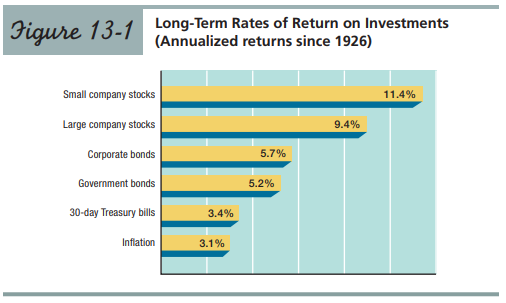

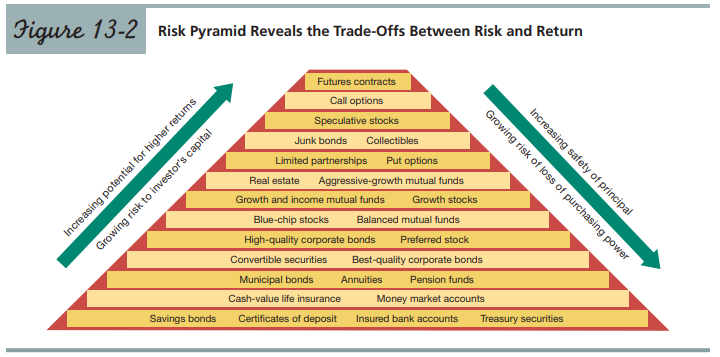

Question: Review Figures 13-1 and 13-2,

Review Figures 13-1 and 13-2, and record in writing an investment plan to fund your retirement, presumably one of your own long-term goals.

Figures 13-1:

Figures 13-2:

Transcribed Image Text:

Figure 13-1 Long-Term Rates of Return on Investments (Annualized returns since 1926) Small company stocks 11.4% Large company stocks 9.4% Corporate bonds 5.7% Government bonds 5.2% 30-day Treasury bills 3.4% Inflation 3.1% Figure 13-2 Risk Pyramid Reveals the Trade-Offs Between Risk and Return Futures contracts Call options Speculative stocks Junk bonds Collectibles Limited partnerships Put options Real estate Aggressive-growth mutual funds Growth and income mutual funds Growth stocks Blue-chip stocks Balanced mutual funds High-quality corporate bonds Preferred stock Convertible securities Best-quality corporate bonds Municipal bonds Annuities Pension funds Cash-value life insurance Money market accounts Savings bonds Certificates of deposit Insured bank accounts Treasury securities Increasing potential for higher retums Growing risk to investor's capital Increasing safety of principal Growing risk of loss of purchasing power

> Summarize the process to determine whether you can afford a particular purchase.

> Distinguish between an unsecured line of credit and a home equity credit line.

> Explain the basic features of bank credit cards..

> The Hernandezes’ older son, Jacob, has reached the age at which it is time to consider purchasing a car for him. Victor and Maria have decided to give Maria’s old car to Jacob and buy a later-model used car for Maria. Required: (a) What sources can Vict

> What is open-end credit and give three examples.

> Distinguish between capital improvements in real estate investing and repairs.

> Distinguish between the price-to-rent ratio and the rental yield as measures of current income.

> What are the two key questions to consider before investing in real estate?

> Name two things investors should consider doing before investing in real estate.

> Name five services that are unique to mutual funds.

> List five advantages of investing in mutual funds.

> Explain how net asset value is calculated and how it is used by mutual funds.

> Illustrate how housing buyers can pay less than renters when taxes and appreciation of housing values are considered.

> Identify three ways that home buyers can save on their income taxes.

> After several years of riding a bus to work, Belinda finds that she can no longer do so because her employer moved to a location that is not convenient for public transportation. Thus the Johnsons are in the market for another car. Harry and Belinda esti

> Distinguish between periodic tenancy and tenancy for a specific time when renting housing.

> Explain the purpose and value of a lease for both the renter and the landlord.

> Now that you have read the chapter on estate planning, what do you recommend to Chrisanna and Fernando on the subject of retirement and estate planning regarding: 1. How much in Social Security benefits can each expect to receive? 2. How much do they eac

> Now that you have read the chapter on real estate and high-risk investments, what do you recommend to Brittany on: 1. Investing in real estate? 2. Putting some money into collectibles or gold? 3. Investing in options and futures contracts?

> Now that you have read the chapter on mutual funds, what do you recommend to Helen and David Lilienthal in the case at the beginning of the chapter regarding: 1. Redeeming their CDs and investing their retirement money in mutual funds? 2. Investing in gr

> Now that you have read the chapter on stocks and bonds, what do you recommend to Ariya Jutanugarn in the case at the beginning of the chapter regarding: 1. Investing for retirement in 18 years? 2. Owning blue-chip common stocks and preferred stocks rathe

> Now that you have read the chapter on investment fundamentals, what do you recommend to Shanice and Sarena on the subject regarding: 1. Portfolio diversification for Sarena? 2. Dollar-cost averaging for Shanice? 3. Investment alternatives for Sarena?

> Shopping for life insurance?

> Coordinating their retirement savings and other investments with their life insurance program?

> What types of life insurance they should consider.

> Lauren Rowland is a dentist in Hebron, Kentucky, who recently entered into a contract to buy a new automobile. After signing to finance $38,000, she hurriedly left the office of the sales finance company with her copy of the contract. Later that evening,

> Now that you have read the chapter on protecting loved ones through life insurance, what would you recommend to Stephanie and Will Bridgeman in the case at the beginning of the chapter regarding: 1. Their changing need for life insurance now that they ha

> Now that you have read the chapter on health care planning, what do you recommend to Danielle DiMartino in the case at the beginning of the chapter regarding: 1. Choosing among the four alternatives available to her? 2. Danielle’s concerns about providin

> Now that you have read the chapter on risk management and property liability insurance, what would you recommend to Nick and Amber in the case at the beginning of the chapter regarding: 1. The risk-management steps they should take to update their insura

> They are considering trading their car in for a newer used vehicle so that Harry can have dependable transportation for commuting to work. The couple still owes $5,130 to the credit union for their current car, or $285 per month for the remaining 18 mont

> Zachary Porter of Abilene, Texas, is contemplating borrowing $10,000 from his bank. The bank could use add-on rates of 6.5 percent for 3 years, 7 percent for 4 years, and 8 percent for 5 years. Use Equation 7.1 to calculate the finance charge and monthly

> Kimberly Jensen of Storm Lake, Iowa, wants to buy some living room furniture for her new apartment. A local store offered credit at an APR of 16 percent, with a maximum term of four years. The furniture she wishes to purchase costs $4,800, with no down p

> Kayla Sampson, an antiques dealer from Mankato, Minnesota, received her monthly billing statement for April for her MasterCard account. The statement indicated that she had a beginning balance of $600, on day 5 she charged $150, on day 12 she charged $30

> Miguel Perez of Pamona, California, obtained a two-year installment loan for $1,500 to buy a television set eight months ago. The loan had a 12.6 percent APR and a finance charge of $204.72. His monthly payment is $71.03. Miguel has made eight monthly pa

> What is the likelihood of average people paying estate or inheritance taxes?

> Distinguish between an irrevocable living trust and testamentary trusts?

> What topics go into a properly drafted will?

> Now that you have read the chapter on buying housing, what do you recommend to Shelby Clark regarding: 1. Buying or renting housing in the Denver area? 2. Steps she should take prior to actively looking at homes? 3. Finding a home and negotiating the pur

> Distinguish between probate and nonprobate property.

> What is probate, and give three examples of how people should transfer assets by contract to avoid probate.

> Offer some positive and negative observations on the wisdom of buying an annuity with some of your retirement nest egg money when you retire.

> Summarize how long one’s retirement money will last given certain withdrawal rates.

> Name two types of penalty-free withdrawals from retirement accounts.

> What are some negative impacts of taking early withdrawals from retirement accounts?

> Offer reasons why futures contracts are not appropriate for the long-term investor.

> Explain how a speculative options investor can make a lot of money.

> Summarize one way a person with a conservative investment philosophy can profit in options.

> Distinguish between a call and a put for the options investor.

> Now that you have read this chapter on vehicle and other major purchases, what do you recommend to David and Lisa Cosgrove regarding: 1. How to search for a vehicle to replace Alyssa’s? 2. Whether to replace Alyssa’s vehicle with a new or used vehicle? 3

> What does a health care proxy achieve?

> What is a living will and what does it try to accomplish?

> Offer some reasons why people should create advance directive documents.

> What does a durable power of attorney provide, and can it be changed?

> Describe the term release and explain why signing a release too soon might work to your disadvantage.

> Describe what you should do to file a claim most effectively when involved in an automobile accident.

> What is the best way to establish documentation for potential losses to your personal property?

> Who would use a Keogh rather than a SEP-IRA to save for retirement?

> List two differences between a Roth IRA and a traditional IRA.

> Now that you have read this chapter on credit cards and consumer loans, what would you recommend to Zachary Cochrane regarding: 1. His approach to using credit cards, including the number of cards he has? 2. Estimating the credit card interest charges he

> Summarize the importance of low-cost investment fees to long-term retirement success.

> Why should workers choose to save for retirement through a personally established retirement account?

> Identify some risks of investing in precious stones and gems.

> Identify one collectible that might be an interesting investment, and explain why it might be difficult to make a profit.

> Give a math example of how to calculate a bond’s yield to maturity that is different than the one in the book.

> Summarize why bonds and interest rates have an inverse relationship.

> Summarize the differences between I-bonds and TIPS bonds.

> Distinguish among Treasury bills, notes, and bonds.

> What are the basic differences between corporate, U.S. government, and municipal bonds?

> Distinguish between investment- and speculative-grade bonds.

> Both options and futures are risky investments. Identify one that seems like an unwise idea, and explain why it is unappealing.

> What happens to a worker’s 401(k) retirement account if he or she signs up for an auto-rebalance account service?

> Comment on three popular rules of thumb of asset allocation including being 100 percent invested in stocks.

> What is asset allocation, and why does it work?

> Explain the concept of dollar-cost averaging including why one invests at below average costs.

> What is the goal of portfolio diversification, and how is this accomplished?

> Summarize what the buy-and-hold long-term investment strategy is all about.

> Distinguish between own-occupation and any-occupation disability income insurance plans.

> Identify three policy provisions to consider when purchasing disability income insurance.

> Explain who needs disability insurance.

> Summarize how you determine your level of need for disability income insurance.

> Describe what would encourage you to invest in real estate given that in recent years prices in some communities have declined.

> Give two examples of someone who might want to purchase a floater insurance policy.

> Who should consider buying flood and earthquake insurance?

> Explain how purchasing an umbrella liability insurance policy applies the large loss principle.

> Describe two costs associated with selling a home in addition to the real estate commission.

> List one advantage and one disadvantage of using a real estate broker to sell a home.

> List some disadvantages of trying to sell a home yourself.

> Explain how the interest is calculated on a consumer loan that uses the discount method.

> What is the effect of the rule of 78s when a borrower repays an add-on method loan early?

> Summarize how interest is calculated on a consumer loan that uses the add-on method.

> Explain how the interest is calculated on a consumer loan that uses the declining balance method.

> What percentage of your portfolio, if any, do you think should be invested in high-risk investments? Explain.

> Comment on why real estate investors often have time-consuming management demands.

> Briefly comment on why interest rate risk is dangerous to real estate investors.

> Summarize why foreclosures and illiquidity are disadvantages in real estate investing.

> How might you go about monitoring your mutual fund investments?

> Explain how you would eliminate funds inappropriate for your investment goals.

> Explain why it is important to review your investment philosophy and goals when selecting mutual fund investments.

> Explain what selling short is and how it can go wrong for an investor.

> What is buying on margin and how it can go wrong for an investor?