Question: Ashley Travis, of Harrisburg, Illinois, is in

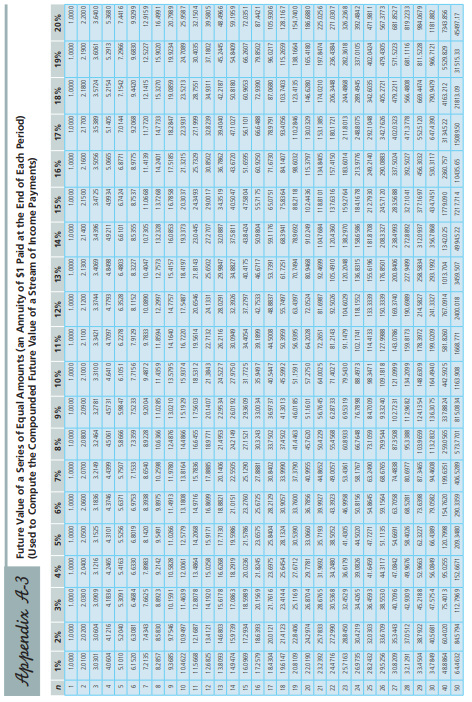

Ashley Travis, of Harrisburg, Illinois, is in the 25 percent marginal tax bracket and is considering the tax consequences of investing $2,000 at the end of each year for 30 years in a tax-sheltered retirement account, assuming that the investment earns 8 percent annually.

(a) How much will Ashley’s account total over 30 years if the growth in the investment remains sheltered from taxes?

(b) How much will the account total if the investments are not sheltered from taxes?

(Hint: Use Appendix A-3 or the Garmim/Forgue companion website.)

Appendix A-3:

Continue to next page..

Transcribed Image Text:

E SIS IE 60YIRIZ PZ IZ RIO DOE 806 911 E8OS 18 10 s 6S O 1299 25I 696 ZII 958 EEL ZIZ ERIE USE IE ISL DREZ POL EIOI ELEE 55065 ISE9 61 E 10 SL IZL 6 606 06 IE DES 4347451 LEGOZIE 2661 1 6020 61 189 SO 690 86 ZEDE 9S 26912LE PEBS BSZ ZLBE BLI 6DE9 I ISEIDZI 6596E0I SE28 8GE9 EL E996 25 88IZ S Z6LBE POSEE ERZ 618 6060 061 660 EI 182S 6006 2 ZISOLE 162 12E 681.1116 LZ58 189 EZE OZO OS ZEE 國 EGGBEZ 6660 I2I IEZZZOI 80S EL8 原 9BLO EI 850L E9 1699 S 960L D EHESE 60Z 80E ELLE L95 EBBO D OZ IES LZE EROZ 1O58 LI GEEE OSI 51.1135 LIIE Ot ZEE6 109.181 8 60 0L8 195I 65 38.5530 60L 9EE 9SZSZ EDE OZE ZE 405.2721 127.9988 I 186 I2E SE09 ZE 240.2140 DE 6LZ IZ 80L 818I 9619 55I GEEE EEI 650 IEL SH98 S 47.7271 6S9 1 E6S E 114.4133 213.9776 192651 118. 1552 ILI Z0I 6I'16 Z ZE S010ZEE SLOBZ SIEB DEI ELE 88 86 8L9L 9518 0S OZOS 6IZVOE SEL 69Z B1 Z PI09 TRI 6209 DO1 61E569 19 ES SO'I 619 IZZ IORI 91 E9LEI 89ES DE 81.2143 sz009 19 Z LS00 E 43.3923 ZSOS BE 236. 4384 628733 71 A027 244716 272990 10 18811 1047681 66 26 2960 18 2266 6 2606'IE 0889 981 GZE ODE I 26LE SII 医て01 eso 10911S 029 SS66 D 958L SE 0990 EE 8821 18 IGER 1991 I SEIPZI 209 6 2606 26 19 16S1' IS 109 06E2E 00 E 06ES D 6911 61 2911'8I 658 SII EON TOI 950VE6 19E852 ISZL'19 65E S EI DFI 0666 EE L506 DE EI E EZIFIZ 1961 90E6 501 LIZO 96 080 8 16L6 DEL9'IL 16L ES LEBB 800S 9 19L'IZ IZI OoZ FOE 8I 40.5447 LE L69E E00EE ZOSLEE ZO8 DE 6ZIZ BE SL69 EZ 874421 ZOS8 L OS26 D9 EES 668I BE 2O6 SE 6951 D EGE 981 5T2I 303243 1888 27 06ZI SZ 91 ISED Z ESG D9 101 195 S IS SLIF O 31.7725 60 9E6Z 26 1092 SO E IZS I22 09LZ EZ SEZO DZ 6865 BI PEGTLI 696 091 6561'65 0818 OS LIBSLE LZ88 E 9BE TE 60 DE SOSS ZZ ISIO'IZ 6162 BI E980 21 149474 159739 996 298L DE 42.2187 6亿 61 SEDE L88 OZE 1620 BZ ES6VIZ 2295 34 IZ88 BI DEIL21 8929 91 BL19SI 138093 146803 EI 2050 201407 SS991 6600 91 L16 SI 37.1802 OSI'ZE SEO DE 1SSL B 6ZEL SZ 243493 S中OEZ 18.5312 E0 952I SEBL SI 9126 I 8902 98 EI 8L08 ZI 289 IZI 8995SI 21.8143 SIZE IZ 9 I 1918TI 1900 ZI 26601 68'0 6580 61 85891 ES8 091 2SI SI 0I ZOE I BZ8S DI 589E6 182847 17.5185 10. 1591 0206 SI OZE SI S ZI 2662 21 9 901 16S6 SIFI ZI 89901| SON LOI EEBL 6 BEGE B ER82 74343 72135 66266 DEB9 6 890 26 LESLB SSE SB LZZE B 6Z162 6SE EL EESI2 ESL69 61089 DEE9 9 180E9 0ZS 19 9 75233 9 IWL 101 99 8rSE 9 865 99985 1 60ES 010 IS loES EI6ZS SIZS SO I'S PE 66 BE O IM 00IEE 190 5 4 1836 6060 E 3.1216 IELS 9IZ I 09 0 1909 E ISE 68E SE 950SE 96EVE 690E HLEE SZSI E 18LZE IZE SEBIT 10E DE 0061Z 008I Z 004 IZ 00917 00SIZ 0001'z 0000 I 0011Z 00 60Z 0090 Z 0 DED Z 002 0 00102 0000I 0000' 0000'1 00001 0000'I 00001 00001 0000'I 00001 00001 00 001 00001 0000' 0000' 0000' 0000' 0000'1 00001 00001 %0Z %61 %81 %91 %SL % EL %0L %6 %9 %S %E (Used to Compute the Compounded Future Value of a Stream of Income Payments) Future Value of a Series of Equal Amounts (an Annuity of $1 Paid at the End of Each Period) Appendix A-3

> What are typical operations that may be performed on a directory?

> Why is the average search time to find a record in a file less for an indexed sequential file than for a sequential file?

> List and briefly define five file organizations.

> What criteria are important in choosing a file organization?

> What is a file management system?

> What is the difference between a file and a database?

> What is the difference between a field and a record?

> List and briefly define four different clustering methods.

> Briefly define feedback scheduling.

> Briefly define highest-response-ratio-next scheduling.

> Briefly define shortest-remaining-time scheduling.

> What is the typical disk sector size?

> Briefly define the seven RAID levels.

> Briefly define the disk scheduling policies illustrated in Figure 11.7. Figure 11.7: 100 125 150 175 199 Time (a) FIFO 25 50 100 125 150 175 199 Time (h) SSTF 50 75 100 125 150 175 199 Time (c) SCAN 50 100 125 150 175 199 Time (d) C-SCAN Figure 11.7

> What delay elements are involved in a disk read or write?

> Why would you expect improved performance using a double buffer rather than a single buffer for I/O?

> What is the difference between block-oriented devices and stream-oriented devices? Give a few examples of each.

> What is the difference between logical I/O and device I/O?

> List some benefits and disadvantages of synchronous and asynchronous RPCs.

> List and briefly define three techniques for performing I/O.

> What items of information about a task might be useful in real-time scheduling?

> List and briefly define four classes of real-time scheduling algorithms.

> List and briefly define five general areas of requirements for a real-time operating system.

> What is the difference between periodic and aperiodic real-time tasks?

> What is the difference between hard and soft real-time tasks?

> List and briefly define three versions of load sharing.

> List and briefly define four techniques for thread scheduling.

> List and briefly define five different categories of synchronization granularity.

> Briefly define shortest-process-next scheduling.

> List some benefits and disadvantages of nonpersistent and persistent binding for RPCs.

> Briefly define round-robin scheduling.

> Briefly define FCFS scheduling.

> What is the difference between preemptive and nonpreemptive scheduling?

> For process scheduling, does a low-priority value represent a low priority or a high priority?

> What is the difference between turnaround time and response time?

> What is usually the critical performance requirement in an operating system?

> Briefly describe the three types of processor scheduling.

> What is the difference between a resident set and a working set?

> Why is it not possible to combine a global replacement policy and a fixed allocation policy?

> What is accomplished by page buffering?

> List some benefits and disadvantages of blocking and non-blocking primitives for message passing.

> Discuss some of the reasons for implementing process migration.

> Jose and Gabriela Perez, of Bridgewater, Virginia, hope to sell their large home for $380,000 and retire to a smaller residence valued at $150,000. After hey sell the property, they plan to invest the $200,000 in equity remaining after selling expenses a

> Insurance Victor and Maria’s next-door neighbor, Ray Jackson, was recently sued over an automobile accident and eventually was held liable for $437,000 in damages. Ray’s automobile policy limits were 100/300/50. Because of the shortfall, he had to sell h

> Jackie Facet of Auburn, Alabama, age 60, was planning on retirement and investing well for it because he now has $400,000 in his retirement accounts and would likely to have doubled that by age 67. But, he became permanently disabled after getting into a

> Shanice Johnson, of Philadelphia, Pennsylvania, wants to invest $4,000 annually for her retirement 30 years from now. She has a conservative investment philosophy and expects to earn a return of 3 percent in a tax-sheltered account. If she took a more ag

> Janet Brooks, of Amarillo, Texas, plans to invest $3,000 each year in a mutual fund for the next 40 years to accumulate savings for retirement. Her twin sister, Rebecca, plans to invest the same amount for the same length of time in the same mutual fund.

> Brenda and Dan Domico, of Weatherford, Texas, desire an annual retirement income of $40,000. They expect to live for 30 years past retirement. Assuming that the couple could earn a 3 percent after-tax and after-inflation rate of return on their investmen

> Over the years, Ahmed and Aamina El-zayaty, of Berkeley, California, have accumulated $200,000 and $220,000, respectively, in their employer-sponsored retirement plans. If the amounts in their two accounts earn a 6 percent rate of return over Ahmed and A

> Discounted Cash Flow to Estimate Price, and give your opinion on which part of the assumptions (rent increase or sales price) is more subject to poor thinking.

> Marianne Mooney, benefits manager and her sister, Laureen, a middle-school teacher from Pompano Beach, Florida, are interested in the numbers of real estate investments. They have reviewed the figures in Table 16-2 on page 499 and are impressed with inve

> Calculate the price-to-rent ratios for the following properties arranged by price of home followed by likely annual rental income: (a) $400,000/$40,000; (b) $300,000/$36,000; (c) $200,000/30,000.

> Last year David McCullough of La Junta, Colorado, bought the XYZ mutual fund, which has total assets of $240 million, liabilities of $10 million, and 15 million shares outstanding. (a) What is the net asset value? (b) If the current price is $18, is this

> Several years have passed since the Johnsons were married, and their financial affairs have become more complicated. They recently purchased a $200,000 condominium that has added only about $400 per month to their housing expenses. And they have purchase

> Two years ago, Izabella Martinez, from Atlanta, Georgia, invested $1,000 by buying 125 shares ($8 per share NAV) in the Can’t Lose Mutual Fund, an aggressive growth no-load mutual fund. Last year, she made two additional investments of $500 each (50 shar

> A year ago, George Jetson, from Orbit City, Texas, invested $1,000 by buying 100 shares of the Can’t Lose Mutual Fund, an aggressive growth no-load mutual fund. George reinvested his dividends, so he now has 112 shares. So far, the NAV for George’s inves

> Your neighbor, Kitty Kardashian, of Philadelphia, Pennsylvania, bought $5,000 worth of mutual funds with a back-end load of 5 percent if she sells within the first year. It decreases 1 percent a year afterward. (a) If Kitty sells during the third year, h

> Michael Margolis is a single parent and motivational training consultant from Palatine, Illinois. He is wondering about potential returns on investments given certain amounts of risk. Michael invested a total of $6,000 in three stocks ($2,000 in each) wi

> A corporate bond maturing in 22 years with a coupon rate of 8.2 percent was purchased for $1,100 and is now selling for $1,190. (a) What is its current yield? (b) Calculate the bond’s YTM using Equation (14.5) or the Garman/ Forgue comp

> For a municipal bond paying 3.4 percent for a taxpayer in the 25 percent tax bracket, what is the equivalent taxable yield? (Hint: See page 140.) Page 140: //

> A stock sells at $15 per share. (a) What is the EPS for the company if it has a P/E ratio of 20? (b) If the company’s dividend yield is 3 percent, what is its dividend per share? (c) What is the book value of the company if the price-to-book ratio is 1.5

> Xiao and Shiao Jing-jian, newlyweds from Laramie, Wyoming, have decided to begin investing for the future. Xiao is a 7-Eleven store manager, and Shiao is a high-school math teacher. The couple intends to take $3,000 out of their savings for investment pu

> A corporate bond maturing in 15 years with a coupon rate of 9.9 percent was purchased for $980 and it now selling for $1,010. (a) What is its current yield? (b) What will be its selling price in two years if comparable market interest rates drop 1.9 perc

> For a municipal bond paying 3.7 percent for a taxpayer in the 33 percent tax bracket, what is the equivalent taxable yield?

> Enlai Li Zhang of Los Angeles, California recently bought a home for $700,000. The previous owner had a $600,000 HO-1 policy on the property, and Enlai can simply pay the premiums to keep the same coverage in effect. Her insurance agent called her and ca

> What is the market price of a $1,000, 8 percent bond if comparable market interest rates rise to 10 percent and the bond matures in 14 years?

> What is the market price of a $1,000, 8 percent bond if comparable market interest rates drop to 6 percent and the bond matures in 15 years?

> Kunal Nayyar from London, had $50,000 in investments in the USA at the beginning of the year that consisted of a diversified portfolio of stocks (40 percent), bonds (40 percent), and cash equivalents (20 percent). His returns over the past 12 months were

> Jordan and Jeremy, who are twins living in Concord, New Hamphire, took different approaches to investing. Jordan saved $2,000 per year for ten years starting at age 23 and never added any more money to the account. Jeremy saved $2,000 per year for 20 yea

> If one year of college currently costs $25,000, how much will it cost Grand Rapids, Michigan’s resident Michelle Spindle to pay for one year of schooling for newborn daughter, Melissa, 18 years from now, assuming a 5 percent annual rate

> Mary Cooper, Sheldon’s mother, who lives in east Texas, wants to help pay for her grandchild’s education. How long will it take Mary to reach her goal of $200,000 if she invests $10,000 per year, earning 6 percent? Use

> Sheldon Cooper and Amy Fowler are married and live in Pasadena, California. They have as a new investment goal to create a college fund for their newborn daughter. They estimate that they will need $200,000 in 18 years. Assuming that the Cooper-Fowler fa

> Alexandra Cunningham of Gardner, Massachusetts, has a $100,000 participating cash-value policy written on her life. The policy has accumulated $4,700 in cash value; Alexandra has borrowed $3,000 of this value. The policy also has accumulated unpaid divid

> Matthew Kennedy of Urbana, Ohio, is single and has been working as an admissions counselor at a university for five years. Matthew owns a home valued at $250,000 on which he owes $135,000. He has a two-year-old vehicle valued at $32,000 on which he owes

> Amy and Mack Holly from Rapid City, South Dakota, have been married for three years. They recently bought a home costing $212,000 using a $190,000 mortgage. They have no other debts. Mack earns $62,000 per year, and Amy earns $71,000. Each has a retireme

> You have been talking at a party to some friends about insurance. One young married couple in the group believes that insurance is almost always a real waste of money. They argue, “The odds of most bad events occurring are so low that you don’t need to w

> Christina Haley of Elko, Nevada, age 57, recently suffered a stroke. She was in intensive care for 3 days and was hospitalized for 10 more days. Her total bill for this care was $125,500. After being discharged from the hospital, she spent 25 days in a n

> Michael Howitt of Berkley, Michigan, recently had his gallbladder removed. His total bill for this surgery, which was his only health care expense for the year, came to $13,890. His health insurance plan has a $500 annual deductible and an 80/20 coinsura

> Social Security Disability Protection. Sandra Hilton of Sisseton, South Dakota, age 60, recently was in a vehicle accident, was hospitalized, and then suffered a heart attack. She took a leave of absence from her longtime job as a data analyst for an env

> Ashley Diamond of Estes Park, Colorado, drives an eight-year-old Toyota valued at $5,600. She has a $75,000 personal automobile policy with $10,000 per-person medical payments coverage and both collision ($200 deductible) and comprehensive coverage. Davi

> Colton Gentry of Lancaster, California, has owned his home for ten years. When he purchased it for $178,000, Colton bought a $160,000 homeowner’s insurance policy. He still owns that policy, even though the replacement cost of the home is now $300,000. (

> Toula and Ian Miller of Gainesville, Florida, recently suffered a fire at their home. The fire, which began in a crawl space at the back of the house, caused $50,000 of damage to the dwelling itself. Their garage, valued at $20,000, was totally destroyed

> Bill Converse of Rexburg, Idaho, recently had his truck slide off a gravel road and strike a tree. Bill’s vehicle suffered $17,500 in damage. The truck has a book value of $40,000. Bill carried collision insurance with a $500 deductible. How much will Bi

> Heather McIntosh of Watertown, South Dakota, recently purchased a home for $190,000. She put $25,000 down and took out a 25-year loan at 5.5 percent interest. a) Use Table 9-4 on page 285 to determine her monthly payment. Table 9-4: (b) How much of he

> Kevin Tutumbo of Terre Haute, Indiana, has owned his home for 15 years and expects to live in it for a least five more. He originally borrowed $135,000 at 6 percent interest for 30 years to buy the home. He still owes $96,000 on the loan. Interest rates

> Alex Guadet of Nashville, Tennessee, has been renting a two-bedroom house for several years. He pays $900 per month in rent for the home and $300 per year in property and liability insurance. The owner of the house wants to sell it, and Alex is consideri

> Michael Joseph and Maggi Lewis of Saluda, Virginia, are trying to decide whether to rent or purchase housing. Michael favors buying and Maggi leans toward renting, and both seem able to justify their particular choice. Michael thinks that the tax advanta

> Seth and Alexandra Moore of Elk Grove Village, Illinois have an annual income of $110,000 and want to buy a home. Currently, mortgage rates are 5 percent. The Moores want to take out a mortgage for 30 years. Real estate taxes are estimated to be $4,800 p

> Dave and Diane Starr of New Orleans, Louisiana, both of whom are in their late 20s, currently are renting an unfurnished two-bedroom apartment for $1,200 per month, plus $230 for utilities and $34 for insurance. They have found a condominium they can buy

> Yvonne Moody of Dallas, Texas, is a 34-year-old police detective earning $58,000 per year. She and her husband, Joshua, who is a public school teacher earning $44,000, have two children in elementary school. They own a modestly furnished home and two lat

> Nicci Denny, age 40, single, and from Colorado Springs, Colorado, is trying to estimate the amount she needs to save annually to meet her retirement needs. Nicci currently earns $65,000 per year. She expects to need 80 percent of her current salary to li

> Harry Johnson’s father, William, was recently forced into early retirement at age 63 because of poor health. In addition to the psychological drawbacks of the unanticipated retirement, William’s financial situation is

> Julia is now in her early 50s. She has had three jobs in her career so far and participated fully in the defined contribution retirement plans offered by her employers. When she left her last position, she rolled her retirement account over to the accoun

> Victor, now age 61, and Maria, age 59, plan to retire at the end of the year. Since his employer changed from a defined-benefit retirement plan to a defined-contribution plan ten years ago, Victor has been contributing the maximum amount of his salary to

> Jonathan Clark and Cody Adams, longtime dental partners in Basking Ridge, New Jersey, have bought and sold real estate properties for ten years. They have profited on many transactions, although they did have some substantial losses during the last reces

> Jeremy Jorgensen of Lawton, Oklahoma, is concerned about the costs involved in selling his home, so he has decided to sell his home himself rather than pay a broker to do it. Required: (a) How would you advise Jeremy if he asked you whether he should se

> Keisha Williams, a senior research analyst in San Bernardino, California, has bought and sold high-technology stocks profitably for years. Lately some of her stock investments have done quite poorly, including one company that went bankrupt. Emily, a lon

> Julia continues to be a hard worker and, at age 60, has saved and invested wisely for her planned financially successful retirement. She has an extra $15,000 in a cash management account beyond what she needs for emergency savings. She rejected options a

> Victor and Maria Hernandez are thinking about selling her mother’s home, which she recently inherited, and use the proceeds to enhance their investments for retirement. Its price increased to about today’s value of $300,000. The home is fully paid for.

> Harry and Belinda Johnson are considering purchasing a residential income property as an investment. The Johnsons want to achieve an after-tax total return of 7 percent. They are considering a property with an asking price of $190,000 that should produce