Question: One of the accounting development patterns that

One of the accounting development patterns that was introduced in Chapter 2 was the macroeconomic development model. Under this framework accounting practices are designed to enhance national macroeconomic goals. A national policy advocating stable employment by avoiding major swings in business cycles would sanction accounting practices that smooth income. Similarly, national policies supporting growth in certain industries would sanction rapid writeoffs of fixed assets to encourage capital formation. Sweden is a good example of this reporting pattern. Assets may be revalued upwards if they are deemed to have “enduring value,†the tax law permits shorter asset lives, and ceiling tests for depreciation charges include the higher of 130 percent declining balance method or 20 percent straight line. Companies are also permitted to allocate a portion of pre-tax earnings to special tax equalization reserves which are not available for dividends until reversed.

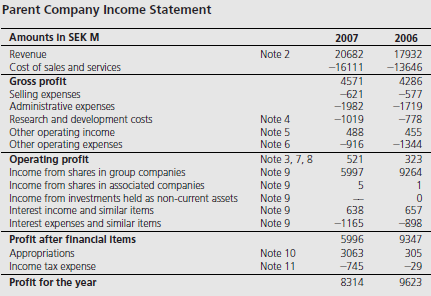

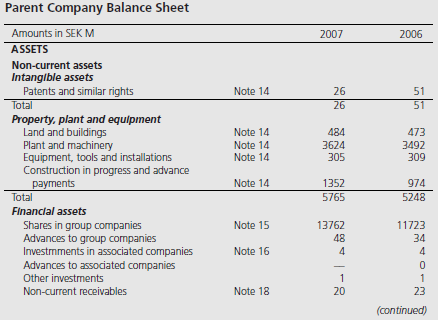

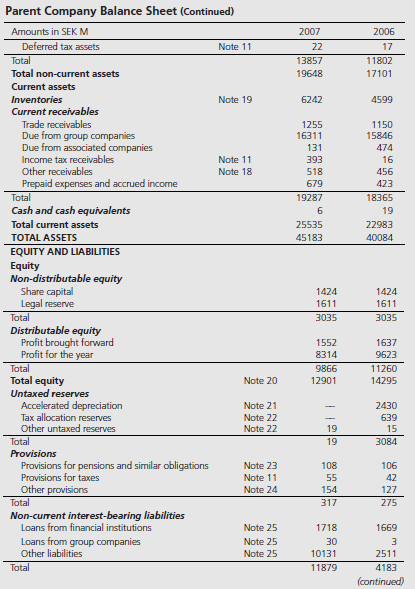

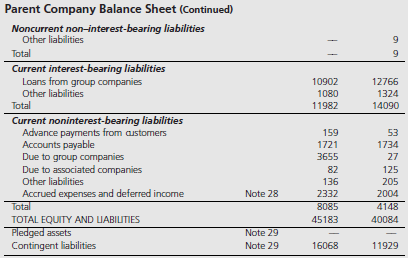

Reproduced below are the parent company financial statements of Sandvik for the years 2006 and 2007 and selected notes. Sandvik is a global high technology company headquartered in Sweden, with advanced products and well-known brands. Its core areas of competence include high speed tools for metal working, machinery, tools and services for rock excavation, and specialty steels. The company states that it applies all IFRS and IFRIC interpretations approved by the EU to the extent possible within the framework of the Swedish Annual Accounts Act and considering the close tie between financial reporting and taxation. Examine the data presented and answer the following questions.

1. What advantages and disadvantages arise for firms that chose to employ the Swedish system of special reserves?

2. What are the potential benefits of the system of special reserves to the Swedish government?

3. In what way does the existence of the Swedish reserve system affect the ability of a financial analyst to evaluate a Swedish firm vis-Ã -vis a non-Swedish firm?

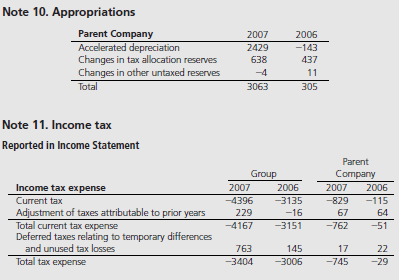

4. In what way does the use of “reserves†affect Sandvik’s financial statements for the year 2007? How does this compare with the effect of reserves in the previous year?

5. Show the accounting entry used to create the 2007 Appropriations figure in the income statement.

6. If you were to unwind the effect of reserves for 2007, how would Sandvik’s key profitability ratios, such as return on sales and return on assets change?

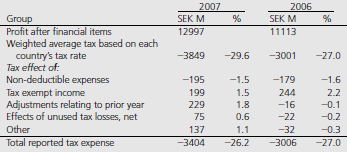

The Group’s tax expense for the year was SEK 3,404 M (3.006) or 26.2% (27.0) of the profit after financial items.

The adjustment of taxes attributable to prior years mainly relates to favorable tax litigation resolutions and advance rulings in Sweden and reversal of tax provisions upon finalization of tax audits of foreign subsidiaries.

Reconciliation of the Group’s tax expense The Group’s weighted average tax based on the tax rates in each country is 29. 6% (27.0). The nominal tax rate in Sweden is 28.0% (28.0).

Reconciliation of the Group’s weighted average tax rate based on the tax rates in each country, and the Group’s actual tax expense:

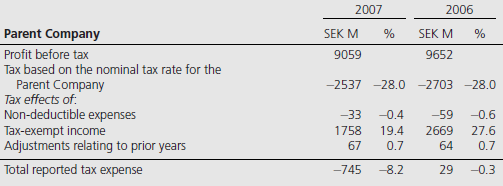

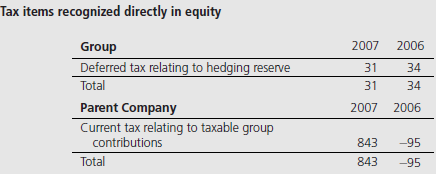

Reconciliation of the Parent Company’s tax expense The Parent Company’s effective tax rate of 8.2% (0.8) is less than the nominal tax rate in Sweden, mainly due to tax-exempt dividend income from subsidiaries and associated companies:

Reconciliation of the Parent Company’s nominal tax rate and actual tax expense:

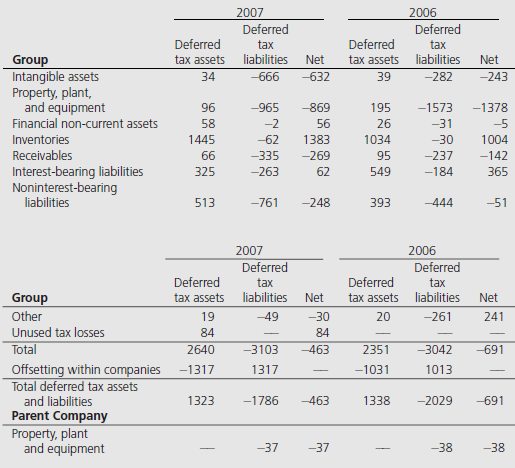

Reported in the balance sheet Deferred tax assets and liabilities The deferred tax assets and liabilities reported in the balance sheet are attributable to the following assets and liabilities (liabilities shown with a minus sign):

Transcribed Image Text:

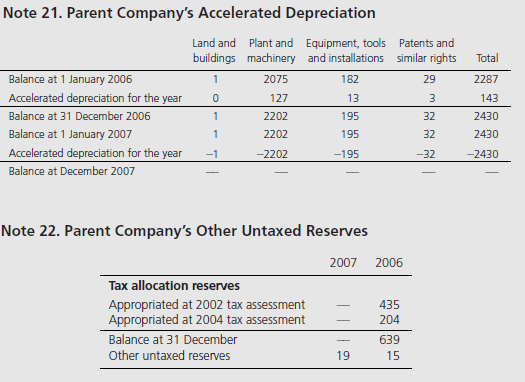

Parent Company Income Statement Amounts In SEK M 2007 2006 Revenue Note 2 20682 17932 Cost of sales and services -16111 -13646 Gross profit Selling expenses Administrative expenses 4571 4286 -621 -577 -1719 -1982 Research and development costs Other operating income Other operating expenses Operating profit Income from shares in group companies Income from shares in associated companies Income from investments held as non-current assets Interest income and similar items Note 4 -1019 -778 Note 5 Note 6 488 -916 455 -1344 Note 3, 7, 8 521 323 Note 9 5997 9264 Note 9 1 Note 9 Note 9 Note 9 638 657 Interest expenses and similar iterns -1165 -898 Profit after financlal Items 5996 9347 3063 Appropriations Income tax expense Profit for the year Note 10 305 Note 11 -745 -29 8314 9623 Parent Company Balance Sheet Amounts in SEK M 2007 2006 ASSETS Non-current assets Intanglble assets Patents and similar rights Note 14 26 Total 26 51 Property, plant and equipment Land and buildings Plant and machinery Equipment, tools and installations Construction in progress and advance раyments Note 14 484 473 Note 14 Note 14 3624 305 3492 309 Note 14 1352 974 Total 5765 5248 Financlal assets 11723 34 Shares in group companies Advances to group companies Investmments in associated companies Advances to associated companies Other investments Note 15 13762 48 Note 16 4 4 Non-current receivables Note 18 20 23 (continued) n in Parent Company Balance Sheet (Continued) Amounts in SEKM 2007 2006 Deferred tax assets Note 11 22 17 Total 13857 11802 Total non-current assets 19648 17101 Current assets Inventories Note 19 6242 4599 Current receivables Trade receivables Due from group companies Due from associated companies Income tax receivables Other receivables 1255 1150 16311 15846 131 474 Note 11 393 16 Note 18 518 456 Prepaid expenses and accrued income 679 423 Total 19287 18365 Cash and cash equivalents 19 Total current assets 25535 22983 TOTAL ASSETS 45183 40084 EQUITY AND LIABILITIES EQUITY Non-distributable equity Share capital Legal reserve 1424 1424 1611 1611 Total 3035 3035 Distributable equity Profit brought forward Profit for the year 1552 1637 8314 9623 Total 9866 11260 Total equity Untaxed reserves Accelerated depreciation Tax allocation reserves Other untaxed reserves Note 20 12901 14295 Note 21 2430 Note 22 639 Note 22 19 15 Total 19 3084 Provisions Provisions for pensions and similar obligations Provisions for taxes Note 23 108 106 Note 11 55 42 Other provisions Total Note 24 154 127 317 275 Non-current interest-bearing liabilities Loans from financial institutions Note 25 1718 1669 Loans from group companies Other liabilities Note 25 Note 25 30 3 10131 2511 Total 11879 4183 (continued) Parent Company Balance Sheet (Continued) Noncurrent non-interest-bearing liabilities Other liabilities Total 9. Current interest-bearing liabilities Loans from group companies Other liabilities Total 10902 12766 1080 1324 11982 14090 Current noninterest-bearing liabilities Advance payments from austomers Accounts payable 159 53 1721 1734 Due to group companies Due to associated companies Other liabilities 3655 27 82 125 136 205 2004 Accrued expenses and deferred income Total Note 28 2332 8085 4148 TOTAL EQUITY AND LIABILITIES 45183 40084 Pledged assets Contingent liabilities Note 29 Note 29 16068 11929 Note 10. Appropriations Parent Company Accelerated depreciation Changes in tax allocation reservIS Changes in other untaxed reserves 2007 2006 2429 -143 638 437 -4 11 Total 3063 305 Note 11. Income tax Reported in Income Statement Parent Group Company 2007 2006 Income tax expense 2007 2006 Current tax -4396 -3135 -829 -115 Adjustment of taxes attributable to prior years Total current tax expense Deferred taxes relating to temporary differences and unused tax losses 229 -16 67 64 -4167 -3151 -762 -51 763 145 17 22 Total tax expense -3404 -3006 -745 -29 2007 2006 Group Profit after financial iterns Weighted average tax based on each country's tax rate Tax effect of: Non-deductible expenses SEK M SEK M 12997 11113 -3849 -29.6 -3001 -27.0 -195 -1.5 -179 -1.6 Tax exempt income Adjustments relating to prior year Effects of unused tax losses, net 199 1.5 244 2.2 229 1.8 -16 -0.1 75 0.6 -22 -0.2 Other 137 1.1 -32 -0.3 Total reported tax expense -3404 -26.2 -3006 -27.0 2007 2006 Parent Company SEK M SEK M Profit before tax Tax based on the nominal tax rate for the 9059 9652 -2537 -28.0 -2703 -28.0 Parent Company Tax effects of: Non-deductible expenses Tax-exempt income Adjustments relating to prior years -33 -0.4 -59 -0.6 1758 19.4 2669 27.6 67 0.7 64 0.7 Total reported tax expense -745 -8.2 29 -0.3 Tax items recognized directly in equity Group 2007 2006 Deferred tax relating to hedging reserve 31 34 Total 31 34 Parent Company 2007 2006 Current tax relating to taxable group contributions 843 -95 Total 843 -95 2007 2006 Deferred Deferred Deferred tax Deferred tax liabilities liabilities Group Intangible assets Property, plant, and equipment Financial non-current assets tax assets Net tax assets Net 34 -666 -632 39 -282 -243 96 -965 -869 195 -1573 -1378 58 -2 56 26 -31 -5 Inventories 1445 -62 1383 1034 -30 1004 Receivables 66 -335 -269 95 -237 -142 Interest-bearing liabilities Noninterest-bearing liabilities 325 -263 62 549 -184 365 513 -761 -248 393 -444 -51 2007 2006 Deferred Deferred Deferred tax Deferred tax Group tax assets liabilities Net tax assets liabilities Net Other 19 -49 -30 20 -261 241 Unused tax losses 84 84 Total 2640 -3103 -463 2351 -3042 -691 Offsetting within companies Total deferred tax assets and liabilities -1317 1317 -1031 1013 - - 1323 -1786 -463 1338 -2029 -691 Parent Company Property, plant and equipment -37 -37 -38 -38 Note 21. Parent Company's Accelerated depreciation Land and Plant and Equipment, tools Patents and buildings machinery and installations similar rights Total Balance at 1 January 2006 2075 182 29 2287 Accelerated depreciation for the year 127 13 143 Balance at 31 December 2006 2202 195 32 2430 Balance at 1 January 2007 2202 195 32 2430 Accelerated depreciation for the year -1 -2202 -195 -32 -2430 Balance at December 2007 Note 22. Parent Company's Other Untaxed Reserves 2007 2006 Tax allocation reserves Appropriated at 2002 tax assessment Appropriated at 2004 tax assessment 435 204 Balance at 31 December 639 Other untaxed reserves 19 15

> Compare and contrast the terms translation, transaction, and economic exposure. Does FAS No. 52 resolve the issue of accounting versus economic exposure?

> The scene is a conference room on the 10th floor of an office building on Wall Street, occupied by Anthes Enterprises, a small, rapidly growing manufacturer of electronic trading systems for equities, commodities, and currencies. The agenda for the 8:00

> You have just landed a summer internship (congratulations) with the management information services group of Pirelli, the Italian global tire manufacturer. Management is acutely aware of the importance of risk management and the market’

> If you had a nontrivial sum of money to invest and decided to invest it in a country index fund, in which country or countries identified in Exhibit 1-7 would you invest your money? What accounting issues would play a role in your decision? Ten Exch

> Parent Company establishes three wholly owned affiliates in countries X, Y, and Z. Its total investment in each of the respective affiliates at the beginning of the year, together with year-end returns in parent currency (PC), appear here: Parent Compa

> Exhibit 10-9 contains a performance report that breaks out various operating variances of a foreign affiliate, assuming the parent currency is the functional currency under FAS No. 52. Using the information in Exhibit 10-9, repeat the variance analysis,

> To encourage its foreign managers to incorporate expected exchange rate changes into their operating decisions, Vancouver Enterprises requires that all foreign currency budgets be set in Canadian dollars using exchange rates projected for the end of the

> In evaluating the performance of a foreign manager, a parent company should never penalize a manager for things the manager cannot control. Given the information provided in Exercise 6, prepare a performance report identifying the relevant elements for e

> Global Enterprises, Inc. uses a number of performance criteria to evaluate its overseas operations, including return on investment. Compagnie de Calais, its Belgian subsidiary, submits the performance report shown in Exhibit 10-13 for the current fisca

> Assume the following: • Inflation and Zambian kwacha (ZMK) devaluation is 30 percent per month, or 1.2 percent per workday. • Foreign exchange rates at selected intervals for the current month are: 1/1 ……………………………………………….100.0 1/10 ……………………………………………..10

> Assume that management is considering whether to make the foreign direct investment described in Exercise 3. Investment will require $6,000,000 in equity capital. Cash flows to the parent are expected to increase by 5 percent over the previous year for e

> Review the operating data incorporated in Exhibit 10-3 for the Russian subsidiary of the U.S. parent company. Required: Using Exhibit 10-3 as a guide, prepare a cash flow report from a parent currency perspective identifying the components of the expe

> Slovenia Corporation manufactures a product that is marketed in North America, Europe, and Asia. Its total manufacturing cost to produce 100 units of product X is 2,250, detailed as follows: Raw materials ………………………………………………………………………€500 Direct labor ………

> Explain the difference between a standard costing system and the Kaizen costing system popularized in Japan.

> Referring to Exhibit 1-6, which geographic region of the world, the Americas, Asia-Pacific, or Europe-Africa-Middle East is experiencing the most activity in foreign listings? Do you expect this pattern to persist in the future? Please explain. EXHI

> How does value reporting differ from the financial reporting model you learned in your basic accounting course? Do you think this is a good reporting innovation?

> List six arguments that support a parent company’s use of its domestic control systems for its foreign operations, and six arguments against this practice.

> This chapter identifies four dimensions of the strategic planning process. How does Daihatsu’s management accounting system, described in this chapter, conform with that process?

> Foreign exchange rates are used to establish budgets and track actual performance. Of the various exchange rate combinations mentioned in this chapter, which do you favor? Why? Is your view the same when you add local inflation to the budgeting process?

> State the unique difficulties involved in designing and implementing performance evaluation systems in multinational companies.

> Refer to Exhibit 10-7 which presents the methodology for analyzing exchange rate variances. Describe in your own words what this methodology accomplishes. EXHIBIT 10-7 Three-Way Analysis of Exchange Rate Variance Computation Exchange Rate Operating

> As an employee on the financial staff of Multinational Enterprises, you are assigned to a three-person team that is assigned to examine the financial feasibility of establishing a wholly owned manufacturing subsidiary in the Czech Republic. You are to co

> Companies must decide whose rate of return (i.e., local vs. parent currency returns) to use when evaluating foreign direct investment opportunities. Discuss the internal reporting dimensions of this decision in a paragraph or two.

> General Electric Company’s worldwide performance evaluation system is based on a policy of decentralization. The policy reflects its conviction that managers will become more responsible and their business will be better managed if they are given the aut

> You are the CFO of Marisa Corporation, a major electronics manufacturer headquartered in Shelton, Connecticut. To date, your company’s operations have been confined to the United States and you are interested in diversifying your operat

> Stock exchange Web sites vary considerably in the information they provide and their ease of use. Required: Select any two of the stock exchanges presented in Appendix 1-1. Explore the Web sites of each of these stock exchanges. Prepare a table that c

> Investors, individual, corporate and institutional, are increasingly investing beyond national borders. The reason is not hard to find. Returns abroad, even after allowing for foreign currency exchange risk, have often exceeded those offered by domestic

> Examine Exhibit 9-9. On the basis of the information provided there, which opinion gives you the most comfort as an investor in nondomestic securities?

> Assume you are a member of an international policy setting committee and are responsible for harmonizing audit report requirements internationally. Examine Exhibit 9-8. Based on the varying requirments you observe, what minimum set of requirements would

> Refer to Exhibit 9-3. This exhibit presents P/E ratios for public companies in various countries. What factors might explain the differences in P/E ratios that you observe? EXHIBIT 9-3 International Price/Earnings Ratios Country Index P/E Canada SPT

> The following sales revenue pattern for a British trading concern was cited earlier in the chapter: Required: a. Perform a convenience translation into U.S. dollars for each year given the following year-end exchange rates: 2009 £1 = $2.10

> Read Appendix 9-1. Referring to Exhibit 9-14 and related notes, assume instead that Toyoza’s inventories were costed using the FIFO method and that Lincoln Enterprises employed the LIFO method. Provide the adjusting journal entries to r

> Infosys Technologies, introduced in Chapter 1, regularly provides investors with a performance measure called economic value-added (EVA). Originally pioneered by GE, EVA measures the profitability of a company after deducting not just the cost of borrowi

> Refer again to Exhibits 9-5 and 9-6. Show how you would modify the consolidated funds statement appearing in Exhibit 9-5 to enable an investor to get a better feel for the actual investing and financing activities of the Norwegian subsidiary. EXHIBI

> Based on the balance sheet and income statement data contained in Exhibit 9-5, and using the suggested worksheet format shown in Exhibit 9-20 or one of your own choosing, show how the statement of cash flows appearing in Exhibit 9-5 was derived. EXH

> Condensed comparative income statements of Señorina Panchos, a Mexican restaurant chain, for the years 2009 through 2011 are presented in Exhibit 9-18 (000,000’s pesos). You are interested in gauging the past trend in div

> One interpretation of the popular efficient markets hypothesis is that the market fully impounds all public information as soon as it becomes available. Thus, it is supposedly not possible to beat the market if fundamental financial analysis techniques a

> Revisit Exhibit 1-5 and show how the ROE statistics of 33.8 percent and 29.5 percent were derived. Which of the two ROE statistics is the better performance measure to use when comparing the financial performance of Infosys with that of Verizon, a leadin

> What are the four main steps in doing a business strategy analysis using financial statements? Why, at each step, is analysis in a cross-border context more difficult than a single-country analysis?

> What is internal control, how do internal auditors relate to it, and how does this process relate to the analysis of financial statements?

> What role does the attest function play in international financial statement analysis?

> ABC Company, a U.S.-based MNC, uses the temporal translation method (see Chapter 6) in consolidating the results of its foreign operations. Translation gains or losses incurred upon consolidation are reflected immediately in reported earnings. Company XY

> If you were asked to provide the five most important recommendations you could think of to others analyzing nondomestic financial statements, what would they be?

> How does the translation of foreign currency financial statements differ from the foreign currency translation process described in Chapter 6?

> What are common pitfalls to avoid in conducting an international prospective analysis?

> Investors can cope with accounting principles in different ways. Can you suggest two methods of coping and which of the two you find most appealing?

> Describe the impact on accounting analysis of cross-country variations in accounting measurement and disclosure practices.

> Marissa Skye and Alexa Reichele, tire analysts for a global investment fund located in Manhattan, are examining the 20X0 earnings performance of two potential investment candidates. Reflecting the company’s investment philosophy of pick

> Exhibit 1-4 lists the number of majority owned foreign affiliates in each country that Nestle includes in its consolidated results. What international accounting issues are triggered by this Exhibit? Countries in Which Nestle Owns One or More Majori

> Identify three to four criteria that you would personally use to judge the merits of any corporate database. Use these criteria to rate the information content of any Web site appearing in exhibit 9-4 as excellent, fair, or poor. // EXHIBIT 9-4 Free

> The IASB Web site (www.iasb.org) summarizes each of the current International Financial Reporting Standards. Required: Answer each of the following questions. a. In measuring inventories at the lower of cost or net realizable value, does net realizable

> The U.S. Securities and Exchange Commission (SEC) roadmap issued in 2008 may eventually move U.S. issuers to report under International Financial Reporting Standards (IFRS). Consider the following critical questions of such a move: a. IFRS lack detailed

> Chapter 3 discusses financial reporting and accounting measurements under International Financial Reporting Standards (IFRS). Chapter 4 discusses the same issues for U.S. GAAP and Exhibit 4-2 summarizes some of the significant differences between IFRS an

> The biographies of current IASB board members are on the IASB Web site (www.iasb.org). Required: Identify the current board members (including the chair and vice-chair). Note each member’s home country and prior affiliation(s). Which board members have

> Exhibit 8-3 identifies current IASB standards and their respective titles. Required: Using information on the IASB Web site (www.iasb.org) or other available information, prepare an updated list of IASB standards. EXHIBIT 8-3 Current IASB Standard

> The chapter contains a chronology of some significant events in the history of international accounting standard setting. Required: Consider the 1995 European Commission adoption of a new approach to accounting harmonization. Consult some literature re

> The text discusses the many organizations involved with international convergence activities, including the IASB, EU, and IFAC. Required: a. Compare and contrast these three organizations in terms of their standard-setting procedures. b. At what types a

> Exhibit 8-2 presents the Web site addresses of national accountancy organizations, many of which are involved in international accounting standard-setting and convergence activities. Required: Select one of the accounting organizations and search its

> What international reporting issues are triggered by AKZO NOBEL’s foreign operations disclosures appearing in Exhibit 1-3 for investors? For managerial accountants? Selected 2008 Foreign Operations Data for AKZO Nobel (Euro million

> Exhibit 8-1 presents the Web site addresses of many major international organizations involved in international accounting harmonization. Consider the following three: the International Federation of Accountants (IFAC), the United Nations Intergovernment

> Three solutions have been proposed for resolving the problems associated with filing financial statements across national borders: (1) reciprocity (also known as mutual recognition), (2) reconciliation, and (3) use of international standards. Required:

> Compare and contrast the following proposed approaches for dealing with international differences in accounting, disclosure, and auditing standards: (1) reciprocity, (2) reconciliation, and (3) international standards.

> Distinguish between the terms “harmonization” and “convergence” as they apply to accounting standards.

> What role do the United Nations and the Organization for Economic Cooperation and Development play in harmonizing accounting and auditing standards?

> Describe IOSCO’s work on harmonizing disclosure standards for cross-border offerings and initial listings by foreign issuers. Why is this work important to securities regulators around the world?

> Why is the concept of auditing convergence important? Will international harmonization of auditing standards be more or less difficult to achieve than international harmonization of accounting principles? Describe IFAC’s work on converging auditing stand

> What is the purpose of accounting harmonization in the European Union (EU)? Why did the EU abandon its approach to harmonization via directives to one favoring the IASB?

> Describe the structure of the International Accounting Standards Board and how it sets International Financial Reporting Standards.

> What evidence is there that International Financial Reporting Standards are becoming widely accepted around the world? Do you believe that worldwide convergence of accounting standards will end investor concerns about cross-national differences in accoun

> Does the geographic pattern of merchandise exports contained in Exhibit 1-2 correlate well with the pattern of AKZO Nobel’s geographic distribution of sales shown in Exhibit 1-3? What might explain any differences you observe? EXHI

> What are the key rationales against the development and widespread application of International Financial Reporting Standards?

> What are the key rationales that support the development and widespread application of International Financial Reporting Standards?

> Sir David Tweedie, chairman of the International Accounting Standards Board, is quoted as saying that the IASB and the FASB will eventually merge. “U.S. standards and ours will become so close that it will be senseless having two boards, and they will me

> Petro China Company Limited (Petro China) was established as a joint stock company under the company law of the People’s Republic of China in 1999 as part of the restructuring of China National Petroleum Corporation. Petro China is an integrated oil and

> The year-end balance sheet of Helsinki Corporation, a wholly owned British affiliate in Finland, is reproduced here. Relevant exchange rate and inflation information is also provided. Exchange rate and price information: January 1: General price index

> Doosan Enterprises, a U.S. subsidiary domiciled in South Korea, accounts for its inventories on a FIFO basis. The company translates its inventories to dollars at the current rate. Year-end inventories are recorded at 10,920,000 won. During the year, the

> Ninsuvaan Corporation, a U.S. subsidiary in Bangkok, Thailand, begins and ends its calendar year with an inventory balance of BHT500 million. The dollar/baht exchange rate on January 1 was $0.02 = BHT1. During the year, the U.S. general price level advan

> The balance sheet of Rackett & Ball plc., a U.K.-based sporting goods manufacturer, is presented here. Figures are stated in millions of pounds (£m). During the year, the producers’ price index increased from 100 to 120

> Now assume that Majikstan Enterprises is a foreign subsidiary of a U.S.-based multinational corporation and that its financial statements are consolidated with those of its U.S. parent. Relevant exchange rate and general price-level information for the y

> Majikstan Enterprises has equipment on its books that it acquired at the start of 2009 . The equipment is being depreciated in straight-line fashion over a 10-year period and has no salvage value. The current cost of this equipment at the end of 2010 was

> Examine the Web sites of five exchanges listed in Appendix 1-1 that you feel would be most attractive to foreign listers. Which exchange in your chosen set proved most popular during the last two years? Provide possible explanations for your observation.

> Revisit Sobrero Corporation in Exercise 1. In addition to the information provided there, assume that Mexico’s construction cost index increased by 80 percent during the year, while the price of vacant land adjacent to Sobrero Corporation’s hotel increas

> Using the information provided in Exercise 2. Calculate Majikstan Enterprises’ net monetary gain or loss in local currency for 2011 based on the following general price-level information. 12/31/10 ……………………………………………………………………………..30,000 Average …………………………

> The comparative historical-cost balance sheets of Majikstan Enterprises for 2010 and 2011 are reproduced below. The accounts are expressed in 000’s of renges (MJR’s). Required: What was the change in Majikstanâ

> Sobrero Corporation, a Mexican affiliate of a major U.S.-based hotel chain, starts the calendar year with 1 billion pesos (P) cash equity investment. It immediately acquires a refurbished hotel in Acapulco for P 900 million. Owing to a favorable tourist

> Examine the income statements of Modello, Vestel, and Infosys, referenced earlier in this chapter. Which earnings number do you feel provides the better earnings metric for an investment analyst, and why?

> From a user’s perspective, what is the inherent problem in attempting to analyze historical cost-based financial statements of a company domiciled in an inflationary, devaluation-prone country?

> What does double-dipping mean in accounting for foreign inflation?

> How does accounting for foreign inflation differ from accounting for domestic inflation?

> What is a gearing adjustment, and on what ideas is it based?

> As a potential investor in the shares of multinational enterprises, which inflation method, restate-translate or translate-restate, would give you consolidated information most relevant to your decision needs? Which information set is best from the viewp

> Examine Exhibit 1-2 and compute the compounded annual growth rate of merchandise trade versus the global trade in services for the 20 year period beginning 1985 and ending 2005. What implication does your finding have for accounting as a service activity

> Briefly describe the historical-cost-constant purchasing power and current-cost models. How are they similar? How do they differ?

> As more and more companies span the globe in terms of their operating, financing, and investing activities, they will increasingly turn to international financial reporting standards when communicating with domestic and non-domestic financial statement r

> Following are the remarks of a prominent member of the U.S. Congress. Explain why you agree or disagree. The plain fact of the matter is that inflation accounting is a premature, imprecise, and underdeveloped method of recording basic business facts. To

> Consider the statement: “The object of accounting for changing prices is to ensure that a company is able to maintain its operating capability.” How accurate is it?

> Inc. In 1993 Icelandic Enterprises was incorporated in Reykjavik to manufacture and distribute women’s cosmetics in Iceland. All of its outstanding stock was acquired at the beginning of 2001 by International Cosmetics, Ltd. (IC), a U.S

> Kashmir Enterprises, an Indian carpet manufacturer, begins the calendar year with the following Indian rupee (INR) balances: During the first week in January, the company acquires additional manufacturing inventories costing INR 2,400,000 on account an

> On December 15, MSC Corporation acquires its first foreign affiliate by acquiring 100 percent of the net assets of the Armaselah Oil Company based in Saudi Arabia for 930,000,000 Saudi Arabian riyals.(SAR). At the time, the exchange rate was $1.00 = SAR3

> A 100 percent–owned foreign subsidiary’s trial balance consists of the accounts listed as follows. Which exchange rate—current, historical, or average—would be used to translate these accounts to parent currency assuming that the foreign currency is the