Question: River City National Bank has been in

River City National Bank has been in business for 10 years and is a fast-growing community bank. Its president, Gary Miller, took over his position 5 years ago in an effort to get the bank on its feet. He is one of the youngest bank presidents in the southwest, and his energy and enthusiasm explain his rapid advancement. Mr. Miller has been the key factor behind the bank’s increased status and maintenance of high standards. One reason for this is that the customers come first in Mr. Miller’s eyes; to him, one of the bank’s main objectives is to serve its customers better.

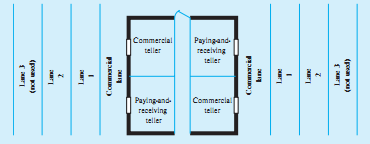

The main bank lobby has one commercial teller and three paying-and-receiving teller booths. The lobby is designed to have room for long lines should they occur. Attached to the main bank are six drive-in lanes (one is commercial only) and one walk-up window to the side of the drive-in. Because of the bank’s rapid growth, the drive-in lanes and lobby have been overcrowded constantly, although the bank has some of the longest hours in town. The lobby is open from 9 AM until 2 PM, Monday through Saturday, and reopens from 4 to 6 PM on Friday. The drive-in is open from 7 AM until midnight, Monday through Friday, and on Saturday from 7 AM. Until 7 PM. Several old and good customers have complained, however. They did not like the long wait in line and also felt that the tellers were becoming quite surly.

This was very disheartening to Mr. Miller, despite the cause of the problem being the increased business. Thus, it was with his strong recommendation that the board of directors finally approved the building of a remote drive-in bank just down the street. As Figure 11.13 shows, this new drive-in can be approached from two directions and has four lanes on either side. The first lane on either side is commercial only, and the last lane on each side has been built but is not yet operational. Hours for this facility are 7 AM to 7 PM, Monday through Saturday.

Figure 11.13: Layout of Remote Drive-In

The bank employs both full-time and part-time tellers. The lobby tellers and the morning tellers (7 AM to 2 PM) are considered to be full-time employees, whereas the drive-in tellers on the afternoon shift (2 PM to 7 PM) and the night-owl shift (7 PM to midnight) are considered to be part-time. The tellers perform normal banking services: cashing checks, receiving deposits, verifying deposit balances, selling money orders and traveler’s checks, and cashing government savings bonds. At present, overcrowding for the most part has been eliminated. The hardest challenge to resolving the situation was making customers aware of the new facility. After six months, tellers at the remote drive-in still hear customers say, “I didn’t realize ya’ll were over here. I’m going to start coming here more often!â€

Now, instead of facing an overcrowding situation, the bank is finding problems with fluctuating demand. River City National rarely experienced this problem until the extra capacity of tellers and drive-in lanes was added in the new remote facility.

Two full- and four part-time tellers are employed at the remote drive-in Monday through Friday. Scheduling on Saturdays is no problem, because all six tellers take turns rotating, with most working every other Saturday. On paydays and Fridays, the lanes at the remote drive-in have cars lined up out to the street. A high demand for money and service from the bank is the main reason for this dilemma, but certainly not the only one. Many customers are not ready when they get to the bank. They need a pen or a deposit slip, or they do not have their check filled out or endorsed yet. Of course, this creates idle time for the tellers. There also are other problems with customers that take time, such as explaining that their accounts are overdrawn and their payroll checks therefore must be deposited instead of cashed. In addition, there usually is a handful of noncustomers who are trying to cash payroll or personal checks. These people can become quite obstinate and take up a lot of time when they find that their checks cannot be cashed. Transactions take 30 seconds on average; transaction times range from 10 seconds for a straight deposit to 90 seconds for cashing a bond to about 3 minutes for making out traveler’s checks. (The latter occurs very rarely.)

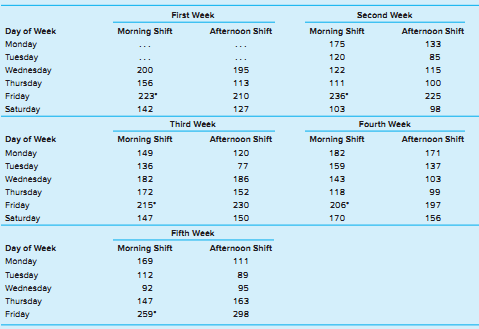

Compared with the peak banking days, the rest of the week is very quiet. The main bank stays busy but is not crowded. On the other hand, business at the remote drive-in is unusually slow. Mr. Miller’s drive-in supervisor, Ms. Shang-ling Chen, studied the number of transactions that tellers at the remote facility made on the average. The figures for a typical month are shown in Table 11.10.

Table 11.10: Transactions for Typical Month at Remote Drive-In

Once again, customers are complaining. When tellers at the remote drive-in close out at 7 PM on Fridays, they are always turning people away while they are in the process of balancing. These customers have asked Mr. Miller to keep the new drive-in open at least until 9 PM on Friday. The tellers are very much against the idea, but the board of directors is beginning to favor it. Mr. Miller wants to keep his customers happy but feels there must be some other way to resolve the situation. Therefore, he calls in Ms. Chen and requests that she look into the problem and make some recommendations for a solution.

Assignment

As Ms. Chen’s top aide, you are assigned the task of analyzing the situation and recommending a solution. This is your opportunity to serve your company and community as well as to make yourself “look good†and earn points toward your raise and promotion.

Transcribed Image Text:

Commercial Paying and teller receiving Paying and Commercial teller receiving teller P kine 1 Lane Z Lane 3 (pon you) Day of Week Monday Tuesday Wednesday Thursday Friday Saturday Day of Week Monday Tuesday Wednesday Thursday Friday Saturday Day of Week Monday Tuesday Wednesday Thursday Friday Morning Shift 200 156 First Week 223* 142 Third Week Morning Shift 149 136 182 172 215* 147 Afternoon Shift Morning Shift 169 112 92 147 259* Fifth Week 195 113 210 127 Afternoon Shift 120 77 186 152 230 150 Afternoon Shift 111 89 95 163 298 Second Week Morning Shift 175 120 122 111 236* 103 206* 170 Morning Shift 182 159 143 118 Afternoon Shift 133 85 Fourth Week 115 100 225 98 Afternoon Shift 171 137 103 99 197 156

> 21. World-class service operations strive to replace workers with enhanced automation. 22. Firms classified as "available for service" view quality improvement efforts with disdain. 23. For a firm achieving "journeyman" competitive status, the back-offic

> 1. Point-of-sale scanning became feasible only when industry agreed upon a universal system of bar coding. 2. One role of holding inventory is to hedge against anticipated increases in the cost of the inventoried items. 3. Inventory management is concern

> 11. Fast-food restaurants use a causal model to forecast daily demand for menu items. 12. Subjective models are used to assess the future impact of changing demographics. 13. Costs for preparing time-series forecasts generally are lower than for other mo

> 1. Because of the nontangible nature of a service, forecasting does not play as important a role in service operations as in manufacturing operations. 2. The trade-off to be made with respect to accuracy is between the costs of inaccurate forecasts and t

> 14. When Xerox Corporation introduced the Model 9200 Duplicating System, the level of service dipped because technical representatives were assigned to territories. 15. The average time a customer should expect to wait can be calculated using just the me

> 1. Capacity planning decisions deal implicitly with decisions on the cost of making consumers wait and the extent to which these costs can be borne. 2. A system is said to be in a transient state when the values of its governing parameters in this state

> 1. Waiting is often seen as psychological punishment because the consumer is aware of the opportunity cost of waiting time and the resulting loss of earnings. 2. The net result of waiting, apart from the boredom and frustration experienced by the consume

> 12. Yield management is a pricing and capacity allocation system that was developed by American Airlines. 13. Yield management is a strategy that manages both demand and capacity. 14. An example of segmenting demand is seen when movie theaters offer mati

> 1. The use of a ski-resort hotel for business conventions during the summer is an example of using the complementary service strategy. 2. Overbooking is a strategy that can be used to smooth demand. 3. The strategy of segmenting demand to reduce variatio

> 11. A diversified network is a situation where many services are offered at a single location. 12. Franchising usually is used when developing a focused network. 13. A family restaurant is an example of a focused service. 14. Communication is included in

> 1. Network development is a consideration in the decision to plan a multinational service. 2. When a firm offers multiple services at a single location, it is using a clustered service strategy. 3. A franchise is a low risk investment, because the franch

> 14. Retail and wholesale trade had the greatest percentage of U.S. employment by industry in 2014. 15. From a marketing perspective, services, unlike goods, involve transfer of ownership. 16. It is convenient and often necessary to combine the operations

> 14. Customer-supplier duality acknowledges the customer inputs in a service relationship. 15. A bank is an example of a service provider with a single-level bi-directional service supply relationship. 16. Transfer enhances productive capacity by enabling

> 1. In the physical goods supply chain, information moves to the left and material to the right. 2. Customer demand variability is the most difficult factor to determine in a goods supply chain. 3. In the past, the flow of goods in a physical supply chain

> 11. Geographic information systems are a visual method of displaying data. 12. Cross-median is an approach to the location of a single facility using the metropolitan metric to maximize the total distance traveled. 13. Marketing intermediaries are busin

> 1. Finding a unique set of sites in a multi-location problem is a simple extension of the methods used for single facility location. 2. When a customer travels to the service facility, the direct cost that is incurred is the decrease in potential custome

> 1. DEA circumvents the need to develop standard costs for each service when comparing the efficiency of multiple service units that provide similar services. 2. Data envelopment analysis (DEA) is best used in an environment of low divergence and high com

> 11. Serving complimentary drinks on a delayed flight is an example of empathy being shown by the service personnel to the irate customer. 12. In the service quality gap model, GAP1 arises because of the management’s lack of understanding about how custom

> 1. The concept of quality service deployment is based on the belief that services should be designed to reflect customer requirements. 2. Being meaningful and easy to invoke are important elements of a good unconditional service guarantee. 3. A process i

> 14. The procedure to improve flow distance in a process layout by arranging the relative location of departments is known as operations sequence analysis. 15. A product layout affords some degree of customization. 16. Mid-Columbia Medical Center has a sp

> 1. The servicescape can influence perceived quality. 2. The design of facilities is dependent entirely on the construction and operating costs of the facilities. 3. A well-conceived servicescape can communicate desired customer behavior. 4. Heuristic alg

> 14. Internet banking is a service that would appeal to the economizing customer, the personalizing customer, and the convenience customer. 15. Efficiency- versus-satisfaction is the possible source of conflict in the relationship between the customer and

> 1. Services are deeds, processes, and performances. 2. The Clark-Fisher hypothesis notes the shift of employment from one sector of the economy to another. 3. The fall in employment in the agricultural sector is the primary reason for the increase in se

> 1. Who are Goodwill’s customers and how have their demo-graphics changed over time? 2. How should the introduction of for-profit thrifts affect Goodwill’s decisions about the role of customer service? 3. How can Goodwi

> 1. Marketing analysts use market position maps to display visually the customers’ perceptions of a firm in relation to its competitors regarding two attributes. Prepare a market position map for Alamo Draft house using “food quality” and “movie selection

> 1. For the Burger Palace example, perform a complete analysis of efficiency improvement alternatives for unit S2, including determination of a composite reference unit. 2. For the Burger Palace example, perform a complete analysis of efficiency improveme

> 1. Compare and contrast the strategic service vision of El Banco and United Commercial Bank. 2. Identify the service winners, qualifiers, and service losers for El Banco and United Commercial Bank. 3. What are the differentiating features of banks tha

> 1. Use DEA to identify efficient and inefficient terminal operations. Formulate the problem as a linear programming model, and solve using computer software such as Excel Solver that permits input file editing between runs. 2. Using the appropriate refer

> 1. Assume that you are part of the management staff whose task is to develop this sketch plan. Using Microsoft Project, develop the PERT network as outlined above, identify the critical path, and determine the expected time to reach basic operational sta

> 1. Using Microsoft Project, prepare a network and identify the critical path activities, the expected project duration, and scheduling times for all activities. 2. The elapsed time for delivery of the hardware is estimated at 90 days. Would the project c

> Located in a major southwestern U.S. city, Elysian Cycles (EC) is a wholesale distributor of bicycles and bicycle parts. Its primary retail outlets are located in eight cities within a 400-mile radius of the distribution center. These retail outlets gene

> 1. Assuming that the cost of stock out is the lost contribution of one dessert, how many portions of Sweet Revenge should the chef prepare each weekday? 2. Based on Martin Quinn’s estimate of other stock out costs, how many servings sho

> A.D. Small, Inc., provides management consulting services from its offices located in more than 300 cities in the United States and abroad. The company recruits its staff from top graduates of recognized MBA programs. Upon joining A.D. Small, a recruit a

> Gnomial Functions, Inc. (GFI), is a medium-sized consulting firm in San Francisco that specializes in developing various forecasts of product demand, sales, consumption, or other information for its clients. To a lesser degree, it also has developed ongo

> Oak Hollow Medical Evaluation Center is a nonprofit agency offering multidisciplinary diagnostic services to study children with disabilities or developmental delays. The center can test each patient for physical, psychological, or social problems. Fees

> Computer simulation provides management an experimental laboratory in which to study a model of a real system and to determine how the system might respond to changes in policies, resource levels, or customer demand. A system, for our purposes, is define

> 1. Describe Xpresso Lube’s service package. 2. How are the distinctive characteristics of a service operation illustrated by Xpresso Lube? 3. What elements of Xpresso Lube’s location contribute to its success? 4. Given the example of Xpresso Lube, what o

> On a hillside in Rolling wood, a community just southwest of Austin, Texas, the Renaissance Clinic provides dedicated obstetric and gynecological services. The medical treatment at this facility is wrapped in an exclusive-feeling physical environment tha

> Let us revisit the Automobile Driver’s License Office Example 5.2 and model the proposed process improvement shown as Figure 5.6 (b). Recall that the improvement consisted of combining activities 1 and 4 (Review Application and Eye Test

> Renaissance Clinic is a hospital dedicated to the health care of women. It is located in the hill country surrounding Austin, Texas, and offers an environment that is unique in the city. At the time of a visit, a patient of Dr. Margaret Thompsonâ&#

> 1. During periods of bad weather, as compared with periods of clear weather, how many additional gallons of fuel on aver-age should FreeEx expect its planes to consume because of airport congestion? 2. Given FreeEx’s policy of ensuring that its planes do

> The Houston Port Authority has engaged you as a consultant to advise it on possible changes in the handling of wheat exports. At present, a crew of dockworkers using conventional belt conveyors unloads hopper cars containing wheat into cargo ships bound

> Go forth armed with clipboard and stopwatch and study an actual waiting experience (e.g., post office, fast-food restaurant, retail bank). Begin with a sketch of the layout noting the queue configuration. Describe the characteristics of the calling popul

> 1. In this chapter, we referred to Maister’s First and Second Laws of Service. How do they relate to this case? 2. What features of a good waiting process are evident in Dr. X’s practice? List the shortcomings that you see. 3. Do you think that Mrs. F is

> Thrifty Car Rental (now part of Hertz) began as a regional business in the southwest, but it now has more than 470 locations across the country and almost 600 international locations. About 80 percent of its U.S. locations are at airports, and the rest a

> 1. For the forecast period (i.e., July–December), determine the number of new trainees who must be hired at the beginning of each month so that total personnel costs for the flight-attendant staff and training program are minimized. For

> On the morning of November 10, 2002, Jon Thomas, market analyst for the Mexico leisure markets, canceled more than 300 seats “illegally” reserved on two flights to Acapulco. All of the seats on Jon’s Acapulco flights were booked by the same sales represe

> 1. How is SSM different from Deming’s PDCA cycle? 2. Prepare a cause-and-effect or fishbone diagram for a problem such as “Why customers have long waits for coffee.” Your fishbone diagram should be s

> 1. Assume that you are the assistant to the manager for operations at the FAA. Use the techniques of work shift scheduling to analyze the total workforce requirements and days-off schedule. For the primary analysis, assume that a. Operator requirements w

> Securing a mortgage often is a time-consuming and frustrating experience for a homebuyer. The process involves multi- ple stages with many handoffs to independent organizations providing specialized services (e.g., property survey and title search). The

> 1. What features of the 7-Eleven Japan distribution system illustrate the concept of the bidirectional service supply relationship? 2. Does the 7-Eleven Japan distribution system exhibit scalability economies? 3. How does the 7-Eleven example of B2C e-co

> 1. How does the Boomer Technology Circle illustrate the concept of the bidirectional service supply relationship? 2. How has Boomer Consulting, Inc., made the client a coproduce in the service delivery process? 3. How is the concept of “

> 1. Utilizing a spreadsheet version of the Huff location model (with λ = 1.0), recommend a store size and location for AFI. Assuming that AFI does not wish to consider a store that is smaller than 10,000 square feet, assess the store sizes (b

> Joan Taylor, the administrator of Life-Time Insurance Company, which is based in Buffalo, New York, was charged with establishing a health maintenance organization (HMO) satellite clinic in Austin, Texas. The HMO concept would offer Austin residents an a

> 1. Briefly summarize the complaints and compliments in Dr. Loflin’s letter. 2. Critique the letter of Gail Pearson in reply to Dr. Loflin. What are the strengths and weaknesses of the letter? 3. Prepare an “improved” response letter from Gail Pearson. 4.

> 1. Prepare an -chart and R-chart for complaints, and plot the average complaints for each crew during the nine-month period. Do the same for the performance ratings. What does this analysis reveal about the service quality of CSI’s

> 1. Describe Village Volvo’s service package. 2. How are the distinctive characteristics of a service firm illustrated by Village Volvo? 3. How could Village Volvo manage its back office (i.e., repair operations) like a factory? 4. How can Village Volvo d

> 1. How do the environmental dimensions of the services cape explain the success of Central Market? 2. Comment on how the services cape shapes the behaviors of both customers and employees. Central Market5 The original Central Market grocery store, locat

> 1. Use CRAFT logic to develop a layout that will maximize customer time in the store. 2. What percentage increase in customer time spent in the store is achieved by the proposed layout? 3. What other consumer behavior concepts should be considered in the

> 1. Identify the bottleneck activity, and show how capacity can be increased by using only two pharmacists and two technicians. 2. In addition to savings on personnel costs, what benefits does this arrangement have? Health Maintenance Organization (B) Th

> 1. Beginning with a good initial layout, use operations sequence analysis to determine a better layout that would minimize the walking distance between different areas in the clinic. 2. Defend your final layout based on features other than minimizing wal

> 1. How has Enterprise Rent-A-Car (ERAC) defined its service differently than that of the typical national car rental company? 2. What features of its business concept allow ERAC to compete effectively with the existing national rental car companies? 3. U

> 1. Describe the service organization culture at Amy’s Ice Cream. 2. What are the personality attributes of the employees who are sought by Amy’s Ice Cream? 3. Design a personnel selection procedure for Amy’s Ice Cream using abstract questioning, a situat

> 1.How does Amazon.com illustrate the sources of service sector growth? Comment on information technology, the Internet as an enabler, innovation, and changing demographics. 2.What generic approach(s) to service design does Amazon.com illustrate, and what

> 1. Prepare a service blueprint for Commuter Cleaning. 2. What generic approach to service system design is illustrated by Commuter Cleaning, and what competitive advantages does this design offer? 3. Using the data in Table 3.5, calculate a break-eve

> 1. Describe the growth strategy of Federal Express. How did this strategy differ from those of its competitors? 2. What risks were involved in the acquisition of Tiger International? 3. In addition to the question of merging FedEx and Flying Tigers pilot

> 1. Prepare a service blueprint for the 100 Yen Sushi House operation. 2. What features of the 100 Yen Sushi House service delivery system differentiate it from the competition, and what competitive advantages do they offer? 3. How has the 100 Yen Sushi

> 1. Prepare a run chart on each of the incident categories. Does she have reason to be concerned about burglaries? What variable might you plot against burglaries to create a scatter diagram to determine a possible explanation? 2. What is unusual about th

> Conduct a Google search on “project finance” and find employment opportunities in project finance. What is the role of finance in projects?

> Could firms in the “world-class service delivery” stage of competitiveness be described as “learning organizations’?

> Discuss the difference between time variance, cost variance, and schedule variance.

> Explain why the PERT estimate of expected project duration always is optimistic. Can we get any feel for the magnitude of this bias?

> Are Gantt charts still viable project management tools? Explain.

> Illustrate the four stages of team building from your own experience.

> Give an example that demonstrates the trade-off inherent in projects among cost, time, and performance.

> Identify dependent and independent demand for an airline and a hospital.

> Service capacity (i.e., seats on an aircraft) has characteristics similar to inventories. What inventory model would apply?

> How is a service level determined for most inventory items?

> How valid are the assumptions for the simple EOQ model?

> Discuss how information technology can help to create a competitive advantage through inventory management?

> Determine if the U.S. service sector currently is expanding or contracting based upon the Non-Manufacturing Index (NMI) found at ISM Report on Business on the Institute of Supply Management website: http://www.ism.ws/pubs/ismmag/.

> Compare and contrast a continuous review inventory system with a periodic review inventory system?

> How would one find values for inventory management costs?

> Discuss the functions of inventory for different organizations in the supply chain (i.e., manufacturing, suppliers, distributors, and retailers).

> What changes in (, (, and ( would you recommend to improve the performance of the trendline seasonal adjustment forecast shown in Figure 11.4? Figure 11.4: Profile of Operator Requirements and Tour Assignments Number of operators 25 20 15 10 5 0 12

> Why is the N-period moving-average model still in common use if the simple exponential smoothing model has superior qualities?

> Suggest a number of independent variables for a regression model to predict the potential sales volume of a given location for a retail store (e.g., a video rental store).

> The number of customers at a bank likely will vary by the hour of the day and by the day of the month. What are the implications of this for choosing a forecasting model?

> For each of the three forecasting methods (i.e., time series, causal, and subjective), what costs are associated with the development and use of the forecast model? What costs are associated with forecast error?

> What characteristics of service organizations make forecast accuracy important?

> Discuss how the M/G/( model could be used to determine the number of emergency medical vehicles that are required to serve a community.

> Give an example of a firm that began as world-class and has remained in that category.

> What are some disadvantages associated with the concept of pooling service resources?

> For a queuing system with a finite queue, the arrival rate can exceed the capacity to serve. Use an example to explain how this is feasible.

> Example 13.1 presents a naïve capacity planning exercise and was criticized for using averages. Recall the concept of a "bottleneck" from Chapter 5, "Supporting Facility and Process Flows," and suggest other reservations about this planning exercise.

> Discuss how one could determine the economic cost of keeping customers waiting.

> When the line becomes long at some fast-food restaurants, an employee will walk along the line taking orders. What are the benefits of this policy?

> Suggest ways that service management can influence the arrival times of customers.

> Select a bad and good waiting experience, and contrast the situations with respect to the aesthetics of the surroundings, diversions, people waiting, and attitude of servers.

> Suggest diversions that could make waiting less painful.