Question: Victor, now age 61, and Maria, age

Victor, now age 61, and Maria, age 59, plan to retire at the end of the year. Since his employer changed from a defined-benefit retirement plan to a defined-contribution plan ten years ago, Victor has been contributing the maximum amount of his salary to several different mutual funds offered through the plan, although his employer never matched any of his contributions. Victor’s tax-sheltered account, which now has a balance of $300,000, has been growing at a rate of 7 percent through the years. Under the previous defined-benefit plan, today Victor is entitled to a single-life pension of $360 per month ($4,320 annually) or a joint and survivor option paying $240 per month ($2,880 annually). The value of Victor’s investment of $20,000 in Pharmacia stock some years ago has now grown to $56,000. Maria’s earlier career as a medical records assistant provided no retirement program, although she did save $10,000 through her credit union, which was later used to purchase zero-coupon bonds now worth $28,000. Maria’s second career as a pharmaceutical representative for Pharmacia allowed her to contribute to her retirement account over the past nine years, which is now worth $98,000. Pharmacia matched a portion of her contributions, and that match is now worth $70,000; its growth rate has ranged from 6 to 10 percent each year. When Maria’s mother died last year, Maria inherited her home, which is rented for $1,800 per month; the house has a market value of $300,000. The Hernandezes’ personal residence is worth $260,000. They pay combined federal and state income taxes at a 30 percent rate.

Required:

(a) Sum up the present values of the Hernandezes’ assets, excluding their personal residence, and identify which assets derive from tax-sheltered accounts.

(b) Assume that the Hernandezes sold their stocks, bonds, and rental property, realizing a gain of $34,000 after income taxes and commissions. If that sum plus their tax-sheltered accounts earned a 7 percent rate of return over the Hernandezes’ anticipated 20 years of retirement, how large an amount could be withdrawn each month? How large an amount could be withdrawn each month if they needed the money over 30 years? How large an amount could be withdrawn each month if the proceeds earned 6 percent for 20 years? For 30 years?

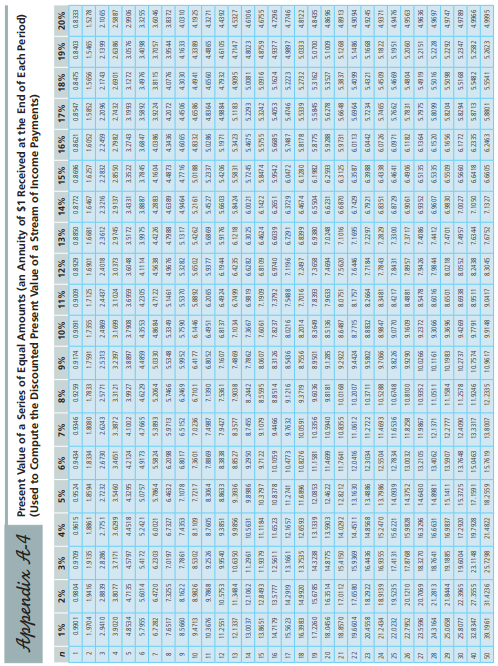

Hint: Use Appendix A4.

Appendix A4:

Continue to next page…

Transcribed Image Text:

5666 EZS ISSS E 50999 ZEI2 166 196 01 12.2335 2008EI 61SI 9EZVIE 1961 BE 182559 21.4822 9966 ZBBSS El LBS SE EZ9 BI199 0S DI 2 BEEB I 56B 16L6 LIEE EI 15.0463 SZZESI 即IEZ 555E LZ DEBZE PEZS 89 IS5 2550 B BE EAB LELZ DI DEDY ZI 596E ZZ UDE SZ DE DOZRS DE RE9 BI ZDR ERGI DI ZD6G EI I IN SI LER6 91 SBBI 61 2696 91 0S S 66 08S SEES 9 20969 862 7.44 12 91 098 990E 6 1911 DI 12.1371 290 EI 50 IZ EI 1 68I 1E99 91 IL BI 19LER SE 96 19EI 9 SE IS9 25 E69 BLISB 9.2372 992D DI ZSEG DI 7.4086 2986 I DE9I DL ZE BI 690L DE 965S EZ 7.9426 DOS IERS 19069 IBB 60916 06 26 6 DOIBDI ZE DO EI DIZI DZ 中9 5.1951 69S 60S 29S 19.5235 ZEZO ZZ 6E60I IE I24 7.3300 ZBIS BEE9 ISEB 9 990L6 114693 DEDEZI 112722 Z100' 986LEI SSE6 91 8.3481 89915 6.0442 B8 BE 9 IZL9 ZEBBB I LEDI 5.4321 98EI ZZEZBI 5.7234 1606 1960S El 109 LBSED SEDI2 SILL'B 12.0416 DE 9I EI 22 EI 68 5.1268 LEBES 600IS 99S IEL6S SZIE9 91012 ISLOB 89 100I SEB DI 1282 12 E DES EI ZI 1021 154150 PI SE9I 9698 LZSES BLZ95 BEZ65 EES79 IEZ99 EE96L SEI SB IBIBE 10.9940 9SEE DI 74694 SLLE 950 BI DZ 48435 DOLDS 291 ES S855 ZE6 I'9 DEE 69 BEDEL EBE BL SE DO6 ES BO ZI 6EEI EI BEZEM SB19 5I 61 EEEDS 6EESS BLIBS 66ER9 95 9LZB DI 48122 1650 DI SESEI ERGE DI BI 52732 96112 7.5的8 9120B LE ZB2 5.2223 91216 ELLPOI 1991 EI 616Z LLEG 2915 E SOS ZI565 BEDO 9 6.9740 ZELEZ KIEB 9.4466 65DI DI BLEB DI EZ 59I I 195ZI LLLSEI 91 9160S ZRES 60 IB9 E0 612 19092 26LEDI 11.1184 196211 SI 9019 EZDB I B00S SZDE9 ZR299 61 R69 98686 IEDS DI 12.1062 LE DOEI ZEE I 21 47147 S606 5.3423 IEBSS BI ZI9 SEZ9 669 7.10 34 6.49 24 LE IB9 BE062 LUSEB 95866 OS E9 DI El 11.384 SD 19 ZEL ED 995 L165 Z0912 1 SES2 BE BE B EESE B ISBE6 ESLS DI 19ER LEEZS DEI2 NDEDI 4 1925 68EE ZE EB 8 10S 1912S 29S 26 88S 109E2 601 I'8 ZDES B 94713 09958 6. 1446 4.03 10 EE 91 DE DE 90 S909 91 L 4.9164 2IEIS 5.3282 OLES S 06LS Z5665 629 ZSI 59 BLOI 2 74353 198L 2 ZLEBE 56E 43436 EL B 6BE9 195 EEES ES S EILES 4.2072 LZEL'9 26102 55ZEZ 4.7988 6.4632 SI IBE BED ERRZ BE9S 4断4 DE EDS EEBES IZD09 EDEZ 9 6.4720 S56L'S 268S E SPT SL66E SOEZ ESSE EL 16 3.3255 9 90 667 SDE E66I E EZE 3.3522 IEEFE ZL ISE 6569E B06LE LEBBE 56ZE 3.1272 BISY SE IL 4.1002 48534 ZENZ 29137 23216 ZIDEZ 1899 ELEDE EDIE EED L'E LEEZE 3.3121 こEE 3.5460 6629'E ZEZLZ DZDEE 66EI Z ZEBZZ BIDVZ EIESZ DEL9Z BE BRZ Z5091 度91 1069 1.7125 SSE L'I 1662 EE LI 65 26D 18334 16581 19881 19135 91161 2. EEE BD E印建BD 12980 16060 NIED 5196D EDLED I DEG D 0.9346 09434 %07 %61 %8L %91 %SL %EL %0L %6 %8 %9 % %E (Used to Compute the Discounted Present Value of a Stream of Income Payments) Appendix A-4 Present Value of a Series of Equal Amounts (an Annuity of $1 Received at the End of Each Period)

> Brenda and Dan Domico, of Weatherford, Texas, desire an annual retirement income of $40,000. They expect to live for 30 years past retirement. Assuming that the couple could earn a 3 percent after-tax and after-inflation rate of return on their investmen

> Over the years, Ahmed and Aamina El-zayaty, of Berkeley, California, have accumulated $200,000 and $220,000, respectively, in their employer-sponsored retirement plans. If the amounts in their two accounts earn a 6 percent rate of return over Ahmed and A

> Ashley Travis, of Harrisburg, Illinois, is in the 25 percent marginal tax bracket and is considering the tax consequences of investing $2,000 at the end of each year for 30 years in a tax-sheltered retirement account, assuming that the investment earns 8

> Discounted Cash Flow to Estimate Price, and give your opinion on which part of the assumptions (rent increase or sales price) is more subject to poor thinking.

> Marianne Mooney, benefits manager and her sister, Laureen, a middle-school teacher from Pompano Beach, Florida, are interested in the numbers of real estate investments. They have reviewed the figures in Table 16-2 on page 499 and are impressed with inve

> Calculate the price-to-rent ratios for the following properties arranged by price of home followed by likely annual rental income: (a) $400,000/$40,000; (b) $300,000/$36,000; (c) $200,000/30,000.

> Last year David McCullough of La Junta, Colorado, bought the XYZ mutual fund, which has total assets of $240 million, liabilities of $10 million, and 15 million shares outstanding. (a) What is the net asset value? (b) If the current price is $18, is this

> Several years have passed since the Johnsons were married, and their financial affairs have become more complicated. They recently purchased a $200,000 condominium that has added only about $400 per month to their housing expenses. And they have purchase

> Two years ago, Izabella Martinez, from Atlanta, Georgia, invested $1,000 by buying 125 shares ($8 per share NAV) in the Can’t Lose Mutual Fund, an aggressive growth no-load mutual fund. Last year, she made two additional investments of $500 each (50 shar

> A year ago, George Jetson, from Orbit City, Texas, invested $1,000 by buying 100 shares of the Can’t Lose Mutual Fund, an aggressive growth no-load mutual fund. George reinvested his dividends, so he now has 112 shares. So far, the NAV for George’s inves

> Your neighbor, Kitty Kardashian, of Philadelphia, Pennsylvania, bought $5,000 worth of mutual funds with a back-end load of 5 percent if she sells within the first year. It decreases 1 percent a year afterward. (a) If Kitty sells during the third year, h

> Michael Margolis is a single parent and motivational training consultant from Palatine, Illinois. He is wondering about potential returns on investments given certain amounts of risk. Michael invested a total of $6,000 in three stocks ($2,000 in each) wi

> A corporate bond maturing in 22 years with a coupon rate of 8.2 percent was purchased for $1,100 and is now selling for $1,190. (a) What is its current yield? (b) Calculate the bond’s YTM using Equation (14.5) or the Garman/ Forgue comp

> For a municipal bond paying 3.4 percent for a taxpayer in the 25 percent tax bracket, what is the equivalent taxable yield? (Hint: See page 140.) Page 140: //

> A stock sells at $15 per share. (a) What is the EPS for the company if it has a P/E ratio of 20? (b) If the company’s dividend yield is 3 percent, what is its dividend per share? (c) What is the book value of the company if the price-to-book ratio is 1.5

> Xiao and Shiao Jing-jian, newlyweds from Laramie, Wyoming, have decided to begin investing for the future. Xiao is a 7-Eleven store manager, and Shiao is a high-school math teacher. The couple intends to take $3,000 out of their savings for investment pu

> A corporate bond maturing in 15 years with a coupon rate of 9.9 percent was purchased for $980 and it now selling for $1,010. (a) What is its current yield? (b) What will be its selling price in two years if comparable market interest rates drop 1.9 perc

> For a municipal bond paying 3.7 percent for a taxpayer in the 33 percent tax bracket, what is the equivalent taxable yield?

> Enlai Li Zhang of Los Angeles, California recently bought a home for $700,000. The previous owner had a $600,000 HO-1 policy on the property, and Enlai can simply pay the premiums to keep the same coverage in effect. Her insurance agent called her and ca

> What is the market price of a $1,000, 8 percent bond if comparable market interest rates rise to 10 percent and the bond matures in 14 years?

> What is the market price of a $1,000, 8 percent bond if comparable market interest rates drop to 6 percent and the bond matures in 15 years?

> Kunal Nayyar from London, had $50,000 in investments in the USA at the beginning of the year that consisted of a diversified portfolio of stocks (40 percent), bonds (40 percent), and cash equivalents (20 percent). His returns over the past 12 months were

> Jordan and Jeremy, who are twins living in Concord, New Hamphire, took different approaches to investing. Jordan saved $2,000 per year for ten years starting at age 23 and never added any more money to the account. Jeremy saved $2,000 per year for 20 yea

> If one year of college currently costs $25,000, how much will it cost Grand Rapids, Michigan’s resident Michelle Spindle to pay for one year of schooling for newborn daughter, Melissa, 18 years from now, assuming a 5 percent annual rate

> Mary Cooper, Sheldon’s mother, who lives in east Texas, wants to help pay for her grandchild’s education. How long will it take Mary to reach her goal of $200,000 if she invests $10,000 per year, earning 6 percent? Use

> Sheldon Cooper and Amy Fowler are married and live in Pasadena, California. They have as a new investment goal to create a college fund for their newborn daughter. They estimate that they will need $200,000 in 18 years. Assuming that the Cooper-Fowler fa

> Alexandra Cunningham of Gardner, Massachusetts, has a $100,000 participating cash-value policy written on her life. The policy has accumulated $4,700 in cash value; Alexandra has borrowed $3,000 of this value. The policy also has accumulated unpaid divid

> Matthew Kennedy of Urbana, Ohio, is single and has been working as an admissions counselor at a university for five years. Matthew owns a home valued at $250,000 on which he owes $135,000. He has a two-year-old vehicle valued at $32,000 on which he owes

> Amy and Mack Holly from Rapid City, South Dakota, have been married for three years. They recently bought a home costing $212,000 using a $190,000 mortgage. They have no other debts. Mack earns $62,000 per year, and Amy earns $71,000. Each has a retireme

> You have been talking at a party to some friends about insurance. One young married couple in the group believes that insurance is almost always a real waste of money. They argue, “The odds of most bad events occurring are so low that you don’t need to w

> Christina Haley of Elko, Nevada, age 57, recently suffered a stroke. She was in intensive care for 3 days and was hospitalized for 10 more days. Her total bill for this care was $125,500. After being discharged from the hospital, she spent 25 days in a n

> Michael Howitt of Berkley, Michigan, recently had his gallbladder removed. His total bill for this surgery, which was his only health care expense for the year, came to $13,890. His health insurance plan has a $500 annual deductible and an 80/20 coinsura

> Social Security Disability Protection. Sandra Hilton of Sisseton, South Dakota, age 60, recently was in a vehicle accident, was hospitalized, and then suffered a heart attack. She took a leave of absence from her longtime job as a data analyst for an env

> Ashley Diamond of Estes Park, Colorado, drives an eight-year-old Toyota valued at $5,600. She has a $75,000 personal automobile policy with $10,000 per-person medical payments coverage and both collision ($200 deductible) and comprehensive coverage. Davi

> Colton Gentry of Lancaster, California, has owned his home for ten years. When he purchased it for $178,000, Colton bought a $160,000 homeowner’s insurance policy. He still owns that policy, even though the replacement cost of the home is now $300,000. (

> Toula and Ian Miller of Gainesville, Florida, recently suffered a fire at their home. The fire, which began in a crawl space at the back of the house, caused $50,000 of damage to the dwelling itself. Their garage, valued at $20,000, was totally destroyed

> Bill Converse of Rexburg, Idaho, recently had his truck slide off a gravel road and strike a tree. Bill’s vehicle suffered $17,500 in damage. The truck has a book value of $40,000. Bill carried collision insurance with a $500 deductible. How much will Bi

> Heather McIntosh of Watertown, South Dakota, recently purchased a home for $190,000. She put $25,000 down and took out a 25-year loan at 5.5 percent interest. a) Use Table 9-4 on page 285 to determine her monthly payment. Table 9-4: (b) How much of he

> Kevin Tutumbo of Terre Haute, Indiana, has owned his home for 15 years and expects to live in it for a least five more. He originally borrowed $135,000 at 6 percent interest for 30 years to buy the home. He still owes $96,000 on the loan. Interest rates

> Alex Guadet of Nashville, Tennessee, has been renting a two-bedroom house for several years. He pays $900 per month in rent for the home and $300 per year in property and liability insurance. The owner of the house wants to sell it, and Alex is consideri

> Michael Joseph and Maggi Lewis of Saluda, Virginia, are trying to decide whether to rent or purchase housing. Michael favors buying and Maggi leans toward renting, and both seem able to justify their particular choice. Michael thinks that the tax advanta

> Seth and Alexandra Moore of Elk Grove Village, Illinois have an annual income of $110,000 and want to buy a home. Currently, mortgage rates are 5 percent. The Moores want to take out a mortgage for 30 years. Real estate taxes are estimated to be $4,800 p

> Dave and Diane Starr of New Orleans, Louisiana, both of whom are in their late 20s, currently are renting an unfurnished two-bedroom apartment for $1,200 per month, plus $230 for utilities and $34 for insurance. They have found a condominium they can buy

> Yvonne Moody of Dallas, Texas, is a 34-year-old police detective earning $58,000 per year. She and her husband, Joshua, who is a public school teacher earning $44,000, have two children in elementary school. They own a modestly furnished home and two lat

> Nicci Denny, age 40, single, and from Colorado Springs, Colorado, is trying to estimate the amount she needs to save annually to meet her retirement needs. Nicci currently earns $65,000 per year. She expects to need 80 percent of her current salary to li

> Harry Johnson’s father, William, was recently forced into early retirement at age 63 because of poor health. In addition to the psychological drawbacks of the unanticipated retirement, William’s financial situation is

> Julia is now in her early 50s. She has had three jobs in her career so far and participated fully in the defined contribution retirement plans offered by her employers. When she left her last position, she rolled her retirement account over to the accoun

> Jonathan Clark and Cody Adams, longtime dental partners in Basking Ridge, New Jersey, have bought and sold real estate properties for ten years. They have profited on many transactions, although they did have some substantial losses during the last reces

> Jeremy Jorgensen of Lawton, Oklahoma, is concerned about the costs involved in selling his home, so he has decided to sell his home himself rather than pay a broker to do it. Required: (a) How would you advise Jeremy if he asked you whether he should se

> Keisha Williams, a senior research analyst in San Bernardino, California, has bought and sold high-technology stocks profitably for years. Lately some of her stock investments have done quite poorly, including one company that went bankrupt. Emily, a lon

> Julia continues to be a hard worker and, at age 60, has saved and invested wisely for her planned financially successful retirement. She has an extra $15,000 in a cash management account beyond what she needs for emergency savings. She rejected options a

> Victor and Maria Hernandez are thinking about selling her mother’s home, which she recently inherited, and use the proceeds to enhance their investments for retirement. Its price increased to about today’s value of $300,000. The home is fully paid for.

> Harry and Belinda Johnson are considering purchasing a residential income property as an investment. The Johnsons want to achieve an after-tax total return of 7 percent. They are considering a property with an asking price of $190,000 that should produce

> Lola Garcia, a single mother of a 6-year-old child, works for a utility company in Baltimore, Maryland, and is willing to invest $3,000 per year in a mutual fund. She wants the investment income to supplement her retirement pension starting in approximat

> It has been over 25 years since Julia graduated with a major in aeronautical engineering, and she has been quite successful in her career as well as in managing her personal finances. She has moved up the career ladder, earns a high salary, has $50,000 i

> After learning about mutual funds, the Johnsons are confident that they are a great way to invest, especially because of the diversification and professional management that funds offer. The couple has a financial nest egg of $9,500 to invest through mut

> Victor and Maria have decided to increase their contribution to their investment portfolio since Victor is now age 59 and thinking about retiring in five years. For years, they have followed a moderate-risk investment philosophy and put their money in su

> Ji Wu of Troy, New York, has $5,000 that he wants to invest in the stock market. Ji is in college on a scholarship and does not plan to use the $5,000 or any dividend income for another five years, when he plans to buy a home. He is currently considering

> Kyle Broflovski, a high school guidance counselor in South Park, Colorado, has purchased several corporate and government bonds over the years, and his total bond investments now exceeds $40,000. He prefers investments with some inflation protection. His

> Julia has been thinking about buying a home. For several months, she has been watching real estate shows on television and visiting open houses in her community. She thinks it is time to take the plunge and buy a much larger home since she can genuinely

> Jessica Varcoe works as a drug manufacturer’s representative based in Irvine, California. She has an aggressive investment philosophy and believes that interest rates on new bonds will drop over the next year or two because of an expected economic slowdo

> Julia’s investments survived the last recession and bear stock market declines because she was well diversified and was investing more heavily in bonds in the years preceding the decline. Julia cashed out of some equities and moved most of that money int

> The investments of Harry and Belinda have done well through the years. While the cash portion of their portfolio has risen to $16,000, it is earning a minuscule 1 percent in a money market account; thus they are Required: (a) What is the current yield

> After nearly 14 years of marriage, Harry and Belinda’s finances have improved, even though they have incurred debts for an automobile loan and a condominium. Plus they now have a 5-year-old son, Benjamin. They have not yet saved enough

> It has been about 20 years since Julia graduated with a major in aeronautical engineering, and she has been quite successful in her career and her personal finances. Accordingly, she wants to sell her home and buy a luxury condominium. She has $40,000 in

> The expenses associated with sending two children through college prevented Victor and Maria Hernandez from adding substantially to their investment program. Now that their younger son, Joseph, has completed school and is working full time, they would li

> Just-married couples sometimes over-indulge in the type and amount of life insurance that they buy. Hakeem and Leshaniqua Jackson of Barstow, California, took a different approach. Both were working and had a small amount of life insurance provided throu

> Julia Price is now in her late 30s and has always wanted children. She has arranged to adopt two siblings from overseas, ages 2 and 4. Julia is happy that she earns enough money to support the children adequately, but the agency sponsoring the adoption a

> Joseph and Marcia Michael of Athens, Georgia, are a married couple in their mid-30s. They have two children, ages 5 and 3, and Marcia is pregnant with their third child. Marcia is a part-time book indexer who earned $30,000 after taxes last year. Because

> Biming Chen is a college student from Cleveland, Mississippi. Soon to graduate, Biming was approached recently by a life insurance agent, who set up a group meeting for several members of his fraternity. During the meeting, the agent presented six life i

> Estate Agents Victor and Maria have been thinking about selling their home and buying a house with more yard space so that they can indulge their passion for gardening. Before they make such a decision, they want to explore the market to see what might b

> Switching Life Insurance Policies Victor and Maria Hernandez have a total of $200,000 in life insurance. Victor has a $50,000 cash-value policy purchased more than 20 years ago soon after when they married and a $100,000 group term policy through his emp

> Coverage Harry and Belinda Johnson spend $20 per month on life insurance in the form of a premium on a $10,000, paid-at-65 cash-value policy on Harry that his parents bought for him years ago. Belinda has a group term insurance policy from her employer w

> Charles Napier of Barstow, California, recently took a new job as a manufacturer’s representative for an aluminum castings company. While looking over his employee benefits materials, he discovered that his employer would provide 10 sick days per year, a

> Julia is about to change jobs. Her new employer offers several different health care plans including a traditional health care plan, an HMO, a PPO, and a high-deductible plan. Her employer will pay the first $300 per month for any plan she chooses. This

> Victor Hernandez recently learned that his uncle has Alzheimer’s disease. While discussing this tragedy with Maria, he realized that both of his grandparents probably had Alzheimer’s or another dementia disease, although no formal diagnoses were ever mad

> Dual-income households often have overlapping health care benefits. For example, both Harry and Belinda Johnson’s employers provide partially subsidized family health insurance plans as employee benefits. The Johnsons chose to be covered under Belinda’s

> Your friend Taliesha Jackson of Edwardsville, Illinois, recently changed to a new job as a CPA in a moderate-size accounting firm. Knowing that you were taking a personal finance course, she asked your advice about selecting the best health insurance pla

> Makiko Iwanami, a student from Osaka, Japan, is in one of your classes. She is considering the purchase of a used car and has been told that she must buy automobile insurance to register the car and obtain license plates. Makiko has come to you for advic

> Mark and Kelly Prince of Emmertsburg, Iowa, face a crisis. Their automobile insurance company has notified them that their current coverage expires in 30 days and will not be renewed. Mark and the Prince’s younger son each had a minor, at-fault accident

> Julia has always tried to keep her insurance spending under control by purchasing low limits on her policies. Now that her assets and income have grown, she is beginning to reconsider the wisdom of this approach when buying insurance. Julia knows she has

> Belinda Johnson’s parents and maternal grandmother have combined their finances and presented Harry and Belinda with $50,000 cash gift to use to purchase a home. The Johnsons have shopped and found a house in a new housing development t

> Justin Kealey, CPA, is auditing Tustin Companies, Inc. Kealey has accumulated factual, judgmental, and projected misstatements for the current year to evaluate whether there is a sufficiently low risk of material misstatement of the financial statements

> Linda Reeves, CPA, receives a telephone call from her client, Lane Company. The company’s controller states that the board of directors of Lane has entered into two contractual arrangements with Ted Forbes, the company’s former president, who has recentl

> The auditor’s opinion on the fairness of financial statements may be affected by subsequent events. Required: a. Define what is commonly referred to in auditing as a subsequent event, and describe the two general types of subsequent events. b. Identify

> a. Calculate the gross margin percentage for each of State University’s product lines. b. Compare State University’s gross margins to industry averages. Indicate any margins that appear out of line, in relation to the

> You are the audit manager in the audit of the financial statements of Midwest Grain Storage, Inc., a new client. The company’s records show that, as of the balance sheet date, approximately 15 million bushels of various grains are in storage for the Comm

> During an audit engagement, Robert Wong, CPA, has satisfactorily completed an examination of accounts payable and other liabilities and now plans to determine whether there are any loss contingencies arising from litigation, claims, or assessments. What

> OA Company recently hired a payroll service provider to process its payroll—that service provider has essentially taken over the payroll function, and payroll represents OA’s largest expense. Comment on the following statement: OA’s auditors should make

> In your audit of the financial statements of Wolfe Company for the year ended April 30, you find that a material account receivable is due from a company in reorganization under Chapter 11 of the Bankruptcy Act. You also learn that on May 28 several form

> Valley Corporation established a stock option plan for its officers and key employees this year. Because the options granted have a higher option price than the stock’s current market price, the company has not recognized any cost for the options in the

> You are retained by Columbia Corporation to audit its financial statements for the fiscal year ended June 30. Your consideration of internal control indicates a fairly satisfactory condition, although there are not enough employees to permit an extensive

> Select the best answer for each of the following and explain fully the reason for your selection. a. Which of the following is least likely to be among the auditors’ objectives in the audit of inventories and cost of goods sold? (1) Det

> You are engaged in the audit of the financial statements of Armada Corporation for the year ended August 31, 20X0. The balance sheet, reflecting all your audit adjustments accepted by the client to date, shows total current assets, $8,000,000; total curr

> During your annual audit of Walker Distributing Co., your assistant, Jane Williams, reports to you that, although a number of entries were made during the year in the general ledger account Notes Payable to Officers, she decided that it was not necessary

> The only long-term liability of Range Corporation is a note payable for $1 million secured by a mortgage on the company’s plant and equipment. You have audited the company annually for the three preceding years, during which time the principal amount of

> Describe the audit steps that generally would be followed in establishing the propriety of the recorded liability for federal income taxes of a corporation you are auditing for the first time. Consideration should be given to the status of (a) the liabi

> During the course of any audit, the auditors are always alert for unrecorded accounts payable or other unrecorded liabilities. Required: For each of the following audit areas, (1) describe an unrecorded liability that might be discovered and (2) state w

> Early in your first audit of Star Corporation, you notice that sales and year-end inventory are almost unchanged from the prior year. However, cost of goods sold is less than in the preceding year, and accounts payable also are down substantially. Gross

> The subsequent period in an audit is the time extending from the balance sheet date to the date of the auditors’ report. Discuss the importance of the subsequent period in the audit of trade accounts payable.