Question: They are considering trading their car in

They are considering trading their car in for a newer used vehicle so that Harry can have dependable transportation for commuting to work. The couple still owes $5,130 to the credit union for their current car, or $285 per month for the remaining 18 months of the 48-month loan. The trade-in value of this car plus $1,000 that Harry earned from a freelance interior design job should allow the couple to pay off the auto loan and leave $1,250 for a down payment on the newer car. The Johnsons have agreed on a sales price for the newer car of $21,000.

Required:

(a) Make recommendations to Harry and Belinda regarding where to seek financing and what APR to expect.

(b) Using the Garman/Forgue companion website or the information in Table 7-2, calculate the monthly payment for a loan period of three, four, five, and six years at 6 percent APR. Describe the relationship between the loan period and the payment amount.

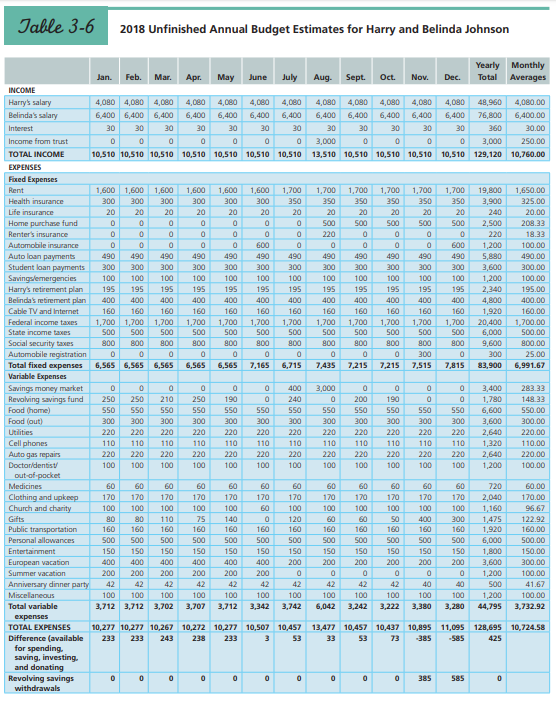

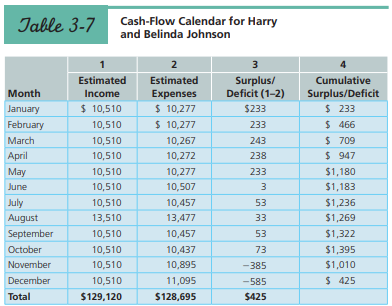

(c) Harry and Belinda have a cash-flow deficit projected for several months this year (see Table 3-6 and Table 3-7. Suggest how, when, and where they might finance the shortages by borrowing.

Table 3-6:

Table 3-7:

Transcribed Image Text:

Table 3-6 2018 Unfinished Annual Budget Estimates for Harry and Belinda Johnson Yearly Monthly Jan. Feb. Mar. Apr. Мay June July Aug. Sept. Oc. Nov. Dec. Total Averages INCOME 4,080 4,080 4,080 Harry's salary Belinda's salary 4,080 4,080 4,080 4,080 4,080 4,080 4,080 4,080 4,080 48,960 4,080.00 6,400 6,400 6,400 6,400 6,400 6,400 6,400 6,400 6,400 6,400 6,400 6,400 76,800 6,400.00 Interest 30 30 30 30 30 30 30 30 30 30 30 30 360 30.00 Income from trust 3,000 3,000 250.00 TOTAL INCOME 10,510 10,510 10,510 10,510 10,510 10,510 10,510 13,510 10,51o 10,510 10,510 10,510 129,120 10,760.00 ЕXPENSES Fixed Expenses Rent 1,600 1,600 1,600 1,600 1,600 1,600 1,700 1,700 1,700 1,700 1,700 1,700 19,800 1,650.00 Health insurance 300 300 300 300 300 300 350 350 350 350 350 350 3,900 325.00 Life insurance 20 20 20 20 20 20 20 20 20 20 20 20 240 20.00 Home purchase fund 500 500 500 500 500 2,500 208.33 Renter's insurance 220 220 18.33 Automobile insurance 600 600 1,200 100.00 Auto loan payments Student loan payments 490 490 490 490 490 490 490 490 490 490 490 490 5,880 490.00 300 300 300 300 300 300 300 300 300 300 300 300 3,600 300.00 Savingslemergencies Harry's retirement plan Belinda's retirement plan 100 100 100 100 100 100 100 100 100 100 100 100 1,200 100.00 195 195 195 195 195 195 195 195 195 195 195 195 2,340 195.00 400 400 400 400 400 400 400 400 400 400 400 400 4,800 400.00 160.00 1,700.00 500.00 Cable TV and Internet 160 160 160 160 160 160 160 160 160 160 160 160 1,920 20,400 6,000 Federal income taxes 1,700 1,700 1,700 1,700 500 1,700 S00 1,700 1,700 1,700 1,700 500 1,700 500 1,700 500 1,700 State income taxes S00 500 500 500 500 500 S00 Social security taxes Automobile registration Total fixed expenses Variable Expenses 800 800 800 800 800 800 800 800 800 800 800 800 9,600 800.00 300 300 25.00 6,565 6,565 6,565 6,565 6,565 7,165 6,715 7,435 7,215 7,215 7,515 7,815 83,900 6,991.67 Savings money market Revolving savings fund Food (home) 400 3,000 3,400 283.33 250 250 210 250 190 240 200 190 1,780 148 33 550 550 550 550 550 550 550 550 550 550 550 550 6,600 550.00 Food (out) 300 300 300 300 300 300 300 300 300 300 300 300 3,600 300.00 Utilities 220 220 220 220 220 220 220 220 220 220 220 220 2,640 220.00 Cell phones Auto gas repairs 110 110 110 110 110 110 110 110 110 110 110 110 1,320 110.00 220 220 220 220 220 220 220 220 220 220 220 220 2,640 220.00 Doctoridentist 100 100 100 100 100 100 100 100 100 100 100 100 1,200 100.00 out-of-pocket Medicines 60 60 60 60 60 60 60 60 60 60 60 60 720 60.00 Clothing and upkeep Church and charity 170.00 96.67 170 170 170 170 170 170 170 170 170 170 170 170 2,040 100 100 100 100 100 60 100 100 100 100 100 100 1,160 1,475 1,920 Gifts 80 80 110 75 140 120 60 60 400 300 122.92 Public transportation Personal allowances 160 160 160 160 160 160 160 160 160 160 160 160 160.00 S00 500 500 500 500 500 500 S00 S00 S00 S00 S00 6,000 500.00 Entertainment 150 150 150 150 150 150 150 150 150 150 150 150 1,800 150.00 European vacation 400 400 400 400 400 400 200 200 200 200 200 200 3,600 300.00 Summer vacation 200 200 200 200 200 200 1,200 100.00 Anniversary dinner party 42 42 42 42 42 42 42 42 42 42 40 40 500 41.67 Miscellaneous 100 100 100 100 100 100 100 100 100 100 100 100 1,200 100.00 Total variable 3,712 3,712 3,702 3,707 3,712 3,342 3,742 6,042 3,242 3,222 3,380 3,280 44,795 3,732.92 expenses TOTAL EXPENSES 10,277 10,277 10,267 10,272 10,277 10,507 10,457 13,477 10,457 10,437 10,895 11,095 128,695 10,724.58 Difference (available 233 233 243 238 233 53 33 53 73 -385 -585 425 for spending. saving, investing. and donating Revolving savings 385 585 withdrawals Table 3-7 Cash-Flow Calendar for Harry and Belinda Johnson 2 3 Estimated Estimated Surplus/ Deficit (1-2) Cumulative Month Surplus/Deficit $ 233 Income Expenses $ 10,510 $ 10,277 $ 10,277 January $233 February 10,510 233 $ 466 243 $ 709 $ 947 March 10,510 10,267 April 10,510 10,272 238 May 10,510 10,277 233 $1,180 June 10,510 10,507 3 $1,183 July 10,510 10,457 53 $1,236 August 13,510 13,477 33 $1,269 September 10,510 10,457 53 $1,322 October 10,510 10,437 73 $1,395 November 10,510 10,895 -385 $1,010 December 10,510 11,095 -585 $ 425 Total $129,120 $128,695 $425

> What two factors in the process of calculating life insurance needs are likely to be the most expensive to replace?

> James Sprater of Grand Junction, Colorado, has been shopping for a loan to buy a used car. He wants to borrow $18,000 for four or five years. James’s credit union offers a declining-balance loan at 9.1 percent for 48 months, resulting in a monthly paymen

> Identify periods in a typical person’s life when the need for life insurance is low and one when it is high.

> Explain why the multiple-of-earnings approach is less accurate than a needs-based approach to life insurance planning

> List five types of needs that can be addressed through life insurance.

> Distinguish between the dying-too-soon problem and the living-too-long problem and the best ways to address each.

> If you choose a “silver” health insurance plan, how much of your out-of-pocket medical costs will be paid by the plan?

> Summarize how subsidies reduce the price of insurance premiums under the ACA.

> List three of the 10 essential benefits of all new health care plans.

> Who does the ACA impact and who does it not?

> Summarize what the Affordable Care Act is supposed to accomplish.

> What does the book say about why the USA has such an expensive health care system?

> Alexis Monroe, a biologist from Dyersburg, Tennessee, is curious about the accuracy of the interest charges shown on her most recent credit card billing statement, which appears as Figure 7-1. Use the average daily balances provided to recalculate the in

> When considering likelihood of loss and severity of loss, explain which one of these two concepts is more important when deciding whether to buy insurance and why.

> List, describe, and give an example of each of the five ways to handle risk of loss.

> Explain the distinctions between risk and odds.

> Distinguish between pure risk and speculative risk.

> When shopping for a vehicle what are three things you need to know about when conducting preshopping research?

> Distinguish between needs and wants, and explain why it may be better to act as if no needs exist.

> What is planned buying?

> Summarize the process to determine whether you can afford a particular purchase.

> Distinguish between an unsecured line of credit and a home equity credit line.

> Explain the basic features of bank credit cards..

> The Hernandezes’ older son, Jacob, has reached the age at which it is time to consider purchasing a car for him. Victor and Maria have decided to give Maria’s old car to Jacob and buy a later-model used car for Maria. Required: (a) What sources can Vict

> What is open-end credit and give three examples.

> Distinguish between capital improvements in real estate investing and repairs.

> Distinguish between the price-to-rent ratio and the rental yield as measures of current income.

> What are the two key questions to consider before investing in real estate?

> Name two things investors should consider doing before investing in real estate.

> Name five services that are unique to mutual funds.

> List five advantages of investing in mutual funds.

> Explain how net asset value is calculated and how it is used by mutual funds.

> Illustrate how housing buyers can pay less than renters when taxes and appreciation of housing values are considered.

> Identify three ways that home buyers can save on their income taxes.

> After several years of riding a bus to work, Belinda finds that she can no longer do so because her employer moved to a location that is not convenient for public transportation. Thus the Johnsons are in the market for another car. Harry and Belinda esti

> Distinguish between periodic tenancy and tenancy for a specific time when renting housing.

> Explain the purpose and value of a lease for both the renter and the landlord.

> Now that you have read the chapter on estate planning, what do you recommend to Chrisanna and Fernando on the subject of retirement and estate planning regarding: 1. How much in Social Security benefits can each expect to receive? 2. How much do they eac

> Now that you have read the chapter on real estate and high-risk investments, what do you recommend to Brittany on: 1. Investing in real estate? 2. Putting some money into collectibles or gold? 3. Investing in options and futures contracts?

> Now that you have read the chapter on mutual funds, what do you recommend to Helen and David Lilienthal in the case at the beginning of the chapter regarding: 1. Redeeming their CDs and investing their retirement money in mutual funds? 2. Investing in gr

> Now that you have read the chapter on stocks and bonds, what do you recommend to Ariya Jutanugarn in the case at the beginning of the chapter regarding: 1. Investing for retirement in 18 years? 2. Owning blue-chip common stocks and preferred stocks rathe

> Now that you have read the chapter on investment fundamentals, what do you recommend to Shanice and Sarena on the subject regarding: 1. Portfolio diversification for Sarena? 2. Dollar-cost averaging for Shanice? 3. Investment alternatives for Sarena?

> Shopping for life insurance?

> Coordinating their retirement savings and other investments with their life insurance program?

> What types of life insurance they should consider.

> Lauren Rowland is a dentist in Hebron, Kentucky, who recently entered into a contract to buy a new automobile. After signing to finance $38,000, she hurriedly left the office of the sales finance company with her copy of the contract. Later that evening,

> Now that you have read the chapter on protecting loved ones through life insurance, what would you recommend to Stephanie and Will Bridgeman in the case at the beginning of the chapter regarding: 1. Their changing need for life insurance now that they ha

> Now that you have read the chapter on health care planning, what do you recommend to Danielle DiMartino in the case at the beginning of the chapter regarding: 1. Choosing among the four alternatives available to her? 2. Danielle’s concerns about providin

> Now that you have read the chapter on risk management and property liability insurance, what would you recommend to Nick and Amber in the case at the beginning of the chapter regarding: 1. The risk-management steps they should take to update their insura

> Zachary Porter of Abilene, Texas, is contemplating borrowing $10,000 from his bank. The bank could use add-on rates of 6.5 percent for 3 years, 7 percent for 4 years, and 8 percent for 5 years. Use Equation 7.1 to calculate the finance charge and monthly

> Kimberly Jensen of Storm Lake, Iowa, wants to buy some living room furniture for her new apartment. A local store offered credit at an APR of 16 percent, with a maximum term of four years. The furniture she wishes to purchase costs $4,800, with no down p

> Kayla Sampson, an antiques dealer from Mankato, Minnesota, received her monthly billing statement for April for her MasterCard account. The statement indicated that she had a beginning balance of $600, on day 5 she charged $150, on day 12 she charged $30

> Miguel Perez of Pamona, California, obtained a two-year installment loan for $1,500 to buy a television set eight months ago. The loan had a 12.6 percent APR and a finance charge of $204.72. His monthly payment is $71.03. Miguel has made eight monthly pa

> What is the likelihood of average people paying estate or inheritance taxes?

> Distinguish between an irrevocable living trust and testamentary trusts?

> What topics go into a properly drafted will?

> Now that you have read the chapter on buying housing, what do you recommend to Shelby Clark regarding: 1. Buying or renting housing in the Denver area? 2. Steps she should take prior to actively looking at homes? 3. Finding a home and negotiating the pur

> Distinguish between probate and nonprobate property.

> What is probate, and give three examples of how people should transfer assets by contract to avoid probate.

> Offer some positive and negative observations on the wisdom of buying an annuity with some of your retirement nest egg money when you retire.

> Summarize how long one’s retirement money will last given certain withdrawal rates.

> Name two types of penalty-free withdrawals from retirement accounts.

> What are some negative impacts of taking early withdrawals from retirement accounts?

> Offer reasons why futures contracts are not appropriate for the long-term investor.

> Explain how a speculative options investor can make a lot of money.

> Summarize one way a person with a conservative investment philosophy can profit in options.

> Distinguish between a call and a put for the options investor.

> Now that you have read this chapter on vehicle and other major purchases, what do you recommend to David and Lisa Cosgrove regarding: 1. How to search for a vehicle to replace Alyssa’s? 2. Whether to replace Alyssa’s vehicle with a new or used vehicle? 3

> Review Figures 13-1 and 13-2, and record in writing an investment plan to fund your retirement, presumably one of your own long-term goals. Figures 13-1: Figures 13-2: Figure 13-1 Long-Term Rates of Return on Investments (Annualized returns since 1

> What does a health care proxy achieve?

> What is a living will and what does it try to accomplish?

> Offer some reasons why people should create advance directive documents.

> What does a durable power of attorney provide, and can it be changed?

> Describe the term release and explain why signing a release too soon might work to your disadvantage.

> Describe what you should do to file a claim most effectively when involved in an automobile accident.

> What is the best way to establish documentation for potential losses to your personal property?

> Who would use a Keogh rather than a SEP-IRA to save for retirement?

> List two differences between a Roth IRA and a traditional IRA.

> Now that you have read this chapter on credit cards and consumer loans, what would you recommend to Zachary Cochrane regarding: 1. His approach to using credit cards, including the number of cards he has? 2. Estimating the credit card interest charges he

> Summarize the importance of low-cost investment fees to long-term retirement success.

> Why should workers choose to save for retirement through a personally established retirement account?

> Identify some risks of investing in precious stones and gems.

> Identify one collectible that might be an interesting investment, and explain why it might be difficult to make a profit.

> Give a math example of how to calculate a bond’s yield to maturity that is different than the one in the book.

> Summarize why bonds and interest rates have an inverse relationship.

> Summarize the differences between I-bonds and TIPS bonds.

> Distinguish among Treasury bills, notes, and bonds.

> What are the basic differences between corporate, U.S. government, and municipal bonds?

> Distinguish between investment- and speculative-grade bonds.

> Both options and futures are risky investments. Identify one that seems like an unwise idea, and explain why it is unappealing.

> What happens to a worker’s 401(k) retirement account if he or she signs up for an auto-rebalance account service?

> Comment on three popular rules of thumb of asset allocation including being 100 percent invested in stocks.

> What is asset allocation, and why does it work?

> Explain the concept of dollar-cost averaging including why one invests at below average costs.

> What is the goal of portfolio diversification, and how is this accomplished?

> Summarize what the buy-and-hold long-term investment strategy is all about.

> Distinguish between own-occupation and any-occupation disability income insurance plans.

> Identify three policy provisions to consider when purchasing disability income insurance.

> Explain who needs disability insurance.

> Summarize how you determine your level of need for disability income insurance.