Question: You went long 20 June 2016 crude

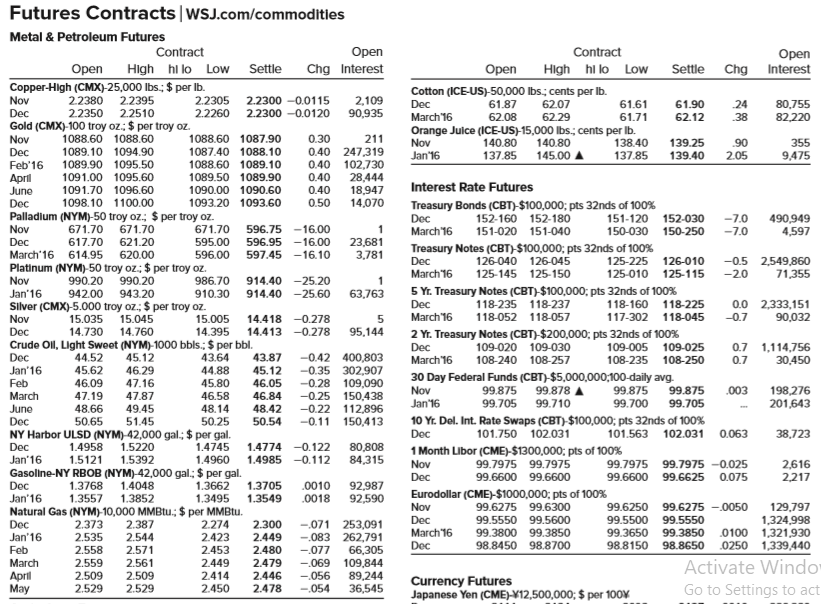

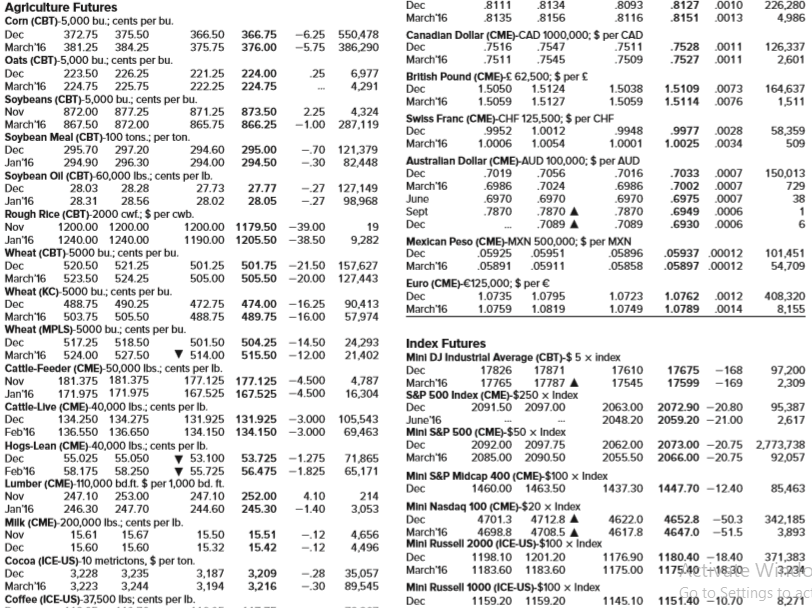

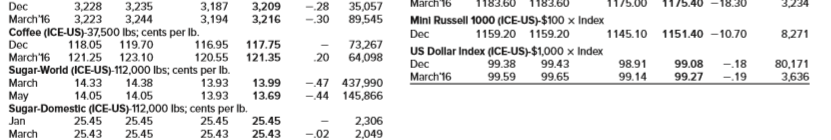

You went long 20 June 2016 crude oil futures contracts at a price of $42.18. Looking back at Figure 14.1, if you closed your position at the settle price on this day, what was your profit?

Figure 14.1:

Transcribed Image Text:

Futures Contracts|WSJ.com/commoditles Metal & Petroleum Futures Contract Оpen Contract Open Interest Оpen High hi lo Low Settle Chg Interest Open High hi lo Low Settle Chg Copper-High (CMX)-25,000 Ibs.; $ per Ib. 22380 2.2395 Cotton (ICE-US)-50,000 Ibs; cents per Ib. Dec 61.87 Nov Dec Gold (CMX)-100 troy oz.: $ per troy oz. Nov Dec Feb'16 2.2305 2.2300 -0.0115 2.2260 2,109 2.2300 -0.0120 90,935 62.07 62.29 61.61 61.90 80,755 24 38 22350 2.2510 March'16 62.08 61.71 62.12 82,220 Orange Juice (ICE-US)-15,000 Ibs.; cents per Ib. 1088.60 1087.90 140.80 1088.60 1088.60 0.30 211 Nov 140.80 138.40 139.25 139.40 90 355 0.40 247,319 0.40 102,730 28,444 18,947 14,070 1089.10 1094.90 1087.40 1088.10 Jan'16 137.85 145.00 A 137.85 2.05 9,475 1089.90 1095.50 1088.60 1089.10 1091.00 1095.60 1089.50 1089.90 0.40 April June Dec Palladium (NYM)-50 troy oz; $ per troy oz. Nov 1091.70 1096.60 1090.00 1090.60 0.40 Interest Rate Futures 1098.10 1100.00 1093.20 1093.60 0.50 Treasury Bonds (CBT)-$100,000; pts 32nds of 100% Dec 152-160 152-180 151-120 152-030 -7.0 -7 490,949 4,597 671.70 671.70 671.70 596.75 -16.00 596.95 -16.00 597.45 -16.10 1 March'16 151-020 151-040 150-030 150-250 595.00 596.00 Platinum (NYM)-50 troy oz: $ per troy oz. 986.70 Dec 617.70 621.20 23,681 3,781 Treasury Notes (CBT)-$100,000; pts 32nds of 100% Dec March'16 March'16 614.95 620.00 126-040 126-045 125-225 126-010 -0.5 2,549,86o -20 990.20 990.20 125-145 125-150 125-010 125-115 71,355 914.40 -25.20 914.40 -25.60 Nov 1 Jan'16 5 Yr. Treasury Notes (CBT)-$100,000; pts 32nds of 100% 942.00 943.20 Silver (CMX)-5.000 troy oz.; $ per troy oz. 15.045 910.30 63,763 Dec March'16 118-235 118-237 118-160 118-225 0.0 2,333,151 -0.7 Nov 15.035 15.005 14.418 -0.278 118-052 118-057 117-302 118-045 90,032 2 Yr. Treasury Notes (CBT)-$200,000; pts 32nds of 100% 109-020 109-030 Dec 14.730 14.760 14.395 14.413 -0.278 95,144 Crude Oll, Light Sweet (NYM)-1000 bbls.; $ per bbl. 45.12 46.29 Dec March'16 0.7 1,114,756 30,450 109-005 109-025 Dec Jan'16 Feb 44.52 43.64 44.88 43.87 45.12 -0.42 400,803 -0.35 302,907 -0.28 109,090 -0.25 150,438 -0.22 112,896 -0.11 150,413 108-240 108-257 108-235 108-250 0.7 45.62 30 Day Federal Funds (CBT)-$5,000,000;100-daily avg. Nov Jan'16 47.16 47.87 49.45 51.45 NY Harbor ULSD (NYM)-42,000 gal; $ per gal. 46.09 45.80 46.05 99.875 99.878 , 99.875 99.875 99.705 .003 198,276 201,643 47.19 46.58 March June Dec 46.84 48.42 50.54 99.705 99.710 99.700 48.66 48.14 10 Yr. Del. Int. Rate Swaps (CBT)-$100,000; pts 32nds of 100% 101.750 102.031 50.65 50.25 Dec 101.563 102.031 0.063 38,723 Dec 1.4958 1.5220 1.4745 1.4774 -0.122 80,808 84,315 1 Month Libor (CME)-$1300,000; pts of 100% Jan'16 1.5121 1.5392 1.4960 1.4985 -0.112 Nov 99.7975 99.7975 99.7975 99.7975 -0.025 2,616 2,217 Gasoline-NY RBOB (NYM)-42,000 gal.; $ per gal. Dec Jan'16 Dec 99.6600 99.6600 99.6600 99.6625 0.075 1.3768 1.3557 1.4048 1.3852 1.3705 1.3549 .0010 .0018 92,987 92,590 1.3662 Eurodollar (CME)-$1000,000; pts of 100% 99.6275 99.6300 1.3495 99.6250 129,797 1,324,998 .0100 1,321,930 1,339,440 Nov 99.6275 -.0050 Natural Gas (NYM)-10,000 MMBtu.; $ per MMBtu. 2.387 2.544 2.571 2.561 2.509 2.529 Dec March'16 Dec 99.5550 99.5600 99.3800 99.3850 98.8450 98.8700 99.5500 99.5550 Dec 2.373 2.535 2.558 2.559 2.509 2.529 2.274 2.300 -.071 253,091 -.083 262,791 66,305 109,844 89,244 36,545 99.3650 99.3850 Jan'16 2.423 2.449 2.480 2.479 2.446 2.478 98.8150 98.8650 .0250 Feb 2.453 2.449 2.414 2.450 -.077 -.069 -.056 -.054 Activate Windo Go to Settings to act March April May Currency Futures Japanese Yen (CME)¥12,500,000; $ per 100% Dec 8111 8134 8093 .8127 0010 Agriculture Futures Corn (CBT)-5,000 bu.; cents per bu. 226,280 4,986 March'16 8135 8156 8116 8151 0013 -6.25 550,478 -5.75 386,290 Canadlan Dollar (CME)-CAD 1000,000; $ per CAD 7516 .7547 .7511 .7545 Dec 372.75 375.50 381.25 384.25 366.50 366.75 Dec March'16 .7511 .7509 .7528 0011 .7527 .0011 126,337 2,601 March'16 375.75 376.00 Oats (CBT)-5,000 bu; cents per bu. Dec 223.50 226.25 221.25 222.25 224.00 224.75 25 6,977 4,291 British Pound (CME)£ 62,500; $ per £ 1.5050 1.5059 March'16 224.75 225.75 1.5124 Dec March'16 1.5038 1.5059 1.5109 0073 1.5114 .0076 164,637 1,511 Soybeans (CBT)-5,000 bu.; cents per bu. 872.00 867.50 1.5127 877.25 871.25 873.50 865.75 866.25 4,324 -1.00 287,119 Nov 225 Swiss Franc (CME)-CHF 125,500; $ per CHE 9952 March'16 872.00 1.0012 Doc March'16 9948 1.0001 .9977 0028 1.0025 .0034 58,359 509 Soybean Meal (CBT)-100 tons.; per ton. 295.70 294.90 296.30 1.0006 1.0054 297.20 Dec Jan'16 294.60 294.00 295.00 294.50 -70 121,379 Australlan Dollar (CME)-AUD 100,000; $ per AUD .7019 7056 -30 82,448 Dec 7016 .7033 0007 150,013 Soybean Oll (CBT)-60,000 lbs.; cents per Ib. 27.73 28.02 March'16 June .6986 6970 .7870 7024 .6970 .7870 6986 .6970 .7870 7089 .7002 0007 .6975 0007 .6949 Dec 28.03 28.28 27.77 729 -27 127,149 -27 Jan'16 28.31 28.56 28.05 98,968 38 Sept Dec „0006 Rough Rice (CBT)-2000 cwf; $ per cwb. Nov 1200.00 1200.00 1200.00 1179.50 -39.00 19 .7089 .6930 .0006 6 Jan'16 1240.00 1240.00 1190.00 1205.50 -38.50 9,282 Mexican Peso (CME)-MXN 500,000; $ per MXN 05925 .05951 05896 Wheat (CBT)-5000 bu.; cents per bu. Doc March'16 523.50 524.25 101,451 54,709 Dec .05937 00012 521.25 501.75 -21.50 157,627 505.50 -20.00 127,443 520.50 501.25 505.00 March'16 .05891 05911 .05858 .05897 .00012 Euro (CME)-€125,000; $ per € Dec Wheat (KC)-5000 bu.; cents per bu. 488.75 503.75 505.50 408,320 8,155 1.0735 1.0795 1.0723 1.0762 0012 472.75 488.75 Dec 490.25 474.00 -16.25 90,413 57,974 March'16 1.0759 1.0789 .0014 1.0819 1.0749 March'16 489.75 -16.00 Wheat (MPLS)-5000 bu.; cents per bu. Dec March'16 517.25 518.50 524.00 527.50 501.50 504.25 -14.50 24,293 21,402 Index Futures Mini DJ Industrial Average (CBT)-$ 5 x index Dec March'16 S&P 500 Index (CME)-$250 x Index Dec June'16 Mini S&P 500 (CME)-$50 x Index Dec March'16 V 514.00 515.50 -12.00 Cattle-Feeder (CME)-50,000 Ibs.; cents per Ib. Nov 17871 17826 17765 17787 17610 17545 17675 -168 181.375 181.375 171.975 171.975 97,200 2,309 177.125 177.125 -4.500 4,787 16,304 17599 -169 Jan'16 Cattle-Live (CME)-40,000 Ibs.; cents per Ib. Dec Feb'16 167.525 167.525 -4.500 2091.50 2097.00 2063.00 2072.90 –20.80 131.925 131.925 -3.000 105,543 69,463 95,387 2,617 134.250 134.275 2048.20 2059.20 -21.00 136.550 136.650 134.150 134.150 -3.000 2092.00 2097.75 Hogs-Lean (CME)-40,000 lbs.; cents per Ib. 55.025 55.050 2062.00 2073.00 -20.75 2,773,738 2055.50 2066.00 -20.75 2085.00 2090.50 92,057 Dec Feb'16 53.100 53.725 -1.275 v 55.725 71,865 65,171 58.250 Lumber (CME)-110,000 bd.ft. $ per 1,000 bd. ft. 247.10 253.00 58.175 56.475 -1.825 Mini S&P Midcap 400 (CME)$100 x Index Dec 1460.00 1463.50 1437.30 1447.7o –12.40 85,463 Nov Jan'16 247.10 252.00 4.10 214 3,053 Mini Nasdaq 100 (CME)-$20 × Index 4712.8 A 4708.5 246.30 247.70 244.60 245.30 -1.40 Dec 4701.3 4622.0 4617.8 4652.8 -50.3 Milk (CME)-200,000 Ibs.; cents per Ib. 15.61 15.60 342,185 3,893 Nov March'16 4698.8 4647.0 -51.5 15.67 15.60 15.50 15.32 15.51 -12 -.12 4,656 4,496 Mini Russell 2000 (ICE-US)-$100 x Index Dec Cocoa (ICE-US)-10 metrictons, $ per ton. Dec March'16 Coffee (ICE-US)-37,500 lbs; cents per Ib. 15.42 Dec 1198.10 1201.20 1180.40 -18.40 371,383 1175.00 117540 t+18,30e Wi3234O So to Settings tgact 1176.90 3,228 March'16 1183.60 1183.60 3,235 3,244 3,187 3,194 3,209 3,216 -.28 -30 35,057 89,545 3,223 Mini Russell 1000 (ICE-US)-$100 x Index Dec 1159.20 1159.20 1145.10 1151.40 10.70 8,271 March 16 18.30 3,234 3,187 3,194 Dec 3,228 3,223 3,235 3,244 3,209 3,216 -28 -.30 35,057 89,545 March'16 Mini Russell 1000 (ICE-US)-$100 x Index Dec 1159.20 1159.20 Coffee (ICE-US)-37,500 lbs; cents per Ib. Dec March'16 121.25 1145.10 1151.40 -10.70 8,271 119.70 117.75 121.35 116.95 120.55 Sugar-World (ICE-US)-112,000 Ibs; cents per Ib. 13.93 118.05 73,267 64,098 US Dollar Index (ICE-US)-$1,000 x Index 99.38 123.10 20 Dec 99.43 99.08 99.27 -18 80,171 3,636 98.91 March'16 99.59 99.65 99.14 -19 14.38 14.05 March 14.33 14.05 13.99 13.69 -47 437,990 145,866 May 13.93 Sugar-Domestic (1CE-US)-112,000 lbs; cents per lb. 25.45 25.43 -44 Jan 25.45 25.43 25.45 25.45 2,306 2,049 March 25.43 25.45 -.02

> For an increase of 100 basis points in the yield to maturity, by what amount would the fixed-rate bond’s price change? a. −$7.49 b. −$5.73 c. −$4.63

> Using the stock prices in Problem 3, calculate the exponential three-month moving average for both stocks where two-thirds of the average weight is placed on the most recent price. Data from Problem 3: The table below shows the closing monthly stock pr

> The table below shows the closing monthly stock prices for IBM and Amazon. Calculate the simple three-month moving average for each month for both companies. IBM………………………………………………….…..AMZN $169.64 …………………………………………………$600.36 173.29 ……………………………………………………

> Using the data in Problem 1, construct the Arms ratio on each of the five trading days. Data from Problem 1: Use the data below to construct the advance/decline line for the stock market. Volume figures are in thousands of shares. Stocks Advancin

> A stock had the following trades during a particular period. What was the money flow for the stock? Is the money flow a positive or negative signal in this case? Week Day Price Volume 1 Monday $61.85 Tuesday 61.81 1,000 Wednesday 61.82 1,400 Thurs

> Use the data below to construct the advance/decline line and Arms ratio for the market. Volume is in thousands of shares. Stocks Advancing Volume Stocks Declining Volume Advancing Declining Monday 2,530 995,111 519 111,203 Tuesday 2,429 934,531 639

> Use the data below to construct the advance/decline line for the stock market. Volume figures are in thousands of shares. Stocks Advancing Volume Stocks Declining Volume Advancing Declining Monday 1,634 825,503 1,402 684,997 Tuesday 1,876 928,360 1

> Star Light & Power increases its dividend 3.8 percent per year every year. This utility is valued using a discount rate of 9 percent, and the stock currently sells for $38 per share. If you buy a share of stock today and hold on to it for at least three

> Xytex Products just paid a dividend of $1.62 per share, and the stock currently sells for $28. If the discount rate is 10 percent, what is the dividend growth rate?

> If a firm has an EV of $750 million and EBITDA of $165 million, what is its EV ratio?

> Using your answers from Problems 3 through 5, value Lauryn’s Doll Co. assuming her FCF is expected to grow at a rate of 3 percent into perpetuity. Is this value the value of the equity?

> What is the estimated value of Country Point in a proposed spin-off? a. $144.5 million b. $162.6 million c. $178.3 million

> Lauryn’s Doll Co. had EBIT last year of $40 million, which is net of a depreciation expense of $4 million. In addition, Lauryn’s made $5 million in capital expenditures and increased net working capital by $3 million. Using the information from Problem 3

> Using your answer to Problem 3, calculate the appropriate discount rate assuming a risk-free rate of 4 percent and a market risk premium of 7 percent. Data from Problem 3: You are going to value Lauryn’s Doll Co. using the FCF model. After consulting v

> You are going to value Lauryn’s Doll Co. using the FCF model. After consulting various sources, you find that Lauryn’s has a reported equity beta of 1.4, a debt-to-equity ratio of 0.3, and a tax rate of 30 percent. Based on this information, what is the

> In Problem 1, suppose the current share price is $60. If all other information remains the same, what must the liquidating dividend be? Data from Problem 1: JJ Industries will pay a regular dividend of $2.40 per share for each of the next four years. A

> For Bill’s Bakery described in Problem 13, suppose instead that current earnings per share are $2.56. Calculate the share price for Bill’s Bakery.

> Bill’s Bakery expects earnings per share of $2.56 next year. Current book value is $4.70 per share. The appropriate discount rate for Bill’s Bakery is 11 percent. Calculate the share price for Bill’s Bakery if earnings grow at 3 percent forever.

> A certain stock has a beta of 1.3. If the risk-free rate of return is 3.2 percent and the market risk premium is 7.5 percent, what is the expected return of the stock? What is the expected return of a stock with a beta of 0.75?

> Joker stock has a sustainable growth rate of 8 percent, ROE of 14 percent, and dividends per share of $1.65. If the P/E ratio is 19, what is the value of a share of stock?

> Johnson Products earned $2.80 per share last year and paid a $1.25 per share dividend. If ROE was 14 percent, what is the sustainable growth rate?

> JJ Industries will pay a regular dividend of $2.40 per share for each of the next four years. At the end of the four years, the company will also pay out a $40 per share liquidating dividend, and the company will cease operations. If the discount rate is

> The value of beta for Country Point is: a. 1.09 b. 1.27 c. 1.00

> In Problem 5, assume the value-weighted index level was 408.16 at the beginning of the year. What is the index level at the end of the year? Data from Problem 5: Calculate the index return for the information in Problem 4 using a value-weighted index.

> In Problem 5, assume that you want to re index with the index value at the beginning of the year equal to 100. What is the index level at the end of the year? Data from Problem 5: Calculate the index return for the information in Problem 4 using a valu

> You are given the following information concerning two stocks that make up an index. What is the price-weighted return for the index? Price per Share Shares Beginning End of Outstanding of Year Year Kirk, Inc. 35,000 $37 $42 Picard Co. 26,000 84 9

> You find the following order book on a particular stock. The last trade on the stock was at $70.54. a. If you place a market buy order for 100 shares, at what price will it be filled? b. If you place a market sell order for 200 shares, at what price

> In Problem 1, assume that Baker undergoes a 4-for-1 stock split. What is the new divisor now? Data from Problem 1: Able, Baker, and Charlie are the only three stocks in an index. The stocks sell for $93, $312, and $78, respectively. If Baker undergoes

> Able, Baker, and Charlie are the only three stocks in an index. The stocks sell for $93, $312, and $78, respectively. If Baker undergoes a 2-for-1 stock split, what is the new divisor for the price-weighted index?

> A closed-end fund has total assets of $240 million and liabilities of $110,000. Currently, 11 million shares are outstanding. What is the NAV of the fund? If the shares currently sell for $19.25, what is the premium or discount on the fund?

> The largest expected loss for a portfolio is −20 percent with a probability of 95 percent. Relate this statement to the Value-at-Risk statistic.

> Explain the meaning of a Value-at-Risk statistic in terms of a smallest expected loss and the probability of such a loss.

> What is meant by a Sharpe-optimal portfolio?

> Given Ms. Nguyen’s estimate of Country Point’s terminal value in 2014, what is the growth assumption she must have used for free cash flow after 2014? a. 7 percent b. 9 percent c. 3 percent

> What are one advantage and one disadvantage of the Sharpe ratio?

> Explain the relationship between Jensen’s alpha and the security market line (SML) of the capital asset pricing model (CAPM).

> What is a common weakness of Jensen’s alpha and the Treynor ratio?

> Most sources report alphas and other metrics relative to a standard benchmark, such as the S&P 500. When might this method be an inappropriate comparison?

> A Treasury bond that settles on October 18, 2016, matures on March 30, 2035. The coupon rate is 5.30 percent and the bond has a 4.45 percent yield to maturity. What are the Macaulay duration and modified duration?

> A bond that settles on June 7, 2016, matures on July 1, 2036, and may be called at any time after July 1, 2026, at a price of 105. The coupon rate on the bond is 6 percent and the price is 115.00. What are the yield to maturity and yield to call on this

> A Treasury bond that settles on August 10, 2016, matures on April 15, 2021. The coupon rate is 4.5 percent and the quoted price is 106:17. What is the bond’s yield to maturity?

> Explain the difference between the Sharpe ratio and the Treynor ratio.

> You have a car loan with a nominal rate of 5.99 percent. With interest charged monthly, what is the effective annual rate (EAR) on this loan?

> A Treasury bill that settles on May 18, 2016, pays $100,000 on August 21, 2016. Assuming a discount rate of 0.44 percent, what are the price and bond equivalent yield?

> You have been given the following return information for two mutual funds (Papa and Mama), the market index, and the risk-free rate. Calculate the Sharpe ratio, Treynor ratio, Jensen’s alpha, information ratio, and R-squared for both

> You are given the following information concerning a stock and the market: Calculate the average return and standard deviation for the market and the stock. Next, calculate the correlation between the stock and the market, as well as the stockâ

> You are constructing a portfolio of two assets. Asset A has an expected return of 12 percent and a standard deviation of 24 percent. Asset B has an expected return of 18 percent and a standard deviation of 54 percent. The correlation between the two asse

> Suppose the CAC-40 Index (a widely followed index of French stock prices) is currently at 4,920, the expected dividend yield on the index is 2 percent per year, and the risk-free rate in France is 6 percent annually. If CAC-40 futures contracts that expi

> You shorted 15 March 2016 British pound futures contracts at the high price for the day. Looking back at Figure 14.1, if you closed your position at the settle price on this day, what was your profit? Figure 14.1: Futures Contracts|WSJ.com/commodit

> What are the Sharpe and Treynor ratios for the fund? Data for Problem 19: You have been given the following return information for a mutual fund, the market index, and the risk-free rate. You also know that the return correlation between th

> Your portfolio allocates equal amounts to three stocks. All three stocks have the same mean annual return of 14 percent. Annual return standard deviations for these three stocks are 30 percent, 40 percent, and 50 percent. The return correlations among al

> Mr. Spice asks Mr. Myers how a fixed-income manager would position his portfolio to capitalize on his expectations of increasing interest rates. Which of the following would be the most appropriate strategy? a. Lengthen the portfolio duration. b. Buy fix

> Using the same return means and standard deviations as in Problem 15 for Tyler Trucks and Michael Moped Manufacturing stocks, but assuming a return correlation of −.5, what is the smallest expected loss for your portfolio in the coming month with a proba

> Tyler Trucks stock has an annual return mean and standard deviation of 10 percent and 26 percent, respectively. Michael Moped Manufacturing stock has an annual return mean and standard deviation of 18 percent and 62 percent, respectively. Your portfolio

> A stock has an annual return of 11 percent and a standard deviation of 54 percent. What is the smallest expected loss over the next year with a probability of 1 percent? Does this number make sense?

> What is the formula for the Sharpe ratio for a portfolio of stocks and bonds with equal expected returns, i.e., E(RS) = E(RB), and a zero return correlation?

> What is the formula for the Sharpe ratio for an equally weighted portfolio of stocks and bonds?

> Look back at Problem 1. Assume that Able undergoes a 1-for-2 reverse stock split. What is the new divisor? Data from Problem 1: Able, Baker, and Charlie are the only three stocks in an index. The stocks sell for $93, $312, and $78, respectively. If Bak

> The beta for a certain stock is 1.15, the risk-free rate is 5 percent, and the expected return on the market is 13 percent. Complete the following table to decompose the stock’s return into the systematic return and the unsystematic ret

> Show that another way to calculate beta is to take the covariance between the security and the market and divide by the variance of the market’s return.

> Stock Y has a beta of 1.05 and an expected return of 13 percent. Stock Z has a beta of 0.70 and an expected return of 9 percent. If the risk-free rate is 5 percent and the market risk premium is 7 percent, are these stocks correctly priced?

> Derive our expression in the chapter for the portfolio weight in the minimum variance portfolio. (Danger! Calculus required!)

> The return calculation method most appropriate for evaluating the performance of a portfolio manager is a. Holding period b. Geometric c. Money-weighted (or dollar-weighted)

> Using the result in Problem 23, show that whenever two assets have perfect negative correlation, it is possible to find a portfolio with a zero standard deviation. What are the portfolio weights? (Hint: Let x be the percentage in the first asset and (1 &

> Suppose two assets have perfect negative correlation. Show that the standard deviation on a portfolio of the two assets is simply: op = ±(X, X o, ーX

> Suppose two assets have perfect positive correlation. Show that the standard deviation on a portfolio of the two assets is simply: Op = X, X 0, + Xg × OB

> You have a three-stock portfolio. Stock A has an expected return of 12 percent and a standard deviation of 41 percent, stock B has an expected return of 16 percent and a standard deviation of 58 percent, and stock C has an expected return of 13 percent a

> The stock of Bruin, Inc., has an expected return of 14 percent and a standard deviation of 42 percent. The stock of Wildcat Co. has an expected return of 12 percent and a standard deviation of 57 percent. The correlation between the two stocks is .25. Is

> Asset K has an expected return of 10 percent and a standard deviation of 28 percent. Asset L has an expected return of 7 percent and a standard deviation of 18 percent. The correlation between the assets is .40. What are the expected return and standard

> What are the expected return and standard deviation of the minimum variance portfolio in Problem 16? Data from Problem 16: Consider two stocks, stock D, with an expected return of 13 percent and a standard deviation of 31 percent, and stock I, an inter

> Consider two stocks, stock D, with an expected return of 13 percent and a standard deviation of 31 percent, and stock I, an international company, with an expected return of 16 percent and a standard deviation of 42 percent. The correlation between the t

> Fill in the missing information assuming a correlation of .30. Portfollo Welghts Stocks Bonds Expected Return Standard Devlatlon 1.00 12% 21% .80 .60 .40 .20 .00 7% 12%

> In Problem 12, what are the expected return and standard deviation on the minimum variance portfolio? Data from Problem 12: Use the following information to calculate the expected return and standard deviation of a portfolio that is 50 percent invested

> Ms. Yamisaka has determined that the average monthly return of another Mega client was 1.63 percent during the past year. What is the annualized rate of return? a. 5.13 percent b. 19.56 percent c. 21.41 percent

> Use the following information to calculate the expected return and standard deviation of a portfolio that is 50 percent invested in 3 Doors, Inc., and 50 percent invested in Down Co.: 3 Doors, Inc. Down Co. Expected return, E(R) 14% 10% Standard d

> Given the following information, calculate the expected return and standard deviation for a portfolio that has 35 percent invested in stock A, 45 percent in stock B, and the balance in stock C. Returns Probablity of State of Economy State of Econom

> You find that the one-, two-, three-, and four-year interest rates are 4.2 percent, 4.5 percent, 4.9 percent, and 5.1 percent. What is the yield to maturity of a four year bond with an annual coupon rate of 6.5 percent? Hint: Use the bootstrapping techni

> One method used to obtain an estimate of the term structure of interest rates is called bootstrapping. Suppose you have a one-year zero coupon bond with a rate of r1 and a two-year bond with an annual coupon payment of C. To bootstrap the two-year rate,

> You find a bond with 19 years until maturity that has a coupon rate of 8 percent and a yield to maturity of 7 percent. What is the Macaulay duration? The modified duration?

> Assume the bond in Problem 27 has a yield to maturity of 7 percent. What is the Macaulay duration now? What does this tell you about the relationship between duration and yield to maturity? Data from Problem 27: A bond with a coupon rate of 8 percent s

> A bond with a coupon rate of 8 percent sells at a yield to maturity of 9 percent. If the bond matures in 10 years, what is the Macaulay duration of the bond? What is the modified duration?

> What is the dollar value of an 01 for the bond in Problem 23? Data from Problem 23: What is the Macaulay duration of a 7 percent coupon bond with five years to maturity and a current price of $1,025.30? What is the modified duration?

> In Problem 23, suppose the yield on the bond suddenly increases by 2 percent. Use duration to estimate the new price of the bond. Compare your answer to the new bond price calculated from the usual bond pricing formula. What do your results tell you abou

> What is the Macaulay duration of a 7 percent coupon bond with five years to maturity and a current price of $1,025.30? What is the modified duration?

> Mr. Spice asks Mr. Myers to quantify the value changes from changes in interest rates. To illustrate, Mr. Myers computes the value change for the fixed-rate note. He assumes an increase in interest rates of 100 basis points. Which of the following is the

> You’ve just found a 10 percent coupon bond on the market that sells for par value. What is the maturity on this bond?

> LKD Co. has 8 percent coupon bonds with a YTM of 6.8 percent. The current yield on these bonds is 7.4 percent. How many years do these bonds have left until they mature?

> For the bond referred to in Problem 14, what would be the realized yield if it were held to maturity? Data from Problem 14: A zero coupon bond with a 6 percent YTM has 20 years to maturity. Two years later, the price of the bond remains the same. What’

> Soprano’s Spaghetti Factory issued 25-year bonds two years ago at a coupon rate of 7.5 percent. If these bonds currently sell for 108 percent of par value, what is the YTM?

> Great Wall Pizzeria issued 10-year bonds one year ago at a coupon rate of 6.20 percent. If the YTM on these bonds is 7.4 percent, what is the current bond price?

> Ghost Rider Corporation has bonds on the market with 10 years to maturity, a YTM of 7.5 percent, and a current price of $938. What must the coupon rate be on the company’s bonds?

> Based on the spot rates in Problem 21, and assuming a constant real interest rate of 2 percent, what are the expected inflation rates for the next four years?

> Based on the spot interest rates in the previous question, what are the following forward rates, where fk,1 refers to a forward rate beginning in k years and extending for 1 year? f21 = ; fa =

> Consider the following spot interest rates for maturities of one, two, three, and four years. What are the following forward rates, where f1, k refers to a forward rate for the period beginning in one year and extending for k years? , = 4.3% r2 =

> According to the pure expectations theory of interest rates, how much do you expect to pay for a five-year STRIPS on November 15, 2016? How much do you expect to pay for a two-year STRIPS on November 15, 2018? Data for Problem 17: U.S. Treasury STRIPS,

> What is Vega’s geometric average return over the five-year period? a. 7.85 percent b. 9.00 percent c. 15.14 percent

> What is the cost of capital that Ms. Nguyen used for her valuation of Country Point? a. 18 percent b. 17 percent c. 15 percent

> What is the yield of the November ’17 STRIPS expressed as an EAR? Data for Problem 15: U.S. Treasury STRIPS, close of business November 15, 2015: Maturity Price Maturity Price November '16 99.471 November '19 95.035 November '1

> The treasurer of a large corporation wants to invest $20 million in excess short-term cash in a particular money market investment. The prospectus quotes the instrument at a true yield of 3.15 percent; that is, the EAR for this investment is 3.15 percent

> A Treasury bill purchased in December 2016 has 55 days until maturity and a bank discount yield of 2.48 percent. What is the price of the bill as a percentage of face value? What is the bond equivalent yield?