Question: Venice InLine, Inc., was founded by Russ

Venice InLine, Inc., was founded by Russ Perez to produce a specialized in-line skate he had designed for doing aerial tricks. Up to this point, Russ has financed the company with his own savings and with cash generated by his business. However, Russ now faces a cash crisis. In the year just ended, an acute shortage of high-impact roller bearings developed just as the company was beginning production for the Christmas season. Russ had been assured by his suppliers that the roller bearings would be delivered in time to make Christmas shipments, but the suppliers were unable to fully deliver on this promise. As a consequence, Venice InLine had large stocks of unfinished skates at the end of the year and was unable to fill all of the orders that had come in from retailers for the Christmas season. Consequently, sales were below expectations for the year, and Russ does not have enough cash to pay his creditors.

Well before the accounts payable were due, Russ visited a local bank and inquired about obtaining a loan. The loan officer at the bank assured Russ that there should not be any problem getting a loan to pay off his accounts payable—providing that on his most recent financial statements the current ratio was above 2.0, the acid-test ratio was above 1.0, and net operating income was at least four times the interest on the proposed loan. Russ promised to return later with a copy of his financial statements.

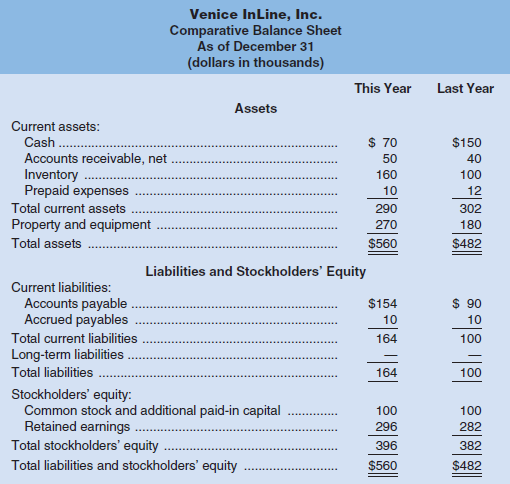

Russ would like to apply for an $80,000 six-month loan bearing an interest rate of 10% per year. The unaudited financial reports of the company appear below:

Venice InLine, Inc.

Income Statement

For the Year Ended December 31

(dollars in thousands)

____________________________This Year

Sales (all on account) ....................................... $420

Cost of goods sold .............................................. 290

Gross margin ...................................................... 130

Selling and administrative expenses:

Selling expenses .................................................. 42

Administrative expenses ..................................... 68

Total selling and administrative expenses ........ 110

Net operating income ......................................... 20

Interest expense .................................................. —

Net income before taxes ..................................... 20

Income taxes (30%) .............................................. 6

Net income ....................................................... $ 14

Required:

1. Based on the unaudited financial statements above and the statement made by the loan officer, would the company qualify for the loan?

2. Last year Russ purchased and installed new, more efficient equipment to replace an older plastic injection molding machine. Russ had originally planned to sell the old machine but found that it is still needed whenever the plastic injection molding process is a bottleneck. When Russ discussed his cash flow problems with his brother-in-law, he suggested to Russ that the old machine be sold or at least reclassified as inventory on the balance sheet because it could be readily sold. At present, the machine is carried in the Property and Equipment account and could be sold for its net book value of $45,000. The bank does not require audited financial statements. What advice would you give to Russ concerning the machine?

Transcribed Image Text:

Venice InLine, Inc. Comparative Balance Sheet As of December 31 (dollars in thousands) This Year Last Year Assets Current assets: Cash . $ 70 $150 Accounts receivable, net Inventory Prepaid expenses 50 40 160 100 10 12 Total current assets 290 302 Property and equipment 270 180 Total assets $560 $482 Liabilities and Stockholders' Equity Current liabilities: Accounts payable Accrued payables $154 $ 90 10 10 Total current liabilities 164 100 Long-term liabilities Total liabilities 164 100 Stockholders' Equity: Common stock and additional paid-in capital Retained earnings. Total stockholders' equity 100 100 296 282 396 382 Total liabilities and stockholders' equity $560 $482

> On numerous occasions, proposals have surfaced to put the federal government on the accrual basis of accounting. This is no small issue because if this basis were used, it would mean that billions in unrecorded liabilities would have to be booked and the

> What is the primary basis of accounting for inventories?

> Jeters Company reports the following for the month of June. Instructions (a) Compute the cost of the ending inventory and the cost of goods sold under (1) FIFO, (2) LIFO, and (3) average-cost. (Round average unit cost to three decimal places.) (b) Which

> Solar Electronics has enjoyed tremendous sales growth during the last 10 years. However, even though sales have steadily increased, the company’s CEO, Dana Byrnes, is concerned about certain aspects of its performance. She has called a

> (a) What is the primary source document for recording (1) cash sales and (2) credit sales? (b) Using XXs for amounts, give the journal entry for each of the transactions in part (a), assuming perpetual inventory.

> Suppose the following information is available for Callaway Golf Company for the years 2017 and 2016. (Dollars are in thousands, except share information.) There were 73,139,000 shares outstanding at the end of 2015. Instructions (a) What was the compa

> The key to successful business operations is effective inventory management.” Do you agree? Explain.

> Selected financial data of two competitors, Target and Wal-Mart, are presented here. (All dollars are in millions.) Suppose the data were taken from the 2017 financial statements of each company. Instructions For each company, compute these values and ra

> Suppose the following items were taken from the 2017 financial statements of Texas Instruments, Inc. (All dollars are in millions.) Instructions Prepare a classified balance sheet in good form as of December 31, 2017. Common stock $2,826 Accumulated

> Tott Company has the following internal control procedures over cash disbursements. Identify the internal control principle that is applicable to each procedure. (a) Company checks are pre numbered. (b) The bank statement is reconciled monthly by an inte

> Indicate whether each statement is true or false. (a) GAAP is a set of rules and practices established by accounting standard-setting bodies to serve as a general guide for financial reporting purposes. (b) Substantial authoritative support for GAAP usua

> What types of receivables does Apple report on its balance sheet? Does it use the allowance method or the direct write-off method to account for uncollectibles?

> What principles of internal control apply to most businesses?

> This is the trial balance of Lacey Company on September 30. The October transactions were as follows. Oct. 5 Received $1,300 in cash from customers for accounts receivable due. 10 Billed customers for services performed $5,100. 15 Paid employee salaries

> Roadside Travel Court was organized on July 1, 2016, by Betty Johnson. Betty is a good manager but a poor accountant. From the trial balance prepared by a part-time bookkeeper, Betty prepared the following income statement for her fourth quarter, which e

> Abbey Park was organized on April 1, 2016, by Trudy Crawford. Trudy is a good manager but a poor accountant. From the trial balance prepared by a part-time bookkeeper, Trudy prepared the following income statement for the quarter that ended March 31, 201

> Masie Ascot believes revenues from credit sales may be recorded before they are collected in cash. Do you agree? Explain.

> (a) “The steps in the accounting cycle for a merchandising company differ from the steps in the accounting cycle for a service company.” Do you agree or disagree? (b) Is the measurement of net income in a merchandising company conceptually the same as in

> Fraser Company will need a new warehouse in five years. The warehouse will cost $500,000 to build. Required: What lump-sum amount should the company invest now to have the $500,000 available at the end of the five-year period? Assume that the compa

> Matheson Electronics has just developed a new electronic device which, when mounted on an automobile, will tell the driver how many miles the automobile is traveling per gallon of gasoline. The company is anxious to begin production of the new device. To

> Westwood Furniture Company is considering the purchase of two different items of equipment, as described below: Machine A A compacting machine has just come onto the market that would permit Westwood Furniture Company to compress sawdust into various she

> What is meant by the term payback period? How is the payback period determined? How can the payback method be useful?

> How is the project profitability index computed, and what does it measure?

> Refer to Exhibit 12–2. Is the return on this investment proposal exactly 14%, more than 14%, or less than 14%? Explain. Exhibit 12–2 The Net Present Value Method—An Extended Example $200,000 125

> As the discount rate increases, the present value of a given future cash flow also increases. Do you agree? Explain.

> Explain how the cost of capital serves as a screening tool when using the net present value method.

> Bilboa Freightlines, S.A., of Panama, has a small truck that it uses for intracity deliveries. The truck is worn out and must be either overhauled or replaced with a new truck. The company has assembled the following information (Panama uses the U.S. dol

> Perit Industries has $100,000 to invest. The company is trying to decide between two alternative uses of the funds. The alternatives are: The working capital needed for project B will be released at the end of six years for investment elsewhere. Perit

> Kathy Myers frequently purchases stocks and bonds, but she is uncertain how to determine the rate of return that she is earning. For example, three years ago she paid $13,000 for 200 shares of Malti Company’s common stock. She received a $420 cash divide

> Labeau Products, Ltd., of Perth, Australia, has $35,000 to invest. The company is trying to decide between two alternative uses for the funds as follows: The company’s discount rate is 18%. Required: (Ignore income taxes.) Which alte

> The Caldwell Herald newspaper reported the following story: Frank Ormsby of Caldwell is the state’s newest millionaire. By choosing the six winning numbers on last week’s state lottery, Mr. Ormsby has won the week’s grand prize totaling $1.6 million. The

> The Atlantic Medical Clinic can purchase a new computer system that will save $7,000 annually in billing costs. The computer system will last for eight years and have no salvage value. Required: Up to how much should the Atlantic Medical Clinic be willi

> Julie has just retired. Her company’s retirement program has two options as to how retirement benefits can be received. Under the first option, Julie would receive a lump sum of $150,000 immediately as her full retirement benefit. Under the second option

> Annual cash inflows that will arise from two competing investment projects are given below: The discount rate is 18%. Required: Compute the present value of the cash inflows for each investment. Year Investment A Investment B $ 3,000 $12,000 1.. 2

> In three years, when he is discharged from the Air Force, Steve wants to buy an $8,000 power boat. Required: What lump-sum amount must Steve invest now to have the $8,000 at the end of three years if he can invest money at: 1. Ten percent? 2. Fourteen p

> What is meant by the dividend yield on a common stock investment?

> If a company has to pay interest of 14% on long-term debt, then its cost of capital is 14%. Do you agree? Explain.

> Linda Clark received $175,000 from her mother’s estate. She placed the funds into the hands of a broker, who purchased the following securities on Linda’s behalf: a. Common stock was purchased at a cost of $95,000. The stock paid no dividends, but it was

> Identify two simplifying assumptions associated with discounted cash flow methods of making capital budgeting decisions.

> What is net present value? Can it ever be negative? Explain.

> Why are discounted cash flow methods of making capital budgeting decisions superior to other methods?

> Why isn’t accounting net income used in the net present value method of making capital budgeting decisions?

> What is meant by the term discounting?

> What is meant by the term time value of money?

> What is the difference between capital budgeting screening decisions and capital budgeting preference decisions?

> The questions in this exercise are based on Target Corporation. To answer the questions, you will need to download Target’s 2004 annual report (the company’s fiscal year ended on January 29, 2005) at http://investors.target.com/. You do not need to print

> Incomplete financial statements for Pepper Industries follow: The following additional information is available about the company: a. All sales during the year were on account. b. There was no change in the number of shares of common stock outstanding

> Typically, the market price of shares of a company’s stock takes a beating when the company announces that it has not met analysts’ expectations. As a result, many companies are under a lot of pressure to meet analysts’ revenue and earnings projections.

> The Riteway Ad Agency provides cars for its sales staff. In the past, the company has always purchased its cars from a dealer and then sold the cars after three years of use. The company’s present fleet of cars is three years old and will be sold very sh

> Paul Ward is interested in the stock of Pecunious Products, Inc. Before purchasing the stock, Mr. Ward would like your help in analyzing the data that are available to him as follows: Mr. Ward would like answers to a number of questions about the trend

> In the right-hand column below, certain financial ratios are listed. To the left of each ratio is a business transaction or event relating to the operating activities of Delta Company (each transaction should be considered independently). Required: Ind

> Refer to the financial statement data for Lydex Company given in Problem 14–14A. In Problem 14–14A You have just been hired as a loan officer at Slippery Rock State Bank. Your supervisor has given you a file containin

> You have just been hired as a loan officer at Slippery Rock State Bank. Your supervisor has given you a file containing a request from Lydex Company, a manufacturer of safety helmets, for a $3,000,000, five-year loan. Financial statement data on the comp

> Refer to the financial statements and other data in Problem 14–12A. Assume that you are an account executive for a large brokerage house and that one of your clients has asked for a recommendation about the possible purchase of Sabin El

> Paul Sabin organized Sabin Electronics 10 years ago to produce and sell several electronic devices on which he had secured patents. Although the company has been fairly profitable, it is now experiencing a severe cash shortage. For this reason, it is req

> Denna Company’s working capital accounts at the beginning of the year follow: During the year, Denna Company completed the following transactions: x. Paid a cash dividend previously declared, $12,000. a. Issued additional shares of co

> Norsk Optronics, ALS, of Bergen, Norway, had a current ratio of 2.5 on June 30 of the current year. On that date, the company’s assets were: Cash ........................................................ Kr 90,000 Accounts receivable, net ...............

> Refer to the financial statements for Castile Products, Inc., in Exercise 14–7. Assets at the beginning of the year totaled $280,000, and the stockholders’ equity totaled $161,600. In Exercise 14–7 The financial statements for Castile Products, Inc., ar

> In eight years, Kent Duncan will retire. He is exploring the possibility of opening a self-service car wash. The car wash could be managed in the free time he has available from his regular occupation, and it could be closed easily when he retires. After

> Refer to the financial statements for Castile Products, Inc., in Exercise 14–7. In addition to the data in these statements, assume that Castile Products, Inc., paid dividends of $2.10 per share during the year. Also assume that the company’s common stoc

> The financial statements for Castile Products, Inc., are given below: Castile Products, Inc. Balance Sheet December 31 Assets Current assets: Cash ........................................................................... $ 6,500 Accounts receivable, n

> Selected financial data from the June 30 year-end statements of Safford Company are given below: Total assets .................................................. $3,600,000 Long-term debt (12% interest rate) ................ $500,000 Preferred stock, $100

> Rotorua Products, Ltd., of New Zealand markets agricultural products for the burgeoning Asian consumer market. The company’s current assets, current liabilities, and sales have been reported as follows over the last five years (Year 5 i

> Refer to the data in Brief Exercise 14–2 for Weller Corporation. In Brief Exercise 14–2 Comparative financial statements for Weller Corporation for the fiscal year ending December 31 appear below. The company did not

> Refer to the data in Brief Exercise 14–2 for Weller Corporation. In Brief Exercise 14–2 Comparative financial statements for Weller Corporation for the fiscal year ending December 31 appear below. The company did not

> Comparative financial statements for Weller Corporation for the fiscal year ending December 31 appear below. The company did not issue any new common or preferred stock during the year. A total of 800,000 shares of common stock were outstanding. The inte

> A comparative income statement is given below for McKenzie Sales, Ltd., of Toronto: Members of the company’s board of directors are surprised to see that net income increased by only $38,000 when sales increased by 2 million dollars.

> A company seeking a line of credit at a bank was turned down. Among other things, the bank stated that the company’s 2 to 1 current ratio was not adequate. Give reasons why a 2 to 1 current ratio might not be adequate.

> If a stock’s market value exceeds its book value, then the stock is overpriced. Do you agree? Explain.

> Sharkey’s Fun Center contains a number of electronic games as well as a miniature golf course and various rides located outside the building. Paul Sharkey, the owner, would like to construct a water slide on one portion of his property. Mr. Sharkey has g

> The president of a plastics company was quoted in a business journal as stating, “We haven’t had a dollar of interest-paying debt in over 10 years. Not many companies can say that.” As a stockholder in this company, how would you feel about its policy of

> What is meant by the term financial leverage?

> Would you expect a company in a rapidly growing technological industry to have a high or low dividend payout ratio?

> Assume that two companies in the same industry have equal earnings. Why might these companies have different price-earnings ratios? If a company has a price-earnings ratio of 20 and reports earnings per share for the current year of $4, at what price wou

> What is the basic purpose for examining trends in a company’s financial ratios and other data? What other kinds of comparisons might an analyst make?

> Distinguish between horizontal and vertical analysis of financial statement data.

> Kingsley Products, Ltd., is using a model 400 shaping machine to make one of its products. The company is expecting to have a large increase in demand for the product and is anxious to expand its productive capacity. Two possibilities are under considera

> Top-Quality Stores, Inc., owns a nationwide chain of supermarkets. The company is going to open another store soon, and a suitable building site has been located in an attractive and rapidly growing area. In discussing how the company can acquire the des

> The Fore Corporation is an integrated food processing company that has operations in over two dozen countries. Fore’s corporate headquarters is in Chicago, and the company’s executives frequently travel to visit Fore’s foreign and domestic facilities. Fo

> Windhoek Mines, Ltd., of Namibia, is contemplating the purchase of equipment to exploit a mineral deposit on land to which the company has mineral rights. An engineering and cost analysis has been made, and it is expected that the following cash flows wo

> Raul Martinas, professor of languages at Eastern University, owns a small office building adjacent to the university campus. He acquired the property 10 years ago at a total cost of $530,000—$50,000 for the land and $480,000 for the bui

> The management of Revco Products is exploring four different investment opportunities. Information on the four projects under study follows: The company’s required rate of return is 10%; thus, a 10% discount rate has been used in the

> Oxford Company has limited funds available for investment and must ration the funds among four competing projects. Selected information on the four projects follows: The net present values above have been computed using a 10% discount rate. The company

> Nick’s Novelties, Inc., is considering the purchase of electronic pinball machines to place in amusement houses. The machines would cost a total of $300,000, have an eight-year useful life, and have a total salvage value of $20,000. The

> A piece of laborsaving equipment has just come onto the market that Mitsui Electronics, Ltd., could use to reduce costs in one of its plants in Japan. Relevant data relating to the equipment follow (currency is in thousands of yen, denoted by ¥): Purcha

> The management of Ballard MicroBrew is considering the purchase of an automated bottling machine for $120,000. The machine would replace an old piece of equipment that costs $30,000 per year to operate. The new machine would cost $12,000 per year to oper

> The management of Unter Corporation, an architectural design firm, is considering an investment with the following cash flows: Required: 1. Determine the payback period of the investment. 2. Would the payback period be affected if the cash inflow in th

> Information on four investment proposals is given below: Required: 1. Compute the project profitability index for each investment proposal. 2. Rank the proposals in terms of preference. Investment Proposal A. B D. Investment required. $(90,000) $(1

> The management of Kunkel Company is considering the purchase of a $40,000 machine that would reduce operating costs by $7,000 per year. At the end of the machine’s eight-year useful life, it will have zero scrap value. The company’s required rate of retu

> Paul Swanson has an opportunity to acquire a franchise from The Yogurt Place, Inc., to dispense frozen yogurt products under The Yogurt Place name. Mr. Swanson has assembled the following information relating to the franchise: a. A suitable location in a

> The Sweetwater Candy Company would like to buy a new machine that would automatically “dip” chocolates. The dipping operation is currently done largely by hand. The machine the company is considering costs $120,000. The manufacturer estimates that the ma

> What is the major criticism of the payback and simple rate of return methods of making capital budgeting decisions?

> Sizemore Landscaping is a firm that provides commercial landscaping and grounds maintenance services. Derek Sizemore, the owner, is trying to find new ways to increase revenues. Mr. Sizemore performs the following actions, not in the order listed. a.

> Madison Foods makes frozen dinners that it sells through grocery stores. Typical products include turkey, pot roast, fried chicken, and meatloaf. The managers at Madison have recently proposed a line of frozen chicken pies. They take the following acti

> Gavin Adams is the president of Trusted Pool Service. He takes the following actions, not necessarily in the order given. For each action (a–e) state whether it is a planning decision or a control decision. a. Adams decides to expand service off

> Gregor Company makes and sells brooms and mops. It takes the following actions, not necessarily in the order given. For each action (a–e), state whether it is a planning decision or a control decision. a. Gregor asks its advertising team to deve

> Vargas Construction Company provides construction services for major projects. Managers at the company believe that construction is a people-management business, and they list the following as factors critical to their success: a. Increase spending on

> Dominion Consulting has issued a report recommending changes for its newest manufacturing client, Gibson Engine Works. Gibson currently manufactures a single product, which is sold and distributed nationally. The report contains the following suggestio

> Burger King, a hamburger fast-food restaurant, incurs the following costs: a. Cost of oil for the deep fryer b. Wages of the counter help who give customers the food they order c. Cost of the costume for the King on the Burger King television commer

> Johnson & Johnson, a health care company, incurs the following costs: a. Payment of booth registration fee at a medical conference to promote new products to physicians b. Cost of redesigning an artificial knee to make it easier to implant in pat