Question: York Co. sells one product, which it

York Co. sells one product, which it purchases from various suppliers. York’s trial balance at December 31, 2018, included the following accounts:

Sales (33,000 units @ $16) ……………………….. $528,000

Sales discounts ………………………………………………. 7,500

Purchases ………………………………………………….. 368,900

Purchase discounts ………………………………………. 18,000

Freight-in ……………………………………………………… 5,000

Freight-out …………………………………………………… 11,000

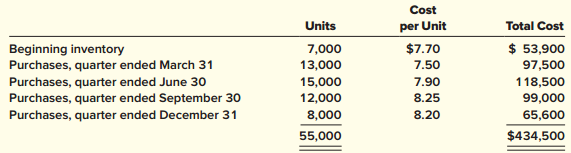

York Co.’s inventory purchases during 2018 were as follows:

Additional Information:

a. York’s accounting policy is to report inventory in its financial statements at the lower of cost or net realizable value, applied to total inventory. Cost is determined under the first-in, first-out (FIFO) method.

b. York has determined that, at December 31, 2018, the net realizable value was $8.00 per unit.

Required:

1. Prepare York’s schedule of cost of goods sold, with a supporting schedule of ending inventory. York includes inventory write-down losses in cost of goods sold.

2. Explain the rule of lower of cost or net realizable value and its application in this situation.

Transcribed Image Text:

Cost Units per Unit Total Cost $7.70 $ 53,900 Beginning inventory Purchases, quarter ended March 31 Purchases, quarter ended June 30 7,000 13,000 7.50 97,500 15,000 7.90 118,500 99,000 Purchases, quarter ended September 30 Purchases, quarter ended December 31 12,000 8.25 8,000 8.20 65,600 55,000 $434,500

> Chadwick Enterprises, Inc. operates several restaurants throughout the Midwest. Three of its restaurants located in the center of a large urban area have experienced declining profits due to declining population. The company’s management has decided to t

> In 2018, internal auditors discovered that PKE Displays, Inc. had debited an expense account for the $350,000 cost of equipment purchased on January 1, 2015. The equipment’s life was expected to be five years with no residual value. Straight-line depreci

> What is a LIFO inventory pool? How the cost of ending inventory is determined when pools are used?

> There are various types of accounting changes, each of which is required to be reported differently. Required: 1. What type of accounting change is a change from the sum-of-the-years’-digits method of depreciation to the straight-line method for previou

> Explain what is meant by the impairment of the value of property, plant, and equipment and intangible assets. How should these impairments be accounted for?

> For financial reporting, Clinton Poultry Farms has used the declining-balance method of depreciation for conveyor equipment acquired at the beginning of 2015 for $2,560,000. Its useful life was estimated to be six years, with a $160,000 residual value. A

> Alta Ski Company’s inventory records contained the following information regarding its latest ski model. The company uses a periodic inventory system. Beginning inventory, January 1, 2018 ……………… 600 units @ $80 each Purchases: January 15 …………………………………………

> Alteran Corporation purchased office equipment for $1.5 million in 2015. The equipment is being depreciated over a 10-year life using the sum-of-the-years’-digits method. The residual value is expected to be $300,000. At the beginning of 2018, Alteran de

> An annual report of Sprint Corporation contained a rather lengthy narrative entitled “Review of Segmental Results of Operation.” The narrative noted that short-term notes payable and commercial paper outstanding at the end of the year aggregated $756 mil

> In 2018, the controller of Sytec Corporation discovered that $42,000 of inventory purchases were incorrectly charged to advertising expense in 2017. In addition, the 2017 year-end inventory count failed to include $30,000 of company merchandise held on c

> Maxtor Technology incurred the following costs during the year related to the creation of a new type of personal computer monitor: Salaries ……………………………………………………………………………………………………………… $220,000 Depreciation on R&D facilities and equipment ……………………………………………

> Refer to the situation described in BE 10–14. Assuming the company uses the weighted-average method, calculate the amount of interest capitalized for the year. In BE 10–14 A company constructs a building for its own use. Construction began on January 1

> Refer to the situation described in BE 8–6. SAM uses a perpetual inventory system. Calculate ending inventory and cost of goods sold for January using (1) FIFO, and (2) Average cost. In BE 8–6 Samuelson and Messenger (SAM) began 2018 with 200 units of i

> A company constructs a building for its own use. Construction began on January 1 and ended on December 30. The expenditures for construction were as follows: January 1, $500,000; March 31, $600,000; June 30, $400,000; October 30, $600,000. To help financ

> Refer to the situation described in BE 10–11. Answer the questions assuming that the exchange lacks commercial substance. In BE 10–11 Calaveras Tire exchanged equipment for two pickup trucks. The book value and fair value of the equipment were $20,000 (

> Define a financial instrument. Provide three examples of current liabilities that represent financial instruments.

> Wardell Company purchased a minicomputer on January 1, 2016, at a cost of $40,000. The computer was depreciated using the straight-line method over an estimated five-year life with an estimated residual value of $4,000. On January 1, 2018, the estimate o

> Refer to the situation described in BE 10–11. Answer the questions assuming that the fair value of the equipment was $24,000, instead of $17,000. In BE 10–11 Calaveras Tire exchanged equipment for two pickup trucks. The book value and fair value of the

> Calaveras Tire exchanged equipment for two pickup trucks. The book value and fair value of the equipment were $20,000 (original cost of $65,000 less accumulated depreciation of $45,000) and $17,000, respectively. Calaveras also paid $8,000 in cash. At wh

> On October 1, Eder Fabrication borrowed $60 million and issued a nine-month promissory note. Interest was discounted at issuance at a 12% discount rate. Prepare the journal entry for the issuance of the note and the appropriate adjusting entry for the no

> The balance sheets of Pinewood Resorts reported net fixed assets of $740,000 and $940,000 at the end of 2017 and 2018, respectively. The fixed-asset turnover ratio for 2018 was 3.25. Calculate Pinewood’s net sales for 2018.

> Huebert Corporation and Winslow Corporation reported the following information: Calculate each companies fixes-asset turnover ratio and determine which company utilizes its fixed assets most efficiently to generate sales. ($ in millions) Huebert Wi

> In what situations is interest capitalized?

> Explain what is meant by the Internal Revenue Service conformity rule with respect to the inventory method choice.

> What is goodwill and how is it measured?

> Briefly summarize the accounting treatment for intangible assets, explaining the difference between purchased and internally developed intangible assets.

> What is included in the original cost of property, plant, and equipment and intangible assets acquired in an exchange transaction?

> The table below contains selected information from recent financial statements of The Home Depot, Inc., and Lowe’s Companies, Inc., two companies in the home improvement retail industry ($ in millions): Required: Calculate the gross p

> Refer to the situation described in BE 8–4. Prepare the necessary journal entries assuming that VTC uses the net method to account for purchase discounts. In BE 8–4 On December 28, 2018, Videotech Corporation (VTC) purchased 10 units of a new satellite

> Saint John Corporation prepares its financial statements according to IFRS. On June 30, 2018, the company purchased a franchise for $1,200,000. The franchise is expected to have a 10-year useful life with no residual value. Saint John uses the straight-l

> On October 1, Eder Fabrication borrowed $60 million and issued a nine-month, 12% promissory note. Interest was payable at maturity. Prepare the journal entry for the issuance of the note and the appropriate adjusting entry for the note at December 31, th

> Identify any differences between U.S. GAAP and International Financial Reporting Standards in the treatment of software development costs.

> Identify any differences between U.S. GAAP and International Financial Reporting Standards in the treatment of research and development expenditures.

> Identify any differences between U.S. GAAP and International Financial Reporting Standards in accounting for government grants received.

> Explain the difference in the accounting treatment of the cost of developed technology and the cost of in-process R&D in an acquisition.

> Explain the accounting treatment of costs incurred to develop computer software.

> Explain the accounting treatment of equipment acquired for use in R&D projects.

> SLR Corporation has 1,000 units of each of its two products in its year-end inventory. Per unit data for each of the products are as follows: Determine the carrying value of SLR’s inventory assuming that the lower of cost or market (L

> Define R&D according to U.S. GAAP.

> What is the effect of a company electing the fair value option with respect to an investment that otherwise would be accounted for using the equity method?

> Explain the difference between the specific interest method and the weighted-average method in determining the amount of interest to be capitalized.

> At March 13, 2019, the Securities Exchange Commission is in the process of investigating a possible securities law violation by Now Chemical. The SEC has not yet proposed a penalty assessment. Now’s fiscal year ends on December 31, 2018, and its financia

> How are refundable deposits and customer advances similar? How do they differ?

> Define average accumulated expenditures and explain how the amount is computed.

> Van Frank Telecommunications has a patent on a cellular transmission process. The company has amortized the patent on a straight-line basis since 2014, when it was acquired at a cost of $9 million at the beginning of that year. Due to rapid technological

> Target Corporation prepares its financial statements according to U.S. GAAP. Target’s financial statements and disclosure notes for the year ended January 30, 2016, are available in Connect. This material is also available under the Investor Relations li

> On December 28, 2018, Videotech Corporation (VTC) purchased 10 units of a new satellite uplink system from Tristar Communications for $25,000 each. The terms of each sale were 1/10, n/30. VTC uses the gross method to account for purchase discounts and a

> The Brenly Paint Company, your client, manufactures paint. The company’s president, Mr. Brenly, decided to open a retail store to sell paint as well as wallpaper and other items that would be purchased from other suppliers. He has asked you for informati

> Huddell Company, which is both a wholesaler and retailer, purchases merchandise from various suppliers. The dollar-value LIFO method is used for the wholesale inventories. Huddell determines the estimated cost of its retail ending inventories using the c

> The management of the Esquire Oil Company believes that the wholesale price of heating oil that they sell to homeowners will increase again as the result of increased political problems in the Middle East. The company is currently paying $0.80 a gallon.

> Danville Bottlers is a wholesale beverage company. Danville uses the FIFO inventory method to determine the cost of its ending inventory. Ending inventory quantities are determined by a physical count. For the fiscal yearend June 30, 2018, ending invento

> How does IFRS differ from U.S. GAAP with respect to using the equity method?

> Quandary Corporation has a major customer who is alleging a significant product defect. Quandary engineers and attorneys have analyzed the claim and have concluded that there is a 51% chance that the customer would be successful in court and that a succe

> Ross Electronics has one product in its ending inventory. Per unit data consist of the following: cost, $20; replacement cost, $18; selling price, $30; selling costs, $4. The normal profit margin is 30% of selling price. What unit value should Ross use w

> Some inventory errors are said to be self-correcting in that the error has the opposite financial statement effect in the period following the error, thereby correcting the original account balance errors. Required: Despite this self-correcting feature,

> Mayfair Department Stores, Inc., operates over 30 retail stores in the Pacific Northwest. Prior to 2018, the company used the FIFO method to value its inventory. In 2018, Mayfair decided to switch to the dollar value LIFO retail inventory method. One of

> On January 2, 2018, David Corporation purchased a patent for $500,000. The remaining legal life is 12 years, but the company estimated that the patent will be useful only for eight years. In January 2020, the company incurred legal fees of $45,000 in suc

> Fred’s Inc. operates general merchandise retail discount stores and full-service pharmacies in the Southeastern United States. Access the company’s 10-K for the fiscal year ended January 30, 2016. You can find the 10-K by using EDGAR at www.sec.gov. Answ

> Abercrombie & Fitch Co. is a specialty retail company operating over 1,000 stores globally. The following disclosure note was included in recent financial statements: 4. Change in Accounting Principle The Company elected to change its method of accountin

> Generally accepted accounting principles should be applied consistently from period to period. However, changes within a company, as well as changes in the external economic environment, may force a company to change an accounting method. The specific re

> Kelly Corporation shipped goods to a customer f.o.b. destination on December 29, 2018. The goods arrived at the customer’s location in January. In addition, one of Kelly’s major suppliers shipped goods to Kelly f.o.b. shipping point on December 30. The m

> Smith-Kline Company maintains inventory records at selling prices as well as at cost. For 2018, the records indicate the following data: Required: Use the retail method to approximate cost of ending inventory in each of the following ways: 1. Average c

> Grand Department Store, Inc., uses the retail inventory method to estimate ending inventory for its monthly financial statements. The following data pertain to a single department for the month of October 2018: Inventory, October 1, 2018: At cost …………………

> Household Solutions manufactures kitchen storage products. During the year, the company became aware of potential costs due to (1) A recently filed lawsuit for patent infringement for which the probability of loss is remote and damages can be reasonably

> Sometimes an investor’s level of influence changes, making it necessary to change from the equity method to another method. How should the investor account for this change in accounting method?

> Alquist Company uses the retail method to estimate its ending inventory. Selected information about its year 2018 operations is as follows: a. January 1, 2018, beginning inventory had a cost of $100,000 and a retail value of $150,000. b. Purchases during

> Sparrow Company uses the retail inventory method to estimate ending inventory and cost of goods sold. Data for 2018 are as follows: The company records sales net of employee discounts. Discounts for 2018 totaled $4,000. Required: Estimate Sparrow&acir

> SLR Corporation has 1,000 units of each of its two products in its year-end inventory. Per unit data for each of the products are as follows: Determine the carrying value of SLR’s inventory assuming that the lower of cost or net reali

> Smith Distributors, Inc., supplies ice cream shops with various toppings for making sundaes. On November 17, 2018, a fire resulted in the loss of all of the toppings stored in one section of the warehouse. The company must provide its insurance company w

> Jackpot Mining Company operates a copper mine in central Montana. The company paid $1,000,000 in 2018 for the mining site and spent an additional $600,000 to prepare the mine for extraction of the copper. After the copper is extracted in approximately fo

> Home Stop sells two product categories, furniture and accessories. Information pertaining to its 2018 year-end inventory is as follows: Required: 1. Determine the carrying value of inventory at year-end, assuming the lower of cost or market (LCM) rule

> Forester Company has five products in its inventory. Information about the December 31, 2018, inventory follows. The cost to sell for each product consists of a 15 percent sales commission. The normal profit percentage for each product is 40 percent of

> Almaden Hardware Store sells two product categories, tools and paint products. Information pertaining to its 2018 year-end inventory is as follows: Required: 1. Determine the carrying value of inventory at year-end, assuming the lower of cost or net re

> Refer to the situation described in BE 9–7. Estimate ending inventory and cost of goods sold using the conventional method. In BE 9–7 Kiddie World uses a periodic inventory system and the retail inventory method to es

> The Phoenix Corporation’s fiscal year ends on December 31. Phoenix determines inventory quantity by a physical count of inventory on hand at the close of business on December 31. The company’s controller has asked for your help in deciding if the followi

> Refer to the situation described in BE 9–7. Estimate ending inventory and cost of goods sold (LIFO). In BE 9–7 Kiddie World uses a periodic inventory system and the retail inventory method to estimate ending inventory

> Describe the ratios used by financial analysts to monitor a company’s investment in inventories.

> Kiddie World uses a periodic inventory system and the retail inventory method to estimate ending inventory and cost of goods sold. The following data are available for the quarter ending September 30, 2018: Estimate ending inventory and cost of goods s

> Adams Corporation estimates that it lost $75,000 in inventory from a recent flood. The following information is available from the records of the company’s periodic inventory system: beginning inventory, $150,000; purchases and net sales from the beginni

> Explain the LIFO retail inventory method.

> Decker Company has five products in its inventory. Information about the December 31, 2018, inventory follows. The cost to sell for each product consists of a 15 percent sales commission. Required: 1. Determine the carrying value of inventory at Decem

> Explain how to estimate the average cost of inventory when using the retail inventory method.

> At the beginning of 2018, Terra Lumber Company purchased a timber tract from Boise Cantor for $3,200,000. After the timber is cleared, the land will have a residual value of $600,000. Roads to enable logging operations were constructed and completed on M

> Explain the steps required to correct an error in accounting for property, plant, and equipment and intangible assets that is discovered in a year subsequent to the year the error was made.

> Define each of the following retail terms: initial markup, additional markup, markup cancellation, markdown, markdown cancellation.

> What is a consignment arrangement? Explain the accounting treatment of goods held on consignment.

> Both the gross profit method and the retail inventory method provide a way to estimate ending inventory. What is the main difference between the two estimation techniques?

> The Rider Company uses the gross profit method to estimate ending inventory and cost of goods sold. The cost percentage is determined based on historical data. What factors could cause the estimate of ending inventory to be overstated?

> The fair value of depreciable assets of Penner Packaging Company exceeds their book value by $12 million. The assets’ average remaining useful life is 10 years. They are being depreciated by the straight-line method. Finest Foods Industries buys 40% of P

> Explain the gross profit method of estimating ending inventory.

> AAA Hardware uses the LIFO method to value its inventory. Inventory at the beginning of the year consisted of 10,000 units of the company’s one product. These units cost $15 each. During the year, 60,000 units were purchased at a cost of $18 each and 64,

> Describe the alternative approaches for recording inventory write-downs.

> Explain the (a) lower of cost or net realizable value (LCNRV) approach and the (b) lower of cost or market (LCM) approach to valuing inventory.

> Explain how purchase commitments are recorded for the lower of contract price or market price.

> Define purchase commitments. What is the advantage(s) of these agreements to buyers?

> In November 2018, the Brunswick Company signed two purchase commitments. The first commitment requires Brunswick to purchase 10,000 units of inventory at $10 per unit by December 15, 2018. The second commitment requires the company to purchase 20,000 uni

> Bell International can estimate the amount of loss that will occur if a foreign government expropriates some company property. Expropriation is considered reasonably possible. How should Bell report the loss contingency?

> On April 17, 2018, the Loadstone Mining Company purchased the rights to a coal mine. The purchase price plus additional costs necessary to prepare the mine for extraction of the coal totaled $4,500,000. The company expects to extract 900,000 tons of coal

> Identify any differences between U.S. GAAP and IFRS when applying the lower of cost or net realizable value rule to inventory valuation.

> Explain the accounting treatment of material inventory errors discovered in an accounting period subsequent to the period in which the error is made.