Question: Coverage Harry and Belinda Johnson spend $20

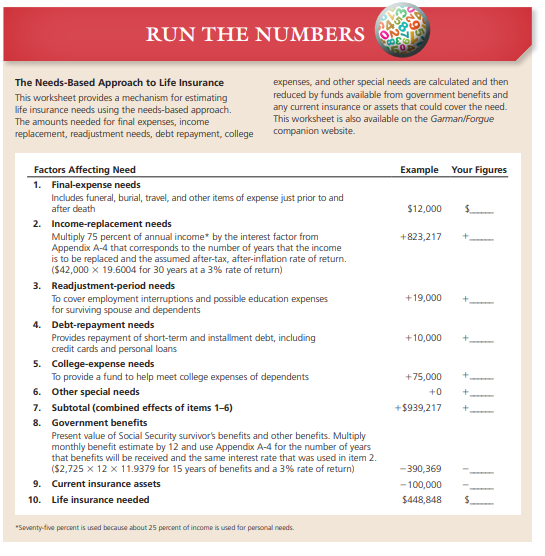

Coverage Harry and Belinda Johnson spend $20 per month on life insurance in the form of a premium on a $10,000, paid-at-65 cash-value policy on Harry that his parents bought for him years ago. Belinda has a group term insurance policy from her employer with a face amount of $200,000. By choosing a group life insurance plan from his menu of employee benefits, Harry now has $100,000 of group term life insurance. Harry and Belinda have decided that, because they have no children, they could reduce their life insurance needs by protecting one another’s income for only four years, assuming the survivor would be able to fend for himself or herself after that time. They also realize that their savings fund is so low that it would have no bearing on their life insurance needs. Harry and Belinda are basing their calculations on a projected 4 percent rate of return after taxes and inflation. They also estimate the following expenses: $15,000 for final expenses, $20,000 for readjustment expenses, and $5,000 for repayment of short-term debts.

Required:

(a) Should the $3,000 interest earnings from Harry’s trust fund be included in his annual income for the purposes of calculating the likely dollar loss if he were to die? Explain your response.

(b) Based on your response to the previous question, how much more life insurance does Harry need? Use the Run the Numbers worksheet to arrive at your answer.

Worksheet:

(c) Repeat the calculations to arrive at the additional life insurance needed on Belinda’s life.

(d) How might the Johnsons most economically meet any additional life insurance needs you have determined they may have?

(e) In addition to their life insurance planning, how might the Johnsons begin to prepare for their retirement years?

Transcribed Image Text:

RUN THE NUMBERS The Needs-Based Approach to Life Insurance This worksheet provides a mechanism for estimating life insurance needs using the needs-based approach. The amounts needed for final expenses, income replacement, readjustment needs, debt repayment, college expenses, and other special needs are calculated and then reduced by funds available from government benefits and any current insurance or assets that could cover the need. This worksheet is also available on the Garman/Forgue companion website. Factors Affecting Need 1. Final-expense needs Example Your Figures Includes funeral, burial, travel, and other items of expense just prior to and after death $12,000 2. Income-replacement needs Multiply 75 percent of annual income by the interest factor from Appendix A-4 that corresponds to the number of years that the income is to be replaced and the assumed after-tax, after-inflation rate of return. ($42,000 x 19.6004 for 30 years at a 3% rate of return) +823,217 3. Readjustment-period needs To cover employment interruptions and possible education expenses for surviving spouse and dependents +19,000 4. Debt-repayment needs Provides repayment of short-term and installment debt, including credit cards and personal loans +10,000 5. College-expense needs To provide a fund to help meet college expenses of dependents +75,000 6. Other special needs +0 7. Subtotal (combined effects of items 1-6) +$939,217 8. Government benefits Present value of Social Security survivor's benefits and other benefits. Multiply monthly benefit estimate by 12 and use Appendix A-4 for the number of years that benefits will be received and the same interest rate that was used in item 2. ($2,725 x 12 x 11.9379 for 15 years of benefits and a 3% rate of return) -390,369 9. Current insurance assets -100,000 10. Life insurance needed $448,848 "Seventy-five percant is used because about 25 percent of income is used for personal needs.

> Alexandra Cunningham of Gardner, Massachusetts, has a $100,000 participating cash-value policy written on her life. The policy has accumulated $4,700 in cash value; Alexandra has borrowed $3,000 of this value. The policy also has accumulated unpaid divid

> Matthew Kennedy of Urbana, Ohio, is single and has been working as an admissions counselor at a university for five years. Matthew owns a home valued at $250,000 on which he owes $135,000. He has a two-year-old vehicle valued at $32,000 on which he owes

> Amy and Mack Holly from Rapid City, South Dakota, have been married for three years. They recently bought a home costing $212,000 using a $190,000 mortgage. They have no other debts. Mack earns $62,000 per year, and Amy earns $71,000. Each has a retireme

> You have been talking at a party to some friends about insurance. One young married couple in the group believes that insurance is almost always a real waste of money. They argue, “The odds of most bad events occurring are so low that you don’t need to w

> Christina Haley of Elko, Nevada, age 57, recently suffered a stroke. She was in intensive care for 3 days and was hospitalized for 10 more days. Her total bill for this care was $125,500. After being discharged from the hospital, she spent 25 days in a n

> Michael Howitt of Berkley, Michigan, recently had his gallbladder removed. His total bill for this surgery, which was his only health care expense for the year, came to $13,890. His health insurance plan has a $500 annual deductible and an 80/20 coinsura

> Social Security Disability Protection. Sandra Hilton of Sisseton, South Dakota, age 60, recently was in a vehicle accident, was hospitalized, and then suffered a heart attack. She took a leave of absence from her longtime job as a data analyst for an env

> Ashley Diamond of Estes Park, Colorado, drives an eight-year-old Toyota valued at $5,600. She has a $75,000 personal automobile policy with $10,000 per-person medical payments coverage and both collision ($200 deductible) and comprehensive coverage. Davi

> Colton Gentry of Lancaster, California, has owned his home for ten years. When he purchased it for $178,000, Colton bought a $160,000 homeowner’s insurance policy. He still owns that policy, even though the replacement cost of the home is now $300,000. (

> Toula and Ian Miller of Gainesville, Florida, recently suffered a fire at their home. The fire, which began in a crawl space at the back of the house, caused $50,000 of damage to the dwelling itself. Their garage, valued at $20,000, was totally destroyed

> Bill Converse of Rexburg, Idaho, recently had his truck slide off a gravel road and strike a tree. Bill’s vehicle suffered $17,500 in damage. The truck has a book value of $40,000. Bill carried collision insurance with a $500 deductible. How much will Bi

> Heather McIntosh of Watertown, South Dakota, recently purchased a home for $190,000. She put $25,000 down and took out a 25-year loan at 5.5 percent interest. a) Use Table 9-4 on page 285 to determine her monthly payment. Table 9-4: (b) How much of he

> Kevin Tutumbo of Terre Haute, Indiana, has owned his home for 15 years and expects to live in it for a least five more. He originally borrowed $135,000 at 6 percent interest for 30 years to buy the home. He still owes $96,000 on the loan. Interest rates

> Alex Guadet of Nashville, Tennessee, has been renting a two-bedroom house for several years. He pays $900 per month in rent for the home and $300 per year in property and liability insurance. The owner of the house wants to sell it, and Alex is consideri

> Michael Joseph and Maggi Lewis of Saluda, Virginia, are trying to decide whether to rent or purchase housing. Michael favors buying and Maggi leans toward renting, and both seem able to justify their particular choice. Michael thinks that the tax advanta

> Seth and Alexandra Moore of Elk Grove Village, Illinois have an annual income of $110,000 and want to buy a home. Currently, mortgage rates are 5 percent. The Moores want to take out a mortgage for 30 years. Real estate taxes are estimated to be $4,800 p

> Dave and Diane Starr of New Orleans, Louisiana, both of whom are in their late 20s, currently are renting an unfurnished two-bedroom apartment for $1,200 per month, plus $230 for utilities and $34 for insurance. They have found a condominium they can buy

> Yvonne Moody of Dallas, Texas, is a 34-year-old police detective earning $58,000 per year. She and her husband, Joshua, who is a public school teacher earning $44,000, have two children in elementary school. They own a modestly furnished home and two lat

> Nicci Denny, age 40, single, and from Colorado Springs, Colorado, is trying to estimate the amount she needs to save annually to meet her retirement needs. Nicci currently earns $65,000 per year. She expects to need 80 percent of her current salary to li

> Harry Johnson’s father, William, was recently forced into early retirement at age 63 because of poor health. In addition to the psychological drawbacks of the unanticipated retirement, William’s financial situation is

> Julia is now in her early 50s. She has had three jobs in her career so far and participated fully in the defined contribution retirement plans offered by her employers. When she left her last position, she rolled her retirement account over to the accoun

> Victor, now age 61, and Maria, age 59, plan to retire at the end of the year. Since his employer changed from a defined-benefit retirement plan to a defined-contribution plan ten years ago, Victor has been contributing the maximum amount of his salary to

> Jonathan Clark and Cody Adams, longtime dental partners in Basking Ridge, New Jersey, have bought and sold real estate properties for ten years. They have profited on many transactions, although they did have some substantial losses during the last reces

> Jeremy Jorgensen of Lawton, Oklahoma, is concerned about the costs involved in selling his home, so he has decided to sell his home himself rather than pay a broker to do it. Required: (a) How would you advise Jeremy if he asked you whether he should se

> Keisha Williams, a senior research analyst in San Bernardino, California, has bought and sold high-technology stocks profitably for years. Lately some of her stock investments have done quite poorly, including one company that went bankrupt. Emily, a lon

> Julia continues to be a hard worker and, at age 60, has saved and invested wisely for her planned financially successful retirement. She has an extra $15,000 in a cash management account beyond what she needs for emergency savings. She rejected options a

> Victor and Maria Hernandez are thinking about selling her mother’s home, which she recently inherited, and use the proceeds to enhance their investments for retirement. Its price increased to about today’s value of $300,000. The home is fully paid for.

> Harry and Belinda Johnson are considering purchasing a residential income property as an investment. The Johnsons want to achieve an after-tax total return of 7 percent. They are considering a property with an asking price of $190,000 that should produce

> Lola Garcia, a single mother of a 6-year-old child, works for a utility company in Baltimore, Maryland, and is willing to invest $3,000 per year in a mutual fund. She wants the investment income to supplement her retirement pension starting in approximat

> It has been over 25 years since Julia graduated with a major in aeronautical engineering, and she has been quite successful in her career as well as in managing her personal finances. She has moved up the career ladder, earns a high salary, has $50,000 i

> After learning about mutual funds, the Johnsons are confident that they are a great way to invest, especially because of the diversification and professional management that funds offer. The couple has a financial nest egg of $9,500 to invest through mut

> Victor and Maria have decided to increase their contribution to their investment portfolio since Victor is now age 59 and thinking about retiring in five years. For years, they have followed a moderate-risk investment philosophy and put their money in su

> Ji Wu of Troy, New York, has $5,000 that he wants to invest in the stock market. Ji is in college on a scholarship and does not plan to use the $5,000 or any dividend income for another five years, when he plans to buy a home. He is currently considering

> Kyle Broflovski, a high school guidance counselor in South Park, Colorado, has purchased several corporate and government bonds over the years, and his total bond investments now exceeds $40,000. He prefers investments with some inflation protection. His

> Julia has been thinking about buying a home. For several months, she has been watching real estate shows on television and visiting open houses in her community. She thinks it is time to take the plunge and buy a much larger home since she can genuinely

> Jessica Varcoe works as a drug manufacturer’s representative based in Irvine, California. She has an aggressive investment philosophy and believes that interest rates on new bonds will drop over the next year or two because of an expected economic slowdo

> Julia’s investments survived the last recession and bear stock market declines because she was well diversified and was investing more heavily in bonds in the years preceding the decline. Julia cashed out of some equities and moved most of that money int

> The investments of Harry and Belinda have done well through the years. While the cash portion of their portfolio has risen to $16,000, it is earning a minuscule 1 percent in a money market account; thus they are Required: (a) What is the current yield

> After nearly 14 years of marriage, Harry and Belinda’s finances have improved, even though they have incurred debts for an automobile loan and a condominium. Plus they now have a 5-year-old son, Benjamin. They have not yet saved enough

> It has been about 20 years since Julia graduated with a major in aeronautical engineering, and she has been quite successful in her career and her personal finances. Accordingly, she wants to sell her home and buy a luxury condominium. She has $40,000 in

> The expenses associated with sending two children through college prevented Victor and Maria Hernandez from adding substantially to their investment program. Now that their younger son, Joseph, has completed school and is working full time, they would li

> Just-married couples sometimes over-indulge in the type and amount of life insurance that they buy. Hakeem and Leshaniqua Jackson of Barstow, California, took a different approach. Both were working and had a small amount of life insurance provided throu

> Julia Price is now in her late 30s and has always wanted children. She has arranged to adopt two siblings from overseas, ages 2 and 4. Julia is happy that she earns enough money to support the children adequately, but the agency sponsoring the adoption a

> Joseph and Marcia Michael of Athens, Georgia, are a married couple in their mid-30s. They have two children, ages 5 and 3, and Marcia is pregnant with their third child. Marcia is a part-time book indexer who earned $30,000 after taxes last year. Because

> Biming Chen is a college student from Cleveland, Mississippi. Soon to graduate, Biming was approached recently by a life insurance agent, who set up a group meeting for several members of his fraternity. During the meeting, the agent presented six life i

> Estate Agents Victor and Maria have been thinking about selling their home and buying a house with more yard space so that they can indulge their passion for gardening. Before they make such a decision, they want to explore the market to see what might b

> Switching Life Insurance Policies Victor and Maria Hernandez have a total of $200,000 in life insurance. Victor has a $50,000 cash-value policy purchased more than 20 years ago soon after when they married and a $100,000 group term policy through his emp

> Charles Napier of Barstow, California, recently took a new job as a manufacturer’s representative for an aluminum castings company. While looking over his employee benefits materials, he discovered that his employer would provide 10 sick days per year, a

> Julia is about to change jobs. Her new employer offers several different health care plans including a traditional health care plan, an HMO, a PPO, and a high-deductible plan. Her employer will pay the first $300 per month for any plan she chooses. This

> Victor Hernandez recently learned that his uncle has Alzheimer’s disease. While discussing this tragedy with Maria, he realized that both of his grandparents probably had Alzheimer’s or another dementia disease, although no formal diagnoses were ever mad

> Dual-income households often have overlapping health care benefits. For example, both Harry and Belinda Johnson’s employers provide partially subsidized family health insurance plans as employee benefits. The Johnsons chose to be covered under Belinda’s

> Your friend Taliesha Jackson of Edwardsville, Illinois, recently changed to a new job as a CPA in a moderate-size accounting firm. Knowing that you were taking a personal finance course, she asked your advice about selecting the best health insurance pla

> Makiko Iwanami, a student from Osaka, Japan, is in one of your classes. She is considering the purchase of a used car and has been told that she must buy automobile insurance to register the car and obtain license plates. Makiko has come to you for advic

> Mark and Kelly Prince of Emmertsburg, Iowa, face a crisis. Their automobile insurance company has notified them that their current coverage expires in 30 days and will not be renewed. Mark and the Prince’s younger son each had a minor, at-fault accident

> Julia has always tried to keep her insurance spending under control by purchasing low limits on her policies. Now that her assets and income have grown, she is beginning to reconsider the wisdom of this approach when buying insurance. Julia knows she has

> Belinda Johnson’s parents and maternal grandmother have combined their finances and presented Harry and Belinda with $50,000 cash gift to use to purchase a home. The Johnsons have shopped and found a house in a new housing development t

> Justin Kealey, CPA, is auditing Tustin Companies, Inc. Kealey has accumulated factual, judgmental, and projected misstatements for the current year to evaluate whether there is a sufficiently low risk of material misstatement of the financial statements

> Linda Reeves, CPA, receives a telephone call from her client, Lane Company. The company’s controller states that the board of directors of Lane has entered into two contractual arrangements with Ted Forbes, the company’s former president, who has recentl

> The auditor’s opinion on the fairness of financial statements may be affected by subsequent events. Required: a. Define what is commonly referred to in auditing as a subsequent event, and describe the two general types of subsequent events. b. Identify

> a. Calculate the gross margin percentage for each of State University’s product lines. b. Compare State University’s gross margins to industry averages. Indicate any margins that appear out of line, in relation to the

> You are the audit manager in the audit of the financial statements of Midwest Grain Storage, Inc., a new client. The company’s records show that, as of the balance sheet date, approximately 15 million bushels of various grains are in storage for the Comm

> During an audit engagement, Robert Wong, CPA, has satisfactorily completed an examination of accounts payable and other liabilities and now plans to determine whether there are any loss contingencies arising from litigation, claims, or assessments. What

> OA Company recently hired a payroll service provider to process its payroll—that service provider has essentially taken over the payroll function, and payroll represents OA’s largest expense. Comment on the following statement: OA’s auditors should make

> In your audit of the financial statements of Wolfe Company for the year ended April 30, you find that a material account receivable is due from a company in reorganization under Chapter 11 of the Bankruptcy Act. You also learn that on May 28 several form

> Valley Corporation established a stock option plan for its officers and key employees this year. Because the options granted have a higher option price than the stock’s current market price, the company has not recognized any cost for the options in the

> You are retained by Columbia Corporation to audit its financial statements for the fiscal year ended June 30. Your consideration of internal control indicates a fairly satisfactory condition, although there are not enough employees to permit an extensive

> Select the best answer for each of the following and explain fully the reason for your selection. a. Which of the following is least likely to be among the auditors’ objectives in the audit of inventories and cost of goods sold? (1) Det

> You are engaged in the audit of the financial statements of Armada Corporation for the year ended August 31, 20X0. The balance sheet, reflecting all your audit adjustments accepted by the client to date, shows total current assets, $8,000,000; total curr

> During your annual audit of Walker Distributing Co., your assistant, Jane Williams, reports to you that, although a number of entries were made during the year in the general ledger account Notes Payable to Officers, she decided that it was not necessary

> The only long-term liability of Range Corporation is a note payable for $1 million secured by a mortgage on the company’s plant and equipment. You have audited the company annually for the three preceding years, during which time the principal amount of

> Describe the audit steps that generally would be followed in establishing the propriety of the recorded liability for federal income taxes of a corporation you are auditing for the first time. Consideration should be given to the status of (a) the liabi

> During the course of any audit, the auditors are always alert for unrecorded accounts payable or other unrecorded liabilities. Required: For each of the following audit areas, (1) describe an unrecorded liability that might be discovered and (2) state w

> Early in your first audit of Star Corporation, you notice that sales and year-end inventory are almost unchanged from the prior year. However, cost of goods sold is less than in the preceding year, and accounts payable also are down substantially. Gross

> The subsequent period in an audit is the time extending from the balance sheet date to the date of the auditors’ report. Discuss the importance of the subsequent period in the audit of trade accounts payable.

> In the course of your initial audit of the financial statements of Sylvan Company, you determine that of the substantial amount of accounts payable outstanding at the close of the period, approximately 75 percent is owed to six creditors. You have reques

> Auditors usually send confirmations to obtain evidence about accounts receivable and accounts payable. a. Is confirmation presumptively required for accounts receivable, accounts payable, or both? b. Are accounts receivable requests, accounts payable req

> Shortly after you were retained to audit the financial statements of Case Corporation, you learned from a preliminary discussion with management that the corporation had recently acquired a competing business, the Mall Company. In your study of the terms

> Auditors report on the consistency of application of accounting principles. Assume that the following list describes changes that have a material effect on a client’s financial statements for the current year. (1) A change from the completed-contract me

> Your new client, Ross Products, Inc., completed its first fiscal year March 31, 20X4. During the course of your audit you discover the following entry in the general journal, dated April 1, 20X3. Required: Under these circumstances, what steps should

> Allen Fraser was president of three corporations: Missouri Metals Corporation, Kansas Metals Corporation, and Iowa Metals Corporation. Each of the three corporations owned land and buildings acquired for approximately $500,000. An appraiser retained by F

> Kadex Corporation, a small manufacturing company, did not use the services of independent auditors during the first two years of its existence. Near the end of the third year, Kadex retained Jones & Scranton, CPAs, to perform an audit for the year ended

> Gruen Corporation is a large diversified company with a large amount of property, plant, and equipment and intangible assets, including goodwill. In the past year the company has experienced a significant decline in a number of its lines of business. Re

> An executive of a manufacturing company informs you that no formal procedures have been followed to control the retirement of machinery and equipment. A physical inventory of plant assets has just been completed. It revealed that 25 percent of the assets

> Assume that a continuing audit client has recorded Accounts Receivable and Equipment both in the amount of $1,000,000. In a typical audit, which account would take more time to audit?

> You are part of the audit team that is auditing Happy Chicken, Inc., a company that franchises Happy Chicken family restaurants. During the current year, management of Happy Chicken purchased for $2 million one of its franchised locations, a store that w

> Girard Corporation has just completed the acquisition of Williams, Inc., at a purchase price significantly higher than the fair values of the identifiable assets. Describe the audit issues caused by the acquisition and how the auditors would likely resol

> List and state the purpose of all audit procedures that might reasonably be applied by the auditors to determine that all property and equipment retirements have been recorded in the accounting records.

> Grandview Manufacturing Company employs standard costs in its cost accounting system. List the audit procedures that you would apply to ascertain that Grandview’s standard costs and related variance amounts are acceptable and have not distorted the finan

> Use the following to provide the type of audit report the auditors generally should issue in the situations presented below: 1. Unmodified—standard. 2. Unmodified—with an emphasis-of-matter paragraph. 3. Qualified. 4. Adverse. 5. Disclaimer Situation: a

> Assume that you are auditing Roberts Wholesale Supply Co. and that you have decided to use data analytics to test the inventory. Specifically, you would like to identify (1) excess and overvalued items in inventory (e.g., possibly obsolete, quantities we

> You are engaged in the audit of Reed Company, a new client, at the end of its first fiscal year, June 30, 20X1. During your work on inventories, you discover that all of the merchandise remaining in stock on June 30, 20X1, had been acquired July 1, 20X0,

> One of the problems faced by the auditors in their verification of inventory is the risk that slow-moving and obsolete items may be included in the goods on hand at the balance sheet date. In the event that such items are identified in the physical inven

> The City of Westmore is confused about the type of audit that it should obtain: an audit in accordance with generally accepted auditing standards, an audit in accordance with Generally Accepted Government Auditing Standards, or an audit in accordance wit

> North County School District expended $1,450,000 in federal financial assistance this year. Required: a. Is North County School District required to have an audit in accordance with the Single Audit Act? Explain. b. What are the requirements of an audit

> Wixon & Co., CPAs, is performing an audit of the City of Brummet for the year ended June 30, 200X, in accordance with Generally Accepted Government Auditing Standards. During the course of the audit, Gerald Yarnell, a senior auditor, discovers violations

> Matt Gunlock, CPA, is performing an audit of the City of Ryan in accordance with generally accepted auditing standards. Required: a. Must Matt be concerned with the city’s compliance with laws and regulations? Explain. b. How should Matt decide on the n

> CPAs may become involved in examinations of broker-dealers. a. Describe the information a broker-dealer who maintains custody of customer funds or securities is required to file in an annual compliance report. b. Which of the required information in part

> You are conducting the first audit of the marketing activities of your organization. Your preliminary survey has disclosed indications of deficient conditions of a serious nature. You expect your audit work to document the need for substantial corrective

> Throughout this book, emphasis has been placed on the concept of independence as the most significant single element underlying the development of the public accounting profession. The term “independent auditor” is sometimes used to distinguish the publi

> For each of the following brief scenarios, assume that you are reporting on a client’s financial statements. Reply as to the type(s) of opinion possible for the scenario. In addition: ∙ Unless stated otherwise, assume