Question: Refer to the financial statements of Samsung

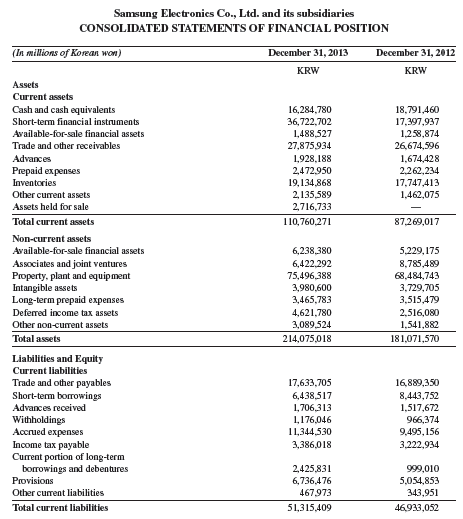

Refer to the financial statements of Samsung in Appendix A. What does Samsung title its accounts receivable on its consolidated balance sheet? What are Samsung’s accounts receivable at December 31, 2013?

Samsung’s financial statements from Appendix A:

Transcribed Image Text:

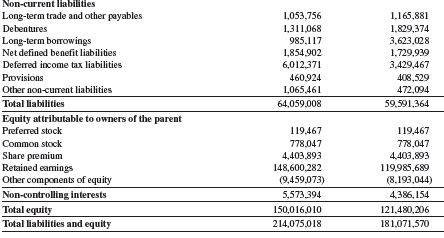

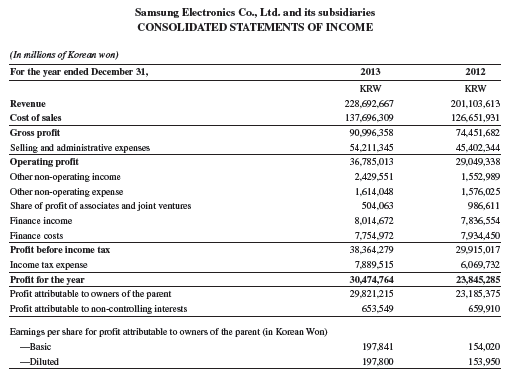

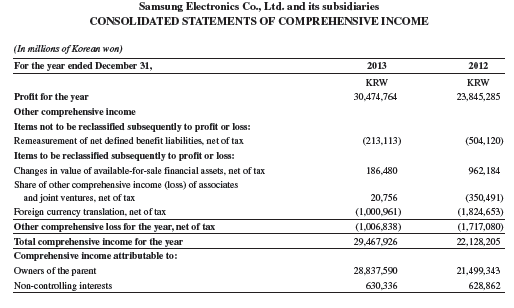

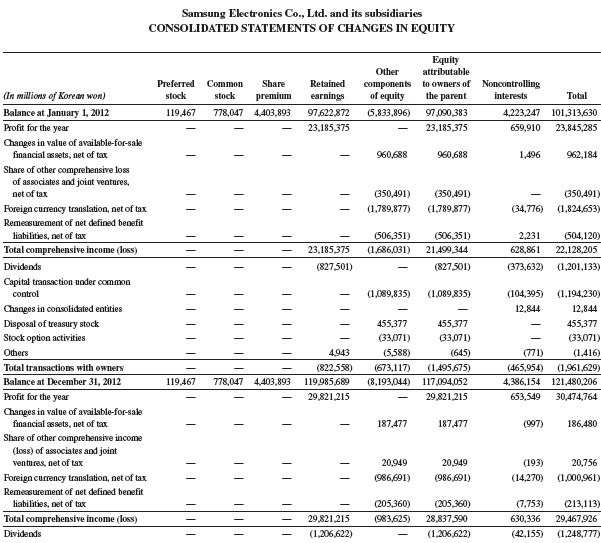

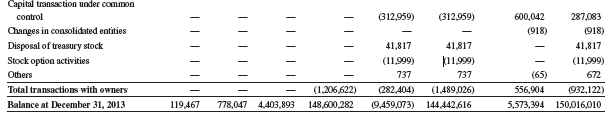

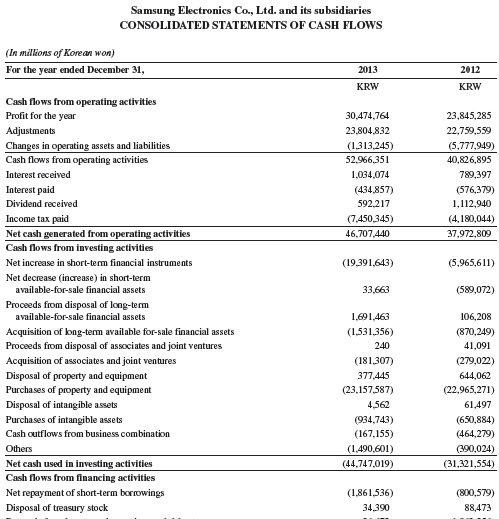

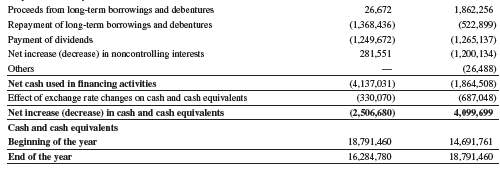

Samsung Electronics Co., Ltd. and its subsidiaries CONSOLIDATED STATEMENTS OF FINANCIAL POSITION (In millions of Korean won) December 31, 2013 December 31, 2012 KRW KRW Assets Current assets Cash and cash equivalents Short-term financial instruments 16,284,780 36,722,702 1,488,527 27,875,934 18,791,460 17,397,937 1,258,874 26,674,596 Available-for-sale financial assets Trade and other receivables Advances 1,928,188 2,472,950 19,134,868 2,135,589 1,674,428 2,262,234 Prepaid expenses Inventories 17,747,413 1,462,075 Other current assets Assets held for sale 2,716,733 Total current assets 110,760,271 87,269,017 Non-current assets Available-for-sale financial assets 6,238,380 5,229,175 Associates and joint ventures Property, plant and equipment Intangible assets Long-term prepaid expenses 6,422,292 75,496,388 3,980,600 3,465,783 4,621,780 8,785,489 68,484,743 3,729,705 3,515,479 2,516,080 Deferred income tax assets Other non-curent assets 3,089,524 1,541,882 Total assets 214,075,018 181,071,570 Liabilities and Equity Current liabilities Trade and other payables 17,633,705 16,889,350 Short-term borrowings 8,443,752 6,438,517 1,706,313 1,176,046 11,344,530 Advances received Withholdings Accrued expenses Income tax payable Current portion of long-term borrowings and debentures 1,517,672 966,374 9,495, 156 3,222,934 3,386,018 2,425,831 6,736,476 999,010 5,054,853 343,951 Provisions Other current liabilities 467,973 Total current liabilities 51,315,409 46,933,052 Non-current Iliabilities Long-term trade and other payables 1,053,756 1,165,881 debentures 1,311,068 1,829,374 3,623,028 1,729,939 3,429,467 Long-term borowings 985,117 Net defined benefit liabilities 1,854,902 6,012,371 Deferred income tax liabilities Provisions 460,924 408,529 472,094 Other non-curent liabilities 1,065,461 Total liabilities 64,059,008 59,591,364 Equity attributable to owners of the parent Preferred stock 119,467 119,467 Common stock 778,047 Share premium Retained eamings Other components of equity 4,403,893 148,600,282 (9,459,073) 778,047 4,403,893 119,985,689 (8,193,044) Non-controlling interests 5,573,394 4,386, 154 Total equity 150,016,010 121,480,206 Total liabilities and equity 214,075,018 181,071,570 Samsung Electronics Co., Ltd. and its subsidiaries CONSOLIDATED STATEMENTS OF INCOME (In millions of Korean won) For the year ended December 31, 2013 2012 KRW KRW Revenue 228,692,667 201,103,613 Cost of sales 137,696,309 126,651,931 Gross profit Selling and administrative expenses Operating profit 90,996,358 74,451,682 54,211,345 45,402,344 36,785,013 29,049,338 Other non-operating income 2,429,551 1,552,989 Other non-operating expense 1,614,048 1,576,025 Share of profit of associates and joint ventures 504,063 986,611 Finance income 8,014,672 7,836,554 Finance costs 7,754,972 7,934,450 Profit before income tax 38,364,279 29,915,017 Income tax expense 7,889,515 6,069,732 Profit for the year 30,474,764 23,845,285 Profit attributable to owners of the parent 29,821,215 23,185,375 Profit attributable to non-controlling interests 653,549 659,910 Eamings per share for profit attributable to owners of the parent (in Korean Won) -Basic 197,841 154,020 -Diluted 197,800 153,950 Samsung Electronics Co., Ltd. and its subsidiaries CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (In millions of Korean won) For the year ended December 31, 2013 2012 KRW KRW Profit for the year 30,474,764 23,845,285 Other comprehensive income Items not to be reclassifled subsequently to profit or loss: Remeasurement of net defined benefit liabilities, net of tax (213,113) (504, 120) Items to be reclassified subsequently to profit or loss: Changes in value of available-for-sale financial assets, net of tax 186,480 962, 184 Share of other comprehensive income (loss) of associates and joint ventures, net of tax 20,756 (350,491) Foreign currency translation, net of tax (1,000,961) (1,824,653) Other comprehensive loss for the year, net of tax Total comprehensive income for the year Comprehensive income attributable to: (1,006,838) (1,717,080) 29,467,926 22,128,205 Owners of the parent 28,837,590 21,499,343 Non-controlling interests 630,336 628,862 Samsung Electronics Co., Ltd. and its subsidiaries CONSOLIDATED STATEMENTS OF CHANGES IN EQUITY Equity attributable components to owners of Noncontrolling the parent Other Retained earnings Preferred Сommon Share (In millions of Korean won) stock stock premium of equity interests Total Balance at January 1, 2012 Profit for the year 119,467 778,047 4,403,893 97,622,872 (5,833,896) 97,090,383 4,223,247 101,313,630 23,185,375 23,185,375 659,910 23,845,285 Changes in value of available-for-sake financial assets, net of tax 960,688 960,688 1,496 962,184 Share of other comprehensive los of associates and joint ventures, net of tax (350,491) (350,491) (350,491) Foreign currency translation, net of tax (1,789,877) (1,789,877) (34,776) (1,824,653) Remezsurement of net defined benefit liabilities, net of tax (506,351) (506,351) 2,231 (504,120) Total comprehensive income (loss) 23,185,375 (1,686,031) 21,499,344 628,861 22,128,205 Dividends (827,501) (827,501) (373,632) (1,201,133) Capital transaction under common control (1,089,835) (1,089,835) (104,395) (1,194,230) Changes in consolidated entities 12,844 12,844 Disposal of treasury stock 455,377 455,377 455,377 Stock option activities (33,071) (33,071) (33,071) Others 4,943 (5,588) (645) (771) (1,416) Total transactions with owners (822,558) (673,117) (1,495,675) (8,193,044) 117,094,052 (465,954) (1,961,629) Balance at December 31, 2012 119,467 778,047 4,403,893 119,985,689 4,386,154 121,480,206 Profit for the year 29,821,215 29,821,215 653,549 30,474,764 Changes in value of available-for-sake financial ssets, net of tax 187,477 187,477 (997) 186,480 Share of other comprebensive income (loss) of associates and joint ventures, net of tax 20,949 20,949 (193) 20,756 Foreign currency translation, net of tax (986,691) (986,691) (14,270) (1,000,961) Remessurement of net defined benefit liabilities, net of tax (205,360) (205,360) (7,753) (213,113) Total comprehensive income (loss) 29,821,215 (983,625) 28,837,590 630,336 29,467,926 Dividends (1,206,622) (1,206,622) (42,155) (1,248,777) Capital transaction under common control (312,959) (312,959) 600,042 287,083 Changes in consolidated entities (918) (918) Disposal of treasury stock 41,817 41,817 41,817 Stock option activities (11,999) k11.999) (11,999) Others 737 737 (65) 672 Total transactions with owners (1,206,622) (282,404) (1,489,026) 556,904 (932,122) Balance at December 31, 2013 119,467 778,047 4,403,893 148,600,282 (9,459,073) 144,442,616 5,573,394 150,016,010 |||||E Samsung Electronics Co., Ltd. and its subsidiaries CONSOLIDATED STATEMENTS OF CASH FLOWS (In millions of Korean won) For the year ended December 31, 2013 2012 KRW KRW Cash flows from operating activities Profit for the year 30,474,764 23,845,285 Adjustments 23,804,832 22,759,559 Changes in operating assets and liabilities (1,313,245) (5,777,949) Cash flows from operating activities 52,966,351 40,826,895 Interest received 1,034,074 789,397 Interest paid (434,857) (576,379) Dividend received 592,217 1,112,940 Income tax paid (7,450,345) (4,180,044) Net cash generated from operating activities 46,707,440 37,972,809 Cash flows from investing activities Net increase in short-tem financial instruments (19,391,643) (5,965,611) Net decrease (increase) in short-term available-for-sale financial assets 33,663 (589,072) Proceeds from disposal of long-tem available-for-sale financial assets 1,691,463 106,208 Acquisition of long-term available for-sale financial assets (1,531,356) (870,249) Proceeds from disposal of associates and joint ventures 240 41,091 Acquisition of associates and joint ventures (181,307) (279,022) Disposal of property and equipment 377,445 644,062 Purchases of property and equipment (23,157,587) (22,965,271) Disposal of intangible assets 4,562 61,497 Purchases of intangible assets Cash outflows from business combination (934,743) (650,884) (167,155) (464,279) Others (1,490,601) (390,024) Net cash used in investing activities Cash flows from financing activities (44,747,019) (31,321,554) Net repayment of short-term borrowings (1,861,536) (800,579) Disposal of treasury stock 34,390 88,473 Proceeds from long-term borrowings and debentures 26,672 1,862,256 Repayment of long-term borrowings and debentures Payment of dividends. (1,368,436) (522,899) (1,249,672) (1,265, 137) Net increase (decrease) in noncontrolling interests 281,551 (1,200, 134) Others (26,488) Net cash used in financing activities (4,137,031) (1,864,508) Effect of exchange rate changes on cash and cash equivalents (330,070) (687,048) Net increase (decrease) in cash and cash equivalents (2,506,680) 4,099,699 Cash and cash equi valents Beginning of the year End of the year 18,791,460 14,691,761 16,284,780 18,791,460

> After researching Valero Energy common stock, Sandra Pearson is convinced the stock is overpriced. She contacts her account executive and arranges to sell short 300 shares of Valero Energy. At the time of the sale, a share of common stock had a value o

> Bob Orleans invested $3,000 and borrowed $3,000 to purchase shares in Verizon Communications. At the time of his investment, Verizon was selling for $45 a share. a. If Bob paid a $30 commission, how many shares could he buy if he used only his own money

> For four years, Marty Campbell invested $4,000 each year in Harley Davidson. The stock was selling for $36 in 2011, $45 in 2012, $52 in 2013, and $70 in 2014. a. What is Marty’s total investment in Harley Davidson? b. After four years, how many shares do

> Three years ago, James Matheson bought 200 shares of a mutual fund for $23 a share. During the three-year period, he received total income dividends of $0.92 per share. He also received total capital gain distributions of $0.80 per share. At the end o

> Jason Mathews purchased 300 shares of the Hodge & Mattox Energy fund. Each share cost $14.15. Fifteen months later, he decided to sell his shares when the share value reached $17.10. a. What is the amount of his total initial investment? b. What was

> The Yamaha Aggressive Growth fund has a 1.83 percent expense ratio. a. If you invest $55,000 in this fund, what is the dollar amount of fees that you would pay this year? b. Based on the information in this chapter and your own research, is this a low,

> Analysts that follow JP Morgan Chase, one of the nation’s largest providers of financial services, estimate that the corporation’s earnings per share will increase from $5.56 in the current year to $6.12 next year. a. What is the amount of the increase

> Michelle Townsend owns stock in National Computers. Based on information in its annual report, National Computers has reported after-tax earnings of $9,700,000 and has issued 7,000,000 shares of common stock. The stock is currently selling for $32 a sh

> Ruby is 25 and has a good job at a biotechnology company. She currently has $10,000 in an IRA, an important part of her retirement nest egg. She believes her IRA will grow at an annual rate of 8 percent, and she plans to leave it untouched until she ret

> 1. It has been suggested by Jamie Lee and Ross’ professional investment counselor to perform a financial check-up as the first step in investing in mutual funds, even though they are investing $50,000 that was inherited from Ross’ late uncle’s estate. I

> Wanda Sotheby purchased 120 shares of Home Depot stock at $82 a share. One year later, she sold the stock for $74 a share. She paid her broker a $34 commission when she purchased the stock and a $39 commission when she sold it. During the 12 months sh

> Sarah and James Hernandez purchased 140 shares of Macy's stock at $57 a share. One year later, they sold the stock for $61 a share. They paid a broker $8 commission when they purchased the stock and a $12 commission when they sold the stock. During th

> The Western Capital Growth mutual fund has Total assets: $750,000,000 Total liabilities: $7,200,000 Total number of shares: 24,000,000 What is the fund’s net asset value (NAV)?

> Over a four-year period, LaKeisha Thompson purchased shares in the Oakmark I Fund. Using the following information, answer the questions that follow. You may want to review the concept of dollar cost averaging in Chapter 12 before completing this probl

> Assume that one year ago, you bought 120 shares of a mutual fund for $33 a share, you received a $0.60 per-share capital gain distribution during the past 12 months, and the market value of the fund is now $38 a share. a. Calculate the total return for y

> Prepare a chart that describes the similarities among the long-term and short-term investment strategies described in this chapter.

> Choose either the Invesco Charter (symbol CHTRX) mutual fund or the Fidelity Fifty (symbol FFTYX) mutual fund. Then describe how each of the following sources of information could help you evaluate one of these funds. a. The Internet b. Professional

> What is the difference between the dividend yield and total return calculations that were described in this chapter?

> Explain the relationship between earnings per share, projected earnings, and the market price for a share of stock.

> 1. Corporations sell common stock to finance their business start-up costs and help pay for expansion and their ongoing business activities. 2. A corporation must pay dividends to stockholders. 3. The record date is the date when a stockholder must be r

> 1. You can’t predict exactly how much money you’ll need when you retire 2. Social Security is an important source of retirement income for most Americans. 3. A defined-contribution plan does not guarantee any particular benefit at retirement. 4 .An execu

> 1. The major reasons why investors purchase mutual funds are professional management and diversification. 2. Shares in a closed-end mutual fund are issued by the investment company only when the fund is organized. 3. Typically, the management fee for a m

> 1. Who elects a corporation’s board of directors? a. Preferred stockholders b. Common stockholders c. The corporation’s top executives d. The corporation’s employees 2. A stock split a. always guarantees that the investor will make money. b. enables man

> 1. The first step in retirement planning is to a. estimate your spending needs. b. estimate the inflation rate. c. evaluate your planned retirement income. d. analyze your current assets and liabilities. 2. Under what retirement plan does your employer

> 1. A mutual fund in which new shares are issued and redeemed by the investment company at the request of investors is called a (n) ____________ fund. a. closed end b. open-end c. load d. no-load 2. Some mutual funds charge 12b-1 fees to defray the cost

> What is the major difference between a regular IRA and a Roth IRA?

> What are the most popular personal retirement plans?

> What are the two basic types of employer pension plans?

> What are four major sources of retirement income?

> In your own words, describe how an investment in common stock could help you obtain your investment goals.

> 1. What is the benefit to Jamie Lee and Ross investing in a company’s IPO? Will they be guaranteed a large return from this investment? At this life stage, would you recommend that Jamie Lee and Ross invest in an IPO? Why? 2. Jamie Lee’s father suggest

> Entering an Industry: A firm (player 1) is considering entering an established industry with one incumbent firm (player 2). Player 1 must choose whether to enter or to not enter the industry. If player 1 enters the industry then player 2 can either accom

> Continuous all pay auction: Consider an all-pay auction for a good worth 1 to each of the two bidders. Each bidder can choose to offer a bid from the unit interval so that Si = [0, 1]. Players only care about the expected value they will e

> Brothers: Consider the following game that proceeds in two steps: In the first stage one brother (player 2) has two $10 bills and can choose one of two options: he can give his younger brother (player 1) $20, or give him one of the $10 bills (giving noth

> Market entry: There are 3 firms that are considering entering a new market. The payoff for each firm that enters is 150 / n where n is the number of firms that enter. The cost of entering is 62. (a) Find all the pure strategy Nash equilibria. (b) Find the

> Mutually Assured Destruction (revisited): Consider the game in section 8.3.3. (a) Find the mixed strategy equilibrium of the war stage game and argue that it is unique. (b) What is the unique sub-game perfect equilibrium that includes the mixed strategy

> Declining Industry: Consider two competing firms in a declining indus- try that cannot support both firms profitably. Each firm has three possible choices as it must decide whether or not to exit the industry immediately, at the end of this quarter, or a

> Centipedes: Imagine a two player game that proceeds as follows. A pot of money is created with $6 in it initially. Player 1 moves first, then player 2, then player 1 again and finally player 2 again. At each player’s turn to move, he has two possible act

> Monitoring: An employee (player 1) who works for a boss (player 2) can either work (W) or shirk (S), while his boss can either monitor the employee (M) or ignore him (I). Like most employee-boss relationships, if the employee is working then the boss pre

> Strategies and equilibrium: Consider a two player game in which player 1 can choose A or B. The game ends if he chooses A while it continues to player 2 if he chooses B. Player 2 can then choose C or D, with the game ending after C and continuing again w

> Entry Deterrence 1: NSG is considering entry into the local phone market in the Bay Area. The incumbent S&P, predicts that a price war will result if NSG enters. If NSG stays out, S&P earns monopoly profits valued at $10 million (net present value, or NP

> Investment in the Future: Consider two firms that play a Cournot competition game with demand p = 100 − q, and costs for each firm given by ci (qi) = 10qi. Imagine that before the two firms play the Cournot game, firm 1 can invest in cost reduction. If i

> The Value of Commitment: Consider the three period example of a player with hyperbolic discounting described in section 8.3.4 with ln(x) utility in each of the three periods and with discount factors = 1 and = 1/2. We solved the optimal consumption p

> The Industry Leader: Three oligopolists operate in a market with inverse demand given by P (Q) = a−Q, where Q = q1+q2+q3, and qi is the quantity produced by firm i. Each firm has a constant marginal cost of production, c and no fixed cost. The firms choo

> Hyperbolic Discounting: Consider the three period example of a player with hyperbolic discounting described in section 8.3.4 with ln(x) utility in each of the three periods and with discount factors 0 < < 1 and 0 < < 1 (a) Solve the optimal choice o

> Agenda Setting: An agenda-setting game is described as follows. The “issue space” (set of possible policies) is an interval X = [0, 5]. An Agenda Setter (player 1) proposes an alternative x ∈ X against the status quo q = 4 After player 1 proposes x, the

> The Tax Man: A citizen (player 1) must choose whether or not to file taxes honestly or whether to cheat. The tax man (player 2) decides how much effort to invest in auditing and can choose ∈ [0, 1], and the cost to the tax man of investing at level

> Playing it safe: Consider the following dynamic game: Player 1 can choose to play it safe (denote this choice by S), in which case both he and player 2 get a payoff of 3 each, or he can risk playing a game with player 2 (denote this choice

> Let i be a mixed strategy of player i that puts positive weight on one strictly dominated pure strategy. Show that there exists a mixed strategy ’i that puts no weight on any dominated pure strategy and that dominates i.

> Compute Topp Company’s price-earnings ratio if its common stock has a market value of $20.54 per share and its EPS is $3.95. Would an analyst likely consider this stock potentially overpriced, underpriced, or neither? Explain.

> Refer to the information in QS 6-4 and assume the periodic inventory system is used. Determine the costs assigned to ending inventory when costs are assigned based on the weighted average method. (Round per unit costs and inventory amounts to cents.)

> Nix’It Company’s ledger on July 31, its fiscal year-end, includes the following selected accounts that have normal balances (Nix’It uses the perpetual inventory system). A physical count of its July

> Refer to the information in QS 6-4 and assume the periodic inventory system is used. Determine the costs assigned to ending inventory when costs are assigned based on the FIFO method. (Round per unit costs and inventory amounts to cents.) Information fr

> Refer to QS 5-7 and prepare journal entries to record each of the merchandising transactions assuming that the periodic inventory system is used. Data from QS 5-7: Apr. 1 Sold merchandise for $3,000, granting the customer terms of 2y10, EOM; invoice dat

> Refer to QS 5-4 and prepare journal entries to record each of the merchandising transactions assuming that the periodic inventory system is used. Data from QS 5-4: Nov. 5 Purchased 600 units of product at a cost of $10 per unit. Terms of the sale are 2/

> Refer to the balance sheet of Google in Appendix A. Does it use the direct write-off method or allowance method in accounting for its accounts receivable? What is the realizable value of its receivables balance as of December 31, 2013? Googleâ

> Refer to the information in QS 6-10 and assume the periodic inventory system is used. Determine the costs assigned to ending inventory when costs are assigned based on the LIFO method. (Round per unit costs and inventory amounts to cents.) Data from QS

> Refer to the information in QS 6-10 and assume the periodic inventory system is used. Determine the costs assigned to ending inventory when costs are assigned based on the FIFO method. (Round per unit costs and inventory amounts to cents.) Data from QS

> Label the following headings, line items, and notes with the numbers 1 through 13 according to their sequential order (from top to bottom) for presentation of the statement of cash flows. a. “Cash flows from investing activities” title b. “For period End

> Refer to the data in QS 16-11. 1. How much cash is received from sales to customers for year 2015? 2. What is the net increase or decrease in cash for year 2015? Data from QS 16-11: CRUZ, INC. Comparative Balance Sheets December 31, 2015 2015 2014

> Classify the following cash flows as either operating, investing, or financing activities. ______ 1. Sold long-term investments for cash. ______ 2. Received cash payments from customers. ______ 3. Paid cash for wages and salaries. ______ 4. Purchased

> On February 1, 2015, Garzon purchased 6% bonds issued by PBS Utilities at a cost of $40,000, which is their par value. The bonds pay interest semiannually on July 31 and January 31. For 2015, prepare entries to record Garzon’s July 31 receipt of interest

> Prepare Hertog Company’s journal entries to reflect the following transactions for the current year. May 7 Purchases 200 shares of Kraft stock as a short-term investment in trading securities at a cost of $50 per share plus $300 in broker fees. June 6

> On April 18, Riley Co. made a short-term investment in 300 common shares of XLT Co. The purchase price is $42 per share and the broker’s fee is $250. The intent is to actively manage these shares for profit. On May 30, Riley Co. receives $1 per share fro

> On March 1, 2015, a U.S. company made a credit sale requiring payment in 30 days from a Malaysian company, Hamac Sdn. Bhd., in 20,000 Malaysian ringgits. Assuming the exchange rate between Malaysian ringgits and U.S. dollars is $0.4538 on March 1 and $0.

> A U.S. company sells a product to a British company with the transaction listed in British pounds. On the date of the sale, the transaction total of $14,500 is billed as £10,000, reflecting an exchange rate of 1.45 (that is, $1.45 per pound). Prepare the

> Refer to the financial statements and notes of Apple in Appendix A. In its presentation of accounts receivable on the balance sheet, how does it title accounts receivable? What does it report for its allowance as of September 28, 2013? Appleâ€

> The return on total assets is the focus of analysts, creditors, and other users of financial statements. 1. How is the return on total assets computed? 2. What does this important ratio reflect?

> On July 1, 2015, Advocate Company exercises an $8,000 call option (plus par value) on its outstanding bonds that have a carrying value of $416,000 and par value of $400,000. The company exercises the call option after the semiannual interest is paid on J

> Garcia Company issues 10%, 15-year bonds with a par value of $240,000 and semiannual interest payments. On the issue date, the annual market rate for these bonds is 8%, which implies a selling price of 117 1⁄4. Prepare the journal entry for the issuance

> Enviro Company issues 8%, 10-year bonds with a par value of $250,000 and semiannual interest payments. On the issue date, the annual market rate for these bonds is 10%, which implies a selling price of 87 1⁄2. Prepare the journal entries for the issuance

> Algoma, Inc., signs a five-year lease for office equipment with Office Solutions. The present value of the lease payments is $15,499. Prepare the journal entry that Algoma records at the inception of this capital lease.

> Jin Li, an employee of ETrain.com, leases a car at O’Hare airport for a three-day business trip. The rental cost is $250. Prepare the entry by ETrain.com to record Jin Li’s short-term car lease cost.

> Madrid Company plans to issue 8% bonds on January 1, 2015, with a par value of $4,000,000. The company sells $3,600,000 of the bonds on January 1, 2015. The remaining $400,000 sells at par on March 1, 2015. The bonds pay interest semiannually as of June

> Garcia Company issues 10%, 15-year bonds with a par value of $240,000 and semiannual interest payments. On the issue date, the annual market rate for these bonds is 8%, which implies a selling price of 117 1⁄4. The effective interest method is used to al

> Garcia Company issues 10%, 15-year bonds with a par value of $240,000 and semiannual interest payments. On the issue date, the annual market rate for these bonds is 14%, which implies a selling price of 75 1⁄4. The effective interest method is used to al

> Compute the debt-to-equity ratio for each of the following companies. Which company appears to have a riskier financing structure? Explain.

> On September 15, Krug Company purchased merchandise inventory from Makarov with an invoice price of $35,000 and credit terms of 2/10, n/30. Krug Company paid Makarov on September 28. Prepare any required journal entry (ies) for Krug Company (the purcha

> Murray Company borrows $340,000 cash from a bank and in return signs an installment note for five annual payments of equal amount, with the first payment due one year after the note is signed. Use Table B.3 in Appendix B to compute the amount of the an

> Prepare journal entries to record the following transactions for Emerson Corporation. July 15 Declared a cash dividend payable to common stockholders of $165,000. Aug. 15 Date of record is August 15 for the cash dividend declared on July 15. Aug. 31

> Prepare the journal entry to record Autumn Company’s issuance of 63,000 shares of no-par value common stock assuming the shares: a. Sell for $29 cash per share. b. Are exchanged for land valued at $1,827,000.

> Prepare the journal entry to record Zende Company’s issuance of 75,000 shares of $5 par value common stock assuming the shares sell for: a. $5 cash per share. b. $6 cash per share.

> Air France-KLM reports the following equity information for its fiscal year ended March 31, 2014 (euros in millions). Prepare its journal entry, using its account titles, to record the issuance of capital stock assuming that its entire par value stock wa

> The stockholders’ equity section of Montel Company’s balance sheet follows. The preferred stock’s call price is $40. Determine the book value per share of the common stock. Preferred stock-5% cum

> Epic Company earned net income of $900,000 this year. The number of common shares outstanding during the entire year was 400,000, and preferred shareholders received a $20,000 cash dividend. Compute Epic Company’s basic earnings per share.

> Murray Company reports net income of $770,000 for the year. It has no preferred stock, and its weighted average common shares outstanding is 280,000 shares. Compute its basic earnings per share.

> Stockholders’ equity of Ernst Company consists of 80,000 shares of $5 par value, 8% cumulative preferred stock and 250,000 shares of $1 par value common stock. Both classes of stock have been outstanding since the company’s inception. Ernst did not decla

> Stein agrees to pay Choi and Amal $10,000 each for a one-third (331⁄3%) interest in the Choi and Amal partnership. Immediately prior to Stein’s admission, each partner had a $30,000 capital balance. Make the journal entry to record Stein’s purchase of th

> On August 1, Gilmore Company purchased merchandise from Hendren with an invoice price of $60,000 and credit terms of 2/10, n/30. Gilmore Company paid Hendren on August 11. Prepare any required journal entry(ies) for Gilmore Company (the purchaser) on: (

> Jules and Johnson are partners, each with $40,000 in their partnership capital accounts. Kwon is admitted to the partnership by investing $40,000 cash. Make the entry to show Kwon’s admission to the partnership.

> Blake and Matthew are partners who agree that Blake will receive a $100,000 salary allowance and that any remaining income or loss will be shared equally. If Matthew’s capital account is credited for $2,000 as his share of the net income in a given perio

> Ann Stolton and Susie Bright are partners in a business they started two years ago. The partnership agreement states that Stolton should receive a salary allowance of $15,000 and that Bright should receive a $20,000 salary allowance. Any remaining income

> On September 11, 2014, Home Store sells a mower for $500 with a one-year warranty that covers parts. Warranty expense is estimated at 8% of sales. On July 24, 2015, the mower is brought in for repairs covered under the warranty requiring $35 in materials

> Chavez Co.’s salaried employees earn four weeks’ vacation per year. It pays $312,000.00 in total employee salaries for 52 weeks, but its employees work only 48 weeks. This means Chavez’s total weekly expense is $6,500 ($312,000/48 weeks) instead of the $

> Noura Company offers an annual bonus to employees if the company meets certain net income goals. Prepare the journal entry to record a $15,000 bonus owed to its workers (to be shared equally) at calendar year-end.

> On January 15, the end of the first biweekly pay period of the year, North Company’s payroll register showed that its employees earned $35,000 of sales salaries. Withholdings from the employees’ salaries include FICA Social Security taxes at the rate of

> Ticketsales, Inc., receives $5,000,000 cash in advance ticket sales for a four-date tour of Bon Jovi. Record the advance ticket sales on October 31. Record the revenue earned for the first concert date of November 5, assuming it represents one-fourth of

> Sera Corporation has made and recorded its quarterly income tax payments. After a final review of taxes for the year, the company identifies an additional $40,000 of income tax expense that should be recorded. A portion of this additional expense, $6,000

> The payroll records of Speedy Software show the following information about Marsha Gottschalk, an employee, for the weekly pay period ending September 30, 2015. Gottschalk is single and claims one allowance. Compute her Social Security tax (6.2%), Medica

> Biloxi Gifts uses a sales journal, a purchases journal, a cash receipts journal, a cash disbursements journal, and a general journal as illustrated in this chapter. Journalize its November transactions that should be recorded in the general journal. For