Question: Wreford Components produces testing equipment for

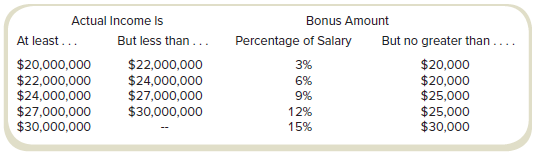

Wreford Components produces testing equipment for hospitals and other health care facilities. The vice president for operations (VP-Ops) and vice president for sales (VP-Sales) are paid a flat salary. The base salary is $200,000 for the VP-Ops and $300,000 for the VP-Sales. The company also has a contingent compensation plan that pays eligible managers, including these two vice presidents, a bonus equal to a percentage of their salary depending on actual income (excluding the bonus). The bonus schedule is as described in the following table:

An employee in sales has suggested to the VP-Sales a modification to the existing distribution process. If implemented, staff analysis indicates it will increase net profits (including costs of the modified process) by $2 million. The VP-Sales is undecided on whether or not to adopt the new process. If the new process is adopted, the compensation schedule will not be modified.

Required

a. Suppose that income without using the new process this year will be $21 million. By how much will the bonus for the VP-Ops change if the new process is adopted? By how much will the bonus for the VP-Sales change if the new process is adopted?

b. Suppose that income without using the new process this year will be $24 million. By how much will the bonus for the VP-Ops change if the new process is adopted? By how much will the bonus for the VP-Sales change if the new process is adopted?

c. Suppose that income without using the new process this year will be $26 million. By how much will the bonus for the VP-Ops change if the new process is adopted? By how much will the bonus for the VP-Sales change if the new process is adopted?

d. Is it ethical for the VP-Sales to consider the impact of the new process on their bonus when deciding whether or not to use it? Explain.

e. Assess the management control system used at Wreford Components and provide recommendations for changes, if any are required. Be sure to discuss

∙ Decision authority.

∙ Performance measures.

∙ Compensation.

> On December 30, a manager determines that income is about $9.9 million. The manager has a compensation plan that calls for a bonus of 25 percent (of salary) if income exceeds $10 million and no bonus if it is below $10 million. What problems might arise

> Burchill Consultants is a global consulting firm. The firm has a travel policy that reimburses employees for the “ordinary and necessary” costs of business travel and reimburses business-class airfare for international

> Manning Systems is a commercial software vendor that sells billing and other financial software to companies around the globe. Manning operates a centralized call center for customer support calls. Costs associated with use of the center are charged to t

> Loretto Outfitters is a retail chain of stores organized into two divisions (East and West) and a corporate headquarters. Corporate planners have prepared financial operating plans (budgets) for the two divisions for the upcoming year (year 2). Selected

> Burwell Manufacturing is organized into two divisions (Agriculture and Mining) and a corporate headquarters. The financial group of the corporate staff prepared financial operating plans (budgets) for the two divisions for the upcoming year (year 1). Sel

> Refer to the information in Problem 12-51 for Elba Consulting Associates. Required Recommend a corporate cost allocation system that would improve the performance measurement system used for the three divisions and would address any issues you may have r

> Elba Consulting Associates (ECA) is organized into three divisions (Manufacturing, Retail, and Entertainment). Many support services, such as human resources, legal, and information technology, are provided by corporate staff. The corporate staff costs a

> Refer to the information in Problem 12-49 for Lilac Group. Required Recommend a corporate cost allocation system that would improve the performance measurement system used for the two divisions and would address any issues you may have raised in Problem

> Lilac Group is organized into two geographic divisions (Americas and Rest of the World, or ROW) and a corporate headquarters. Late last year, the Lilac CFO prepared financial operating plans (budgets) for the two divisions for the current year, shown as

> Racine Chemicals’ division managers have been expressing growing dissatisfaction with the methods the company uses to measure division performance. Division operations are evaluated every quarter by comparing them with a budget prepared during the prior

> Cherrylawn Appliance Stores is a nationwide chain of kitchen appliance stores. The company operates with a widely based retail and distribution system that has led to a highly decentralized management structure. Each area manager is responsible for purch

> Give two reasons why dividing production cost variances into price and efficiency variances is useful for management control.

> Burt Management Consultants (BMC) is a multinational consulting group organized geographically. In the U.S. Division, the managing partner for sales (MPS) is responsible for client acquisition. The MPS negotiates project scopes and budgets with the clien

> The board of directors of the Cortez Beach Yacht Club (CBYC) is developing plans to acquire more equipment for lessons and rentals and to expand club facilities. The board plans to purchase about $50,000 of new equipment each year and wants to begin a fu

> Following several years of tight budgets, administrators at the University of California, Davis, looked for ways “to do more with less.” Janet Hamilton, vice chancellor of administration, researched books and articles,

> I just don’t understand these financial statements at all!” exclaimed Mr. Elmo Knapp. Mr. Knapp explained that he had turned over management of Racketeer, Inc., a division of American Recreation Equipment, Inc., to his

> I thought the Internet would be an ideal way to distribute our products. We’ve had a lot of success with our direct sales, but now we can reach a much larger audience. The baskets we make and sell appeal to people everywhere. I thought

> Keewee Company manufactures a single product for the military. Keewee Company had steady work, but it only had a return on investment of 6 percent. The CEO of Keewee Company did a test flight of Keewee’s product and subsequently had a heart attack and di

> Fargo Industries manufactures and sells snowmobiles. The company has eight business units strategically located near the major markets, each with a sales force and two to four manufacturing plants. These business units operate as autonomous profit center

> Stockton Distributors is a large, privately held warehousing and freight company with managers assigned to each region of the U.S. The company managers are developing Stockton’s sales budget for the following year. The budget department of the CFO’s offi

> Refer to the data in Exercise 15-22. PSC management has disallowed any change in transfer prices for special orders. Required a. Does PSC want to accept this order? b. Will the Assembly Division manager be willing to accept this order? c. Will the Packag

> Philadelphia Supply Corporation (PSC) produces and distributes various products for the hospitality industry. It is organized in two divisions: Assembly and Packaging. The managers of both divisions are evaluated and compensated based on divisional incom

> Pick an organization you know, such as a school, a local firm, a business, an entertainment business, a sports team, and so on. Identify an example of when a favorable cost variance (actual cost relative to a budget) is not good news for the performance

> Post Parts manufactures components used in audio and video systems. The year just ended was Post’s first year of operations and it is preparing financial statements. The immediate issue facing Post is the treatment of the direct labor costs. Post set a s

> Volte Corporation produces small electric appliances. The following information is available for the most recent period of operations: Volte never has any work-in-process inventories and began the year with no finished goods inventory. Required a. What w

> Lamphere Lawn Care provides lawn and gardening services. The price of the service is fixed at a flat rate for each service, and most costs of providing the service are the same, given the similarity in the lawns and lots. The owner budgets income by esti

> The director of marketing for Marbud Hardware is responsible for, among other things, identifying new geographic regions for the company to enter. As part of the company’s zero-based budgeting process, the director submitted the followi

> Avery Equipment Rental is a regional firm servicing agricultural and construction clients in the northern plains states. The CFO of Avery is preparing next quarter’s budget and has two forecasts for sales in the Western Branch. The market research group

> Refer to the information in Exercise 13-47. For November, Lambie Custodial Services has budgeted profit of $1,620 based on 50 commercial clients. All information about unit costs for cleaners and supplies, about fixed monthly costs, and about hourly clea

> Lambie Custodial Services (LCS) offers residential and commercial janitorial services. Clients are billed monthly but can cancel the service at the end of any month. In addition to the employees who do the actual cleaning, the firm employs two managers w

> Curtis Party Rentals offers party equipment such as tents, tables, chairs, and so on for outdoor events. The rental fees average $750 per event. Curtis receives a 15 percent deposit two months before the event, 60 percent the month before, and the remain

> Hackett Produce Supply is preparing its cash budget for April. The following information is available: Required What is the estimated amount of cash receipts from accounts receivable collections in April?

> Commonly in many organizations, including corporations, universities, and government agencies, when more than one employee from the organization is having a business meal paid by the organization, the most senior person (in terms of authority, not age) p

> What are the advantages and disadvantages of starting the budgeting process early in the year versus later in the year prior to the budget year?

> One of the authors of this book has a favorite sandwich shop where one person makes the sandwich and another person rings up the sale and takes the customer’s cash. At first, this author thought that having two people involved had something to do with hi

> Cornwall Mobile Detailing (CMD) is a service that washes and details a customer’s vehicle at their home or office. It operates on a membership basis. Members pay $200 dues per month, which entitle them to a complete wash and detail serv

> Dill Shipyards operates a dry dock on the East Coast, where it builds and repairs ships. The company’s Payroll Department supports its two divisions, Naval and Private. The Naval division has contracts with the Department of Defense and

> All sales at Alaska Company are on credit. The company is preparing a cash budget for November. The following information on accounts receivable collections is available from customer payment history: The remaining 2 percent is not collected and is writt

> Kentfield Advisory Services (KAS) is a large management consulting firm organized into two groups: Governmental Services (GS) and Commercial Support (CS). Corporate information technology (IT) services support both groups. The cost of computer support is

> Montrose Instrumentation produces measurement equipment. One component, used in a variety of the company’s products, is critical, and the supply chain often breaks. For that reason, Montrose has a policy to hold in inventory enough of t

> Giardin Outdoors is a recreational goods retailer with two divisions: Online and Stores. The two divisions both use the services of the corporate Finance and Accounting (F&A) Department. Annual costs of the F&A Department total $5.2 million a yea

> Equipment is a specialty nozzle. The budgeting team is now determining the purchase requirements and monthly cash disbursements for this part. Eliot wishes to have in stock enough nozzles to use for the coming month. On August 1, the company has 16,800 n

> Benham Foundries manufactures metal components. The inventory policy at Benham is to hold inventory equal to 150 percent of the average monthly sales for its main product. Sales for the main product for the following year are expected to be 480,000 units

> Cherboneau Novelties produces drink coasters (among many other products). During the current year (year 0), the company sold 520,000 units (packages of 6 coasters). In the coming year (year 1), the company expects to sell 540,000 units, and, in year 2, i

> What is the link between flexible budgeting and management control?

> Sauer Instruments manufactures a surgical tool used in cardiovascular procedures. The demand for the instrument has been strong after a competitor’s instrument was deemed defective and is currently off the market. Sauer management is developing the produ

> Consider the Business Application, “Centralizing as a Cost-Cutting Approach.” Required What best describes the benefits that the companies cited that chose not to centralize likely hoped to receive by keeping certain s

> Zender Fabrication is a long-established manufacturer of various industrial products located in the United States. This company’s products have a well-respected brand name and receive a premium price in the market. The unionized workforce is well paid an

> Shadownook Industries is a multinational firm operating in many businesses, including manufacturing, mining, and agriculture. Top management focuses on the annual earnings in evaluating the performance of sector managers. (Sector managers include a mix o

> Westphalia Corporation produces audio equipment for home, office, and vehicles. The production manager (PM) and marketing manager (MM) are both are paid a flat salary and are eligible for a bonus. The bonus is equal to 2 percent of company profit that is

> Lamont Copy Centers (LCC) operates several stores in the upper midwest. The company is decentralized. At the corporate level, there are two operating managers: chief personnel officer (CPO) and chief operating officer (COO). The CPO’s p

> Bramell Park is an amusement park with an entrance fee that allows unlimited rides. Last year, the company sold 88,000 one-day admission tickets with an average price of $125 and 30,000 three-day admission tickets with an average price of $280. The park

> Emmons Lawn Maintenance (ELM) provides lawn and garden care for residential properties. In the current year, ELM maintains 75 properties and earns an average of $5,000 annually for each property. The owner of ELM is planning for the coming year. New buil

> Write a memo to Megan Okoye outlining how you would recommend measuring “correct orders” for Silo Coffee and Tea. Be sure to discuss the advantages and disadvantages of your proposed measure.

> What is the advantage of preparing the flexible budget? The period is over and the actual results are known. Is this just extra work for the staff?

> Trombly Fabrication has three production facilities located in the state, each producing the same basic mix of products. Facility 1 was the original plant and the only one for several years. Facilities 2 and 3 were added recently to handle the increased

> Ternes Manufacturing produces metal products primarily used in the construction industry. The three main inputs in production are materials (metal), labor, and overhead. Data for the previous three reporting periods follow: Required a. Compute the total

> Cahalan is a network of clinics performing laser surgery for vision correction. Each clinic tracks the number of patients treated and the number of professional-hours spent on the laser patient procedure. Consultations, follow-up visits, and so on are tr

> Canfield Transition Centers is a not-for-profit organization to teach new technical skills to individuals looking to change careers. Canfield operates four campuses (Construction, Electrical, Plumbing, and Carpentry). Because the programs require all-day

> The controller’s staff at McNichols Lubricants is responsible for preparing quarterly performance reports. One report evaluates quarter-to-quarter improvement in partial productivity of the two main inputs in the production process: bas

> Top management at Reisener Corporation are looking to improve productivity in corporate staff functions. One area targeted for the initiative is the Human Resources (HR) department. The following data were collected for three relatively routine actions f

> RST Airlines operates call centers for customer service in four locations: Minneapolis, Phoenix, Boise, and Singapore. Although all four call centers can handle any inquiries, calls from elite customers are generally routed to the Boise center, and inter

> For each category of functional measures listed in Exhibit 18.9, add one additional specific measurement that is not already listed.

> Gordon Industries has the following mission statement: To be the low-cost leader in package delivery services. Gordon’s CEO tells you that the financial staff has developed the following initial balanced scorecard: Required Comment on t

> Romeyn Food Markets has decided to adopt a balanced scorecard to monitor performance. The company’s strategy is to be a provider of premium foods, sourced from local farms and nationally known organic suppliers. The initial scorecard re

> What is the advantage of recognizing materials price variances at the time of purchase rather than at the time of use?

> What are the advantages of the contribution margin format based on variable costing compared to the traditional format based on full absorption costing?

> What would it take to implement your ideas/plans to move forward with these goals?

> Develop a plan to address key stakeholder concerns from each perspective. Can you find a pathway in the stakeholder analysis to build support for your key goals?

> List your personal goals. Which stakeholders are supportive of these goals? Which are likely to try to block these goals?

> Are efforts such as the MBA oath (discussed in this chapter) reflections of a different approach that Gen Z will bring to the business environment, compared with prior generations?

> As this cohort expands in the work force, do you expect to see different sets of business ethics and workplace culture take hold? Please explain.

> As you consider your career after graduation, which control-and-reward system would you find most motivating? Is this different from the controls used at some jobs you have had in the past? How do you think you would perform in a holacracy such as Zappos

> Have you been in school or work situations in which your values did not align with those of your peers or colleagues? How did you handle the situation? Are there certain values or norms important enough for you to consider as you look for a new job?

> Review Exhibit 11.11 and circle the organizational characteristics you find appealing. Cross out those factors you think you would not like.

> Identify at least three activities you could do this week to get started. For example, you could choose to work with international students on group projects in class. Perhaps invite students with diverse backgrounds to lunch. What questions could you as

> Identify your weakest area and make a list of activities that will help you improve your capital in that area.

> Why is it that PESTEL factors can have such a strong impact on the future of a business? Do you support legislation such as that passed in New York (and elsewhere), or do you think it has more to do with protecting vested interests such as the hotel indu

> As a baseline of your current position, list your strengths and weaknesses for each component.

> Now compare your actual career-related network using a site such as LinkedIn. Are any of your connections linked together? With how many alumni from your university are you linked? These alumni can provide a source of “weak ties” that may help you get a

> Create a list of up to 12 people at your university with whom you regularly communicate (in person, electronically, or both). Draw your network (place names or initials next to each node), and connect every node where people you communicate with also tal

> Let’s consider dynamics—has your level of diversification changed over time (say, over the last five years)? Looking toward the future, do you expect your level of diversification to change as you complete your degree? Why or why not?

> Do you need to make adjustments to your portfolio of activities? Explain the reasons for your answer.

> Using Exhibit 8.8 as a guide, list each of your major activity areas. Think of each of these as a business. (If you are literally “all work and no play,” you are a single-business type of personal diversification.) Instead of revenues, estimate the perce

> Explain how you would apply the strategic management framework to enhance your startup’s chances to gain and sustain a competitive advantage.

> Do you see higher education as a benefit or detriment to becoming a successful entrepreneur? Why?

> Thinking about today’s business climate, would you say that now is a good time to start a business? Why or why not?

> Before you launch into a new project, job, or firm, or even before you make a change in industry in the effort to move forward in your career, always consider the trade-offs that you would and would not be willing to make.

> How was an internet startup able to disrupt the hotel industry, long dominated by giants such as Marriott and Hilton, which took decades to become successful worldwide hospitality chains? Explain.

> Amazon has surpassed 650,000 employees and was the second publicly traded company in the world to hit $1 trillion market capitalization (just after Apple). The company offers bold new ideas as a retailer and is under an intense pressure to deliver on its

> Employees and consultants say the Amazon workplace is the epitome of a “do more for less cost” environment. We recognize this is a hallmark goal of a cost-leadership business strategy. But ask yourself this key question: is it the type of high-pressure w

> The myStrategy box at the end of Chapter 2 asked how much you would be willing to pay for the job you want—for a job that reflects your values. Here, we look at a different issue relating to worth: How much is an MBA worth over the course of your career?

> As an employee, how could you persuade your boss that you could be a vital source of sustainable competitive advantage? What evidence could you provide to make such an argument?

> Are some of your strengths valuable, rare, and costly to imitate? How can you organize your work to help capture the value of your key strengths (or mitigate your weaknesses)? Are your strengths specific to one or a few employers, or are they more genera

> Personal capabilities also need to be evaluated over time. Are your strengths and weaknesses different today from what they were five years ago? What are you doing to make sure your capabilities are dynamic?

> Write down your own strengths and weaknesses. What sort of organization will permit you to really leverage your strengths and keep you highly engaged in your work (person–organization fit)? Do some of your weaknesses need to be mitigated through addition

> Do these types of macro-environmental trends affect your thought process about selecting a career field after college? Why or why not? Explain.

> What industries do you think may offer the best U.S. (or domestic) job opportunities in the future? Which industries do you think may offer the greatest job opportunities in the global market in the future? Use the PESTEL framework and the five forces mo

> Many people approach the job market by thinking about particular firms. What are some advantages of broadening this thought process to consider the industry-level factors of a potential new employer?

> Given the apparent leadership crisis at Facebook, should Mark Zuckerberg and/or Sheryl Sandberg be replaced? Why, or why not? Explain your answers.