Question: The Tusquittee Company is a retail company

The Tusquittee Company is a retail company that began operations on October 1, 2018, when it incorporated in the state of North Carolina. The Tusquittee Company is authorized to issue 100,000 shares of $1 par value common stock and 50,000 shares of 5%, $50 par value preferred stock. The company sells a product that includes a one-year warranty and records estimated warranty payable each month. Customers are charged a 6% state sales tax. The company uses a perpetual inventory system. There are three employees that are paid a monthly salary on the last day of the month.

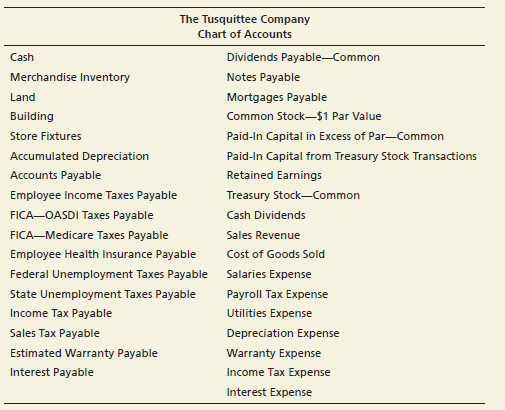

Following is the chart of accounts for The Tusquittee Company. As a new business, all beginning balances are $0.

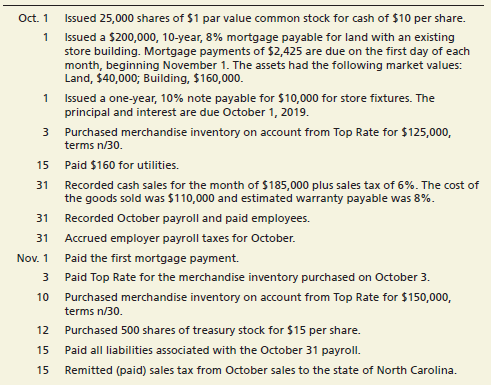

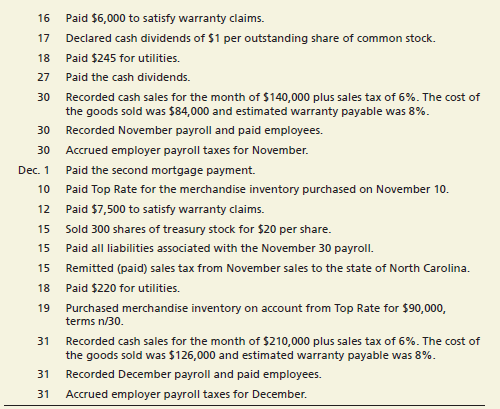

The Tusquittee Company completed the following transactions during the last quarter of 2018, its first year of operations:

Requirements:

1. In preparation for recording the transactions, prepare:

a. An amortization schedule for the first 3 months of the mortgage payable issued on October 1. Round interest calculations to the nearest dollar.

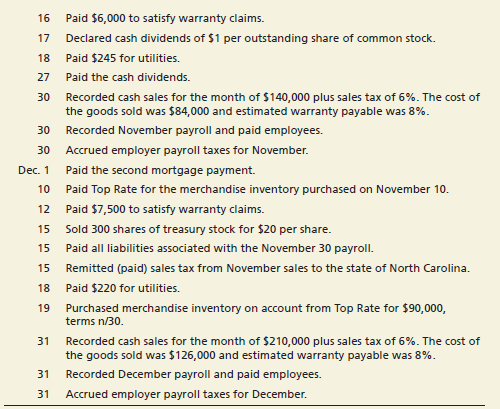

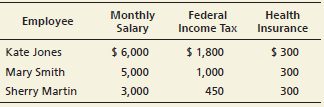

b. Payroll registers for October, November, and December. All employees worked October 1 through December 31 and are subject to the following FICA taxes: OASDI: 6.2% on first $118,500 earned; Medicare: 1.45% up to $200,000, 2.35% on earnings above $200,000. Additional payroll information includes:

c. Calculations for employer payroll taxes liabilities for October, November, and December: OASDI: 6.2% on first $118,500 earned; Medicare: 1.45%; SUTA: 5.4% on first $7,000 earned; FUTA: 0.6% on first $7,000 earned.

2. Record the transactions in the general journal. Omit explanations.

3. Post to the general ledger.

4. Record adjusting entries for the three month period ended December 31, 2018:

a. Depreciation on the Building, straight-line, 40 years, no residual value.

b. Store Fixtures, straight-line, 20 years, no residual value.

c. Accrued interest expense on the note payable for the store fixtures.

d. Accrued interest expense on the mortgage payable.

e. Accrued income tax expense of $36,000.

5. Post adjusting entries and prepare an adjusted trial balance.

6. Prepare a multi-step income statement and statement of retained earnings for the quarter ended December 31, 2018. Prepare a classified balance sheet as of December 31, 2018. Assume that $13,840 of the mortgage payable is due within the next year.

7. Evaluate the company’s success for the first quarter of operations by calculating the following ratios. The market price of the common stock is $25 on December 31, 2018. Round to two decimal places.

a. Times interest earned

b. Debt to equity

c. Earnings per share

d. Price/earnings ratio

e. Rate of return on common stock

8. The Tusquittee Company wants to expand and is considering options for raising additional cash. The company estimates net income before the expansion of $250,000 in 2019 and that the expansion will provide additional operating income of $75,000 in 2019. The company intends to sell the shares of treasury stock, so use issued shares for the analysis rather than current shares outstanding. Compare these options, assuming a 30% income tax rate:

Plan 1: Issue 10,000 additional shares of common stock for $20 per share

Plan 2: Issue $200,000 in 20-year, 12% bonds payable.

Which option will contribute more net income in 2019? Which option provides the highest EPS?

Transcribed Image Text:

The Tusquittee Company Chart of Accounts Cash Dividends Payable--Common Merchandise Inventory Notes Payable Land Mortgages Payable Building Common Stock-$1 Par Value Store Fixtures Paid-In Capital in Excess of Par-Common Accumulated Depreciation Paid-In Capital from Treasury Stock Transactions Accounts Payable Retained Earnings Employee Income Taxes Payable Treasury Stock-Common FICA-OASDI Taxes Payable Cash Dividends FICA-Medicare Taxes Payable Sales Revenue Employee Health Insurance Payable Cost of Goods Sold Federal Unemployment Taxes Payable Salaries Expense State Unemployment Taxes Payable Payroll Tax Expense Income Tax Payable Utilities Expense Sales Tax Payable Depreciation Expense Estimated Warranty Payable Warranty Expense Interest Payable Income Tax Expense Interest Expense Issued 25,000 shares of $1 par value common stock for cash of $10 per share. 1 Issued a $200,000, 10-year, 8% mortgage payable for land with an existing store building. Mortgage payments of $2,425 are due on the first day of each month, beginning November 1. The assets had the following market values: Land, $40,000; Building, $160,000. Oct. 1 Issued a one-year, 10% note payable for $10,000 for store fixtures. The principal and interest are due October 1, 2019. 3 Purchased merchandise inventory on account from Top Rate for $125,000, 1 terms n/30. 15 Paid $160 for utilities. 31 Recorded cash sales for the month of $185,000 plus sales tax of 6%. The cost of the goods sold was $110,000 and estimated warranty payable was 8%. 31 Recorded October payroll and paid employees. 31 Accrued employer payroll taxes for October. Nov. 1 Paid the first mortgage payment. 3 Paid Top Rate for the merchandise inventory purchased on October 3. 10 Purchased merchandise inventory on account from Top Rate for $150,000, terms n/30. 12 Purchased 500 shares of treasury stock for $15 per share. 15 Paid all liabilities associated with the October 31 payroll. 15 Remitted (paid) sales tax from October sales to the state of North Carolina. 16 Paid $6,000 to satisfy warranty claims. 17 Declared cash dividends of $1 per outstanding share of common stock. 18 Paid $245 for utilities. 27 Paid the cash dividends. 30 Recorded cash sales for the month of $140,000 plus sales tax of 6%. The cost of the goods sold was $84,000 and estimated warranty payable was 8%. 30 Recorded November payroll and paid employees. 30 Accrued employer payroll taxes for November. Dec. 1 Paid the second mortgage payment. 10 Paid Top Rate for the merchandise inventory purchased on November 10. 12 Paid $7,500 to satisfy warranty claims. 15 Sold 300 shares of treasury stock for $20 per share. 15 Paid all liabilities associated with the November 30 payroll. 15 Remitted (paid) sales tax from November sales to the state of North Carolina. 18 Paid $220 for utilities. 19 Purchased merchandise inventory on account from Top Rate for $90,000, terms n/30. Recorded cash sales for the month of $210,000 plus sales tax of 6%. The cost of the goods sold was $126,000 and estimated warranty payable was 8%. 31 31 Recorded December payroll and paid employees. 31 Accrued employer payroll taxes for December. 16 Paid $6,000 to satisfy warranty claims. 17 Declared cash dividends of $1 per outstanding share of common stock. 18 Paid $245 for utilities. 27 Paid the cash dividends. 30 Recorded cash sales for the month of $140,000 plus sales tax of 6%. The cost of the goods sold was $84,000 and estimated warranty payable was 8%. 30 Recorded November payroll and paid employees. 30 Accrued employer payroll taxes for November. Dec. 1 Paid the second mortgage payment. 10 Paid Top Rate for the merchandise inventory purchased on November 10. 12 Paid $7,500 to satisfy warranty claims. 15 Sold 300 shares of treasury stock for $20 per share. 15 Paid all liabilities associated with the November 30 payroll. 15 Remitted (paid) sales tax from November sales to the state of North Carolina. 18 Paid $220 for utilities. 19 Purchased merchandise inventory on account from Top Rate for $90,000, terms n/30. Recorded cash sales for the month of $210,000 plus sales tax of 6%. The cost of the goods sold was $126,000 and estimated warranty payable was 8%. 31 31 Recorded December payroll and paid employees. 31 Accrued employer payroll taxes for December. Monthly Salary Federal Health Employee Income Tax Insurance Kate Jones $ 6,000 $ 1,800 $ 300 Mary Smith 5,000 1,000 300 Sherry Martin 3,000 450 300

> How does the Sarbanes-Oxley Act relate to internal controls?

> Ward Hardware does not expect costs to change dramatically and wants to use an inventory costing method that averages cost changes. Requirements: 1. Which inventory costing method would best meet Ward’s goal? 2. Assume Ward wanted to expense out the new

> What are two common methods used when accepting deposits for credit card and debit card transactions?

> What does the cash ratio help determine, and how is it calculated?

> Why is it necessary to record journal entries after the bank reconciliation has been prepared? Which side of the bank reconciliation requires journal entries?

> List some examples of timing differences, and for each difference, determine if it would affect the book side of the reconciliation or the bank side of the reconciliation.

> What is a bank reconciliation?

> What are some common controls used with a bank account?

> When are the only times the Petty Cash account is used in a journal entry?

> What are the controls needed to secure the petty cash fund?

> List internal control procedures related to e-commerce.

> What does the lower-of-cost-or-market (LCM) rule require?

> What is par value?

> Tillman Comfort Specialists, Inc. reported the following stockholders’ equity on its balance sheet at June 30, 2018: Requirements: 1. Identify the different classes of stock that Tillman Comfort Specialists has outstanding. 2. What is

> Ward Hardware used the FIFO inventory costing method in 2018. Ward plans to continue using the FIFO method in future years. Which accounting principle is most relevant to Ward’s decision?

> Jimmy and Randy are opening a comic store. There are no competing comic stores in the area. They must decide how to organize the business. They anticipate profits of $550,000 the first year, with the ability to sell franchises in the future. Although the

> Bianchi Company reported these figures for 2018 and 2017: Requirements: 1. Compute Bianchi Company’s earnings per share for 2018. Assume the company paid the minimum preferred dividend during 2018. Round to the nearest cent. 2. Comput

> The balance sheet of Goldstein Management Consulting, Inc. at December 31, 2017, reported the following stockholders’ equity: During 2018, Goldstein completed the following selected transactions: Requirements: 1. Record the transact

> The following information was taken from the records of Chua Motorsports, Inc. at November 30, 2018: Prepare a multi-step income statement for Chua Motorsports for the fiscal year ended November 30, 2018. Include earnings per share. $ 110,000 Commo

> Deerborn Manufacturing Co. completed the following transactions during 2018: Requirements: 1. Record the transactions in Deerborn’s general journal. 2. Prepare the Deerborn’s stockholders’ equity se

> D-Mobile Wireless needed additional capital to expand, so the business incorporated. The charter from the state of Georgia authorizes D-Mobile to issue 50,000 shares of 8%, $50 par value cumulative preferred stock and 160,000 shares of $4 par value commo

> Voyage Comfort Specialists, Inc. reported the following stockholders’ equity on its balance sheet at June 30, 2018: Requirements: 1. Identify the different classes of stock that Voyage Comfort Specialists has outstanding. 2. What is t

> Montel and Jeremy are opening a paint store. There are no competing paint stores in the area. They must decide how to organize the business. They anticipate profits of $350,000 the first year, with the ability to sell franchises in the future. Although t

> Use Target Corporation’s financial statements to answer the following questions. Visit http://www.pearsonhighered.com/Horngren to view a link to Target Corporation’s Fiscal 2015 Annual Report. Requirements: 1. Review the stockholders’ equity section of

> Rocket Corp. earned net income of $153,040 and paid the minimum dividend to preferred stockholders for 2018. Assume that there are no changes in common shares outstanding during 2018. Rocket’s books include the following figures: Requ

> Discuss some measures that should be taken to maintain control over merchandise inventory.

> Kelly May Bakery, Inc. reported a prior-period adjustment in 2018. An accounting error caused net income of prior years to be overstated by $1,000. Retained Earnings at December 31, 2017, as previously reported, was $48,000. Net income for 2018 was $74,0

> Faccone Academy Surplus had 60,000 shares of common stock and 9,000 shares of 20%, $15 par value preferred stock outstanding through December 31, 2018. Income from continuing operations for 2018 was $711,000, and loss on discontinued operations (net of i

> Many types of transactions may affect stockholders’ equity. Identify the effects of the following transactions on total stockholders’ equity. Each transaction is independent. a. A 10% stock dividend. Before the dividend, 540,000 shares of $1 par value c

> Complete the following chart by inserting a check mark (U ) for each statement that is true. Cash dividend Stock dividend Stock split Decreases retained earnings Has no effect on a liability Increases paid-in capital by the same amount that it decre

> Wood Golf Club Corp. had the following stockholders’ equity at December 31, 2017: On June 30, 2018, Wood Golf Club split its common stock 2-for-1. Prepare the stockholders’ equity section of the balance sheet immedia

> Self-Defense Schools, Inc. is authorized to issue 200,000 shares of $2 par common stock. The company issued 73,000 shares at $5 per share. When the market price of common stock was $7 per share, Self-Defense Schools declared and distributed a 14% stock d

> The stockholders’ equity of Lakeside Occupational Therapy, Inc. on December 31, 2017, follows: On April 30, 2018, the market price of Lakeside’s common stock was $16 per share and the company declared a 13% stock div

> The following elements of stockholders’ equity are from the balance sheet of Sneed Marketing Corp. at December 31, 2017: Sneed paid no preferred dividends in 2017. Requirements: 1. Compute the dividends to the preferred and common sh

> Northern Communications has the following stockholders’ equity on December 31, 2018: Requirements: 1. Assuming the preferred stock is cumulative, compute the amount of dividends to preferred stockholders and to common stockholders for

> Stock transactions for Careful Driving School, Inc. follow: Journalize the transactions. Mar. 4 Issued 27,000 shares of $1 par value common stock at $10 per share. May 22 Purchased 1,300 shares of treasury stock-common at $13 per share. Sep. 22 Sol

> What is the goal of conservatism?

> Southern Amusements Corporation had the following stockholders’ equity on November 30: On December 30, Southern purchased 200 shares of treasury stock at $15 per share. Requirements: 1. Journalize the purchase of the treasury stock.

> The charter of Evergreen Corporation authorizes the issuance of 900 shares of preferred stock and 1,400 shares of common stock. During a two-month period, Evergreen completed these stock-issuance transactions: Requirements: 1. Record the transactions i

> The charter for ASAP-TV, Inc. authorizes the company to issue 100,000 shares of $5, no-par preferred stock and 500,000 shares of common stock with $1 par value. During its start-up phase, ASAP-TV completed the following transactions: Requirements: 1. R

> Eates Corp. issued 8,000 shares of no-par common stock for $13 per share. Requirements: 1. Record issuance of the stock if the stock: a. is true no-par stock. b. has stated value of $3 per share. 2. Which type of stock results in more total paid-in capi

> Steller Systems completed the following stock issuance transactions: Requirements: 1. Journalize the transactions. Explanations are not required. 2. How much paid-in capital did these transactions generate for Steller Systems? May 19 Issued 1,700 s

> LaSalle Exploration Company reported these figures for 2018 and 2017: Compute rate of return on common stockholders’ equity for 2018 assuming no dividends were declared or paid to preferred stockholders. 2018 2017 Income Statement

> Clix Photographic Supplies, Inc.’s accounting records include the following for 2018: Prepare Clix’s multi-step income statement for the year ending December 31, 2018. Omit earnings per share. $ 12,000 $ 525,000

> Aruba Corporation recently organized. The company issued common stock to an inventor in exchange for a patent with a market value of $57,000. In addition, Aruba received cash for 6,000 shares of its $10 par preferred stock at par value and 6,500 shares o

> Following is a list of advantages and disadvantages of the corporate form of business. Identify each quality as either an advantage or a disadvantage. a. Ownership and management are separated. b. Entity has continuous life. c. Transfer of ownership is

> Lena Kay and Kathy Lauder have a patent on a new line of cosmetics. They need additional capital to market the products, and they plan to incorporate the business. They are considering the capital structure for the corporation. Their primary goal is to r

> Discuss the materiality concept. Is the dollar amount that is material the same for a company that has annual sales of $10,000 compared with a company that has annualsales of $1,000,000?

> After looking into debt financing through notes, mortgage, and bonds payable, Canyon Canoe Company decides to raise additional capital for the planned business expansion. The company will be able to acquire cash as well as land adjacent to its current bu

> In 75 words or fewer, explain the difference between stock dividends and stock splits. Include the effect on stock values.

> The Walt Disney Company is a diversified entertainment company that is comprised of five different business segments. Walt Disney began as a cartoon studio in 1920 and today is known as a leading worldwide entertainment provider. Requirements: 1. On the

> On December 31, 2018, when the market interest rate is 8%, Biggs Realty issues $450,000 of 5.25%, 10-year bonds payable. The bonds pay interest semiannually. The present value of the bonds at issuance is $365,732. Requirements: 1. Prepare an amortizatio

> On December 31, 2018, when the market interest rate is 12%, Benson Realty issues $600,000 of 9.25%, 10-year bonds payable. The bonds pay interest semiannually. Determine the present value of the bonds at issuance.

> Your grandfather would like to share some of his fortune with you. He offers to give you money under one of the following scenarios (you get to choose): 1. $8,750 per year at the end of each of the next six years 2. $49,650 (lump sum) now 3. $100,450 (l

> Luxury Suites Hotels includes the following selected accounts in its general ledger at December 31, 2018: Prepare the liabilities section of Luxury Suites’s balance sheet at December 31, 2018. Notes Payable (long-term) $ 200,000 A

> On January 1, 2018, Powell Company issued $350,000 of 10%, five-year bonds payable at 102. Powell Company has extra cash and wishes to retire the bonds payable on January 1, 2019, immediately after making the second semiannual interest payment. To retire

> McQueen Company issued a $100,000, 7.5%, 10-year bond payable. Journalize the following transactions for McQueen Company, and include an explanation for each entry: a. Issuance of the bond payable at face value on January 1, 2018. b. Payment of semiannu

> When using the periodic inventory system and weighted-average inventory costing method, when is the weighted-average cost per unit computed?

> Wilkes Mutual Insurance Company issued a $100,000, 5%, 10-year bond payable at 111 on January 1, 2018. Interest is paid semiannually on January 1 and July 1. Requirements: 1. Journalize the issuance of the bond payable on January 1, 2018. 2. Journalize

> Owen Company issued a $110,000, 11%, 10-year bond payable at 94 on January 1, 2018. Interest is paid semiannually on January 1 and July 1. Requirements: 1. Journalize the issuance of the bond payable on January 1, 2018. 2. Journalize the payment of sem

> Savvy Drive-Ins borrowed money by issuing $3,500,000 of 9% bonds payable at 99.5. Interest is paid semiannually. Requirements: 1. How much cash did Savvy receive when it issued the bonds payable? 2. How much must Savvy pay back at maturity? 3. How much

> Bond prices depend on the market rate of interest, stated rate of interest, and time. Requirements: 1. Compute the price of the following 8% bonds of Country Telecom. a. $100,000 issued at 75.25 b. $100,000 issued at 103.50 c. $100,000 issued at 94.50 d

> Ember Company purchased a building with a market value of $280,000 and land with a market value of $55,000 on January 1, 2018. Ember Company paid $15,000 cash and signed a 25-year, 12% mortgage payable for the balance. Requirements: 1. Journalize the Ja

> On January 1, 2018, Lake man-Fay signed a $1,500,000, 15-year, 7% note. The loan required Lake man-Fay to make annual payments on December 31 of $100,000 principal plus interest. Requirements: 1. Journalize the issuance of the note on January 1, 2018. 2

> On December 31, 2018, when the market interest rate is 6%, Benson Realty issues $700,000 of 6.25%, 10-year bonds payable. The bonds pay interest semiannually. Benson Realty received $713,234 in cash at issuance. Requirements: 1. Prepare an amortization

> David is entering high school and is determined to save money for college. David feels he can save $5,000 each year for the next four years from his part-time job. If David is able to invest at 6%, how much will he have when he starts college?

> Jackson Corporation has the following amounts as of December 31, 2018. Compute the debt to equity ratio at December 31, 2018. Total assets $ 55,250 Total liabilities 22,750 Total equity 32,500

> Power Company issued a $1,000,000, 5%, 5-year bond payable at face value on January 1, 2018. Interest is paid semiannually on January 1 and July 1. Requirements: 1. Journalize the issuance of the bond payable on January 1, 2018. 2. Journalize the paymen

> When using the periodic inventory system, which inventory costing method(s) always produces the same result as when using the perpetual inventory system?

> Bond prices depend on the market rate of interest, stated rate of interest, and time. Determine whether the following bonds payable will be issued at face value, at a premium, or at a discount: a. The market interest rate is 8%. Idaho issues bonds payab

> What is the difference between the stated interest rate and the market interest rate?

> Explain each of the key factors that the time value of money depends on.

> In regard to a bond discount or premium, what is the effective-interest amortization method?

> How does compound interest differ from simple interest?

> What is an annuity?

> What does the debt to equity ratio show, and how is it calculated?

> What are the two categories of liabilities reported on the balance sheet? Provide examples of each.

> What does it mean when a company calls a bond?

> What is the journal entry to retire bonds at maturity?

> Consider the December transactions for Crystal Clear Cleaning that were presented in Chapter 5. (Cost data have been removed from the sale transactions.) Crystal Clear uses the perpetual inventory system. Requirements: 1. Prepare perpetual inventory re

> Which principle states that businesses should use the same accounting methods and procedures from period to period?

> What type of account is Premium on Bonds Payable? What is its normal balance? Is it added to or subtracted from the Bonds Payable account to determine the carrying amount?

> What type of account is Discount on Bonds Payable? What is its normal balance? Is it added to or subtracted from the Bonds Payable account to determine the carrying amount?

> In regard to a bond discount or premium, what is the straight-line amortization method?

> What is the carrying amount of a bond?

> Why would a company choose to issue bonds instead of issuing stock?

> When a bond is issued, what is its present value?

> When does a premium on bonds payable occur?

> When does a discount on bonds payable occur?

> What is a bond payable?

> What is a mortgage payable?

> At the beginning of the January 2019, Canyon Canoe Company decided to carry and sell T-shirts with its logo printed on them. Canyon Canoe Company uses the perpetual inventory system to account for the inventory. During February 2019, Canyon Canoe Company

> What is an amortization schedule?

> Where is the current portion of notes payable reported on the balance sheet?

> Sleep Well, Inc. is authorized to issue 9%, 10-year bonds payable. On January 1, 2018, when the market interest rate is 10%, the company issues $500,000 of the bonds. The bonds pay interest semiannually. Requirements: 1. How much cash did the company re

> Ari Goldstein issued $300,000 of 11%, five-year bonds payable on January 1, 2018. The market interest rate at the date of issuance was 10%, and the bonds pay interest semiannually. Requirements: 1. How much cash did the company receive upon issuance of

> The accounting records of Compass Wireless include the following as of December 31, 2018: Requirements: 1. Report these liabilities on the Compass Wireless balance sheet, including headings and totals for current liabilities and long-term liabilities.

> On January 1, 2018, Electricians Credit Union (ECU) issued 8%, 20-year bonds payable with face value of $400,000. The bonds pay interest on June 30 and December 31. The issue price of the bonds is 104. Journalize the following bond transactions: a. Issu

> On January 1, 2018, Doctors Credit Union (DCU) issued 7%, 20-year bonds payable with face value of $200,000. The bonds pay interest on June 30 and December 31. Requirements: 1. If the market interest rate is 5% when DCU issues its bonds, will the bonds

> Johnny’s Hamburgers issued 8%, 10-year bonds payable at 85 on December 31, 2018. At December 31, 2020, Johnny reported the bonds payable as follows: Johnny pays semiannual interest each June 30 and December 31. Requirements: 1. Answe