Question: The following diagram shows the value of

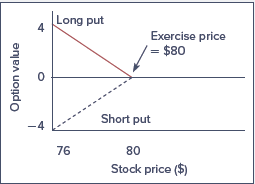

The following diagram shows the value of a put option at expiration:

Which of the following statements about the value of the put option at expiration is true?

a. The expiration value of the short position in the put is $4 if the stock price is $76.

b. The expiration value of the long position in the put is −$4 if the stock price is $76.

c. The long put has a positive expiration value when the stock price is below $80. d. The value of the short position in the put is zero for stock prices equaling or exceeding $76.

> a. Calculate the value of a call option on the stock in the previous problem with an exercise price of 110. b. Verify that the put-call parity relationship is satisfied by your answers to both Problems 8 and 9. (Do not use continuous compounding to calc

> We will derive a two-state put option value in this problem. Data: S0 = 100; X = 110; 1 + r = 1.10. The two possibilities for ST are 130 and 80. a. Show that the range of S is 50 while that of P is 30 across the two states. What is the hedge ratio of th

> Show that Black-Scholes call option hedge ratios increase as the stock price increases. Consider a one-year option with exercise price $50 on a stock with annual standard deviation 20%. The Tbill rate is 3% per year. Find N(d1) for stock prices (a) $45,

> Reconsider the determination of the hedge ratio in the two-state model (Section 16.2), where we showed that one-third share of stock would hedge one option. What would be the hedge ratio for each of the following exercise prices: (a) $120; (b) $110; (

> In each of the following questions, you are asked to compare two options with parameters as given. The risk-free interest rate for all cases should be assumed to be 6%. Assume the stocks on which these options are written pay no dividends. a. Which put

> a. Return to Problem 37. What will be the payoff to the put, Pu, if the stock goes up? b. What will be the payoff, Pd, if the stock price falls? c. Value the put option using the risk-neutral shortcut described in the On the Market Front box. Confirm t

> Return to Problem 35. Value the call option using the risk-neutral shortcut described in the On the Market Front box. Confirm that your answer matches the value you get using the two-state approach.

> Use the put-call parity relationship to demonstrate that an at-the-money European call option on a nondividend-paying stock must cost more than an at-the-money put option. Show that the prices of the put and call will be equal if X = S0(1 + r)T.

> The following questions have appeared on CFA examinations a. Which one of the following statements best expresses the central idea of countercyclical fiscal policy? Planned government deficits are appropriate during economic booms, and planned surpluses

> You build a binomial model with one period and assert that over the course of a year, the stock price will either rise by a factor of 1½ or fall by a factor of ⅔. What is your implicit assumption about the volatility of the stock’s rate of return over th

> Suppose you are attempting to value a one-year maturity option on a stock with volatility (i.e., annualized standard deviation) of σ = 0.40. What would be the appropriate values for u and d if your binomial model is set up using the following? a. One pe

> We showed in the chapter that the value of a call option increases with the volatility of the stock. Is this also true of put option values? Use the putcall parity relationship as well as a numerical example to demonstrate your answer. (

> You would like to be holding a protective put position on the stock of XYZ Co. to lock in a guaranteed minimum value of $100 at year-end. XYZ currently sells for $100. Over the next year, the stock price will either increase by 10% or decrease by 10%. Th

> You are a provider of portfolio insurance and are establishing a four-year program. The portfolio you manage is currently worth $100 million, and you promise to provide a minimum return of 0%. The equity portfolio has a standard deviation of 25% per year

> a. Return to Example 16.1. Use the binomial model to value a one-year European put option with exercise price $110 on the stock in that example. b. Show that your solution for the put price satisfies put-call parity.

> Consider an increase in the volatility of the stock in the previous problem. Suppose that if the stock increases in price, it will increase to $130, and that if it falls, it will fall to $70. Show that the value of the call option is higher than the valu

> You are attempting to value a call option with an exercise price of $100 and one year to expiration. The underlying stock pays no dividends, its current price is $100, and you believe it has a 50% chance of increasing to $120 and a 50% chance of decreasi

> You are very bullish (optimistic) on stock EFG, much more so than the rest of the market. In each question, choose the portfolio strategy that will give you the biggest dollar profit if your bullish forecast turns out to be correct. Explain your answer.

> A collar is established by buying a share of stock for $50, buying a six-month put option with exercise price $45, and writing a six-month call option with exercise price $55. Based on the volatility of the stock, you calculate that for an exercise price

> Janet Ludlow is preparing a report on U.S.-based manufacturers in the electric toothbrush industry and has gathered the information shown in Tables 12.8. Ludlow’s report concludes that the electric toothbrush industry is in the maturity

> In this problem, we derive the put-call parity relationship for European options on stocks that pay dividends before option expiration. For simplicity, assume that the stock makes one dividend payment of $D per share at the expiration date of the option.

> These three put options all are written on the same stock. One has a delta of −0.9, one a delta of −0.5, and one a delta of −0.1. Assign deltas to the three puts by filling in the table below.

> Consider a six-month expiration European call option with exercise price $105. The underlying stock sells for $100 a share and pays no dividends. The risk-free rate is 5%. What is the implied volatility of the option if the option currently sells for $8?

> A call option on Jupiter Motors stock with an exercise price of $75 and one-year expiration is selling at $3. A put option on Jupiter stock with an exercise price of $75 and one-year expiration is selling at $2.50. If the risk-free rate is 8% and Jupiter

> The hedge ratio (delta) of an at-the-money call option on IBM is 0.4. The hedge ratio of an at-themoney put option is − 0.6. What is the hedge ratio of an at-the-money straddle position on IBM?

> According to the Black-Scholes formula, what will be the hedge ratio (delta) of a put option for a very small exercise price?

> According to the Black-Scholes formula, what will be the hedge ratio (delta) of a call option as the stock price becomes infinitely large? Explain briefly.

> If the time to expiration falls and the put price rises, then what has happened to the put option’s implied volatility?

> If the stock price falls and the call price rises, then what has happened to the call option’s implied volatility?

> Should the rate of return of a call option on a long-term Treasury bond be more or less sensitive to changes in interest rates than the rate of return of the underlying bond?

> Adams’s research report (see the previous problem) continued as follows: “With a business expansion already under way, the expected profit surge should lead to a much higher price for Universal Auto stock. We strongly recommend purchase.” a. Discuss the

> All else being equal, will a call option with a high exercise price have a higher or lower hedge ratio than one with a low exercise price?

> All else being equal, is a call option on a stock with a lot of firm-specific risk worth more than one on a stock with little firm-specific risk? The betas of the stocks are equal.

> All else being equal, is a put option on a highbeta stock worth more than one on a low-beta stock? The firms have identical firm-specific risk

> Would you expect a $1 increase in a call option’s exercise price to lead to a decrease in the option’s value of more or less than $1?

> A put option on a stock with a current price of $33 has an exercise price of $35. The price of the corresponding call option is $2.25. According to put-call parity, if the effective annual risk-free rate of interest is 4% and there are three months until

> What would be the Excel formula in Spreadsheet 16.1 for the Black-Schools value of a straddle position?

> Recalculate the value of the option in Problem 16, successively substituting one of the changes below while keeping the other parameters as in Problem 16: Templates and spreadsheets are available in Connect a. Time to expiration = 3 months b. Standard

> Find the Black-Scholes value of a put option on the stock in the previous problem with the same exercise price and expiration as the call option.

> Use the Black-Scholes formula to find the value of a call option on the following stock: Time to expiration = 6 months Standard deviation = 50% per year Exercise price = $50 Stock price = $50 Interest rate = 3% Dividend = 0

> Mark Washington, CFA, is an analyst with BIC. One year ago, BIC analysts predicted that the U.S. equity market would most likely experience a slight downturn and suggested delta-hedging the BIC portfolio. As predicted, the U.S. equity markets did indeed

> Universal Auto is a large multinational corporation headquartered in the United States. For segment reporting purposes, the company is engaged in two businesses: production of motor vehicles and information processing services. The motor vehicle business

> Mark Washington, CFA, is an analyst with BIC. One year ago, BIC analysts predicted that the U.S. equity market would most likely experience a slight downturn and suggested delta-hedging the BIC portfolio. As predicted, the U.S. equity markets did indeed

> Mark Washington, CFA, is an analyst with BIC. One year ago, BIC analysts predicted that the U.S. equity market would most likely experience a slight downturn and suggested delta-hedging the BIC portfolio. As predicted, the U.S. equity markets did indeed

> Mark Washington, CFA, is an analyst with BIC. One year ago, BIC analysts predicted that the U.S. equity market would most likely experience a slight downturn and suggested delta-hedging the BIC portfolio. As predicted, the U.S. equity markets did indeed

> Mark Washington, CFA, is an analyst with BIC. One year ago, BIC analysts predicted that the U.S. equity market would most likely experience a slight downturn and suggested delta-hedging the BIC portfolio. As predicted, the U.S. equity markets did indeed

> Mark Washington, CFA, is an analyst with BIC. One year ago, BIC analysts predicted that the U.S. equity market would most likely experience a slight downturn and suggested delta-hedging the BIC portfolio. As predicted, the U.S. equity markets did indeed

> A call option with a strike price of $50 on a stock selling at $55 costs $6.50. What are the call option’s intrinsic and time values?

> You are a portfolio manager who uses options positions to customize the risk profile of your clients. In each case, what strategy is best given your client’s objective? a. Performance to date: Up 16%. Client objective: Earn at least 15%. Your forecast:

> You establish a straddle on Fincorp using September call and put options with a strike price of $80. The call premium is $7.00 and the put premium is $8.50. a. What is the most you can lose on this position? b. What will be your profit or loss if Finco

> An investor buys a call at a price of $4.50 with an exercise price of $40. At what stock price will the investor break even on the purchase of the call?

> As a securities analyst you have been asked to review a valuation of a closely held business, Wigwam Autoparts Heaven, Inc. (WAH), prepared by the Red Rocks Group (RRG). You are to give an opinion on the valuation and to support your opinion by analyzing

> You purchase one Microsoft December $140 put contract for a premium of $5.30. What is you rmaximum possible profit? (See Figure 15.1.)

> Turn back to Figure 15.1, which lists the prices of various Microsoft options. Use the data in the figure to calculate the payoff and the profits for investments in each of the following November 2019 expiration options, assuming that the stock price on

> The following price quotations are for exchangelisted options on Primo Corporation common stock. With transaction costs ignored, how much would a buyer have to pay for one call option contract?

> Some agricultural price support systems have guaranteed farmers a minimum price for their output. a. Describe the program provisions as an option. What type of option do the farmers receive? b. What is the asset? C. What is the exercise price?

> Devise a portfolio using only call options and shares of stock with the following value (payoff) at the option expiration date. If the stock price is currently $55, what kind of bet is the investor making?

> You write a call option with X = $50 and buy a call with X = $60. The options are on the same stock and have the same expiration date. One of the calls sells for $3; the other sells for $9. a. Draw the payoff graph for this strategy at the option expirat

> Joe Finance has just purchased a stock-index fund, currently selling at $2,400 per share. To protect against losses, Joe plans to purchase an at-the-money European put option on the fund for $120, with exercise price $2,400-, and three-month time to expi

> You buy a share of stock, write a one-year call option with X = $10, and buy a one-year put option with X = $10. Your net outlay to establish the entire portfolio is $9.50. What is the payoff of your portfolio? What must be the risk-free interest rate? T

> A put option with strike price $60 trading on the Acme options exchange sells for $2. To your amazement, a put on the firm with the same expiration selling on the Apex options exchange but with strike price $62 also sells for $2. If you plan to hold the

> Consider the following portfolio. You write a put option with exercise price $90 and buy a put with the same expiration date with exercise price $95. a. Plot the value of the portfolio at the expiration date of the options. b. Now, plot the profit of t

> The following bond swaps could have been made in recent years as investors attempted to increase the total return on their portfolio. From the information presented below, identify possible reason(s) that investors may have made each swap.

> Consider the following options portfolio: You write a November 2019 expiration call option on Microsoft with exercise price $140. You also write a November expiration Microsoft put option with exercise price $145. a. Graph the payoff of this portfolio a

> An executive compensation scheme might provide a manager a bonus of $1,000 for every dollar by which the company’s stock price exceeds some cutoff level. In what way is this arrangement equivalent to issuing the manager calls options on the firm’s stock?

> what ways is owning a corporate bond similar to writing a put option? A call option?

> Why do you think the most actively traded options tend to be the ones that are near the money?

> Use the spreadsheet from the Excel Application boxes on spreads and straddles (page 492, also available in Connect; link to Chapter 15 material) to answer these questions. a. Plot the payoff and profit diagrams to a straddle position with an exercise (

> You think there is great upward potential in the stock market and would like to participate in the upward move if it materializes. However, you cannot afford substantial stock market losses and so cannot run the risk of a stock market collapse, which you

> A bearish spread is the purchase of a call with exercise price X2 and the sale of a call with exercise price X1, with X2 greater than X1. Graph the payoff to this strategy and compare it to Figure 15.10.

> a. A butterfly spread is the purchase of one call at exercise price X1, the sale of two calls at exercise price X2, and the purchase of one call at exercise price X3. X1 is less than X2, and X2 is less than X3 by equal amounts, and all calls have the sam

> Jane Joseph, a manager at Computer Science, Inc. (CSI), received 1,000 shares of company stock as part of her compensation package. The stock currently sells at $40 a share. Joseph would like to defer selling the stock until the next tax year. In January

> The common stock of the C.A.L.L. Corporation has been trading in a narrow range around $50 per share for months, and you believe it is going to stay in that range for the next three months. The price of a three-month put option with an exercise price of

> A member of a firm’s investment committee is very interested in learning about the management of fixed-income portfolios. He would like to know how fixed-income managers position portfolios to capitalize on their expectations concerning three factors tha

> The common stock of the P.U.T.T. Corporation has been trading in a narrow price range for the past month, and you are convinced it is going to break far out of that range in the next three months. You do not know whether it will go up or down, however. T

> Suppose you think AppX stock is going to appreciate substantially in value in the next year. Say the stock’s current price, S0, is $100, and the call option expiring in one year has an exercise price, X, of $100 and is selling at a pric

> Imagine that you are holding 5,000 shares of stock, currently selling at $40 per share. You are ready to sell the shares but would prefer to put off the sale until next year due to tax reasons. If you continue to hold the shares until January, however, y

> An investor purchases a stock for $38 and a put for $0.50 with a strike price of $35. The investor also sells a call for $0.50 with a strike price of $40. a. What are the maximum profit and loss for this position? b. Draw the profit and loss diagram f

> We said that options can be used to either scale up or reduce overall portfolio risk. What are some examples of risk-increasing and risk-reducing options strategies? Explain each.

> Hatfield Industries is a large manufacturing conglomerate based in the United States with annual sales in excess of $300 million. Hatfield is currently under investigation by the Securities and Exchange Commission (SEC) for accounting irregularities and

> Recently, Galaxy Corporation lowered its allowance for doubtful accounts by reducing bad debt expense from 2% of sales to 1% of sales. Ignoring taxes, what are the immediate effects on (a) operating income and (b) operating cash flow?

> Cash flow from operating activities includes: a. Inventory increases resulting from acquisitions. b. Inventory changes due to changing exchange rates. c. Interest paid to bondholders. d. Dividends paid to stockholders.

> Cash flow from investing activities excludes: a. Cash paid for acquisitions. b. Cash received from the sale of fixed assets. c. Inventory increases due to a new (internally developed) product line. d. All of the above.

> A company’s current ratio is 2. If the company uses cash to retire notes payable due within one year, would this transaction increase or decrease the current ratio? What about the asset turnover ratio?

> a. Which set of conditions will result in a bond with the greatest price volatility? high coupon and a short maturity. A high coupon and a long maturity. A low coupon and a short maturity. A low coupon and a long maturity. b. An investor who expects de

> Rank the following bonds in order of descending duration.

> Suppose that the president proposes a new law aimed at reducing healthcare costs: All Americans are required to eat one apple daily. a. How would this apple-a-day law affect the demand and equilibrium price of apples? b. How would the law affect the marg

> Two towns, each with three residents, are deciding whether to put on a fireworks display to celebrate the New Year. Fireworks cost $360. In each town, some people enjoy fireworks more than others. a. In the town of Bayport, each of the residents values t

> Some years ago, the New York Times reported that “the inability of OPEC to agree last week to cut production has sent the oil market into turmoil . . . [leading to] the lowest price for domestic crude oil since June 1990.” a. Why were the members of OPEC

> Using supply-and-demand diagrams, show the effects of the following events on the market for sweatshirts. a. A hurricane in South Carolina damages the cotton crop. b. The price of leather jackets falls. c. All colleges require morning exercise in appropr

> You are the chief financial officer for a firm that sells gaming consoles. Your firm has the following average-total-cost schedule: Your current level of production is 600 consoles, all of which have been sold. Someone calls, desperate to buy one of your

> Buffy is thinking about opening an amulet store. She estimates that it would cost $350,000 per year to rent the location and buy the merchandise. In addition, she would have to quit her $80,000 per year job as a vampire hunter. a. Define opportunity cost

> Fredo loves watching Downton Abbey on his local public TV station, but he never sends any money to support the station during its fund-raising drives. a. What name do economists have for people like Fredo? b. How can the government solve the problem caus

> Suppose you are a typical person in the U.S. economy. You pay 4 percent of your income in a state income tax and 15.3 percent of your labor earnings in federal payroll taxes (employer and employee shares combined). You also pay federal income taxes. How

> This chapter discusses many types of costs: opportunity cost, total cost, fixed cost, variable cost, average total cost, and marginal cost. Fill in the type of cost that best completes each sentence: a. What you give up in taking some action is called th

> List some of the ways that the problems caused by externalities can be solved without government intervention.

> Why do some economists advocate taxing consumption rather than income?

> Why is the burden of a tax to taxpayers greater than the revenue received by the government?

> Explain how corporate profits are taxed twice.

> Henry Potter owns the only well in town that produces clean drinking water. He faces the following demand, marginal-revenue, and marginal-cost curves: Demand: P = 70 - Q Marginal Revenue: MR = 70 – 2Q Marginal Cost: MC = 10 + Q a. Graph these three cur