Question: Refer to Apple’s financial statements in

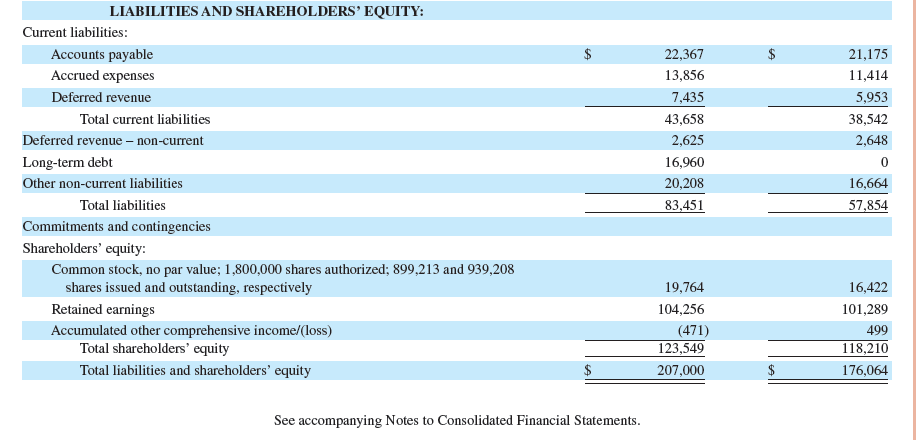

Refer to Apple’s financial statements in Appendix A. Compute its profit margin for the years ended September 28, 2013, and September 29, 2012.

Apple’s financial statements from Appendix A:

Transcribed Image Text:

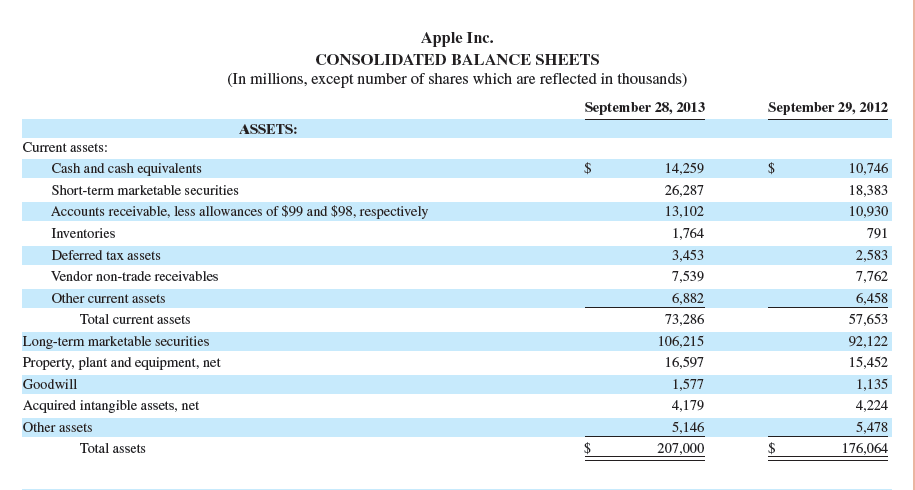

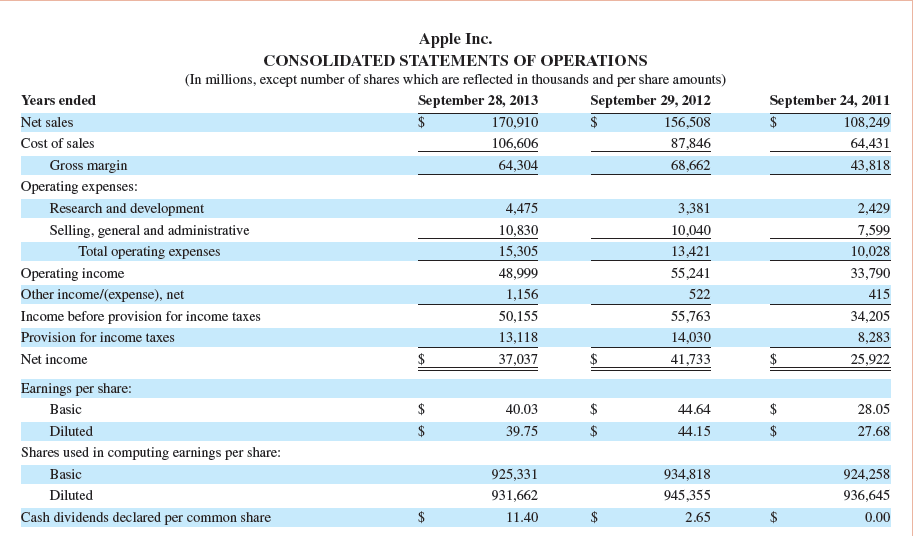

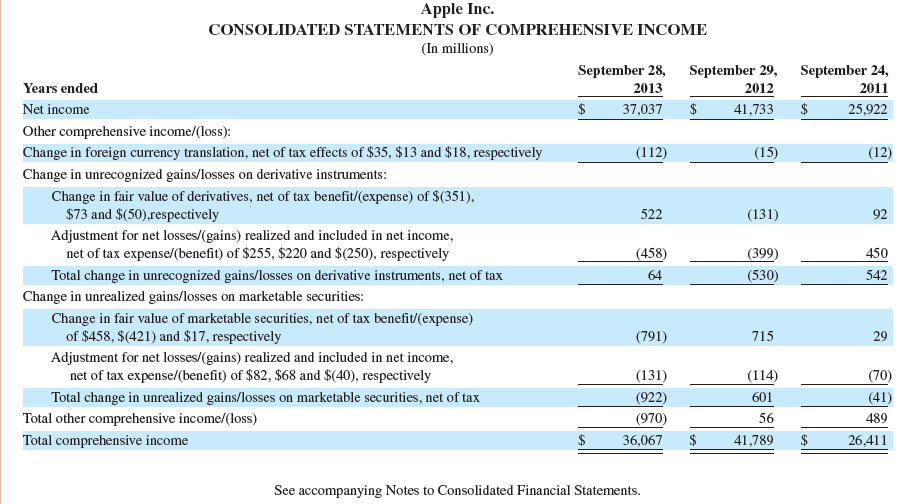

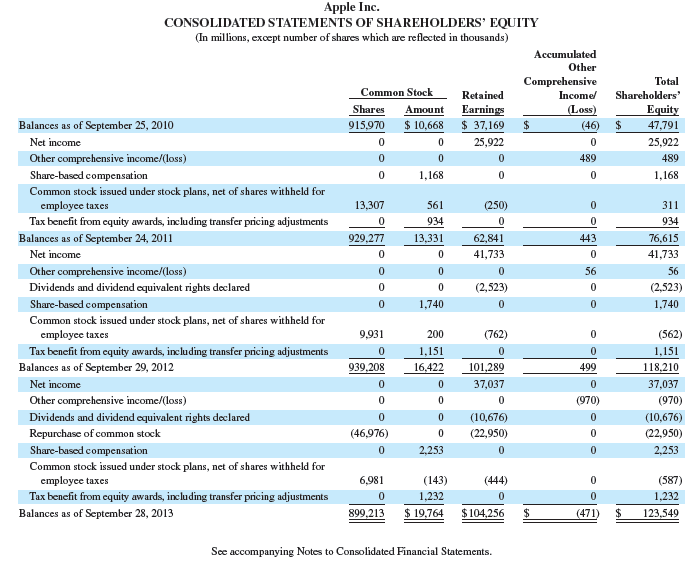

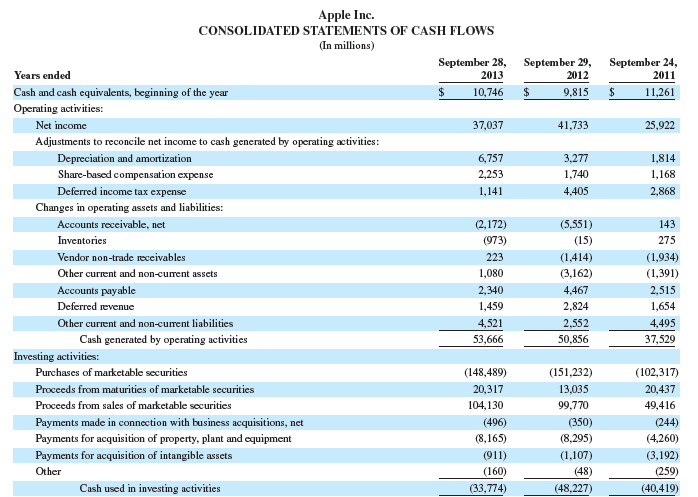

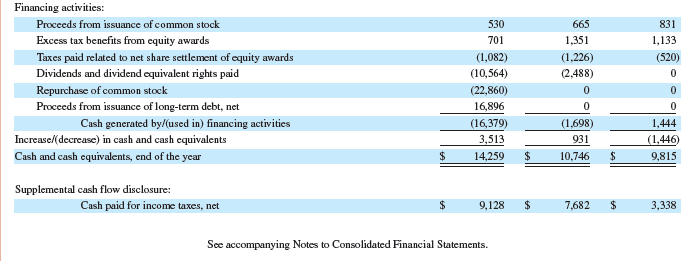

Apple Inc. CONSOLIDATED BALANCE SHEETS (In millions, except number of shares which are reflected in thousands) September 28, 2013 September 29, 2012 ASSETS: Current assets: Cash and cash equivalents 14,259 10,746 Short-term marketable securities 26,287 18,383 Accounts receivable, less allowances of $99 and $98, respectively 13,102 10,930 Inventories 1,764 791 Deferred tax assets 3,453 2,583 Vendor non-trade receivables 7,539 7,762 Other current assets 6,882 6,458 Total current assets 73,286 57,653 Long-term marketable securities 106,215 92,122 Property, plant and equipment, net 16,597 15,452 Goodwill 1,577 1,135 Acquired intangible assets, net 4,179 4,224 Other assets 5,146 5,478 Total assets 207,000 176,064 LIABILITIES AND SHAREHOLDERS’ EQUITY: Current liabilities: Accounts payable $ 22,367 $ 21,175 Accrued expenses 13,856 11,414 Deferred revenue 7,435 5,953 Total current liabilities 43,658 38,542 Deferred revenue – non-current 2,625 2,648 Long-term debt 16,960 Other non-current liabilities 20,208 16,664 Total liabilities 83,451 57,854 Commitments and contingencies Shareholders' equity: Common stock, no par value; 1,800,000 shares authorized; 899,213 and 939,208 shares issued and outstanding, respectively 19,764 16,422 Retained earnings 104,256 101,289 499 Accumulated other comprehensive income/(loss) Total shareholders' equity (471) 123,549 118,210 Total liabilities and shareholders' equity 207,000 176,064 See accompanying Notes to Consolidated Financial Statements. Apple Inc. CONSOLIDATED STATEMENTS OF OPERATIONS (In millions, except number of shares which are reflected in thousands and per share amounts) Years ended September 28, 2013 September 29, 2012 156,508 September 24, 2011 Net sales $ 170,910 108,249 24 Cost of sales 106,606 87,846 64,431 Gross margin Operating expenses: 64,304 68,662 43,818 Research and development 4,475 3,381 2,429 Selling, general and administrative 10,830 10,040 7,599 Total operating expenses 15,305 13,421 10,028 Operating income 48,999 55,241 33,790 Other income/(expense), net 1,156 522 415 Income before provision for income taxes 50,155 55,763 34,205 Provision for income taxes 13,118 14,030 8,283 Net income $ 37,037 41,733 25,922 Earnings per share: Basic 40.03 44.64 28.05 Diluted $ 39.75 44.15 27.68 Shares used in computing earnings per share: Basic 925,331 934,818 924,258 Diluted 931,662 945,355 936,645 Cash dividends declared per common share $ 11.40 2.65 0.00 Apple Inc. CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (In millions) September 29, 2012 September 24, September 28, 2013 Years ended 2011 Net income $ 37,037 $ 41,733 $ 25,922 Other comprehensive income/(loss): Change in foreign currency translation, net of tax effects of $35, $13 and $18, respectively (112) (15) (12) Change in unrecognized gains/losses on derivative instruments: Change in fair value of derivatives, net of tax benefit/(expense) of $(351), $73 and $(50),respectively Adjustment for net losses/(gains) realized and included in net income, net of tax expense/(benefit) of $255, $220 and $(250), respectively 522 (131) 92 (458) (399) 450 Total change in unrecognized gains/losses on derivative instruments, net of tax 64 (530) 542 Change in unrealized gains/losses on marketable securities: Change in fair value of marketable securities, net of tax benefit/(expense) of $458, $(421) and $17, respectively (791) 715 29 Adjustment for net losses/(gains) realized and included in net income, net of tax expense/(benefit) of $82, $68 and $(40), respectively (131) (114) (70) (922) (970) Total change in unrealized gains/losses on marketable securities, net of tax 601 (41) Total other comprehensive income/(loss) 56 489 Total comprehensive income $ 36,067 $ 41,789 $ 26,411 See accompanying Notes to Consolidated Financial Statements. Apple Inc. CONSOLIDATED STATEMENTS OF SHAREHOLDERS' EQUITY (In millions, except number of shares which are reflected in thousands) Accumulated Other Comprehensive Total Common Stock Retained Income/ Shareholders' Shares Amount Earnings (Loss) 915,970 $ 10,668 $ 37,169 $ EQUITY 2$ Balances as of September 25, 2010 (46) 47,791 Net income 25,922 25,922 Other comprehensive income/(loss) 489 489 Share-based compensation 1,168 1,168 Common stock issued under stock plans, net of shares withheld for employee taxes 13,307 561 (250) 311 Tax benefit from equity awards, including transfer pricing adjustments 934 934 Balances as of September 24, 2011 929,277 13,331 62,841 443 76,615 Net income 41,733 41,733 Other comprehensive income/(loss) 56 56 Dividends and dividend equivalent rights declared (2,523) (2,523) Share-based compensation 1,740 1,740 Common stock issucd under stock plans, net of shares withheld for employee taxes 9,931 200 (762) (562) Tax benefit from equity awards, including transfer pricing adjustments 1,151 1,151 Balances as of September 29, 2012 939,208 16,422 101,289 499 118,210 Net income 37,037 37,037 Other comprehensive income/(loss) (970) (970) Dividends and dividend equivalent rights declared (10,676) (10,676) Repurchase of common stock (46,976) (22,950) (22,950) Share-based compensation 2,253 2,253 Common stock issued under stock plans, net of shares withheld for employee taxes 6,981 (143) (444) (587) Tax benefit from equity awards, including transfer pricing adjustments 1,232 1,232 Balances as of September 28, 2013 899,213 $ 19,764 $104,256 (471) $ 123,549 Sec accompanying Notes to Consolidated Financial Statements. O ol Apple Inc. CONSOLIDATED STATEMENTS OF CASH FLOWS (In millions) September 28, 2013 September 29, 2012 September 24, 2011 Years ended Cash and cash equivalents, beginning of the ycar 10,746 9,815 %2$ 11,261 Operating activities: Net income 37,037 41,733 25,922 Adjustments to reconcile net income to cash generated by operating activities: Depreciation and amortization 6,757 3,277 1,814 Share-based compensation expense 2,253 1,740 1,168 Deferred income tax expense 1,141 4,405 2,868 Changes in operating assets and liabilities: Accounts receivable, net (2,172) (5,551) 143 Inventories (973) (15) 275 Vendor non-trade receivables 223 (1,414) (1,934) Other current and non-curent assets 1,080 (3,162) (1,391) Accounts payable 2,340 4,467 2,515 Deferred revenue 1,459 2,824 1,654 Other current and non-curent liabilities 4,521 2,552 4,495 Cash generated by operating activities 53,666 50,856 37,529 Investing activities: Purchases of marketable securities (148,489) (151,232) (102,317) Proceeds from maturities of marketable securities 20,317 13,035 20,437 Proceeds from sales of marketable securities 104,130 99,770 49,416 Payments made in connection with business acquisitions, net (496) (350) (244) Payments for acquisition of property, plant and equipment (8,165) (8,295) (4,260) Payments for acquisition of intangible assets (911) (1,107) (3,192) Other (160) (48) (259) Cash used in investing activities (33,774) (48,227) (40,419) Financing activities: Proceeds from issuance of common stock 530 665 831 Excess tax benefits from cquity awards 701 1,351 1,133 Taxes paid related to net share settlement of equity awards (1,082) (1,226) (520) Dividends and dividend equivalent rights paid (10,564) (2,488) Repurchase of common stock (22,860) Proceeds from issuance of long-term debt, net 16,896 Cash generated by/(used in) financing activities (16,379) (1,698) 1,444 Increase/(decrease) in cash and cash equivalents 3,513 931 (1,446) Cash and cash equivalents, end of the year 14,259 $ 10,746 2$ 9,815 Supplemental cash flow disclosure: Cash paid for income taxes, net 24 9,128 24 7,682 24 3,338 See accompanying Notes to Consolidated Financial Statements.

> SBD Phone Company sells its waterproof phone case for $90 per unit. Fixed costs total $162,000, and variable costs are $36 per unit. Determine the (1) contribution margin ratio and (2) break-even point in dollars.

> SBD Phone Company sells its waterproof phone case for $90 per unit. Fixed costs total $162,000, and variable costs are $36 per unit. How will the break-even point in units change in response to each of the following independent changes in selling price p

> SBD Phone Company sells its waterproof phone case for $90 per unit. Fixed costs total $162,000, and variable costs are $36 per unit. Determine the (1) contribution margin per unit and (2) break-even point in units.

> Compute and interpret the contribution margin ratio using the following data: sales, $5,000; total variable cost, $3,000.

> The following information is available for a company’s maintenance cost over the last seven months. Using the high-low method, estimate both the fixed and variable components of its maintenance cost. Month Maintenance Hours Mainten

> Determine whether each of the following is best described as a fixed, variable, or mixed cost with respect to product units. ______ 1. Rubber used to manufacture athletic shoes. ______ 2. Maintenance of factory machinery. ______ 3. Packaging expense. ___

> Zhao Co. has fixed costs of $354,000. Its single product sells for $175 per unit, and variable costs are $116 per unit. Compute the level of sales in units needed to produce a target (pretax) income of $118,000.

> Identify which standard of comparison, (a) intracompany, (b) competitor, (c) industry, or (d) guidelines, is best described by each of the following. ______ 1. Is often viewed as the best standard of comparison. ______ 2. Rules of thumb developed fro

> Zhao Co. has fixed costs of $354,000. Its single product sells for $175 per unit, and variable costs are $116 per unit. Determine the break-even point in units.

> Listed here are four series of separate costs measured at various volume levels. Examine each series and identify whether it is best described as a fixed, variable, step-wise, or curvilinear cost. (It can help to graph the cost series.) Volume (Unit

> What two arguments tend to justify classifying all costs as either fixed or variable even though individual costs might not behave exactly as classified?

> Refer to the information in QS 20-10. Prepare the November 30 journal entry to record the transfer of units (and costs) from the assembly department to the painting department. Use the FIFO method. Information from QS 20-10: The Carlberg Company has tw

> For each of the following products and services, indicate whether it is more likely produced in a process operation or a job order operation. ______ 1. Beach toys ______ 2. Concrete swimming pool ______ 3. iPhones ______ 4. Wedding reception ______ 5

> Label each statement below as either true (“T”) or false (“F”). ______ 1. The cost per equivalent unit is computed as the total costs of a process divided by the number of equivalent units passing through that process. ______ 2. Service companies are not

> For each of the following products and services, indicate whether it is more likely produced in a process operation or in a job order operation. ______ 1. Tennis courts ______ 2. Organic juice ______ 3. Audit of financial statements ______ 4. Luxury y

> Refer to the information in QS 20-10. Prepare the November 30 journal entry to record the transfer of units (and costs) from the assembly department to the painting department. Use the weighted-average method. Information from QS 20-10: The Carlberg Co

> Match each concept with its best description by entering its letter in the blank. ______ 1. Just-in-time manufacturing ______ 2. Continuous improvement ______ 3. Customer orientation ______ 4. Total quality management A. Focuses on quality throughout

> At the beginning of a year, a company predicts total direct materials costs of $900,000 and total overhead costs of $1,170,000. If the company uses direct materials costs as its activity base to allocate overhead, what is the predetermined overhead rate

> A company incurred the following manufacturing costs this period: direct labor, $468,000; direct materials, $390,000; and factory overhead, $117,000. Compute its overhead cost as a percent of (1) direct labor and (2) direct materials. Express your answe

> Determine which of the following are most likely to be considered as a job and which as a job lot. ______ 1. Hats imprinted with company logo. ______ 2. Little League trophies. ______ 3. A hand-crafted table. ______ 4. A 90-foot motor yacht. ______ 5.

> If a potential investment’s internal rate of return is above the company’s hurdle rate, should the investment be made?

> Why is it possible for direct labor in process operations to include the labor of employees who do not work directly on products or services?

> What is the average amount invested in a machine during its predicted five-year life if it costs $200,000 and has a $20,000 salvage value? Assume that net income is received evenly throughout each year and straight-line depreciation is used.

> Identify two disadvantages of using the payback period for comparing investments.

> Identify four reasons that capital budgeting decisions by managers are risky.

> Apple is considering expanding a store. Identify three methods management can use to evaluate whether to expand.

> Samsung must confront sunk costs. Why are sunk costs irrelevant in deciding whether to sell a product in its present condition or to make it into a new product through additional processing?

> Google has many types of costs. What is an out-of-pocket cost? What is an opportunity cost? Are opportunity costs recorded in the accounting records?

> Is it possible to evaluate a cost center’s profitability? Explain.

> Can management of a company such as Samsung use cycle time and cycle efficiency as useful measures of performance? Explain.

> Apple delivers its products to locations around the world. List three controllable and three uncontrollable costs for its delivery department.

> Google aims to give its managers timely cost reports. In responsibility accounting, who receives timely cost reports and specific cost information? Explain.

> Companies such as Apple commonly prepare a process cost summary. What purposes does a process cost summary serve?

> Samsung has many departments. How is a department’s contribution to overhead measured?

> What is the purpose of using standard costs?

> What is a selling expense budget? What is a capital expenditures budget?

> Apple regularly uses budgets. What is the difference between a production budget and a manufacturing budget?

> Google produces tablet computers for sale. Identify some of the variable and fixed product costs associated with that production.

> Access Dell’s annual report (10-K) for the fiscal year ended February 1, 2013, at the SEC’s EDGAR database (SEC.gov) or its website (Dell.com). From its financial statement notes, identify the titles and amounts of its inventory components.

> Can management of a company such as Apple use cycle time and cycle efficiency as useful measures of performance? Explain.

> ______ of ______ reflects expected sales in excess of the level of break-even sales.

> Apple has both fixed and variable costs. Why are fixed costs depicted as a horizontal line on a CVP chart?

> Samsung produces digital televisions with a multiple process production line. Identify and list some of its production processing steps and departments.

> Assume Sprint will install and service a server to link all of a customer’s employees’ smartphones to a centralized company server, for an up-front flat price. How can Sprint use a job order costing system?

> Are there situations where Google can use process costing? Identify at least one and explain it.

> Companies such as Samsung apply process operations. List the four steps in accounting for production activity in a reporting period (for process operations).

> Use Samsung’s financial statements in Appendix A to compute its return on total assets for fiscal year ended December 31, 2013. Samsung’s Financial Statements from Appendix A: Samsung Electronics Co., Ltd. an

> Refer to Samsung’s financial statements in Appendix A. Compute its debt ratio as of December 31, 2013, and December 31, 2012. Samsung’s Financial Statements from Appendix A: Samsung Electronics Co., Ltd. and

> Refer to Google’s financial statements in Appendix A to compute its equity ratio as of December 31, 2013, and December 31, 2012. Google’s Financial Statements from Appendix A: Google Inc. CONSOLIDATED BAL

> Why does managerial accounting often involve working with numerous predictions and estimates?

> Would a manager of an Apple retail store participate more in budgeting than a manager at the corporate offices? Explain.

> At the end of a period, what balance should remain in the Factory Overhead account?

> Samsung uses a “time ticket” for some employees. How are time tickets used in job order costing?

> How do an income statement and a balance sheet for a manufacturing company and a merchandising company differ?

> Should we evaluate a production manager’s performance on the basis of operating expenses? Why?

> What events cause debits to be recorded in the Factory Overhead account? What events cause credits to be recorded in the Factory Overhead account?

> What product cost is listed as both a prime cost and a conversion cost?

> What are two main goals in managerial accounting for reporting on and analyzing departments?

> What is capital budgeting?

> When output volume increases, do fixed costs per unit increase, decrease, or stay the same within the relevant range of activity? Explain.

> Which items are usually assigned a 100% value on (a) a common-size balance sheet and (b) a common-size income statement?

> The focus in a job order costing system is the job or batch. Identify the main focus in process costing.

> Capital budgeting decisions require careful analysis because they are generally the and decisions that management faces.

> Champ, Inc., predicts the following sales in units for the coming three months: Each month’s ending inventory of finished units should be 60% of the next month’s sales. The April 30 finished goods inventory is 108 un

> Harley-Davidson manufactures 30 custom-made, luxury-model motorcycles. Does it account for these motorcycles as 30 individual jobs or as a job lot? Explain.

> X-Tel budgets sales of $60,000 for April, $100,000 for May, and $80,000 for June. In addition, sales commissions are 10% of sales dollars and the company pays a sales manager a salary of $6,000 per month. Sales commissions and salaries are paid in the mo

> X-Tel budgets sales of $60,000 for April, $100,000 for May, and $80,000 for June. In addition, sales are 40% cash and 60% on credit. All credit sales are collected in the month following the sale. The April 1 balance in accounts receivable is $15,000. Pr

> Singh Co. reports a contribution margin of $960,000 and fixed costs of $720,000. (1) Compute the company’s degree of operating leverage. (2) If sales increase by 15%, what amount of income will Singh Co. report?

> US-Mobile manufactures and sells two products, tablet computers and smartphones, in the ratio of 5:3. Fixed costs are $105,000, and the contribution margin per composite unit is $125. What number of each type of product is sold at the break-even point?

> Zhao Co. has fixed costs of $354,000. Its single product sells for $175 per unit, and variable costs are $116 per unit. The company expects sales of 10,000 units. Prepare a contribution margin income statement for the year ended December 31, 2015.

> Refer to QS 20-8 and compute the total equivalent units of production with respect to conversion for July using the FIFO inventory method. Data from QS 20-8: The following refers to units processed by an ice cream maker in July. Gallons of Perce

> The following refers to units processed by an ice cream maker in July. Compute the total equivalent units of production with respect to conversion for July using the weighted-average inventory method. Gallons of Percent of Product Conversion Added B

> Refer to QS 20-4. Compute the total equivalent units of production with respect to conversion for March using the FIFO inventory method. Data from QS 20-4: The following refers to units processed in Sunflower Printing’s binding depart

> Anheuser-Busch InBev is attempting to reduce its water usage. How could a company manager use a process cost summary to determine if the program to reduce water usage is successful?

> The following refers to units processed in Sunflower Printing’s binding department in March. Prepare a physical flow reconciliation. Units of Percent of Product Conversion Added Beginning work in process........ Goods started.....

> Assume that Apple produces a batch of 1,000 iPhones. Does it account for this as 1,000 individual jobs or as a job lot? Explain (consider costs and benefits).

> Prepare journal entries to record the following production activities for Hotwax. 1. Requisitioned $9,000 of indirect materials for use in production of surfboard wax. 2. Incurred $156,000 overhead costs (credit “Other accounts”). 3. Applied overhead at

> Refer to the information in QS 20-10. Calculate the assembly department’s equivalent units of production for materials and for conversion for November. Use the FIFO method. Information from QS 20-10: The Carlberg Company has two manuf

> Refer to the information in QS 20-10. Assign costs to the assembly department’s output—specifically, the units transferred out to the painting department and the units that remain in process in the assembly department

> Refer to QS 20-21. Using the FIFO method, assign direct materials costs to the roasting department’s output—specifically, the units transferred out to the mixing department and the units that remain in process in the r

> BOGO Inc. has two sequential processing departments, roasting and mixing. At the beginning of the month, the roasting department has 2,000 units in inventory, 70% complete as to materials. During the month, the roasting department started 18,000 units. A

> Azule Co. manufactures in two sequential processes, cutting and binding. The two departments report the information below for a recent month. Determine the ending balances in the Work in Process Inventory accounts of each department. Cutting Binding

> Refer to information in QS 20-18. Using the weighted-average method, assign direct materials costs to the molding department’s output—specifically, the units transferred out to the packaging department and the units th

> The Plastic Flowerpots Company has two manufacturing departments, molding and packaging. At the beginning of the month, the molding department has 2,000 units in inventory, 70% complete as to materials. During the month, the molding department started 18

> Refer to the information in QS 20-10. Calculate the assembly department’s cost per equivalent unit of production for materials and for conversion for November. Use the weighted-average method. Information from QS 20-10: The Carlberg C

> Refer to the information in QS 20-10. Assign costs to the assembly department’s output—specifically, the units transferred out to the painting department and the units that remain in process in the assembly department

> Why must a company use predetermined overhead rates when using job order costing?

> Refer to the information in QS 20-10. Calculate the assembly department’s cost per equivalent unit of production for materials and for conversion for November. Use the FIFO method. Information from QS 20-10: The Carlberg Company has t

> Nestlé reports beginning raw materials inventory of 3,815 and ending raw materials inventory of 3,499 (both numbers in millions of Swiss francs). Assume Nestlé purchased 13,860 and used 14,176 (both amounts in millions of Swiss francs) in raw materials d

> The Carlberg Company has two manufacturing departments, assembly and painting. The assembly department started 10,000 units during November. The following production activity unit and cost information refers to the assembly department’s

> Refer to the information in QS 19-11. During the month, the jobs used direct labor as shown below. Jobs 1 and 3 are not finished by the end of March, and Job 2 is finished but not sold by the end of March. (1) Determine the amounts of direct materials, d

> Compute cost of goods sold for 2015 using the following information. Finished goods inventory, Dec. 31, 2014 ... Work in process inventory, Dec. 31, 2014 ... Work in process inventory, Dec. 31, 2015 ... Cost of goods manufactured, 2015 Finished good

> Prepare the 2015 schedule of cost of goods manufactured for Barton Company using the following information. Direct materials..... Direct labor ... $190,500 ... 63,150 Factory overhead costs... 24,000 Work in process, Dec. 31, 2014. 157,600 Work in p

> Compute ending work in process inventory for a manufacturer with the following information. Raw materials purchased.... Raw materials used in production. $124,800 .... 74,300 Direct labor used..... Total factory overhead Work in process inventory, b

> A review of the notes payable files discovers that three years ago the company reported the entire $1,000 cash payment (consisting of $800 principal and $200 interest) toward an installment note payable as interest expense. This mistake had a material ef

> The following information is available for Morgan Company and Parker Company, similar firms operating in the same industry. Write a half-page report comparing Morgan and Parker using the available information. Your discussion should include their ability

> For each ratio listed, identify whether the change in ratio value from 2014 to 2015 is usually regarded as favorable or unfavorable. Ratio 2015 2014 Ratio 2015 2014 I. Profit margin.... 2. Debt ratio.... 3. Gross margin.... 9% 8% 5. Accounts receiva

> How does inventory turnover provide information about a company’s short-term liquidity?

> Describe the managerial accountant’s role in business planning, control, and decision making.

> Suppose Canwest Global Communications Corp. reported net cash used by operating activities of $104,539,000 and sales revenue of $2,867,459,000 during 2014. Cash spent on plant asset additions during the year was $79,330,000. Calculate free cash flow.