Question: Brooke Stauffer recently graduated from college and

Brooke Stauffer recently graduated from college and moved to Atlanta to take a job as a market research analyst. She was pleased to be financially independent and was sure that, with her $45,000 salary, she could cover her living expenses and have plenty of money left over to furnish her studio apartment and enjoy the wide variety of social and recreational activities available in Atlanta. She opened several department-store charge accounts and obtained a bank credit card. For a while, Brooke managed pretty well on her monthly take-home pay of $2,893, but by the end of 2016, she was having trouble fully paying all his credit card charges each month. Concerned that her spending had gotten out of control and that she was barely making it from paycheck to paycheck, she decided to list her expenses for the past calendar year and develop a budget. She hoped not only to reduce her credit card debt but also to begin a regular savings program.

Brooke prepared the following summary of expenses for 2016:

Item

Annual Expenditure

Rent

$12,000

Auto insurance

1,855

Auto loan payments

3,840

Auto expenses (gas, repairs, and fees)

1,560

Clothing

3,200

Installment loan for stereo

540

Personal care

424

Phone

600

Cable TV

440

Gas and electricity

1,080

Medical care

120

Dentist

70

Groceries

2,500

Dining out

2,600

Furniture purchases

1,200

Recreation and entertainment

2,900

Other expenses

600

After reviewing his 2016 expenses, Brooke made the following assumptions about her expenses for 2017:

1. All expenses will remain at the same levels, with these exceptions:

a. Auto insurance, auto expenses, gas and electricity, and groceries will increase 5 percent.

b. Clothing purchases will decrease to $2,250.

c. Phone and cable TV will increase $5 per month.

d. Furniture purchases will decrease to $660, most of which is for a new television.

e. She will take a one-week vacation to Colorado in July, at a cost of $2,100.

2. All expenses will be budgeted in equal monthly installments except for the vacation and these items:

a. Auto insurance is paid in two installments due in June and December.

b. She plans to replace the brakes on her car in February, at a cost of $220.

c. Visits to the dentist will be made in March and September.

3. She will eliminate her bank credit card balance by making extra monthly payments of $75 during each of the first six months.

4. Regarding her income, Brooke has just received a small raise, so her take-home pay will be $3,200 per month.

Required:

1. a. Prepare a preliminary cash budget for Brooke for the year ending December 31, 2016, using the format shown in Worksheet 2.3.

b. Compare Brooke’s estimated expenses with his expected income and make recommendations that will help him balance her budget.

2. Make any necessary adjustments to Brooke’s estimated monthly expenses, and revise her annual cash budget for the year ending December 31, 2016, using Worksheet 2.3.

3. Analyze the budget and advise Brooke on her financial situation. Suggest some long-term, intermediate, and short-term financial goals for Brooke, and discuss some steps she can take to reach them.

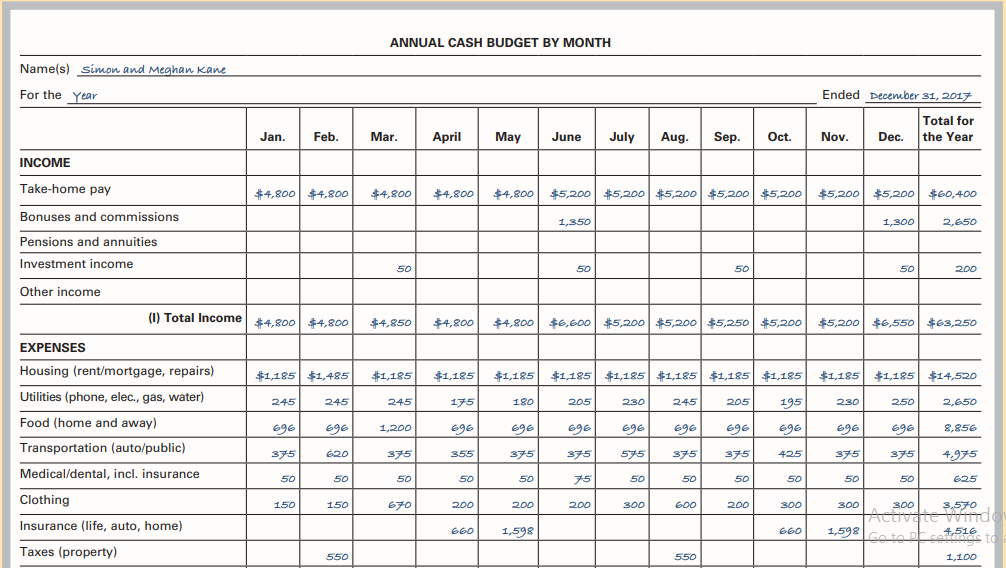

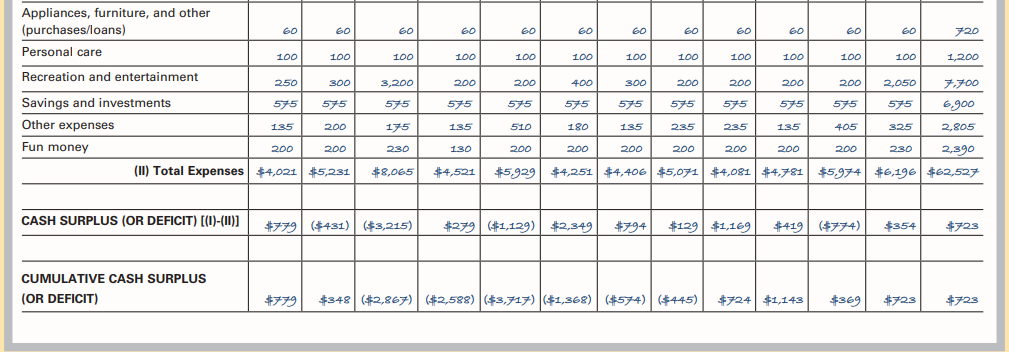

Worksheet 2.3:

Transcribed Image Text:

ANNUAL CASH BUDGET BY MONTH Namels) simon and Meghan Kang For the Year Ended December 31, 2017 Total for Jan. Feb. Mar. April May June July Aug. Sep. Oct. Nov. Dec. the Year INCOME Take-home pay #4,800 44,800 $4,800 $4,800 $4,800 $5,200 #5,200 $5,200 $5,200 $5,200 $5,200 $5,200 $60,400 Bonuses and commissions 1,350 1,300 2,650 Pensions and annuities Investment income 50 50 50 50 200 Other income (1) Total Income $4,800 4,800 $4,850 $4,800 44,800| 46,6o0| #5,200| #5,200| 45,250| $5,200| 45,20이 46,550| 463,250 EXPENSES Housing (rent/mortgage, repairs) $1,185 $1,485 $1,185 $1,185 $1,185 $1,185 $1,185 #1,185 $1,185 $1,185 $1,185 $1,185 $14,520 Utilities (phone, elec., gas, water) 245 245 245 175 180 205 195 230 250 2,650 205 230 245 Food (home and away) 696 696 1,200 696 696 696 696 696 696 696 696 696 8,856 Transportation (auto/public) 375 620 375 355 375 375 575 375 375 425 375 375 4,975 Medical/dental, incl. insurance 625 50 50 50 50 50 75 50 50 50 50 50 50 Clothing 150 150 670 200 200 200 300 GO0 200 300 300 3,570 Activate Windo Go to PE set to 300 Insurance (life, auto, home) 660 1,598 660 4,516 Taxes (property) 550 550 1,100 Appliances, furniture, and other (purchases/loans) 60 60 60 60 60 60 60 60 60 60 60 60 720 Personal care 100 100 100 100 100 100 100 100 100 100 100 100 1,200 Recreation and entertainment 250 300 3,200 200 200 400 300 200 200 200 200 2,050 アプ00 Savings and investments 575 575 575 575 575 575 575 575 575 575 575 575 6,900 Other expenses 135 200 エア5 510 180 135 2,805 135 235 235 135 405 325 Fun money 230 2,390 200 200 230 130 200 200 200 200 200 200 200 (II) Total Expenses $4,021 #5,231 $8,065 *4,521 #5929| #4,251 +4,406 $5,071 #4,081 #4,781 $5974 #6,196| $62,527 CASH SURPLUS (OR DEFICIT) [(1)-(II)] キアア9|(キ431)|(キ3,215) #279 (#1,129)| #2,349 キ794 #129 $1,169 キ419|| (アア4) $354 キア23 CUMULATIVE CASH SURPLUS (OR DEFICIT) キアラ $348 ($2,867)| (#2,588) ($3,717) ($1,368)| (*574) ($445) $724 $1,143 $369 キア23 キア23

> Describe your current status based on the personal financial planning life cycle shown in Exhibit 1.7. Fill out Worksheet 1.1, “Summary of Personal Financial Goals,” with goals reflecting your current situation and you

> How can using personal financial planning tools help you improve your financial situation? Describe changes you can make in at least three areas.

> Summarize important legislation affecting estate taxes, and briefly describe the impact on estate planning. Explain why getting rid of the estate tax doesn’t eliminate the need for estate planning.

> Use Worksheet 15.2. When Jacob Kohler died unmarried in 2015 he left an estate valued at $7,850,000. His trust directed distribution as follows: $20,000 to local hospital, $160,000 to his alma mater, and the remainder to his three adult children. Death-r

> Define and differentiate between the average tax rate and the marginal tax rate. How does a tax credit differ from an itemized deduction?

> Griffin West, 48 and a widower, and Hailey Burnette, 44 and previously divorced, were married five years ago. There are children from their prior marriages, two children for Griffin and one child for Hailey. The couple’s estate is valued at $1.4 million,

> Your best friend has asked you to be executor of his estate. What qualifications do you need, and would you accept the responsibility?

> State the topics you would cover in your ethical will. Would you consider recording it digitally?

> Prepare a basic will for yourself, using the guidelines presented in the text; also prepare your brief letter of last instructions.

> Darrell and Karla Boykin are in their mid-30s and have two children, ages 8 and 5. They have combined annual income of $95,000 and own a house in joint tenancy with a market value of $310,000, on which they have a mortgage of $250,000. Darrell has $100,0

> Generate a list of estate planning objectives that apply to your personal family situation. Be sure to consider the size of your potential estate as well as people planning and asset planning. Estate planning is not just about taxes.

> Brad Shin is an operations manager for a large manufacturer. He earned $68,500 in 2012 and plans to contribute the maximum allowed to the firm’s 401(k) plan. Assuming that Brad is in the 25 percent tax bracket, calculate his taxable income and the amount

> Ellen Honeycut has just graduated from college and is considering job offers from two companies. Although the salary and insurance benefits are similar, the retirement programs are not. One firm offers a 401(k) plan that matches employee contributions wi

> Use Exhibit 14.3 to determine the annual Social Security benefit for Bob Lemus, assuming that he is an “average” retiree. Bob is 65 years old and earns $18,000 a year at a part-time job. (Note that Bob is already at &a

> Use Exhibit 14.3 to estimate the average Social Security benefits for a retired couple. Assume that one spouse has a part-time job that pays $24,000 a year, and that this person also receives another $47,000 a year from a company pension. Based on curren

> Dan Caldwell was married on January 15, 2014. His wife, Catherine, is a full-time student at the university and earns $625 a month working in the library. How many personal exemptions will Dan and Catherine be able to claim on their joint return? Would i

> Use Worksheet 14.1 to assist Tara Easley with her retirement planning needs. She plans to retire in 15 years, and her current household expenditures run about $50,000 per year. Tara estimates that she’ll spend 80 percent of that amount

> Many critics of the Social Security program feel that participants are getting a substandard investment return on their money. Discuss why you agree or disagree with this viewpoint.

> Use Worksheet 14.1 to help Bill and Shirley Hogan, who’d like to retire while they’re still relatively young—in about 20 years. Both have promising careers, and both make good money. As a result, they

> What are the main differences between fixed and variable annuities? Which type is more appropriate for someone who is 60 years old and close to retirement?

> Why is it important to check an insurance company’s financial ratings when buying an annuity? Why should you look at past performance when considering the purchase of a variable annuity?

> Briefly explain why annuities are a type of tax-sheltered investment. Do you have to give up anything to obtain this tax-favored treatment?

> Explain how buying a variable annuity is much like investing in a mutual fund. Do you, as a buyer, have any control over the amount of investment risk to which you’re exposed in a variable annuity contract? Explain.

> Clint Crandall is in his early 30s and is thinking about opening an IRA. He can’t decide whether to open a traditional/deductible IRA or a Roth IRA, so he turns to you for help. a. To support your explanation, you decide to run some comparative numbers

> Describe the three basic types of IRAs (traditional, Roth, and nondeductible), including their respective tax features and what it takes to qualify for each. Which is most appealing to you personally? Explain.

> Defined benefit vs. defined contribution pension plans. Briefly describe the main characteristics of defined contribution and defined benefit pension plans, and discuss how they differ from cash-balance plans. In each of these plans, does the employee or

> If you itemize your deductions, you may include certain expenses as part of your itemized deductions. Discuss five types of itemized deductions and the general rules that apply to them.

> Marisa Gale, a 25-year-old personal loan officer at Second National Bank, understands the importance of starting early when it comes to saving for retirement. She has designated $3,000 per year for her retirement fund and assumes that she’ll retire at ag

> About a year ago, Ramon Navarrete bought some shares in the Sapphire Lake Mutual Fund. He bought the fund at $24.50 a share, and it now trades at $26. Last year, the fund paid dividends of 40 cents a share and had capital gains distributions of $1.83 a s

> Using the Morningstar information in Exhibit 13.10, evaluate the performance of the QQQ index-based ETF. Specifically, comment on how well it tracks the underlying NASDAQ 100 index and how its performance compares with other similar ETFs. Exhibit 13.10:

> For each pair of funds listed below, select the fund that would be less risky and briefly explain your answer. a. Growth versus growth-and-income b. Equity-income versus high-grade corporate bonds c. Intermediate-term bonds versus high-yield municipals d

> Contrast mutual fund ownership with direct investment in stocks and bonds. Assume that your class is going to debate the merits of investing through mutual funds versus investing directly in stocks and bonds. Develop some pro and con arguments for this d

> What investor service is most closely linked to the notion of a fund family? If a fund is not part of a family of mutual funds, can it still offer a full range of investor services? Explain. Using a source such as The Wall Street Journal or perhaps your

> Describe an ETF and explain how these funds combine the characteristics of open- and closed-end funds. Within the Vanguard family of funds, which would most closely resemble a “Spider” (SPDR)? In what respects are the Vanguard fund (that you selected) an

> Mallory Comer is thinking about investing in some residential income-producing property that she can purchase for $200,000. Mallory can either pay cash for the full amount of the property or put up $50,000 of her own money and borrow the remaining $150,0

> Assume that you’ve just inherited $100,000 and wish to use all or part of it to make a real estate investment. a. Would you invest directly in real estate, or indirectly through something like a REIT? Explain. b. Assuming that you decided to invest direc

> Here is the per-share performance record of the Abacus Growth-and-Income fund for 2017 and 2016: Use this information to find the rate of return earned on this fund in 2016 and in 2017. What is your assessment of the investment performance of this fund

> What is a capital gain, and how is it treated for tax purposes?

> A year ago, the Stellar Growth Fund was being quoted at an NAV of $21.50 and an offer price of $23.35; today, it’s being quoted at $23.04 (NAV) and $25.04 (offer). Use the approximate yield formula or a handheld financial calculator to find the rate of r

> Using the mutual fund quotes in Exhibit 13.4, and assuming that you can buy these funds at their quoted NAVs, how much would you have to pay to buy each of the following funds? a. American Century Emerging Markets Fund, A shares (AEMMX) b. American Cen

> The price of Green Mountain Homes, Inc. is now $85. The company pays no dividends. Sean Perth expects the price four years from now to be $125 a share. Should Sean buy Garden Designs if he wants a 15 percent rate of return? Explain.

> Discuss the evidence regarding the ability of most investors to effectively time getting in and out of the stock market. How sensitive are returns to being out of the market for just a few months of good stock market performance?

> Assume that you’ve just inherited $500,000 and have decided to invest a big chunk of it ($350,000, to be exact) in common stocks. Your objective is to build up as much capital as you can over the next 15 to 20 years, and you’re willing to tolerate a “goo

> Selected financial information about Backpacking Resources, Inc., is as follows: Total assets …………………………………………………….…..…..$20,000,000 Total liabilities …………………………………………………….……..$8,000,000 Total preferred stock …………………………………………..……..$3,000,000 Total annu

> You have decided to sell a 5 percent semiannual coupon bond two months after the last coupon payment. The bond is currently selling for $951.25. Answer the following questions about the bond: a. What is the clean price of the bond? b. What is the dirty (

> Calculate current yield, conversion ratio, conversion price, and yield to maturity. A 6 percent convertible bond (maturing in 20 years) is convertible into 25 shares of the company’s common stock. The bond has a par value of $1,000 and is currently tradi

> Find the conversion value of a convertible bond that carries a conversion ratio of 24, given that the market price of the underlying common stock is $55 a share. Would there be any conversion premium if the convertible bond had a market price of $1,500?

> Assume that an investor pays $850 for a long-term bond that carries a 7.5 percent coupon. During the next 12 months, interest rates drop sharply, and the investor sells the bond at a price of $962.50. a. Find the current yield that existed on this bond a

> Define and differentiate between gross income and AGI. Name several types of tax-exempt income. What is passive income?

> A 25-year, zero coupon bond was recently quoted at 6.500. Find the current yield and yield to maturity of this issue, given the bond has a par value of $1,000. (Assume annual compounding for the yield to maturity measure.)

> Find the current yield of a 5.65 percent, 8-year bond that’s currently priced in the market at $853.75. Now, use a financial calculator to find the yield to maturity on this bond (use annual compounding). What’s the current yield and yield to maturity on

> Which of these two bonds offers the highest current yield? Which one has the highest yield to maturity? a. A 6.55 percent, 22-year bond quoted at 52.000 b. A 10.25 percent, 27-year bond quoted at 103.625

> Describe and differentiate between a bond’s (a) current yield and (b) yield to maturity. Why are these yield measures important to the bond investor? Find the yield to maturity of a 20-year, 9 percent, $1,000 par value bond trading at a price of $850. Wh

> An investor in the 28 percent tax bracket is trying to decide which of two bonds to select: one is a 5.5 percent U.S. Treasury bond selling at par; the other is a municipal bond with a 4.25 percent coupon, which is also selling at par. Which of these two

> Ranking investments by expected returns. What makes for a good investment? Use the approximate yield formula or a financial calculator to rank the following investments according to their expected returns. a. Buy a stock for $30 a share, hold it for thr

> Assume that an investor short-sells 500 shares of stock at a price of $85 a share, making a 50 percent margin deposit. A year later, she repurchases the borrowed shares at $50 a share. a. How much of her own money did the short-seller have to put up to m

> Given that Hometown Care, Inc.’s stock is currently selling for $40 a share, calculate the amount of money that Calvin Haskins will make (or lose) on each of the following transactions. Assume that all transactions involve 100 shares of stock, and ignore

> Which of the following would offer the best return on investment? Assume that you buy $5,000 in stock in all three cases, and ignore interest and transaction costs in all your calculations. a. Buy a stock at $60 without margin, and sell it a year later a

> Claire Gerber wants to buy 300 shares of Google, which is currently selling in the market for $537.34 a share. Rather than liquidate all her savings, she decides to borrow through her broker. Assume that the margin requirement on common stock is 50 perce

> Distinguish between gross earnings and take-home pay. What does the employer do with the difference?

> Suppose Gary Hooker places an order to buy 100 shares of The Gap. Explain how the order will be processed if it’s a market order. Would it make any difference if it had been a limit order? Explain.

> Listed below are three pairs of stocks. Look at each pair and select the security you’d like to own, given that you want to select the one that’s worth more money. Then, after making all three of your selections, use The Wall Street Journal or some other

> Assume that the following quote for The Walt Disney Company, a NYSE stock, appeared on May 1, 2015 (Friday) on Yahoo! Finance (http://finance.yahoo.com/q?s=DIS&ql=1): Given this information, answer the following questions. a. At what price did the stock

> Use Worksheet 11.2 to help Clayton and Julie Grover, a married couple in their early 40s, evaluate their securities portfolio, which includes these holdings. a. IBM. (NYSE; symbol IBM): 100 shares bought in 2011 for $170.40 per share. b. Verizon (NYSE; s

> Using the S&P report in Exhibit 11.6, find the following information for Apple. a. What was the amount of revenues (i.e., sales) generated by the company in 2014? b. What were the latest annual dividends per share and dividend yield? c. What were the ear

> Why do you suppose that large, well-known companies such as Apple, Starbucks, and Facebook prefer to have their shares traded on the NASDAQ rather than on one of the major listed exchanges, such as the NYSE (for which they’d easily meet all listing requi

> Use Worksheet 11.1 Alison Conroy is a young career woman who’s now employed as the managing editor of a well-known business journal. Although she thoroughly enjoys her job and the people she works with, what she would really like to do

> Jose Ruiz is a single 40-year-old loan officer at large regional bank; he has a 16-year-old son. He has decided to use his annual bonus as a down payment on a new car. One Saturday afternoon in late September, he visits Unique Motors and buys a new car f

> Marc Rose has a PAP with coverage of $25,000/$50,000 for bodily injury liability, $25,000 for property damage liability, $5,000 for medical payments, and a $500 deductible for collision insurance. How much will his insurance cover in each of the followin

> Tyler and Sherry Hughes, both graduate students, moved into an apartment near the university. Sherry wants to buy renter’s insurance, but Fred thinks that they don’t need it because their furniture isn’t worth much. Sherry a points out that, among other

> Briefly define the five filing categories available to taxpayers. When might married taxpayers choose to file separately?

> Last year, Brett and Amber Walsh bought a home with a dwelling replacement value of $250,000 and insured it (via an HO-5 policy) for $210,000. The policy reimburses for actual cash value and has a $500 deductible, standard limits for coverage C items, an

> Assume that Tina Walsh had a homeowner’s insurance policy with $100,000 of coverage on the dwelling. Would a 90 percent co-insurance clause be better than an 80 percent clause in such a policy? Give reasons to support your answer.

> Assess your current health insurance situation. Do you have any health insurance now? What does your policy cover? What is excluded? Are there any gaps that you think need to be filled? Are there any risks in your current lifestyle or situation that migh

> Ben West, a 35-year-old computer programmer, earns $72,000 a year. His monthly take-home pay is $3,750. His wife, Ashley, works part-time at their children’s elementary school but receives no benefits. Under state law, Ashleyâ

> Discuss the pros and cons of long-term-care insurance. Does it make sense for anyone in your family right now? Why or why not? What factors might change this assessment in the future?

> Use Worksheet 9.1. Erika Willis, a recent college graduate, has decided to accept a job offer from a nonprofit organization. She’ll earn $34,000 a year but will receive no employee health benefits. Erika estimates that her monthly livin

> John Chang was seriously injured in a snowboarding accident that broke both his legs and an arm. His medical expenses included five days of hospitalization at $900 a day, $6,200 in surgical fees, $4,300 in physician’s fees (including time in the hospital

> Joe and Whitney Alexander have two children, with ages of 6 years and 5 months. Their younger child, Nathan, was born with a congenital heart defect that will require several major surgeries in the next few years to correct fully. Joe is employed as a sa

> While at lunch with a group of coworkers, one of your friends mentions that he plans to buy a variable life insurance policy because it provides a good annual return and is a good way to build savings for his 5-year-old’s college education. Another colle

> Ramona and Pablo Valdez are a dual-career couple who just had their first child. Pablo age 29, already has a group life insurance policy, but Ramona’s employer does not offer life insurance. A financial planner is recommending that the 25-year-old Ramona

> Explain each of the following strategies for reducing current taxes: (a) maximizing deductions, (b) income shifting, (c) tax-free income, and (d) tax-deferred income.

> Using the premium schedules provided in Exhibits 8.2, 8.3, and 8.5, how much in annual premiums would a 25-year-old male have to pay for $100,000 of annual renewable term, level premium term, and whole life insurance? (Assume a five-year term or period o

> Use Worksheet 8.1. Rudy Steele, 43, is a recently divorced father of two children, ages 9 and 7. He currently earns $95,000 a year as an operations manager for a utility company. The divorce settlement requires him to pay $1,500 a month in child support

> Katie Holt is a 72-year-old widow who has recently been diagnosed with Alzheimer’s disease. She has limited financial assets of her own and has been living with her daughter Laurie for two years. Her only income is $850 a month in Socia

> Assuming that interest is the only finance charge, how much interest would be paid on a $5,000 installment loan to be repaid in 36 monthly installments of $166.10? What is the APR on this loan?

> Todd Kowalski is borrowing $10,000 for five years at 7 percent. Payments are made on a monthly basis, which are determined using the add-on method. a. How much total interest will Chris pay on the loan if it is held for the full five-year term? b. What

> Chris Jenkins needs to borrow $4,000. First State Bank will lend her the money for 12 months through a single-payment loan at 8 percent, discount; Home Savings and Loan will make her a $4,000, single-payment, 12-month loan at 10 percent, simple interest.

> Find the finance charges on a 6.5 percent, 18-month, single-payment loan when interest is computed using the simple interest method. Find the finance charges on the same loan when interest is computed using the discount method. Determine the APR in each

> Using the simple interest method, find the monthly payments on a $3,000 installment loan if the funds are borrowed for 24 months at an annual interest rate of 6 percent. How much interest will be paid during the first year of this loan?

> Every six months, Larry Sun takes an inventory of the consumer debts that he has outstanding. His latest tally shows that he still owes $4,000 on a home improvement loan (monthly payments of $125); he is making $85 monthly payments on a personal loan wit

> Assume that you’ve been shopping for a new car and intend to finance part of it through an installment loan. The car you’re looking for has a sticker price of $18,000. The local dealership has offered to sell it to you for $3,000 down and finance the bal

> What types of assistance and tax preparation services does the IRS provide?

> Because of a job change, Ben Hardesty has just relocated to the southeastern United States. He sold his furniture before he moved, so he’s now shopping for new furnishings. At a local furniture store, he’s found an assortment of couches, chairs, tables,

> Use Worksheet 7.2. Elizabeth Erlich wants to buy a home entertainment center. Complete with a big-screen TV, DVD, and sound system, the unit would cost $4,500. Elizabeth has over $15,000 in a money fund, so she can easily afford to pay cash for the whole

> Sherman Jacobs plans to borrow $5,000 and to repay it in 36 monthly installments. This loan is being made at an annual add-on interest rate of 7.5 percent. a. Calculate the finance charge on this loan, assuming that the only component of the finance cha

> Lina Martinez wants to buy a new high-end audio system for her car. The system is being sold by two dealers in town, both of whom sell the equipment for the same price of $2,000. Lina can buy the equipment from Dealer A, with no money down, by making pay

> After careful comparison shopping, Bill Withers decides to buy a new Toyota Camry. With some options added, the car has a price of $23,558—including plates and taxes. Because he can’t afford to pay cash for the car, he will use some savings and his old c

> Marilyn Seacrest is a sophomore at State College and is running out of money. Wanting to continue her education, Marilyn is considering a student loan. Explain her options. How can she minimize her borrowing costs and maximize her flexibility?

> Wyatt Collins recently graduated from college and is evaluating two credit cards. Card A has an annual fee of $75 and an interest rate of 9 percent. Card B has no annual fee and an interest rate of 16 percent. Assuming that Wyatt intends to carry no bala