Question: Does the geographic pattern of merchandise exports

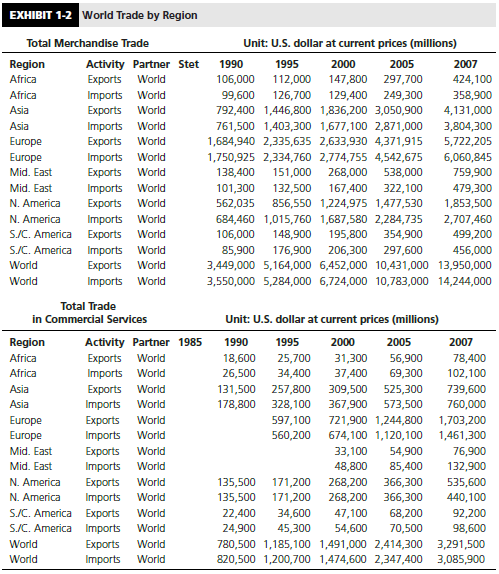

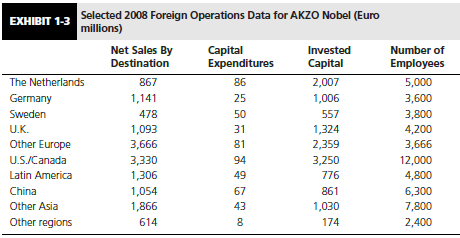

Does the geographic pattern of merchandise exports contained in Exhibit 1-2 correlate well with the pattern of AKZO Nobel’s geographic distribution of sales shown in Exhibit 1-3? What might explain any differences you observe?

Transcribed Image Text:

EXHIBIT 1-2 World Trade by Region Total Merchandise Trade Unit: U.S. dollar at current prices (millions) Region Activity Partner Stet Exports World 1990 1995 2000 2005 2007 Africa 424,100 106,000 99,600 112,000 147,800 297,700 Africa Imports World Еxports 126,700 792,400 1,446,800 1,836,200 3,050,900 129,400 249,300 358,900 Asia World 4,131,000 Imports World Exports World Imports World Asia 761,500 1,403,300 1,677,100 2,871,000 1,684,940 2,335,635 2,633,930 4,371,915 3,804,300 Europe 5,722,205 Europe 1,750,925 2,334,760 2,774,755 4,542,675 151,000 6,060,845 759,900 Mid. East Exports World 138,400 268,000 538,000 Mid. East Imports World Еxports 101,300 167,400 856,550 1,224,975 1,477,530 132,500 322,100 479,300 N. America World 562,035 1,853,500 2,707,460 499,200 N. America Imports World 684,460 1,015,760 1,687,580 2,284,735 195,800 206,300 S.C. America Exports World 106,000 148,900 354,900 S.C. America Imports World Exports World Imports World 85,900 176,900 297,600 456,000 World 3,449,000 5,164,000 6,452,000 10,431,000 13,950,000 World 3,550,000 5,284,000 6,724,000 10,783,000 14,244,000 Total Trade in Commercial Services Unit: U.S. dollar at current prices (millions) Region Activity Partner 1985 1990 1995 2000 2005 2007 Africa 18,600 Exports World Imports World Exports World Imports World 25,700 34,400 31,300 56,900 69,300 78,400 Africa 26,500 37,400 102,100 Asia 739,600 131,500 257,800 328,100 597,100 309,500 525,300 Asia 178,800 367,900 573,500 760,000 Europe Europe Exports World Imports Exports World 721,900 1,244,800 1,703,200 World 560,200 674,100 1,120,100 1,461,300 Mid. East 33,100 54,900 76,900 Mid. East Imports World 48,800 85,400 132,900 N. America 171,200 Exports World Imports World 135,500 135,500 22,400 24,900 268,200 366,300 268,200 366,300 535,600 N. America 171,200 440,100 S.C. America Exports S/C. America Imports World 34,600 47,100 54,600 68,200 92,200 98,600 World 45,300 70,500 World Еxports World Imports World 780,500 1,185,100 1,491,000 2,414,300 3,291,500 820,500 1,200,700 1,474,600 2,347,400 3,085,900 World Selected 2008 Foreign Operations Data for AKZO Nobel (Euro millions) EXHIBIT 1-3 Net Sales By Destination Capital Expenditures Invested Number of Capital Employees The Netherlands 867 86 2,007 5,000 Germany 1,141 25 1,006 3,600 Sweden 478 50 557 3,800 U.K. 1,093 3,666 31 1,324 2,359 4,200 Other Europe U.S./Canada 81 3,666 3,330 94 3,250 12,000 4,800 6,300 Latin America 1,306 49 776 China 1,054 1,866 67 861 Other Asia 43 1,030 7,800 Other regions 614 8 174 2,400

> As an employee on the financial staff of Multinational Enterprises, you are assigned to a three-person team that is assigned to examine the financial feasibility of establishing a wholly owned manufacturing subsidiary in the Czech Republic. You are to co

> Companies must decide whose rate of return (i.e., local vs. parent currency returns) to use when evaluating foreign direct investment opportunities. Discuss the internal reporting dimensions of this decision in a paragraph or two.

> General Electric Company’s worldwide performance evaluation system is based on a policy of decentralization. The policy reflects its conviction that managers will become more responsible and their business will be better managed if they are given the aut

> You are the CFO of Marisa Corporation, a major electronics manufacturer headquartered in Shelton, Connecticut. To date, your company’s operations have been confined to the United States and you are interested in diversifying your operat

> Stock exchange Web sites vary considerably in the information they provide and their ease of use. Required: Select any two of the stock exchanges presented in Appendix 1-1. Explore the Web sites of each of these stock exchanges. Prepare a table that c

> Investors, individual, corporate and institutional, are increasingly investing beyond national borders. The reason is not hard to find. Returns abroad, even after allowing for foreign currency exchange risk, have often exceeded those offered by domestic

> Examine Exhibit 9-9. On the basis of the information provided there, which opinion gives you the most comfort as an investor in nondomestic securities?

> Assume you are a member of an international policy setting committee and are responsible for harmonizing audit report requirements internationally. Examine Exhibit 9-8. Based on the varying requirments you observe, what minimum set of requirements would

> Refer to Exhibit 9-3. This exhibit presents P/E ratios for public companies in various countries. What factors might explain the differences in P/E ratios that you observe? EXHIBIT 9-3 International Price/Earnings Ratios Country Index P/E Canada SPT

> The following sales revenue pattern for a British trading concern was cited earlier in the chapter: Required: a. Perform a convenience translation into U.S. dollars for each year given the following year-end exchange rates: 2009 £1 = $2.10

> Read Appendix 9-1. Referring to Exhibit 9-14 and related notes, assume instead that Toyoza’s inventories were costed using the FIFO method and that Lincoln Enterprises employed the LIFO method. Provide the adjusting journal entries to r

> Infosys Technologies, introduced in Chapter 1, regularly provides investors with a performance measure called economic value-added (EVA). Originally pioneered by GE, EVA measures the profitability of a company after deducting not just the cost of borrowi

> Refer again to Exhibits 9-5 and 9-6. Show how you would modify the consolidated funds statement appearing in Exhibit 9-5 to enable an investor to get a better feel for the actual investing and financing activities of the Norwegian subsidiary. EXHIBI

> Based on the balance sheet and income statement data contained in Exhibit 9-5, and using the suggested worksheet format shown in Exhibit 9-20 or one of your own choosing, show how the statement of cash flows appearing in Exhibit 9-5 was derived. EXH

> Condensed comparative income statements of Señorina Panchos, a Mexican restaurant chain, for the years 2009 through 2011 are presented in Exhibit 9-18 (000,000’s pesos). You are interested in gauging the past trend in div

> One interpretation of the popular efficient markets hypothesis is that the market fully impounds all public information as soon as it becomes available. Thus, it is supposedly not possible to beat the market if fundamental financial analysis techniques a

> Revisit Exhibit 1-5 and show how the ROE statistics of 33.8 percent and 29.5 percent were derived. Which of the two ROE statistics is the better performance measure to use when comparing the financial performance of Infosys with that of Verizon, a leadin

> What are the four main steps in doing a business strategy analysis using financial statements? Why, at each step, is analysis in a cross-border context more difficult than a single-country analysis?

> What is internal control, how do internal auditors relate to it, and how does this process relate to the analysis of financial statements?

> What role does the attest function play in international financial statement analysis?

> ABC Company, a U.S.-based MNC, uses the temporal translation method (see Chapter 6) in consolidating the results of its foreign operations. Translation gains or losses incurred upon consolidation are reflected immediately in reported earnings. Company XY

> If you were asked to provide the five most important recommendations you could think of to others analyzing nondomestic financial statements, what would they be?

> How does the translation of foreign currency financial statements differ from the foreign currency translation process described in Chapter 6?

> What are common pitfalls to avoid in conducting an international prospective analysis?

> Investors can cope with accounting principles in different ways. Can you suggest two methods of coping and which of the two you find most appealing?

> Describe the impact on accounting analysis of cross-country variations in accounting measurement and disclosure practices.

> Marissa Skye and Alexa Reichele, tire analysts for a global investment fund located in Manhattan, are examining the 20X0 earnings performance of two potential investment candidates. Reflecting the company’s investment philosophy of pick

> Exhibit 1-4 lists the number of majority owned foreign affiliates in each country that Nestle includes in its consolidated results. What international accounting issues are triggered by this Exhibit? Countries in Which Nestle Owns One or More Majori

> One of the accounting development patterns that was introduced in Chapter 2 was the macroeconomic development model. Under this framework accounting practices are designed to enhance national macroeconomic goals. A national policy advocating stable emplo

> Identify three to four criteria that you would personally use to judge the merits of any corporate database. Use these criteria to rate the information content of any Web site appearing in exhibit 9-4 as excellent, fair, or poor. // EXHIBIT 9-4 Free

> The IASB Web site (www.iasb.org) summarizes each of the current International Financial Reporting Standards. Required: Answer each of the following questions. a. In measuring inventories at the lower of cost or net realizable value, does net realizable

> The U.S. Securities and Exchange Commission (SEC) roadmap issued in 2008 may eventually move U.S. issuers to report under International Financial Reporting Standards (IFRS). Consider the following critical questions of such a move: a. IFRS lack detailed

> Chapter 3 discusses financial reporting and accounting measurements under International Financial Reporting Standards (IFRS). Chapter 4 discusses the same issues for U.S. GAAP and Exhibit 4-2 summarizes some of the significant differences between IFRS an

> The biographies of current IASB board members are on the IASB Web site (www.iasb.org). Required: Identify the current board members (including the chair and vice-chair). Note each member’s home country and prior affiliation(s). Which board members have

> Exhibit 8-3 identifies current IASB standards and their respective titles. Required: Using information on the IASB Web site (www.iasb.org) or other available information, prepare an updated list of IASB standards. EXHIBIT 8-3 Current IASB Standard

> The chapter contains a chronology of some significant events in the history of international accounting standard setting. Required: Consider the 1995 European Commission adoption of a new approach to accounting harmonization. Consult some literature re

> The text discusses the many organizations involved with international convergence activities, including the IASB, EU, and IFAC. Required: a. Compare and contrast these three organizations in terms of their standard-setting procedures. b. At what types a

> Exhibit 8-2 presents the Web site addresses of national accountancy organizations, many of which are involved in international accounting standard-setting and convergence activities. Required: Select one of the accounting organizations and search its

> What international reporting issues are triggered by AKZO NOBEL’s foreign operations disclosures appearing in Exhibit 1-3 for investors? For managerial accountants? Selected 2008 Foreign Operations Data for AKZO Nobel (Euro million

> Exhibit 8-1 presents the Web site addresses of many major international organizations involved in international accounting harmonization. Consider the following three: the International Federation of Accountants (IFAC), the United Nations Intergovernment

> Three solutions have been proposed for resolving the problems associated with filing financial statements across national borders: (1) reciprocity (also known as mutual recognition), (2) reconciliation, and (3) use of international standards. Required:

> Compare and contrast the following proposed approaches for dealing with international differences in accounting, disclosure, and auditing standards: (1) reciprocity, (2) reconciliation, and (3) international standards.

> Distinguish between the terms “harmonization” and “convergence” as they apply to accounting standards.

> What role do the United Nations and the Organization for Economic Cooperation and Development play in harmonizing accounting and auditing standards?

> Describe IOSCO’s work on harmonizing disclosure standards for cross-border offerings and initial listings by foreign issuers. Why is this work important to securities regulators around the world?

> Why is the concept of auditing convergence important? Will international harmonization of auditing standards be more or less difficult to achieve than international harmonization of accounting principles? Describe IFAC’s work on converging auditing stand

> What is the purpose of accounting harmonization in the European Union (EU)? Why did the EU abandon its approach to harmonization via directives to one favoring the IASB?

> Describe the structure of the International Accounting Standards Board and how it sets International Financial Reporting Standards.

> What evidence is there that International Financial Reporting Standards are becoming widely accepted around the world? Do you believe that worldwide convergence of accounting standards will end investor concerns about cross-national differences in accoun

> What are the key rationales against the development and widespread application of International Financial Reporting Standards?

> What are the key rationales that support the development and widespread application of International Financial Reporting Standards?

> Sir David Tweedie, chairman of the International Accounting Standards Board, is quoted as saying that the IASB and the FASB will eventually merge. “U.S. standards and ours will become so close that it will be senseless having two boards, and they will me

> Petro China Company Limited (Petro China) was established as a joint stock company under the company law of the People’s Republic of China in 1999 as part of the restructuring of China National Petroleum Corporation. Petro China is an integrated oil and

> The year-end balance sheet of Helsinki Corporation, a wholly owned British affiliate in Finland, is reproduced here. Relevant exchange rate and inflation information is also provided. Exchange rate and price information: January 1: General price index

> Doosan Enterprises, a U.S. subsidiary domiciled in South Korea, accounts for its inventories on a FIFO basis. The company translates its inventories to dollars at the current rate. Year-end inventories are recorded at 10,920,000 won. During the year, the

> Ninsuvaan Corporation, a U.S. subsidiary in Bangkok, Thailand, begins and ends its calendar year with an inventory balance of BHT500 million. The dollar/baht exchange rate on January 1 was $0.02 = BHT1. During the year, the U.S. general price level advan

> The balance sheet of Rackett & Ball plc., a U.K.-based sporting goods manufacturer, is presented here. Figures are stated in millions of pounds (£m). During the year, the producers’ price index increased from 100 to 120

> Now assume that Majikstan Enterprises is a foreign subsidiary of a U.S.-based multinational corporation and that its financial statements are consolidated with those of its U.S. parent. Relevant exchange rate and general price-level information for the y

> Majikstan Enterprises has equipment on its books that it acquired at the start of 2009 . The equipment is being depreciated in straight-line fashion over a 10-year period and has no salvage value. The current cost of this equipment at the end of 2010 was

> Examine the Web sites of five exchanges listed in Appendix 1-1 that you feel would be most attractive to foreign listers. Which exchange in your chosen set proved most popular during the last two years? Provide possible explanations for your observation.

> Revisit Sobrero Corporation in Exercise 1. In addition to the information provided there, assume that Mexico’s construction cost index increased by 80 percent during the year, while the price of vacant land adjacent to Sobrero Corporation’s hotel increas

> Using the information provided in Exercise 2. Calculate Majikstan Enterprises’ net monetary gain or loss in local currency for 2011 based on the following general price-level information. 12/31/10 ……………………………………………………………………………..30,000 Average …………………………

> The comparative historical-cost balance sheets of Majikstan Enterprises for 2010 and 2011 are reproduced below. The accounts are expressed in 000’s of renges (MJR’s). Required: What was the change in Majikstanâ

> Sobrero Corporation, a Mexican affiliate of a major U.S.-based hotel chain, starts the calendar year with 1 billion pesos (P) cash equity investment. It immediately acquires a refurbished hotel in Acapulco for P 900 million. Owing to a favorable tourist

> Examine the income statements of Modello, Vestel, and Infosys, referenced earlier in this chapter. Which earnings number do you feel provides the better earnings metric for an investment analyst, and why?

> From a user’s perspective, what is the inherent problem in attempting to analyze historical cost-based financial statements of a company domiciled in an inflationary, devaluation-prone country?

> What does double-dipping mean in accounting for foreign inflation?

> How does accounting for foreign inflation differ from accounting for domestic inflation?

> What is a gearing adjustment, and on what ideas is it based?

> As a potential investor in the shares of multinational enterprises, which inflation method, restate-translate or translate-restate, would give you consolidated information most relevant to your decision needs? Which information set is best from the viewp

> Examine Exhibit 1-2 and compute the compounded annual growth rate of merchandise trade versus the global trade in services for the 20 year period beginning 1985 and ending 2005. What implication does your finding have for accounting as a service activity

> Briefly describe the historical-cost-constant purchasing power and current-cost models. How are they similar? How do they differ?

> As more and more companies span the globe in terms of their operating, financing, and investing activities, they will increasingly turn to international financial reporting standards when communicating with domestic and non-domestic financial statement r

> Following are the remarks of a prominent member of the U.S. Congress. Explain why you agree or disagree. The plain fact of the matter is that inflation accounting is a premature, imprecise, and underdeveloped method of recording basic business facts. To

> Consider the statement: “The object of accounting for changing prices is to ensure that a company is able to maintain its operating capability.” How accurate is it?

> Inc. In 1993 Icelandic Enterprises was incorporated in Reykjavik to manufacture and distribute women’s cosmetics in Iceland. All of its outstanding stock was acquired at the beginning of 2001 by International Cosmetics, Ltd. (IC), a U.S

> Kashmir Enterprises, an Indian carpet manufacturer, begins the calendar year with the following Indian rupee (INR) balances: During the first week in January, the company acquires additional manufacturing inventories costing INR 2,400,000 on account an

> On December 15, MSC Corporation acquires its first foreign affiliate by acquiring 100 percent of the net assets of the Armaselah Oil Company based in Saudi Arabia for 930,000,000 Saudi Arabian riyals.(SAR). At the time, the exchange rate was $1.00 = SAR3

> A 100 percent–owned foreign subsidiary’s trial balance consists of the accounts listed as follows. Which exchange rate—current, historical, or average—would be used to translate these accounts to parent currency assuming that the foreign currency is the

> Company A is headquartered in Country A and reports in the currency unit of Country A, the Apeso. Company B is headquartered in Country B and reports in the currency unit of Country B, the Bol. Company A and B hold identical assets, Apeso100 and Bol100,

> Use the information provided in Exercise 6. Required: a. What would be the translation effect if Shanghai Corporation’s balance sheet were translated by the temporal method assuming the Chinese yuan appreciates by 25 percent? By the current rate method?

> Re-examine Exhibit 1-1 which describes the outsourcing process for HP’s production of the Proliant ML150. For each leg of the production chain, identify the various accounting and related issues that might arise. EXHIBIT 1-1 Outsou

> Shanghai Corporation, the Chinese affiliate of a U.S. manufacturer, has the balance sheet shown below. The current exchange rate is $.0.15 = CNY1. Required: a. Translate the Chinese dollar balance sheet of Shanghai Corporation into U.S. dollars at the

> Sydney Corporation, an Australian-based multinational, borrowed 10,000,000 euros from a German lender at the beginning of the calendar year when the exchange rate was EUR.60 = AUD1. Before repaying this oneyear loan, Sydney Corporation learns that the Au

> U.S. Multinational Corporation’s subsidiary in Bangkok has on its books fixed assets valued at 7,500,000 baht. One-third of the assets were acquired two years ago when the exchange rate was THB40 = $1. The other fixed assets were acquired last year when

> On January 1, the wholly-owned Mexican affiliate of a Canadian parent company acquired an inventory of computer hard drives for its assembly operation. The cost incurred was 15,000,000 pesos when the exchange rate was MXN11.3 = C$1. By yearend, the Mexic

> On April 1, A. C. Corporation, a calendar-year U.S. electronics manufacturer, buys 32.5 million yen worth of computer chips from the Hidachi Company paying 10 percent down, the balance to be paid in 3 months. Interest at 8 percent per annum is payable on

> Assume that your Japanese affiliate reports sales revenue of 250,000,000 yen. Referring to Exhibit 6-1, translate this revenue figure to U.S. dollars using the direct bid spot rate. Do the same using the indirect spot quote. EXHIBIT 6-1 Sample of Sp

> What do current, historical, and average exchange rates mean in the context of foreign currency translation? Which of these rates give rise to translation gains and losses? Which do not?

> What is the difference between the spot, forward, and swap markets? Illustrate each description with an example.

> How does the treatment of translation gains and losses differ between the current and temporal translation methods under FAS No. 52, and what is the rationale for the differing accounting treatments?

> In what way is foreign currency translation tied to foreign inflation?

> Accounting may be viewed as having three components: measurement, disclosure, and auditing. What are the advantages and disadvantages of this classification? Can you suggest alternative classifications that might be useful?

> What lessons, if any, can be learned from examining the history of foreign currency translation in the United States?

> Under what set of conditions would the temporal method of currency translation be appropriate. Under what set of conditions would the current rate method be appropriate?

> Compare and contrast features of the major foreign currency translation methods introduced in this chapter. Which method do you think is best? Why?

> Briefly explain the nature of foreign currency translation as (a) a restatement process and (b) a remeasurement process.

> What is the difference between a transaction gain or loss and a translation gain or loss?

> A foreign currency transaction can be denominated in one currency, yet measured in another. Explain the difference between these two terms using the case of a Canadian dollar borrowing on the part of a Mexican affiliate of a U.S. parent company that desi

> The Offshore Investment Fund (OIF) was incorporated in Fairfield, Connecticut, for the sole purpose of allowing U.S. shareholders to invest in Spanish securities. The fund is listed on the New York Stock Exchange. The fund custodian is the Shady Rest Ban