Question: What role, if any, will short-term

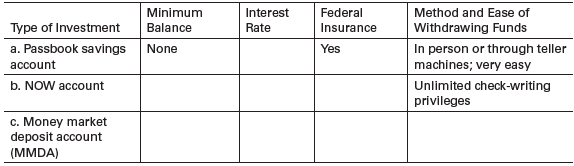

What role, if any, will short-term investments play in your portfolio? Why? Complete the following table for the short-term investments listed. Find their current yields online, and explain which, if any, you would include in your investment portfolio.

Transcribed Image Text:

Minimum Interest Federal Method and Ease of Type of Investment Balance Rate Insurance Withdrawing Funds In person or through teller machines; very easy a. Passbook savings None Yes account Unlimited check-writing privileges b. NOW account c. Money market deposit account (MMDA) Minimum Interest Federal Method and Ease of Type of Investment Balance Rate Insurance Withdrawing Funds d. Asset manage- ment account e. Series I savings Virtually none bond f. U.S. Treasury bill g. Certificate of deposit (CD) h. Commercial paper i. Banker's accep- tance j. Money market mutual fund (money fund)

> Use a financial calculator or an Excel spreadsheet to estimate the IRR for each of the following investments. Investment A B Initial Investment $8,500 $9,500 End of Year Income 1 $2,500 $2,000 2 $2,500 $2,500 $2,500 $3,000 4 $2,500 $3,500 5 $2,500 $

> Your friend asks you to invest $10,000 in a business venture. Based on your estimates, you would receive nothing for three years, at the end of year four you would receive $4,900, and at the end of year five you would receive $14,500. If your estimates a

> You invest $7,000 in stock and receive dividends of $65, $70, $70, and $65 over the following four years. At the end of the four years, you sell the stock for $7,900. What was the IRR on this investment?

> Assume you invest $4,000 today in an investment that promises to return $9,000 in exactly 10 years. a. Use the present value technique to estimate the IRR on this investment. b. If a minimum annual return of 9% is required, would you recommend this inves

> Briefly describe the price-to-sales ratio and explain how it is used to value stocks. Why not just use the P/E multiple? How does the P/S ratio differ from the P/BV measure?

> In this problem we will visit United Rentals Inc. (URI), which was introduced at the beginning of the chapter. The following table shows the monthly return on URI stock and on the S&P 500 stock index from January 2009 to December 2014. a. Using an

> Explain the role that formula plans can play in the timing of security transactions. Describe the logic underlying the use of these plans.

> Define and differentiate between the following pairs of terms. a. Treasury stock versus classified stock b. Round lot versus odd lot c. Par value versus market value d. Book value versus investment value

> You are considering two investment alternatives. The first is a stock that pays quarterly dividends of $0.25 per share and is trading at $20 per share; you expect to sell the stock in six months for $24. The second is a stock that pays quarterly dividend

> If you place a stop-loss order to sell at $23 on a stock currently selling for $26.50 per share, what is likely to be the minimum loss you will experience on 50 shares if the stock price rapidly declines to $20.50 per share? Explain. What if you had plac

> Imagine that you have placed a limit order to buy 100 shares of Sallisaw Tool at a price of $38, although the stock is currently selling for $41. Discuss the consequences, if any, of each of the following situations. a. The stock price drops to $39 per s

> Al Cromwell places a market order to buy a round lot of Thomas, Inc., common stock, which is traded on the NYSE and is currently quoted at $50 per share. Ignoring brokerage commissions, determine how much money Cromwell will probably have to pay. If he h

> Deepa Chungi wishes to develop an average, or index, that can be used to measure the general behavior of stock prices over time. She has decided to include six closely followed, high-quality stocks in the average or index. She plans to use August 15, 198

> The SP-6 Index (a fictitious index) is used by many investors to monitor the general behavior of the stock market. It has a base value set equal to 100 at January 1, 1978. In the accompanying table, the closing market values for each of the six stocks in

> Charlene Hickman expected the price of Bio International shares to drop in the near future in response to the expected failure of its new drug to pass FDA tests. As a result, she sold short 200 shares of Bio International at $27.50. How much would Charle

> Calculate the profit or loss per share realized on each of the following short-sale transactions. Stock Sold Short at Stock Purchased to Cover Transaction Price/Share Short at Price/Share $83 $75 $30 $18 $27 A $24 $15 $32 $45 $53 BCDE

> An investor short sells 100 shares of a stock for $20 per share. The initial margin is 50%, and the maintenance margin is 30%. The price of the stock rises to $28 per share. What is the margin, and will there be a margin call?

> What is industry analysis, and why is it important?

> What role do an investor’s portfolio objectives play in constructing a portfolio?

> An investor short sells 100 shares of a stock for $20 per share. The initial margin is 50%, and the maintenance margin is 30%. The price of the stock falls to $12 per share. What is the margin, and will there be a margin call?

> The table below shows the annual change in the average U.S. home price from 2005 to 2014 according to the S&P/Case-Shiller Index. Calculate the average annual return and its standard deviation. Compare this to the average return and standard deviatio

> You have $5,000 in a 50% margin account. You have been following a stock that you think you want to buy. The stock is priced at $52. You decide that if the stock falls to $50, you would like to buy it. You place a limit order to buy 300 shares at $50. Th

> You own 500 shares of Ups & Downs, Inc., stock. It is currently priced at $50. You are going on vacation, and you realize that the company will be reporting earnings while you are away. To protect yourself against a rapid drop in the price, you place a s

> Not long ago, Jack Edwards bought 200 shares of Almost Anything Inc. at $45 per share; he bought the stock on margin of 60%. The stock is now trading at $60 per share, and the Federal Reserve has recently lowered initial margin requirements to 50%. Jack

> Marlene Bellamy purchased 300 shares of Writeline Communications stock at $55 per share using the prevailing minimum initial margin requirement of 50%. She held the stock for exactly four months and sold it without brokerage costs at the end of that peri

> An investor buys 200 shares of stock selling at $80 per share using a margin of 60%. The stock pays annual dividends of $1 per share. A margin loan can be obtained at an annual interest cost of 8%. Determine what return on invested capital the investor w

> Jerri Kingston bought 100 shares of stock at $80 per share using an initial margin of 50%. Given a maintenance margin of 25%, how far does the stock have to drop before Jerri faces a margin call? (Assume that there are no other securities in the margin a

> Miguel Torres purchased 100 shares of CantWin.com.com for $50 per share, using as little of his own money as he could. His broker has a 50% initial margin requirement and a 30% maintenance margin requirement. The price of the stock falls to $30 per share

> Assume that an investor buys 100 shares of stock at $35 per share, putting up a 75% margin. a. What is the debit balance in this transaction? b. How much equity funds must the investor provide to make this margin transaction? c. If the stock rises to $55

> Explain the role of portfolio revision in the process of managing a portfolio.

> What effect, if any, does inflation have on common stocks?

> Chris LeBlanc estimates that if he does five hours of research using data that will cost $75, there is a good chance that he can improve his expected return on a $10,000, 1-year investment from 8% to 10%. Chris feels that he must earn at least $20 per ho

> You sell 200 shares of a stock short for $60 per share. You want to limit your loss on this transaction to no more than $1,400. What order should you place?

> Following is a sample of 11 Level-I CFA exam questions that deal with many topics covered in Chapters 6, 7, 8, and 9 of this text, including the use of financial ratios, various stock valuation models, and efficient market concepts. (Note: When answering

> Elmo Inc.’s stock is currently selling at $60 per share. For each of the following situations (ignoring brokerage commissions), calculate the gain or loss that Courtney Schinke realizes if she makes a 100-share transaction. a. She sells short and repurch

> Erin McQueen purchased 50 shares of BMW, a German stock traded on the Frankfurt Exchange, for €64.5 (euros) per share exactly one year ago when the exchange rate was €0.67>US$1. Today the stock is trading at €71.8 per share, and the exchange rate is €0.7

> What Is the Mystery in Futures Markets?

> Why do you think sell ratings tend to cause stock prices to fall, while buy ratings do not lead to stock price increases?

> Two investments offer a series of cash payments over the next four years, as shown in the following table. a. What is the total amount of money paid by each investment over the four years? b. From a time value of money perspective, which of these inves

> Differentiate between the financial advice you would receive from a traditional investment advisor and one of the new online planning and advice sites. Which would you prefer to use, and why? How could membership in an investment club serve as an alterna

> It’s probably safe to say that there’s nothing more important in determining a bond’s rating than the underlying financial condition and operating results of the company issuing the bond. Just as fina

> Prepare a checklist of questions and issues you would use when shopping for a stockbroker. Describe both the ideal broker and the ideal brokerage firm, given your investment goals and disposition. Discuss the pros and cons of using a full-service rather

> Briefly describe each of the following: a. Gross domestic product b. Leading indicators c. Money supply d. Producer prices

> Describe how, if at all, a conservative and an aggressive investor might use each of the following types of orders as part of their investment programs. Contrast these two types of investors in view of these preferences. a. Market b. Limit c. Stop-loss

> Why do you think some large, well-known companies such as Cisco Systems, Intel, and Microsoft prefer to trade on the Nasdaq OMX markets rather than on an organized securities exchange such as the NYSE (for which they easily meet the listing requirements)

> From 1999 to 2014, the average IPO rose by 19% in its first day of trading. In 1999, 117 deals doubled in price on the first day. What factors might contribute to the huge first-day returns on IPOs? Some critics of the current IPO system claim that under

> Following is a sample of 12 Level-I CFA exam questions that deal with many of the topics covered in Chapters 14 and 15 of this text, including basic properties of options and futures, pricing characteristics, return behavior, and various option strategie

> Critics of longer trading hours believe that expanded trading sessions turn the stock market into a casino and place the emphasis more on short-term gains than on long-term investment. Do you agree? Why or why not? Is it important to have a “breathing pe

> On the basis of the current structure of the world’s financial markets and your knowledge of the NYSE and Nasdaq OMX markets, describe the key features, functions, and problems that would be faced by a single global market (exchange) on which transaction

> Assume that you are 35 years old, are married with two young children, are renting a condo, and have an annual income of $90,000. Use the following questions to guide your preparation of a rough investment plan consistent with these facts. a. What are yo

> Carolyn Bowen, who just turned 55, is employed as an administrative assistant for the Xcon Corporation, where she has worked for the past 20 years. She is in good health, lives alone, and has two grown children. A few months ago her husband died, leaving

> On the basis of the information provided, indicate how much profit or loss you would make in each of the futures transactions listed below. (Hint: You might want to visit http:// www.cmegroup.com for the size of the contract, pricing unit, and so on.)

> Three of the biggest U.S. commodities exchanges—the CME, CBOT, and NYMEX—were identified in this chapter. Other U.S. exchanges and several foreign commodities exchanges are also closely followed in the United States. Go to the Wall Street Journal Online,

> Wally Wilson is a commercial artist who makes a good living by doing freelance work—mostly layouts and illustrations—for local ad agencies and major institutional clients (such as large department stores). Wally has be

> Assume you hold a well-balanced portfolio of common stocks. Under what conditions might you want to use a stock-index (or ETF) option to hedge the portfolio? a. Briefly explain how such options could be used to hedge a portfolio against a drop in the mar

> Alcan stock recently closed at $52.51. Assume that you write a covered call on Alcan by writing one September call with a strike price of $55 and buying 100 shares of stock at the market price. The option premium that you obtain from writing the call is

> Using the Facebook stock option quotations in Figure 14.1, find the option premium, the time value, and the stock index breakeven point for the following puts and calls. Figure 14.1: a. The August put with a strike price of $82.50 b. The August call w

> In the absence of any load charges, open-end mutual funds are priced at (or very close to) their net asset values, whereas closed-end funds rarely trade at their NAVs. Explain why one type of fund would normally trade at its NAV while the other type (CEF

> Following is a sample of 10 Level-I CFA exam questions that deal with many of the topics covered in Chapters 10 and 11 of this text, including bond prices and yields, interest rates and risks, bond price volatility, and bond redemption provisions. (When

> Describe an ETF and explain how these funds combine the characteristics of both open end and closed-end funds. Consider the Vanguard family of funds. Which of its funds most closely resembles a “spider” (SPDR)? In what respects are the Vanguard fund (tha

> For each pair of funds listed below, select the one that is likely to be less risky. Briefly explain your answer. a. Growth versus growth-and-income funds b. Equity-income versus high-grade corporate bond funds c. Balanced versus sector funds d. Global v

> Why is Jensen’s measure (alpha) generally preferred over the measures of Sharpe and Treynor for assessing portfolio performance? Explain.

> Describe the process of creating an ETF. How does it differ from the process by which an open-end fund is created?

> Contrast mutual fund ownership with direct investment in stocks and bonds. Assume your class is going to debate the merits of investing through mutual funds versus investing directly in stocks and bonds. Develop some arguments on each side of this debate

> Assume that an investor comes to you looking for advice. She has $200,000 to invest and wants to put it all into bonds. a. If she considers herself a fairly aggressive investor who is willing to take the risks necessary to generate the big returns, what

> Why is the business cycle so important to economic analysis? Does the business cycle have any bearing on the stock market?

> Briefly explain what will happen to a bond’s duration measure if each of the following events occur. a. The yield to maturity on the bond falls from 8.5% to 8%. b. The bond gets 1 year closer to its maturity. c. Market interest rates go from 8% to 9%. d.

> Briefly describe each of the following theories of the term structure of interest rates. a. Expectations hypothesis b. Liquidity preference theory c. Market segmentation theory According to these theories, what conditions would result in a downward-slopi

> Using the resources at your campus or public library or on the Internet, find the information requested below. a. Select any two convertible debentures (notes or bonds) and determine the conversion ratio, conversion parity, conversion value, conversion p

> Describe LYONs, and note how they differ from conventional convertible securities. Are there any similarities between LYONs and conventional convertibles? Explain.

> Why do companies like to issue convertible securities? What’s in it for them?

> Jim Pernelli and his wife, Polly, live in Augusta, Georgia. Like many young couples, the Pernellis are a two-income family. Jim and Polly are both college graduates and hold high-paying jobs. Jim has been an avid investor in the stock market for a number

> Briefly describe each of the following measures for assessing portfolio performance and explain how they are used. a. Sharpe’s measure b. Treynor’s measure c. Jensen’s measure (Jensen’s alpha)

> Dara Simmons, a 40-year-old financial analyst and divorced mother of two teenage children, considers herself a savvy investor. She has increased her investment portfolio considerably over the past five years. Although she has been fairly conservative wit

> Treasury securities are guaranteed by the U.S. government. Therefore, there is no risk in the ownership of such bonds.” Briefly discuss the wisdom (or folly) of this statement.

> Identify and briefly describe each of the following types of bonds. a. Agency bonds b. Municipal bonds c. Zero-coupon bonds d. Junk bonds e. Foreign bonds f. Collateralized mortgage obligations (CMOs) What type of investor do you think would be most attr

> Using the bond returns in Table 10.1 as a basis of discussion: Table 10.1: a. Compare the total returns on Treasury bonds during the 1970s to those produced in the 1980s. How do you explain the differences? b. How did the bond market do in the 1990s?

> Describe the general concept of economic analysis. Is this type of analysis necessary, and can it really help the individual investor make a decision about a stock? Explain.

> Briefly define each of the following and note the conditions that would suggest the market is technically strong. a. Breadth of the market b. Short interest c. Relative strength index d. Theory of contrary opinion e. Head and shoulders

> Describe each of the following approaches to technical analysis and note how it would be used by investors. a. Confidence index b. Arms index c. Trading action d. Odd-lot trading e. Charting f. Moving averages g. On-balance volume Which of these approach

> Briefly describe how technical analysis is used as part of the stock valuation process. What role does it play in an investor’s decision to buy or sell a stock?

> Describe how representativeness may lead to biases in stock valuation.

> Briefly define each of the following terms and describe how it can affect investors’ decisions. a. Loss aversion b. Representativeness c. Narrow framing d. Overconfidence e. Biased self-attribution

> What is an odd-lot differential? How can you avoid odd-lot differentials? Which of the following transactions would involve an odd-lot differential? a. Buy 90 shares of stock b. Sell 200 shares of stock c. Sell 125 shares of stock

> Each year financial periodicals like the Wall Street Journal and Money Magazine publish a list of the top performing mutual fund managers. And every year there are some fund managers who earn much higher returns than the market average, and in some cases

> Much has been written about the concept of an efficient market. It’s probably safe to say that some of your classmates believe the markets are efficient and others believe they are not. Have a debate to see whether you can resolve this issue (at least am

> T. J. Patrick is a young, successful industrial designer in Portland, Oregon, who enjoys the excitement of commodities speculation. T. J. has been dabbling in commodities since he was a teenager—he was introduced to this market by his dad, who is a grain

> Assume an investor uses the constant-growth DVM to value a stock. Listed below are various situations that could affect the computed value of a stock. Look at each one of these individually and indicate whether it would cause the computed value of a stoc

> Explain the role that the future plays in the stock valuation process. Why not just base the valuation on historical information? Explain how the intrinsic value of a stock is related to its required rate of return. Illustrate what happens to the value o

> Would there be any need for security analysis if we operated in an efficient market environment? Explain.

> In this chapter, we examined nine stock valuation procedures: • Zero-growth DVM • Constant-growth DVM • Variable-growth DVM • Free cash flow to equity approach • Expected return (IRR) approach • P/E approach • Price-to-cash-flow ratio • Price-to-sales ra

> As an investor, what kind(s) of economic information would you look for if you were thinking about investing in the following? a. An airline stock b. A cyclical stock c. An electrical utility stock d. A building materials stock e. An aerospace firm, with

> Economic analysis is generally viewed as an integral part of the top-down approach to security analysis. In this context, identify each of the following and note how each would probably behave in a strong economy. a. Fiscal policy b. Interest rates c. In

> Briefly define each of the following types of investment programs and note the kinds of stock (blue chips, speculative stocks, etc.) that would best fit with each. a. A buy-and-hold strategy b. A current-income portfolio c. Long-term total return d. Aggr

> Why is comparing a portfolio’s return to the return on a broad market index generally inadequate? Explain.

> Identify and briefly describe the three sources of return to U.S. investors in foreign stocks. How important are currency exchange rates? With regard to currency exchange rates, when is the best time to be in foreign securities? a. Listed below are excha

> Assume that a wealthy woman comes to you looking for some investment advice. She is in her early forties and has $250,000 to put into stocks. She wants to build up as much capital as she can over a 15-year period and is willing to tolerate a “fair amount

> Look at the record of stock returns in Table 6.1. a. How would you compare the average annual returns for the various decades? b. Considering the average annual returns that have been generated over holding periods of 10 years or more, what rate of retur

> Suppose you are on an airplane and you overhear two executives of a company talking about a merger that is about to take place. If you buy stock based on what you overheard, are you committing insider trading?

> A little more than 10 months ago, Luke Weaver, a mortgage banker in Phoenix, bought 300 shares of stock at $40 per share. Since then, the price of the stock has risen to $75 per share. It is now near the end of the year, and the market is starting to wea