Question: Xiao and Shiao Jing-jian, newlyweds from

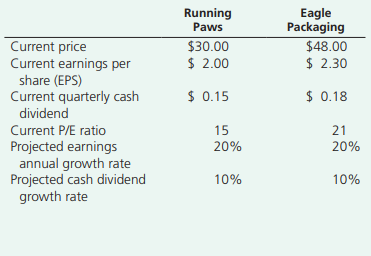

Xiao and Shiao Jing-jian, newlyweds from Laramie, Wyoming, have decided to begin investing for the future. Xiao is a 7-Eleven store manager, and Shiao is a high-school math teacher. The couple intends to take $3,000 out of their savings for investment purposes and then continue to invest an additional $200 to $400 per month. Both have a moderate investment philosophy and seek some cash dividends as well as price appreciation. Calculate the five-year return on the investment choices in the table below. Put your calculations in tabular form like that shown in Table 14-2. (Hint: When making your calculations you should assume at the end of the first year. At the end of the first year the EPS for Running Paws will be $2.40 with a dividend of $0.66, and the EPS for Eagle Packaging will be $2.76 with a projected dividend of $0.86.)

(a) Using the appropriate P/E ratios, what are the estimated market prices of the Running Paws and Eagle Packaging stocks after five years?

(b) Show your calculations in determining the projected price appreciations for the two stocks over the five years.

(c) Add the projected price appreciation of each stock to its projected cash dividends, and show the total five-year percentage returns for the two stocks.

(d) Determine the average annual dividend for each stock, and use these figures in calculating the approximate compound yields for each.

(e) Assume that the beta is 2.5 for Running Paws and 2.8 for Eagle Packaging. If the market went up 20 percent during the year, what would be the likely stock prices for Running Paws and Eagle Packaging?

(f) Assume that inflation is approximately 4 percent and the return on high-quality, long-term, corporate bonds is 8 percent. Given the Jing-jians’ investment philosophy, explain why you would recommend (1) Running Paws, (2) Eagle Packaging, or (3) a high-quality, long-term corporate bond as a growth investment. Support your answer by calculating the potential rate of return using the information; or by using the Garman/Forgue website. The Jing-jians are in the 25 percent marginal tax bracket.

Rate of return using the information:

Transcribed Image Text:

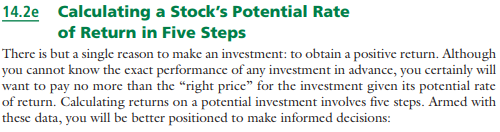

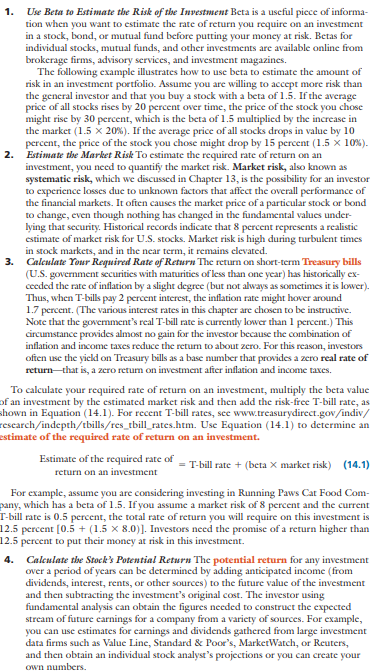

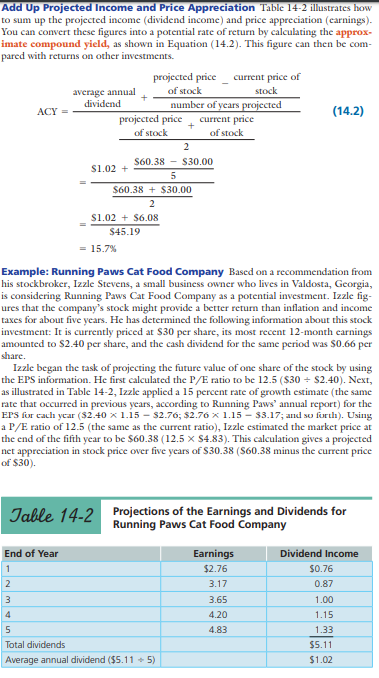

Eagle Packaging $48.00 $ 2.30 Running Paws Current price Current earnings per share (EPS) Current quarterly cash dividend $30.00 $ 2.00 $ 0.15 $ 0.18 Current P/E ratio 15 21 Projected earnings annual growth rate Projected cash dividend growth rate 20% 20% 10% 10% 14.2e Calculating a Stock's Potential Rate of Return in Five Steps There is but a single reason to make an investment: to obtain a positive return. Although you cannot know the exact performance of any investment in advance, you certainly will want to pay no more than the "right price" for the investment given its potential rate of return. Calculating returns on a potential investment involves five steps. Armed with these data, you will be better positioncd to make informed decisions: Use Beta to Estimate the Risk of the Investment Beta is a useful piece of informa- tion when you want to estimate the rate of return you require on an investment in a stock, bond, or mutual fund before putting your moncy at risk. Betas for individual stocks, mutual funds, and other investments are available online from brokerage firms, advisory services, and investment magazines. The following example illustrates how to use beta to estimate the amount of risk in an investment portfolio. Assume you are willing to accept more risk than the general investor and that you buy a stock with a beta of 1.5. If the average price of all stocks rises by 20 percent over time, the price of the stock you chose might rise by 30 percent, which is the beta of 1.5 multiplied by the increase in the market (1.5 x 20%). If the average price of all stocks drops in value by 10 percent, the price of the stock you chose might drop by 15 percent (1.5 x 10%). Estimate the Market Risk To estimate the required rate of return on an investment, you need to quantify the market risk. Market risk, also known as systematic risk, which we discussed in Chapter 13, is the possibility for an investor to experience losses due to unknown factors that affect the overall performance of the financial markets. It often causes the market price of a particular stock or bond to change, even though nothing has changed in the fundamental values under- lying that security. Historical records indicate that 8 percent represents a realistic estimate of market risk for U.S. stocks. Market risk is high during turbulent times in stock markets, and in the near term, it remains clevated. 3. Calculate Your required rate of return The return on short-term Treasury bills (U.S. government securities with maturities of less than one year) has historically ex- ceeded the rate of inflation by a slight degree (but not always as sometimes it is lower). Thus, when T-bills pay 2 percent interest, the inflation rate might hover around 1.7 percent. (The various interest rates in this chapter are chosen to be instructive. Note that the government's real T-bill rate is currently lower than 1 percent.) This circumstance provides almost no gain for the investor because the combination of inflation and income taxes reduce the retum to about zero. For this reason, investors ofien use the yield on Treasury bills as a base number that provides a zero real rate of 1. 2. return-that is, a zero retum on investment after inflation and income taxes. To calculate your required rate of return on an investment, multiply the beta value of an investment by the estimated market risk and then add the risk-free T-bill rate, as shown in Equation (14.1). For recent T-bill rates, see www.treasurydirect.gov/indiv/ research/indepth/tbills/res_tbill_rates.htm. Use Equation (14.1) to determine an estimate of the required rate of return on an investment. Estimate of the required rate of - T-bill rate + (beta X market risk) (14.1) return on an investment For example, assume you are considering investing in Running Paws Cat Food Com- pany, which has a beta of 1.5. If you assume a market risk of 8 percent and the current T-bill rate is 0.5 percent, the total rate of return you will require on this investment is 12.5 percent [0.5 + (1.5 x 8.0)]. Investors need the promise of a return higher than 12.5 percent to put their money at risk in this investment. 4. Calculate the Stock's Potential Return The potential return for any investment over a period of years can be determined by adding anticipated income (from dividends, interest, rents, or other sources) to the future value of the investment and then subtracting the investment's original cost. The investor using fundamental analysis can obtain the figures needed to construct the expected stream of future earnings for a company from a variety of sources. For example, you can use estimates for carnings and dividends gathered from large investment data firms such Value Line, Standard & Poor's, MarketWatch, or Reuters, and then obtain an individual stock analyst's projections or you can create your own numbers. Add Up Projected Income and Price Appreciation Table 14-2 illustrates how to sum up the projected income (dividend income) and price appreciation (carnings). You can convert these figures into a potential rate of return by calculating the approx- imate compound yield, as shown in Equation (14.2). This figure can then be com- pared with returns on other investments. projected price current price of of stock stock average annual dividend number of years projected АCY (14.2) projected price current price of stock of stock 2 S60.38 - S30.00 S1.02 + S60.38 + $30.00 S1.02 + $6.08 $45.19 = 15.7% Example: Running Paws Cat Food Company Based on a recommendation from his stockbroker, Izzle Stevens, a small business owner who lives in Valdosta, Georgia, is considering Running Paws Cat Food Company as a potential investment. Izzle fig- ures that the company's stock might provide a better return than inflation and income taxes for about five years. He has determined the following information about this stock investment: It is currently priced at S30 per share, its most recent 12-month carnings amounted to S2.40 per share, and the cash dividend for the same period was $0.66 per share. Izzle began the task of projecting the future value of one share of the stock by using the EPS information. He first calculated the P/E ratio to be 12.5 ($30 + S2.40). Next, as illustrated in Table 14-2, Izzle applied a 15 percent rate of growth estimate (the same rate that occurred in previous years, according to Running Paws' annual report) for the EPS for cach year ($2.40 x 1.15 - s2.76; $2.76 x 1.15 - 3.17; and so forth). Using a P/E ratio of 12.5 (the same as the current ratio), Izzle estimated the market price at the end of the fifih year to be $60.38 (12.5 x $4.83). This calculation gives a projected net appreciation in stock price over five years of $30.38 (S60.38 minus the current price of $30). Table 14-2 Projections of the Earnings and Dividends for Running Paws Cat Food Company End of Year Earnings Dividend Income 1 $2.76 $0.76 2 3.17 0.87 3 3.65 1.00 4.20 1.15 5 4.83 1.33 Total dividends $5.11 Average annual dividend ($5.11 + 5) $1.02 To project the future income of the investment in Running Paws-the anticipated cash dividends-Table 14-2 shows that Izzle estimated a 15 percent growth rate in the cash dividend (S0.66 x 1.15 = S0.76; $0.76 x 1.15 = $o.87; and so forth). Adding the projected cash dividends over five years gives a total of S5.11. Izzle obtained the potential return for one share of Running Paws over five years by adding anticipated dividend income (S5.11) to the future value of the investment (S60.38) less its original cost ($30.00), for a result of $35.49 ($5.11 + S30.38). Thus, Izzle has projected that $30 invested in one share of Running Paws will carn a potential total return of $35.49 in five years. The ACY Says What Makes a Good Investment The question now becomes, what is the percentage yield for this dollar return? The approximate compound yield (ACY) provides a measure of the annualized compound growth of any long-term in- vestment. In short, it tells you whether or not one stock or another investment is good. You can determine this value by using Equation (14.2). The calculation requires use of an annual average dividend rather than the specific projected dividends. In this exam- ple, the annual average dividend of $1.02 is computed by dividing the $5.11 in divi- dend income by five years. Substituting the data from Table 14-2 into Equation (14.2) and using the average annual dividend figure results in an approximate compound yield of 15.7 percent on the potential investment in one share of Running Paws stock for five years. (This formula can be found on the Garman/Forgue companion website.) 5. Compare the required rate of return with the Potential Rate of Return on the Investment Now the moment of decision making is at hand. You compare the estimated required rate of return on an investment (given its risk) with the investment's potential projected rate of return. In our example involving Running Paws Cat Food Company, the risk suggested a required rate of return of 12.5 percent. The investment's potential rate of return was projected to be 15.7 percent, which suggests that Running Paws is a good buy for Izzle at the current selling price of $30-that is, the stock is under priced. Once armed with projected rate of return information for an investment, you can compare it with other investments.

> Briefly define the disk scheduling policies illustrated in Figure 11.7. Figure 11.7: 100 125 150 175 199 Time (a) FIFO 25 50 100 125 150 175 199 Time (h) SSTF 50 75 100 125 150 175 199 Time (c) SCAN 50 100 125 150 175 199 Time (d) C-SCAN Figure 11.7

> What delay elements are involved in a disk read or write?

> Why would you expect improved performance using a double buffer rather than a single buffer for I/O?

> What is the difference between block-oriented devices and stream-oriented devices? Give a few examples of each.

> What is the difference between logical I/O and device I/O?

> List some benefits and disadvantages of synchronous and asynchronous RPCs.

> List and briefly define three techniques for performing I/O.

> What items of information about a task might be useful in real-time scheduling?

> List and briefly define four classes of real-time scheduling algorithms.

> List and briefly define five general areas of requirements for a real-time operating system.

> What is the difference between periodic and aperiodic real-time tasks?

> What is the difference between hard and soft real-time tasks?

> List and briefly define three versions of load sharing.

> List and briefly define four techniques for thread scheduling.

> List and briefly define five different categories of synchronization granularity.

> Briefly define shortest-process-next scheduling.

> List some benefits and disadvantages of nonpersistent and persistent binding for RPCs.

> Briefly define round-robin scheduling.

> Briefly define FCFS scheduling.

> What is the difference between preemptive and nonpreemptive scheduling?

> For process scheduling, does a low-priority value represent a low priority or a high priority?

> What is the difference between turnaround time and response time?

> What is usually the critical performance requirement in an operating system?

> Briefly describe the three types of processor scheduling.

> What is the difference between a resident set and a working set?

> Why is it not possible to combine a global replacement policy and a fixed allocation policy?

> What is accomplished by page buffering?

> List some benefits and disadvantages of blocking and non-blocking primitives for message passing.

> Discuss some of the reasons for implementing process migration.

> Jose and Gabriela Perez, of Bridgewater, Virginia, hope to sell their large home for $380,000 and retire to a smaller residence valued at $150,000. After hey sell the property, they plan to invest the $200,000 in equity remaining after selling expenses a

> Insurance Victor and Maria’s next-door neighbor, Ray Jackson, was recently sued over an automobile accident and eventually was held liable for $437,000 in damages. Ray’s automobile policy limits were 100/300/50. Because of the shortfall, he had to sell h

> Jackie Facet of Auburn, Alabama, age 60, was planning on retirement and investing well for it because he now has $400,000 in his retirement accounts and would likely to have doubled that by age 67. But, he became permanently disabled after getting into a

> Shanice Johnson, of Philadelphia, Pennsylvania, wants to invest $4,000 annually for her retirement 30 years from now. She has a conservative investment philosophy and expects to earn a return of 3 percent in a tax-sheltered account. If she took a more ag

> Janet Brooks, of Amarillo, Texas, plans to invest $3,000 each year in a mutual fund for the next 40 years to accumulate savings for retirement. Her twin sister, Rebecca, plans to invest the same amount for the same length of time in the same mutual fund.

> Brenda and Dan Domico, of Weatherford, Texas, desire an annual retirement income of $40,000. They expect to live for 30 years past retirement. Assuming that the couple could earn a 3 percent after-tax and after-inflation rate of return on their investmen

> Over the years, Ahmed and Aamina El-zayaty, of Berkeley, California, have accumulated $200,000 and $220,000, respectively, in their employer-sponsored retirement plans. If the amounts in their two accounts earn a 6 percent rate of return over Ahmed and A

> Ashley Travis, of Harrisburg, Illinois, is in the 25 percent marginal tax bracket and is considering the tax consequences of investing $2,000 at the end of each year for 30 years in a tax-sheltered retirement account, assuming that the investment earns 8

> Discounted Cash Flow to Estimate Price, and give your opinion on which part of the assumptions (rent increase or sales price) is more subject to poor thinking.

> Marianne Mooney, benefits manager and her sister, Laureen, a middle-school teacher from Pompano Beach, Florida, are interested in the numbers of real estate investments. They have reviewed the figures in Table 16-2 on page 499 and are impressed with inve

> Calculate the price-to-rent ratios for the following properties arranged by price of home followed by likely annual rental income: (a) $400,000/$40,000; (b) $300,000/$36,000; (c) $200,000/30,000.

> Last year David McCullough of La Junta, Colorado, bought the XYZ mutual fund, which has total assets of $240 million, liabilities of $10 million, and 15 million shares outstanding. (a) What is the net asset value? (b) If the current price is $18, is this

> Several years have passed since the Johnsons were married, and their financial affairs have become more complicated. They recently purchased a $200,000 condominium that has added only about $400 per month to their housing expenses. And they have purchase

> Two years ago, Izabella Martinez, from Atlanta, Georgia, invested $1,000 by buying 125 shares ($8 per share NAV) in the Can’t Lose Mutual Fund, an aggressive growth no-load mutual fund. Last year, she made two additional investments of $500 each (50 shar

> A year ago, George Jetson, from Orbit City, Texas, invested $1,000 by buying 100 shares of the Can’t Lose Mutual Fund, an aggressive growth no-load mutual fund. George reinvested his dividends, so he now has 112 shares. So far, the NAV for George’s inves

> Your neighbor, Kitty Kardashian, of Philadelphia, Pennsylvania, bought $5,000 worth of mutual funds with a back-end load of 5 percent if she sells within the first year. It decreases 1 percent a year afterward. (a) If Kitty sells during the third year, h

> Michael Margolis is a single parent and motivational training consultant from Palatine, Illinois. He is wondering about potential returns on investments given certain amounts of risk. Michael invested a total of $6,000 in three stocks ($2,000 in each) wi

> A corporate bond maturing in 22 years with a coupon rate of 8.2 percent was purchased for $1,100 and is now selling for $1,190. (a) What is its current yield? (b) Calculate the bond’s YTM using Equation (14.5) or the Garman/ Forgue comp

> For a municipal bond paying 3.4 percent for a taxpayer in the 25 percent tax bracket, what is the equivalent taxable yield? (Hint: See page 140.) Page 140: //

> A stock sells at $15 per share. (a) What is the EPS for the company if it has a P/E ratio of 20? (b) If the company’s dividend yield is 3 percent, what is its dividend per share? (c) What is the book value of the company if the price-to-book ratio is 1.5

> A corporate bond maturing in 15 years with a coupon rate of 9.9 percent was purchased for $980 and it now selling for $1,010. (a) What is its current yield? (b) What will be its selling price in two years if comparable market interest rates drop 1.9 perc

> For a municipal bond paying 3.7 percent for a taxpayer in the 33 percent tax bracket, what is the equivalent taxable yield?

> Enlai Li Zhang of Los Angeles, California recently bought a home for $700,000. The previous owner had a $600,000 HO-1 policy on the property, and Enlai can simply pay the premiums to keep the same coverage in effect. Her insurance agent called her and ca

> What is the market price of a $1,000, 8 percent bond if comparable market interest rates rise to 10 percent and the bond matures in 14 years?

> What is the market price of a $1,000, 8 percent bond if comparable market interest rates drop to 6 percent and the bond matures in 15 years?

> Kunal Nayyar from London, had $50,000 in investments in the USA at the beginning of the year that consisted of a diversified portfolio of stocks (40 percent), bonds (40 percent), and cash equivalents (20 percent). His returns over the past 12 months were

> Jordan and Jeremy, who are twins living in Concord, New Hamphire, took different approaches to investing. Jordan saved $2,000 per year for ten years starting at age 23 and never added any more money to the account. Jeremy saved $2,000 per year for 20 yea

> If one year of college currently costs $25,000, how much will it cost Grand Rapids, Michigan’s resident Michelle Spindle to pay for one year of schooling for newborn daughter, Melissa, 18 years from now, assuming a 5 percent annual rate

> Mary Cooper, Sheldon’s mother, who lives in east Texas, wants to help pay for her grandchild’s education. How long will it take Mary to reach her goal of $200,000 if she invests $10,000 per year, earning 6 percent? Use

> Sheldon Cooper and Amy Fowler are married and live in Pasadena, California. They have as a new investment goal to create a college fund for their newborn daughter. They estimate that they will need $200,000 in 18 years. Assuming that the Cooper-Fowler fa

> Alexandra Cunningham of Gardner, Massachusetts, has a $100,000 participating cash-value policy written on her life. The policy has accumulated $4,700 in cash value; Alexandra has borrowed $3,000 of this value. The policy also has accumulated unpaid divid

> Matthew Kennedy of Urbana, Ohio, is single and has been working as an admissions counselor at a university for five years. Matthew owns a home valued at $250,000 on which he owes $135,000. He has a two-year-old vehicle valued at $32,000 on which he owes

> Amy and Mack Holly from Rapid City, South Dakota, have been married for three years. They recently bought a home costing $212,000 using a $190,000 mortgage. They have no other debts. Mack earns $62,000 per year, and Amy earns $71,000. Each has a retireme

> You have been talking at a party to some friends about insurance. One young married couple in the group believes that insurance is almost always a real waste of money. They argue, “The odds of most bad events occurring are so low that you don’t need to w

> Christina Haley of Elko, Nevada, age 57, recently suffered a stroke. She was in intensive care for 3 days and was hospitalized for 10 more days. Her total bill for this care was $125,500. After being discharged from the hospital, she spent 25 days in a n

> Michael Howitt of Berkley, Michigan, recently had his gallbladder removed. His total bill for this surgery, which was his only health care expense for the year, came to $13,890. His health insurance plan has a $500 annual deductible and an 80/20 coinsura

> Social Security Disability Protection. Sandra Hilton of Sisseton, South Dakota, age 60, recently was in a vehicle accident, was hospitalized, and then suffered a heart attack. She took a leave of absence from her longtime job as a data analyst for an env

> Ashley Diamond of Estes Park, Colorado, drives an eight-year-old Toyota valued at $5,600. She has a $75,000 personal automobile policy with $10,000 per-person medical payments coverage and both collision ($200 deductible) and comprehensive coverage. Davi

> Colton Gentry of Lancaster, California, has owned his home for ten years. When he purchased it for $178,000, Colton bought a $160,000 homeowner’s insurance policy. He still owns that policy, even though the replacement cost of the home is now $300,000. (

> Toula and Ian Miller of Gainesville, Florida, recently suffered a fire at their home. The fire, which began in a crawl space at the back of the house, caused $50,000 of damage to the dwelling itself. Their garage, valued at $20,000, was totally destroyed

> Bill Converse of Rexburg, Idaho, recently had his truck slide off a gravel road and strike a tree. Bill’s vehicle suffered $17,500 in damage. The truck has a book value of $40,000. Bill carried collision insurance with a $500 deductible. How much will Bi

> Heather McIntosh of Watertown, South Dakota, recently purchased a home for $190,000. She put $25,000 down and took out a 25-year loan at 5.5 percent interest. a) Use Table 9-4 on page 285 to determine her monthly payment. Table 9-4: (b) How much of he

> Kevin Tutumbo of Terre Haute, Indiana, has owned his home for 15 years and expects to live in it for a least five more. He originally borrowed $135,000 at 6 percent interest for 30 years to buy the home. He still owes $96,000 on the loan. Interest rates

> Alex Guadet of Nashville, Tennessee, has been renting a two-bedroom house for several years. He pays $900 per month in rent for the home and $300 per year in property and liability insurance. The owner of the house wants to sell it, and Alex is consideri

> Michael Joseph and Maggi Lewis of Saluda, Virginia, are trying to decide whether to rent or purchase housing. Michael favors buying and Maggi leans toward renting, and both seem able to justify their particular choice. Michael thinks that the tax advanta

> Seth and Alexandra Moore of Elk Grove Village, Illinois have an annual income of $110,000 and want to buy a home. Currently, mortgage rates are 5 percent. The Moores want to take out a mortgage for 30 years. Real estate taxes are estimated to be $4,800 p

> Dave and Diane Starr of New Orleans, Louisiana, both of whom are in their late 20s, currently are renting an unfurnished two-bedroom apartment for $1,200 per month, plus $230 for utilities and $34 for insurance. They have found a condominium they can buy

> Yvonne Moody of Dallas, Texas, is a 34-year-old police detective earning $58,000 per year. She and her husband, Joshua, who is a public school teacher earning $44,000, have two children in elementary school. They own a modestly furnished home and two lat

> Nicci Denny, age 40, single, and from Colorado Springs, Colorado, is trying to estimate the amount she needs to save annually to meet her retirement needs. Nicci currently earns $65,000 per year. She expects to need 80 percent of her current salary to li

> Harry Johnson’s father, William, was recently forced into early retirement at age 63 because of poor health. In addition to the psychological drawbacks of the unanticipated retirement, William’s financial situation is

> Julia is now in her early 50s. She has had three jobs in her career so far and participated fully in the defined contribution retirement plans offered by her employers. When she left her last position, she rolled her retirement account over to the accoun

> Victor, now age 61, and Maria, age 59, plan to retire at the end of the year. Since his employer changed from a defined-benefit retirement plan to a defined-contribution plan ten years ago, Victor has been contributing the maximum amount of his salary to

> Jonathan Clark and Cody Adams, longtime dental partners in Basking Ridge, New Jersey, have bought and sold real estate properties for ten years. They have profited on many transactions, although they did have some substantial losses during the last reces

> Jeremy Jorgensen of Lawton, Oklahoma, is concerned about the costs involved in selling his home, so he has decided to sell his home himself rather than pay a broker to do it. Required: (a) How would you advise Jeremy if he asked you whether he should se

> Keisha Williams, a senior research analyst in San Bernardino, California, has bought and sold high-technology stocks profitably for years. Lately some of her stock investments have done quite poorly, including one company that went bankrupt. Emily, a lon

> Julia continues to be a hard worker and, at age 60, has saved and invested wisely for her planned financially successful retirement. She has an extra $15,000 in a cash management account beyond what she needs for emergency savings. She rejected options a

> Victor and Maria Hernandez are thinking about selling her mother’s home, which she recently inherited, and use the proceeds to enhance their investments for retirement. Its price increased to about today’s value of $300,000. The home is fully paid for.

> Harry and Belinda Johnson are considering purchasing a residential income property as an investment. The Johnsons want to achieve an after-tax total return of 7 percent. They are considering a property with an asking price of $190,000 that should produce

> Lola Garcia, a single mother of a 6-year-old child, works for a utility company in Baltimore, Maryland, and is willing to invest $3,000 per year in a mutual fund. She wants the investment income to supplement her retirement pension starting in approximat

> It has been over 25 years since Julia graduated with a major in aeronautical engineering, and she has been quite successful in her career as well as in managing her personal finances. She has moved up the career ladder, earns a high salary, has $50,000 i

> After learning about mutual funds, the Johnsons are confident that they are a great way to invest, especially because of the diversification and professional management that funds offer. The couple has a financial nest egg of $9,500 to invest through mut

> Victor and Maria have decided to increase their contribution to their investment portfolio since Victor is now age 59 and thinking about retiring in five years. For years, they have followed a moderate-risk investment philosophy and put their money in su

> Ji Wu of Troy, New York, has $5,000 that he wants to invest in the stock market. Ji is in college on a scholarship and does not plan to use the $5,000 or any dividend income for another five years, when he plans to buy a home. He is currently considering

> Kyle Broflovski, a high school guidance counselor in South Park, Colorado, has purchased several corporate and government bonds over the years, and his total bond investments now exceeds $40,000. He prefers investments with some inflation protection. His

> Julia has been thinking about buying a home. For several months, she has been watching real estate shows on television and visiting open houses in her community. She thinks it is time to take the plunge and buy a much larger home since she can genuinely

> Jessica Varcoe works as a drug manufacturer’s representative based in Irvine, California. She has an aggressive investment philosophy and believes that interest rates on new bonds will drop over the next year or two because of an expected economic slowdo

> Julia’s investments survived the last recession and bear stock market declines because she was well diversified and was investing more heavily in bonds in the years preceding the decline. Julia cashed out of some equities and moved most of that money int

> The investments of Harry and Belinda have done well through the years. While the cash portion of their portfolio has risen to $16,000, it is earning a minuscule 1 percent in a money market account; thus they are Required: (a) What is the current yield

> After nearly 14 years of marriage, Harry and Belinda’s finances have improved, even though they have incurred debts for an automobile loan and a condominium. Plus they now have a 5-year-old son, Benjamin. They have not yet saved enough

> It has been about 20 years since Julia graduated with a major in aeronautical engineering, and she has been quite successful in her career and her personal finances. Accordingly, she wants to sell her home and buy a luxury condominium. She has $40,000 in

> The expenses associated with sending two children through college prevented Victor and Maria Hernandez from adding substantially to their investment program. Now that their younger son, Joseph, has completed school and is working full time, they would li