Question: Refer to the information in QS 20-

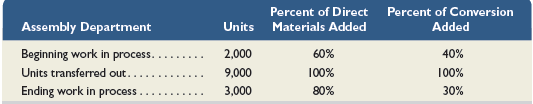

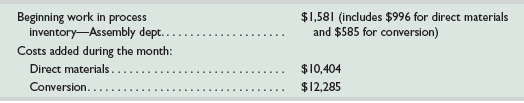

Refer to the information in QS 20-10. Prepare the November 30 journal entry to record the transfer of units (and costs) from the assembly department to the painting department. Use the FIFO method.

Information from QS 20-10:

The Carlberg Company has two manufacturing departments, assembly and painting. The assembly department started 10,000 units during November. The following production activity unit and cost information refers to the assembly department’s November production activities.

Transcribed Image Text:

Percent of Direct Percent of Conversion Assembly Department Units Materials Added Added Beginning work in process. . 2,000 60% 40% Units transforred out.. 9,000 100% 100% Ending work in process. 3,000 80% 30% Beginning work in process inventory-Assembly dept.. $1,581 (includes $996 for direct materials and $585 for conversion) Costs added during the month: Direct materials. $10,404 Conversion..... $12,285

> Why is an investment more attractive to management if it has a shorter payback period?

> Assume that Samsung manufactures and sells 60,000 units of a product at $11,000 per unit in domestic markets. It costs $6,000 per unit to manufacture ($4,000 variable cost per unit, $2,000 fixed cost per unit). Can you describe a situation under which th

> Identify the incremental costs incurred by Apple for shipping one additional iPod from a warehouse to a retail store along with the store’s normal order of 75 iPods.

> Why does the use of the accelerated depreciation method (instead of straight-line) for income tax reporting increase an investment’s value?

> Suggest a reasonable basis for allocating each of the following indirect expenses to departments: (a) salary of a supervisor who manages several departments, (b) rent, (c) heat, (d) electricity for lighting, (e) janitorial services, (f) advertising,

> Each Apple retail store has several departments. Why is it useful for its management to (a) collect accounting information about each department and (b) treat each department as a profit center?

> Identify the usual changes that a company must make when it adopts a customer orientation.

> Google monitors its fixed overhead. In an analysis of fixed overhead cost variances, what is the volume variance?

> Assume that Samsung is budgeted to operate at 80% of capacity but actually operates at 75% of capacity. What effect will the 5% deviation have on its controllable variance? Its volume variance?

> How can the manager of advertising sales at Google use flexible budgets to enhance performance?

> Samsung monitors its overhead. In an analysis of overhead cost variances, what is the controllable variance and what causes it?

> Assume that Samsung’s consumer electronics division is charged with preparing a master budget. Identify the participants— for example, the sales manager for the sales budget—and describe the information each person provides in preparing the master budget

> Does the manager of a Samsung distribution center participate in long-term budgeting? Explain.

> Samsung is thinking of expanding sales of its most popular smartphone model by 65%. Should we expect its variable and fixed costs for this model to stay within the relevant range? Explain.

> Describe the relations among the income statement, the schedule of cost of goods manufactured, and a detailed listing of factory overhead costs.

> Prepare a proper title for the annual schedule of cost of goods manufactured of Google. Does the date match the balance sheet or income statement? Why?

> The left column lists the titles of documents and accounts used in job order costing. The right column presents short descriptions of the purposes of the documents. Match each document in the left column to its numbered description in the right column. A

> Identify each of the following costs as either a product cost or a period cost. ______ 1. Factory maintenance ______ 2. Sales commissions ______ 3. Depreciation—Factory equipment ______ 4. Depreciation—Office equipment ______ 5. Rent on factory building

> Identify each of the following costs as either direct materials, direct labor, or factory overhead. The company manufactures tennis balls. ______ 1. Rubber used to form the cores ______ 2. Factory maintenance ______ 3. Wages paid to assembly workers ____

> Diez Company produces sporting equipment, including leather footballs. Identify each of the following costs as direct or indirect. The cost object is a football produced by Diez. ______ 1. Electricity used in the production plant. ______ 2. Labor used on

> Refer to the information in QS 17-4. Use that information for Tide Corporation to determine the 2014 and 2015 common-size percents for cost of goods sold using net sales as the base. Data from QS 17-4:

> Use the following information for Tide Corporation to determine the 2014 and 2015 trend percents for net sales using 2014 as the base year. ($ thousands) 2015 2014 Net sales $801,810 $453,000 Cost of goods sold 392,887 134,088

> Peng Company is considering an investment expected to generate an average net income after taxes of $1,950 for three years. The investment costs $45,000 and has an estimated $6,000 salvage value. Compute the accounting rate of return for this investment;

> Project A requires a $280,000 initial investment for new machinery with a five-year life and a salvage value of $30,000. The company uses straight-line depreciation. Project A is expected to yield annual net income of $20,000 per year for the next five y

> Label each of the following statements as either true (“T”) or false (“F”). ______ 1. Relevant costs are also known as unavoidable costs. ______ 2. Incremental costs are also known as differential costs. ______ 3. An out-of-pocket cost requires a current

> Should Apple use single product or multiproduct break-even analysis? Explain.

> What is the main factor for a company in choosing between the job order costing and process costing systems? Give two likely applications of each system.

> A company is considering investing in a new machine that requires a cash payment of $47,947 today. The machine will generate annual cash flows of $21,000 for the next three years. What is the internal rate of return if the company buys this machine?

> Yokam Company is considering two alternative projects. Project 1 requires an initial investment of $400,000 and has a present value of cash flows of $1,100,000. Project 2 requires an initial investment of $4 million and has a present value of cash flows

> Park Co. is considering an investment that requires immediate payment of $27,000 and provides expected cash inflows of $9,000 annually for four years. What is the investment’s payback period?

> In each blank next to the following terms, place the identifying letter of its best description. ______ 1. Indirect expenses ______ 2. Controllable costs ______ 3. Direct expenses ______ 4. Uncontrollable costs A. Costs not within a manager’s control

> In each blank next to the following terms, place the identifying letter of its best description. ______ 1. Cost center ______ 2. Investment center ______ 3. Departmental accounting system ______ 4. Operating department ______ 5. Profit center ______ 6. R

> Classify each of the performance measures below into the most likely balanced scorecard perspective it relates to. Label your answers using C (customer), P (internal process), I (innovation and growth), or F (financial). ______ 1. Customer wait time ____

> Compute the annual dollar changes and percent changes for each of the following accounts.

> Identify which of the following sets of items are necessary components of the master budget. ______ 1. Operating budgets, historical income statement, and budgeted balance sheet. ______ 2. Prior sales reports, capital expenditures budget, and financial b

> The motivation of employees is one goal of budgeting. Identify three guidelines that organizations should follow if budgeting is to serve effectively as a source of motivation for employees.

> SBD Phone Company sells its waterproof phone case for $90 per unit. Fixed costs total $162,000, and variable costs are $36 per unit. Compute the units of product that must be sold to earn pretax income of $200,000. (Round to the nearest whole unit.)

> Google prepares a cash budget. What is a cash budget? Why must operating budgets and the capital expenditures budget be prepared before the cash budget?

> SBD Phone Company sells its waterproof phone case for $90 per unit. Fixed costs total $162,000, and variable costs are $36 per unit. Determine the (1) contribution margin ratio and (2) break-even point in dollars.

> SBD Phone Company sells its waterproof phone case for $90 per unit. Fixed costs total $162,000, and variable costs are $36 per unit. How will the break-even point in units change in response to each of the following independent changes in selling price p

> SBD Phone Company sells its waterproof phone case for $90 per unit. Fixed costs total $162,000, and variable costs are $36 per unit. Determine the (1) contribution margin per unit and (2) break-even point in units.

> Compute and interpret the contribution margin ratio using the following data: sales, $5,000; total variable cost, $3,000.

> The following information is available for a company’s maintenance cost over the last seven months. Using the high-low method, estimate both the fixed and variable components of its maintenance cost. Month Maintenance Hours Mainten

> Determine whether each of the following is best described as a fixed, variable, or mixed cost with respect to product units. ______ 1. Rubber used to manufacture athletic shoes. ______ 2. Maintenance of factory machinery. ______ 3. Packaging expense. ___

> Zhao Co. has fixed costs of $354,000. Its single product sells for $175 per unit, and variable costs are $116 per unit. Compute the level of sales in units needed to produce a target (pretax) income of $118,000.

> Identify which standard of comparison, (a) intracompany, (b) competitor, (c) industry, or (d) guidelines, is best described by each of the following. ______ 1. Is often viewed as the best standard of comparison. ______ 2. Rules of thumb developed fro

> Zhao Co. has fixed costs of $354,000. Its single product sells for $175 per unit, and variable costs are $116 per unit. Determine the break-even point in units.

> Listed here are four series of separate costs measured at various volume levels. Examine each series and identify whether it is best described as a fixed, variable, step-wise, or curvilinear cost. (It can help to graph the cost series.) Volume (Unit

> What two arguments tend to justify classifying all costs as either fixed or variable even though individual costs might not behave exactly as classified?

> For each of the following products and services, indicate whether it is more likely produced in a process operation or a job order operation. ______ 1. Beach toys ______ 2. Concrete swimming pool ______ 3. iPhones ______ 4. Wedding reception ______ 5

> Label each statement below as either true (“T”) or false (“F”). ______ 1. The cost per equivalent unit is computed as the total costs of a process divided by the number of equivalent units passing through that process. ______ 2. Service companies are not

> For each of the following products and services, indicate whether it is more likely produced in a process operation or in a job order operation. ______ 1. Tennis courts ______ 2. Organic juice ______ 3. Audit of financial statements ______ 4. Luxury y

> Refer to the information in QS 20-10. Prepare the November 30 journal entry to record the transfer of units (and costs) from the assembly department to the painting department. Use the weighted-average method. Information from QS 20-10: The Carlberg Co

> Match each concept with its best description by entering its letter in the blank. ______ 1. Just-in-time manufacturing ______ 2. Continuous improvement ______ 3. Customer orientation ______ 4. Total quality management A. Focuses on quality throughout

> At the beginning of a year, a company predicts total direct materials costs of $900,000 and total overhead costs of $1,170,000. If the company uses direct materials costs as its activity base to allocate overhead, what is the predetermined overhead rate

> A company incurred the following manufacturing costs this period: direct labor, $468,000; direct materials, $390,000; and factory overhead, $117,000. Compute its overhead cost as a percent of (1) direct labor and (2) direct materials. Express your answe

> Determine which of the following are most likely to be considered as a job and which as a job lot. ______ 1. Hats imprinted with company logo. ______ 2. Little League trophies. ______ 3. A hand-crafted table. ______ 4. A 90-foot motor yacht. ______ 5.

> If a potential investment’s internal rate of return is above the company’s hurdle rate, should the investment be made?

> Why is it possible for direct labor in process operations to include the labor of employees who do not work directly on products or services?

> What is the average amount invested in a machine during its predicted five-year life if it costs $200,000 and has a $20,000 salvage value? Assume that net income is received evenly throughout each year and straight-line depreciation is used.

> Identify two disadvantages of using the payback period for comparing investments.

> Identify four reasons that capital budgeting decisions by managers are risky.

> Apple is considering expanding a store. Identify three methods management can use to evaluate whether to expand.

> Samsung must confront sunk costs. Why are sunk costs irrelevant in deciding whether to sell a product in its present condition or to make it into a new product through additional processing?

> Google has many types of costs. What is an out-of-pocket cost? What is an opportunity cost? Are opportunity costs recorded in the accounting records?

> Is it possible to evaluate a cost center’s profitability? Explain.

> Can management of a company such as Samsung use cycle time and cycle efficiency as useful measures of performance? Explain.

> Apple delivers its products to locations around the world. List three controllable and three uncontrollable costs for its delivery department.

> Google aims to give its managers timely cost reports. In responsibility accounting, who receives timely cost reports and specific cost information? Explain.

> Companies such as Apple commonly prepare a process cost summary. What purposes does a process cost summary serve?

> Samsung has many departments. How is a department’s contribution to overhead measured?

> What is the purpose of using standard costs?

> What is a selling expense budget? What is a capital expenditures budget?

> Apple regularly uses budgets. What is the difference between a production budget and a manufacturing budget?

> Google produces tablet computers for sale. Identify some of the variable and fixed product costs associated with that production.

> Access Dell’s annual report (10-K) for the fiscal year ended February 1, 2013, at the SEC’s EDGAR database (SEC.gov) or its website (Dell.com). From its financial statement notes, identify the titles and amounts of its inventory components.

> Can management of a company such as Apple use cycle time and cycle efficiency as useful measures of performance? Explain.

> ______ of ______ reflects expected sales in excess of the level of break-even sales.

> Apple has both fixed and variable costs. Why are fixed costs depicted as a horizontal line on a CVP chart?

> Samsung produces digital televisions with a multiple process production line. Identify and list some of its production processing steps and departments.

> Assume Sprint will install and service a server to link all of a customer’s employees’ smartphones to a centralized company server, for an up-front flat price. How can Sprint use a job order costing system?

> Are there situations where Google can use process costing? Identify at least one and explain it.

> Companies such as Samsung apply process operations. List the four steps in accounting for production activity in a reporting period (for process operations).

> Use Samsung’s financial statements in Appendix A to compute its return on total assets for fiscal year ended December 31, 2013. Samsung’s Financial Statements from Appendix A: Samsung Electronics Co., Ltd. an

> Refer to Samsung’s financial statements in Appendix A. Compute its debt ratio as of December 31, 2013, and December 31, 2012. Samsung’s Financial Statements from Appendix A: Samsung Electronics Co., Ltd. and

> Refer to Google’s financial statements in Appendix A to compute its equity ratio as of December 31, 2013, and December 31, 2012. Google’s Financial Statements from Appendix A: Google Inc. CONSOLIDATED BAL

> Refer to Apple’s financial statements in Appendix A. Compute its profit margin for the years ended September 28, 2013, and September 29, 2012. Apple’s Financial Statements from Appendix A: Apple Inc. CONSOLID

> Why does managerial accounting often involve working with numerous predictions and estimates?

> Would a manager of an Apple retail store participate more in budgeting than a manager at the corporate offices? Explain.

> At the end of a period, what balance should remain in the Factory Overhead account?

> Samsung uses a “time ticket” for some employees. How are time tickets used in job order costing?

> How do an income statement and a balance sheet for a manufacturing company and a merchandising company differ?

> Should we evaluate a production manager’s performance on the basis of operating expenses? Why?

> What events cause debits to be recorded in the Factory Overhead account? What events cause credits to be recorded in the Factory Overhead account?

> What product cost is listed as both a prime cost and a conversion cost?

> What are two main goals in managerial accounting for reporting on and analyzing departments?

> What is capital budgeting?

> When output volume increases, do fixed costs per unit increase, decrease, or stay the same within the relevant range of activity? Explain.

> Which items are usually assigned a 100% value on (a) a common-size balance sheet and (b) a common-size income statement?

> The focus in a job order costing system is the job or batch. Identify the main focus in process costing.