Question: Use Worksheet 15.2. When Jacob Kohler

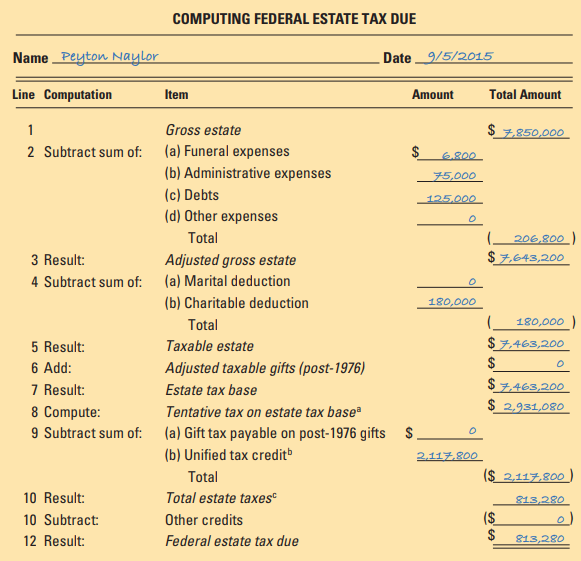

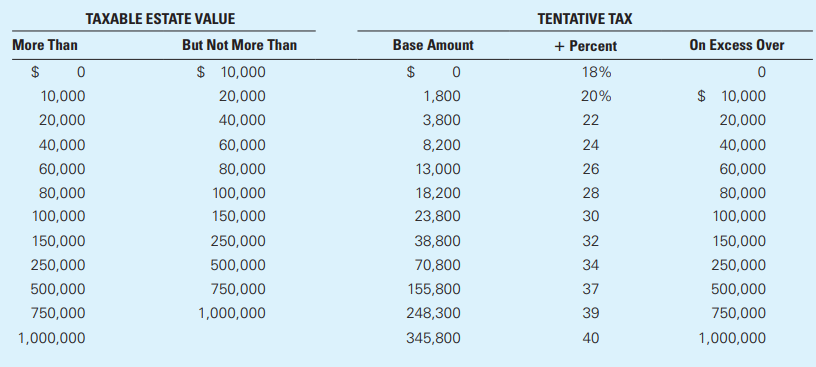

Use Worksheet 15.2. When Jacob Kohler died unmarried in 2015 he left an estate valued at $7,850,000. His trust directed distribution as follows: $20,000 to local hospital, $160,000 to his alma mater, and the remainder to his three adult children. Death-related costs and expenses were $16,800 for funeral expenses, $40,000 paid to attorneys, $5,000 paid to accountants, and $30,000 paid to the trustee of his living trust. In addition, there were debts of $125,000. Use Worksheet 15.2 and Exhibits 15.7 and 15.8 to calculate the federal estate tax due on his estate.

Worksheet 15.2:

Exhibits 15.7:

Exhibits 15.8:

Transcribed Image Text:

COMPUTING FEDERAL ESTATE TAX DUE Name Peyton Naylor Date_9/5/2015 Line Computation Item Amount Total Amount 1 Gross estate 7,850,000 (a) Funeral expenses (b) Administrative expenses (c) Debts 2 Subtract sum of: 6,800 75,000 125,000 (d) Other expenses Total 206,800) 3 Result: $ 7,643,200 Adjusted gross estate (a) Marital deduction 4 Subtract sum of: (b) Charitable deduction 180,000 Total 180,000) 5 Result: Taxable estate $ 7,463,20O 6 Add: 7 Result: 8 Compute: 9 Subtract sum of: Adjusted taxable gifts (post-1976) Estate tax base 7:463,200 2,931,080 Tentative tax on estate tax base (a) Gift tax payable on post-1976 gifts $. (b) Unified tax creditb 2,117,800 Total 2,117,800 10 Result: Total estate taxes® 813,280 10 Subtract: Other credits (24 12 Result: Federal estate tax due 2$ 813,280 TAXABLE ESTATE VALUE TENTATIVE TAX More Than But Not More Than Base Amount + Percent On Excess Over $ 0 $ 10,000 2$ 18% 10,000 20,000 1,800 20% $ 10,000 20,000 40,000 3,800 22 20,000 40,000 60,000 8,200 24 40,000 60,000 80,000 13,000 26 60,000 80,000 100,000 18,200 28 80,000 100,000 150,000 23,800 30 100,000 150,000 250,000 38,800 32 150,000 250,000 500,000 70,800 34 250,000 500,000 750,000 155,800 37 500,000 750,000 1,000,000 248,300 39 750,000 1,000,000 345,800 40 1,000,000 Year Unified Tax Applicable Exclusion Amount-Estates Unified Tax Applicable Exclusion Amount-Gifts Credit-Estates Credit-Gifts 2006 $780,800 $2,000,000 $345,800 $1,000,000 2007 $780,800 $2,000,000 $345,800 $1,000,000 2008 $780,800 $2,000,000 $345,800 $1,000,000 2009 $1,455,800 $3,500,000 $345,800 $1,000,000 2010 Estate tax repealed for 2010 $330,800 $1,000,000 2011 $1,730,800 $5,000,000 $1,730,800 $5,000,000 2012 $1,772,800 $5,120,000 $1,772,800 $5,120,000 2013 $2,045,800 $5,250,000 $2,045,800 $5,250,000 2014 $2,081,800 $5,340,000 $2,081,800 $5,340,000 2015 $2,117,800 $5,430,000 $2,117,800 $5,430,000

> Does Social Security coverage relieve you of the need to do some retirement planning on your own?

> What are the most important sources of retirement income?

> Which type of contract (fixed or variable) might be most suitable for someone who wants a minimum amount of risk exposure?

> Which one of the annuity distribution procedures will result in the highest monthly benefit payment?

> Why does it pay to invest in no-load funds rather than load funds? Under what conditions might it make sense to invest in a load fund?

> If growth, income, and capital preservation are the primary objectives of mutual funds, why do we bother to categorize them by type?

> What are your legal rights and responsibilities when using EFTSs?

> Explain the difference between dirty (full) and clean bond prices? What is the significance of the difference in the prices for a bond buyer?

> Why is it important to have investment objectives when embarking on an investment program?

> Discuss the role of asset allocation in portfolio management.

> What’s the difference between an investment plan and a capital accumulation plan?

> Describe what is meant by a participating policy, and explain the role of policy dividends in these policies.

> Why might an investor buy securities on margin?

> What are some products and services that you, as an individual investor, can now obtain online?

> What are online brokers, and what kinds of investors are most likely to use them?

> What are the perils that most properties are insured for under various types of homeowner’s policies?

> What characteristics would be most important to you when choosing an insurance agent?

> Briefly describe (a) debit cards, (b) banking at ATMs, (c) preauthorized deposits and payments, (d) bank-by-phone accounts, and (e) online banking and bill-paying services.

> Why should the following types of life insurance contracts be avoided? (a) credit life insurance, (b) mortgage life insurance, (c) industrial life insurance (home service life insurance).

> When does it make more sense to pay cash for a big-ticket item than to borrow the money to finance the purchase?

> The monthly statement is a key feature of bank and retail credit cards. What does this statement typically disclose?

> Differentiate between tax evasion and tax avoidance.

> What are the advantages of using tax preparation software?

> Discuss the basics of the Blue Cross/Blue Shield plans.

> What are the two main sources of health insurance coverage in the United States?

> Discuss some benefits of life insurance in addition to protecting family members financially after the primary wage earner’s death.

> What does the loan-to-value ratio on a home represent? Is the down payment on a home related to its loan-to-value ratio? Explain.

> How can accurate records and control procedures be used to ensure the effectiveness of the personal financial planning process?

> Describe the features of an AMA, its advantages, and its disadvantages.

> Given your personal financial circumstances, if you were buying a car today, would you probably pay cash, lease, or finance it, and why? Which factors are most important to you in making this decision?

> Distinguish between fixed and variable expenses, and give examples of each.

> Give two reasons for holding liquid assets. Identify and briefly describe the popular types of liquid assets.

> What is an income and expense statement? What role does it serve in personal financial planning?

> What two factors determine the amount of federal withholding.

> What is the balance sheet equation? Explain when a family may be viewed as technically insolvent.

> Are consumption patterns related to quality of life? Explain.

> Why should health insurance planning be included in your personal financial plan?

> Eva Stone's luxurious home in Georgetown, a neighborhood in Washington, DC, was recently gutted in a fire. Her living and dining rooms were destroyed completely, and the damaged personal property had a replacement price of $27,000. The average age of the

> Explain how the composition of the principal and interest components of a fixed-rate mortgage change over the life of the mortgage. What are the implications of this change?

> What is cash management, and what are its major functions?

> Use Worksheet 9.2. Do you need disability income insurance? Calculate your need using Worksheet 9.2. Discuss how you’d go about purchasing this coverage. Worksheet 9.2: DISABILITY BENEFIT NEEDS Name(s) Date 1. Estimate current mon

> Isabella Harris has an overdraft protection line. Assume that her October 2015 statement showed a latest (new) balance of $862. If the line had a minimum monthly payment requirement of 5 percent of the latest balance (rounded to the nearest $5 figure), t

> Jim Grant plans to borrow $8,000 for five years. The loan will be repaid with a single payment after five years, and the interest on the loan will be computed using the simple interest method at an annual rate of 6 percent. How much will Jim have to pay

> Demonstrate the differences resulting from a $1,000 tax credit versus a $1,000 tax deduction for a single taxpayer in the 25 percent tax bracket with $40,000 of pre-tax income.

> Calculate your own debt safety ratio. What does it tell you about your current credit situation and your debt capacity? Does this information indicate a need to make any changes in your credit use patterns? If so, what steps should you take?

> Recommend three financial goals and related activities for someone in each of the following circumstances: a. A junior in college b. A 30-year-old computer programmer who plans to earn an MBA degree c. A couple in their 30s with two children, ages 3 and

> Describe your current status based on the personal financial planning life cycle shown in Exhibit 1.7. Fill out Worksheet 1.1, “Summary of Personal Financial Goals,” with goals reflecting your current situation and you

> How can using personal financial planning tools help you improve your financial situation? Describe changes you can make in at least three areas.

> Summarize important legislation affecting estate taxes, and briefly describe the impact on estate planning. Explain why getting rid of the estate tax doesn’t eliminate the need for estate planning.

> Define and differentiate between the average tax rate and the marginal tax rate. How does a tax credit differ from an itemized deduction?

> Griffin West, 48 and a widower, and Hailey Burnette, 44 and previously divorced, were married five years ago. There are children from their prior marriages, two children for Griffin and one child for Hailey. The couple’s estate is valued at $1.4 million,

> Your best friend has asked you to be executor of his estate. What qualifications do you need, and would you accept the responsibility?

> State the topics you would cover in your ethical will. Would you consider recording it digitally?

> Prepare a basic will for yourself, using the guidelines presented in the text; also prepare your brief letter of last instructions.

> Darrell and Karla Boykin are in their mid-30s and have two children, ages 8 and 5. They have combined annual income of $95,000 and own a house in joint tenancy with a market value of $310,000, on which they have a mortgage of $250,000. Darrell has $100,0

> Generate a list of estate planning objectives that apply to your personal family situation. Be sure to consider the size of your potential estate as well as people planning and asset planning. Estate planning is not just about taxes.

> Brad Shin is an operations manager for a large manufacturer. He earned $68,500 in 2012 and plans to contribute the maximum allowed to the firm’s 401(k) plan. Assuming that Brad is in the 25 percent tax bracket, calculate his taxable income and the amount

> Ellen Honeycut has just graduated from college and is considering job offers from two companies. Although the salary and insurance benefits are similar, the retirement programs are not. One firm offers a 401(k) plan that matches employee contributions wi

> Use Exhibit 14.3 to determine the annual Social Security benefit for Bob Lemus, assuming that he is an “average” retiree. Bob is 65 years old and earns $18,000 a year at a part-time job. (Note that Bob is already at &a

> Use Exhibit 14.3 to estimate the average Social Security benefits for a retired couple. Assume that one spouse has a part-time job that pays $24,000 a year, and that this person also receives another $47,000 a year from a company pension. Based on curren

> Dan Caldwell was married on January 15, 2014. His wife, Catherine, is a full-time student at the university and earns $625 a month working in the library. How many personal exemptions will Dan and Catherine be able to claim on their joint return? Would i

> Use Worksheet 14.1 to assist Tara Easley with her retirement planning needs. She plans to retire in 15 years, and her current household expenditures run about $50,000 per year. Tara estimates that she’ll spend 80 percent of that amount

> Many critics of the Social Security program feel that participants are getting a substandard investment return on their money. Discuss why you agree or disagree with this viewpoint.

> Use Worksheet 14.1 to help Bill and Shirley Hogan, who’d like to retire while they’re still relatively young—in about 20 years. Both have promising careers, and both make good money. As a result, they

> What are the main differences between fixed and variable annuities? Which type is more appropriate for someone who is 60 years old and close to retirement?

> Why is it important to check an insurance company’s financial ratings when buying an annuity? Why should you look at past performance when considering the purchase of a variable annuity?

> Briefly explain why annuities are a type of tax-sheltered investment. Do you have to give up anything to obtain this tax-favored treatment?

> Explain how buying a variable annuity is much like investing in a mutual fund. Do you, as a buyer, have any control over the amount of investment risk to which you’re exposed in a variable annuity contract? Explain.

> Clint Crandall is in his early 30s and is thinking about opening an IRA. He can’t decide whether to open a traditional/deductible IRA or a Roth IRA, so he turns to you for help. a. To support your explanation, you decide to run some comparative numbers

> Describe the three basic types of IRAs (traditional, Roth, and nondeductible), including their respective tax features and what it takes to qualify for each. Which is most appealing to you personally? Explain.

> Defined benefit vs. defined contribution pension plans. Briefly describe the main characteristics of defined contribution and defined benefit pension plans, and discuss how they differ from cash-balance plans. In each of these plans, does the employee or

> If you itemize your deductions, you may include certain expenses as part of your itemized deductions. Discuss five types of itemized deductions and the general rules that apply to them.

> Marisa Gale, a 25-year-old personal loan officer at Second National Bank, understands the importance of starting early when it comes to saving for retirement. She has designated $3,000 per year for her retirement fund and assumes that she’ll retire at ag

> About a year ago, Ramon Navarrete bought some shares in the Sapphire Lake Mutual Fund. He bought the fund at $24.50 a share, and it now trades at $26. Last year, the fund paid dividends of 40 cents a share and had capital gains distributions of $1.83 a s

> Using the Morningstar information in Exhibit 13.10, evaluate the performance of the QQQ index-based ETF. Specifically, comment on how well it tracks the underlying NASDAQ 100 index and how its performance compares with other similar ETFs. Exhibit 13.10:

> For each pair of funds listed below, select the fund that would be less risky and briefly explain your answer. a. Growth versus growth-and-income b. Equity-income versus high-grade corporate bonds c. Intermediate-term bonds versus high-yield municipals d

> Contrast mutual fund ownership with direct investment in stocks and bonds. Assume that your class is going to debate the merits of investing through mutual funds versus investing directly in stocks and bonds. Develop some pro and con arguments for this d

> What investor service is most closely linked to the notion of a fund family? If a fund is not part of a family of mutual funds, can it still offer a full range of investor services? Explain. Using a source such as The Wall Street Journal or perhaps your

> Describe an ETF and explain how these funds combine the characteristics of open- and closed-end funds. Within the Vanguard family of funds, which would most closely resemble a “Spider” (SPDR)? In what respects are the Vanguard fund (that you selected) an

> Mallory Comer is thinking about investing in some residential income-producing property that she can purchase for $200,000. Mallory can either pay cash for the full amount of the property or put up $50,000 of her own money and borrow the remaining $150,0

> Assume that you’ve just inherited $100,000 and wish to use all or part of it to make a real estate investment. a. Would you invest directly in real estate, or indirectly through something like a REIT? Explain. b. Assuming that you decided to invest direc

> Here is the per-share performance record of the Abacus Growth-and-Income fund for 2017 and 2016: Use this information to find the rate of return earned on this fund in 2016 and in 2017. What is your assessment of the investment performance of this fund

> What is a capital gain, and how is it treated for tax purposes?

> A year ago, the Stellar Growth Fund was being quoted at an NAV of $21.50 and an offer price of $23.35; today, it’s being quoted at $23.04 (NAV) and $25.04 (offer). Use the approximate yield formula or a handheld financial calculator to find the rate of r

> Using the mutual fund quotes in Exhibit 13.4, and assuming that you can buy these funds at their quoted NAVs, how much would you have to pay to buy each of the following funds? a. American Century Emerging Markets Fund, A shares (AEMMX) b. American Cen

> The price of Green Mountain Homes, Inc. is now $85. The company pays no dividends. Sean Perth expects the price four years from now to be $125 a share. Should Sean buy Garden Designs if he wants a 15 percent rate of return? Explain.

> Discuss the evidence regarding the ability of most investors to effectively time getting in and out of the stock market. How sensitive are returns to being out of the market for just a few months of good stock market performance?

> Assume that you’ve just inherited $500,000 and have decided to invest a big chunk of it ($350,000, to be exact) in common stocks. Your objective is to build up as much capital as you can over the next 15 to 20 years, and you’re willing to tolerate a “goo

> Selected financial information about Backpacking Resources, Inc., is as follows: Total assets …………………………………………………….…..…..$20,000,000 Total liabilities …………………………………………………….……..$8,000,000 Total preferred stock …………………………………………..……..$3,000,000 Total annu

> You have decided to sell a 5 percent semiannual coupon bond two months after the last coupon payment. The bond is currently selling for $951.25. Answer the following questions about the bond: a. What is the clean price of the bond? b. What is the dirty (

> Calculate current yield, conversion ratio, conversion price, and yield to maturity. A 6 percent convertible bond (maturing in 20 years) is convertible into 25 shares of the company’s common stock. The bond has a par value of $1,000 and is currently tradi

> Find the conversion value of a convertible bond that carries a conversion ratio of 24, given that the market price of the underlying common stock is $55 a share. Would there be any conversion premium if the convertible bond had a market price of $1,500?

> Assume that an investor pays $850 for a long-term bond that carries a 7.5 percent coupon. During the next 12 months, interest rates drop sharply, and the investor sells the bond at a price of $962.50. a. Find the current yield that existed on this bond a

> Define and differentiate between gross income and AGI. Name several types of tax-exempt income. What is passive income?

> Brooke Stauffer recently graduated from college and moved to Atlanta to take a job as a market research analyst. She was pleased to be financially independent and was sure that, with her $45,000 salary, she could cover her living expenses and have plenty

> A 25-year, zero coupon bond was recently quoted at 6.500. Find the current yield and yield to maturity of this issue, given the bond has a par value of $1,000. (Assume annual compounding for the yield to maturity measure.)

> Find the current yield of a 5.65 percent, 8-year bond that’s currently priced in the market at $853.75. Now, use a financial calculator to find the yield to maturity on this bond (use annual compounding). What’s the current yield and yield to maturity on

> Which of these two bonds offers the highest current yield? Which one has the highest yield to maturity? a. A 6.55 percent, 22-year bond quoted at 52.000 b. A 10.25 percent, 27-year bond quoted at 103.625

> Describe and differentiate between a bond’s (a) current yield and (b) yield to maturity. Why are these yield measures important to the bond investor? Find the yield to maturity of a 20-year, 9 percent, $1,000 par value bond trading at a price of $850. Wh

> An investor in the 28 percent tax bracket is trying to decide which of two bonds to select: one is a 5.5 percent U.S. Treasury bond selling at par; the other is a municipal bond with a 4.25 percent coupon, which is also selling at par. Which of these two