Question: What is the Treynor measure for the

> Use the information from Problem 29 and calculate the stock price with the clean surplus dividend. Do you get the same stock price as in Problem 29? Why or why not? Data from Problem 29: Assume the sustainable growth rate and required return you calcul

> Assume the sustainable growth rate and required return you calculated in Problem 27 are valid. Use the clean surplus relationship to calculate the share price for Beagle Beauties with the residual income model. Data for Problem 29: Beagle Beauties enga

> Using the P/E, P/CF, and P/S ratios, estimate the 2016 share price for Beagle Beauties. Data for Problem 28: Beagle Beauties engages in the development, manufacture, and sale of a line of cosmetics designed to make your dog look glamorous.

> What are the sustainable growth rate and required return for Beagle Beauties? Using these values, estimate the current share price of Beagle Beauties stock according to the constant dividend growth model. Data for Problem 27: Beagle Beauties engages in

> The current price of Parador Industries stock is $67 per share. Current sales per share are $18.75, the sales growth rate is 8 percent, and Parador does not pay a dividend. The expected return on Parador stock is 13 percent. What one-year-ahead P/S ratio

> In regard to the table that Dr. Miles constructed, which of the following is true? a. The receiving foreign currency position is correct; the action is incorrect. b. The receiving foreign currency position is incorrect; the action is also incorrect. c. T

> The current price of Parador Industries stock is $67 per share. Current earnings per share are $3.40, the earnings growth rate is 6 percent, and Parador does not pay a dividend. The expected return on Parador stock is 13 percent. What one year-ahead P/E

> In Problem 21, suppose the dividends per share over the same period were $1.00, $1.08, $1.17, $1.25, $1.35, and $1.40, respectively. Compute the expected share price at the end of 2017 using the perpetual growth method. Assume the market risk premium is

> Sea Side, Inc., just paid a dividend of $1.68 per share on its stock. The growth rate in dividends is expected to be a constant 5.5 percent per year indefinitely. Investors require an 18 percent return on the stock for the first three years, then a 13 pe

> Leisure Lodge Corporation is expected to pay the following dividends over the next four years: $15.00, $10.00, $5.00, and $2.20. Afterwards, the company pledges to maintain a constant 4 percent growth rate in dividends forever. If the required return on

> Jonah’s Fishery has EBITDA of $65 million. Jonah’s has market value of equity and debt of $420 million and $38 million, respectively. Jonah’s has cash on the balance sheet of $12 million. What is Jonah’s EV ratio?

> Netscrape Communications does not currently pay a dividend. You expect the company to begin paying a $4 per share dividend in 15 years, and you expect dividends to grow perpetually at 5.5 percent per year thereafter. If the discount rate is 15 percent, h

> Could I Industries just paid a dividend of $1.10 per share. The dividends are expected to grow at a 20 percent rate for the next six years and then level off to a 4 percent growth rate indefinitely. If the required return is 12 percent, what is the value

> In Problem 16, will your answers change if the Douglas McDonnell stock splits? Why or why not? Data from Problem 16: Repeat Problem 14 if a value-weighted index is used. Assume the index is scaled by a factor of 10 million; that is, if the average firm

> You construct a price-weighted index of 40 stocks. At the beginning of the day, the index is 8,465.52. During the day, 39 stock prices remain the same, and one stock price increases $5.00. At the end of the day, your index value is 8,503.21. What is the

> Looking back at Problems 10 and 11, what would the new index level be if all stocks on the DJIA increased by $1.00 per share on the next day? Data from Problems 10: On October 28, 2015, the DJIA opened at 17,581.43. The divisor at that time was 0.14967

> To hedge the foreign exchange risk relative to the Canadian dollar, Jackson should: a. Buy a futures contract to exchange $7,083,333 for C$8.5 million. b. Buy a futures contract to exchange $6,390,977 for C$8.5 million. c. Sell a futures contract to exch

> In October 2015, Goldman Sachs was the highest priced stock in the DJIA and Cisco was the lowest. The closing price for Goldman Sachs on October 27, 2015, was $186.31, and the closing price for Cisco was $29.05. Suppose the next day the other 29 stock pr

> Suppose you purchase 5,000 shares of a closed-end mutual fund at its initial public offering; the offer price is $10 per share. The offering prospectus discloses that the fund promoter gets an 8 percent fee from the offering. If this fund sells at a 7 p

> The Argentina Fund has $560 million in assets and sells at a 6.9 percent discount to NAV. If the quoted share price for this closed-end fund is $14.29, how many shares are outstanding? If you purchase 1,000 shares of this fund, what will the total shares

> In Problem 18, which MMMF offers you the highest yield if you are a resident of Texas, which has no state income tax? Data from Problem 18: Suppose you’re evaluating three alternative MMMF investments. The first fund buys a diversified portfolio of mun

> Suppose you’re evaluating three alternative MMMF investments. The first fund buys a diversified portfolio of municipal securities from across the country and yields 3.2 percent. The second fund buys only taxable, short-term commercial paper and yields 4.

> You are going to invest in a stock mutual fund with a 6 percent front-end load and a 1.75 percent expense ratio. You also can invest in a money market mutual fund with a 3.30 percent return and an expense ratio of 0.10 percent. If you plan to keep your i

> The Bruin Stock Fund sells Class A shares that have a front-end load of 5.75 percent, a 12b-1 fee of 0.23 percent, and other fees of 0.73 percent. There are also Class B shares with a 5 percent CDSC that declines 1 percent per year, a 12b-1 fee of 1.00 p

> Suppose you just inherited $25,000 from your Aunt Louise. You have decided to invest in an S&P Index fund, but you haven’t decided yet whether to use an ETF or a mutual fund. Suppose the ETF has an annual expense ratio of 0.09 percent, while the mutual f

> In Problem 11, suppose the annual operating expense ratio for the mutual fund is 0.75 percent and the management fee is 0.45 percent. How much money did the fund’s management earn during the year? If the fund doesn’t charge any 12b-1 fees, how much were

> Suppose you hold a particular investment for seven months. You calculate that your holding period return is 14 percent. What is your annualized return?

> When hedging its exchange rate risk on the freight car sale, Jackson used a futures contract to: a. Sell €15 million in exchange for $18.75 million. b. Buy €15 million in exchange for $18.75 million. c. Sell €15 million in exchange for $16.67 million.

> Suppose you take out a margin loan for $75,000. You pay a 6.4 percent effective rate. If you repay the loan in two months, how much interest will you pay?

> Repeat Problem 23 assuming you short the 800 shares on 60 percent margin. Problem 2: You believe that Rose, Inc., stock is going to fall and you’ve decided to sell 800 shares short. If the current share price is $47, construct the equity account balanc

> You believe that Rose, Inc., stock is going to fall and you’ve decided to sell 800 shares short. If the current share price is $47, construct the equity account balance sheet for this trade. Assume the initial margin is 100 percent.

> Suppose that an investor opens an account by investing $1,000. At the beginning of each of the next four years, he deposits an additional $1,000 each year, and he then liquidates the account at the end of the total five-year period.

> Suppose you buy stock at a price of $57 per share. Five months later, you sell it for $61. You also received a dividend of $0.60 per share. What is your annualized return on this investment?

> In Problem 19, suppose your holding period was five months instead of seven. What is your annualized return? What do you conclude in general about the length of your holding period and your annualized return? Problem 19: Suppose you hold a particular i

> A stock has had the following year-end prices and dividends: What are the arithmetic and geometric returns for the stock? Year Price Dividend $13.25 1 15.61 $0.15 2 16.72 0.18 15.18 0.20 4 17.12 0.24 5 20.43 0.28

> A stock has returns of −9 percent, 17 percent, 9 percent, 14 percent, and −4 percent. What are the arithmetic and geometric returns?

> Suppose you take out a margin loan for $50,000. The rate you pay is an 8.4 percent effective rate. If you repay the loan in six months, how much interest will you pay?

> Suppose you sell 25 of the May corn futures at the high price of the day. You close your position later when the price is 465.375. Ignoring commission, what is your dollar profit on this transaction?

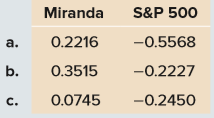

> What is the Jensen alpha for the Miranda Fund? a. 0.2216 b. 0.3515 c. 0.0745

> Your grandfather invested $1,000 in a stock 50 years ago. Currently the value of his account is $324,000. What is his geometric return over this period?

> How many of the March contracts are currently open? How many of these contracts should you sell if you wish to deliver 225,000 bushels of corn in March? If you actually make delivery, how much will you receive? Assume you locked in the settle price.

> Suppose you buy 15 of the September corn futures contracts at the last price of the day. One month from now, the futures price of this contract is 462.125, and you close out your position. Calculate your dollar profit on this investment. Use the followi

> You’ve just opened a margin account with $20,000 at your local brokerage firm. You instruct your broker to purchase 500 shares of Landon Golf stock, which currently sells for $60 per share. What is your initial margin? Construct the equity account balanc

> Using the information in Problem 1, construct your equity account balance sheet at the time of your purchase. What does your balance sheet look like if the share price rises to $24? What if it falls to $14 per share? What is your margin in both cases? Ro

> Suppose you want to hedge a $400 million bond portfolio with a duration of 8.4 years using 10-year Treasury note futures with a duration of 6.2 years, a futures price of 102, and 85 days to expiration. The multiplier on Treasury note futures is $100,000.

> Suppose you want to hedge a $500 million bond portfolio with a duration of 5.1 years using 10-year Treasury note futures with a duration of 6.7 years, a futures price of 102, and 3 months to expiration. The multiplier on Treasury note futures is $100,0

> Suppose the 6-month S&P 500 futures price is 2,399.25, while the cash price is 2,370.48. What is the implied dividend yield on the S&P 500 if the risk free interest rate is 5 percent?

> Suppose the 6-month S&P 500 futures price is 2,281.55, while the cash price is 2,270.42. What is the implied difference between the risk-free interest rate and the dividend yield on the S&P 500?

> On October 28, 2015, the DJIA opened at 17,581.43. The divisor at that time was 0.14967727343. Suppose on this day the prices for 29 of the stocks remained unchanged and one stock increased $5.00. What would the DJIA level be at the end of the day? &n

> A stock has had returns of 21 percent, 12 percent, 7 percent, −13 percent, −4 percent, and 26 percent over the last six years. What are the arithmetic and geometric returns for the stock?

> Using the information from Problem 5, what is the geometric return for Cherry Jalopies, Inc.?

> A particular stock has a dividend yield of 1.2 percent. Last year, the stock price fell from $65 to $59. What was the return for the year?

> You buy 500 shares of stock at a price of $38 and an initial margin of 60 percent. If the maintenance margin is 30 percent, at what price will you receive a margin call?

> The rates of return on Cherry Jalopies, Inc., stock over the last five years were 17 percent, 11 percent, −2 percent, 3 percent, and 14 percent. Over the same period, the returns on Straw Construction Company’s stock were 16 percent, 18 per

> What is the historical rate of return on each of the following investments? What is the historical risk premium on these investments? a. Long-term government bonds b. Treasury bills c. Large stocks d. Small stocks

> A mutual fund sold $36 million of assets during the year and purchased $32 million in assets. If the average daily assets of the fund were $96 million, what was the fund turnover?

> In Problem 6, assume the fund is sold with a 6.25 percent front-end load. What is the offering price of the fund? Data from Problem 6: Suppose the fund in Problem 5 has liabilities of $110,000. What is the NAV of the fund now?

> Suppose the fund in Problem 5 has liabilities of $110,000. What is the NAV of the fund now? Data from Problem 5: An open-end mutual fund has the following stocks: If there are 50,000 shares of the mutual fund, what is the NAV?

> Rework Problems 1 and 2 assuming that you buy 500 shares of the stock and the ending share price is $34. Problems 1: Suppose you bought 100 shares of stock at an initial price of $37 per share. The stock paid a dividend of $0.28 per share during

> What are the Sharpe ratios for the Miranda Fund and the S&P 500?

> An open-end mutual fund has the following stocks: If there are 50,000 shares of the mutual fund, what is the NAV?

> The Aqua Liquid Assets Money Market Mutual Fund has a NAV of $1 per share. During the year, the assets held by this fund appreciated by 1.7 percent. If you had invested $25,000 in this fund at the start of the year, how many shares would you own at the e

> The Emerging Growth and Equity Fund is a “low-load” fund. The current offer price quotation for this mutual fund is $15.95, and the front-end load is 2.0 percent. What is the NAV? If there are 19.2 million shares outstanding, what is the current market v

> Suppose the mutual fund in Problem 1 has a current market price quotation of $21.89. Is this a load fund? If so, calculate the front-end load. Data from Problem 1: The World Income Appreciation Fund has current assets with a market value of $8.5 billio

> You invested $10,000 in a mutual fund at the beginning of the year when the NAV was $32.24. At the end of the year, the fund paid $0.24 in short-term distributions and $0.41 in long-term distributions. If the NAV of the fund at the end of the year was $3

> The World Income Appreciation Fund has current assets with a market value of $8.5 billion and has 410 million shares outstanding. What is the net asset value (NAV) for this mutual fund?

> What is the yield to maturity of the bond? What is the current yield of the bond?

> You found the following stock quote for Gigantus Corporation in today’s newspaper. What was the stock selling for on January 1? Use the following bond quote for Problems 9 and 10: Data from Problems 9: What is the yield to maturity

> The contract size for platinum futures is 50 troy ounces. Suppose you need 300 troy ounces of platinum and the current futures price is $2,025 per ounce. How many contracts do you need to purchase? How much will you pay for your platinum? What is your d

> You purchase 3,000 bonds with a par value of $1,000 for $980 each. The bonds have a coupon rate of 7.2 percent paid semiannually and mature in 10 years. How much will you receive on the next coupon date? How much will you receive when the bonds mature?

> If the market risk premium decreases by 1 percent while the risk-free rate remains the same, the security market line: a. Becomes steeper. b. Becomes flatter. c. Parallel shifts downward.

> In Problem 1, what is the capital gains yield? The dividend yield? What is the total rate of return on the investment? Problem 1: Suppose you bought 100 shares of stock at an initial price of $37 per share. The stock paid a dividend of $0.28 per share

> In Problem 3, if the company has a P/E ratio of 21.5, what is the earnings per share (EPS) for the company? Data from Problem 3: You find a stock selling for $74.20 that has a dividend yield of 3.4 percent. What was the last quarterly dividend paid?

> You find a stock selling for $74.20 that has a dividend yield of 3.4 percent. What was the last quarterly dividend paid?

> In Problem 1, assume the company has 100 million shares of stock outstanding and a P/E ratio of 15. What was net income for the most recent four quarters? Data from Problem 1: You found the following stock quote for DRK Enterprises, Inc., at your favor

> If you currently own 15 of the bonds, how much will you receive on the next coupon date? Use the following corn futures quotes for Problems 11–13: Data from Problems 11: How many of the March contracts are currently open? How many

> You short sold 1,000 shares of stock at a price of $36 and an initial margin of 55 percent. If the maintenance margin is 35 percent, at what share price will you receive a margin call? What is your account equity at this stock price?

> The stock of Flop Industries is trading at $48. You feel the stock price will decline, so you short 1,000 shares at an initial margin of 60 percent. If the maintenance margin is 30 percent, at what share price will you receive a margin call?

> You decide to buy 1,200 shares of stock at a price of $34 and an initial margin of 55 percent. What is the maximum percentage decline in the stock before you will receive a margin call if the maintenance margin is 35 percent?

> You have $22,000 and decide to invest on margin. If the initial margin requirement is 55 percent, what is the maximum dollar purchase you can make?

> You purchase 275 shares of 2nd Chance Co. stock on margin at a price of $53. Your broker requires you to deposit $8,000. What is your margin loan amount? What is the initial margin requirement?

> The beta of stock B is closest to: a. 0.51 b. 1.07 c. 1.46

> You purchased a stock at the end of the prior year at a price of $73. At the end of this year, the stock pays a dividend of $1.20 and you sell the stock for $78. What is your return for the year? Now suppose that dividends are taxed at 15 percent and l

> Carson Corporation stock sells for $17 per share, and you’ve decided to purchase as many shares as you possibly can. You have $31,000 available to invest. What is the maximum number of shares you can buy if the initial margin is 60 percent?

> A stock has a current share price of $49.24 and a dividend yield of 1.5 percent. If the risk-free rate is 5.4 percent, what is the futures price if the maturity is four months?

> A non-dividend-paying stock has a current share price of $42.60 and a futures price of $42.95. If the maturity of the futures contract is four months, what is the risk-free rate?

> A non-dividend-paying stock has a futures contract with a price of $94.90 and a maturity of two months. If the risk-free rate is 4.5 percent, what is the price of the stock?

> A non-dividend-paying stock is currently priced at $16.40. The risk-free rate is 3 percent and a futures contract on the stock matures in six months. What price should the futures be?

> You are short 30 March 2016 five-year Treasury note futures contracts. Calculate your profit or loss from this trading day using Figure 14.1. Figure 14.1: Futures Contracts|WSJ.com/commoditles Metal & Petroleum Futures Contract Оpen Contract Open I

> You are short 15 March 2016 corn futures contracts. Calculate your dollar profit or loss from this trading day using Figure 14.1. Figure 14.1: Futures Contracts|WSJ.com/commoditles Metal & Petroleum Futures Contract Оpen Contract Open Interest Оpe

> You are long 20 November 2015 soybean futures contracts. Calculate your dollar profit or loss from this trading day using Figure 14.1. Figure 14.1: Futures Contracts|WSJ.com/commoditles Metal & Petroleum Futures Contract Оpen Contract Open Interest

> A stock futures contract is priced at $27.18. The stock has a dividend yield of 1.25 percent and the risk-free rate is 2.5 percent. If the futures contract matures in six months, what is the current stock price?

> Based on the stock and market data provided above, which of the following data regarding stock A is most accurate? Required Return Recommendation а. 16.1% Sell b. 16.1% Buy C. 14.15% Sell

> Your portfolio allocates equal funds to the DW Co. and Woodpecker, Inc., stocks referred to in Problems 7 and 8. The return correlation between DW Co. and Woodpecker, Inc., is zero. What is the smallest expected loss for your portfolio in the coming mont

> Woodpecker, Inc., stock has an annual return mean and standard deviation of 18 percent and 44 percent, respectively. What is the smallest expected loss in the coming month with a probability of 2.5 percent?

> DW Co. stock has an annual return mean and standard deviation of 12 percent and 30 percent, respectively. What is the smallest expected loss in the coming year with a probability of 5 percent?

> The Layton Growth Fund has an alpha of 2.1 percent. You have determined that Layton’s information ratio is 0.5. What must Layton’s tracking error be relative to its benchmark?

> In Problem 3, assume that the correlation of returns on portfolio Y to returns on the market is .75. What is the percentage of portfolio Y’s return that is driven by the market? Data from Problem 3: You are given the following informa

> Assume that the tracking error of portfolio X in Problem 3 is 9.2 percent. What is the information ratio for portfolio X? Data from Problem 3: You are given the following information concerning three portfolios, the market portfolio, and the risk-free

> You are given the following information concerning three portfolios, the market portfolio, and the risk-free asset: What are the Sharpe ratio, Treynor ratio, and Jensen’s alpha for each portfolio? Portfolio R, Pp 12% 29% 1.25 Y