Question: This chapter explained two methods to evaluate

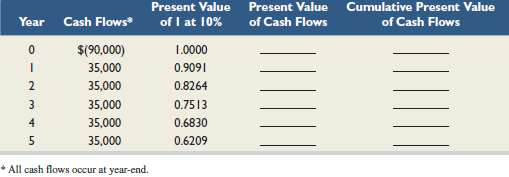

This chapter explained two methods to evaluate investments using recovery time, the payback period and break-even time (BET). Refer to QS 25-26 and

(1) compute the recovery time for both the payback period and break-even time,

(2) discuss the advantage(s) of break-even time over the payback period, and

(3) list two conditions under which payback period and break-even time are similar.

Information from QS 25-26:

Heels, a shoe manufacturer, is evaluating the costs and benefits of new equipment that would custom fit each pair of athletic shoes. The customer would have his or her foot scanned by digital computer equipment; this information would be used to cut the raw materials to provide the customer a perfect fit. The new equipment costs $90,000 and is expected to generate an additional $35,000 in cash flows for five years. A bank will make a $90,000 loan to the company at a 10% interest rate for this equipment’s purchase.

Transcribed Image Text:

Present Value Present Value Cumulative Present Value of I at 10% Year Cash Flows* of Cash Flows of Cash Flows $(90,000) 1.0000 35,000 0.9091 35,000 0.8264 3 35,000 0.7513 4 35,000 0.6830 5 35,000 0.6209 * All cash flows occur at year-end.

> Bonanza Entertainment began operations in January 2015 with two operating (selling) departments and one service (office) department. Its departmental income statements follow. The company plans to open a third department in January 2016 that will sell

> Harmon’s has several departments that occupy all floors of a two-story building that includes a basement floor. Harmon rented this building under a long-term lease negotiated when rental rates were low. The departmental accounting syste

> Britney Brown, the plant manager of LMN Co.’s Chicago plant, is responsible for all of that plant’s costs other than her own salary. The plant has two operating departments and one service department. The refrigerator

> Kenya Company’s standard cost accounting system recorded this information from its June operations. Required 1. Prepare journal entries dated June 30 to record the company’s costs and variances for the month. (Do not

> Refer to information in Problem 23-4B. Required Compute these variances: (a) variable overhead spending and efficiency, (b) fixed overhead spending and volume, and (c) total overhead controllable. Information from Problem 23-4B: Kryll Company set the f

> Kryll Company set the following standard unit costs for its single product. The predetermined overhead rate is based on a planned operating volume of 80% of the productive capacity of 60,000 units per quarter. The following flexible budget information

> Suncoast Company set the following standard costs for one unit of its product. The predetermined overhead rate ($16.00 per direct labor hour) is based on an expected volume of 75% of the factory’s capacity of 20,000 units per month. F

> Refer to the information in Problem 23-1B. Tohono Company’s actual income statement for 2015 follows. Required 1. Prepare a flexible budget performance report for 2015. Analysis Component 2. Analyze and interpret both the (a) sales v

> Tohono Company’s 2015 master budget included the following fixed budget report. It is based on an expected production and sales volume of 20,000 units. Required 1. Classify all items listed in the fixed budget as variable or fixed. Al

> Near the end of 2015, the management of Isle Corp., a merchandising company, prepared the following estimated balance sheet for December 31, 2015. To prepare a master budget for January, February, and March of 2016, management gathers the following inf

> Connick Company sells its product for $22 per unit. Its actual and budgeted sales follow. All sales are on credit. Recent experience shows that 40% of credit sales is collected in the month of the sale, 35% in the month after the sale, 23% in the secon

> During the last week of March, Sony Stereo’s owner approaches the bank for an $80,000 loan to be made on April 1 and repaid on June 30 with annual interest of 12%, for an interest cost of $2,400. The owner plans to increase the store&ac

> H20 Sports Company is a merchandiser of three different products. The company’s March 31 inventories are water skis, 40,000 units; tow ropes, 90,000 units; and life jackets, 150,000 units. Management believes that excessive inventories

> The management of Nabar Manufacturing prepared the following estimated balance sheet for June, 2015: To prepare a master budget for July, August, and September of 2015, management gathers the following information: a. Sales were 20,000 units in June. F

> HCS Mfg. makes its product for $60 and sells it for $130 per unit. The sales staff receives a 10% commission on the sale of each unit. Its June income statement follows. Management expects June’s results to be repeated in July, August

> A1 Manufacturing is preparing its master budget for the quarter ended September 30, 2015. Budgeted sales and cash payments for product costs for the quarter follow. Sales are 20% cash and 80% on credit. All credit sales are collected in the month follo

> NSA Company produces baseball bats. Each bat requires 3 pounds of aluminum alloy. Management predicts that 8,000 bats and 15,000 pounds of aluminum alloy will be in inventory on March 31 of the current year and that 250,000 bats will be sold during this

> Elegant Decor Company’s management is trying to decide whether to eliminate Department 200, which has produced losses or low profits for several years. The company’s 2015 departmental income statements show the followi

> Edgerron Company is able to produce two products, G and B, with the same machine in its factory. The following information is available. The company presently operates the machine for a single eight-hour shift for 22 working days each month. Management

> Jones Products manufactures and sells to wholesalers approximately 400,000 packages per year of underwater markers at $6 per package. Annual costs for the production and sale of this quantity are shown in the table. A new wholesaler has offered to buy

> Manning Corporation is considering a new project requiring a $90,000 investment in test equipment with no salvage value. The project would produce $66,000 of pretax income before depreciation at the end of each of the next six years. The companyâ&#

> Most Company has an opportunity to invest in one of two new projects. Project Y requires a $350,000 investment for new machinery with a four-year life and no salvage value. Project Z requires a $350,000 investment for new machinery with a three-year life

> Factor Company is planning to add a new product to its line. To manufacture this product, the company needs to buy a new machine at a $480,000 cost with an expected four-year life and a $20,000 salvage value. All sales are for cash, and all costs are out

> Georgia Orchards produced a good crop of peaches this year. After preparing the following income statement, the company believes it should have given its No. 3 peaches to charity and saved its efforts. In preparing this statement, the company allocated

> Vortex Company operates a retail store with two departments. Information about those departments follows. The company also incurred the following indirect costs. Indirect costs are allocated as follows: salaries on the basis of sales; insurance and d

> Williams Company began operations in January 2015 with two operating (selling) departments and one service (office) department. Its departmental income statements follow. Williams plans to open a third department in January 2016 that will sell painting

> National Bank has several departments that occupy both floors of a two-story building. The departmental accounting system has a single account, Building Occupancy Cost, in its ledger. The types and amounts of occupancy costs recorded in this account for

> Billie Whitehorse, the plant manager of Travel Free’s Indiana plant, is responsible for all of that plant’s costs other than her own salary. The plant has two operating departments and one service department. The campe

> Boss Company’s standard cost accounting system recorded this information from its December operations. Required 1. Prepare December 31 journal entries to record the company’s costs and variances for the month. (Do no

> Refer to information in Problem 23-4A. Required Compute these variances: (a) variable overhead spending and efficiency, (b) fixed overhead spending and volume, and (c) total overhead controllable. Information from Problem 23-4A: Trico Company set the f

> Trico Company set the following standard unit costs for its single product. The predetermined overhead rate is based on a planned operating volume of 80% of the productive capacity of 60,000 units per quarter. The following flexible budget information

> Antuan Company set the following standard costs for one unit of its product. The predetermined overhead rate ($18.50 per direct labor hour) is based on an expected volume of 75% of the factory’s capacity of 20,000 units per month. Fol

> Refer to the information in Problem 23-1A. Phoenix Company’s actual income statement for 2015 follows. Required 1. Prepare a flexible budget performance report for 2015. Analysis Component 2. Analyze and interpret both the (a) sales

> Phoenix Company’s 2015 master budget included the following fixed budget report. It is based on an expected production and sales volume of 15,000 units. Required 1. Classify all items listed in the fixed budget as variable or fixed. A

> Merline Manufacturing makes its product for $75 per unit and sells it for $150 per unit. The sales staff receives a 10% commission on the sale of each unit. Its December income statement follows. Management expects December’s results

> Built-Tight is preparing its master budget for the quarter ended September 30, 2015. Budgeted sales and cash payments for product costs for the quarter follow: Sales are 20% cash and 80% on credit. All credit sales are collected in the month following

> Near the end of 2015, the management of Dimsdale Sports Co., a merchandising company, prepared the following estimated balance sheet for December 31, 2015. To prepare a master budget for January, February, and March of 2016, management gathers the foll

> Aztec Company sells its product for $180 per unit. Its actual and budgeted sales follow. All sales are on credit. Recent experience shows that 20% of credit sales is collected in the month of the sale, 50% in the month after the sale, 28% in the second

> During the last week of August, Oneida Company’s owner approaches the bank for a $100,000 loan to be made on September 2 and repaid on November 30 with annual interest of 12%, for an interest cost of $3,000. The owner plans to increase

> Keggler’s Supply is a merchandiser of three different products. The company’s February 28 inventories are footwear, 20,000 units; sports equipment, 80,000 units; and apparel, 50,000 units. Management believes that exce

> The management of Zigby Manufacturing prepared the following estimated balance sheet for March, 2015: To prepare a master budget for April, May, and June of 2015, management gathers the following information: a. Sales for March total 20,500 units. Fore

> Maxlon Company manufactures custom-made furniture for its local market and produces a line of home furnishings sold in retail stores across the country. The company uses traditional volume-based methods of assigning direct materials and direct labor to i

> Tent Master produces two lines of tents sold to outdoor enthusiasts. The tents are cut to specifications in department A. In department B the tents are sewn and folded. The activities, costs, and drivers associated with these two manufacturing processes

> Craftmore Machining produces machine tools for the construction industry. The following details about overhead costs were taken from its company records. Additional information on the drivers for its production activities follows. Required 1. Compute

> B2B Co. is considering the purchase of equipment that would allow the company to add a new product to its line. The equipment is expected to cost $360,000 with a six-year life and no salvage value. It will be depreciated on a straight-line basis. The com

> Refer to the information in Exercise 25-5. Assume the company requires a 10% rate of return on its investments. Compute the net present value of each potential investment. (Round to the nearest dollar.) Information from Exercise 25-5: a. A new operating

> Compute the payback period for each of these two separate investments (round the payback period to two decimals): a. A new operating system for an existing machine is expected to cost $520,000 and have a useful life of six years. The system yields an inc

> Refer to the information in Exercise 25-3 and assume instead that double-declining depreciation is applied. Compute the machine’s payback period (ignore taxes). (Round the payback period to three decimals.) Information from Exercise 25

> A machine can be purchased for $150,000 and used for five years, yielding the following net incomes. In projecting net incomes, straight-line depreciation is applied, using a five-year life and a zero salvage value. Compute the machine’

> Xinhong Company is considering replacing one of its manufacturing machines. The machine has a book value of $45,000 and a remaining useful life of 5 years, at which time its salvage value will be zero. It has a current market value of $52,000. Variable m

> Suresh Co. expects its five departments to yield the following income for next year. Recompute and prepare the departmental income statements (including a combined total column) for the company under each of the following separate scenarios: Management

> Colt Company owns a machine that can produce two specialized products. Production time for Product TLX is two units per hour and for Product MTV is five units per hour. The machine’s capacity is 2,750 hours per year. Both products are s

> Cobe Company has already manufactured 28,000 units of Product A at a cost of $28 per unit. The 28,000 units can be sold at this stage for $700,000. Alternatively, the units can be further processed at a $420,000 total additional cost and be converted int

> Varto Company has 7,000 units of its sole product in inventory that it produced last year at a cost of $22 each. This year’s model is superior to last year’s and the 7,000 units cannot be sold at last year’s regular selling price of $35 each. Varto has t

> A company must decide between scrapping or reworking units that do not pass inspection. The company has 22,000 defective units that cost $6 per unit to manufacture. The units can be sold as is for $2.50 each, or they can be reworked for $4.50 each and th

> Gelb Company currently manufactures 40,000 units per year of a key component for its manufacturing process. Variable costs are $1.95 per unit, fixed costs related to making this component are $65,000 per year, and allocated fixed costs are $58,500 per ye

> Refer to the information in Exercise 25-1 and assume that Beyer requires a 10% return on its investments. Compute the net present value of this investment. (Round to the nearest dollar.) Should Beyer accept the investment? Information from Exercise 25-1

> Gilberto Company currently manufactures 65,000 units per year of one of its crucial parts. Variable costs are $1.95 per unit, fixed costs related to making this part are $75,000 per year, and allocated fixed costs are $62,000 per year. Allocated fixed co

> Goshford Company produces a single product and has capacity to produce 100,000 units per month. Costs to produce its current sales of 80,000 units follow. The regular selling price of the product is $100 per unit. Management is approached by a new custom

> Farrow Co. expects to sell 150,000 units of its product in the next period with the following results. The company has an opportunity to sell 15,000 additional units at $12 per unit. The additional sales would not affect its current expected sales. Dir

> Refer to the information in Exercise 25-10. Create an Excel spreadsheet to compute the internal rate of return for each of the projects. Round the percentage return to two decimals. Information from Exercise 25-10: Following is information on two altern

> Phoenix Company can invest in each of three cheese-making projects: C1, C2, and C3. Each project requires an initial investment of $228,000 and would yield the following annual cash flows. (1) Assuming that the company requires a 12% return from its in

> Refer to the information in Exercise 25-11. Create an Excel spreadsheet to compute the internal rate of return for each of the projects. Based on internal rate of return, determine whether the company should accept either of the two projects. Informatio

> Refer to the information in Exercise 25-11 and instead assume the company requires a 12% return on its investments. Compute each project’s (a) net present value and (b) profitability index. (Round present value calculations to the neare

> Following is information on two alternative investments being considered by Tiger Co. The company requires a 4% return from its investments. Compute each project’s (a) net present value and (b) profitability index. (Round present valu

> Following is information on two alternative investments being considered by Jolee Company. The company requires a 10% return from its investments. For each alternative project compute the (a) net present value, and (b) profitability index. (Round your

> Beyer Company is considering the purchase of an asset for $180,000. It is expected to produce the following net cash flows. The cash flows occur evenly throughout each year. Compute the payback period for this investment (round years to two decimals).

> Megamart, a retailer of consumer goods, provides the following information on two of its departments (each considered an investment center). 1. Compute return on investment for each department. Using return on investment, which department is most effic

> You must prepare a return on investment analysis for the regional manager of Fast & Great Burgers. This growing chain is trying to decide which outlet of two alternatives to open. The first location (A) requires a $1,000,000 investment and is expected to

> Jansen Company reports the following for its ski department for the year 2015. All of its costs are direct, except as noted. Prepare a (1) departmental income statement for 2015 and (2) departmental contribution to overhead report for 2015. (3) Based o

> Woh Che Co. has four departments: materials, personnel, manufacturing, and packaging. In a recent month, the four departments incurred three shared indirect expenses. The amounts of these indirect expenses and the bases used to allocate them follow. De

> Jessica Porter works in both the jewelry department and the hosiery department of a retail store. Porter assists customers in both departments and arranges and stocks merchandise in both departments. The store allocates Porter’s $30,000

> L’Oréal reports the following for a recent year for the major divisions in its cosmetics branch. 1. Compute profit margin for each division. State your answers as percents, rounded to two decimal places. Which Lâ

> Pirate Seafood Company purchases lobsters and processes them into tails and flakes. It sells the lobster tails for $21 per pound and the flakes for $14 per pound. On average, 100 pounds of lobster are processed into 52 pounds of tails and 22 pounds of fl

> Marathon Running Shop has two service departments (advertising and administrative) and two operating departments (shoes and clothing). During 2015, the departments had the following direct expenses and occupied the following amount of floor space. The

> Heart & Home Properties is developing a subdivision that includes 600 home lots. The 450 lots in the Canyon section are below a ridge and do not have views of the neighboring canyons and hills; the 150 lots in the Hilltop section offer unobstructed views

> The trailer division of Baxter Bicycles makes bike trailers that attach to bicycles and can carry children or cargo. The trailers have a retail price of $200 each. Each trailer incurs $80 of variable manufacturing costs. The trailer division has capacity

> Best Ink produces ink-jet printers for personal computers. It received an order for 500 printers from a customer. The following information is available for this order. 1. Compute the company’s manufacturing cycle time. 2. Compute the

> Oakwood Company produces maple bookcases to customer order. It received an order from a customer to produce 5,000 bookcases. The following information is available for the production of the bookcases. 1. Compute the company’s manufact

> ZNet Co. is a web-based retail company. The company reports the following for 2015. The company’s CEO believes that sales for 2016 will increase by 20%, and both profit margin (%) and the level of average invested assets will be the s

> Kraft Foods Group reports the following for two of its divisions for a recent year. All numbers are in millions of dollars. For each division, compute (1) return on investment, (2) profit margin, and (3) investment turnover for the year. Round answers t

> Refer to information in Exercise 24-9. Compute profit margin and investment turnover for each department. Which department generates the most net income per dollar of sales? Which department is most efficient at generating sales from average invested ass

> Marvin Dinardo manages an auto dealership’s service department. Costs and expenses for a recent quarter for his department follows. List the controllable costs that would appear on a responsibility accounting report for the service depa

> Refer to the information in Exercise 23-8 and compute the (1) direct materials price and (2) direct materials quantity variances. Indicate whether each variance is favorable or unfavorable. Information from Exercise 23-8: A manufactured product has the

> A manufactured product has the following information for June. Compute the (1) standard cost per unit and (2) total cost variance for June. Indicate whether the cost variance is favorable or unfavorable. Standard Actual Direct materials.. (6 Ibs. @

> Resset Co. provides the following results of April’s operations: F indicates favorable and U indicates unfavorable. Applying the management by exception approach, which of the variances are of greatest concern? Why? Direct material

> Bay City Company’s fixed budget performance report for July follows. The $647,500 budgeted total expenses include $487,500 variable expenses and $160,000 fixed expenses. Actual expenses include $158,000 fixed expenses. Prepare a flexibl

> Comp Wiz sells computers. During May 2015, it sold 350 computers at a $1,200 average price each. The May 2015 fixed budget included sales of 365 computers at an average price of $1,100 each. 1. Compute the sales price variance and the sales volume varian

> Blaze Corp. applies overhead on the basis of direct labor hours. For the month of March, the company planned production of 8,000 units (80% of its production capacity of 10,000 units) and prepared the following budget: During March, the company operate

> James Corp. applies overhead on the basis of direct labor hours. For the month of May, the company planned production of 8,000 units (80% of its production capacity of 10,000 units) and prepared the following overhead budget: During May, the company op

> Refer to the information from Exercise 23-19. Compute the (1) overhead volume variance and (2) overhead controllable variance. Information from Exercise 23-19: World Company expects to operate at 80% of its productive capacity of 50,000 units per month.

> Tempo Company’s fixed budget (based on sales of 7,000 units) for the first quarter of calendar year 2015 reveals the following. Prepare flexible budgets following the format of Exhibit 23.3 that show variable costs per unit, fixed costs

> World Company expects to operate at 80% of its productive capacity of 50,000 units per month. At this planned level, the company expects to use 25,000 standard hours of direct labor. Overhead is allocated to products using a predetermined standard rate

> Refer to the information from Exercise 23-17. Compute and interpret the following. 1. Variable overhead spending and efficiency variances. 2. Fixed overhead spending and volume variances. 3. Controllable variance. Information from Exercise 23-17: Sedona

> Sedona Company set the following standard costs for one unit of its product for 2015. The $5.60 ($4.00 1 $1.60) total overhead rate per direct labor hour is based on an expected operating level equal to 75% of the factory’s capacity o

> Refer to Exercise 23-13. Hart Company records standard costs in its accounts and its materials variances in separate accounts when it assigns materials costs to the Work in Process Inventory account. 1. Show the journal entry that both charges the direct

> Hart Company made 3,000 bookshelves using 22,000 board feet of wood costing $266,200. The company’s direct materials standards for one bookshelf are 8 board feet of wood at $12 per board foot. 1. Compute the direct materials price and quantity variances

> Reed Corp. has set the following standard direct materials and direct labor costs per unit for the product it manufactures. During June the company incurred the following actual costs to produce 9,000 units. Compute the (1) direct materials price and

> Hutto Corp. has set the following standard direct materials and direct labor costs per unit for the product it manufactures. During May the company incurred the following actual costs to produce 9,000 units. Compute the (1) direct materials price and

> Refer to the information in Exercise 23-8 and compute the (1) direct labor rate and (2) direct labor efficiency variances. Indicate whether each variance is favorable or unfavorable. Information from Exercise 23-8: A manufactured product has the followi