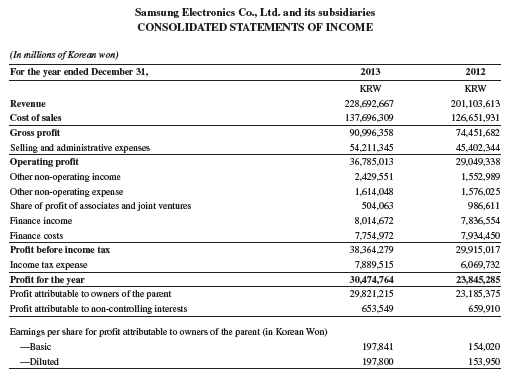

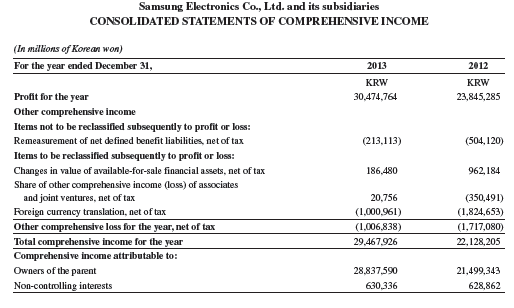

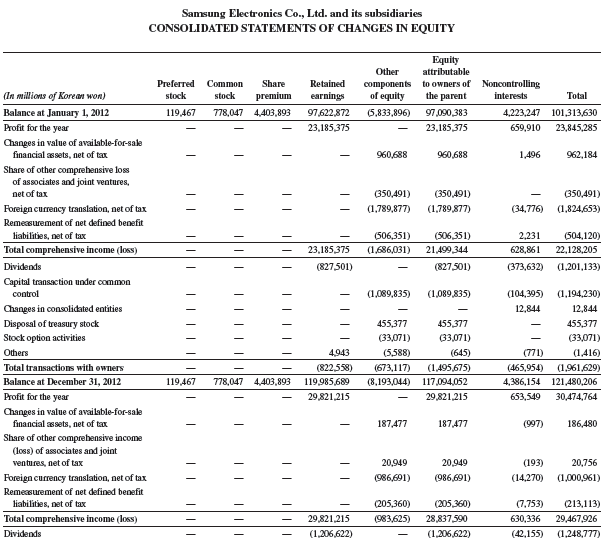

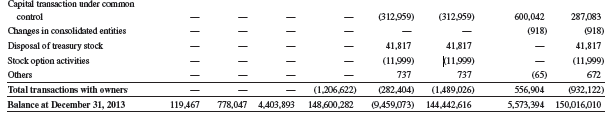

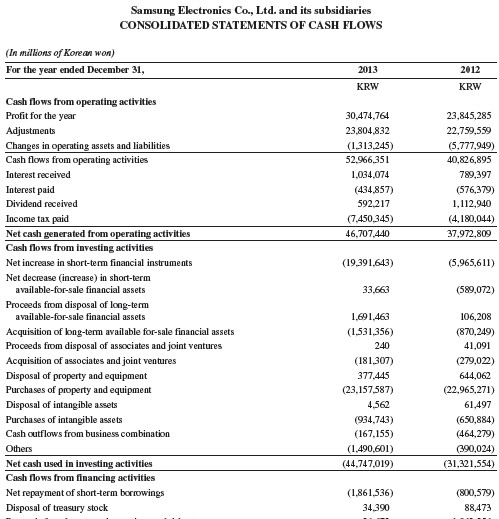

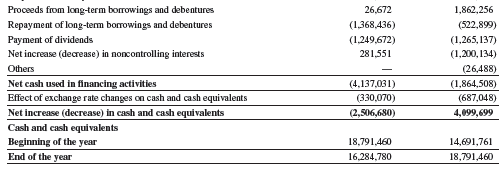

Samsung Electronics Co., Ltd. and its subsidiaries CONSOLIDATED STATEMENTS OF FINANCIAL POSITION (In millions of Korean won) December 31, 2013 December 31, 2012 KRW KRW Assets Current assets Cash and cash equivalents Short-term financial instruments 16,284,780 36,722,702 1,488,527 27,875,934 18,791,460 17,397,937 1,258,874 26,674,596 Available-for-sale financial assets Trade and other receivables Advances 1,928,188 2,472,950 19,134,868 2,135,589 1,674,428 2,262,234 Prepaid expenses Inventories 17,747,413 1,462,075 Other current assets Assets held for sale 2,716,733 Total current assets 110,760,271 87,269,017 Non-current assets Available-for-sale financial assets 6,238,380 5,229,175 Associates and joint ventures Property, plant and equipment Intangible assets Long-term prepaid expenses 6,422,292 75,496,388 3,980,600 3,465,783 4,621,780 8,785,489 68,484,743 3,729,705 3,515,479 2,516,080 Deferred income tax assets Other non-curent assets 3,089,524 1,541,882 Total assets 214,075,018 181,071,570 Liabilities and Equity Current liabilities Trade and other payables 17,633,705 16,889,350 Short-term borrowings 8,443,752 6,438,517 1,706,313 1,176,046 11,344,530 Advances received Withholdings Accrued expenses Income tax payable Current portion of long-term borrowings and debentures 1,517,672 966,374 9,495, 156 3,222,934 3,386,018 2,425,831 6,736,476 999,010 5,054,853 343,951 Provisions Other current liabilities 467,973 Total current liabilities 51,315,409 46,933,052 Non-current Iliabilities Long-term trade and other payables 1,053,756 1,165,881 debentures 1,311,068 1,829,374 3,623,028 1,729,939 3,429,467 Long-term borowings 985,117 Net defined benefit liabilities 1,854,902 6,012,371 Deferred income tax liabilities Provisions 460,924 408,529 472,094 Other non-curent liabilities 1,065,461 Total liabilities 64,059,008 59,591,364 Equity attributable to owners of the parent Preferred stock 119,467 119,467 Common stock 778,047 Share premium Retained eamings Other components of equity 4,403,893 148,600,282 (9,459,073) 778,047 4,403,893 119,985,689 (8,193,044) Non-controlling interests 5,573,394 4,386, 154 Total equity 150,016,010 121,480,206 Total liabilities and equity 214,075,018 181,071,570 Samsung Electronics Co., Ltd. and its subsidiaries CONSOLIDATED STATEMENTS OF INCOME (In millions of Korean won) For the year ended December 31, 2013 2012 KRW KRW Revenue 228,692,667 201,103,613 Cost of sales 137,696,309 126,651,931 Gross profit Selling and administrative expenses Operating profit 90,996,358 74,451,682 54,211,345 45,402,344 36,785,013 29,049,338 Other non-operating income 2,429,551 1,552,989 Other non-operating expense 1,614,048 1,576,025 Share of profit of associates and joint ventures 504,063 986,611 Finance income 8,014,672 7,836,554 Finance costs 7,754,972 7,934,450 Profit before income tax 38,364,279 29,915,017 Income tax expense 7,889,515 6,069,732 Profit for the year 30,474,764 23,845,285 Profit attributable to owners of the parent 29,821,215 23,185,375 Profit attributable to non-controlling interests 653,549 659,910 Eamings per share for profit attributable to owners of the parent (in Korean Won) -Basic 197,841 154,020 -Diluted 197,800 153,950 Samsung Electronics Co., Ltd. and its subsidiaries CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (In millions of Korean won) For the year ended December 31, 2013 2012 KRW KRW Profit for the year 30,474,764 23,845,285 Other comprehensive income Items not to be reclassifled subsequently to profit or loss: Remeasurement of net defined benefit liabilities, net of tax (213,113) (504, 120) Items to be reclassified subsequently to profit or loss: Changes in value of available-for-sale financial assets, net of tax 186,480 962, 184 Share of other comprehensive income (loss) of associates and joint ventures, net of tax 20,756 (350,491) Foreign currency translation, net of tax (1,000,961) (1,824,653) Other comprehensive loss for the year, net of tax Total comprehensive income for the year Comprehensive income attributable to: (1,006,838) (1,717,080) 29,467,926 22,128,205 Owners of the parent 28,837,590 21,499,343 Non-controlling interests 630,336 628,862 Samsung Electronics Co., Ltd. and its subsidiaries CONSOLIDATED STATEMENTS OF CHANGES IN EQUITY Equity attributable components to owners of Noncontrolling the parent Other Retained earnings Preferred Сommon Share (In millions of Korean won) stock stock premium of equity interests Total Balance at January 1, 2012 Profit for the year 119,467 778,047 4,403,893 97,622,872 (5,833,896) 97,090,383 4,223,247 101,313,630 23,185,375 23,185,375 659,910 23,845,285 Changes in value of available-for-sake financial assets, net of tax 960,688 960,688 1,496 962,184 Share of other comprehensive los of associates and joint ventures, net of tax (350,491) (350,491) (350,491) Foreign currency translation, net of tax (1,789,877) (1,789,877) (34,776) (1,824,653) Remezsurement of net defined benefit liabilities, net of tax (506,351) (506,351) 2,231 (504,120) Total comprehensive income (loss) 23,185,375 (1,686,031) 21,499,344 628,861 22,128,205 Dividends (827,501) (827,501) (373,632) (1,201,133) Capital transaction under common control (1,089,835) (1,089,835) (104,395) (1,194,230) Changes in consolidated entities 12,844 12,844 Disposal of treasury stock 455,377 455,377 455,377 Stock option activities (33,071) (33,071) (33,071) Others 4,943 (5,588) (645) (771) (1,416) Total transactions with owners (822,558) (673,117) (1,495,675) (8,193,044) 117,094,052 (465,954) (1,961,629) Balance at December 31, 2012 119,467 778,047 4,403,893 119,985,689 4,386,154 121,480,206 Profit for the year 29,821,215 29,821,215 653,549 30,474,764 Changes in value of available-for-sake financial ssets, net of tax 187,477 187,477 (997) 186,480 Share of other comprebensive income (loss) of associates and joint ventures, net of tax 20,949 20,949 (193) 20,756 Foreign currency translation, net of tax (986,691) (986,691) (14,270) (1,000,961) Remessurement of net defined benefit liabilities, net of tax (205,360) (205,360) (7,753) (213,113) Total comprehensive income (loss) 29,821,215 (983,625) 28,837,590 630,336 29,467,926 Dividends (1,206,622) (1,206,622) (42,155) (1,248,777) Capital transaction under common control (312,959) (312,959) 600,042 287,083 Changes in consolidated entities (918) (918) Disposal of treasury stock 41,817 41,817 41,817 Stock option activities (11,999) k11.999) (11,999) Others 737 737 (65) 672 Total transactions with owners (1,206,622) (282,404) (1,489,026) 556,904 (932,122) Balance at December 31, 2013 119,467 778,047 4,403,893 148,600,282 (9,459,073) 144,442,616 5,573,394 150,016,010 |||||E Samsung Electronics Co., Ltd. and its subsidiaries CONSOLIDATED STATEMENTS OF CASH FLOWS (In millions of Korean won) For the year ended December 31, 2013 2012 KRW KRW Cash flows from operating activities Profit for the year 30,474,764 23,845,285 Adjustments 23,804,832 22,759,559 Changes in operating assets and liabilities (1,313,245) (5,777,949) Cash flows from operating activities 52,966,351 40,826,895 Interest received 1,034,074 789,397 Interest paid (434,857) (576,379) Dividend received 592,217 1,112,940 Income tax paid (7,450,345) (4,180,044) Net cash generated from operating activities 46,707,440 37,972,809 Cash flows from investing activities Net increase in short-tem financial instruments (19,391,643) (5,965,611) Net decrease (increase) in short-term available-for-sale financial assets 33,663 (589,072) Proceeds from disposal of long-tem available-for-sale financial assets 1,691,463 106,208 Acquisition of long-term available for-sale financial assets (1,531,356) (870,249) Proceeds from disposal of associates and joint ventures 240 41,091 Acquisition of associates and joint ventures (181,307) (279,022) Disposal of property and equipment 377,445 644,062 Purchases of property and equipment (23,157,587) (22,965,271) Disposal of intangible assets 4,562 61,497 Purchases of intangible assets Cash outflows from business combination (934,743) (650,884) (167,155) (464,279) Others (1,490,601) (390,024) Net cash used in investing activities Cash flows from financing activities (44,747,019) (31,321,554) Net repayment of short-term borrowings (1,861,536) (800,579) Disposal of treasury stock 34,390 88,473 Proceeds from long-term borrowings and debentures 26,672 1,862,256 Repayment of long-term borrowings and debentures Payment of dividends. (1,368,436) (522,899) (1,249,672) (1,265, 137) Net increase (decrease) in noncontrolling interests 281,551 (1,200, 134) Others (26,488) Net cash used in financing activities (4,137,031) (1,864,508) Effect of exchange rate changes on cash and cash equivalents (330,070) (687,048) Net increase (decrease) in cash and cash equivalents (2,506,680) 4,099,699 Cash and cash equi valents Beginning of the year End of the year 18,791,460 14,691,761 16,284,780 18,791,460

> Compute the debt-to-equity ratio for each of the following companies. Which company appears to have a riskier financing structure? Explain.

> On September 15, Krug Company purchased merchandise inventory from Makarov with an invoice price of $35,000 and credit terms of 2/10, n/30. Krug Company paid Makarov on September 28. Prepare any required journal entry (ies) for Krug Company (the purcha

> Murray Company borrows $340,000 cash from a bank and in return signs an installment note for five annual payments of equal amount, with the first payment due one year after the note is signed. Use Table B.3 in Appendix B to compute the amount of the an

> Prepare journal entries to record the following transactions for Emerson Corporation. July 15 Declared a cash dividend payable to common stockholders of $165,000. Aug. 15 Date of record is August 15 for the cash dividend declared on July 15. Aug. 31

> Prepare the journal entry to record Autumn Company’s issuance of 63,000 shares of no-par value common stock assuming the shares: a. Sell for $29 cash per share. b. Are exchanged for land valued at $1,827,000.

> Prepare the journal entry to record Zende Company’s issuance of 75,000 shares of $5 par value common stock assuming the shares sell for: a. $5 cash per share. b. $6 cash per share.

> Air France-KLM reports the following equity information for its fiscal year ended March 31, 2014 (euros in millions). Prepare its journal entry, using its account titles, to record the issuance of capital stock assuming that its entire par value stock wa

> The stockholders’ equity section of Montel Company’s balance sheet follows. The preferred stock’s call price is $40. Determine the book value per share of the common stock. Preferred stock-5% cum

> Epic Company earned net income of $900,000 this year. The number of common shares outstanding during the entire year was 400,000, and preferred shareholders received a $20,000 cash dividend. Compute Epic Company’s basic earnings per share.

> Murray Company reports net income of $770,000 for the year. It has no preferred stock, and its weighted average common shares outstanding is 280,000 shares. Compute its basic earnings per share.

> Stockholders’ equity of Ernst Company consists of 80,000 shares of $5 par value, 8% cumulative preferred stock and 250,000 shares of $1 par value common stock. Both classes of stock have been outstanding since the company’s inception. Ernst did not decla

> Stein agrees to pay Choi and Amal $10,000 each for a one-third (331⁄3%) interest in the Choi and Amal partnership. Immediately prior to Stein’s admission, each partner had a $30,000 capital balance. Make the journal entry to record Stein’s purchase of th

> On August 1, Gilmore Company purchased merchandise from Hendren with an invoice price of $60,000 and credit terms of 2/10, n/30. Gilmore Company paid Hendren on August 11. Prepare any required journal entry(ies) for Gilmore Company (the purchaser) on: (

> Jules and Johnson are partners, each with $40,000 in their partnership capital accounts. Kwon is admitted to the partnership by investing $40,000 cash. Make the entry to show Kwon’s admission to the partnership.

> Blake and Matthew are partners who agree that Blake will receive a $100,000 salary allowance and that any remaining income or loss will be shared equally. If Matthew’s capital account is credited for $2,000 as his share of the net income in a given perio

> Ann Stolton and Susie Bright are partners in a business they started two years ago. The partnership agreement states that Stolton should receive a salary allowance of $15,000 and that Bright should receive a $20,000 salary allowance. Any remaining income

> On September 11, 2014, Home Store sells a mower for $500 with a one-year warranty that covers parts. Warranty expense is estimated at 8% of sales. On July 24, 2015, the mower is brought in for repairs covered under the warranty requiring $35 in materials

> Chavez Co.’s salaried employees earn four weeks’ vacation per year. It pays $312,000.00 in total employee salaries for 52 weeks, but its employees work only 48 weeks. This means Chavez’s total weekly expense is $6,500 ($312,000/48 weeks) instead of the $

> Noura Company offers an annual bonus to employees if the company meets certain net income goals. Prepare the journal entry to record a $15,000 bonus owed to its workers (to be shared equally) at calendar year-end.

> On January 15, the end of the first biweekly pay period of the year, North Company’s payroll register showed that its employees earned $35,000 of sales salaries. Withholdings from the employees’ salaries include FICA Social Security taxes at the rate of

> Ticketsales, Inc., receives $5,000,000 cash in advance ticket sales for a four-date tour of Bon Jovi. Record the advance ticket sales on October 31. Record the revenue earned for the first concert date of November 5, assuming it represents one-fourth of

> Sera Corporation has made and recorded its quarterly income tax payments. After a final review of taxes for the year, the company identifies an additional $40,000 of income tax expense that should be recorded. A portion of this additional expense, $6,000

> The payroll records of Speedy Software show the following information about Marsha Gottschalk, an employee, for the weekly pay period ending September 30, 2015. Gottschalk is single and claims one allowance. Compute her Social Security tax (6.2%), Medica

> Biloxi Gifts uses a sales journal, a purchases journal, a cash receipts journal, a cash disbursements journal, and a general journal as illustrated in this chapter. Journalize its November transactions that should be recorded in the general journal. For

> Compute the times interest earned for Park Company, which reports income before interest expense and income taxes of $1,885,000 and interest expense of $145,000. Interpret its times interest earned (assume that its competitors average a times interest ea

> Assume a company’s equipment carries a book value of $16,000 ($16,500 cost less $500 accumulated depreciation) and a fair value of $14,750, and that the $1,250 decline in fair value in comparison to the book value meets the two-step impairment test. Prep

> On January 2, 2015, the Matthews Band acquires sound equipment for concert performances at a cost of $65,800. The band estimates it will use this equipment for four years. It estimates that after four years it can sell the equipment for $2,000. Matthews

> On January 2, 2015, the Matthews Band acquires sound equipment for concert performances at a cost of $65,800. The band estimates it will use this equipment for four years, during which time it anticipates performing about 200 concerts. It estimates that

> On January 2, 2015, the Matthews Band acquires sound equipment for concert performances at a cost of $65,800. The band estimates it will use this equipment for four years, during which time it anticipates performing about 200 concerts. It estimates that

> Listed below are certain costs (or discounts) incurred in the purchase or construction of new plant assets. (1) Indicate whether the costs should be expensed or capitalized (meaning they are included in the cost of the plant assets on the balance sheet).

> Aneko Company reports the following ($000s): net sales of $14,800 for 2015 and $13,990 for 2014; end-of-year total assets of $19,100 for 2015 and $17,900 for 2014. Compute its total asset turnover for 2015, and assess its level if competitors average a t

> On January 4 of this year, Diaz Boutique incurs a $105,000 cost to modernize its store. Improvements include new floors, ceilings, wiring, and wall coverings. These improvements are estimated to yield benefits for 10 years. Diaz leases its store and has

> Identify the following assets a through h as reported on the balance sheet as intangible assets (IA), natural resources (NR), or other (O). ______ a. Oil well ______ b. Trademark ______ c. Leasehold ______ d. Gold mine ______ e. Building ______ f. Copyri

> Perez Company acquires an ore mine at a cost of $1,400,000. It incurs additional costs of $400,000 to access the mine, which is estimated to hold 1,000,000 tons of ore. The estimated value of the land after the ore is removed is $200,000. 1. Prepare the

> Solstice Company determines on October 1 that it cannot collect $50,000 of its accounts receivable from its customer P. Moore. It uses the direct write-off method to record this loss as of October 1. On October 30, P. Moore unexpectedly paid his account

> Kegler Bowling installs automatic scorekeeping equipment with an invoice cost of $190,000. The electrical work required for the installation costs $20,000. Additional costs are $4,000 for delivery and $13,700 for sales tax. During the installation, a com

> On August 2, 2015, Jun Co. receives a $6,000, 90-day, 12% note from customer Ryan Albany as payment on his $6,000 account. Prepare Jun’s journal entry assuming the note is honored by the customer on October 31, 2015.

> Warner Company’s year-end unadjusted trial balance shows accounts receivable of $99,000, allowance for doubtful accounts of $600 (credit), and sales of $280,000. Uncollectibles are estimated to be 0.5% of sales. Prepare the December 31 year-end adjusting

> The following list describes aspects of either the allowance method or the direct write-off method to account for bad debts. For each item listed, indicate if the statement best describes either the allowance method or the direct write-off method. ______

> Record the sale by Balus Company of $125,000 in accounts receivable on May 1. Balus is charged a 2.5% factoring fee.

> Daw Company’s December 31 year-end unadjusted trial balance shows a $10,000 balance in Notes Receivable. This balance is from one 6% note dated December 1, with a period of 45 days. Prepare any necessary journal entries for December 31 and for the note’s

> Nolan Company deposits all cash receipts on the day when they are received and it makes all cash payments by check. At the close of business on June 30, 2015, its Cash account shows a $22,352 debit balance. Nolan’s June 30 bank statement shows $21,332 on

> Confucius Bookstore’s inventory is destroyed by a fire on September 5, 2015. The following data for year 2015 are available from the accounting records. Estimate the cost of the inventory destroyed. Jan. I inventory $190,000 Jan. I

> Endor Company begins the year with $140,000 of goods in inventory. At year-end, the amount in inventory has increased to $180,000. Cost of goods sold for the year is $1,200,000. Compute Endor’s inventory turnover and days’ sales in inventory. Assume that

> Refer to QS 7-6 and for each of the May transactions identify the journal in which it would be recorded. Assume the company uses a sales journal, purchases journal, cash receipts journal, cash disbursements journal, and general journal as illustrated in

> Solstice Company determines on October 1 that it cannot collect $50,000 of its accounts receivable from its customer P. Moore. Apply the direct write-off method to record this loss as of October 1.

> Ames Trading Co. has the following products in its ending inventory. Compute lower of cost or market for inventory applied separately to each product. Product Quantity Cost per Unit Market per Unit Mountain bikes .. $600 $550 Skateboards .... 13 350

> Refer to the information in QS 6-10 and assume the periodic inventory system is used. Determine the costs assigned to ending inventory when costs are assigned based on specific identification. Of the units sold, eight are from the December 7 purchase and

> Refer to Samsung’s financial statements in Appendix A. What percent of its current assets are inventory as of December 31, 2013 and 2012? Samsung’s Financial Statements from Appendix A: Samsung Electronics Co

> Refer to Apple’s financial statements in Appendix A and compute its cost of goods available for sale for the year ended September 28, 2013. Apple’s Financial Statements from Appendix A: Apple Inc. CONSOLIDATE

> Refer to Google’s financial statements in Appendix A. On December 31, 2013, what percent of current assets are represented by inventory? Google’s Financial Statements from Appendix A: Google Inc. CONSOLIDAT

> Refer to the information in QS 6-10 and assume the perpetual inventory system is used. Determine the costs assigned to ending inventory when costs are assigned based on specific identification. Of the units sold, eight are from the December 7 purchase an

> Peachtree Company uses a sales journal, a purchases journal, a cash receipts journal, a cash disbursements journal, and a general journal. The following transactions occur in the month of May. May 1 Purchased $10,100 of merchandise on credit from Kraus

> Nestlé, a Switzerland-based company, uses a sales journal, a purchases journal, a cash receipts journal, a cash disbursements journal, and a general journal in a manner similar to that explained in this chapter. Journalize the following summary transacti

> Refer to the information in QS 6-4 and assume the periodic inventory system is used. Determine the costs assigned to ending inventory when costs are assigned based on the LIFO method. (Round per unit costs and inventory amounts to cents.) Information fr

> Homestead Crafts, a distributor of handmade gifts, operates out of owner Emma Finn’s house. At the end of the current period, Emma reports she has 1,300 units (products) in her basement, 20 of which were damaged by water and cannot be sold. She also has

> A company reports the following beginning inventory and purchases for the month of January. On January 26, the company sells 350 units. 150 units remain in ending inventory at January 31. Required Assume the perpetual inventory system is used and then

> Refer to the information in QS 6-10 and assume the perpetual inventory system is used. Determine the costs assigned to ending inventory when costs are assigned based on the weighted average method. (Round per unit costs and inventory amounts to cents.)

> Refer to the information in QS 6-10 and assume the periodic inventory system is used. Determine the costs assigned to ending inventory when costs are assigned based on the weighted average method. (Round per unit costs and inventory amounts to cents.) D

> Refer to the information in QS 6-10 and assume the perpetual inventory system is used. Determine the costs assigned to ending inventory when costs are assigned based on the LIFO method. (Round per unit costs and inventory amounts to cents.) Data from QS

> Income statement information for adidas Group, a German footwear, apparel, and accessories manufacturer, for the year ended December 31, 2013, follows. The company applies IFRS, as adopted by the European Union, and reports its results in millions of eur

> Compute net sales, gross profit, and the gross margin ratio for each separate case a through d. Interpret the gross margin ratio for case a. a Sales $150,000 $550,000 $38,700 $255,700 Sales discounts 5,000 17,500 600 4,800 Sales returns and allowanc

> Identify similarities and differences between the acid-test ratio and the current ratio. Compare and describe how the two ratios reflect a company’s ability to meet its current obligations.

> Use the following information on current assets and current liabilities to compute and interpret the acid-test ratio. Explain what the acid-test ratio of a company measures. Prepaid expenses. Accounts payable . Cash $1,490 $ 700 .... .... Accounts r

> Trey Monson starts a merchandising business on December 1 and enters into the following three inventory purchases. Also, on December 15, Monson sells 15 units for $20 each. Required Monson uses a perpetual inventory system. Determine the costs assigned

> Refer to QS 5-8 and prepare journal entries to close the balances in temporary revenue and expense accounts. Remember to consider the entry for shrinkage that is made to solve QS 5-8. Data from QS 5-8: $ 37,800 $ 6,500 Merchandise inventory T. Nix,

> Identify events that might lead to disposal of a plant asset.

> Wattan Company reports beginning inventory of 10 units at $60 each. Every week for four weeks it purchases an additional 10 units at respective costs of $61, $62, $65, and $70 per unit for weeks 1 through 4. Calculate the cost of goods available for sale

> Prepare journal entries to record each of the following sales transactions of a merchandising company. Show supporting calculations and assume a perpetual inventory system. Apr. 1 Sold merchandise for $3,000, granting the customer terms of 2y10, EOM; in

> Refer to the information in QS 6-4 and assume the perpetual inventory system is used. Determine the costs assigned to ending inventory when costs are assigned based on the weighted average method. (Round per unit costs and inventory amounts to cents.) I

> Refer to the information in QS 6-4 and assume the perpetual inventory system is used. Determine the costs assigned to ending inventory when costs are assigned based on LIFO. (Round per unit costs and inventory amounts to cents.) Information from QS 6-4:

> Prepare journal entries to record each of the following purchases transactions of a merchandising company. Show supporting calculations and assume a perpetual inventory system. Nov. 5 Purchased 600 units of product at a cost of $10 per unit. Terms of th

> Use the following information (in random order) from a service company and from a merchandiser to compute net income. For the merchandiser, also compute gross profit, the goods available for sale, and the cost of goods sold. Krug Service Company Kl

> A car dealer acquires a used car for $14,000, terms FOB shipping point. Additional costs in obtaining and offering the car for sale include $250 for transportation-in, $900 for import duties, $300 for insurance during shipment, $150 for advertising, and

> Prepare journal entries for the following credit card sales transactions (the company uses the perpetual inventory system). 1. Sold $20,000 of merchandise, that cost $15,000, on MasterCard credit cards. The net cash receipts from sales are immediately de

> The following selected information is from Princeton Company’s comparative balance sheets. The company’s net income for the year ended December 31, 2015, was $48,000. 1. Compute the cash received from the sale of its

> The plant assets section of the comparative balance sheets of Anders Company is reported below. Refer to the balance sheet data above from Anders Company. During 2015, a building with a book value of $70,000 and an original cost of $300,000 was sold at

> If inventory errors are said to correct themselves, why are accounting users concerned when such errors are made?

> The plant assets section of the comparative balance sheets of Anders Company is reported below. Refer to the balance sheet data above from Anders Company. During 2015, equipment with a book value of $40,000 and an original cost of $210,000 was sold at

> Use the following information to determine this company’s cash flows from operating activities using the indirect method. MOSS COMPANY Selected Balance Sheet Information December 31, 2015 and 2014 2015 2014 Current assets Cash ...

> For each of the following three separate cases X, Y and Z, compute cash flows from operations using the indirect method. The list includes all balance sheet accounts related to cash from operating activities. Case X Case Y Case Z Net income $ 4,000

> Answer each of the following questions related to international accounting standards. 1. Which method, indirect or direct, is acceptable for reporting operating cash flows under IFRS? 2. For each of the following four cash flows, identify whether it is r

> Use the following financial statements and additional information to (1) prepare a statement of cash flows for the year ended December 31, 2016, using the indirect method, and (2) analyze and briefly discuss the statement prepared in part 1 with specia

> When a spreadsheet for a statement of cash flows is prepared, all changes in noncash balance sheet accounts are fully explained on the spreadsheet. Explain how these noncash balance sheet accounts are used to fully account for cash flows on a spreadsheet

> Refer to the data in QS 16-11. Use the direct method to prepare the cash provided or used from operating activities section only of the statement of cash flows for this company. Data from QS 16-11: CRUZ, INC. Comparative Balance Sheets December 31

> Refer to the data in QS 16-11. 1. How much cash is paid to acquire inventory during year 2015? 2. How much cash is paid for operating expenses during year 2015? Data from QS 16-11: CRUZ, INC. Comparative Balance Sheets December 31, 2015 2015 2014

> Refer to the data in QS 16-11. 1. Assume that all common stock is issued for cash. What amount of cash dividends is paid during 2015? 2. Assume that no additional notes payable are issued in 2015. What cash amount is paid to reduce the notes payable bala

> Refer to the data in QS 16-11. Furniture costing $55,000 is sold at its book value in 2015. Acquisitions of furniture total $45,000 cash, on which no depreciation is necessary because it is acquired at year-end. What is the cash inflow related to the sal

> Does the balance in the Accumulated Depreciation— Machinery account represent funds to replace the machinery when it wears out? If not, what does it represent?

> Use the following balance sheets and income statement to answer this. Required Use the indirect method to prepare the cash provided or used from operating activities section only of the statement of cash flows for this company. CRUZ, INC. Comparat

> During the current year, Reed Consulting Group acquired long-term available-for-sale securities at a $70,000 cost. At its December 31 year-end, these securities had a fair value of $58,000. This is the first and only time the company purchased such secur

> Hiker Company completes the following transactions during the current year. Prepare the May 9 and June 2 journal entries and the December 31 adjusting entry. This is the first and only time the company purchased such securities. May 9 Purchases 200 share

> Journ Co. purchased short-term investments in available-for-sale securities at a cost of $50,000 on November 25, 2015. At December 31, 2015, these securities had a fair value of $47,000. This is the first and only time the company has purchased such secu

> Kitty Company began operations in 2014 and maintains short-term investments in trading securities. The year-end cost and fair values for its portfolio of these investments follow. Prepare journal entries to record each December 31 year-end fair value adj

> The Carrefour Group reports the following description of its trading securities (titled “financial assets reported at fair value in the income statement”). Carrefour’s financial statements report &a

> Return on total assets can be separated into two important components. 1. Write the formula to separate the return on total assets into its two basic components. 2. Explain how these components of the return on total assets are helpful to financial state

> Complete the following descriptions by filling in the blanks. 1. Equity securities giving an investor significant influence are accounted for using the ______ ______. 2. Available-for-sale debt securities are reported on the balance sheet at ______ _____

> Montero Co. holds 100,000 common shares (40%) of ORD Corp. as a long-term investment. ORD Corp. paid a $100,000 dividend on November 1, 2015, and reported a net income of $700,000 for 2015. Prepare Montero’s entries to record (a) the receipt of the divi

> On May 20, 2015, Montero Co. paid $1,000,000 to acquire 25,000 common shares (10%) of ORD Corp. as a long-term investment. On August 5, 2016, Montero sold one-half of these shares for $625,000. What valuation method should be used to account for this sto

> Why does the Bad Debts Expense account usually not have the same adjusted balance as the Allowance for Doubtful Accounts?