Question: The expenses associated with sending two children

The expenses associated with sending two children through college prevented Victor and Maria Hernandez from adding substantially to their investment program. Now that their younger son, Joseph, has completed school and is working full time, they would like to build up their investments quickly. Victor is 47 years old and wants to retire early, perhaps by age 60. In addition to the retirement program at his place of employment, Victor believes that their investment portfolio, currently valued at $120,000, will need to triple to $360,000 by his planned retirement time, in 13 years. He and Maria realize that they will have to sacrifice a lot of current spending to save and invest for retirement.

Required:

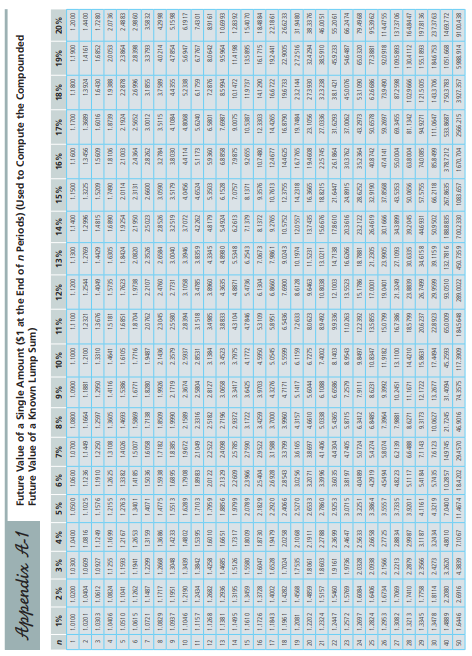

(a) What rate of return is needed on the $120,000 portfolio to reach their goal of $360,000 (assuming no additional contributions)? Use Appendix A-1 or visit the Garman/Forgue companion website.

Appendix A-1:

(b) Victor and Maria think they will need a total of $600,000 for a retirement financial nest egg to supplement his anticipated small pension from teaching. Therefore, they will need to create an additional sum of about $240,000 through new investments. Assuming an annual return of 8 percent, how much do the Hernandezes need to invest each year to reach their goal of $240,000? Use Appendix A-3 or visit the Garman/Forgue companion website.

(c) If they assume a 6 percent annual return, how much do the Hernandezes need to invest each year to reach their goal of $240,000? Use Appendix A-3 or visit the Garman/Forgue companion website.

Appendix A-3:

Transcribed Image Text:

BEPO0 16 PI6 B865 SIZ 99 L59 EROI DEE Z00L 6SEL DS SISE W 19012 FERE FRI ETISJ L898 EES ZIZZBLE SEB BE8I 918BL ZEI DISO E6 600 050 DI O8 31.4094 66 66.2118 2OS 60S IE69t 6SII E 666 62 290 DI SENS ERE 155.1 893 19781 36 S00SIZI 9996201 1Z26 16 S80 O LEZ 90 IE98 SI 9.3173 EI 12 541 84 1911'E 28IIE 99SE Z 1 3345 EIZEI 34.6158 121722 66 SBI 90LELEI E8560I SSE 43.5353 668EE 001I EI ISE DI 18862 BEI29 482 23 3.7335 2.2213 SSII B16026 999 IDE SO66 Z 66LOSI 2016'11 1962 NORS 474141 296E56 188ELL 989929 0616 ZE 619 SOEZ'IE 1000 '21 S58SEI S889 85 997 10.8347 BEGOZ 54274 89 6 6 OZE O59 ZS29 ELEZ E 531 090 2900 ZE 19EZSE 232122 188L BI 98LI SI Z6EZZI II162 6.3412 LOS I SZZE 2.56 33 BZED Z 29LEDE SI68 919E02 999 91 EZSS EI SILBS 26 1BE 8.9543 1902 55 459233 IZ IBE E629'IE 198 192 0198LI BEIL DI ED0I ZI SEE 66 EDIB OE 3.6035 ESZ6Z 669EZ 19161 I500 01658E 18.8215 9995I BEDB DI 880I9 323238 BEEDS 90 I 96 BEE 27.0336 LEE BE DEGELZ 9501 EZ 59E 91 13.7435 IEZS'II D199 19081 2.6533 1.2202 WIZEZ 14.2318 ZSIS DI ZIPIS SIE 61 EE Z99Z 5006 ZZ SSLE ZI SES9 0966 E 66LEE 990Z 1 961'I 196 733 BI 198IZZ ZZ991 E1 DI SAZ 6 1962 2692 SIL 191 EDEE ZI EL902 HOEI9 601 ES EDL6E 8 1372 2.1829 DE L8I 1.1726 1.3728 91 6E 12 906 60 0I 0191'1 SI SL006 E1929 LIEE 2.9372 SBL S7 60927 LIEL'I S6IEI SII 5.5348 43 104 E6 690 I 19656 6658 B5889 BZSI 9 O B68 SEDE EZSE B590 E 9612Z 21329 9588 I 15991 I BEI'I 38833 EI 19 168 21908 1085 9 0SE 65 EDSES 0968E S86VE BEIE 656LI DI 091 8I'I 4.3345 2.8127 2.5182 65L 19 ELI IS 6SEBE SBLE BIS IE IESB Z 18983 EDIL'I 56 ESI 1.2434 LSII'I 2.3316 L1619 695 Z1961 06121 86SIS SSE DED BE 6LISE 6ISZE IELL Z 6SEZ SBEBI 56 891 E ISS I EE ZVI LEGO' 662 SIISE 608'I ZE BSE EGLEE SEB IE ZI00E BEIL'I B5091 SE OS 65 IEI 25023 096 96692 IEIEZ S190'1 EB 19BEZ ED0 I7 IS891 S019'1 9BES'I 29 IT I 1. 1041 0 150'1 13382 SSIZ'I 6691'I 15 181 Z5891 DE91 9109'1 6095I SIBVI 1.7280 1.0612 E DED'I 1.3310 1.1249 00HI 191I SZZE'I 12321 001 I'I 00IZ'I SEZI'I 91 80 I 60901 00 0I 006 I'I 008 I'I 009 I'I 0001'I 0080'I 00 901 0050'I 0010'1 % 02 % 94 %SL 14% %EL % 0L %6 %9 Future Value of a Known Lump Sum) Future Value of a Single Amount ($1 at the End of n Periods) (Used to Compute the Compounded Appendix A-1 ESIS IE 60 YIRIZ 06 911 0S I8 10LLLS 6S YO 6S D6 0 60 l299 2SI 696 ZII E IOPS RIO DO 958 EEL ZIZE9I USE IE ISL DREZ 0606I POL EIOI IszS S5ZO 56 1181882 IZIL 996 606 0 IEDES 2661 16 6020 661 6 99 189 S 6290 6 区1555 ZEDE 95 26912 LE LEGOZIE PEBS BSZ ZUBE BLI 60E9 8 ISEIDZI 656E0I SE28 ZZE 79 E996 25 88IZ S Z26LBE POS VEE ERZ 618 6069 061 660I 6006 2 ZISOE 1区ZE 681.1116 2び819 OS ZEE 873508 1027231 BES SAL9 9 EZE OZO 8895EB 908 DO 9BLO EI 6660 I2I 850L E9 1699 S 960L D 308 209 35343 ELLE L9S OZ IES LZEEBOZ 1O58 AI 818I'601 Ot ZEE6 195I 65 SELL'IS LIIE lDESS E 60L 9EE 952 56Z 405.2721 150.3339 I 186 IL SE09 ZE DE 6LZ IZ 80L 8181 9619 55I BEEE EEI 60 0L8 650 IEL 47.7271 6S9 I EDE OZE 114.4133 Z ZE SLOBZ LL6 EIZ 985 985I OZOS S80 6E 136. 8315 6209 101 118. 1552 ILI Z0I 6I'16 86 BL9L 29LI BS 9518 0S 6IZVOE SEL 69Z 88 4973 B1 Z 192651 61ES69 19 S S66 SO'I 619 9 62 2E SE DEZ IZL I'08 I 91 E9LEI 09EFOZI 43.3923 Z5OS E 34 2480 89ES DE 81.2143 Sz00 19 LS00 6 244716 272990 12 628733 920 s c LESI 10 188 II 66 26 Z66 6E 2606'IE 0889 981 GZE ODE I 26LE SII 医けて01 osE IS 1091'15 029 958L E 0990 EE 18LL 6 06102 1991 I SEIPZI 200 6 2606 26 19 51.1591 109 00 E 06ES DE 6911 601 80Z 61 65 SI1 EON EDI 950VE6 656E DS 45.5992 EI DE I LE L69E ZOSE 23.4144 IZI O0Z OE 81 ISL'19 OG6 EE 1506 TE EEI 196147 21A123 81 758364 683941 906 S01 LIZO 96 0890 28 16L6BL IS2O59 16EL ES LEBB BOOS ZOe DE 6ZIZ BE SL6D EZ 9 19L'IZ ZOS8 L 88 999 OS26 09 EESL Z 668I BE LO6 SE E00EE EEDE 1888 E SZ9 6951 D EGE 981 91 72.035 I 20 6561'65 ES96 09 31.7725 60 9E6Z 26 1092 SEZO DZ 18.5989 E980 21 SLID 06ZI S 696 091 SI 56.1 101 0B18 DS 11852E 9E ZE 60 DE SOSS E ISIO'IZ 6162 BI 149474 159739 1 38093 EI 996 298L DE 61 SEE 1620 8929 91 BL1951 26.2116 EE IZ IZ88 BI DEIL'2I E0B 9I 42.2187 24.5227 SOS 6E I 0062 66 91 L16 SI 0261 I 134121 OSI'ZE 666 122 6ZEL SZ S中OEZ 243493 EPIB'IZ F195 61 18.531 2 E0 952I SS991 SEBL SI 9126 I 890Z I 98 EI 8L08 ZI 30.4035 600 EIZS YZ SIZE IZ 1918TI 1900 ZI 6580 61 85891 ES8091 56S EI 0I ZUE I 9920'11 88S DI 589E6 182847 17.5185 10. 1591 16691 O206 SI OZE SI 9 901 12. 1415 890 26 899011 SOE LDI 0680 DI EEBL6 BEGE B EB8 2 11.7720 74343 72135 66266 LESLB SSE SB LZZE B ZSIIB 6Z162 6SE EL EESI2 ESL69 61089 DEE9 9 180E9 0ZS 19 752 33 716 089ES 101 99 8ZSE 9 I S0I9 865 99985 95255 E9IS 160ES 010 IS 6.7424 EI6ZS SIZS SO IS 5990S E66 BES O IM IELS 190 S 10IE 4.1836 41 216 1909 E ISE 68E SE 9505 E 96EVE 00IEE 3.1216 6060E 0DED Z HLEE 18LZE IZE SEBI E SZSIE 10E DE 000Z 008IZ 00L IZ 00917 00SIZ 00 12 0DEIZ 00117 00 607 008 02 0090 Z 001 0Z 0000I 0000'I 0000' 00001 00001 00001 00001 00001 00001 0000' 0000 1 00001 0000'1 0000'1 0000'1 00001 00001 00001 00001 %6L %81 %91 % % EL %0L %6 %8 %9 %E (Used to Compute the Compounded Future Value of a Stream of Income Payments) Appendix A-3 Future Value of a Series of Equal Amounts (an Annuity of $1 Paid at the End of Each Period)

> What is the market price of a $1,000, 8 percent bond if comparable market interest rates rise to 10 percent and the bond matures in 14 years?

> What is the market price of a $1,000, 8 percent bond if comparable market interest rates drop to 6 percent and the bond matures in 15 years?

> Kunal Nayyar from London, had $50,000 in investments in the USA at the beginning of the year that consisted of a diversified portfolio of stocks (40 percent), bonds (40 percent), and cash equivalents (20 percent). His returns over the past 12 months were

> Jordan and Jeremy, who are twins living in Concord, New Hamphire, took different approaches to investing. Jordan saved $2,000 per year for ten years starting at age 23 and never added any more money to the account. Jeremy saved $2,000 per year for 20 yea

> If one year of college currently costs $25,000, how much will it cost Grand Rapids, Michigan’s resident Michelle Spindle to pay for one year of schooling for newborn daughter, Melissa, 18 years from now, assuming a 5 percent annual rate

> Mary Cooper, Sheldon’s mother, who lives in east Texas, wants to help pay for her grandchild’s education. How long will it take Mary to reach her goal of $200,000 if she invests $10,000 per year, earning 6 percent? Use

> Sheldon Cooper and Amy Fowler are married and live in Pasadena, California. They have as a new investment goal to create a college fund for their newborn daughter. They estimate that they will need $200,000 in 18 years. Assuming that the Cooper-Fowler fa

> Alexandra Cunningham of Gardner, Massachusetts, has a $100,000 participating cash-value policy written on her life. The policy has accumulated $4,700 in cash value; Alexandra has borrowed $3,000 of this value. The policy also has accumulated unpaid divid

> Matthew Kennedy of Urbana, Ohio, is single and has been working as an admissions counselor at a university for five years. Matthew owns a home valued at $250,000 on which he owes $135,000. He has a two-year-old vehicle valued at $32,000 on which he owes

> Amy and Mack Holly from Rapid City, South Dakota, have been married for three years. They recently bought a home costing $212,000 using a $190,000 mortgage. They have no other debts. Mack earns $62,000 per year, and Amy earns $71,000. Each has a retireme

> You have been talking at a party to some friends about insurance. One young married couple in the group believes that insurance is almost always a real waste of money. They argue, “The odds of most bad events occurring are so low that you don’t need to w

> Christina Haley of Elko, Nevada, age 57, recently suffered a stroke. She was in intensive care for 3 days and was hospitalized for 10 more days. Her total bill for this care was $125,500. After being discharged from the hospital, she spent 25 days in a n

> Michael Howitt of Berkley, Michigan, recently had his gallbladder removed. His total bill for this surgery, which was his only health care expense for the year, came to $13,890. His health insurance plan has a $500 annual deductible and an 80/20 coinsura

> Social Security Disability Protection. Sandra Hilton of Sisseton, South Dakota, age 60, recently was in a vehicle accident, was hospitalized, and then suffered a heart attack. She took a leave of absence from her longtime job as a data analyst for an env

> Ashley Diamond of Estes Park, Colorado, drives an eight-year-old Toyota valued at $5,600. She has a $75,000 personal automobile policy with $10,000 per-person medical payments coverage and both collision ($200 deductible) and comprehensive coverage. Davi

> Colton Gentry of Lancaster, California, has owned his home for ten years. When he purchased it for $178,000, Colton bought a $160,000 homeowner’s insurance policy. He still owns that policy, even though the replacement cost of the home is now $300,000. (

> Toula and Ian Miller of Gainesville, Florida, recently suffered a fire at their home. The fire, which began in a crawl space at the back of the house, caused $50,000 of damage to the dwelling itself. Their garage, valued at $20,000, was totally destroyed

> Bill Converse of Rexburg, Idaho, recently had his truck slide off a gravel road and strike a tree. Bill’s vehicle suffered $17,500 in damage. The truck has a book value of $40,000. Bill carried collision insurance with a $500 deductible. How much will Bi

> Heather McIntosh of Watertown, South Dakota, recently purchased a home for $190,000. She put $25,000 down and took out a 25-year loan at 5.5 percent interest. a) Use Table 9-4 on page 285 to determine her monthly payment. Table 9-4: (b) How much of he

> Kevin Tutumbo of Terre Haute, Indiana, has owned his home for 15 years and expects to live in it for a least five more. He originally borrowed $135,000 at 6 percent interest for 30 years to buy the home. He still owes $96,000 on the loan. Interest rates

> Alex Guadet of Nashville, Tennessee, has been renting a two-bedroom house for several years. He pays $900 per month in rent for the home and $300 per year in property and liability insurance. The owner of the house wants to sell it, and Alex is consideri

> Michael Joseph and Maggi Lewis of Saluda, Virginia, are trying to decide whether to rent or purchase housing. Michael favors buying and Maggi leans toward renting, and both seem able to justify their particular choice. Michael thinks that the tax advanta

> Seth and Alexandra Moore of Elk Grove Village, Illinois have an annual income of $110,000 and want to buy a home. Currently, mortgage rates are 5 percent. The Moores want to take out a mortgage for 30 years. Real estate taxes are estimated to be $4,800 p

> Dave and Diane Starr of New Orleans, Louisiana, both of whom are in their late 20s, currently are renting an unfurnished two-bedroom apartment for $1,200 per month, plus $230 for utilities and $34 for insurance. They have found a condominium they can buy

> Yvonne Moody of Dallas, Texas, is a 34-year-old police detective earning $58,000 per year. She and her husband, Joshua, who is a public school teacher earning $44,000, have two children in elementary school. They own a modestly furnished home and two lat

> Nicci Denny, age 40, single, and from Colorado Springs, Colorado, is trying to estimate the amount she needs to save annually to meet her retirement needs. Nicci currently earns $65,000 per year. She expects to need 80 percent of her current salary to li

> Harry Johnson’s father, William, was recently forced into early retirement at age 63 because of poor health. In addition to the psychological drawbacks of the unanticipated retirement, William’s financial situation is

> Julia is now in her early 50s. She has had three jobs in her career so far and participated fully in the defined contribution retirement plans offered by her employers. When she left her last position, she rolled her retirement account over to the accoun

> Victor, now age 61, and Maria, age 59, plan to retire at the end of the year. Since his employer changed from a defined-benefit retirement plan to a defined-contribution plan ten years ago, Victor has been contributing the maximum amount of his salary to

> Jonathan Clark and Cody Adams, longtime dental partners in Basking Ridge, New Jersey, have bought and sold real estate properties for ten years. They have profited on many transactions, although they did have some substantial losses during the last reces

> Jeremy Jorgensen of Lawton, Oklahoma, is concerned about the costs involved in selling his home, so he has decided to sell his home himself rather than pay a broker to do it. Required: (a) How would you advise Jeremy if he asked you whether he should se

> Keisha Williams, a senior research analyst in San Bernardino, California, has bought and sold high-technology stocks profitably for years. Lately some of her stock investments have done quite poorly, including one company that went bankrupt. Emily, a lon

> Julia continues to be a hard worker and, at age 60, has saved and invested wisely for her planned financially successful retirement. She has an extra $15,000 in a cash management account beyond what she needs for emergency savings. She rejected options a

> Victor and Maria Hernandez are thinking about selling her mother’s home, which she recently inherited, and use the proceeds to enhance their investments for retirement. Its price increased to about today’s value of $300,000. The home is fully paid for.

> Harry and Belinda Johnson are considering purchasing a residential income property as an investment. The Johnsons want to achieve an after-tax total return of 7 percent. They are considering a property with an asking price of $190,000 that should produce

> Lola Garcia, a single mother of a 6-year-old child, works for a utility company in Baltimore, Maryland, and is willing to invest $3,000 per year in a mutual fund. She wants the investment income to supplement her retirement pension starting in approximat

> It has been over 25 years since Julia graduated with a major in aeronautical engineering, and she has been quite successful in her career as well as in managing her personal finances. She has moved up the career ladder, earns a high salary, has $50,000 i

> After learning about mutual funds, the Johnsons are confident that they are a great way to invest, especially because of the diversification and professional management that funds offer. The couple has a financial nest egg of $9,500 to invest through mut

> Victor and Maria have decided to increase their contribution to their investment portfolio since Victor is now age 59 and thinking about retiring in five years. For years, they have followed a moderate-risk investment philosophy and put their money in su

> Ji Wu of Troy, New York, has $5,000 that he wants to invest in the stock market. Ji is in college on a scholarship and does not plan to use the $5,000 or any dividend income for another five years, when he plans to buy a home. He is currently considering

> Kyle Broflovski, a high school guidance counselor in South Park, Colorado, has purchased several corporate and government bonds over the years, and his total bond investments now exceeds $40,000. He prefers investments with some inflation protection. His

> Julia has been thinking about buying a home. For several months, she has been watching real estate shows on television and visiting open houses in her community. She thinks it is time to take the plunge and buy a much larger home since she can genuinely

> Jessica Varcoe works as a drug manufacturer’s representative based in Irvine, California. She has an aggressive investment philosophy and believes that interest rates on new bonds will drop over the next year or two because of an expected economic slowdo

> Julia’s investments survived the last recession and bear stock market declines because she was well diversified and was investing more heavily in bonds in the years preceding the decline. Julia cashed out of some equities and moved most of that money int

> The investments of Harry and Belinda have done well through the years. While the cash portion of their portfolio has risen to $16,000, it is earning a minuscule 1 percent in a money market account; thus they are Required: (a) What is the current yield

> After nearly 14 years of marriage, Harry and Belinda’s finances have improved, even though they have incurred debts for an automobile loan and a condominium. Plus they now have a 5-year-old son, Benjamin. They have not yet saved enough

> It has been about 20 years since Julia graduated with a major in aeronautical engineering, and she has been quite successful in her career and her personal finances. Accordingly, she wants to sell her home and buy a luxury condominium. She has $40,000 in

> Just-married couples sometimes over-indulge in the type and amount of life insurance that they buy. Hakeem and Leshaniqua Jackson of Barstow, California, took a different approach. Both were working and had a small amount of life insurance provided throu

> Julia Price is now in her late 30s and has always wanted children. She has arranged to adopt two siblings from overseas, ages 2 and 4. Julia is happy that she earns enough money to support the children adequately, but the agency sponsoring the adoption a

> Joseph and Marcia Michael of Athens, Georgia, are a married couple in their mid-30s. They have two children, ages 5 and 3, and Marcia is pregnant with their third child. Marcia is a part-time book indexer who earned $30,000 after taxes last year. Because

> Biming Chen is a college student from Cleveland, Mississippi. Soon to graduate, Biming was approached recently by a life insurance agent, who set up a group meeting for several members of his fraternity. During the meeting, the agent presented six life i

> Estate Agents Victor and Maria have been thinking about selling their home and buying a house with more yard space so that they can indulge their passion for gardening. Before they make such a decision, they want to explore the market to see what might b

> Switching Life Insurance Policies Victor and Maria Hernandez have a total of $200,000 in life insurance. Victor has a $50,000 cash-value policy purchased more than 20 years ago soon after when they married and a $100,000 group term policy through his emp

> Coverage Harry and Belinda Johnson spend $20 per month on life insurance in the form of a premium on a $10,000, paid-at-65 cash-value policy on Harry that his parents bought for him years ago. Belinda has a group term insurance policy from her employer w

> Charles Napier of Barstow, California, recently took a new job as a manufacturer’s representative for an aluminum castings company. While looking over his employee benefits materials, he discovered that his employer would provide 10 sick days per year, a

> Julia is about to change jobs. Her new employer offers several different health care plans including a traditional health care plan, an HMO, a PPO, and a high-deductible plan. Her employer will pay the first $300 per month for any plan she chooses. This

> Victor Hernandez recently learned that his uncle has Alzheimer’s disease. While discussing this tragedy with Maria, he realized that both of his grandparents probably had Alzheimer’s or another dementia disease, although no formal diagnoses were ever mad

> Dual-income households often have overlapping health care benefits. For example, both Harry and Belinda Johnson’s employers provide partially subsidized family health insurance plans as employee benefits. The Johnsons chose to be covered under Belinda’s

> Your friend Taliesha Jackson of Edwardsville, Illinois, recently changed to a new job as a CPA in a moderate-size accounting firm. Knowing that you were taking a personal finance course, she asked your advice about selecting the best health insurance pla

> Makiko Iwanami, a student from Osaka, Japan, is in one of your classes. She is considering the purchase of a used car and has been told that she must buy automobile insurance to register the car and obtain license plates. Makiko has come to you for advic

> Mark and Kelly Prince of Emmertsburg, Iowa, face a crisis. Their automobile insurance company has notified them that their current coverage expires in 30 days and will not be renewed. Mark and the Prince’s younger son each had a minor, at-fault accident

> Julia has always tried to keep her insurance spending under control by purchasing low limits on her policies. Now that her assets and income have grown, she is beginning to reconsider the wisdom of this approach when buying insurance. Julia knows she has

> Belinda Johnson’s parents and maternal grandmother have combined their finances and presented Harry and Belinda with $50,000 cash gift to use to purchase a home. The Johnsons have shopped and found a house in a new housing development t

> Justin Kealey, CPA, is auditing Tustin Companies, Inc. Kealey has accumulated factual, judgmental, and projected misstatements for the current year to evaluate whether there is a sufficiently low risk of material misstatement of the financial statements

> Linda Reeves, CPA, receives a telephone call from her client, Lane Company. The company’s controller states that the board of directors of Lane has entered into two contractual arrangements with Ted Forbes, the company’s former president, who has recentl

> The auditor’s opinion on the fairness of financial statements may be affected by subsequent events. Required: a. Define what is commonly referred to in auditing as a subsequent event, and describe the two general types of subsequent events. b. Identify

> a. Calculate the gross margin percentage for each of State University’s product lines. b. Compare State University’s gross margins to industry averages. Indicate any margins that appear out of line, in relation to the

> You are the audit manager in the audit of the financial statements of Midwest Grain Storage, Inc., a new client. The company’s records show that, as of the balance sheet date, approximately 15 million bushels of various grains are in storage for the Comm

> During an audit engagement, Robert Wong, CPA, has satisfactorily completed an examination of accounts payable and other liabilities and now plans to determine whether there are any loss contingencies arising from litigation, claims, or assessments. What

> OA Company recently hired a payroll service provider to process its payroll—that service provider has essentially taken over the payroll function, and payroll represents OA’s largest expense. Comment on the following statement: OA’s auditors should make

> In your audit of the financial statements of Wolfe Company for the year ended April 30, you find that a material account receivable is due from a company in reorganization under Chapter 11 of the Bankruptcy Act. You also learn that on May 28 several form

> Valley Corporation established a stock option plan for its officers and key employees this year. Because the options granted have a higher option price than the stock’s current market price, the company has not recognized any cost for the options in the

> You are retained by Columbia Corporation to audit its financial statements for the fiscal year ended June 30. Your consideration of internal control indicates a fairly satisfactory condition, although there are not enough employees to permit an extensive

> Select the best answer for each of the following and explain fully the reason for your selection. a. Which of the following is least likely to be among the auditors’ objectives in the audit of inventories and cost of goods sold? (1) Det

> You are engaged in the audit of the financial statements of Armada Corporation for the year ended August 31, 20X0. The balance sheet, reflecting all your audit adjustments accepted by the client to date, shows total current assets, $8,000,000; total curr

> During your annual audit of Walker Distributing Co., your assistant, Jane Williams, reports to you that, although a number of entries were made during the year in the general ledger account Notes Payable to Officers, she decided that it was not necessary

> The only long-term liability of Range Corporation is a note payable for $1 million secured by a mortgage on the company’s plant and equipment. You have audited the company annually for the three preceding years, during which time the principal amount of

> Describe the audit steps that generally would be followed in establishing the propriety of the recorded liability for federal income taxes of a corporation you are auditing for the first time. Consideration should be given to the status of (a) the liabi

> During the course of any audit, the auditors are always alert for unrecorded accounts payable or other unrecorded liabilities. Required: For each of the following audit areas, (1) describe an unrecorded liability that might be discovered and (2) state w

> Early in your first audit of Star Corporation, you notice that sales and year-end inventory are almost unchanged from the prior year. However, cost of goods sold is less than in the preceding year, and accounts payable also are down substantially. Gross

> The subsequent period in an audit is the time extending from the balance sheet date to the date of the auditors’ report. Discuss the importance of the subsequent period in the audit of trade accounts payable.

> In the course of your initial audit of the financial statements of Sylvan Company, you determine that of the substantial amount of accounts payable outstanding at the close of the period, approximately 75 percent is owed to six creditors. You have reques

> Auditors usually send confirmations to obtain evidence about accounts receivable and accounts payable. a. Is confirmation presumptively required for accounts receivable, accounts payable, or both? b. Are accounts receivable requests, accounts payable req

> Shortly after you were retained to audit the financial statements of Case Corporation, you learned from a preliminary discussion with management that the corporation had recently acquired a competing business, the Mall Company. In your study of the terms

> Auditors report on the consistency of application of accounting principles. Assume that the following list describes changes that have a material effect on a client’s financial statements for the current year. (1) A change from the completed-contract me

> Your new client, Ross Products, Inc., completed its first fiscal year March 31, 20X4. During the course of your audit you discover the following entry in the general journal, dated April 1, 20X3. Required: Under these circumstances, what steps should

> Allen Fraser was president of three corporations: Missouri Metals Corporation, Kansas Metals Corporation, and Iowa Metals Corporation. Each of the three corporations owned land and buildings acquired for approximately $500,000. An appraiser retained by F

> Kadex Corporation, a small manufacturing company, did not use the services of independent auditors during the first two years of its existence. Near the end of the third year, Kadex retained Jones & Scranton, CPAs, to perform an audit for the year ended

> Gruen Corporation is a large diversified company with a large amount of property, plant, and equipment and intangible assets, including goodwill. In the past year the company has experienced a significant decline in a number of its lines of business. Re

> An executive of a manufacturing company informs you that no formal procedures have been followed to control the retirement of machinery and equipment. A physical inventory of plant assets has just been completed. It revealed that 25 percent of the assets

> Assume that a continuing audit client has recorded Accounts Receivable and Equipment both in the amount of $1,000,000. In a typical audit, which account would take more time to audit?

> You are part of the audit team that is auditing Happy Chicken, Inc., a company that franchises Happy Chicken family restaurants. During the current year, management of Happy Chicken purchased for $2 million one of its franchised locations, a store that w

> Girard Corporation has just completed the acquisition of Williams, Inc., at a purchase price significantly higher than the fair values of the identifiable assets. Describe the audit issues caused by the acquisition and how the auditors would likely resol

> List and state the purpose of all audit procedures that might reasonably be applied by the auditors to determine that all property and equipment retirements have been recorded in the accounting records.

> Grandview Manufacturing Company employs standard costs in its cost accounting system. List the audit procedures that you would apply to ascertain that Grandview’s standard costs and related variance amounts are acceptable and have not distorted the finan

> Use the following to provide the type of audit report the auditors generally should issue in the situations presented below: 1. Unmodified—standard. 2. Unmodified—with an emphasis-of-matter paragraph. 3. Qualified. 4. Adverse. 5. Disclaimer Situation: a

> Assume that you are auditing Roberts Wholesale Supply Co. and that you have decided to use data analytics to test the inventory. Specifically, you would like to identify (1) excess and overvalued items in inventory (e.g., possibly obsolete, quantities we

> You are engaged in the audit of Reed Company, a new client, at the end of its first fiscal year, June 30, 20X1. During your work on inventories, you discover that all of the merchandise remaining in stock on June 30, 20X1, had been acquired July 1, 20X0,

> One of the problems faced by the auditors in their verification of inventory is the risk that slow-moving and obsolete items may be included in the goods on hand at the balance sheet date. In the event that such items are identified in the physical inven

> The City of Westmore is confused about the type of audit that it should obtain: an audit in accordance with generally accepted auditing standards, an audit in accordance with Generally Accepted Government Auditing Standards, or an audit in accordance wit